Market Overview:

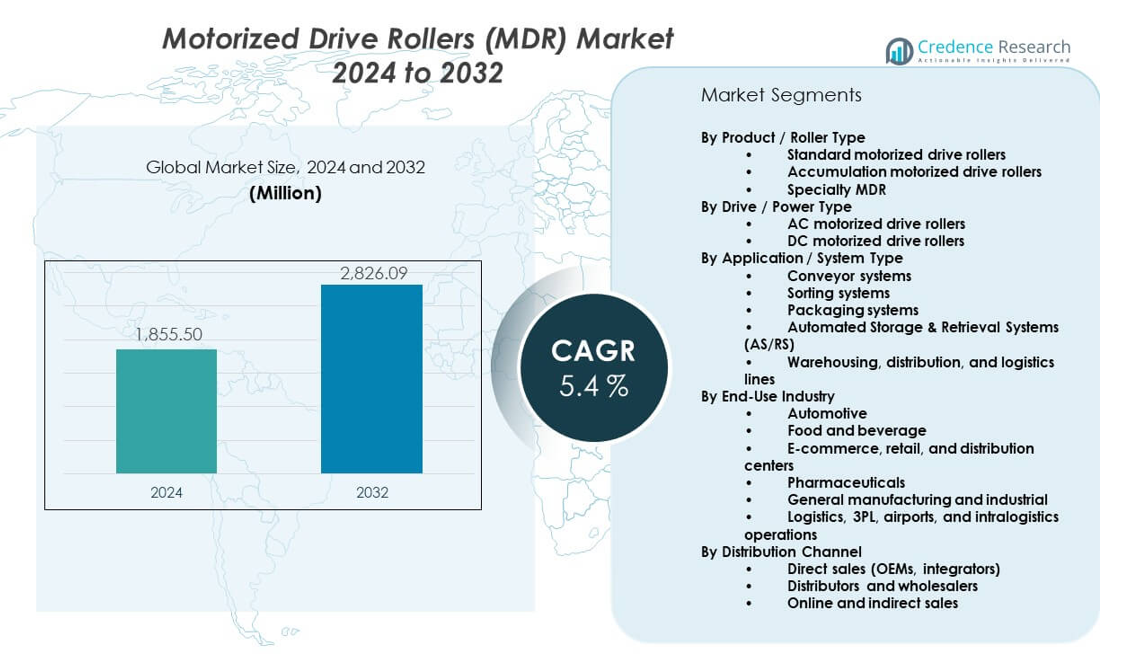

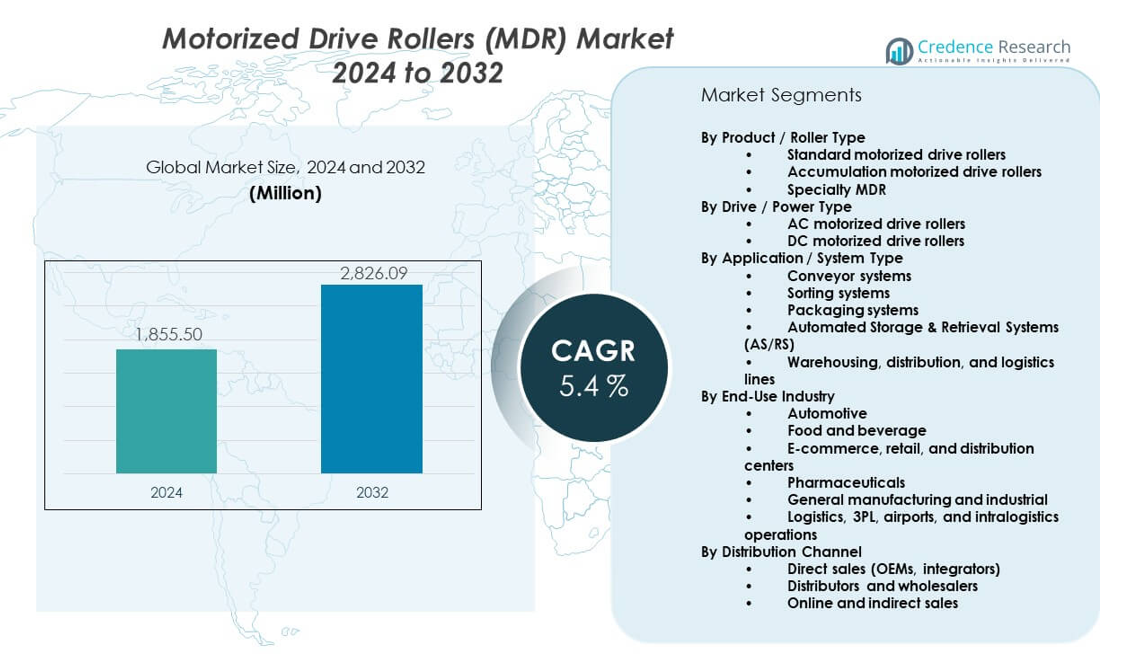

The Motorized Drive Rollers (MDR) Market moves from USD 1,855.5 million in 2024 toward an expected USD 2,826.09 million by 2032, supported by a CAGR of 5.4% during the period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Motorized Drive Rollers (MDR) Market Size 2024 |

