Market Overview

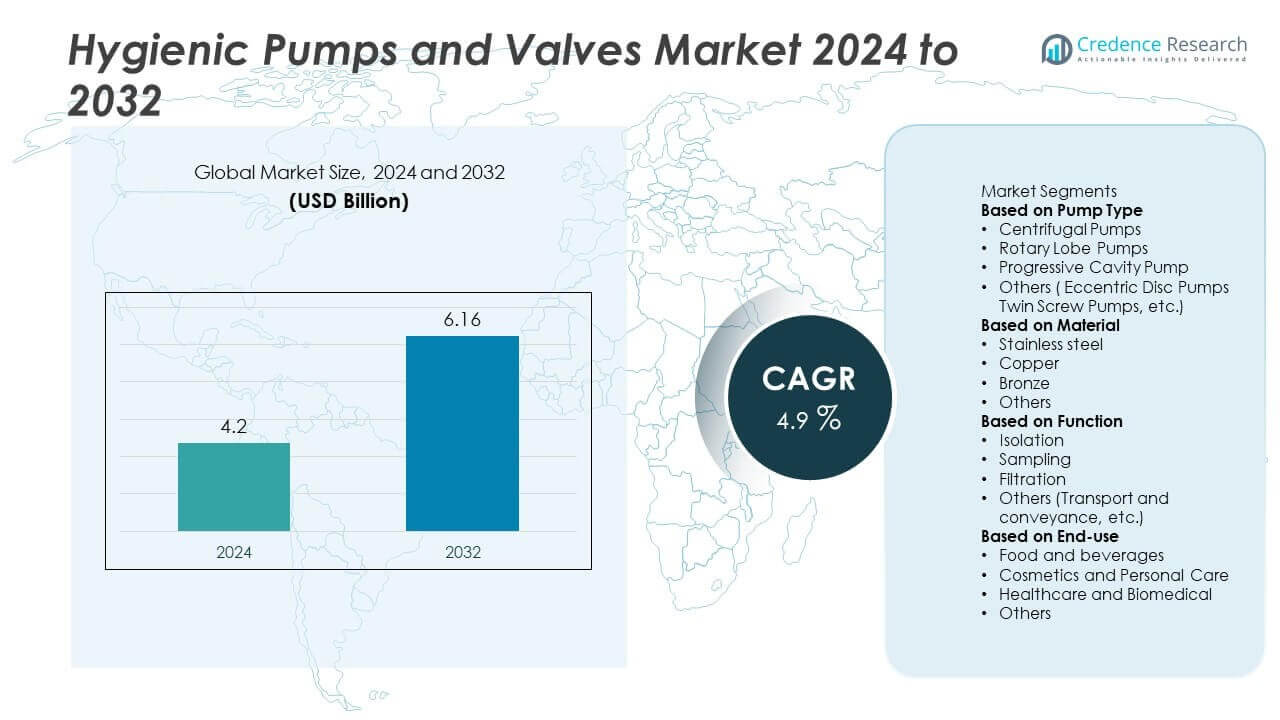

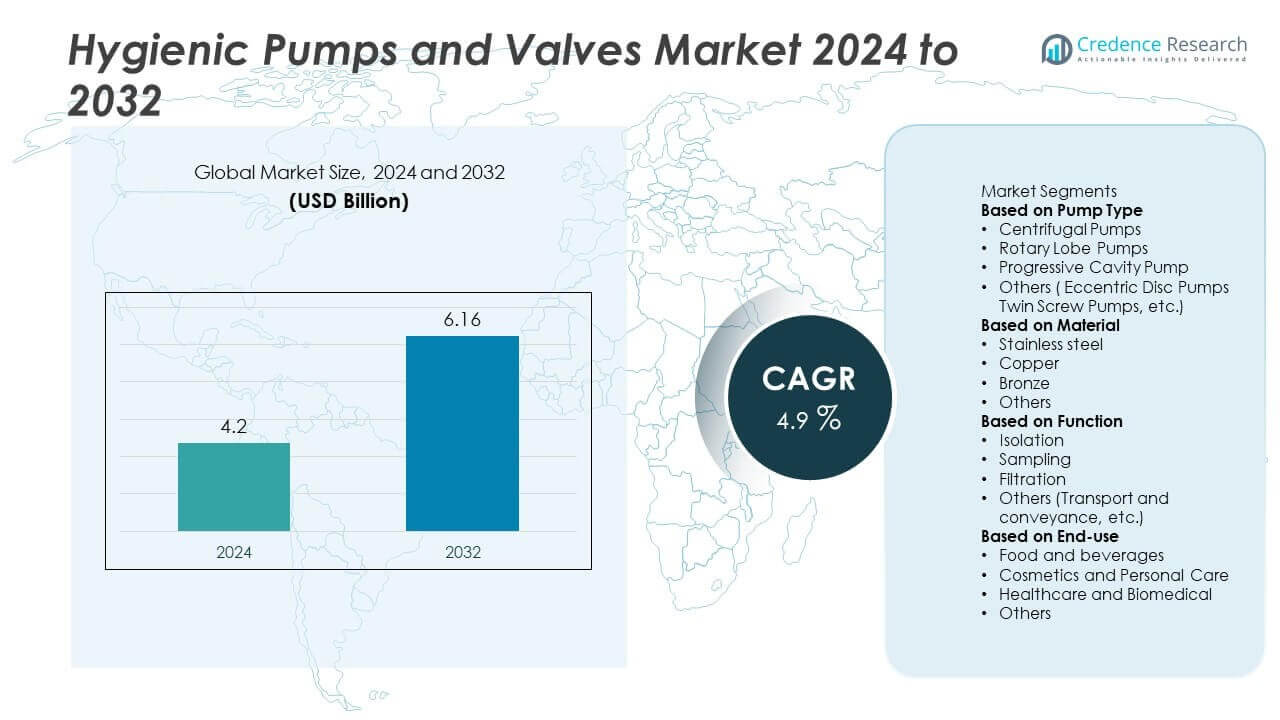

The global Hygienic Pumps and Valves Market was valued at USD 4.2 billion in 2024. It is projected to reach USD 6.16 billion by 2032, expanding at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hygienic Pumps And Valves Market Size 2024 |

USD 4.2 Billion |

| Hygienic Pumps And Valves Market, CAGR |

4.9% |

| Hygienic Pumps And Valves Market Size 2032 |

USD 6.16 Billion |

The hygienic pumps and valves market is led by major players including Alfa Laval, Flowserve Corporation, Pentair plc, Johnson Pump, GEA Group, Grundfos, KSB Group, Bürkert Fluid Control Systems, ITT Corporation, and Crane Co. These companies focus on product innovation, energy efficiency, and compliance with stringent hygiene standards to cater to food, beverage, and pharmaceutical industries. North America emerged as the leading region in 2024 with 34% market share, supported by advanced manufacturing and regulatory frameworks. Europe followed with 30% share, driven by strong demand in food and biotechnology, while Asia Pacific accounted for 25% share, fueled by rapid industrial growth and rising healthcare investments.

Market Insights

Market Insights

- The global hygienic pumps and valves market was valued at USD 4.2 billion in 2024 and is projected to reach USD 6.16 billion by 2032, expanding at a CAGR of 4.9% during the forecast period.

- Rising demand from food, beverage, and pharmaceutical industries is a key driver, as these sectors require hygienic, contamination-free fluid handling systems to comply with strict health and safety regulations.

- Market trends highlight growing adoption of energy-efficient and automated valve and pump technologies, along with increasing integration of digital monitoring systems for real-time performance optimization.

- The market is competitive with players such as Alfa Laval, GEA Group, Grundfos, Pentair plc, and Flowserve Corporation focusing on product innovation, regulatory compliance, and regional expansion strategies.

- Regionally, North America held 34% share in 2024, Europe accounted for 30%, and Asia Pacific captured 25%, while Latin America and the Middle East & Africa represented 6% and 5% shares, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Pump Type

The centrifugal pumps segment dominated the hygienic pumps and valves market in 2024 with 43% share. These pumps are widely used in food, beverage, and pharmaceutical industries due to their ability to handle large volumes of low-viscosity fluids with high efficiency. Their simple design, ease of cleaning, and compliance with hygiene standards make them the preferred choice for applications requiring strict sanitation. Rotary lobe pumps and progressive cavity pumps follow with strong demand in high-viscosity fluid handling, but centrifugal pumps maintain leadership owing to their versatility and lower operational costs.

