Market Overview

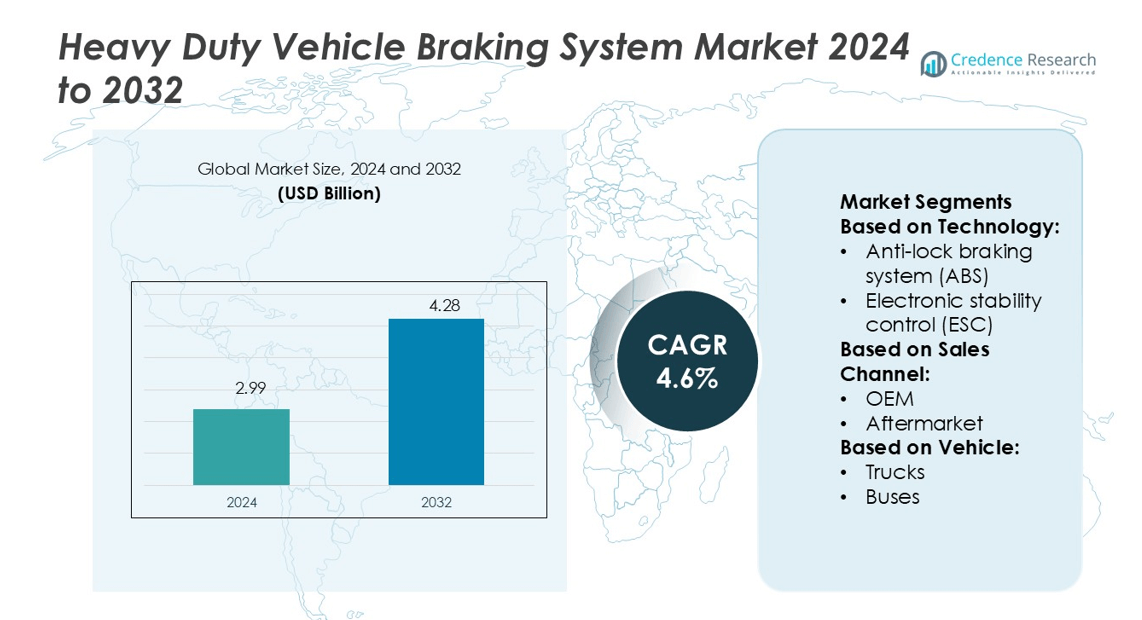

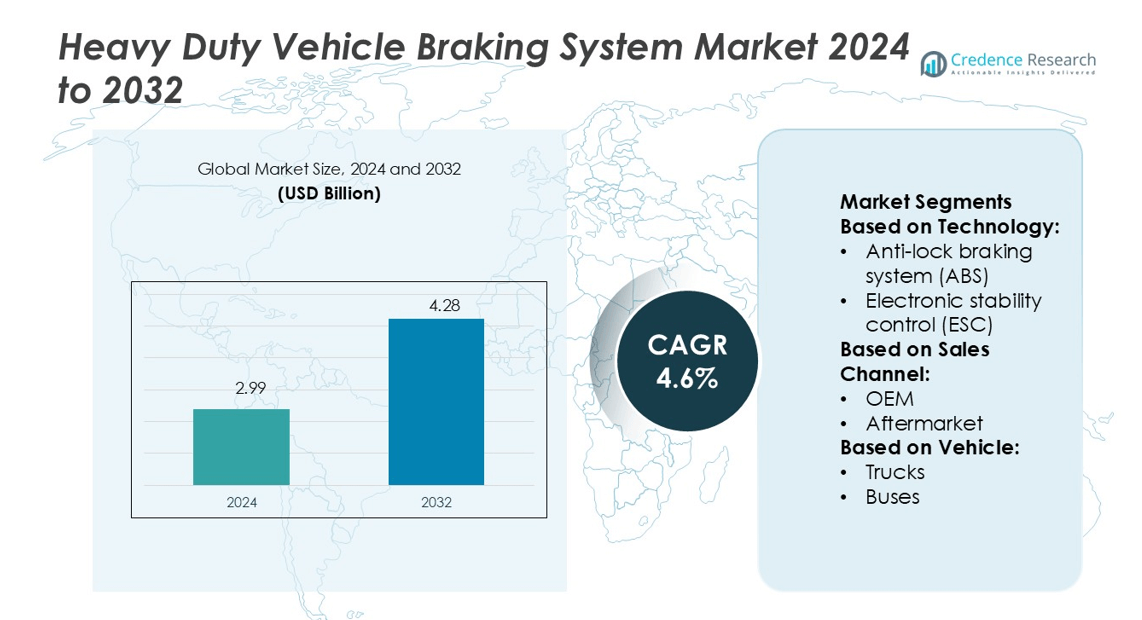

Heavy Duty Vehicle Braking System Market size was valued USD 2.99 billion in 2024 and is anticipated to reach USD 4.28 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heavy Duty Vehicle Braking System Market Size 2024 |

