| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare E-Commerce Market Size 2024 |

USD 3,47,834.86 million |

| Healthcare E-Commerce Market, CAGR |

16.18% |

| Healthcare E-Commerce Market Size 2032 |

USD 11,50,558.01 million |

Market Overview

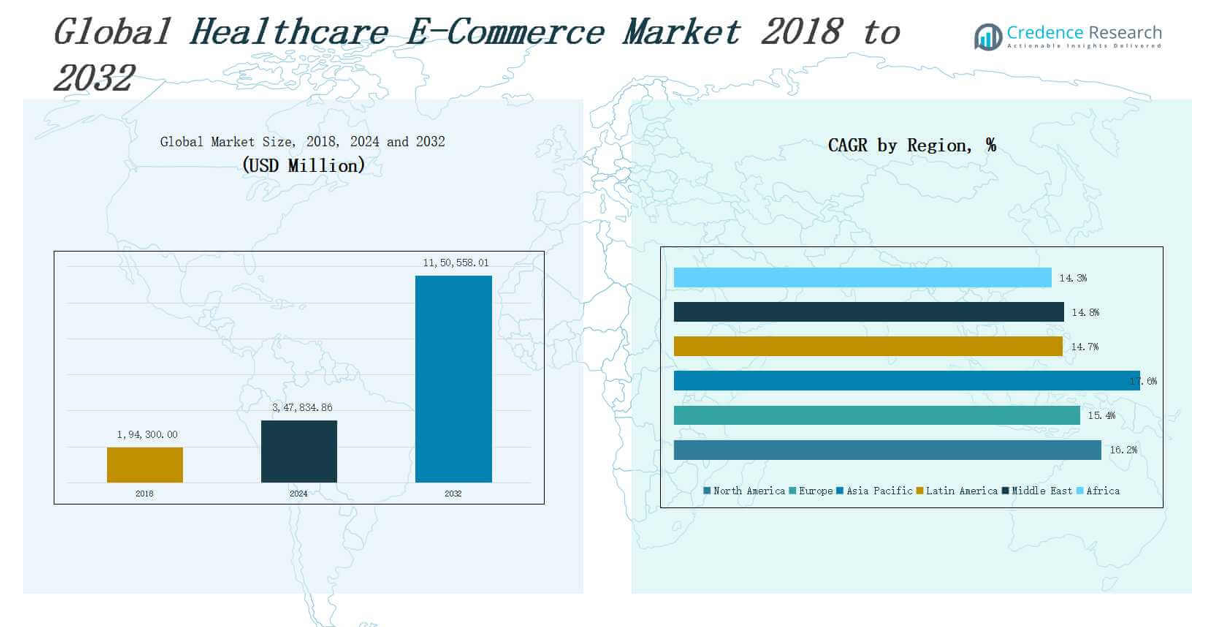

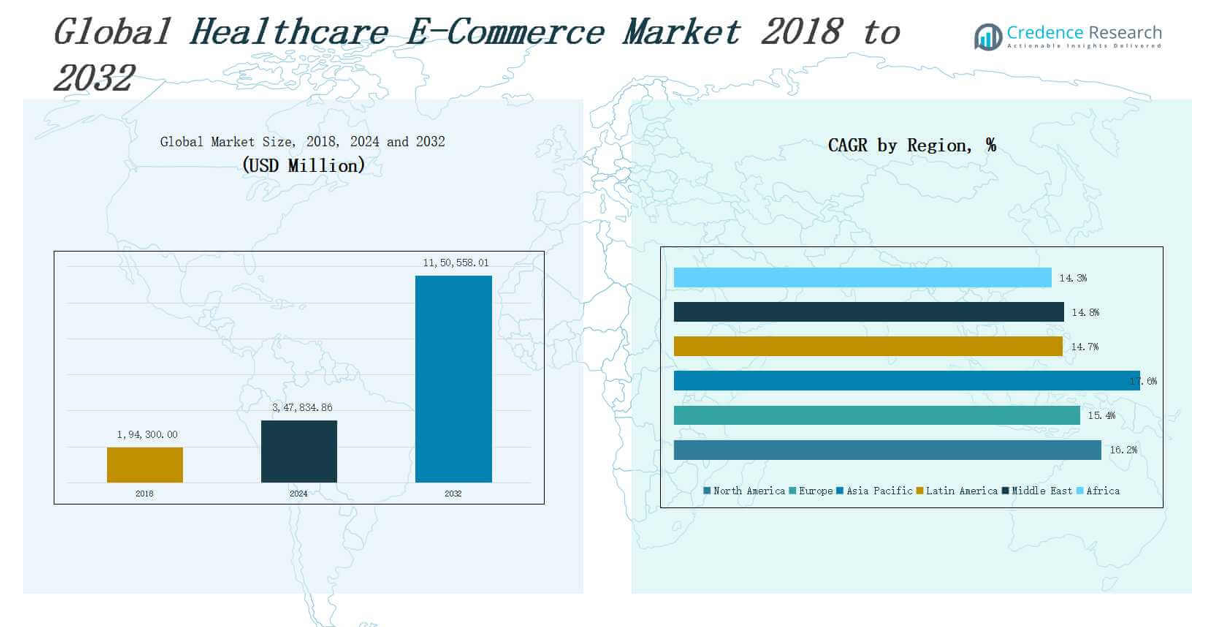

The Healthcare E-Commerce Market size was valued at USD 1,94,300.00 million in 2018 to USD 3,47,834.86 million in 2024 and is anticipated to reach USD 11,50,558.01 million by 2032, at a CAGR of 16.18 % during the forecast period.

The Healthcare E-Commerce Market is expanding rapidly due to increasing internet penetration, rising consumer preference for online purchasing, and growing demand for convenient access to healthcare products and services. The surge in chronic diseases, aging populations, and heightened health awareness are prompting patients to seek online platforms for medications, wellness products, and medical devices. The market benefits from advancements in digital infrastructure, mobile commerce, and secure payment technologies, which streamline user experiences and build trust. Strong support from governments and regulatory bodies for telemedicine and e-prescriptions is further accelerating digital healthcare adoption. Meanwhile, trends highlight a significant shift toward personalized health offerings, subscription-based delivery models, and the integration of artificial intelligence for inventory and logistics optimization. Market players are focusing on omnichannel strategies, data-driven marketing, and partnerships with logistics providers to ensure timely and safe delivery. The entry of traditional pharmaceutical giants and new-age startups is intensifying competition, fostering innovation, and reshaping the future of healthcare accessibility and delivery.

