Market Overview

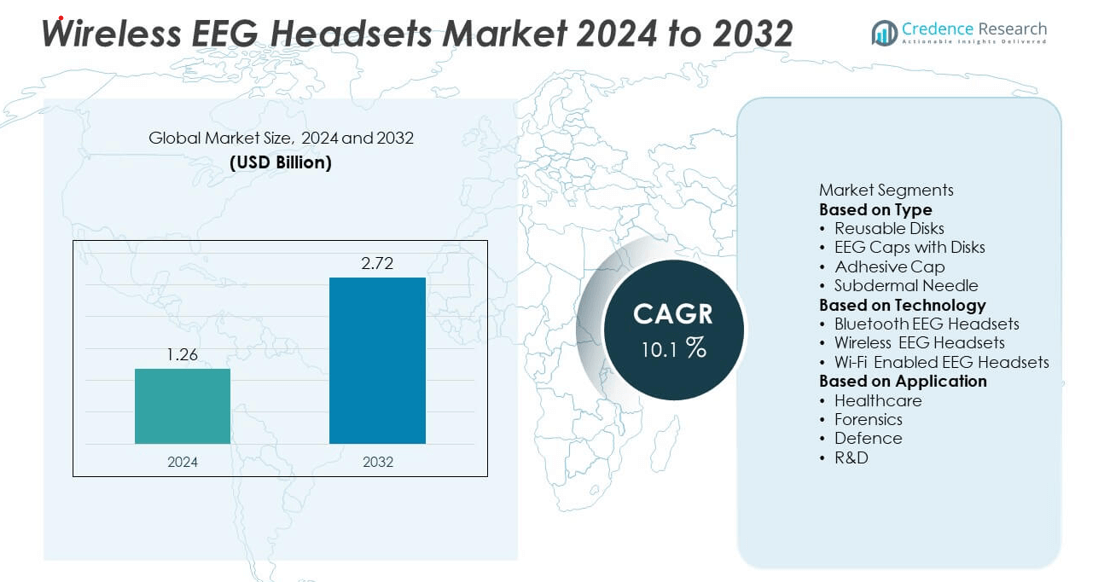

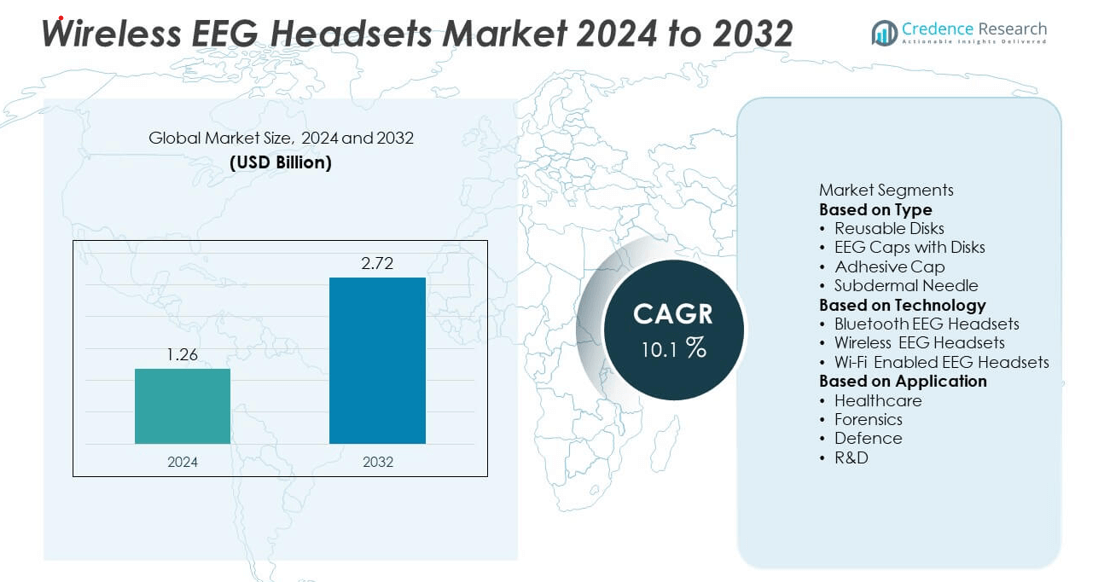

The Wireless EEG Headsets market was valued at USD 1.26 billion in 2024 and is anticipated to reach USD 2.72 billion by 2032, registering a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wireless EEG Headsets Market Size 2024 |

