Market Overview:

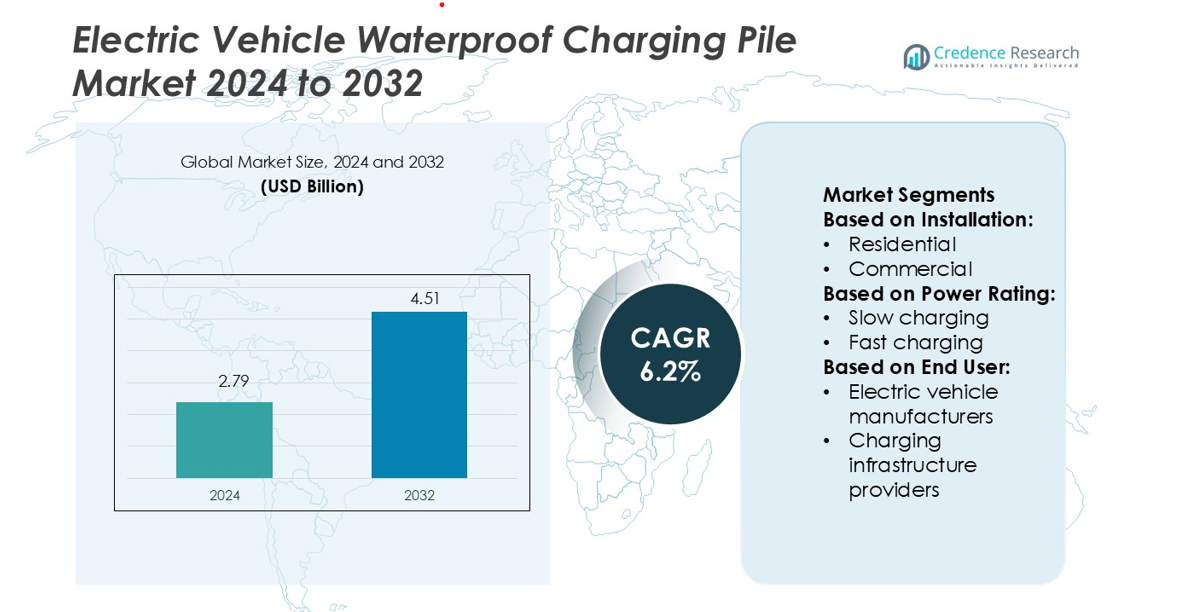

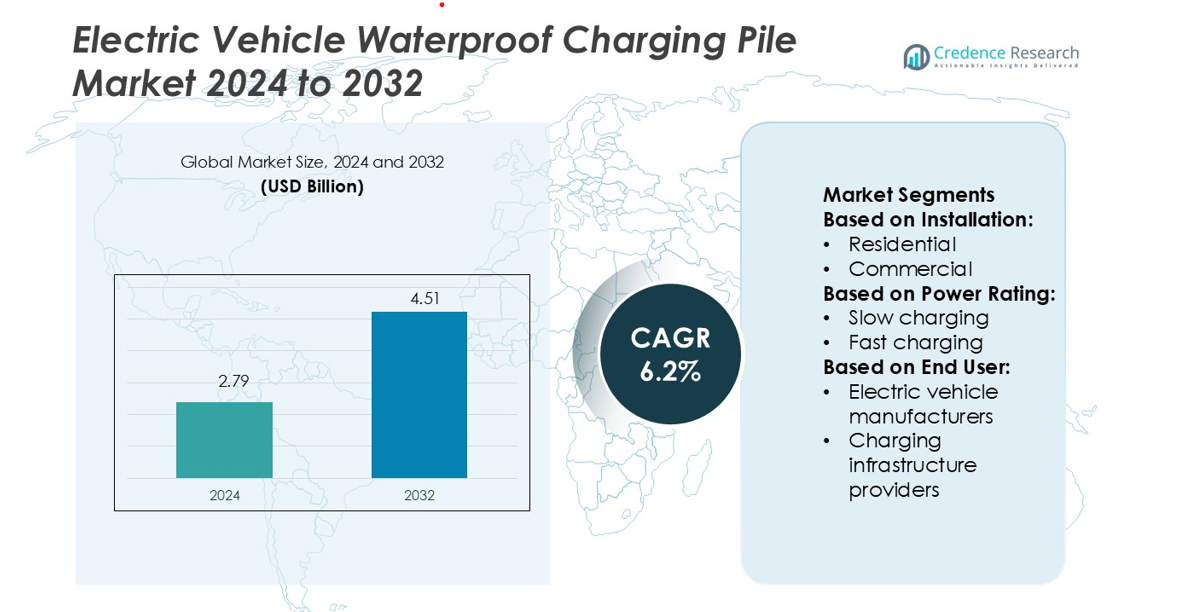

Electric Vehicle Waterproof Charging Pile Market size was valued USD 2.79 billion in 2024 and is anticipated to reach USD 4.51 billion by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Waterproof Charging Pile Market Size 2024 |