The Healthcare E-Commerce Market shows strong geographical expansion across North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America leads in revenue share, driven by mature digital infrastructure and high consumer adoption. Europe follows with strong regulatory frameworks and e-prescription adoption. Asia Pacific is the fastest-growing region, led by China and India, due to rising internet penetration and healthcare demand. Latin America and the Middle East are emerging markets with growing investments in digital healthcare services, while Africa presents untapped potential supported by mobile-first solutions. Key players in the Healthcare E-Commerce Market include Amazon Inc., CVS Health, Alibaba Group, Flipkart Pvt. Ltd., eBay Inc., Walgreens Boots Alliance Inc., ExactCare Pharmacy, Remedi SeniorCare, Lloyds Pharmacy Limited, and McCabes Pharmacy, all competing through innovation, logistics optimization, and strategic partnerships to expand global reach and enhance user experience.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Healthcare E-Commerce Market was valued at USD 1,94,300.00 million in 2018 and reached USD 3,47,834.86 million in 2024; it is projected to hit USD 11,50,558.01 million by 2032, growing at a CAGR of 16.18%.

- Rising digital health adoption, internet penetration, and consumer demand for convenience are driving market expansion across urban and rural regions.

- Chronic disease prevalence and a shift toward preventive care are increasing demand for subscription-based medicines, wellness products, and home diagnostics.

- Government initiatives supporting telemedicine, e-prescriptions, and digital procurement systems are accelerating online healthcare adoption.

- The market faces challenges such as navigating global regulatory standards, ensuring data privacy, and managing supply chain authenticity and logistics.

- North America leads in revenue share, Europe follows with strong e-prescription integration, while Asia Pacific is the fastest-growing market; Latin America, the Middle East, and Africa show rising adoption with digital infrastructure improvements

- Key players include Amazon, Alibaba, CVS Health, Flipkart, eBay, Walgreens Boots Alliance, ExactCare Pharmacy, Remedi SeniorCare, Lloyds Pharmacy, and McCabes Pharmacy.

