Market Overview

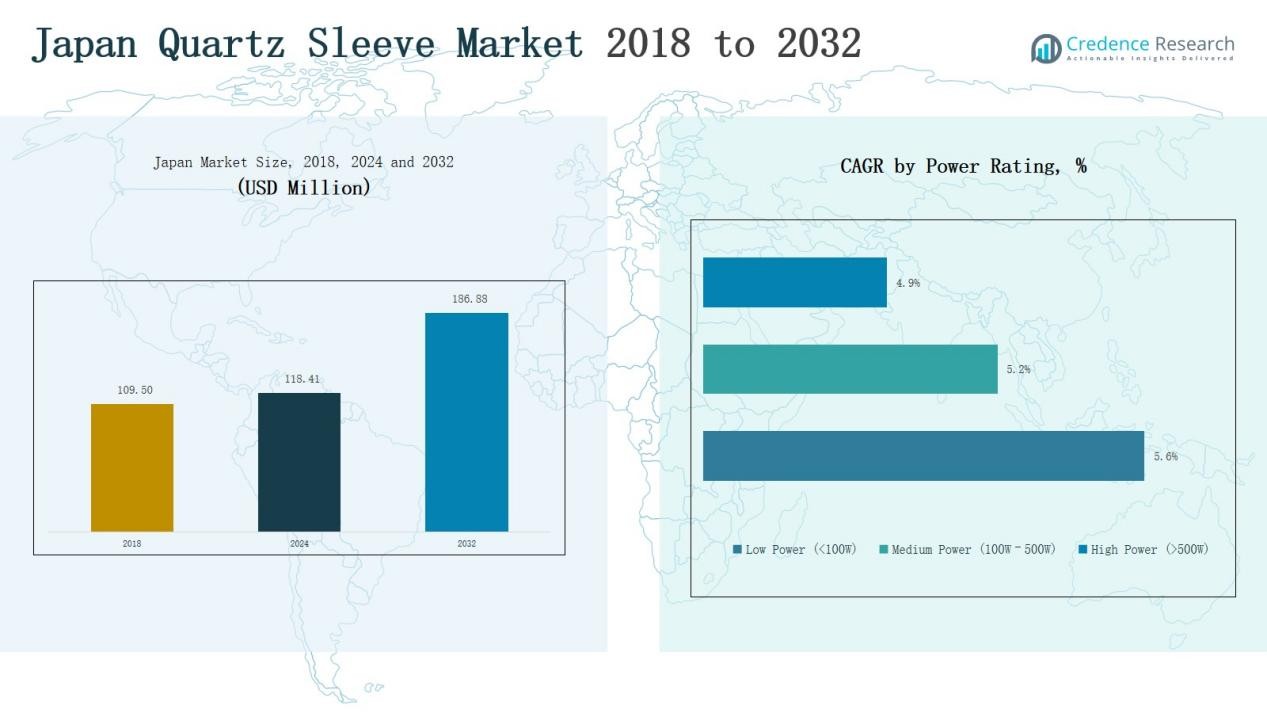

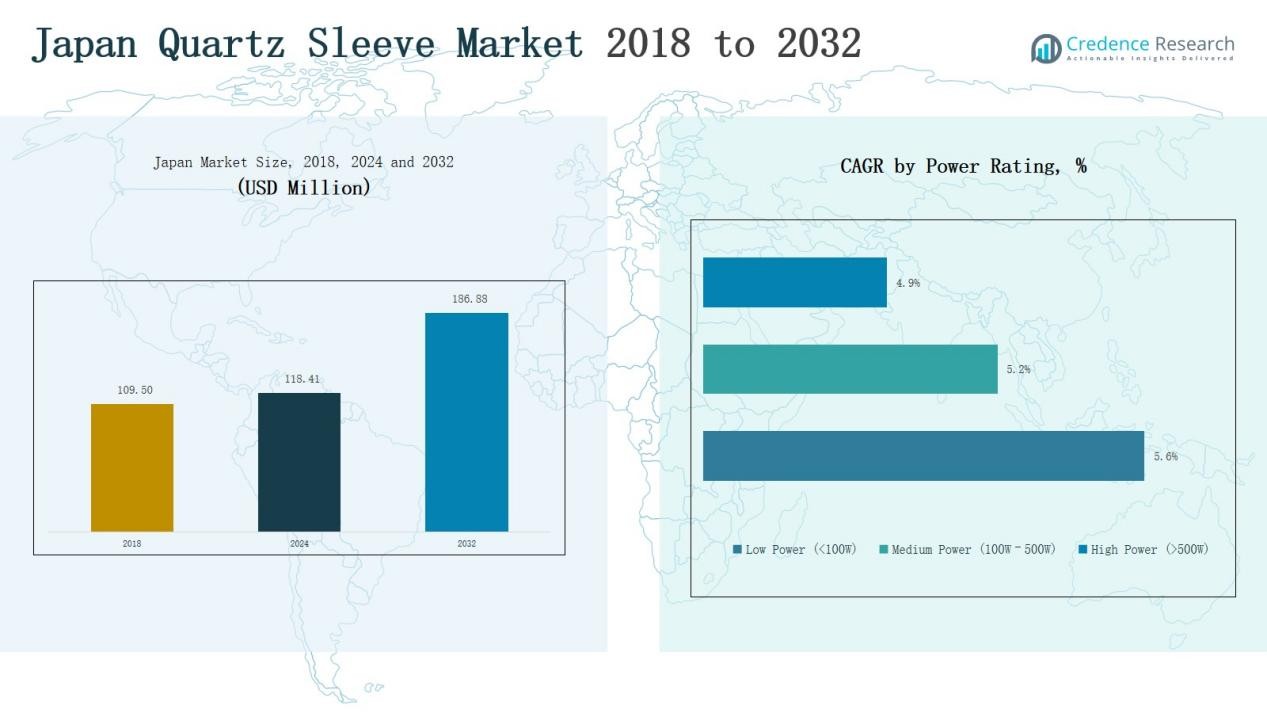

The Japan Quartz Sleeve Market size was valued at USD 109.50 million in 2018, reached USD 118.41 million in 2024, and is anticipated to reach USD 186.88 million by 2032, at a CAGR of 5.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Quartz Sleeve Market Size 2024 |

USD 118.41 Million |

| Japan Quartz Sleeve Market, CAGR |

5.87% |

| Japan Quartz Sleeve Market Size 2032 |

USD 186.88 Million |

The Japan Quartz Sleeve Market is led by established domestic players including Tosoh Quartz Corporation, Shin-Etsu Quartz Products Co., Ltd., Himeji Rika Quartz Glass Co., Ltd., Ohara Corporation, Nihon Dempa Kogyo Co., Ltd. (NDK), and Nippon Electric Glass Co., Ltd. (NEG). These companies maintain strong positions through advanced manufacturing, high-purity quartz solutions, and application-specific innovations supporting water treatment, semiconductors, pharmaceuticals, and food industries. Regionally, Kanto emerged as the dominant hub with a 37% share in 2024, driven by advanced industrial clusters, municipal water projects, and expanding semiconductor manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Quartz Sleeve Market grew from USD 109.50 million in 2018 to USD 118.41 million in 2024 and is projected to reach USD 186.88 million by 2032, at 5.87% CAGR.