USD 2.79 billion |

| Electric Vehicle Waterproof Charging Pile Market, CAGR |

6.2% |

| Electric Vehicle Waterproof Charging Pile Market Size 2032 |

USD 4.51 billion |

The Electric Vehicle Waterproof Charging Pile Market is driven by leading companies including Schneider Electric, Tesla Inc., Webasto Group, ABB Ltd., ChargePoint, Inc., bp pulse (Bp p.l.c.), Blink Charging Co., Siemens, Eaton Corporation plc, and Leviton Manufacturing Co., Inc. These players focus on advanced waterproof technology, smart charging solutions, and network expansion to strengthen their market positions. Strategic collaborations with governments and utility providers support large-scale deployments across commercial, residential, and public spaces. North America leads the global market with a 34% share, supported by strong policy incentives, high EV adoption, and well-developed charging infrastructure. This leadership reflects its strong investment capacity and rapid network rollout.

Market Insights

- The Electric Vehicle Waterproof Charging Pile Market size was valued at USD 2.79 billion in 2024 and is projected to reach USD 4.51 billion by 2032, growing at a CAGR of 6.2%.

- Market growth is driven by strong government incentives, fast-charging infrastructure expansion, and increased EV adoption across commercial, residential, and public spaces.

- Advanced waterproof technology and smart charging solutions are key trends, with companies focusing on durability, energy efficiency, and smart grid integration to strengthen their market positions.

- High installation and maintenance costs along with grid capacity constraints remain major restraints, impacting large-scale infrastructure rollout in cost-sensitive regions.

- North America leads the market with a 34% share, followed by Europe at 31% and Asia Pacific at 25%, with the commercial installation segment holding the largest share due to strong investment in fast-charging infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Installation

The commercial segment dominates the Electric Vehicle Waterproof Charging Pile Market with the largest market share. Commercial installations in malls, workplaces, and service stations meet rising demand for convenient and accessible charging. Businesses invest heavily in waterproof and weather-resistant charging piles to ensure safe outdoor operation and long-term reliability. Expansion of EV fleets and corporate sustainability goals further strengthen the commercial segment. Government incentives for setting up public charging infrastructure also support adoption, making this segment the key growth driver in overall market expansion.

- For instance, Schneider Electric’s EVlink Pro AC charging stations feature IP55-rated enclosures and operate efficiently in temperatures from –30 °C to 50 °C, with a charging capacity of up to 22 kW per unit, enabling reliable deployment in commercial outdoor environments.

By Power Rating

Fast charging holds the dominant share in the market due to its ability to significantly reduce charging time. Waterproof fast chargers are preferred for urban and highway locations, where quick turnaround and high durability are critical. Growing demand for long-range EVs and advancements in charging technologies support this segment. Governments and private companies are investing in fast-charging networks to enhance EV accessibility and encourage adoption. This segment also benefits from reduced installation costs compared to ultra-fast systems, balancing performance and affordability.

- For instance, Tesla’s V3 Supercharger architecture, first announced in 2019, uses a 1 MW power cabinet and is designed to support peak charging rates of up to 250 kW per vehicle.

By End User

Charging infrastructure providers lead the market as the dominant end-user segment. These companies deploy waterproof charging piles across public and commercial spaces, ensuring large-scale availability. Strategic collaborations with utility companies and automakers accelerate network expansion. Their focus on durable, weatherproof solutions helps maintain system performance in varying environmental conditions. Rising investment in EV charging infrastructure and government funding programs further drive this segment’s growth. This dominance reflects their critical role in shaping the global EV charging ecosystem.

Key Growth Drivers

Rising Electric Vehicle Adoption

Surging EV adoption drives strong demand for waterproof charging piles. Expanding EV fleets in residential, commercial, and public spaces require reliable and weather-resistant charging infrastructure. Governments and automakers are investing in large-scale charging station deployment to support growing vehicle volumes. Waterproof designs ensure durability against rain, snow, and dust, making them ideal for outdoor environments. This growing EV base directly boosts installation rates and revenue streams for charging infrastructure providers worldwide.

- For instance, ABB’s Terra HP Generation III charger supports output voltages from 150 V to 920 V DC and a maximum current of 500 A via a CCS connector. A fully configured system can deliver up to 350 kW to a single vehicle.

