Market Overview:

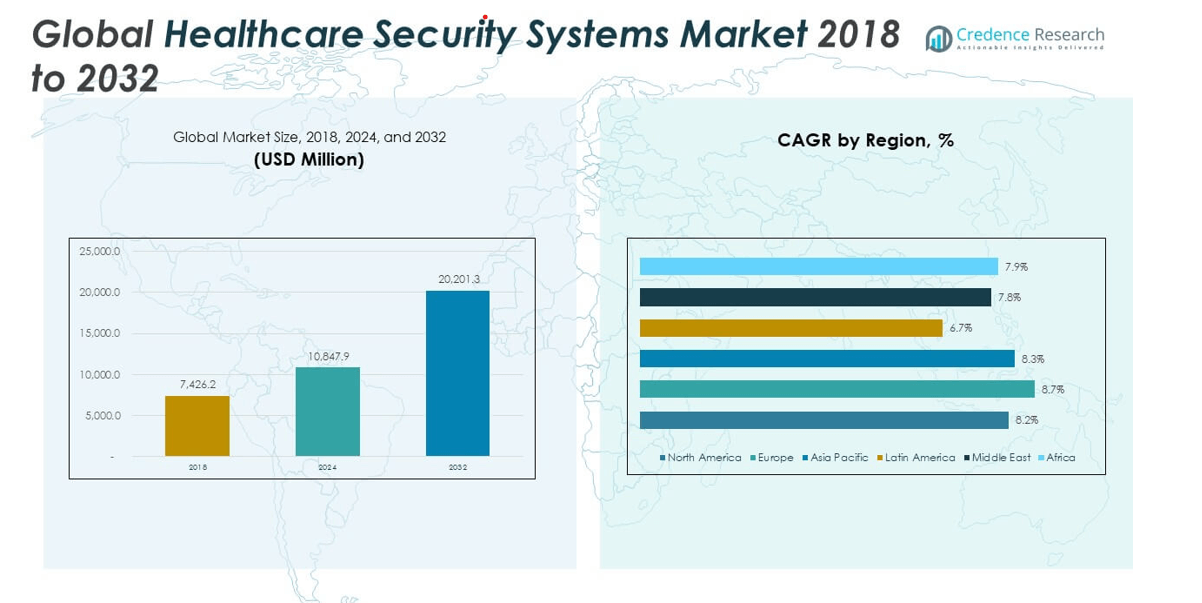

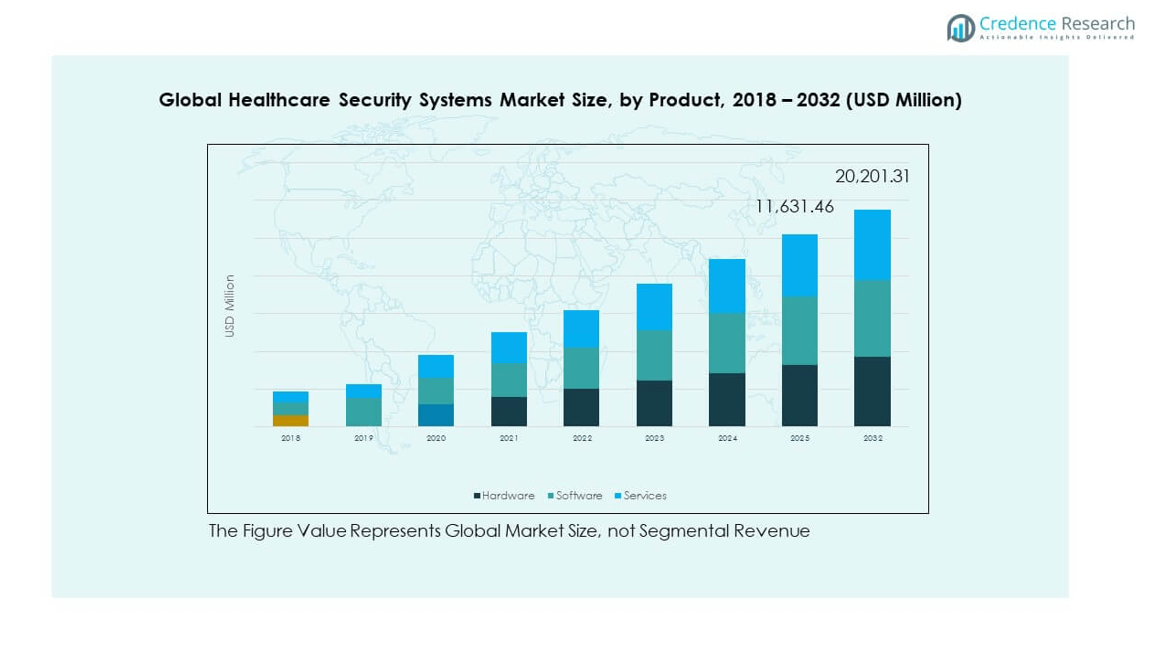

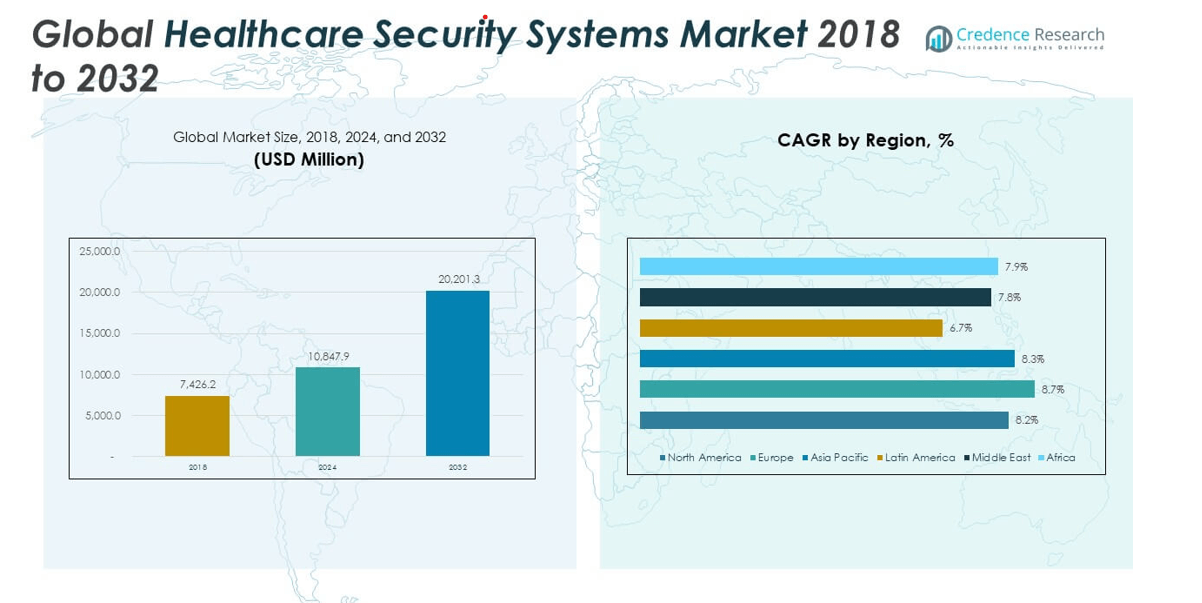

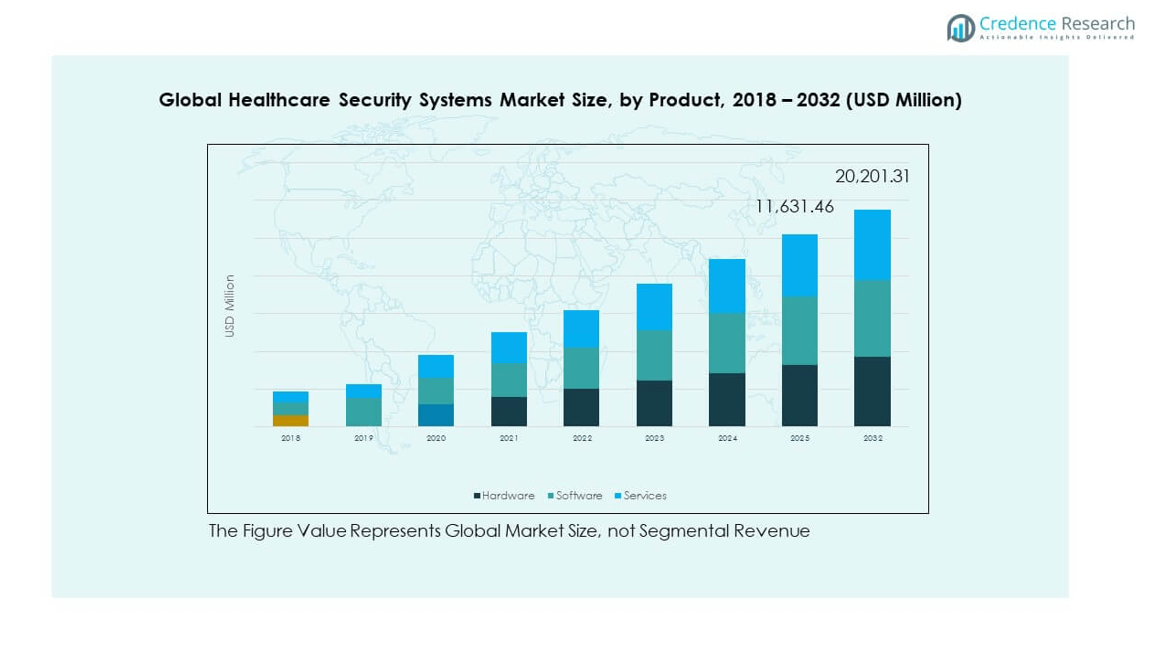

The Healthcare Security Systems Market size was valued at USD 7,426.2 million in 2018 to USD 10,847.9 million in 2024 and is anticipated to reach USD 20,201.3 million by 2032, at a CAGR of 8.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Security Systems Market Size 2024 |

USD 10,847.9 million |

| Healthcare Security Systems Market, CAGR |

8.21% |

| Healthcare Security Systems Market Size 2032 |

USD 20,201.3 million |

The growth of the healthcare security systems market is primarily driven by the increasing need to safeguard sensitive patient data, ensure physical safety within healthcare facilities, and comply with stringent data protection regulations. As healthcare institutions adopt digital solutions and IoT-connected medical devices, the risk of cyber threats and data breaches escalates. This has compelled hospitals, clinics, and other providers to invest in advanced surveillance, access control, and cybersecurity systems. Furthermore, rising healthcare infrastructure investments and growing awareness of security vulnerabilities continue to reinforce the demand for integrated security solutions.

North America leads the healthcare security systems market due to its mature healthcare infrastructure, higher adoption of digital technologies, and strong regulatory mandates on patient data protection. Europe follows closely with similar regulatory frameworks and increasing investment in hospital modernization. Meanwhile, Asia-Pacific is emerging as the fastest-growing region, driven by rapid