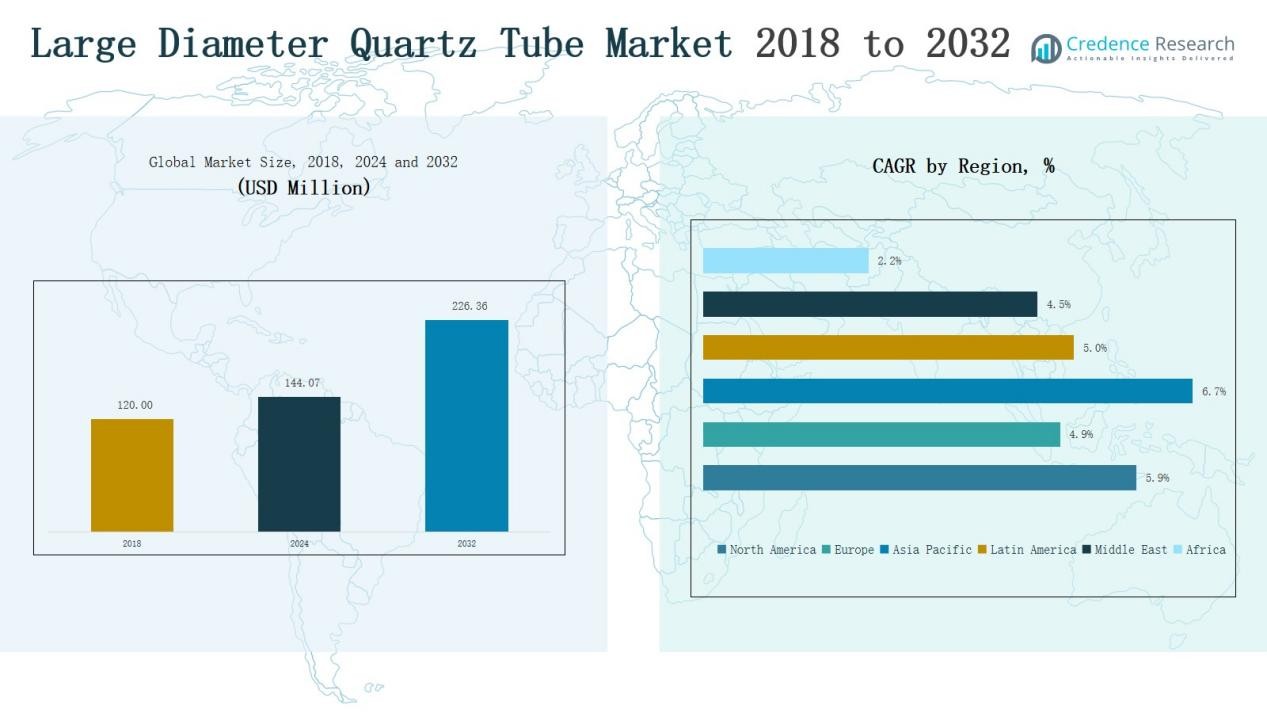

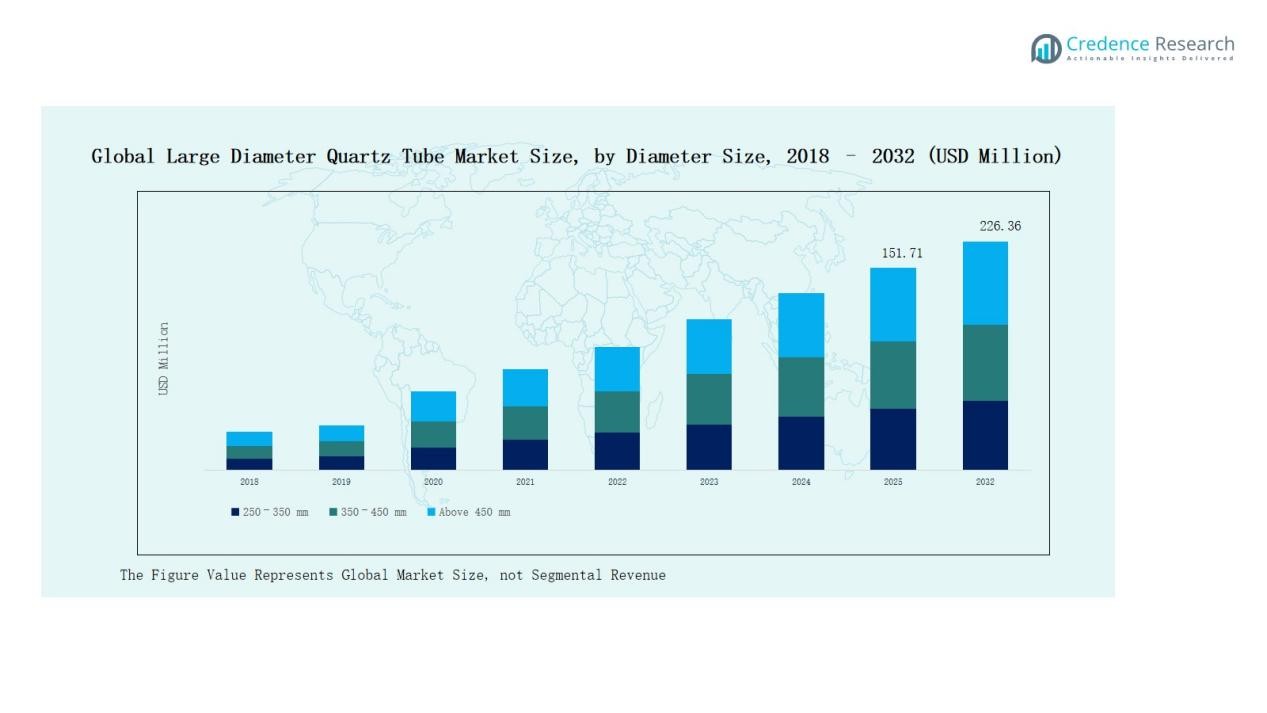

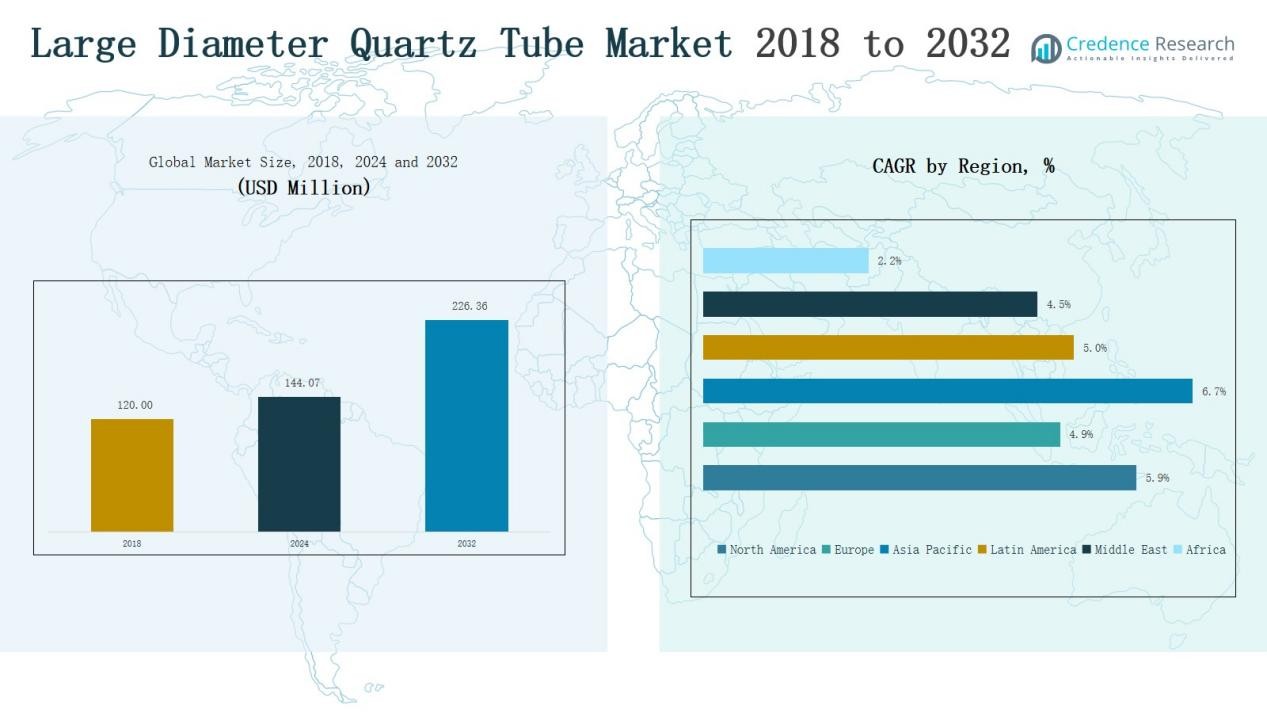

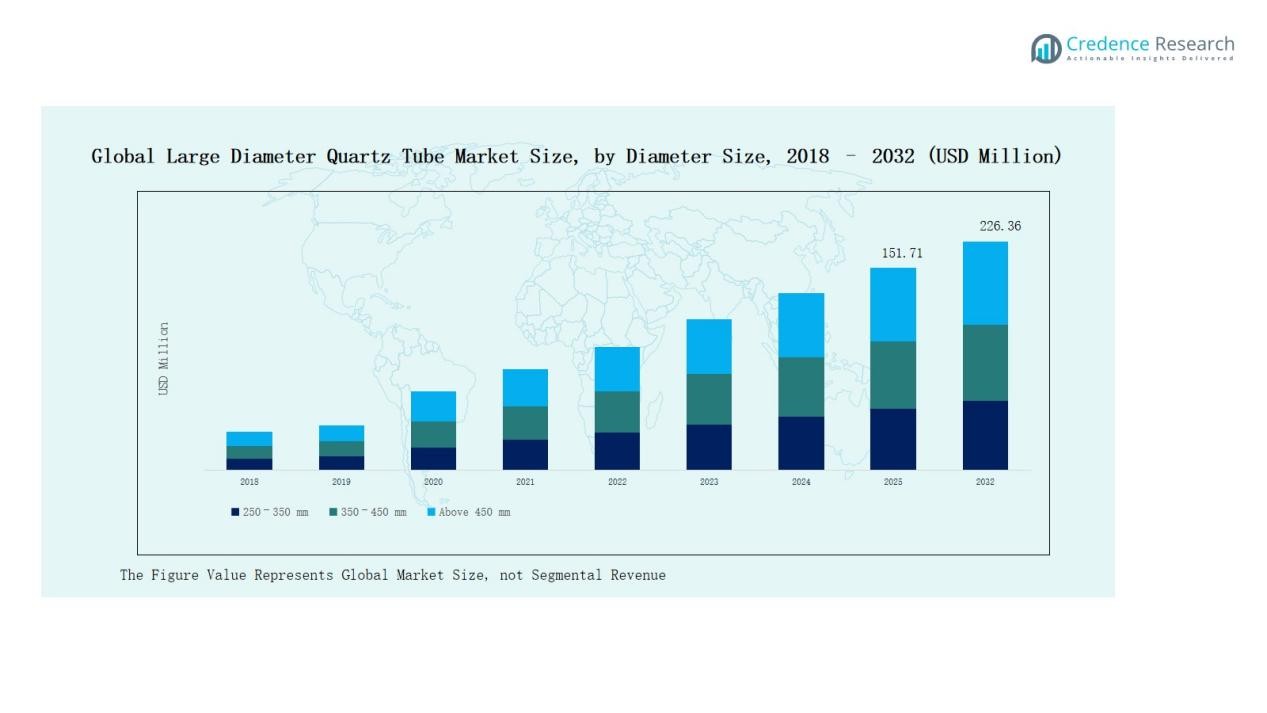

Large Diameter Quartz Tube Market size was valued at USD 120.00 million in 2018, reached USD 144.07 million in 2024, and is anticipated to reach USD 226.36 million by 2032, at a CAGR of 5.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Large Diameter Quartz Tube Market Size 2024 |

USD 144.07 Million |

| Large Diameter Quartz Tube Market, CAGR |

5.88% |

| Large Diameter Quartz Tube Market Size 2032 |

USD 226.36 Million |

The Large Diameter Quartz Tube Market is shaped by prominent players including Heraeus Quarzglas, Momentive Performance Materials, Tosoh Quartz Corporation, Shin-Etsu Chemical, QSIL GmbH, Jiangsu Pacific Quartz, Raesch Quarz GmbH, Saint-Gobain Quartz, Ohara Inc., Nippon Electric Glass, and Technical Glass Products. These companies compete through high-purity offerings, advanced fusion technologies, and strong global distribution networks to meet semiconductor, photovoltaic, and industrial demands. Among regions, Asia Pacific led the market with a 43.7% share in 2024, driven by strong semiconductor fabrication bases in China, Japan, and South Korea, alongside rapid solar energy expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Large Diameter Quartz Tube Market grew from USD 120.00 million in 2018 to USD 144.07 million in 2024, with projections of USD 226.36 million by 2032.