USD 1.26 billion |

| Wireless EEG Headsets Market, CAGR |

10.1% |

| Wireless EEG Headsets Market Size 2032 |

USD 2.72 billion |

The wireless EEG headsets market is driven by leading players including NeuroSky Inc., BrainCo Inc., Emotiv Inc., Muse (InteraXon Inc.), IMEC, and Neuroelectrics, who focus on advancing portable neurodiagnostic solutions with AI-enabled analytics and real-time data streaming. These companies are expanding applications beyond clinical diagnostics into brain-computer interface research, mental wellness, and cognitive training. North America leads the market with over 38% share in 2024, supported by strong adoption in hospitals, research centers, and telehealth programs. Europe follows with 30% share driven by neuroscience research funding, while Asia-Pacific accounts for 22% and is the fastest-growing region due to rising healthcare investment and increasing awareness of neurological health.

Market Insights

- The wireless EEG headsets market was valued at USD 1.26 billion in 2024 and is projected to reach USD 2.72 billion by 2032, growing at a CAGR of 10.1% during the forecast period.

- Rising prevalence of epilepsy, Alzheimer’s, and sleep disorders drives demand, with healthcare applications holding over 50% share in 2024 due to high use in clinical diagnostics and remote patient monitoring.

- Key trends include integration of AI-driven analytics, cloud data platforms, and brain-computer interface applications, enhancing accuracy and enabling real-time monitoring in clinical and research environments.

- The market is competitive with players such as NeuroSky Inc., Emotiv Inc., BrainCo Inc., and Neuroelectrics focusing on product miniaturization, mobile app connectivity, and partnerships with hospitals and research institutions.

- North America leads with over 38% share, followed by Europe at 30%, while Asia-Pacific holds 22% and remains the fastest-growing region supported by rising healthcare spending and adoption of telehealth solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

EEG Caps with Disks dominate the market, holding over 40% share in 2024, due to their high accuracy and ease of use in clinical and research applications. These caps enable multi-channel data acquisition and are preferred in hospitals, neurology clinics, and academic institutions for continuous monitoring. Reusable disks follow, supported by their cost-effectiveness and durability for repetitive testing. Adhesive caps are gaining traction for home monitoring and telehealth solutions, while subdermal needles remain niche, serving specialized invasive diagnostic needs where higher precision and long-term data collection are required in critical neurological assessments.

- For instance, the Emotiv EPOC X system uses 14 electroplated silver chloride (Ag/AgCl) sensors with saline-soaked felt pads, plus two reference sensors, following the International 10-20 system for electrode placement. It provides user-configurable sampling rates of 128 and 256 Hz and offers resolutions of 14-bit or 16-bit. This enables brain data capture for various research and commercial environments

By Technology

Bluetooth EEG Headsets lead the market with over 45% share in 2024, driven by their portability, low power consumption, and compatibility with mobile devices. These headsets are widely used for neurofeedback, brain-computer interface (BCI) applications, and mental wellness tracking. Wireless EEG headsets with proprietary connections hold a significant share, particularly in clinical settings requiring stable, uninterrupted data transmission. Wi-Fi-enabled EEG headsets are growing rapidly as they offer high data bandwidth and real-time streaming for research laboratories and telemedicine platforms. Technological advances are improving signal quality, battery life, and user comfort across all categories.

