Market Overview

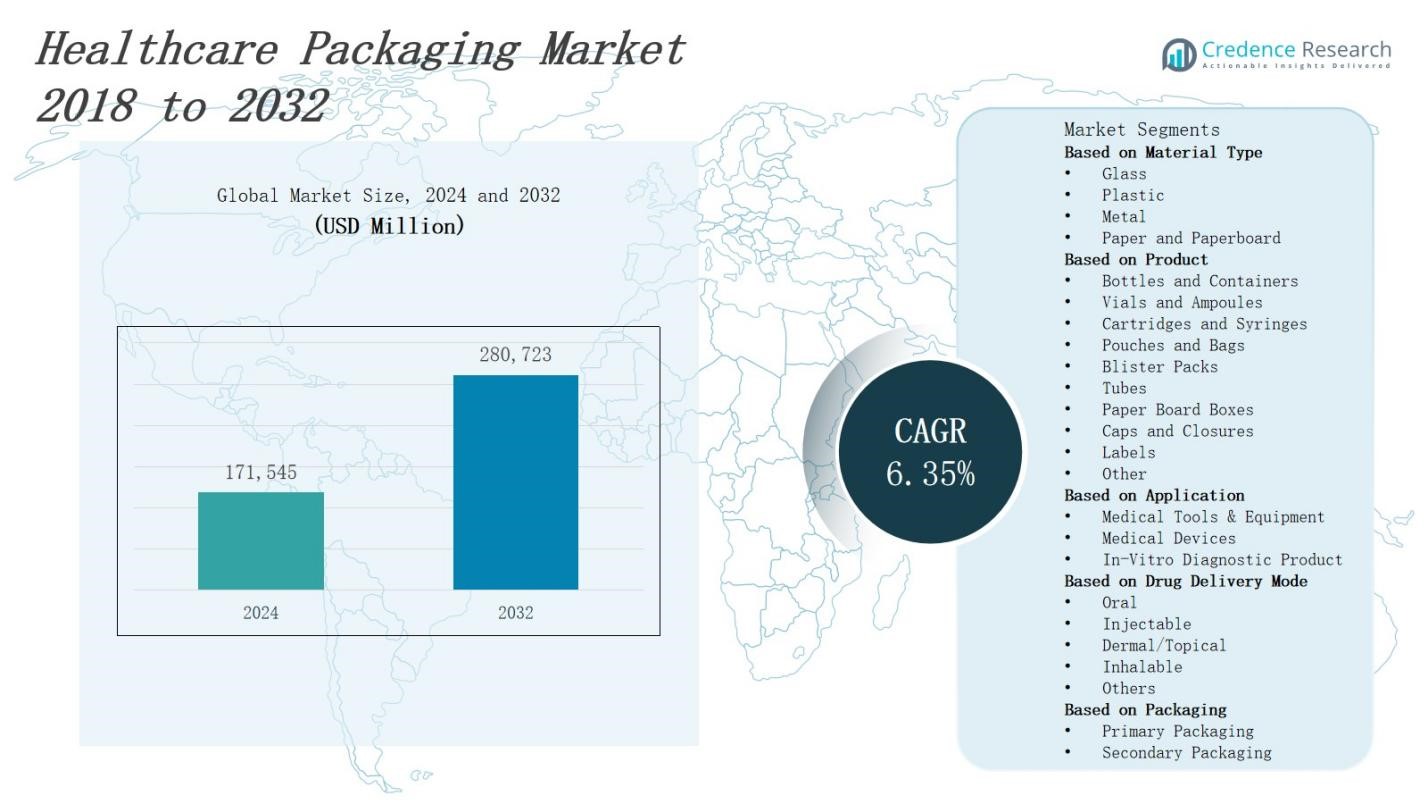

The healthcare packaging market is projected to grow from USD 171,545 million in 2024 to USD 280,723 million by 2032 at a compound annual growth rate of 6.35%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Packaging Market Size 2024 |

USD 171,545 Million |

| Healthcare Packaging Market, CAGR |

6.35% |

| Healthcare Packaging Market Size 2032 |

USD 280,723 Million |

The healthcare packaging market benefits from strict regulatory requirements and growing demand for product safety. Manufacturers develop advanced sterilization‑compatible materials and tamper‑evident designs to meet FDA and EU standards. Rising patient awareness drives adoption of antimicrobial coatings and temperature‑monitoring labels. Sustainability initiatives prompt investment in recyclable and bio‑based substrates that reduce environmental impact. The expansion of pharmaceutical e‑commerce channels increases demand for durable, leak‑proof formats. Technological innovations such as serialization and RFID tracking enhance supply chain traceability. Automation and digital printing streamline production and support personalized labeling. Combined, these trends and drivers significantly propel market growth at a steady pace.