Market Drivers

Rising Digital Health Adoption and Consumer Convenience

The Healthcare E-Commerce Market is experiencing strong momentum due to increasing adoption of digital health services and a growing preference for convenience-driven purchasing. Consumers are increasingly using mobile apps and online platforms to access healthcare products, reducing dependency on traditional brick-and-mortar pharmacies. It caters to the modern demand for 24/7 accessibility, product comparison, and discreet purchasing. It also eliminates geographical limitations, offering wider access to medications, wellness products, and diagnostic tools.

- For instance, in India, Tata 1mg’s mobile app has enabled over 30 million users to compare prices and order medicines, diagnostic tests, and wellness products online, expanding healthcare access beyond urban centers.

Expansion of Chronic Disease Management and Preventive Care Needs

A growing global burden of chronic diseases is driving sustained demand for continuous medical supplies and health monitoring products, which the Healthcare E-Commerce Market efficiently delivers. It serves patients managing diabetes, hypertension, cardiovascular diseases, and respiratory disorders through subscription models and doorstep delivery. The increasing shift toward preventive healthcare fuels online sales of nutritional supplements, fitness trackers, and diagnostic kits. This trend supports patient engagement and reduces clinical visits for routine care.

- For instance, Amazon has expanded its healthcare offerings by acquiring PillPack, enabling direct-to-door prescription deliveries for patients managing conditions like diabetes and hypertension.

Government Support and Regulatory Digitization Efforts

Government-led digital health initiatives and streamlined e-prescription regulations support the rapid growth of the Healthcare E-Commerce Market. It benefits from frameworks promoting telemedicine, digital health records, and electronic procurement of pharmaceuticals. Authorities are promoting policy reforms to improve e-pharmacy legitimacy, data security, and prescription verification systems. These developments encourage healthcare institutions and consumers to adopt online channels confidently, fostering transparency and improving access to underserved regions.

Technological Advancements and Supply Chain Optimization

Rapid advancements in AI, machine learning, and big data analytics are transforming operational efficiency within the Healthcare E-Commerce Market. It leverages smart algorithms to manage inventory, personalize user experiences, and automate logistics. Integration with real-time tracking, automated warehousing, and predictive analytics improves service quality and delivery speed. These innovations enable companies to reduce costs, minimize errors, and meet growing customer expectations across diverse geographies and demographics.

Market Trends

Growth of Omnichannel Strategies and Hybrid Service Models

Retailers and digital health platforms are increasingly adopting omnichannel approaches to bridge the gap between physical and digital healthcare services. The Healthcare E-Commerce Market is witnessing a shift toward hybrid models where online platforms are integrated with in-store pickups, teleconsultations, and home delivery. Companies are streamlining user experiences by enabling seamless transitions between virtual and in-person touchpoints. It is helping traditional pharmacies expand their digital footprint while improving consumer loyalty and operational flexibility.

- For instance, Avi Medical in Germany combines online appointment booking, digital medical history questionnaires, and a blend of virtual and physical appointments, streamlining patient experiences and reducing administrative burdens for physicians.

Increased Penetration of AI and Personalized Recommendations

rtificial intelligence is playing a pivotal role in enhancing user engagement through tailored product suggestions, dynamic pricing, and real-time support. The Healthcare E-Commerce Market is incorporating AI to offer personalized experiences based on browsing behavior, medical history, and purchase patterns. It is improving diagnostic kit recommendations, medication adherence tools, and wellness subscriptions. AI-based chatbots and virtual assistants are simplifying navigation and support, making the digital healthcare journey intuitive and customer-centric.

- For instance, Mayo Clinic partnered with IBM Watson Health to offer AI-driven personalized cancer treatment suggestions, improving patient outcomes.

Surge in Demand for Subscription-Based Healthcare Products

Consumers are increasingly opting for subscription models that ensure regular, uninterrupted delivery of health products. The Healthcare E-Commerce Market is responding to this demand with customizable plans for chronic disease medications, nutritional supplements, and personal care items. It is improving customer retention and operational efficiency by predicting reorder cycles and optimizing inventory. Subscription models are particularly popular among elderly patients and caregivers, helping reduce pharmacy visits and improving therapy compliance.

