Market Overview

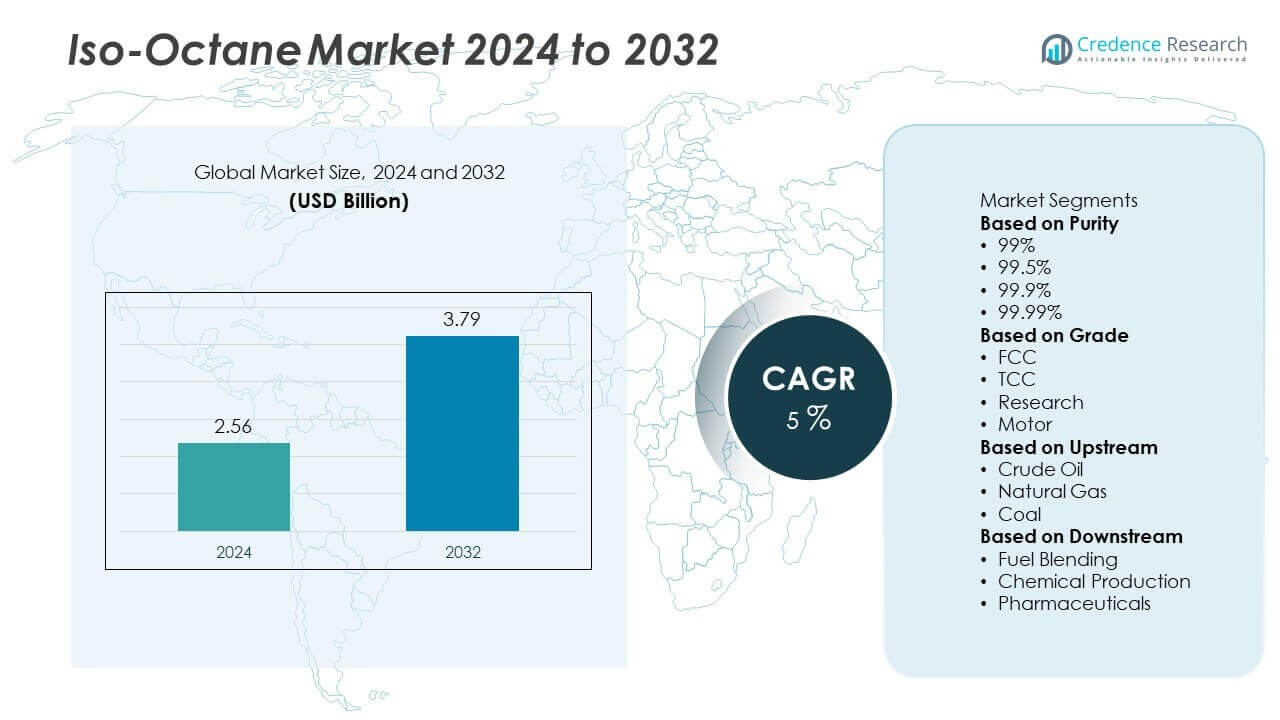

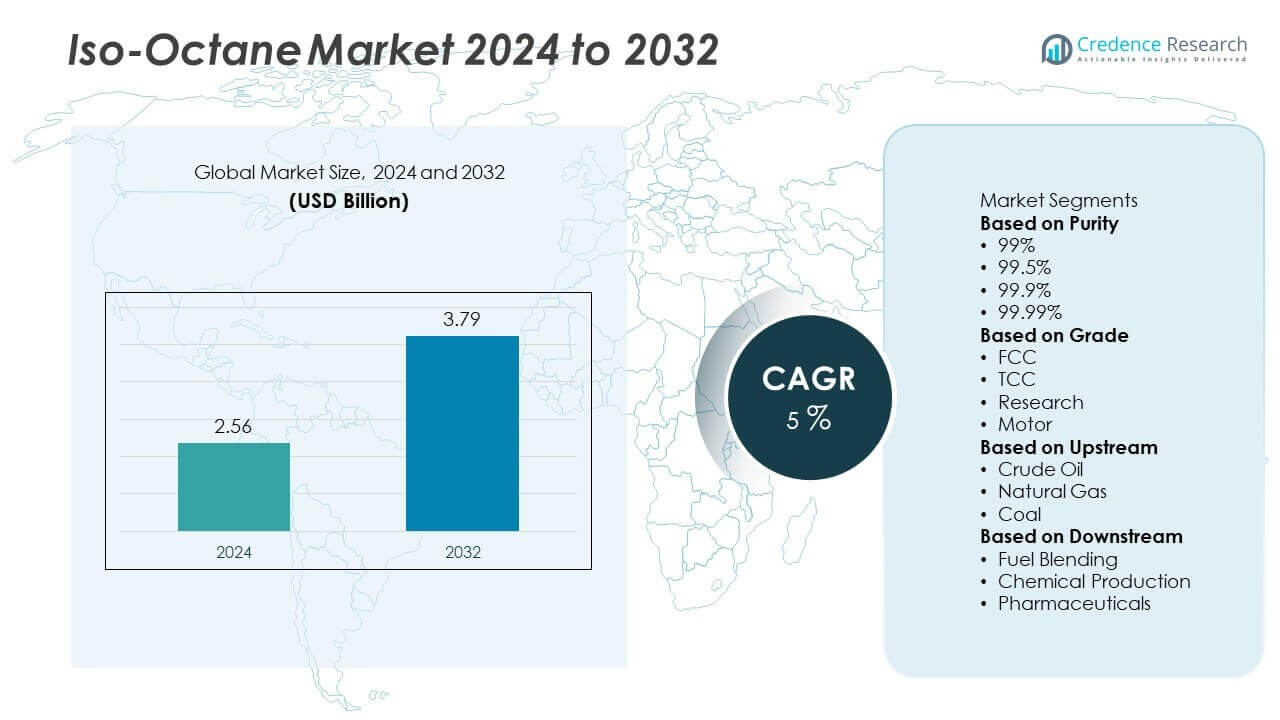

Iso-Octane Market size was valued at USD 2.56 billion in 2024 and is projected to reach USD 3.79 billion by 2032, growing at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Iso-Octane Market Size 2024 |

USD 2.56 Billion |

| Iso-Octane Market, CAGR |

5% |

| Iso-Octane Market Size 2032 |

USD 3.79 Billion |

Top players in the Iso-Octane market include Borealis, ExxonMobil, Gazprom, LyondellBasell, PBF Energy, Rosneft, BP, SK Chemical, Shell, and Phillips 66. These companies focus on expanding production capacity, optimizing refinery operations, and investing in sustainable feedstocks to meet the growing demand for high-octane gasoline blending components. Asia-Pacific leads the market with 34% share, supported by rising vehicle production, urbanization, and government regulations encouraging higher-octane fuel use. North America follows with 30% share, driven by advanced refining infrastructure and strong adoption in premium fuel applications, while Europe holds 28% share, supported by strict Euro 6 fuel quality regulations.

Market Insights

- Iso-Octane market was valued at USD 2.56 billion in 2024 and is projected to reach USD 3.79 billion by 2032, growing at a CAGR of 5% during the forecast period.

- Rising demand for high-octane gasoline to meet stricter emission norms and improve engine efficiency drives market growth, with 99% purity iso-octane holding the largest share.

- Trends include the adoption of sustainable production technologies, investment in bio-based feedstocks, and process innovations to reduce carbon footprint and improve yield.

- The market is moderately consolidated with key players such as Borealis, ExxonMobil, Gazprom, LyondellBasell, and Shell focusing on capacity expansion, technology upgrades, and long-term supply agreements.

- Asia-Pacific leads with 34% share, followed by North America at 30% and Europe at 28%, driven by rising vehicle production, growing fuel consumption, and government mandates for cleaner, high-octane fuel formulations across all regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Purity