- Asia Pacific led with 43.7% share in 2024, supported by strong semiconductor bases in China, Japan, and South Korea, alongside rapid expansion in solar energy adoption.

- By diameter size, the 250–350 mm segment dominated with 44% share in 2024, driven by high demand in semiconductor wafer processing and photovoltaic manufacturing.

- By purity, semiconductor-grade quartz tubes held 52% share in 2024, fueled by advanced chip production for AI, 5G, and automotive electronics requiring ultra-clean materials.

- By end-use, semiconductors accounted for 48% share in 2024, with photovoltaics following closely, while fiber optics, UV lighting, and laboratory applications contributed steady niche demand.

Market Segment Insights

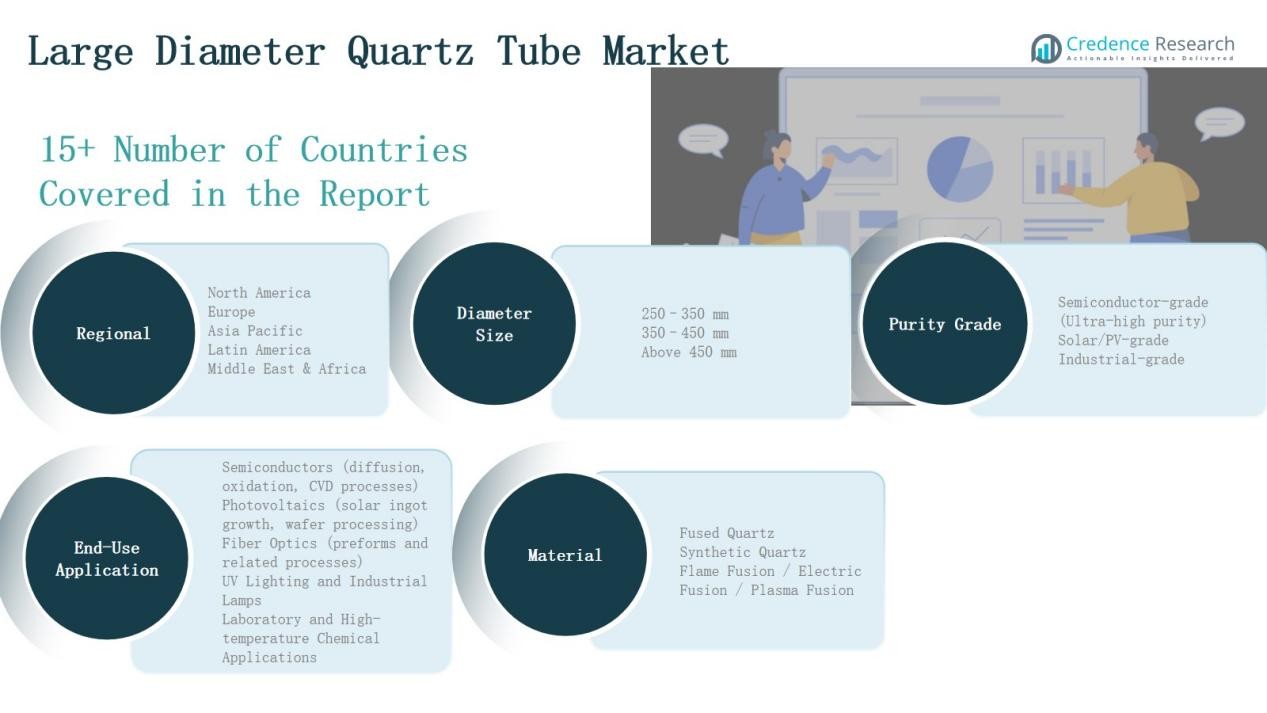

By Diameter Size

The 250–350 mm segment held the dominant share of 44% in 2024, driven by widespread use in semiconductor wafer processing and photovoltaic manufacturing. Its balance of durability and processing efficiency makes it the preferred option for high-volume production environments. The 350–450 mm segment is expanding at a steady pace with adoption in large-scale solar applications, while tubes above 450 mm remain niche, mainly used in specialized research and industrial applications requiring extreme thermal stability.