Focus on Last-Mile Delivery and Cold Chain Logistics

Fast and reliable delivery is becoming a key differentiator in the Healthcare E-Commerce Market. It is driving investments in last-mile delivery systems, cold chain logistics, and temperature-sensitive packaging to handle vaccines, biologics, and specialty drugs. Companies are collaborating with logistics providers to ensure safe and timely deliveries across urban and remote areas. It is enhancing trust and expanding accessibility, especially in regions with limited healthcare infrastructure or transport challenges.

Market Challenges Analysis

Regulatory Compliance and Data Privacy Concerns

The Healthcare E-Commerce Market faces persistent challenges in navigating complex regulatory frameworks and ensuring compliance with national and international health laws. It must manage the safe handling, verification, and delivery of prescription drugs while adhering to evolving telemedicine and e-pharmacy regulations. Strict data privacy laws such as HIPAA and GDPR require robust cybersecurity protocols, which increase operational costs. Breaches or mishandling of patient data can erode consumer trust and lead to legal consequences. Aligning digital platforms with medical guidelines, while maintaining user accessibility, remains a key constraint across many regions.

Logistical Limitations and Product Authenticity Risks

Ensuring the integrity and safety of medical products during transit poses a major logistical hurdle, especially for temperature-sensitive pharmaceuticals and rural deliveries. The Healthcare E-Commerce Market must invest in specialized infrastructure such as cold chains and last-mile solutions to prevent spoilage or delays. It also struggles with counterfeit products entering the supply chain, which undermines brand reputation and patient safety. Verifying authenticity, tracking shipments, and managing returns require coordinated systems and partnerships. Building trust while scaling operations efficiently continues to challenge emerging and established players.

Market Opportunities

Expansion into Underserved and Rural Markets

The Healthcare E-Commerce Market holds significant growth potential in reaching underserved and rural populations with limited access to physical healthcare infrastructure. It can bridge the healthcare gap by offering affordable, timely access to essential medicines, diagnostic kits, and wellness products. The rise in smartphone penetration and mobile payment platforms supports digital adoption in these regions. Partnerships with local logistics providers and government health programs can strengthen last-mile delivery. It also creates opportunities for tailored offerings that address regional health needs and language preferences.

Integration with Telehealth and Digital Wellness Platforms

The integration of e-commerce with telehealth and virtual care platforms presents a major opportunity to create seamless, end-to-end healthcare experiences. The Healthcare E-Commerce Market can link digital consultations with immediate product fulfillment, improving continuity of care. It enables real-time prescription processing, automated refill systems, and personalized health solutions. Collaborations with telemedicine providers, health insurers, and wearable tech companies can unlock new revenue models. This convergence supports proactive health management and enhances patient engagement across age groups.

Market Segmentation Analysis:

By Type

The Healthcare E-Commerce Market is segmented into drugs and medical devices. Drugs account for the largest share due to high consumer demand for prescription and over-the-counter medications through online platforms. It offers convenience and timely access, especially for chronic conditions. Medical devices are gaining traction with the rise in at-home diagnostics, wearable health monitors, and mobility aids. Both categories benefit from growing health awareness and the expansion of digital health ecosystems.

- For instance, CVS Caremark partnered with Novo Nordisk to expand access to the GLP-1 drug Wegovy, taking a formulary action in July 2025 to prefer Wegovy for its members and integrating it with the CVS Weight Management program for additional clinical support.

By Application

The Healthcare E-Commerce Market covers telemedicine, caregiving services, and medical consultation. Telemedicine is a dominant segment driven by its integration with e-prescriptions and online pharmacies. Caregiving services leverage e-commerce platforms to deliver personal care products and assistive tools directly to patients. Medical consultation, supported by AI and video interfaces, enhances patient-provider interaction and links users to relevant health products instantly. These applications collectively strengthen user engagement and platform value.

- For instance, Doxy.me offers a HIPAA-compliant telemedicine platform praised for its reliability and ease of use, allowing clinicians and patients to conduct secure video visits without complex setup, enhancing accessibility and patient satisfaction.

By End-User

End-users in the Healthcare E-Commerce Market include consumers, healthcare professionals, hospitals & clinics, pharmacies, and others. Consumers form the largest segment due to rising demand for personalized, accessible healthcare solutions. Healthcare professionals and institutions use these platforms for procurement efficiency and supply management. Pharmacies adopt online channels to expand reach and improve customer retention. This broad end-user base supports sustained market scalability across geographies.