Iso-octane with 99% purity dominates the market with over 60% share due to its cost-effectiveness and suitability for most gasoline blending applications. This segment is widely preferred by refiners to meet standard octane rating requirements while keeping production economical. The 99.5% and 99.9% purity grades cater to premium fuel applications, particularly in regions with strict emission norms and high-performance engine demand. The 99.99% purity grade is used in research and specialized applications, but its adoption is limited due to high production costs and niche demand from laboratories and testing facilities.

- For instance, Chevron Phillips Chemical Company’s “Isooctane Pure” product is offered with purity of 99.0 weight-percent minimum for standard high-purity applications

By Grade

The FCC (Fluid Catalytic Cracking) grade leads the market with nearly 65% share, driven by its high yield and ability to produce consistent quality iso-octane for fuel blending. FCC technology is widely used in refineries, making it the most cost-efficient and scalable production route. TCC (Thermal Catalytic Cracking) grade follows, serving markets where FCC units are not feasible or available. Research and motor grades are primarily utilized for engine testing, performance analysis, and calibration purposes, with demand concentrated among OEMs, fuel testing labs, and automotive research centers.

- For instance, Chevron Phillips’ TrusTec® PRF Isooctane (a research / reference grade) is specified at a minimum 99.75 volume-percent purity as 2,2,4-trimethylpentane, used for ASTM methods D-2699 and D-2700.

By Upstream

Crude oil remains the dominant upstream source with more than 70% share of iso-octane production due to its global availability and established refining infrastructure. The crude oil route provides a reliable feedstock for alkylation processes used in iso-octane production. Natural gas-based production is gaining traction in regions with abundant reserves, offering a cleaner alternative with lower carbon intensity. Coal-based routes remain limited due to higher emissions and environmental concerns but are used in select markets with large coal resources and limited crude oil access, such as parts of China.