USD 1,855.5 million |

| Motorized Drive Rollers (MDR) Market, CAGR |

5.4% |

| Motorized Drive Rollers (MDR) Market Size 2032 |

USD 2,826.09 million |

Stronger warehouse automation fuels steady MDR demand across global facilities. Firms prefer MDR units due to low maintenance needs and better speed control. E-commerce players expand sorting hubs, which lifts interest in energy-efficient rollers. Manufacturers use MDR modules to reduce downtime and improve line flexibility. Safety rules push buyers toward powered rollers with smarter control features. Growth in distribution networks supports higher adoption across new plants. The trend boosts strong use of MDR solutions across industries.

North America leads adoption due to strong automation upgrades and mature logistics networks. Europe follows closely because firms seek cleaner and quieter transport systems in advanced warehouses. Asia Pacific shows the fastest rise as China, India, and Southeast Asia expand manufacturing output. Japan and South Korea invest in high-tech conveyors to support electronics production. Latin America gains momentum as retail networks grow. The Middle East adopts MDR systems to support new supply hubs. Africa remains early-stage but shows slow improvement through rising industrial projects

Market Insights:

- The Motorized Drive Rollers (MDR) Market reached USD 1,855.5 million in 2024 and is projected to hit USD 2,826.09 million by 2032, growing at a 5.4% CAGR, driven by automation upgrades and higher throughput needs in logistics and manufacturing.

- Asia Pacific (34%), North America (32%), and Europe (28%) dominate due to strong industrial bases, advanced fulfillment networks, and rapid adoption of automated conveyor systems across major economies.

- Asia Pacific, holding 34%, remains the fastest-growing region supported by expanding e-commerce hubs, rising industrial output, and large-scale investments in intralogistics modernization.

- Conveyor systems account for the largest application share at over 35%, driven by their essential role in material handling and automated warehousing.

- DC motorized drive rollers hold the highest drive-type share at around 45%, supported by demand for low-noise, energy-efficient, and modular control capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Automated Material Flow

Growing interest in fast and safe product handling strengthens investment across factories. Firms deploy smarter rollers to support flexible conveyor layouts. The Motorized Drive Rollers (MDR) Market gains momentum through warehouse expansion. E-commerce networks push higher throughput needs across sorting centers. It lifts demand for low-noise and energy-efficient drives in busy facilities. Manufacturers upgrade systems to control speed more precisely. Users prefer modular designs for simple scaling during peak cycles. Global supply chains rely on MDR units to improve movement efficiency.

- For instance, Interroll Holding AG offers the RollerDrive EC5000 series with a range of speeds, with some configurations, such as specific 50 mm models, capable of speeds up to 41 m/s, while other gear ratios offer a speed of 0.4 m/s. These models feature fully integrated drum motors, enabling high throughput in distribution centers without the need for added external drives.

Growing Focus on Energy-Efficient Conveyor Systems

Energy-saving targets push firms to replace older motors with controlled roller drives. Many operations cut power use through zone-based movement. MDR units help teams lower idle running time across lines. The design supports reduced noise levels in compact warehouses. It improves handling safety for workers near fast moving cartons. Adoption rises across cold-chain hubs due to better low-temperature performance. Industries depend on these rollers to stabilize load movement in narrow aisles. Global automation programs raise interest in efficient conveyor lines.

- For instance, Interroll’s EC5000 offers brushless drives with 35 W or 50 W power consumption, and the design features overload protection and maintenance-free operation — reducing energy usage and downtime in cold-storage conveyors.

Expansion of E-Commerce and Distribution Networks

Online retail growth pushes companies to enhance sorting accuracy. MDR systems support rapid routing across multi-level hubs. Operators increase installation rates to reduce manual touching points. It improves shipment speed across dense fulfillment clusters. Many logistics firms deploy high-speed rollers for peak-volume weeks. Large retailers upgrade conveyor routes to manage SKU diversity. MDR modules allow quick repair without full line shutdowns. Demand grows across emerging markets due to rising parcel density.