Segments:

Based on Type

Based on Application

- Telemedicine

- Caregiving Services

- Medical Consultation

Based on End-User

- Consumers

- Healthcare Professionals

- Hospitals & Clinics

- Pharmacies

- Others

Based on Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The North America Healthcare E-Commerce Market size was valued at USD 74,222.60 million in 2018 to USD 131,340.36 million in 2024 and is anticipated to reach USD 433,877.50 million by 2032, at a CAGR of 16.2% during the forecast period. North America dominates the Healthcare E-Commerce Market with the highest revenue share, driven by advanced digital infrastructure, strong consumer adoption, and favorable regulatory support. It benefits from a mature healthcare ecosystem and widespread insurance coverage, supporting digital prescriptions and virtual consultations. The United States leads the region, followed by Canada and Mexico, with rapid growth in chronic disease management solutions and direct-to-consumer pharmacy models. Investments in AI, logistics, and last-mile delivery continue to improve service efficiency. Key players in the region are also expanding their telehealth partnerships to drive integrated care solutions.

Europe

The Europe Healthcare E-Commerce Market size was valued at USD 51,295.20 million in 2018 to USD 88,270.98 million in 2024 and is anticipated to reach USD 275,849.34 million by 2032, at a CAGR of 15.4% during the forecast period. Europe holds the second-largest market share, supported by stringent data privacy laws, robust e-prescription systems, and rising demand for at-home healthcare services. Countries like Germany, the UK, and France are leading in terms of adoption and infrastructure. The market is benefiting from cross-border digital health initiatives and expanding e-pharmacy licenses. Consumers in Europe show strong preference for regulated, high-quality health products with transparent supply chains. It is also seeing growth in wellness and preventive care product categories.

Asia Pacific

The Asia Pacific Healthcare E-Commerce Market size was valued at USD 45,854.80 million in 2018 to USD 85,861.58 million in 2024 and is anticipated to reach USD 314,448.42 million by 2032, at a CAGR of 17.6% during the forecast period. Asia Pacific is emerging as the fastest-growing region due to high mobile internet usage, growing middle-class population, and increasing healthcare awareness. China, India, and Japan drive the market, supported by digital health campaigns and expanding logistics networks. It is witnessing strong demand for over-the-counter medicines, wellness products, and teleconsultation services. Government initiatives to boost telemedicine and online pharmacies further accelerate market expansion. Domestic e-commerce giants are investing heavily in digital healthcare channels to capture market share.

Latin America

The Latin America Healthcare E-Commerce Market size was valued at USD 9,093.24 million in 2018 to USD 16,066.49 million in 2024 and is anticipated to reach USD 47,943.74 million by 2032, at a CAGR of 14.7% during the forecast period. Latin America is showing steady growth supported by improving internet penetration and growing interest in affordable healthcare alternatives. Brazil and Argentina lead the market with rising consumer adoption of online pharmacies and wellness platforms. It is overcoming regulatory challenges through localized e-commerce models and cash-on-delivery services. The region is also investing in digital payment integration and remote care delivery to reach underserved areas. Public-private partnerships are creating new opportunities for digital health innovation.

Middle East

The Middle East Healthcare E-Commerce Market size was valued at USD 7,616.56 million in 2018 to USD 12,798.06 million in 2024 and is anticipated to reach USD 38,319.91 million by 2032, at a CAGR of 14.8% during the forecast period. The Middle East is experiencing rising demand for healthcare e-commerce platforms driven by urbanization, chronic illness rates, and digital transformation initiatives. Countries like the UAE and Saudi Arabia are investing in healthcare digitization and smart city infrastructure. It benefits from growing interest in personalized care, online consultations, and direct product delivery. Consumer behavior is shifting toward wellness and premium health offerings. Government strategies such as Vision 2030 are helping shape a tech-enabled healthcare environment.