- For instance, the EMOTIV Insight 2.0 EEG headset features Bluetooth 5 Low Energy connectivity supporting real-time, 5-channel EEG data acquisition with a sampling rate of 128 SPS and a battery life extending up to 20 hours. Its semi-dry hydrophilic polymer sensors deliver robust signals optimized for neurofeedback and BCI applications across PC and mobile platforms.

By Application

Healthcare dominates the application segment with over 50% share in 2024, as wireless EEG headsets are extensively used in epilepsy monitoring, sleep studies, and neurological disorder diagnostics. Rising demand for remote patient monitoring and portable brain activity assessment tools supports growth. The research and development (R&D) segment is expanding steadily, driven by investments in neuroscience and cognitive studies. Forensics is emerging as a niche application for lie detection and cognitive analysis, while defense applications focus on soldier fatigue monitoring and brain-computer interface projects. Increased funding in neurotechnology boosts adoption across all application areas.

Market Overview

Rising Prevalence of Neurological Disorders

The increasing incidence of epilepsy, Alzheimer’s disease, and sleep disorders is driving demand for wireless EEG headsets. These devices allow real-time brain activity monitoring and facilitate early diagnosis without restricting patient mobility. Hospitals and clinics are adopting portable EEG systems to improve diagnostic efficiency and patient comfort. Growing awareness about neurological health and the need for long-term monitoring supports higher adoption. This driver is particularly strong in developed healthcare markets where demand for accurate, non-invasive monitoring solutions is rapidly increasing to address rising neurological disease burdens.

- For instance, Macrotellect launched the BrainLink Lite v2.0 EEG headset, which features three gold-plated dry copper sensors placed on the forehead. The device supports Bluetooth 4.0 connectivity with a range of up to 10 meters and offers a battery life providing 4–5 hours of continuous use after a recharge.

Advancements in Wireless and Wearable Technologies

Technological innovations in wireless communication, such as Bluetooth Low Energy and Wi-Fi streaming, are improving data accuracy and usability of EEG headsets. Enhanced battery life, reduced signal noise, and lightweight designs make these devices suitable for continuous monitoring and home-based applications. Integration with cloud platforms allows remote data access for clinicians and researchers, enabling faster decision-making. These advancements are encouraging adoption across healthcare, sports neuroscience, and mental wellness sectors, making wireless EEG headsets more accessible and effective for both clinical and consumer-focused applications.

- For instance, Neuroelectrics launched the Starstim 8 headset featuring 8-channel wireless EEG combined with transcranial current stimulation (tCS). The device supports real-time EEG data streaming at a 500 Hz sampling rate. Starstim 8’s wireless connectivity uses proprietary low-latency protocols, enabling stable communication with a rechargeable battery life of up to 5 hours.

Growth in Brain-Computer Interface (BCI) Applications

Expanding research and commercialization of brain-computer interface technology is boosting demand for wireless EEG headsets. BCIs enable direct communication between the brain and external devices, supporting applications in neurorehabilitation, assistive technology for paralyzed patients, and gaming. Research institutions and tech companies are investing in developing user-friendly EEG headsets to capture brain signals with high precision. This growth driver is creating new opportunities beyond healthcare, including education, human-computer interaction, and cognitive training, further accelerating market adoption worldwide.

Key Trends & Opportunities

Integration with AI and Cloud Analytics

A major trend is the adoption of AI-driven data analytics for EEG signal processing, enabling faster and more accurate interpretation of brainwave patterns. Cloud integration supports real-time remote monitoring and collaboration between clinicians and researchers. This combination enhances predictive diagnostics and opens opportunities for large-scale population studies. Vendors are focusing on developing platforms with automated data visualization and machine-learning algorithms, reducing the need for manual interpretation and improving efficiency across healthcare and research applications.

- For instance, Neuroelectrics released the NIC2 platform, which supports real-time streaming and cloud integration for wireless EEG systems including Starstim 8 and Enobio 32. The platform offers AI-driven advanced analysis tools for multi-channel EEG data, which are used in conjunction with third-party libraries and integrations like LSL to process data sampled at rates up to 512 Hz.