The healthcare packaging market spans North America, Europe, Asia Pacific, Latin America and Middle East & Africa, each region display dynamics. North America commands leadership with robust production and logistics. Europe emphasizes sustainability and regulatory compliance. Asia Pacific offers volume growth in China and India. Latin America benefits from growth in pharma sectors in Brazil and Mexico. Middle East & Africa posts demand in GCC and South Africa. Leading firms such as Amcor plc, Berry Global Inc., Huhtamäki Oyj, 3M Company and Sonoco Products Company shape competition through innovative solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market will expand from USD 171,545 million in 2024 to USD 280,723 million by 2032 at a 6.35% CAGR.

- It faces stringent FDA, EMA and ISO standards that drive adoption of high‑barrier polymers, multilayer films and tamper‑evident closures.

- Serialization, RFID tracking and temperature‑sensitive labels enhance traceability and protect biologics across the supply chain.

- Recyclable plastics, bio‑based substrates and lightweight designs reduce environmental impact and support corporate sustainability goals.

- Digital printing and automated inspection accelerate SKU changeovers, ensure label accuracy and boost production throughput.

- Asia Pacific commands 37% market share, North America holds 28%, Europe 24%, Latin America 7% and Middle East & Africa 4%.

- Amcor plc, Berry Global Inc., Huhtamäki Oyj, 3M Company and Sonoco Products Company lead competition through innovation and green credentials.

Market Drivers

Stringent Standards Drive Material Development

The healthcare packaging market faces rigorous FDA, EMA and ISO requirements that mandate sterilization compatibility and barrier performance. It compels manufacturers to adopt high‑performance polymers and multilayer films. Producers test materials for extractables and leachables. They validate designs for medical devices and injectable drugs. Regulatory audits push innovation in tamper‑evident closures and peelable seals. Companies invest in quality systems to ensure compliance. This regulatory environment propels market expansion.

Patient Safety and Traceability Enhance Solutions

The healthcare packaging market emphasizes patient safety and supply chain transparency. It drives adoption of serialization and RFID tracking across primary and secondary packaging. Stakeholders require unique identification on vials and blister packs. Manufacturers integrate temperature‑sensitive labels to protect biologics. Companies implement anti‑counterfeit features to guard against diversion. It stimulates collaboration between packaging converters and biotech firms. This focus on traceability reinforces trust and propels market demand.

For instance, Schreiner MediPharm integrates RFID tags directly during manufacturing of pharmaceutical products, enabling hospitals to automate inventory management and monitor medication stock and expiration dates with 100% transparency.

Sustainability Initiatives Drive Material Selection

The healthcare packaging market adopts eco‑friendly substrates to meet environmental targets. It encourages use of recyclable plastics and bio‑based polymers. Manufacturers transition to lightweight designs that lower carbon footprint during transport. Companies develop compostable pouches for single‑use devices. Stakeholders partner with resin suppliers to secure certified sustainable materials. It reduces waste across clinical and retail channels. This shift toward green packaging enhances brand reputation and supports long‑term growth.

For instance, SÜDPACK Medica developed PharmaGuard®, a polypropylene (PP)-based recyclable blister packaging that aligns with sustainability standards, reduces eco-footprint, and can be processed on existing blister lines without compromising quality or product protection.

Digital Print and Automation Enhance Efficiency

The healthcare packaging market leverages digital print for customized labeling that meets patient‑specific needs. It integrates automated inspection systems to detect defects and ensure quality. Manufacturers deploy robotic assembly for consistent seal integrity on syringes and vials. Companies implement machine vision to verify label accuracy and lot codes. It streamlines changeover between SKUs and reduces downtime. Automation lowers labor costs and accelerates production throughput. This technological drive boosts market efficiency and competitiveness.