Shift Toward Safer and Smarter Conveying Technologies

Safety mandates push firms to adopt drive rollers with controlled torque. MDR systems reduce pinch risks due to zone isolation. The design supports cleaner lines in food and pharma sites. It raises adoption across sites with strict hygiene standards. Smart controls help avoid overload events during heavy cycles. Users get better diagnostics for predictive maintenance tasks. Software-linked rollers support smoother integration with warehouse systems. Industries choose MDR modules to reduce equipment stress.

Market Trends:

Rising Use of IoT-Linked Conveyor Intelligence

Digital tracking tools reshape how companies run conveyor routes. Users gain real-time visibility on load movement across lines. IoT pairing helps identify faults before downtime occurs. It increases demand for rollers with built-in sensors. Many plants test connected rollers to improve cycle timing. Smart hubs rely on data flows to balance traffic loads. The Motorized Drive Rollers (MDR) Market sees growth in predictive control adoption. Global factories modernize equipment to support intelligent routing.

- For instance, the EC5000 with bus-interface from Interroll enables millimeter-accurate positioning, delivering tight integration with robotics or sorting arms for automotive and retail fulfillment centres.

Growth of Modular and Plug-and-Play Conveyor Designs

Companies seek quick setup options for new warehouse layouts. MDR modules support easy swapping during load shifts. It reduces installation effort for seasonal expansions. Many users prefer compact drives that fit tight spaces. The trend improves adaptability during SKU fluctuations. Logistics firms value rollers that sync with automated sorters. Plug-in controls lower integration time for new nodes. Modular layouts gain traction across midsize distribution hubs.

- For instance, Interroll’s RollerDrive cylindrical design (50 mm diameter) allows replacement of traditional under-belt or side-mounted motors, reducing conveyor footprint and simplifying modular conveyor assembly in small warehouses.

Increasing Adoption of Low-Noise Conveyor Infrastructure

Noise control rules drive interest in quieter drives. MDR rollers lower decibel levels during peak traffic. Firms redesign work zones to support quieter environments. It improves operator comfort across dense packing floors. Acoustic guidelines support broader acceptance in urban warehouses. Many cold-chain hubs use silent rollers to improve compliance. Facilities with night-shift cycles prefer quiet lines for smoother workflow. The shift boosts use of advanced low-noise components.

Rising Integration of AI in High-Speed Sorting Lines

AI-based routing tools reshape material handling strategies. Many hubs use AI to balance line pressure. It improves accuracy for high-volume parcel clusters. The Motorized Drive Rollers (MDR) Market benefits from smart sorting upgrades. Vision systems guide rollers for smoother product flow. AI improves handling predictability during overload events. Firms deploy intelligent modules across cross-belt and MDR hybrids. Adoption expands as digital twins support layout optimization.

Market Challenges Analysis:

High Initial Costs and Integration Complexities

Upfront prices limit adoption across small facilities. Many firms delay upgrades due to budget pressure. Complex integration steps slow deployment in legacy plants. It increases overall planning time for automation teams. MDR lines demand skilled technicians to tune controls. Smaller distributors struggle with training programs. Compatibility issues appear when merging old and new drives. The Motorized Drive Rollers (MDR) Market faces resistance from cost-sensitive buyers.

Maintenance Burden and Sensitivity to Harsh Environments

Dust and moisture affect roller performance in tough sites. Many plants need strict cleaning rules to avoid failure. It lifts maintenance cycles for high-load areas. Temperature shifts reduce lifespan in some industries. Firms combat breakdowns through frequent checks. Operators face delays during spare part shortages. Rough material edges cause early wear on rollers. These issues limit usage in aggressive industrial zones.

Market Opportunities:

Rapid Expansion of Automated Warehousing Infrastructure

Large logistics hubs invest in next-gen conveyor layouts. MDR units support scalable routing across dense clusters. It helps operators reduce manual handling pressure. Many emerging markets adopt these systems for new fulfillment sites. Firms upgrade networks to meet rising order velocity. Distribution hubs expand capacity to improve delivery time. The Motorized Drive Rollers (MDR) Market gains traction from automation reforms. Retail and e-commerce growth strengthens long-term demand.

Rising Investment in Smart Conveyor Controls and Services

Many companies fund software-driven control upgrades. MDR rollers pair with digital dashboards for efficient routing. It improves downtime prediction for maintenance teams. Service vendors offer tailored retrofitting programs. Global plants adopt smarter rollers for flexible lines. Operators value remote diagnostic capability for uptime stability. Growth in robotics lifts interest in intelligent conveyor paths. Industrial modernization programs encourage broader adoption.