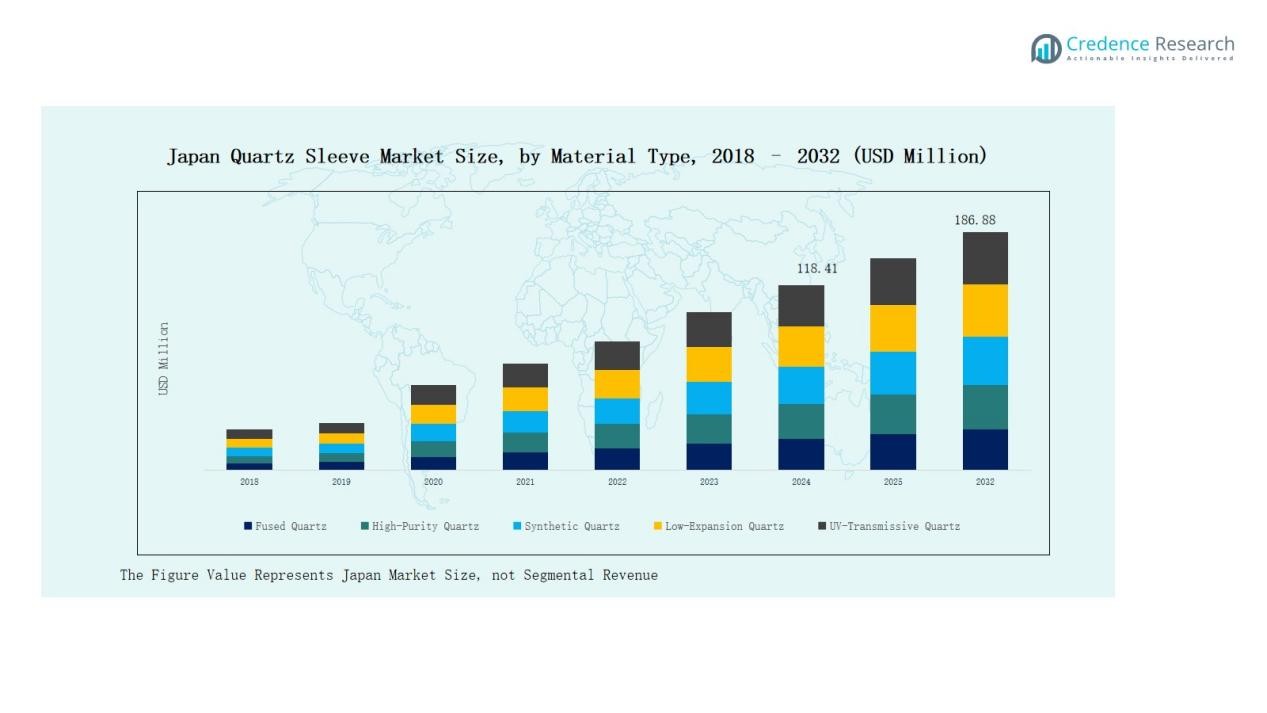

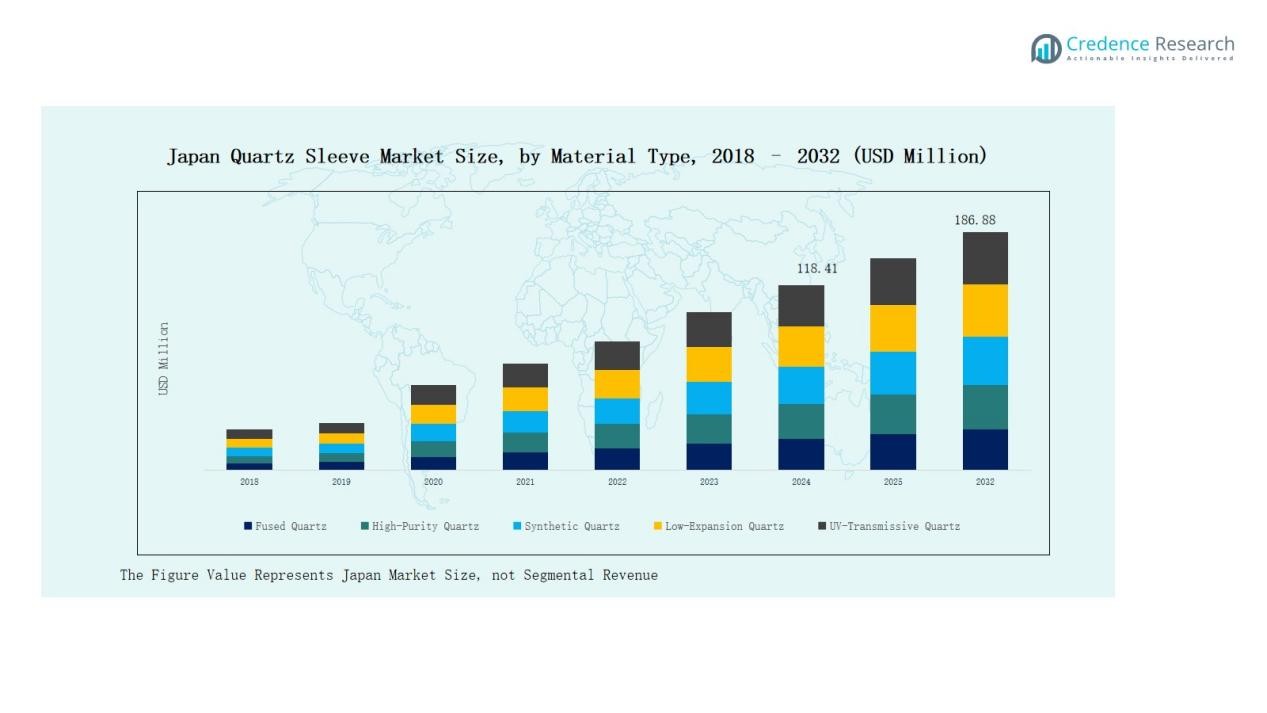

- Fused quartz held the largest share at 38% in 2024, driven by its superior UV transmission, thermal resistance, and durability, supporting widespread use in water and air disinfection systems.