Market Trends

Smart Packaging Enhances Product Integrity

The healthcare packaging market leverages smart labels with embedded sensors that verify temperature and humidity. It supports real‑time quality checks for temperature‑sensitive therapeutics. Manufacturers equip vials and cartridges with NFC tags that grant instant authentication. Developers integrate QR codes to deliver patient guidance and dosage instructions. Converters install cloud platforms to monitor distribution data. Providers expand remote diagnostics by linking sensors to healthcare networks. This trend secures product integrity.

For instance, Pfizer incorporates NFC tags on packaging to authenticate products instantly and enhances patient engagement through digital interaction, securing supply chain integrity and reducing counterfeit risks.

Personalization and Patient‑Centric Designs Rise

The healthcare packaging market sees growth in patient‑centric formats that improve dosing accuracy and ease of use. It drives companies to offer personalized blister packs and pre‑filled syringes. Manufacturers tailor ergonomic shapes and color schemes to enhance patient adherence. Converters employ variable data printing to encode individual instructions. Providers test user feedback to optimize cap designs and clear instructions. This shift reduces medication errors and improves patient outcomes.

For instance, Dr Ferrer BioPharma introduced an award-winning nasal spray packaging that enhances patient comfort and compliance through user-friendly design features tested in patient feedback sessions.

Eco‑Conscious Materials Gain Momentum

The healthcare packaging market adopts recyclable polymers and bio‑based substrates to cut waste. It prompts partnerships with resin suppliers that hold sustainability certifications. Manufacturers replace single‑use plastics with compostable films for device packaging. Converters redesign cartons to use minimal materials without compromising protection. Providers implement return programs for reusable containers. This strategy supports corporate responsibility and aligns with global environmental targets. It reduces landfill impact and enhances brand credibility.

Digital Transformation Streamlines Production

The healthcare packaging market integrates robotics and AI‑driven inspection to boost output quality. It installs automated seal verification on pouch and bottle lines. Manufacturers use digital printing systems to apply dynamic labels and batch codes in real time. Converters adopt vision systems that validate every package before shipment. Providers monitor performance metrics through cloud dashboards. This digital makeover reduces manual errors and speeds delivery. It improves compliance with stringent labeling regulations.

Market Challenges Analysis

Complex Regulatory Landscape Strains Innovation

The healthcare packaging market faces a rigorous regulatory environment that demands thorough validation and documentation. It compels manufacturers to allocate resources for compliance audits and quality management systems. Regulators enforce strict criteria for material safety, sterilization compatibility and label accuracy. It extends development timelines and raises barriers for new product launches. Companies engage with notified bodies and certification agencies to secure approvals. It challenges smaller converters that lack comprehensive compliance frameworks. These requirements slow time to market and inflate R&D expenditures.

Rising Raw Material Costs and Supply Volatility

The healthcare packaging market grapples with volatile raw material prices that challenge packaging converters. Demand spikes for specialty polymers lead suppliers to raise resin costs. It affects profit margins for both primary and secondary packaging providers. Global supply chain disruptions hinder timely delivery of essential components. Companies face inventory shortages and scramble to qualify alternative sources. It forces stakeholders to adjust production schedules and negotiate longer lead times. These cost pressures reduce flexibility for innovation and strain operational budgets.

Market Opportunities

Growth in Biologics and Personalized Therapy Fuels Demand

The healthcare packaging market benefits from the rise of biologics and personalized therapies that require specialized containment and delivery formats. Increased use of single‑dose autoinjectors and prefilled syringes demands novel barrier films and advanced closure systems. It opens opportunities for converters to supply high‑barrier laminates and puncture‑resistant pouches. Manufacturers that offer compatibility with cold chain protocols gain competitive advantage in biologic drug distribution. Pharmaceutical companies seek packaging partners that can validate sterile barrier performance under strict protocols. This alignment of material science with therapy trends drives adoption of next‑generation packaging solutions. Stakeholders that invest in collaborative R&D projects capture a larger share of this high‑growth segment.