healthcare expansion in countries like China and India, alongside increasing focus on improving hospital security. The Middle East and Latin America are also showing growth potential as healthcare facilities modernize and prioritize security enhancements across their operations.

Market Insights:

- The Healthcare Security Systems Market was valued at USD 10,847.9 million in 2024 and is expected to reach USD 20,201.3 million by 2032, growing at a CAGR of 8.21%.

- Rising cyber threats and increasing adoption of connected medical devices are driving demand for integrated physical and digital security solutions.

- Regulatory compliance requirements such as HIPAA and GDPR continue to push healthcare providers toward investing in advanced security infrastructure.

- High initial costs and budget constraints in smaller healthcare facilities limit widespread adoption of next-generation security systems.

- North America led the Healthcare Security Systems Market in 2024, capturing 32.02% of the global share, supported by strong digital infrastructure.

- Asia Pacific is emerging as the fastest-growing region, fueled by healthcare digitization initiatives in China, India, and Southeast Asia.

- Hospitals remain the largest end-user segment due to their complex security needs and higher exposure to physical and cyber threats.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Regulatory Mandates are Accelerating Demand for Comprehensive Healthcare Security Systems

Government regulations such as HIPAA, GDPR, and other patient data protection laws are driving the integration of robust security infrastructure in healthcare facilities. Organizations must meet strict compliance standards to avoid penalties and legal consequences. Healthcare providers now prioritize secure data storage and transmission across all endpoints. Security systems that offer real-time monitoring, encryption, and breach detection have become essential. The Healthcare Security Systems Market is expanding due to this rising need for compliance-driven solutions. It benefits vendors offering tools that align with regulatory frameworks. Failure to meet these legal standards can severely impact operational continuity. Healthcare institutions recognize security as an operational necessity rather than a discretionary expense.

- For example, TechMagic developed a HIPAA-compliant digital platform for a U.S.-based healthcare provider with over 60 specialty care locations. The solution enabled secure data storage, billing workflows, and strict access controls aligned with regulatory standards.

Increasing Incidences of Cybersecurity Threats in Healthcare Environments

Cyberattacks targeting healthcare institutions have become more frequent and sophisticated. Ransomware, phishing, and data exfiltration attacks jeopardize patient safety and data integrity. Hospitals and clinics handle vast amounts of sensitive information, making them high-value targets. The Healthcare Security Systems Market continues to grow as cybersecurity threats escalate globally. It supports adoption of firewalls, multi-factor authentication, and endpoint detection systems. Decision-makers now invest in proactive and layered cybersecurity approaches. Real-time threat intelligence and zero-trust architectures gain momentum across institutions. These evolving threats push healthcare organizations to overhaul outdated IT and security systems.