- UV water disinfection dominated applications with 42% share in 2024, fueled by Japan’s strict water quality regulations and increasing adoption of UV-based purification in municipal and residential sectors.

- Water treatment led end-user demand with 36% share in 2024, supported by infrastructure upgrades and recycling initiatives, while pharmaceuticals and semiconductors showed strong momentum in high-purity quartz adoption.

- Kanto remained the leading region with 37% share in 2024, supported by urban infrastructure, semiconductor hubs, and municipal water projects, while Kansai and Chubu followed with strong industrial demand.

Market Segment Insights

By Material Type

Fused quartz dominated the Japan Quartz Sleeve Market with a 38% share in 2024. Its high thermal resistance, durability, and superior UV transmission make it the preferred choice for water and air disinfection systems. High-purity quartz followed closely, driven by demand in semiconductor and pharmaceutical applications requiring contaminant-free materials. Synthetic quartz is expanding due to controlled manufacturing benefits, while UV-transmissive quartz gains traction in advanced sterilization systems. Low-expansion quartz remains niche, serving precision optical and specialty chemical processing needs.

- For instance,Heraeus introduced a fused quartz sleeve with enhanced UV transmittance tailored for municipal water disinfection, increasing operational durability in high-temperature environments.

By Application

UV water disinfection held the largest share at 42% in 2024, supported by Japan’s stringent water quality regulations and growing adoption of UV-based purification in municipal and residential sectors. UV air disinfection is gaining traction in healthcare and commercial spaces amid rising demand for clean indoor environments. Surface disinfection solutions are expanding in food processing and pharmaceutical industries. Chemical processing applications benefit from quartz’s chemical stability, while the “others” category includes niche uses across research and specialty industrial systems.

- For instance, Signify launched its UV-C disinfection upper air luminaires in Japan to reduce airborne pathogens in medical facilities and office environments.

By End-User

Water treatment dominated the Japan Quartz Sleeve Market with a 36% share in 2024, fueled by municipal infrastructure upgrades and industrial water recycling initiatives. The food and beverage sector follows, using quartz sleeves in disinfection units to maintain hygiene standards. Pharmaceutical applications are expanding rapidly due to cleanroom requirements. Semiconductor and electronics remain a critical driver, with quartz used for high-precision processes. Oil and gas adoption is steady for chemical stability in harsh environments, while other industries reflect specialized applications.

Key Growth Drivers

Rising Demand for UV Disinfection Systems

The Japan Quartz Sleeve Market benefits from strong adoption of UV disinfection systems across municipal and industrial sectors. Stringent water quality regulations drive widespread use of quartz sleeves in water purification, while healthcare facilities and commercial buildings increase UV air and surface disinfection applications. Public awareness of hygiene standards has also surged, creating sustained demand. This trend strengthens quartz sleeves’ role as a critical component in ensuring efficiency, durability, and safety across Japan’s growing disinfection infrastructure.

- For instance, Toshiba Lighting & Technology has been distributing ULTRAAQUA’s UV water disinfection systems since 2022, serving industrial and municipal water treatment needs with solutions capable of handling flow capacities up to 6,000 m³/h while ensuring high durability even in corrosive environments.

Expanding Semiconductor and Electronics Industry

Japan’s semiconductor and electronics sector significantly supports quartz sleeve adoption. High-purity quartz is essential for wafer processing, cleanroom environments, and precision equipment, where resistance to thermal shock and chemical corrosion is critical. The market gains momentum from rising global chip demand, supported by Japan’s investments in advanced manufacturing and partnerships with global technology firms. Quartz sleeves’ ability to maintain process integrity under extreme conditions positions them as indispensable in semiconductor production, driving steady growth within the end-user segment.

Growing Adoption in Pharmaceutical and Food Industries

The pharmaceutical and food & beverage industries are expanding their use of quartz sleeves due to increasing hygiene and safety requirements. In pharmaceutical cleanrooms, UV disinfection systems equipped with quartz sleeves help control microbial contamination. The food industry leverages UV water and surface disinfection to ensure compliance with safety standards and maintain product quality. Rising consumer demand for safe, high-quality goods encourages manufacturers to adopt UV-based sterilization, directly fueling demand for quartz sleeves across these regulated and hygiene-sensitive industries.