Growing Use in Mental Health and Wellness

Wireless EEG headsets are increasingly used in mindfulness, stress management, and cognitive behavioral therapy programs. Consumer-focused devices enable tracking of attention and relaxation levels, supporting personalized wellness solutions. This trend is creating opportunities for headset manufacturers to tap into the mental wellness and neurofitness markets. Rising adoption in corporate wellness initiatives and among individuals seeking non-invasive tools for mental health improvement is expected to further boost market expansion in this emerging application area.

- For instance, BrainCo’s FocusCalm EEG headband launched prior to 2025, first appearing on Kickstarter in 2020. It uses three electrodes on the forehead to detect brainwaves. It leverages AI and neurofeedback games, meditations, and exercises to help users practice calming their mind and improving focus

Key Challenges

High Cost of Devices and Maintenance

The premium pricing of wireless EEG headsets and the cost of software subscriptions can limit adoption, particularly in developing economies. Maintenance requirements, calibration, and replacement of consumables add to the total cost of ownership. This financial barrier can restrict accessibility for smaller healthcare facilities and research institutions, slowing market penetration. Manufacturers are working on cost-effective models and subscription-based offerings to address this challenge and expand their customer base globally.

Data Accuracy and Signal Interference Issues

Ensuring high signal quality in wireless EEG systems remains a major challenge. Signal interference from external devices, motion artifacts, and poor electrode contact can affect data reliability. These issues can hinder clinical decision-making and reduce confidence among healthcare providers. Continuous improvements in electrode design, signal filtering, and artifact removal algorithms are essential to overcome these barriers and deliver consistent, clinically reliable outputs for diagnostic and research applications.

Regional Analysis

North America

North America leads the wireless EEG headsets market with over 38% share in 2024, driven by strong adoption in hospitals, sleep clinics, and research institutes. The United States dominates demand due to advanced healthcare infrastructure and early adoption of portable neurodiagnostic devices. Increasing prevalence of epilepsy, sleep disorders, and neurodegenerative diseases supports market growth. Funding for brain research programs and collaborations between healthcare providers and technology companies boost adoption. The region’s focus on remote monitoring and telehealth solutions continues to strengthen the market outlook, making North America the most lucrative region for wireless EEG headset manufacturers.

Europe

Europe holds around 30% share in 2024, supported by growing use of wireless EEG systems in neurological research, epilepsy monitoring, and cognitive studies. Countries like Germany, the UK, and France lead adoption due to strong investments in neuroscience and digital healthcare programs. Rising demand for home-based monitoring and telemedicine applications is creating opportunities for portable EEG devices. Regulatory support for early diagnosis of neurological disorders further fuels adoption. Integration with AI-based analytics and the focus on reducing hospital stay durations drive steady growth, positioning Europe as a key region for innovative wireless EEG solutions.

Asia-Pacific

Asia-Pacific accounts for over 22% share in 2024 and represents the fastest-growing regional market. Rising healthcare expenditure, increasing awareness about neurological disorders, and government support for digital health initiatives drive adoption. China, Japan, and India lead growth with expanding hospital infrastructure and growing use of brain-monitoring devices in clinical and research applications. Rising interest in brain-computer interface (BCI) research and mental wellness devices also fuels demand. Rapid penetration of telehealth services and mobile health apps supports wider accessibility, positioning Asia-Pacific as a major growth engine for wireless EEG headsets over the forecast period.

Latin America

Latin America captures around 6% share in 2024, with Brazil and Mexico leading demand. Expanding neurology departments, growing research activity, and increasing cases of epilepsy and sleep disorders are driving the adoption of wireless EEG systems. Local healthcare providers are investing in portable EEG devices to improve accessibility and patient monitoring outside hospitals. Government programs supporting modernization of healthcare infrastructure further aid market growth. While price sensitivity remains a challenge, growing partnerships with international medical device companies and wider availability of cost-effective wireless headsets are expected to support steady adoption in the region.