Market Segmentation Analysis:

By Product / Roller Type

Standard motorized drive rollers hold strong adoption due to wide use in routine material handling. Accumulation rollers gain demand in high-throughput sorting and packaging lines where controlled buffering improves flow. Specialty MDR units grow steadily in cold storage, heavy-load zones, and high-torque environments that require enhanced durability. The Motorized Drive Rollers (MDR) Market benefits from rising customization needs across large warehouses and temperature-sensitive facilities. It supports diverse layouts that require tailored roller capabilities across multiple operating conditions.

- For instance, Interroll’s EC5000 offers nine gear ratios to adjust speed-to-torque ratio and supports 24 V and 48 V DC variants for different load and environment requirements.

By Drive / Power Type

AC motorized drive rollers remain relevant for heavy-duty and long-run conveyor tasks. DC motorized drive rollers dominate due to 24 V DC systems that deliver safe operation, low noise, and flexible zoning. Many warehouses prefer DC rollers for energy savings and simple control integration. It helps teams deploy modular zones across compact layouts with limited wiring effort. Growth in e-commerce hubs strengthens the popularity of DC-powered units across high-speed lines.

- For instance, the EC5000 DC-driven roller provides IP54 protection, runs quietly (noise emission near 55 dB(A)), and requires virtually no maintenance — making it ideal for parcel-sorting centers.

By Application / System Type

Conveyor systems form the core use case across manufacturing and logistics sites. Sorting systems adopt MDR units to support fast routing in distribution centers. Packaging lines rely on stable load handling during labeling and sealing cycles. AS/RS operations integrate rollers to improve movement precision in dense storage grids. Warehousing and logistics networks remain key buyers due to rising parcel volumes and automation projects. It drives consistent deployment across multi-level handling environments.

By End-Use Industry

Automotive plants use MDR units for parts handling and assembly support. Food and beverage sites deploy cold-rated rollers to maintain reliable flow under low temperatures. E-commerce and retail facilities depend on high-speed systems for order fulfillment efficiency. Pharmaceutical environments adopt MDR modules to support hygiene and controlled movement. General manufacturing and logistics operations expand usage to reduce manual strain. It strengthens broad adoption across global industrial segments.

By Distribution Channel

Direct sales through OEMs and integrators lead adoption due to tailored system design. Distributors and wholesalers support mid-size buyers with standard configurations. Online and indirect channels grow with rising demand for modular and ready-to-install units. It broadens access for small and regional operators upgrading their conveyor routes.

Segmentation:

By Product / Roller Type

- Standard motorized drive rollers

- Accumulation motorized drive rollers

- Specialty MDR (cold-rated, high-torque, heavy-duty)

By Drive / Power Type

- AC motorized drive rollers

- DC motorized drive rollers (24 V DC MDR is the most common)

By Application / System Type

- Conveyor systems (general material handling)

- Sorting systems

- Packaging systems

- Automated Storage & Retrieval Systems (AS/RS)

- Warehousing, distribution, and logistics lines

By End-Use Industry

- Automotive

- Food and beverage

- E-commerce, retail, and distribution centers

- Pharmaceuticals

- General manufacturing and industrial

- Logistics, 3PL, airports, and intralogistics operations

By Distribution Channel

- Direct sales (OEMs, integrators)

- Distributors and wholesalers

- Online and indirect sales

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe

North America holds around 32% share due to strong automation upgrades across distribution and manufacturing hubs. High labor costs drive faster adoption of powered roller systems across warehouses. The Motorized Drive Rollers (MDR) Market benefits from rapid expansion of e-commerce fulfillment centers in the U.S. and Canada. Europe captures nearly 28% share supported by strict safety rules and demand for quieter conveyor systems. It gains further traction from high use of AS/RS and automated packaging lines across Germany, the U.K., and France. Cold-chain growth in Northern Europe increases demand for specialty MDR units. Regional players invest in modernizing logistics routes to shorten lead times.

Asia Pacific

Asia Pacific commands the largest share at nearly 34% driven by high manufacturing output across China, India, Japan, and South Korea. Strong investments in intralogistics support widespread MDR deployment across consumer goods and electronics plants. It strengthens demand for DC-powered rollers that deliver safe operation and faster zoning. Expansion of megawarehouses and cross-border e-commerce hubs lifts installation rates across fast-growing economies. Local producers launch cost-effective units to meet rising demand from mid-size operators. Government programs promoting industrial automation increase system replacement cycles. The region maintains the highest growth pace due to rapid industrial expansion.