Government Incentives and Policy Support

Supportive government policies play a crucial role in market growth. Subsidies, tax benefits, and grants encourage infrastructure investments across residential and public spaces. Several countries have launched strategic EV infrastructure plans, mandating waterproof and durable charging solutions for outdoor use. These policies also attract private investments and promote technological advancements. Consistent regulatory backing accelerates installation rates and expands charging networks, creating a strong foundation for market expansion.

- For instance, ChargePoint’s new AC Level 2 charging architecture supports up to 80 amps (≈ 19.2 kW) and includes bi-directional (vehicle-to-everything) capability.

Technological Advancements in Charging Infrastructure

Rapid improvements in fast and ultra-fast charging technologies fuel market growth. Modern waterproof charging piles integrate smart monitoring, thermal protection, and corrosion-resistant enclosures to enhance safety and lifespan. Advanced power modules enable stable performance in extreme environmental conditions, reducing maintenance costs. Integration with digital payment systems and grid management platforms improves user experience. These innovations make waterproof charging stations a preferred choice for large-scale deployment in both urban and remote locations.

Key Trends & Opportunities

Expansion of Fast and Ultra-Fast Charging Networks

Global charging infrastructure is shifting toward fast and ultra-fast charging networks. These systems reduce charging time significantly, making EVs more practical for daily use. Waterproof fast chargers are increasingly installed along highways and urban transit routes to support long-distance travel. Charging operators view this as an opportunity to enhance service coverage and improve station utilization. The trend aligns with automakers’ focus on extended-range EVs and supports infrastructure scalability.

- For instance, bp pulse’s hub in Kettering features ten 300 kW chargers, with each providing two charging points for a total of 20. The hub can charge 20 vehicles simultaneously at speeds of up to 150 kW per vehicle.

Integration of Smart and Connected Features

Smart charging technology is becoming standard in new installations. Waterproof charging piles now feature real-time monitoring, predictive maintenance, and mobile app connectivity. This integration improves operational efficiency, enhances customer convenience, and optimizes energy distribution. Opportunities also arise in dynamic load balancing, enabling better grid integration. These smart solutions support the broader shift toward digitalized mobility infrastructure and strengthen charging networks’ reliability and performance.

- For instance, Blink achieved OCPP 2.0.1 certification for its Series 7, Series 8, and Series 9 charger models. Blink stated this places them among a limited number of models worldwide with OCPP 2.0 certification.

Growing Investments in Public Charging Infrastructure

Public infrastructure expansion is a key opportunity area. Governments and private companies are deploying waterproof charging piles across transport hubs, highways, and parking lots. This network growth improves charging accessibility and encourages mass EV adoption. Public-private partnerships further accelerate project timelines and reduce capital burdens. Increased availability of public charging enhances consumer confidence, driving EV sales and infrastructure demand simultaneously.

Key Challenges

High Installation and Maintenance Costs

Waterproof charging piles involve higher material and design costs compared to standard chargers. Additional protective layers, insulation, and sealing technologies increase upfront investment. Regular maintenance is required to ensure weather resistance and performance stability, adding operational expenses. These cost pressures can slow infrastructure rollout in price-sensitive regions. Limited funding for large-scale deployments remains a key barrier to faster market penetration.

Grid Capacity and Infrastructure Constraints

Expanding fast and ultra-fast charging networks increases pressure on existing power grids. Many regions face challenges in grid capacity, load balancing, and distribution. Waterproof charging piles require stable energy supply for consistent performance. Insufficient infrastructure can lead to delays, downtime, and increased costs. Upgrading grid networks involves significant investment and time, making this a critical challenge for widespread deployment.

Regional Analysis

North America

North America leads the Electric Vehicle Waterproof Charging Pile Market with a 34% market share. Strong government incentives, tax credits, and infrastructure programs drive adoption across residential, commercial, and public spaces. High EV penetration in the U.S. and Canada supports rapid expansion of waterproof fast-charging stations. Utilities and private operators are investing in weatherproof charging infrastructure to meet extreme climatic conditions. Strategic partnerships between automakers and charging network providers strengthen market growth. The region also benefits from advanced grid integration and digital payment solutions, improving charging accessibility and user experience.

Europe

Europe holds a 31% share of the Electric Vehicle Waterproof Charging Pile Market. Strict emission targets and EU climate goals accelerate investment in charging infrastructure. Countries such as Germany, the Netherlands, and the UK lead in deploying waterproof fast chargers in public and commercial locations. Cold and wet weather conditions make waterproof charging solutions essential for durability and safety. The region emphasizes smart grid integration and renewable energy-powered charging stations. Public-private collaborations and Green Deal initiatives also support network expansion. This regulatory environment positions Europe as a key growth engine for the global market.