Expansion of Telehealth and Remote Patient Monitoring Solutions

The proliferation of remote healthcare services raises new concerns about data transmission and endpoint security. Telehealth platforms require encrypted communication channels and authenticated access to maintain confidentiality. Hospitals must safeguard not only internal systems but also patient devices connecting to networks. The Healthcare Security Systems Market responds to these new vulnerabilities with advanced telehealth-compatible solutions. It enables secure virtual consultations, remote diagnostics, and real-time monitoring without compromising privacy. Healthcare providers now embed security at the design stage of digital health solutions. Rising demand for home-based care further amplifies the need for secure data environments. Organizations also train staff and patients in best practices to minimize risks.

Rising Physical Security Threats Within Healthcare Infrastructure

Physical threats, including theft, unauthorized access, and violence in hospitals, highlight the need for advanced surveillance and control systems. Emergency rooms, pharmacies, and data centers are particularly vulnerable areas. The Healthcare Security Systems Market gains momentum by providing integrated video surveillance, smart ID systems, and visitor management tools. It enables administrators to monitor staff, patients, and third-party contractors in real time. With increasing foot traffic in healthcare environments, manual security becomes ineffective. Organizations adopt AI-powered surveillance and biometric access control to address security loopholes. These systems also support post-incident analysis and forensic investigations. Investment in physical security solutions remains essential to maintain operational safety and regulatory compliance.

- For instance, Northwell Health expanded AI-powered physical security, integrating Motorola Solutions’ analytics across its 26 hospitals and 1,000 care sites. The system’s smart video, radio integration, and automated threat detection supports real-time alerts for incidents like unauthorized entry, unattended items, and fall risks.

Market Trends

Integration of AI and Predictive Analytics into Healthcare Security Systems

AI-powered tools help healthcare institutions detect anomalies, automate responses, and reduce reliance on manual monitoring. Predictive analytics identifies potential threats by analyzing behavioral and usage patterns across systems. The Healthcare Security Systems Market sees strong traction in solutions offering AI-driven threat detection and prevention. It supports smarter surveillance, incident response, and risk management. AI also improves false-positive rates, reducing the workload on security teams. Machine learning models continuously refine threat recognition capabilities based on historical data. Hospitals now rely on AI to secure both digital and physical environments. This trend continues to redefine security management strategies across the healthcare sector.

Adoption of IoT Security Protocols to Safeguard Connected Medical Devices

The proliferation of IoT-enabled medical devices increases the complexity of securing healthcare networks. Connected systems such as infusion pumps, wearables, and diagnostic devices introduce new attack surfaces. The Healthcare Security Systems Market adapts by embedding security protocols at the device level. It enhances authentication, encryption, and remote device management capabilities. Healthcare institutions now demand security-by-design principles for all connected technologies. Vendors develop security solutions tailored for medical IoT ecosystems. Device-specific firewalls, endpoint isolation, and firmware protection play critical roles. Organizations also segment networks to minimize risk exposure from compromised devices. This trend reinforces the importance of end-to-end device security.

- For instance, a security assessment of over 200,000 infusion pumps across various hospitals using IoT Security from Palo Alto Networks revealed that 75% of devices had at least one known vulnerability.

Growth in Cloud-Based Healthcare Security Platforms and Services

Healthcare institutions are migrating to cloud environments to improve scalability and access. This transition requires security solutions capable of managing hybrid and multi-cloud infrastructures. The Healthcare Security Systems Market expands to support cloud-native security tools and SaaS-based monitoring platforms. It offers centralized dashboards, automated threat alerts, and policy enforcement across distributed systems. Hospitals now prefer security models that adapt to evolving cloud architectures. Cloud-based systems enable faster response times and easier updates. Vendors are integrating compliance checks and audit trails into cloud security offerings. This trend enhances both efficiency and transparency for security teams.