Latin America and Middle East & Africa

Latin America holds about 4% share supported by logistics expansions in Mexico, Brazil, and Chile. Regional warehouses adopt MDR systems to improve handling efficiency under rising parcel loads. It gains steady momentum as more retailers transition toward automated sorting environments. Middle East & Africa capture roughly 2% share driven by new logistics parks in the UAE, Saudi Arabia, and South Africa. Cold-chain development drives interest in specialty rollers suited for temperature-sensitive cargo. Local integrators offer tailored layouts for aviation, retail, and industrial clients. Both regions show gradual improvement driven by private investment in distribution and storage infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Motorized Drive Rollers (MDR) Market features strong competition driven by technology leadership, product reliability, and global distribution strength. Interroll, Itoh Denki, and Pulseroller dominate due to advanced control systems and broad application coverage. It sees rising pressure from regional manufacturers offering cost-efficient DC roller options. Large integrators expand portfolios to deliver full conveyor solutions rather than standalone rollers. Demand for low-noise, energy-saving, and IoT-enabled units strengthens differentiation among premium vendors. Partnerships between OEMs and automation providers support system-level integration. Market players focus on modularity, diagnostics, and durability to secure long-term contracts.

Recent Developments:

- In August 2025, Itoh Denki USA, the Japan-based motorized conveyor roller manufacturer, announced a significant capacity expansion at its Luzerne County, Pennsylvania headquarters and production facility. The expansion includes an additional 73,600 square feet at the Hanover Crossings Industrial Park location and was driven by increasing demand for industrial automation products, particularly Itoh’s Power Moller internally powered rollers, which have become the top choice for low-noise warehousing and distribution center applications owing to their energy efficiency and run-on-demand technology.

- In April 2025, Daifuku opened a new manufacturing plant in India to meet rapidly growing automation needs in the region. The new facility expands Daifuku’s production lineup by manufacturing automated storage and retrieval systems (AS/RS), rail-guided pallet sorters, and conveyors for food, chemical, machinery, rubber products, and other manufacturing industries, as well as for retail, transportation, warehousing, and distribution sectors, while also supporting efforts to move parts production in-house and raise manufacturing efficiency. In November 2025, Daifuku opened its Kyoto Lab, a new research and development hub designed to strengthen engineering talent and accelerate innovation in digital transformation (DX) and artificial intelligence (AI). Additionally, Daifuku Intralogistics America developed and launched the next-generation AS-35 high-speed sorter in 2024–2025 and began exploring strategic partnerships with Unit Sorter, specialty conveyor technology providers, and Automated Mobile Robot (AMR) systems to enhance competitive positioning.

- In March 2025, Dematic announced its participation at ProMat 2025 (March 17–20, 2025), where it showcased innovative supply chain automation solutions. The company demonstrated live automation capabilities featuring products such as the Eurofork 4es, AutoStore, Autonomous Mobile Robots (AMRs), and the Dematic Multishuttle, along with virtual reality warehouse experiences and sustainability initiatives focused on reducing energy consumption. Dematic has formed strategic partnerships with AutoStore, Transcend, Eurofork, and fellow KION Group brand Linde to enhance its integrated solutions capability and competitiveness in the material handling automation market.

- In March 2025, Pulseroller will exhibit at ProMat 2025, showcasing its entire line of motor drive roller (MDR) and controller solutions, with particular emphasis on new products. The company introduced the Raptor Motor Drive Roller (Raptor-Ai-ST), which delivers 80W of continuous performance designed for high-demand environments requiring exceptional acceleration for long belted zones and sorter induction applications. Pulseroller is preparing to launch the Raptor-HT, which will deliver even higher torque and performance, further closing the performance gap between MDR and traditional AC/DC solutions. Additionally, Pulseroller released the Senergy-Ai-48 (48V) Motorized Drive Roller, featuring a brushless 48V DC motor designed to deliver precise, smooth acceleration of heavy goods with maximum torque and longer power supply run capabilities.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Drive Type, Application, End-Use Industry, Distribution Channel, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market. [replace all segments in report coverage]

Future Outlook:

- Growing automation in warehouses will expand MDR usage across global facilities.

- Rising demand for quieter and energy-efficient systems will lift adoption of DC rollers.

- AI-enabled routing and diagnostic tools will enhance line performance.

- Cold-chain expansion will push demand for specialty MDR units.

- Modular conveyor architectures will increase retrofitting opportunities.

- E-commerce logistics networks will continue to drive high-volume MDR installations.

- Smart control integrations will strengthen adoption in complex sorting hubs.

- Manufacturers will invest in stronger torque and low-temperature designs.

- Regional players will rise due to demand for cost-effective MDR solutions.

- Global sustainability goals will accelerate the shift toward low-power conveyor systems.