Asia Pacific

Asia Pacific accounts for a 25% market share, driven by rapid EV adoption in China, Japan, South Korea, and India. Government-backed infrastructure programs and high urban EV penetration fuel strong demand for waterproof charging piles. China remains the largest market in the region, focusing on ultra-fast charging networks for mass EV deployment. Monsoon-prone countries prioritize waterproof technology to ensure charging reliability. Expansion of public infrastructure and fleet electrification further accelerates growth. Investments from global and local charging operators strengthen the region’s role as a major production and deployment hub.

Latin America

Latin America holds a 6% market share, supported by growing EV initiatives in Brazil, Mexico, and Chile. Governments are gradually introducing incentive programs to promote EV adoption and infrastructure expansion. Waterproof charging piles are gaining attention due to variable climate conditions and outdoor installation needs. Private operators are focusing on commercial hubs and public transit locations for deployment. Infrastructure development is at an early stage but shows strong potential for fast-charging network growth. Increasing foreign investments and regional partnerships are expected to accelerate adoption in the coming years.

Middle East & Africa

The Middle East & Africa represent a 4% market share, with early-stage development in waterproof EV charging infrastructure. The UAE, Saudi Arabia, and South Africa lead regional deployments. Hot, humid, and dusty climates make waterproof and weather-resistant charging solutions essential. Government sustainability programs and smart city projects are driving initial installations. Infrastructure development focuses on commercial and highway networks, supported by foreign investments. While adoption remains limited compared to other regions, policy support and upcoming EV expansion plans are expected to unlock significant growth potential.

Market Segmentations:

By Installation:

By Power Rating:

- Slow charging

- Fast charging

By End User:

- Electric vehicle manufacturers

- Charging infrastructure providers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Vehicle Waterproof Charging Pile Market is shaped by leading players such as Schneider Electric, Tesla Inc., Webasto Group, ABB Ltd., ChargePoint, Inc., bp pulse (Bp p.l.c.), Blink Charging Co., Siemens, Eaton Corporation plc, and Leviton Manufacturing Co., Inc. The Electric Vehicle Waterproof Charging Pile Market is defined by rapid innovation, strategic partnerships, and strong investment in infrastructure. Companies are focusing on advanced waterproof technologies to ensure reliable performance in harsh outdoor environments. Fast and ultra-fast charging solutions are at the core of competition, enabling reduced charging time and higher station utilization. Many players are integrating smart connectivity, remote monitoring, and energy management systems to enhance user experience and operational efficiency. Expansion strategies include collaborations with automakers, governments, and utility providers to strengthen charging networks. Continuous R&D and large-scale deployment initiatives support market leadership and global expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schneider Electric

- Tesla Inc.

- Webasto Group

- ABB Ltd.

- ChargePoint, Inc.

- bp pulse (Bp p.l.c.)

- Blink Charging Co.

- Siemens

- Eaton Corporation plc

- Leviton Manufacturing Co., Inc.

Recent Developments

- In January 2025, Maruti Suzuki announced the launch of its first electric SUV, the e Vitara, at the Bharat Mobility Global Auto Expo. This launch is expected to be held till the end of April.

- In July 2024, Enphase Energy, Inc. launched the CS-100 EV Charger for commercial fleet electric vehicles (EVs) in the United States. The CS-100, a Level 2 charging station, delivers up to 19.2 kW of continuous power. It features customized charging schedules and smart capabilities via Enphase’s COSMOS interface, including digital load management, waterproof casing, and access control, integrating seamlessly with fleet management and building energy systems.

- In March 2024, EVBox and EAVE partnered to deploy EVBox AC and DC charging solutions across Spain. EAVE’s focus on charging ecosystems has integrated EVBox’s residential and commercial solutions with energy management systems, enabling the use of renewable energy sources like solar panels.

- In April 2023, ABB Ltd.’s ABB E-mobility business signed a Memorandum of Understanding (MoU) with PLN Icon Plus, a subsidiary of PT PLN Persero, to facilitate a partnership for developing the EV charging infrastructure in Indonesi

Report Coverage

The research report offers an in-depth analysis based on Installation, Power Rating, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for waterproof charging piles will grow as EV adoption accelerates globally.

- Fast and ultra-fast charging technology will dominate future installations.

- Governments will increase investments in public and commercial charging infrastructure.

- Smart and connected charging systems will become standard in new deployments.

- Integration with renewable energy sources will improve sustainability and grid efficiency.

- Expansion of highway charging corridors will enhance long-distance EV travel.

- Advanced waterproof materials will boost charger durability and reduce maintenance needs.

- Private-public partnerships will play a larger role in network expansion.

- Regional markets in Asia Pacific and Europe will lead future infrastructure growth.

- Automation and digital payment solutions will improve user experience and station performance.