Expansion into Emerging Regions and Smart Technologies

The healthcare packaging market extends into emerging regions with expanding pharmaceutical sectors in Latin America and Asia‑Pacific. It presents converters with volume growth and the need for cost‑effective, scalable production lines. Digital print integration allows rapid label customization and local language compliance for diverse markets. Smart packaging technologies that incorporate RFID and NFC tags enable remote monitoring and patient engagement. Stakeholders that deploy automated production cells reduce lead times and improve quality metrics. This blend of regional expansion and digital adoption supports sustainable growth trajectories. Partners that align with these trends position themselves for long‑term success in global supply chains.

Market Segmentation Analysis:

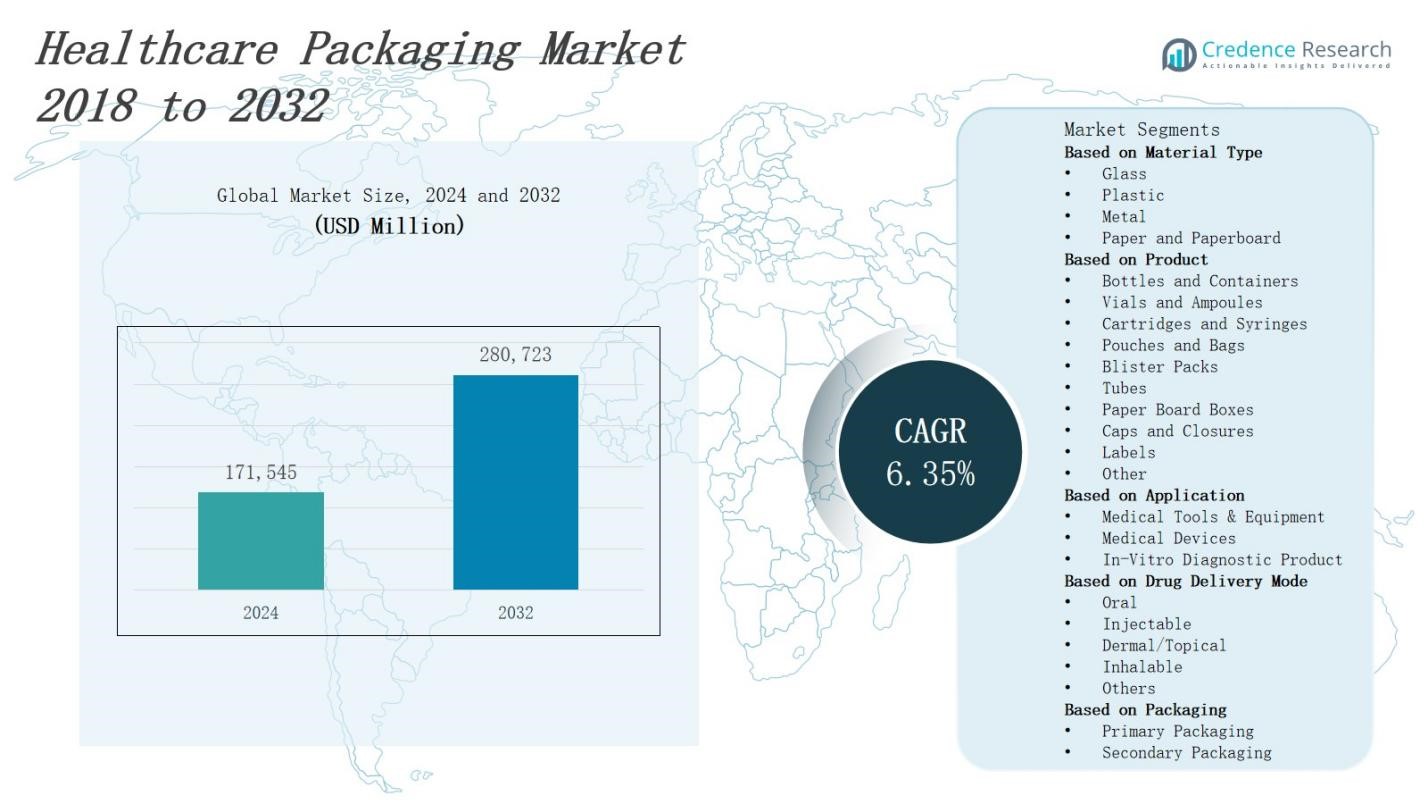

By Material Type

The healthcare packaging market divides into glass, plastic, metal and paper & paperboard segments that address varied protection requirements. It assigns glass to injectables and diagnostics because of its chemical inertness and clarity. Plastic dominates disposables due to low cost and impact resistance. Metal supports advanced barrier properties for oxygen‑sensitive drugs. Paper & paperboard serves secondary packaging and cartons. This segmentation guides converters to select substrates that optimize safety, durability and regulatory compliance for each application.