- For example, Censinet RiskOps™ enabled healthcare organizations to automate third‑party risk assessments and maintain real‑time monitoring, achieving an average Mean Time to Contain (MTTC) of just 2 hours in cloud-based environments. It automates vendor evaluation, reduces manual processes, and continuously updates risk profiles to accelerate incident containment and strengthen cybersecurity resilience

Focus on Identity and Access Management to Prevent Unauthorized Data Access

Ensuring that only authorized personnel can access sensitive data is critical to healthcare operations. Organizations implement identity and access management (IAM) frameworks to manage users, roles, and privileges. The Healthcare Security Systems Market supports IAM through biometric authentication, smart cards, and role-based controls. It limits exposure to insider threats and unintentional data leaks. IAM tools also streamline audit processes and user provisioning. With growing workforce mobility, healthcare institutions need secure access across locations and devices. Vendors offer integrated IAM solutions that work across cloud, on-premise, and mobile platforms. This trend addresses both compliance and operational efficiency requirements.

Market Challenges Analysis

High Costs of Advanced Security Infrastructure and Limited IT Budgets in Smaller Facilities

Implementing modern security systems often involves significant upfront investments in hardware, software, and skilled personnel. Smaller clinics and regional hospitals struggle to allocate sufficient funds for such infrastructure. The Healthcare Security Systems Market must address the affordability gap that persists among low- and mid-tier institutions. It often excludes smaller providers from adopting comprehensive solutions. Budget constraints limit integration of AI, biometrics, and advanced access control technologies. Subscription-based models help mitigate costs but may still be unsustainable in some geographies. Organizations face trade-offs between immediate operational needs and long-term security goals. Lack of financial flexibility delays modernization efforts and exposes these facilities to avoidable risks.

Shortage of Cybersecurity Expertise and Operational Knowledge in Healthcare Settings

Healthcare providers face difficulty hiring and retaining skilled cybersecurity professionals who understand both IT systems and clinical operations. The shortage of talent leads to inadequate monitoring, delayed incident responses, and misconfigured systems. The Healthcare Security Systems Market continues to suffer from a lack of in-house expertise, especially in public sector healthcare. It increases dependence on third-party vendors and managed security services, which may not always align with the organization’s internal workflows. Training programs remain limited or outdated, resulting in operational inefficiencies and increased vulnerabilities. Constant technology upgrades demand continuous skill development, which most healthcare institutions find hard to sustain.

Market Opportunities

Growing Demand for Integrated Solutions Across Physical and Digital Security Domains

Healthcare providers increasingly seek unified platforms that consolidate physical surveillance, access control, and cybersecurity functions. The Healthcare Security Systems Market sees rising demand for integrated systems that offer centralized management and interoperability. It allows administrators to oversee facility-wide security from a single interface. Vendors offering flexible, scalable solutions tailored to hospital workflows are well-positioned. Demand also grows for modular platforms that support phased implementation across departments. This integration enhances efficiency while minimizing complexity.

Emergence of Regional Healthcare Infrastructure Projects in Developing Nations

Government-led healthcare expansion projects in Asia-Pacific, Latin America, and parts of Africa create new opportunities for security vendors. The Healthcare Security Systems Market stands to benefit from hospital construction, telehealth rollout, and digital health records programs. It enables vendors to introduce cost-effective, cloud-based, and mobile-compatible solutions in emerging economies. Rising focus on patient safety and compliance further accelerates procurement of advanced security tools. Vendors that adapt solutions to local regulations and resource constraints can gain early mover advantage.

Market Segmentation Analysis:

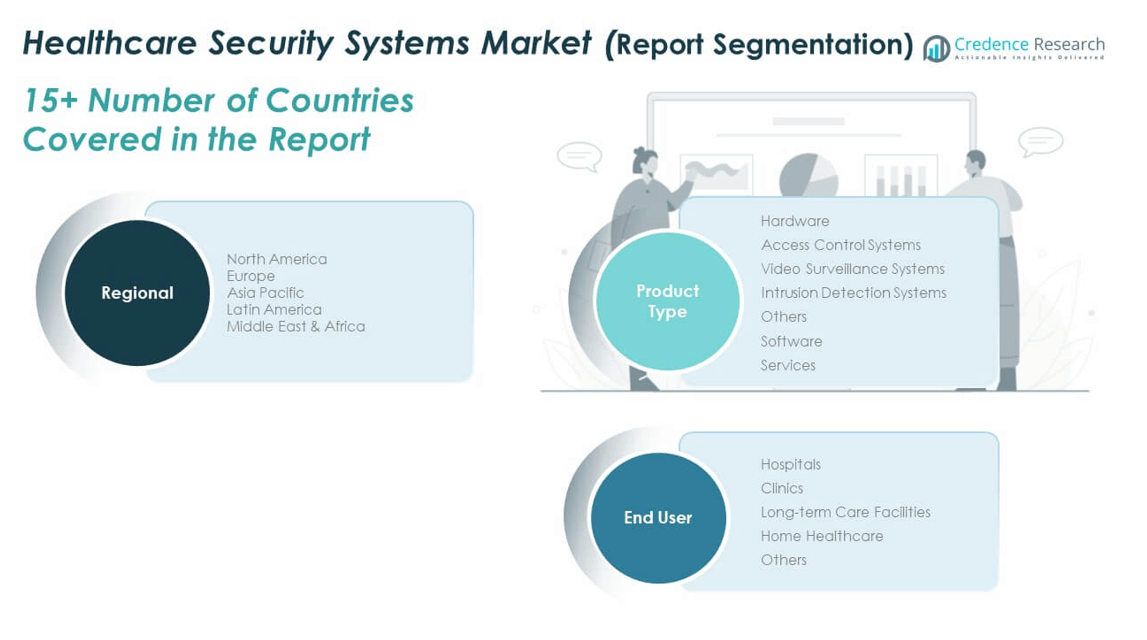

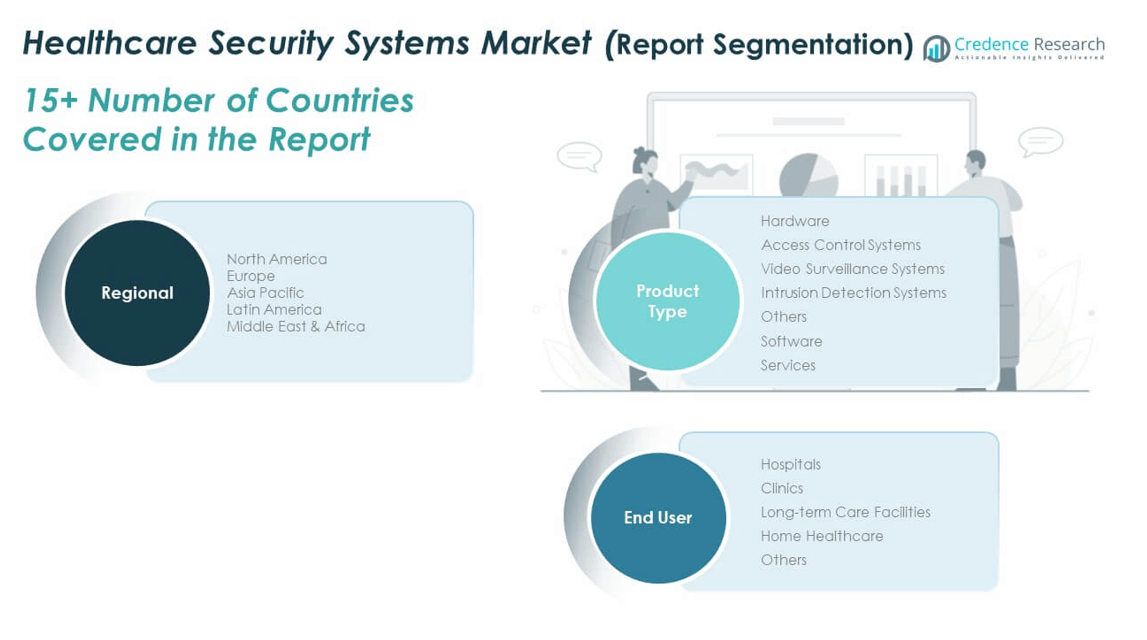

The Healthcare Security Systems Market is segmented by product into hardware, software, and services.

By product type, hardware solutions, access control systems hold a dominant share due to their critical role in restricting unauthorized physical entry to sensitive areas. Video surveillance systems are widely deployed for real-time monitoring, especially in emergency departments, pharmacies, and data centers. Intrusion detection systems gain traction in hospitals and clinics with growing security awareness. The hardware segment leads in terms of revenue, driven by mandatory compliance and infrastructure upgrades. Software solutions provide network security, real-time alerts, and integration with hospital management systems. Demand for cloud-based platforms and cybersecurity software continues to increase. The services segment includes installation, maintenance, and monitoring, which support long-term functionality and optimization of security systems.

- For instance, many hospitals implement RFID access cards, smart locks, and biometric readers. ASSA ABLOY, a leading global provider, delivers physical hardware such as RFID cards, controllers, and readers that enable secure access to restricted areas like pharmacies, data centers, and patient records rooms.

By end user, hospitals represent the largest segment owing to their expansive infrastructure and higher security risks. Clinics and long-term care facilities show steady adoption of basic surveillance and access systems. Home healthcare drives emerging demand for mobile-compatible security tools. The market adapts to each segment’s operational scale and specific security priorities. It continues to expand with tailored offerings for varied healthcare environments.