Africa

The Africa Healthcare E-Commerce Market size was valued at USD 6,217.60 million in 2018 to USD 13,497.40 million in 2024 and is anticipated to reach USD 40,119.09 million by 2032, at a CAGR of 14.3% during the forecast period. Africa represents an emerging growth frontier for the Healthcare E-Commerce Market, driven by mobile-first internet access and the need for improved healthcare accessibility. South Africa and Egypt are at the forefront, with expanding digital health infrastructure and local e-pharmacy startups. It is addressing challenges such as logistics and regulatory gaps through innovative delivery models and community health partnerships. The market is gaining traction in essential medicines, maternal care products, and basic diagnostics. E-commerce platforms are also supporting health education and outreach in remote areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amazon Inc.

- Exactcare Pharmacy

- CVS Health

- Flipkart Pvt. Ltd.

- Alibaba Group Holding Limited

- eBay Inc.

- Remdi SeniorCare

- Lloyds Pharmacy Limited

- McCabes Pharmacy

- Walgreens Boots Alliance Inc.

Competitive Analysis

The Healthcare E-Commerce Market is highly competitive, with a mix of global e-commerce giants, specialized healthcare platforms, and regional players vying for market share. It is characterized by rapid technological innovation, aggressive pricing strategies, and expanding product portfolios. Companies like Amazon, Alibaba, and CVS Health lead with extensive distribution networks, scalable platforms, and integrated services such as telehealth and pharmacy fulfillment. Startups and niche players focus on personalized care, subscription models, and region-specific solutions. Strategic collaborations with logistics providers, health insurers, and telemedicine platforms help strengthen competitive positioning. The market rewards players that ensure product authenticity, data security, and reliable delivery. Regulatory compliance, user experience, and brand trust remain key differentiators. It continues to evolve with advancements in AI, last-mile delivery, and digital payment systems, encouraging new entrants and forcing incumbents to innovate continuously. Competitive intensity is expected to increase as more players enter and consumer expectations rise.

Recent Developments

- In July 2025, Nordic Capital acquired the U.S.-based healthcare analytics firm Arcadia Solutions, aiming to leverage its AI-driven data tools to improve patient outcomes and expand Middle East presence.

- In June 2025, Amazon Pharmacy introduced a caregiver support feature and extended Medicare eligibility for its PillPack service, enhancing assistance for older adults and caregivers.

- in October 2023, Dr. Reddy’s Laboratories launched its first direct-to-consumer (D2C) e-commerce website, Celevida Wellness, targeting diabetes patients through its subsidiary Svaas Wellness Limited.

- In May 2024, Johnson & Johnson announced its acquisition of ShockWave Medical, a cardiovascular medical device company, in a deal valued at approximately \$13.1 billion.

Market Concentration & Characteristics

The Healthcare E-Commerce Market is moderately concentrated, with a mix of global giants and regional players shaping its competitive landscape. It is dominated by a few key players such as Amazon, Alibaba, CVS Health, and Walgreens Boots Alliance, who hold significant market shares due to their extensive infrastructure, brand trust, and integrated service offerings. The market features high entry barriers related to regulatory compliance, product authentication, and secure logistics. It is characterized by rapid innovation, frequent product rollouts, and strong investment in digital platforms. Companies compete by offering seamless user experiences, personalized services, and robust supply chain capabilities. Strategic partnerships with healthcare providers, logistics firms, and technology companies help strengthen market position. The rise of local startups in emerging economies is contributing to increased fragmentation, offering specialized services and catering to region-specific needs. The Healthcare E-Commerce Market rewards scale, reliability, and compliance while creating opportunities for niche innovation and digital-first business models.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for online healthcare platforms will grow due to increasing consumer preference for convenience and home-based care.

- Integration of AI and machine learning will enhance personalization, inventory management, and real-time customer support.

- Telemedicine and e-pharmacy services will become more connected through unified digital health ecosystems.

- Governments will continue to refine regulations to support safe and secure digital healthcare transactions.

- Subscription-based models for recurring healthcare needs will gain more popularity among aging and chronic care populations.

- Companies will invest in cold chain logistics to support the growth of temperature-sensitive pharmaceutical deliveries.

- Mobile-first strategies will drive adoption in developing regions with limited physical healthcare access.

- Consumer demand for health and wellness products will increase across preventive care and lifestyle management categories.

- Strategic collaborations between e-commerce platforms, insurers, and healthcare providers will strengthen market presence.

- Innovation in last-mile delivery and automation will improve operational efficiency and expand rural service reach.