- For instance, in the food industry, Carlsberg Brewery in Denmark implemented UV water disinfection systems to maintain ultra-pure water quality critical for brewing processes, effectively reducing microbial presence without altering taste or chemical properties, thereby preserving product quality.

Key Trends & Opportunities

Shift Toward Advanced UV-Transmissive Quartz

Manufacturers in Japan are increasingly shifting toward UV-transmissive quartz to support high-performance sterilization applications. These materials enhance UV penetration, extending lamp efficiency and improving disinfection outcomes. This trend is especially relevant in healthcare facilities and laboratories where maximum sterilization efficiency is required. Investments in R&D to develop advanced UV-grade quartz materials create growth opportunities for domestic suppliers and position Japan as a technology leader in specialized quartz sleeve production for global applications.

- For instance, Shin-Etsu Chemical announced the development of a high-purity synthetic quartz material optimized for deep-UV applications, designed to improve optical transmission in sterilization lamps.

Expansion of Smart and Sustainable Water Infrastructure

Japan’s investments in smart water treatment and sustainable infrastructure create strong opportunities for the quartz sleeve market. UV water disinfection systems are integrated into municipal water facilities to improve efficiency while reducing chemical dependence. The shift toward eco-friendly treatment methods enhances the role of quartz sleeves, which enable longer lamp life and consistent performance. As sustainability goals align with public safety requirements, quartz sleeves find expanding applications in modernized water treatment systems across Japan’s urban and industrial centers.

- For instance, Xylem Inc. introduced its Wedeco UV systems for municipal applications in Asia, integrating advanced quartz sleeve designs to improve durability and optimize water treatment efficiency.

Key Challenges

High Production and Material Costs

The Japan Quartz Sleeve Market faces challenges from the high cost of producing high-purity and fused quartz materials. Specialized manufacturing processes, energy-intensive production, and limited raw material availability increase pricing pressure. These costs limit adoption in price-sensitive applications and create barriers for smaller players competing with established companies. Managing production efficiency and supply chain optimization remains critical to addressing cost constraints and sustaining broader market penetration in Japan.

Competition from Alternative Technologies

Alternative disinfection technologies, such as chemical-based systems and LED-based UV solutions, pose competitive challenges to quartz sleeve adoption. While quartz sleeves remain reliable for traditional UV lamp systems, emerging LED solutions promise energy efficiency and compact designs, reducing reliance on sleeves. Chemical systems also continue to dominate in certain industrial processes. To remain competitive, quartz sleeve manufacturers must emphasize durability, long-term performance, and compatibility advantages to counter the adoption of competing solutions across Japan’s industrial and municipal sectors.

Stringent Quality and Regulatory Requirements

Japan’s regulatory environment for water treatment, healthcare, and pharmaceuticals imposes strict quality and safety standards on quartz sleeves. Manufacturers must consistently meet rigorous specifications for purity, durability, and UV transmission. Non-compliance risks rejection in critical applications, leading to financial and reputational losses. Meeting these requirements demands continuous investment in advanced manufacturing processes and quality control. For smaller manufacturers, adapting to these regulatory expectations presents a significant barrier, creating an uneven competitive landscape within the Japanese quartz sleeve market.

Regional Analysis

Kanto

Kanto dominated the Japan Quartz Sleeve Market with 37% share in 2024, supported by advanced industrial clusters and dense urban infrastructure. Tokyo and surrounding prefectures drive strong demand for water and air disinfection systems in residential, healthcare, and commercial facilities. The semiconductor industry in the region further strengthens demand for high-purity quartz sleeves. Strong municipal water treatment programs and rising investments in smart infrastructure contribute to the growth outlook. It continues to be the key hub for both production and consumption.

Kansai

Kansai accounted for 23% share in 2024, supported by its manufacturing base and robust food and beverage sector. Osaka and Kyoto lead demand for quartz sleeves in food processing, pharmaceuticals, and commercial applications. Water treatment projects in industrial facilities also expand the adoption of UV disinfection systems. It benefits from advanced R&D presence, creating opportunities for specialized quartz products. Growing healthcare investments reinforce demand, making Kansai a consistent growth contributor in the national market landscape.