- For instance, the rise in home healthcare has increased demand for mobile-compatible security platforms. Vendors now provide mobile threat prevention, endpoint protection, and secure remote access tools tailored to support virtual care delivery and mobile healthcare workforce operations.

Segmentation:

By Product:

- Hardware

- Access Control Systems

- Video Surveillance Systems

- Intrusion Detection Systems

- Others

- Software

- Services

By End User:

- Hospitals

- Clinics

- Long-term Care Facilities

- Home Healthcare

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Healthcare Security Systems Market size was valued at USD 2,384.56 million in 2018 to USD 3,473.02 million in 2024 and is anticipated to reach USD 6,442.20 million by 2032, at a CAGR of 8.2% during the forecast period. North America accounted for 32.02% of the global market in 2024. The region leads the market due to widespread implementation of digital health infrastructure and strict data protection regulations. It benefits from early adoption of technologies such as AI-driven surveillance and zero-trust cybersecurity models. Hospitals and health systems in the U.S. and Canada prioritize cybersecurity investment in response to rising ransomware threats. Strong public and private sector collaboration fosters rapid deployment of security upgrades. The presence of major security solution vendors accelerates innovation and adoption. Cloud-based security platforms are widely used across healthcare networks in the region. North America maintains leadership due to its technology maturity and compliance-driven culture.

Europe

The Europe Healthcare Security Systems Market size was valued at USD 1,988.74 million in 2018 to USD 2,992.93 million in 2024 and is anticipated to reach USD 5,791.72 million by 2032, at a CAGR of 8.7% during the forecast period. Europe held 27.60% of the global market share in 2024. Healthcare organizations in the region adopt integrated security solutions to comply with GDPR and other national regulations. It shows high demand for identity and access management systems, video analytics, and threat intelligence platforms. Countries like Germany, France, and the UK drive market expansion through investments in smart hospitals and eHealth. The market is supported by consistent funding from national health systems. Vendors benefit from strong procurement frameworks and centralized security planning. The region’s aging population increases healthcare service demand, further emphasizing secure digital transformation. Europe continues to grow due to its emphasis on patient privacy and operational resilience.

Asia Pacific

The Asia Pacific Healthcare Security Systems Market size was valued at USD 1,757.79 million in 2018 to USD 2,577.92 million in 2024 and is anticipated to reach USD 4,826.09 million by 2032, at a CAGR of 8.3% during the forecast period. Asia Pacific contributed 23.76% to the global market in 2024. The region shows rapid growth due to increasing investments in healthcare digitization and infrastructure development. Countries such as China, India, Japan, and South Korea deploy modern surveillance and cybersecurity systems across hospital networks. Rising adoption of telemedicine and connected medical devices prompts demand for robust endpoint protection. Government initiatives in smart healthcare accelerate market expansion. Security vendors tailor offerings to suit localized needs and regulatory environments. Language-specific interfaces and scalable cloud models gain traction across public and private hospitals. Asia Pacific is positioned as a high-growth region due to its large population base and fast digital adoption.

Latin America

The Latin America Healthcare Security Systems Market size was valued at USD 627.52 million in 2018 to USD 849.23 million in 2024 and is anticipated to reach USD 1,414.09 million by 2032, at a CAGR of 6.7% during the forecast period. Latin America accounted for 7.83% of the global market in 2024. The region witnesses growing adoption of security systems amid rising threats to healthcare infrastructure. Countries such as Brazil, Mexico, and Chile invest in surveillance and data protection tools to enhance hospital safety. Budget constraints remain a key challenge, leading to phased implementation of solutions. The private healthcare sector leads in integrating digital security systems. Public hospitals focus on upgrading legacy systems through pilot programs and international partnerships. Cloud-based platforms and mobile-accessible security tools gain popularity. Vendors offer cost-effective packages that align with local compliance norms. Latin America shows moderate growth driven by urban healthcare development and regulatory evolution.

Middle East

The Middle East Healthcare Security Systems Market size was valued at USD 478.99 million in 2018 to USD 683.42 million in 2024 and is anticipated to reach USD 1,232.28 million by 2032, at a CAGR of 7.8% during the forecast period. The Middle East contributed 6.30% of the global market in 2024. The region advances in healthcare security through high investment in hospital infrastructure and smart city initiatives. Gulf countries such as UAE and Saudi Arabia deploy biometric access controls, smart ID systems, and cloud-native cybersecurity platforms. Rising medical tourism and international accreditation requirements enhance demand for advanced security protocols. Hospitals integrate surveillance with building automation and IoT platforms. Cross-border collaborations and foreign technology adoption accelerate deployment. The region focuses on security as part of healthcare modernization. It maintains growth momentum due to strategic health sector reforms and rising patient volume.