- For instance, GEA Group’s Hilge HYGIA centrifugal pump delivers flow rates up to 180 m³/h at pressures of 16 bar, featuring electropolished stainless steel surfaces with Ra ≤ 0.8 µm, ensuring compliance with EHEDG and FDA standards for dairy and beverage processing.

By Material

The stainless steel segment led the market in 2024 with 58% share, reflecting its dominance in hygienic applications requiring corrosion resistance, durability, and compliance with sanitary regulations. Stainless steel is the material of choice in food processing, biotechnology, and pharmaceutical production, where contamination prevention is critical. Its strength and long service life support widespread adoption across industries. Copper and bronze maintain niche applications but are less favored due to corrosion and wear concerns. Stainless steel’s ability to meet regulatory standards ensures it remains the primary material in hygienic pump and valve manufacturing.

- For instance, Alfa Laval’s Unique SSV stainless steel valves are constructed with AISI 316L steel containing 2–3% molybdenum, which provides resistance to chloride-induced corrosion and allows it to withstand operating pressures up to 10 bar in hygienic pharmaceutical systems.

By Function

The isolation function segment accounted for the largest share in 2024 with 39% of the market. Isolation valves are essential in preventing contamination, ensuring safe maintenance, and maintaining sterile processing environments in industries like pharmaceuticals and dairy. Their role in protecting process integrity and ensuring compliance with hygiene standards drives strong adoption. Sampling and filtration functions also show significant demand, particularly in biotechnology and beverage applications where quality control is vital. However, isolation remains dominant as it addresses a fundamental need for cleanliness and process safety in hygienic operations.

Key Growth Drivers

Rising Demand in Food and Beverage Processing

The food and beverage sector drives strong demand for hygienic pumps and valves due to strict safety standards. Increasing consumption of packaged and processed foods requires reliable systems for safe fluid handling. Hygienic pumps ensure contamination-free processing of dairy, juices, and brewery products, while valves maintain sanitation integrity. Compliance with FDA, EU, and ISO regulations continues to support adoption, making this sector a key driver of long-term market growth.

- For instance, Alfa Laval’s LKH Prime is a hygienic pump series that can achieve capacities of up to 110 m³/h and pressures of up to 115 meters of head, with models like the LKH Prime 10 offering a lower range suitable for applications like CIP systems in breweries and juice processing lines. The entire LKH Prime series combines EHEDG and 3-A certification, ensuring both high efficiency and contamination-free operation.

Expansion in Pharmaceutical and Biotechnology Applications

The pharmaceutical and biotechnology industries represent a major growth area due to sterile fluid transfer needs. Rising production of vaccines, biologics, and sterile formulations requires advanced hygienic systems. Pumps and valves ensure compliance with GMP and other global standards, maintaining contamination-free environments. Increasing investments in biotech infrastructure and drug manufacturing further support demand. Strong emphasis on process safety and cleanroom operations positions pharma and biotech as critical drivers of market expansion.

- For instance, Bürkert’s Type 2103 diaphragm valve system is built in stainless steel with Ra ≤ 0.4 µm surface finish and is capable of operating with sterile steam up to 150°C, making it suitable for biopharma cleanroom facilities producing vaccines and monoclonal antibodies.

Shift Toward Automation and Smart Fluid Handling

Automation in industrial processing is fueling demand for intelligent hygienic pumps and valves. Manufacturers are adopting systems with sensors, IoT connectivity, and automated cleaning features to boost efficiency. Smart valves and pumps also support predictive maintenance, reducing downtime and operational risks. Integration with Industry 4.0 platforms enhances process monitoring and cost savings. As industries focus on digital transformation, automated hygienic systems are becoming essential, reinforcing their role as a major growth driver.

Key Trends & Opportunities

Growing Adoption of Stainless Steel Solutions

Stainless steel continues to dominate due to its corrosion resistance, durability, and hygiene compliance. Manufacturers are innovating with stainless steel designs to improve cleanability and operational efficiency. Regulatory frameworks in food and pharma strengthen demand for stainless steel equipment. Its use in biotechnology and dairy plants is rising, ensuring consistent adoption. With long service life and reliability, stainless steel remains the most preferred material across hygienic pump and valve applications.