- For instance, Applied Materials expanded its Endura platform with advanced chambers optimized for 300 mm wafers, strengthening adoption in semiconductor fabrication.

By Purity / Grade

Semiconductor-grade quartz tubes accounted for 52% share in 2024, reflecting their critical role in ultra-clean environments for semiconductor manufacturing. Rising global demand for advanced chips, particularly in AI and 5G, drives this segment’s dominance. Solar/PV-grade quartz tubes captured notable demand from the booming renewable energy sector, especially in Asia Pacific. Industrial-grade tubes represent a smaller portion but remain vital in high-temperature processes and general industrial applications, supported by their cost efficiency and broader availability.

- For instance, Heraeus Conamic expanded its semiconductor-grade fused silica production in Germany to address the growing requirements of chip manufacturers.

By End-Use Application

Semiconductors dominated with 48% share in 2024, underpinned by the sector’s continuous expansion and high dependence on ultra-pure quartz tubes. Growth in advanced chip fabrication and scaling toward larger wafer sizes reinforces this leadership. Photovoltaics followed closely, with robust adoption in solar panel production supported by global renewable energy targets. Fiber optics, UV lighting, and laboratory uses provide steady demand, though their shares remain comparatively smaller, driven by specialized industrial applications and emerging demand in scientific research.

Key Growth Drivers

Rising Semiconductor Manufacturing Demand

The surge in semiconductor production is a major driver for the Large Diameter Quartz Tube Market. Manufacturers increasingly rely on ultra-pure quartz tubes for wafer processing and deposition systems. Expanding investment in advanced chip fabrication for AI, 5G, and automotive electronics strengthens demand. As wafer sizes grow, larger diameter tubes become essential for precision and thermal stability. This rising dependence on high-quality quartz materials positions the market as a critical enabler of global semiconductor supply chains.

- For instance, NVIDIA’s adoption of CoWoS-L packaging technology for its Blackwell chips addresses the need for higher bandwidth and multi-HBM requirements, highlighting the role of high-quality quartz materials in next-gen chip fabrication.

Expansion of Solar Photovoltaics

The global shift toward renewable energy strongly supports demand for large diameter quartz tubes. Solar/PV-grade quartz tubes are vital in the production of silicon wafers for solar cells. Growing government incentives, clean energy targets, and falling costs of solar power installations drive adoption. Asia Pacific leads growth due to rapid solar capacity additions, while Europe and North America follow with increasing renewable investments. The consistent rise in solar energy installations ensures sustained demand for high-purity quartz tubes across regions.

- For instance, India’s solar capacity soared to 119 GW by July 2025, reflecting robust adoption supported by large-scale ground-mounted and rooftop solar projects, further stimulating demand for specialized quartz tubes used in wafer production.

Adoption in High-Temperature Industrial Applications

Industries such as chemical processing, metallurgy, and lighting increasingly use large diameter quartz tubes for their excellent thermal and chemical resistance. They support operations in extreme environments, including laboratory research and specialized high-temperature furnaces. Demand is also reinforced by rising use in UV industrial lamps and fiber optics, where quartz’s durability and clarity provide performance advantages. This broader industrial reliance ensures steady consumption, making industrial-grade quartz tubes an important revenue contributor alongside semiconductor and solar-grade applications.

Key Trends & Opportunities

Advances in Manufacturing Techniques

Ongoing innovations in fusion processes, such as plasma and electric fusion, are reshaping the market. These techniques enhance purity levels, reduce defects, and increase scalability for large diameter quartz tube production. Companies investing in advanced manufacturing achieve higher efficiency and cost optimization, meeting stricter requirements from semiconductor and solar industries. This trend creates opportunities for suppliers to differentiate by offering superior quality and larger tube sizes that align with next-generation technologies and evolving customer needs.

- For instance, Tosoh Quartz developed advanced large-diameter quartz tubes designed to withstand higher thermal shock, expanding their role in photovoltaic cell production lines where next-generation wafer sizes are increasingly adopted.

Growing Focus on Regional Supply Security

Geopolitical uncertainties and supply chain risks are pushing semiconductor and solar companies to localize raw material sources. Governments encourage domestic production of high-purity quartz materials to reduce dependence on imports. This creates opportunities for regional quartz tube manufacturers to scale operations and capture market share. Asia Pacific continues to dominate due to strong industrial bases in China, Japan, and South Korea, while North America and Europe strengthen local sourcing strategies to ensure long-term supply resilience.