Africa

The Africa Healthcare Security Systems Market size was valued at USD 188.63 million in 2018 to USD 271.35 million in 2024 and is anticipated to reach USD 494.93 million by 2032, at a CAGR of 7.9% during the forecast period. Africa held 2.50% of the global market in 2024. The region remains in an early phase of healthcare security implementation. Public health systems prioritize basic infrastructure development, with gradual integration of surveillance and data security. Countries such as South Africa, Nigeria, and Kenya drive demand through private sector healthcare growth. International aid programs and NGO support aid digitization efforts in rural hospitals. Security adoption focuses on theft prevention, patient monitoring, and electronic health record protection. Vendors entering the African market tailor offerings for low-bandwidth and mobile-first environments. The market exhibits steady progress due to rising awareness and incremental investments in health tech.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Siemens AG

- Bosch Security Systems

- Tyco Integrated Security

- Honeywell International, Inc.

- Schneider Electric

- Cisco Systems, Inc.

- Avigilon Corporation

- Nedap Security Management

- Stanley Security Solutions

- Genetec Inc.

- Other Key Players

Competitive Analysis:

The Healthcare Security Systems Market features a mix of global technology leaders, specialized security firms, and regional solution providers. Key players include Siemens Healthineers, Johnson Controls, Honeywell, GE HealthCare, and Bosch Security Systems. These companies compete on innovation, scalability, and compliance-oriented solutions. The market favors vendors that offer integrated physical and cybersecurity systems tailored for healthcare workflows. It continues to evolve with increasing partnerships between health IT providers and security technology firms. Strategic acquisitions and product launches strengthen competitive positioning. Companies focus on AI integration, cloud capabilities, and zero-trust architecture to differentiate offerings. It shows a trend toward end-to-end platforms that reduce complexity and enhance operational efficiency.

Recent Developments:

- In July 2025, Axonius, a global leader in cyber asset intelligence, announced its acquisition of Cynerio, a pioneer in medical device security, for over $100 million. This acquisition aims to tackle the significant security risks associated with the proliferation of connected medical devices in healthcare settings, which have often gone unprotected and invisible to traditional security tools.

- In June 2025, Genetec launched Security Center SaaS, a cloud-based security platform developed to allow healthcare organizations to deploy both cloud and on-premises systems for enhanced flexibility and protection. This new solution enables healthcare entities to scale their security systems efficiently and maintain robust defenses for their facilities and sensitive data.

- In January 2025, Siemens AGlaunched an Apple Wallet-integrated mobile access solution for its Building X Security Manager. This innovation enables secure building entry for healthcare staff and patients using Apple devices, streamlining secure access and enhancing convenience within healthcare facilities.

Market Concentration & Characteristics:

The Healthcare Security Systems Market demonstrates moderate concentration, with a few large players holding significant market share across high-value regions such as North America and Europe. It is characterized by rapid innovation, high regulatory alignment, and a growing demand for customized, interoperable solutions. Tier-1 companies dominate enterprise-level hospital networks, while regional players address smaller facilities with localized offerings. It supports both hardware-intensive and cloud-based models, driven by the evolving nature of healthcare delivery and digital threats. Competitive dynamics emphasize technological adaptability, compliance, and service integration. The market remains sensitive to healthcare reforms and funding cycles across regions.

Report Coverage:

The research report offers an in-depth analysis based on product and end-user It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of AI and machine learning will enhance threat detection and automate incident response in healthcare settings.

- Cloud-based security platforms will see greater implementation due to scalability and lower maintenance costs.

- Integration of physical and cybersecurity systems will become standard in modern healthcare infrastructure.

- Growing demand for remote healthcare services will increase the need for secure telehe

- alth and mobile access solutions.

- Regulatory pressure will drive investment in identity management and compliance-focused security frameworks.

- Emerging markets will accelerate adoption through government-backed healthcare digitization programs.

- Biometric authentication and real-time monitoring tools will become more prevalent in high-risk hospital zones.

- Partnerships between healthcare providers and cybersecurity firms will intensify to address evolving threat landscapes.

- Vendors will focus on modular and interoperable systems to support diverse healthcare facility needs.

- Continued innovation in IoT device security will protect connected medical equipment from cyber intrusions.