- For instance, GEA Group’s Hilge MAXA stainless steel pump is constructed from 1.4404 (AISI 316L) steel and offers maximum flow rates of up to 1,400 m³/h, ensuring reliable performance in large dairy and biotech installations.

Integration of Sustainability and Energy Efficiency

Sustainability is shaping product design, with manufacturers focusing on energy-efficient and eco-friendly solutions. Pumps are being developed with lower power consumption, recyclable materials, and reduced water usage in cleaning. Regulatory pressure for sustainable food and pharma production supports this trend. Growing demand for green manufacturing and carbon reduction goals drives adoption of eco-friendly pumps and valves. This alignment with global decarbonization ensures sustainability-focused solutions remain a strong opportunity.

- For instance, Grundfos’ CRE pumps, featuring an IE5-rated permanent magnet MGE motor and intelligent drive, can achieve significant energy savings, with some case studies showing reductions of over 35% depending on the application.

Key Challenges

High Installation and Maintenance Costs

Hygienic pumps and valves require advanced engineering, sterile materials, and compliance with regulations, driving up costs. Smaller manufacturers face financial barriers in adopting these systems. Routine maintenance and validation testing further add to expenses. While they offer long-term efficiency, high upfront costs limit penetration in cost-sensitive markets. This challenge remains a hurdle, especially in developing economies where budget constraints impact adoption.

Complexity of Compliance and Standardization

Meeting multiple regulatory standards across regions adds complexity for manufacturers. Strict guidelines from FDA, EMA, and local food and pharma authorities require extensive certifications. Designing equipment that meets global compliance increases production costs and time. Inconsistent regional standards also create trade barriers, limiting expansion for some players. Continuous regulatory updates further complicate operations, making compliance a persistent challenge for industry growth.

Regional Analysis

North America

North America held 34% share of the hygienic pumps and valves market in 2024, driven by strong adoption in food and beverage processing, dairy, and pharmaceutical industries. The United States leads demand with strict FDA regulations ensuring product safety, while Canada supports growth through investments in biotechnology and packaged food sectors. Increasing adoption of automation and smart fluid handling technologies enhances regional competitiveness. Demand for stainless steel hygienic systems remains strong, supported by regulatory compliance and advanced processing facilities. Rising healthcare spending and strong pharmaceutical R&D also reinforce market growth across the region.

Europe

Europe accounted for 30% share of the hygienic pumps and valves market in 2024, supported by stringent EU regulations on food safety, hygiene, and pharmaceutical manufacturing. Germany, France, and the United Kingdom dominate adoption, with established food, beverage, and biotech industries. Widespread implementation of GMP and ISO standards drives demand for advanced stainless-steel pumps and valves. The region also benefits from the presence of leading global manufacturers focused on innovation and energy-efficient designs. Rising demand in brewing, dairy, and processed food applications ensures stable growth, while investments in biotechnology further strengthen Europe’s market position.

Asia Pacific

Asia Pacific captured 25% share of the hygienic pumps and valves market in 2024, fueled by rapid industrialization and urbanization. China and India dominate regional demand with growing food processing and pharmaceutical production capacities. Japan and South Korea add strong contributions from biotechnology and high-quality manufacturing standards. Expanding middle-class populations, rising packaged food consumption, and increasing healthcare investments drive demand for hygienic systems. Government initiatives promoting industrial modernization and regulatory compliance further support growth. The region’s growing role as a global manufacturing hub positions Asia Pacific as the fastest-growing market for hygienic pumps and valves.

Latin America

Latin America represented 6% share of the hygienic pumps and valves market in 2024, supported by rising adoption in Brazil, Mexico, and Argentina. Growth is led by the food and beverage sector, particularly dairy, breweries, and packaged foods. Increasing investments in pharmaceutical and healthcare manufacturing further boost demand for hygienic solutions. However, high equipment costs and limited regulatory enforcement in smaller markets slow adoption. Government-led initiatives to improve food safety and expand exports strengthen opportunities. The growing middle-class population and rising demand for processed foods provide long-term prospects for market expansion across Latin America.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the hygienic pumps and valves market in 2024, driven by demand from food processing, beverage, and pharmaceutical sectors. Gulf countries such as Saudi Arabia and the United Arab Emirates invest heavily in food production and pharmaceutical projects, fueling adoption. South Africa contributes with growth in dairy and healthcare applications. However, limited infrastructure and high initial costs present challenges for widespread adoption. Ongoing industrial diversification efforts and government-backed initiatives to expand local food processing and healthcare manufacturing will create new opportunities in this region.