For instance, Gerresheimer utilizes glass extensively for injectable pharmaceuticals due to its chemical inertness and clarity, ensuring drug stability and patient safety.

By Product

The healthcare packaging market organizes products into bottles & containers, vials & ampoules, cartridges & syringes, pouches & bags, blister packs, tubes, paperboard boxes, caps & closures, labels and other formats. It allocates vials & ampoules and cartridges & syringes for parenteral therapies. Bottles & containers and tubes suit oral and topical drugs. Pouches & bags and blister packs protect single‑dose units. Caps & closures and labels integrate tracking and tamper evidence. This structure helps manufacturers tailor designs to meet dosing accuracy, handling and supply‑chain traceability requirements.

For instance, Uhlmann’s LiPro system efficiently packages vials, ampoules, and cartridges with integrated Track & Trace software to ensure patient safety and clear product traceability.

By Application

The healthcare packaging market applies to medical tools & equipment, medical devices and in‑vitro diagnostic products. It serves medical tools & equipment with rigid trays and pouches that ensure sterility during storage and transport. Medical devices require customized packaging that preserves calibration and functionality. In‑vitro diagnostic products demand barrier films and compartmented formats to prevent cross‑contamination. This categorization enables stakeholders to address unique performance specifications, validate packaging protocols and maintain compliance across diverse healthcare segments.

Segments:

Based on Material Type

- Glass

- Plastic

- Metal

- Paper and Paperboard

Based on Product

- Bottles and Containers

- Vials and Ampoules

- Cartridges and Syringes

- Pouches and Bags

- Blister Packs

- Tubes

- Paper Board Boxes

- Caps and Closures

- Labels

- Other

Based on Application

- Medical Tools & Equipment

- Medical Devices

- In-Vitro Diagnostic Product

Based on Drug Delivery Mode

- Oral

- Injectable

- Dermal/Topical

- Inhalable

- Others

Based on Packaging

- Primary Packaging

- Secondary Packaging

Based on Packaging Format

-

- Bags & Pouches

- Envelopes

- Tubes

- Sachets

-

- Trays

- Boxes & Folding Cartons

- Clamshells

- Blisters

- Bottles & Jars

- Containers

- Aerosol Cans

- Ampoules & Vials

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The healthcare packaging market holds a 28 percent share in North America. It benefits from robust pharmaceutical production and stringent FDA regulations. Manufacturers deploy high‑barrier polymers and multilayer films for sterile injectables. Converters integrate serialization systems to prevent counterfeiting. Companies invest in digital printing for rapid label customization. This region supports advanced automation and quality management systems. Stakeholders drive innovation through strategic technical collaborations and infrastructure investments globally across sectors.

Europe

The healthcare packaging market commands a 24 percent share in Europe. It relies on stringent EU directives and comprehensive sustainability mandates. Manufacturers adopt recyclable polymers and lightweight laminate designs. Converters integrate advanced barrier films for diagnostic kits and medical devices. Companies employ automated inspection systems to verify seal integrity. Stakeholders invest in digital printing for rapid SKU changeovers. Regulatory frameworks and green policies drive improvement and competitive differentiation across markets.

Asia Pacific

The healthcare packaging market secures a 37 percent share in Asia Pacific. It leverages cost-efficient manufacturing hubs in China and India. Manufacturers produce high-volume syringe and vial packaging to meet growing demand. Converters expand cold chain capabilities for sensitive biologics and vaccines. Companies customize labels for local language requirements and regulatory compliance. Stakeholders adopt scalable automation to enhance throughput. This focus drives sustainable growth and competitive advantage across emerging economies.