Middle East & Africa

The Middle East & Africa hold around 4% share in 2024, with demand concentrated in Gulf Cooperation Council (GCC) countries and South Africa. Rising investments in healthcare infrastructure, neurodiagnostics, and telemedicine solutions support market growth. Hospitals are adopting portable and wireless EEG devices for faster and more efficient brain monitoring. Awareness campaigns about neurological health are gradually improving adoption rates. However, limited availability of skilled professionals and high equipment costs challenge wider penetration. Strategic collaborations and government initiatives to expand neurodiagnostic capabilities are expected to drive gradual growth in this emerging regional market.

Market Segmentations:

By Type

- Reusable Disks

- EEG Caps with Disks

- Adhesive Cap

- Subdermal Needle

By Technology

- Bluetooth EEG Headsets

- Wireless EEG Headsets

- Wi-Fi Enabled EEG Headsets

By Application

- Healthcare

- Forensics

- Defence

- R&D

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the wireless EEG headsets market features key players such as NeuroSky Inc., BrainCo Inc., Emotiv Inc., Neorowear, Melomind, Macrotellect Ltd., Muse (InteraXon Inc.), IMEC, Advanced Brain Monitoring Inc., and Neuroelectrics. These companies focus on developing advanced wireless EEG solutions with improved signal quality, portability, and user comfort to serve clinical, research, and consumer applications. Strategic priorities include integrating AI-powered analytics, cloud connectivity, and mobile app compatibility to support real-time monitoring and data sharing. Leading players are also investing in brain-computer interface (BCI) research, mental wellness applications, and telehealth solutions to expand their customer base. Partnerships with hospitals, research institutes, and technology firms help enhance product development and accelerate commercialization. Many vendors are targeting consumer markets with affordable, user-friendly devices for stress management, cognitive training, and meditation, strengthening their competitive position in both healthcare and wellness segments globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NeuroSky Inc.

- BrainCo Inc.

- Emotiv Inc.

- Neorowear

- Melomind

- Macrotellect Ltd.

- Muse (InteraXon Inc.)

- IMEC

- Advanced Brain Monitoring Inc.

- Neuroelectrics

Recent Developments

- In May 2025, Melomind rolled out their updated wearable EEG headband targeting meditation and sleep improvement. The device captures EEG signals through 4 channels and employs adaptive AI algorithms to personalize feedback, achieving 95% accuracy in detecting relaxation states during user sessions across a 7-hour battery span.

- In May 2025, Neuroelectrics launched Starstim 8, a wireless hybrid EEG and transcranial current stimulation (tCS) headset with 8 EEG channels and 2 tCS electrodes. The headset supports real-time monitoring at 256 Hz sampling rate with latency below 40 ms and advanced closed-loop neuromodulation for cognitive enhancement and rehabilitation therapies.

- In 2024, Macrotellect expanded its BrainLink product line with BrainLink Tune, a Bluetooth earphone embedding EEG sensors delivering real-time brain state monitoring with sub-50 ms latency

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The wireless EEG headsets market will expand as demand for portable neurodiagnostic tools increases.

- AI-powered data analysis will improve brainwave interpretation and support faster clinical decision-making.

- Brain-computer interface applications will grow in gaming, neurorehabilitation, and assistive technology.

- Consumer adoption will rise with stress management, meditation, and cognitive training use cases.

- Cloud-based platforms will enable remote patient monitoring and real-time collaboration for clinicians.

- Miniaturization and improved battery life will enhance user comfort and device portability.

- Integration with telehealth services will support wider use in home-based neurological monitoring.

- Partnerships between tech firms and hospitals will accelerate innovation and market penetration.

- Asia-Pacific will witness the fastest growth due to rising healthcare investments and awareness.

- Cost-effective wireless EEG devices will make neurotechnology more accessible in developing markets.