- For instance, South Korea’s SK Siltron announced plans to expand its local wafer manufacturing capacity, securing high-purity quartz inputs from domestic suppliers to strengthen its semiconductor supply chain stability.

Key Challenges

High Production Costs and Capital Investment

Producing large diameter quartz tubes requires advanced equipment, high-purity raw materials, and stringent quality control, driving up costs. Capital-intensive setups limit new entrants, and existing manufacturers face pricing pressure from buyers in semiconductors and photovoltaics. Maintaining competitive pricing while ensuring ultra-high purity standards remains a challenge. These financial barriers create reliance on a few established players, reducing competitive flexibility and hindering broader market expansion, particularly in regions with weaker manufacturing infrastructure.

Supply Chain and Raw Material Constraints

The availability of natural quartz and synthetic precursors affects production consistency. Supply chain disruptions, such as mining restrictions or geopolitical trade issues, can create bottlenecks and raise costs. Dependency on specific regions for raw quartz increases vulnerability, particularly when demand surges in semiconductors and solar sectors. Manufacturers must balance sourcing strategies while investing in alternative supply channels. Ensuring continuous raw material availability at stable costs remains a pressing challenge that impacts industry scalability.

Competition from Alternative Materials

Advancements in ceramics, specialized glass, and composite materials pose a competitive threat to quartz tubes. Some alternatives offer cost benefits, enhanced durability, or easier scalability in certain industrial applications. Although quartz retains advantages in purity and thermal stability, innovation in substitutes could reduce its market share over time. The challenge for manufacturers is to continually innovate and justify performance superiority. Failure to adapt may allow competing materials to capture demand in cost-sensitive or niche markets.

Regional Analysis

North America

North America held a 25.3% share in 2024, valued at USD 36.53 million, and is projected to reach USD 57.29 million by 2032 at a CAGR of 5.9%. The market was worth USD 30.96 million in 2018. Growth is driven by robust semiconductor fabrication in the U.S. and Canada, alongside rising adoption in photovoltaic applications. Strong R&D investments, local supply initiatives, and demand for advanced electronics support market expansion. The U.S. dominates regional revenue, backed by its leadership in chip manufacturing and industrial innovation.

Europe

Europe accounted for 18.3% of the global market in 2024, valued at USD 26.42 million, with forecasts to reach USD 38.33 million by 2032 at a CAGR of 4.9%. The market size was USD 23.23 million in 2018. Growth stems from advanced research hubs in Germany, France, and the UK, which support applications in semiconductors, fiber optics, and laboratory environments. Increasing solar capacity additions, coupled with industrial demand for UV lighting and high-temperature chemical applications, drive adoption. Europe also benefits from strong local producers and sustainability-focused initiatives promoting advanced material use.

Asia Pacific

Asia Pacific dominated with a 43.7% share in 2024, valued at USD 62.94 million, and is projected to reach USD 104.87 million by 2032 at the highest regional CAGR of 6.7%. The market stood at USD 51.12 million in 2018. China, Japan, and South Korea drive demand through their strong semiconductor industries, while India and Southeast Asia expand photovoltaic adoption. Growing investments in electronics, renewable energy, and advanced optical technologies reinforce dominance. The region’s integrated supply chain and cost-competitive production capabilities ensure Asia Pacific remains the global growth hub.

Latin America

Latin America represented 7.1% of the global market in 2024, valued at USD 10.28 million, and is forecast to reach USD 15.14 million by 2032 at a CAGR of 5.0%. The market was worth USD 8.64 million in 2018. Growth is fueled by rising adoption of solar technologies in Brazil, Mexico, and Argentina, where renewable energy expansion is prioritized. Emerging semiconductor and fiber optics projects add incremental demand. Though smaller compared to Asia Pacific and North America, the region’s renewable energy policies create steady growth opportunities for quartz tube suppliers.

Middle East

The Middle East accounted for 3.6% of the global market in 2024, valued at USD 5.13 million, and is projected to reach USD 7.27 million by 2032, growing at a CAGR of 4.5%. The market stood at USD 4.56 million in 2018. Demand is supported by expanding solar power projects in GCC countries, with strong government investments in clean energy. Growth is also supported by adoption of quartz tubes in industrial and laboratory applications. Although niche, the Middle East market offers opportunities as regional energy diversification accelerates.