Chubu

Chubu held 18% share in 2024, driven by its concentration of electronics and automotive industries. The region leverages high-purity and fused quartz sleeves for semiconductor production and precision manufacturing. Strong industrial clusters in Aichi and surrounding prefectures sustain adoption in chemical processing and industrial water treatment. It benefits from ongoing infrastructure modernization that emphasizes eco-friendly disinfection systems. Demand continues to expand in specialized industrial environments, positioning Chubu as a vital contributor to overall market expansion.

Kyushu

Kyushu represented 12% share in 2024, supported by water treatment projects and energy-related industries. The oil and gas sector uses quartz sleeves for chemical stability in harsh processing environments. Growing adoption of UV disinfection in municipal facilities strengthens its role in the market. Fukuoka serves as a hub for innovation, encouraging adoption of advanced UV-transmissive quartz products. It remains a growing regional market with opportunities tied to infrastructure development and industrial diversification.

Other Regions

Other regions collectively accounted for 10% share in 2024, driven by steady adoption across smaller industrial clusters and healthcare facilities. Local governments invest in water and air disinfection solutions, supporting demand growth. It sees moderate adoption in pharmaceuticals and food processing industries. Demand is reinforced by smaller-scale semiconductor applications and urban infrastructure upgrades. While growth is balanced compared to major hubs, these regions contribute stability and incremental expansion opportunities within the broader market landscape.

Market Segmentations:

By Material Type

- Fused Quartz

- High-Purity Quartz

- Synthetic Quartz

- Low-Expansion Quartz

- UV-Transmissive Quartz

By Application

- UV Water Disinfection

- UV Air Disinfection

- UV Surface Disinfection

- Chemical Processing

- Others

By End-User

- Water Treatment

- Food & Beverage

- Pharmaceutical

- Semiconductor & Electronics

- Oil & Gas

- Others

By Power Rating

- Low Power (<100W)

- Medium Power (100W–500W)

- High Power (>500W)

By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Aftermarket / Distributors

- Direct Sales

- Online / E-Commerce

- Others

By Region

- Kanto

- Kansai

- Chubu

- Kyushu

- Others

Competitive Landscape

The Japan Quartz Sleeve Market is characterized by the presence of leading domestic manufacturers and specialized suppliers that focus on innovation, product quality, and application-specific solutions. Key players such as Tosoh Quartz Corporation, Shin-Etsu Quartz Products Co., Ltd., Himeji Rika Quartz Glass Co., Ltd., Ohara Corporation, Nihon Dempa Kogyo Co., Ltd. (NDK), and Nippon Electric Glass Co., Ltd. (NEG) dominate the competitive environment. These companies strengthen their positions through high-purity quartz materials, UV-transmissive technologies, and advanced manufacturing capabilities that meet stringent regulatory and quality requirements. It is further defined by growing R&D investments aimed at improving UV transmission efficiency, extending product durability, and catering to rising demand in water treatment, semiconductor, pharmaceutical, and food industries. International collaborations and export opportunities also contribute to the competitive edge of Japanese players. Market competition remains intense, with established leaders focusing on innovation while smaller firms target niche applications and customized solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In 2025, Atlantic Ultraviolet Corporation launched SaniUV-Cube, a UV-C disinfection cabinet with adjustable quartz shelves.

- In April 2025, Tosoh Quartz, Inc. received Intel’s 2025 EPIC Supplier Award, highlighting its strong role in supplying high-purity quartz materials to the semiconductor sector .

- In March 2025, Nippon Electric Glass (NEG) introduced a glass-made Faraday element designed for laser systems, showcasing advancements in specialty glass technology with potential overlap in quartz applications .

- In March 2025, AGC partnered with ORIX to launch Japan’s first horizontal recycling business for window glass, marking progress in sustainable glass practices that may influence future quartz product development .

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, End User, Power Rating, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz sleeves in UV water disinfection will expand with stricter sanitation standards.

- Semiconductor industry growth will increase adoption of high-purity and fused quartz sleeves.

- Healthcare investments will drive rising use of UV air and surface disinfection systems.

- Food and beverage manufacturers will adopt quartz sleeves to strengthen hygiene compliance.

- UV-transmissive quartz will gain traction due to its superior efficiency in sterilization processes.

- Sustainable water infrastructure projects will create strong opportunities for quartz sleeve suppliers.

- Online and direct sales channels will expand market access for specialized quartz products.

- Local players will focus on innovation and customization to stay competitive in niche segments.

- Partnerships between quartz producers and technology firms will accelerate advanced product development.

- Regulatory pressures will ensure continuous improvement in quality standards and product reliability.