USD 2.99 billion |

| Heavy Duty Vehicle Braking System Market, CAGR |

4.6% |

| Heavy Duty Vehicle Braking System Market Size 2032 |

USD 4.28 billion |

The Heavy Duty Vehicle Braking System Market is shaped by key players including Knorr-Bremse, Meritor, Aisin Seiki, ZF Friedrichshafen, Robert Bosch, Continental, Cummins, Brembo, Akebono Brake Industry, and Haldex. These companies lead through advanced braking technologies, strategic partnerships, and global distribution networks. They focus on integrating ABS, ESC, and regenerative braking systems to meet evolving safety standards. North America emerges as the leading region, holding a 36% market share, driven by strict regulatory frameworks, advanced fleet modernization, and strong OEM presence. This regional leadership is further supported by high R&D investment and rapid adoption of smart braking solutions.

Market Insights

- The Heavy Duty Vehicle Braking System Market was valued at USD 2.99 billion in 2024 and is expected to reach USD 4.28 billion by 2032, growing at a CAGR of 4.6%.

- Rising safety regulations and fleet modernization are driving demand for ABS, ESC, and regenerative braking systems across key vehicle segments.

- Leading companies focus on innovation, smart braking integration, and OEM partnerships to strengthen their global market position.

- High system costs and limited technical expertise in emerging regions act as key restraints to large-scale adoption.

- North America holds 36% market share, leading the global landscape, followed by Europe and Asia Pacific, with OEM segments contributing the largest share in the overall market structure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The anti-lock braking system (ABS) dominates the Heavy Duty Vehicle Braking System Market with the highest market share. Its strong position comes from its proven ability to prevent wheel lock-up and maintain steering control during sudden braking. Rising government safety regulations, along with the increasing adoption of advanced driver assistance technologies, further support this demand. ABS remains the standard in most heavy-duty vehicles, including trucks and buses, due to its cost-effectiveness and reliability. Growing fleet modernization and stricter safety standards continue to drive ABS integration across both developed and emerging markets.

- For instance, Continental’s new generation electronic-brake system, the MK 120 ESC, features a valve block, solenoid valve, pump and motor design that is about 5 % lighter and about 7 % smaller than the previous generation while delivering the same performance.

By Sales Channel

The OEM segment holds the dominant share in the Heavy Duty Vehicle Braking System Market. Vehicle manufacturers increasingly integrate advanced braking technologies during production to meet stringent safety norms. OEM systems ensure higher compatibility and performance, which encourages fleet operators to prefer factory-installed solutions. This trend is fueled by the rising demand for advanced braking technologies such as ABS and ESC. Growing commercial vehicle production and stricter regulatory compliance further strengthen OEM leadership, while the aftermarket segment grows steadily through replacement and retrofitting services.

- For instance, Cummins Drivetrain and Braking Systems has invested over $190 million to boost production capacity for air disc brakes and rear axles. This includes a $33 million investment to elevate North American air disc brake production capacity by approximately 75%, primarily focused on the Monterrey, Mexico facility.

By Vehicle

Trucks lead the Heavy Duty Vehicle Braking System Market among vehicle types, accounting for the largest market share. High fleet volumes, long-haul operations, and growing logistics demand drive strong adoption of advanced braking systems in trucks. Truck operators prioritize reliable braking performance to enhance safety and reduce accident risks. Regulations requiring ABS and ESC in commercial fleets further support this dominance. Additionally, increased infrastructure development and e-commerce logistics expansion accelerate truck deployment, strengthening demand for robust braking systems. Buses and construction vehicles follow with significant but smaller shares.

Key Growth Drivers

Rising Safety Regulations

Government agencies are enforcing strict safety standards for heavy-duty vehicles. These regulations push manufacturers to integrate advanced braking technologies, including ABS, ESC, and AEB. Fleet operators are adopting modern systems to reduce accident risks and improve operational compliance. The focus on reducing fatalities and ensuring road safety is creating steady demand. This trend aligns with global initiatives to reduce commercial vehicle accidents, driving innovation and higher adoption rates of advanced braking systems across developed and developing economies.