Africa

Africa held the smallest share at 1.9% in 2024, valued at USD 2.77 million, and is forecast to reach USD 3.46 million by 2032 at a CAGR of 2.2%. The market was USD 1.49 million in 2018. Limited semiconductor infrastructure and modest industrial adoption constrain growth. However, gradual expansion of solar projects in South Africa and Egypt contributes to steady demand. Despite its small base, Africa’s long-term potential lies in renewable energy deployment, but slower industrialization and supply constraints restrict its current contribution to the global quartz tube market.

Market Segmentations:

By Diameter Size

- 250–350 mm

- 350–450 mm

- Above 450 mm

By Purity / Grade

- Semiconductor-grade (Ultra-high purity)

- Solar/PV-grade

- Industrial-grade

By End-Use Application

- Semiconductors

- Photovoltaics

- Fiber Optics

- UV Lighting and Industrial Lamps

- Laboratory and High-temperature Chemical Applications

By Material / Manufacturing Method

- Fused Quart

- Synthetic Quartz

- Flame Fusion / Electric Fusion / Plasma Fusion

By Region

- North America(U.S., Canada, Mexico)

- Europe(UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific(China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America(Brazil, Argentina, Rest of Latin America)

- Middle East(GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa(South Africa, Egypt, Rest of Africa)

Competitive Landscape

The Large Diameter Quartz Tube Market is moderately consolidated, with a mix of global leaders and regional specialists competing through technological innovation and product quality. Key players such as Heraeus Quarzglas, Momentive Performance Materials, Tosoh Quartz Corporation, Shin-Etsu Chemical, and QSIL GmbH dominate through extensive product portfolios and strong global distribution networks. Asian firms like Jiangsu Pacific Quartz and Japanese producers including Ohara Inc. and Nippon Electric Glass strengthen regional supply and cater to semiconductor and photovoltaic demand. European companies such as Raesch Quarz GmbH and Saint-Gobain Quartz maintain strong positions with advanced manufacturing methods and customized solutions. Competition focuses on purity levels, tube diameters, and consistency in high-temperature performance, with increasing emphasis on sustainable production practices. Companies actively pursue capacity expansion, partnerships with semiconductor manufacturers, and R&D investments to meet growing demand from electronics, solar, and fiber optics sectors, ensuring long-term strategic advantage in a niche but critical materials market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Heraeus Quarzglas (Germany)

- Momentive Performance Materials (USA)

- Tosoh Quartz Corporation (Japan)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- QSIL GmbH (Germany)

- Jiangsu Pacific Quartz Co., Ltd. (China)

- Raesch Quarz GmbH (Germany)

- Saint-Gobain Quartz (France)

- Ohara Inc. (Japan)

- Nippon Electric Glass Co., Ltd. (Japan)

- Technical Glass Products (USA)

Recent Developments

- In March 2024, Heraeus Comvance expanded its operations by acquiring a fiber drawing facility in Denmark and launched new fiber-optic glass products to complement its quartz portfolio.

- In July 2023, Heraeus Comvance acquired part of the OFS Fitel Denmark ApS plant in Brøndby, strengthening its quartz glass manufacturing footprint.

- In October 2024, Zhongjuxin announced plans to acquire 100% shares of Heraeus Conamic UK Ltd., aiming to establish a stronger semiconductor-focused high-purity quartz platform.

- In May 2024, Momentive Technologies was fully acquired by KCC Corporation, integrating its specialty quartz and materials business into KCC’s strategic global portfolio.

Report Coverage

The research report offers an in-depth analysis based on Diameter Size, Purity/Grade, End-Use Application, Material / Manufacturing Method and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise steadily with growth in global semiconductor manufacturing.

- Solar energy expansion will continue to drive strong adoption of quartz tubes.

- Asia Pacific will maintain dominance due to integrated supply chains and low-cost production.

- North America will strengthen its role with advanced chip fabrication projects.

- Europe will focus on sustainable production and research-driven applications.

- Fiber optics and UV lighting will create niche but consistent growth opportunities.

- Innovation in fusion technologies will improve purity and tube performance.

- Strategic partnerships with electronics and solar firms will boost supplier competitiveness.

- Supply security initiatives will encourage regional production investments.

- Alternative materials will challenge market growth, pushing quartz manufacturers toward differentiation.