Latin America & Middle East & Africa

The healthcare packaging market holds 7 percent in Latin America and 4 percent in Middle East & Africa. It serves growing pharmaceutical sectors in Brazil, Mexico, Gulf states and South Africa. Manufacturers produce cost‑efficient blister packs and sachets for generics. Converters adapt materials to withstand tropical and arid climates. Companies integrate multilingual labels, tamper‑evident seals. Stakeholders establish regional facilities to improve distribution speed. This focus offers growth through collaborations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Berry Global Inc.

- Dunmore Corporation

- Toray Plastics, Inc.

- CCL Industries Inc.

- Sonoco Products Company

- Winpak Ltd.

- 3M Company

- Constantia Flexibles Group GmbH

- Sealed Air Corporation

- Huhtamäki Oyj

- Gerresheimer AG.

- Amcor plc

- DS Smith Plc

Competitive Analysis

Leading packaging converters and material suppliers such as Amcor plc, Berry Global Inc., and Huhtamäki Oyj compete on quality, innovation and sustainability. The healthcare packaging market demands high barrier performance for sterile drugs and sensitive biologics. It pushes firms to develop multilayer films, advanced polymers and peelable seals that meet stringent FDA and EMA requirements. Companies such as Sealed Air Corporation and Constantia Flexibles Group secure contracts by offering tamper‑evident closures and digital printing capabilities that enable rapid SKU customization. Firms like 3M Company differentiate offerings through antimicrobial coatings and surface modifications. Smaller specialists such as Winpak Ltd. and Toray Plastics, Inc. target niche applications with bespoke pouches and cold‑chain liners. Industry leaders invest in automation and serialization technology to accelerate throughput and enhance traceability. Strategic partnerships between converters and pharmaceutical brands streamline supply chains and reduce lead times. Competitive pressure drives consolidation through mergers and acquisitions, while joint R&D projects accelerate material innovation and reduce overall packaging costs.

Recent Developments

- In December 2024, Japan-based TOPPAN Holdings acquired the thermoformed and flexibles packaging business of Sonoco Products, a deal valued at $1.8 billion, highlighting consolidation in the packaging sector.

- On July 21, 2025, Ampersand Capital Partners completed the acquisition of CurTec Group B.V., a specialist in high‑performance plastic packaging for pharmaceutical and specialty chemicals

- On July 25, 2025, Nelipak® Corporation broke ground on a new ISO 13485‑certified healthcare packaging facility in Grecia, Alajuela, Costa Rica.

- On July 24, 2025, DuPont launched Tyvek® with Renewable Attribution, an extension of its sustainable healthcare packaging portfolio designed to lower carbon footprint.

Market Concentration & Characteristics

The healthcare packaging market exhibits moderate-to-high concentration, with top ten players controlling the majority of global revenue. Major firms such as Amcor plc, Berry Global Inc., Huhtamäki Oyj and 3M Company secure contracts with leading pharmaceutical manufacturers through proven compliance and advanced material portfolios. It features high entry barriers due to strict regulatory approval processes, capital-intensive production lines and certified quality management systems. Market participants compete on innovation in barrier technologies, tamper‑evident solutions and sustainability credentials. Niche specialists provide tailored offerings for regional biosimilar and vaccine packaging segments. It involves strategic partnerships between converters, resin suppliers and pharmaceutical brands to accelerate product development. Regional fragmentation persists in emerging markets, where local converters adapt materials for climate resilience and cost optimization. Volume production centers in Asia Pacific supply cost‑effective solutions, while North America and Europe drive high‑margin custom formats. It demands continuous investment in automation and traceability systems to comply with evolving pharmaceutical distribution models.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Product, Application, Drug Delivery Mode, Packaging, Packaging Format and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will adopt smart labels with real‑time monitoring to ensure product integrity.

- Companies will expand cold‑chain packaging solutions to support growing biologics and vaccines.

- Converters will integrate digital printing for on‑demand, patient‑specific labeling.

- Suppliers will develop bio‑based and recyclable materials to meet environmental mandates.

- Firms will deploy robotics and AI‑driven inspection to enhance production accuracy.

- Stakeholders will collaborate on serialization networks to combat counterfeiting globally.

- Providers will customize ergonomic packaging to improve patient adherence and dosing.

- Regions will localize manufacturing to reduce lead times and supply‑chain risk.

- Partners will invest in modular production lines to accommodate rapid SKU changes.

- Brands will leverage data analytics to optimize packaging design and reduce waste.