- For instance, DHL partnered with Daimler and Hylane to rent 30 Mercedes-Benz eActros 600 electric trucks, transitioning its heavy transport operations toward zero-emission freight.

Expanding Heavy-Duty Fleet Size

The rapid expansion of logistics, construction, and mining sectors is increasing fleet sizes worldwide. Heavy-duty trucks, buses, and construction vehicles require robust and efficient braking systems to handle demanding operations. Growing freight transport activities and infrastructure development amplify this demand. Fleet operators prioritize braking system upgrades to enhance vehicle reliability and uptime. This surge in fleet volume, combined with replacement cycles, is boosting both OEM and aftermarket sales of advanced braking solutions.

- For instance, Ryder System, Inc. manages nearly 260,000 commercial vehicles as part of its broad logistics offerings, which include advanced supply chain services for Original Equipment Manufacturers (OEMs).

Advancements in Braking Technologies

Continuous technological innovation is improving braking system performance, efficiency, and responsiveness. Manufacturers are introducing sensor-based braking systems, regenerative braking, and integrated electronic controls. These solutions enhance vehicle stability, reduce wear, and improve energy efficiency. Digital control integration also supports predictive maintenance, lowering long-term operational costs. The increased focus on vehicle automation and smart mobility is further accelerating the adoption of advanced braking technologies in heavy-duty vehicles.

Key Trends & Opportunities

Electrification of Heavy-Duty Vehicles

The shift toward electric heavy-duty vehicles is creating strong opportunities for regenerative braking systems. These systems convert kinetic energy into electrical energy, improving range and efficiency. OEMs are integrating advanced brake-by-wire technologies to match EV architectures. This trend is encouraging component suppliers to develop lightweight, energy-efficient braking solutions tailored for electric trucks and buses.

- For instance, Kuehne + Nagel expanded its processing capacity at its new Paris Charles-de-Gaulle air hub: the 12,900 m² facility enables handling of 300 airfreight pallets per week, increasing throughput by a factor of 2.5.

Integration of IoT and Predictive Maintenance

IoT-enabled braking systems are gaining traction due to their ability to monitor performance in real time. Predictive maintenance reduces unplanned downtime and enhances safety. Manufacturers are offering connected braking platforms with sensor data integration for fleets. This technological shift is opening new opportunities for service providers and aftermarket suppliers focusing on digital solutions.

- For instance, CEVA has launched a reverse logistics solution for EV batteries designed to cover 80 % of European volumes by 2030, with battery logistics centers already tested in Ghislenghien, Belgium.

Increasing Aftermarket Demand

Aging heavy-duty fleets and longer vehicle lifecycles are driving strong aftermarket opportunities. Fleet operators prefer upgrading existing braking systems to meet regulatory standards and improve safety. High replacement rates of brake components ensure steady aftermarket growth. This trend benefits both local component suppliers and global braking system manufacturers.

Key Challenges

High System Costs

Advanced braking systems involve high production and installation costs. OEMs and fleet operators face financial challenges in adopting technologies like ESC and AEB at scale. These costs can be a barrier in price-sensitive markets, slowing penetration rates. Manufacturers must find ways to balance innovation with affordability to maintain market momentum.

Complex Maintenance and Skill Gaps

Modern braking systems require specialized maintenance and skilled technicians. Many fleet operators, especially in emerging markets, lack access to trained personnel. This creates operational delays and higher service costs. Bridging the skill gap through training programs and simplified maintenance solutions is essential for sustaining adoption rates.

Regional Analysis

North America

North America leads the Heavy Duty Vehicle Braking System Market with a 36% market share in 2024. The region benefits from strict vehicle safety regulations, advanced logistics infrastructure, and strong OEM presence. Fleet modernization programs are driving rapid adoption of ABS, ESC, and AEB systems. The U.S. dominates regional demand due to its large commercial vehicle fleet and high replacement rates. Canada also contributes steadily with increased investments in construction and mining vehicles. High R&D spending by key players further supports the region’s leadership in advanced braking technologies and system integration.

Europe

Europe holds a 29% market share in the Heavy Duty Vehicle Braking System Market. The region’s strong focus on vehicle safety and environmental regulations fuels the adoption of advanced braking systems. Germany, France, and the UK lead demand through well-established automotive industries and growing fleet upgrades. The EU’s zero-fatality vision promotes technologies like ESC and automated emergency braking. Expansion of electric heavy-duty vehicles also boosts regenerative braking system integration. Strategic partnerships between OEMs and technology suppliers enhance innovation and strengthen Europe’s competitive position in the global market.