Market Segmentations:

By Pump Type

- Centrifugal Pumps

- Rotary Lobe Pumps

- Progressive Cavity Pump

- Others ( Eccentric Disc Pumps Twin Screw Pumps, etc.)

By Material

- Stainless steel

- Copper

- Bronze

- Others

By Function

- Isolation

- Sampling

- Filtration

- Others (Transport and conveyance, etc.)

By End-use

- Food and beverages

- Cosmetics and Personal Care

- Healthcare and Biomedical

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

Competitive landscape of the hygienic pumps and valves market is shaped by leading players such as Flowserve Corporation, Pentair plc, Johnson Pump, Alfa Laval, KSB Group, Bürkert Fluid Control Systems, ITT Corporation, GEA Group, Crane Co., and Grundfos. These companies focus on innovation, product efficiency, and compliance with stringent hygiene standards to strengthen their market positions. They actively invest in advanced stainless-steel solutions, automation, and energy-efficient technologies to meet the rising demand from industries such as food and beverage, pharmaceuticals, and biotechnology. Partnerships, acquisitions, and expansion of global service networks are common strategies, enabling players to improve their customer reach and ensure timely after-sales support. With increasing regulatory pressures on safety and quality, manufacturers are integrating digital monitoring, clean-in-place (CIP) compatibility, and modular product designs. The competitive environment remains intense, as companies strive to balance cost-effectiveness, reliability, and technological advancements to serve a highly regulated and quality-driven market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Flowserve Corporation

- Pentair plc

- Johnson Pump

- Alfa Laval

- KSB Group

- Bürkert Fluid Control Systems

- ITT Corporation

- GEA Group

- Crane Co.

- Grundfos

Recent Developments

- In May 2025, Grundfos expanded its U.S. production capacity by enlarging its Brookshire, Texas, facility to increase output of hygienic pumps.

- In March 2025, Alfa Laval expanded its hygienic valve portfolio by unveiling a Unique SSV Pressure Relief Valve and a Leakage Detection Butterfly Valve, plus adding smaller sizes (DN25, DN40) to its mixproof range.

- In March 2025, Flowserve Corporation launched the INNOMAG TB-MAG Dual Drive sealless pump with secondary containment for enhanced safety.

- In November 2024, Crane Co. completed acquisition of Technifab Products, Inc., adding vacuum insulated piping and cryogenic valves to its portfolio, relevant for hygienic / high-purity sectors.

Report Coverage

The research report provides a detailed analysis based on Pump Type, Material, Function, End-use, and Geography. It highlights leading market players with an overview of their business, product portfolios, investments, revenue streams, and key applications. The report also offers insights into the competitive landscape, SWOT analysis, prevailing market trends, and the primary drivers and challenges influencing growth. In addition, it examines factors contributing to recent market expansion, industry dynamics, regulatory frameworks, and technological advancements shaping the sector. The report further evaluates the impact of external influences and global economic changes while delivering strategic recommendations for both new entrants and established companies to navigate market complexities effectively.

Future Outlook

- Demand for hygienic pumps and valves will grow with stricter food and pharmaceutical safety standards.

- Adoption of stainless-steel pumps will increase due to durability and compliance with hygiene norms.

- Smart monitoring systems will gain traction for real-time flow, pressure, and contamination tracking.

- The pharmaceutical industry will drive growth through rising investments in biologics and sterile manufacturing.

- Automation and energy-efficient technologies will become standard in fluid handling processes.

- Asia Pacific will emerge as the fastest-growing region with strong food and beverage sector expansion.

- Europe and North America will maintain dominance through regulatory compliance and technological innovation.

- Sustainability initiatives will encourage adoption of pumps and valves designed for reduced energy use.

- Competition among key players will intensify through mergers, partnerships, and product innovation.

- Growth in emerging markets will accelerate with rising packaged food consumption and healthcare investments.

Market Insights

Market Insights