Asia Pacific

Asia Pacific commands a 25% market share and is the fastest-growing region in the Heavy Duty Vehicle Braking System Market. Rapid industrialization, urbanization, and infrastructure investments in China, India, and Japan are driving demand. The region’s expanding logistics and construction industries boost heavy-duty vehicle sales. Governments are introducing safety mandates that accelerate the integration of ABS and AEB systems. Local manufacturers are increasing production capacity, while international OEMs are investing in partnerships to tap into rising fleet volumes. Cost-effective manufacturing capabilities also enhance Asia Pacific’s global market competitiveness.

Latin America

Latin America accounts for a 6% market share in the Heavy Duty Vehicle Braking System Market. The region’s demand is primarily driven by Brazil and Mexico, supported by growing transportation, construction, and mining sectors. Economic development and infrastructure expansion projects increase the need for reliable braking solutions in commercial fleets. Regulatory adoption is improving, though at a slower pace than developed regions. Aftermarket opportunities remain strong due to aging fleets and replacement demand. Regional OEM collaborations are gradually strengthening market penetration and encouraging broader adoption of advanced braking technologies.

Middle East & Africa

The Middle East & Africa region holds a 4% market share in the Heavy Duty Vehicle Braking System Market. Market growth is driven by rising investments in infrastructure and logistics, particularly in GCC countries and South Africa. The demand for durable braking systems is increasing with fleet expansions in mining, oil and gas, and transport sectors. Regulatory frameworks are gradually aligning with global safety standards, supporting ABS and ESC adoption. The region remains dependent on imports and international OEM partnerships. However, steady fleet modernization and infrastructure projects support its long-term growth potential.

Market Segmentations:

By Technology:

- Anti-lock braking system (ABS)

- Electronic stability control (ESC)

By Sales Channel:

By Vehicle:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Heavy Duty Vehicle Braking System Market features leading players such as Knorr-Bremse, Meritor, Aisin Seiki, ZF Friedrichshafen, Robert Bosch, Continental, Cummins, Brembo, Akebono Brake Industry, and Haldex. The Heavy Duty Vehicle Braking System Market is highly competitive, driven by continuous innovation and strong regulatory compliance. Companies focus on developing advanced braking technologies such as ABS, ESC, and regenerative systems to enhance safety and vehicle performance. Strategic partnerships with OEMs and fleet operators strengthen market positioning, while expanding manufacturing footprints ensure better supply chain control. Many manufacturers invest in IoT-based solutions and predictive maintenance platforms to boost operational efficiency. Intense competition encourages cost optimization, faster product development cycles, and improved aftermarket support, shaping a dynamic and technology-driven competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Knorr-Bremse

- Meritor

- Aisin Seiki

- ZF Friedrichshafen

- Robert Bosch

- Continental

- Cummins

- Brembo

- Akebono Brake Industry

- Haldex

Recent Developments

- In April 2025, IKEA, a supply part of the Inter IKEA Group, and BLR Logistiks deployed the first electric heavy-duty truck to run on the public road network in India.

- In April 2025, California regulators released a new proposal to allow the testing of self-driving heavy-duty trucks on public roads. The proposal has unlocked the opportunities for companies to test self-driving technology.

- In May 2024, Volvo Financial Services and Volvo Trucks North America partnered to launch Volvo on Demand, an initiative to increase the adoption of BEVs. Through the initiative, the company offers an accessible solution for acquiring BEVs, reducing the need for significant upfront investments.

- In March 2023, SAF-HOLLAND SE acquired all of the outstanding minority shares of Haldex AB, a Swedish company, and now holds 100% of the shares. The company introduced two products incorporating Haldex: the CBXA AeroBeam air suspension systems and the P89 Series air disc brakes

Report Coverage

The research report offers an in-depth analysis based on Technology, Sales Channel, Vehicle and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness faster adoption of advanced braking technologies to meet strict safety standards.

- Fleet modernization initiatives will increase demand for reliable and efficient braking systems.

- Electrification of heavy-duty vehicles will boost the use of regenerative braking solutions.

- Integration of IoT and predictive maintenance will enhance system performance and uptime.

- OEMs will expand production capacity to meet rising demand from logistics and construction sectors.

- Aftermarket services will grow due to aging fleets and higher component replacement rates.

- Strategic collaborations will accelerate innovation and support global market expansion.

- Autonomous driving advancements will drive the integration of smart braking systems.

- Emerging economies will contribute significantly to market growth through fleet expansion.

- Regulatory alignment across regions will support uniform adoption of advanced braking technologies.