Key Growth Drivers

Rising Demand for High-Octane Fuels

Growing vehicle production and rising demand for cleaner, high-performance gasoline are driving iso-octane consumption. Iso-octane serves as a key blending component to achieve higher octane ratings, enabling improved engine efficiency and reduced knocking. Stricter fuel quality standards in the U.S., Europe, and Asia-Pacific are encouraging refiners to increase iso-octane usage. Its ability to provide lead-free octane enhancement supports global emission reduction goals, making it a preferred choice for automotive fuel producers and sustaining market growth through the forecast period.

- For instance, Haltermann-Carless supplies iso-octane with minimum purity of 99.75% for use as a primary reference fuel in research engines per ASTM standards.

Expansion of Refining and Alkylation Capacity

The market benefits from ongoing investments in refinery upgrades and expansion of alkylation units. Refiners are modernizing facilities to meet stringent fuel specifications and increase production of high-octane gasoline components. New alkylation projects in Asia-Pacific, the Middle East, and North America are expected to significantly boost iso-octane supply. This expansion ensures stable availability, supports competitive pricing, and strengthens the supply chain for downstream fuel producers. Increased capacity also enables producers to serve export markets more efficiently, enhancing global market reach.

- For instance, Tupras (Turkey) has selected Honeywell UOP’s ISOALKY™ technology for its refineries to produce high-quality alkylate for blending, with the project licensing covering basic engineering and equipment supply.

Shift Toward Cleaner and Sustainable Fuels

Environmental regulations and rising focus on low-emission fuels are accelerating demand for iso-octane as a clean-burning additive. Iso-octane has low aromatic content, reducing particulate emissions and improving overall air quality. Governments worldwide are promoting cleaner gasoline formulations to align with climate goals and public health initiatives. Automotive OEMs are also designing engines compatible with higher octane fuels to meet performance and efficiency standards. This trend positions iso-octane as a key enabler of sustainable mobility and supports long-term demand growth globally.

Key Trends & Opportunities

Adoption of Bio-Based Iso-Octane

Development of bio-based iso-octane using renewable feedstocks is gaining traction as part of the transition toward sustainable fuels. Companies are investing in bio-refineries and green chemistry processes to produce iso-octane with a lower carbon footprint. This shift helps refiners meet renewable fuel mandates and appeal to environmentally conscious consumers. Bio-based iso-octane also provides an opportunity for market players to diversify product portfolios and strengthen ESG compliance, making it a promising growth avenue over the next decade.

- For instance, a study in Fuel (2024) produced gasoline RON 92, RON 95, and RON 98 using isopropanol (a renewable feedstock), demonstrating that bio-feedstocks can reach octane grades commonly used in commercial fuel blends.

Integration of Advanced Refining Technologies

Technological advancements in catalytic processes and digital refinery solutions are enhancing iso-octane production efficiency. Integration of process automation, AI-driven yield optimization, and predictive maintenance reduces operational costs and improves product consistency. These innovations allow refiners to maximize alkylate output while minimizing energy consumption and emissions. Adoption of such technologies creates opportunities for suppliers to meet growing demand while complying with increasingly stringent environmental regulations across major markets.

- For instance, studies exploring low-carbon high-octane gasoline additives assess bioblendstock molecules like olefinic alcohols that demonstrate favorable octane numbers while being derived from renewable feedstocks.

Key Challenges

High Production and Capital Costs

Iso-octane production involves significant investment in alkylation units and related refinery infrastructure. High capital requirements can be a barrier for small and mid-sized refiners, limiting capacity expansion. Additionally, fluctuations in feedstock prices such as isobutane and butylene can impact production costs, creating pricing volatility. Producers must balance investment strategies with market demand to maintain profitability while meeting regulatory requirements for fuel quality and emissions.

Competition from Alternative Octane Enhancers

The market faces competition from ethanol and other oxygenates that also serve as octane boosters. Ethanol blending is widely adopted due to lower cost and government mandates in several countries. This can limit iso-octane demand in certain regions, particularly in markets with high ethanol blending ratios. Market participants need to focus on promoting the performance and environmental benefits of iso-octane to retain share and compete effectively against alternative octane enhancement solutions.

Regional Analysis

North America

North America holds 30% market share, driven by strong demand for high-octane gasoline and growing adoption of clean fuel technologies. The United States leads with extensive refinery infrastructure and significant blending capacity for iso-octane in premium fuels. Supportive regulations promoting low-emission fuels and rising vehicle sales contribute to steady market growth. Canada shows growing consumption, supported by its refining sector and export opportunities to neighboring markets. Investments in upgrading refinery units and compliance with environmental standards further strengthen the region’s position, ensuring consistent demand for high-purity iso-octane across automotive and industrial applications.

Europe

Europe accounts for 28% market share, supported by stringent fuel quality regulations under Euro 6 standards. Countries such as Germany, France, and the U.K. are major consumers, with demand driven by premium gasoline production and increasing preference for high-performance vehicles. The region benefits from well-established refinery infrastructure and focus on reducing emissions through cleaner-burning fuels. Growing adoption of bio-based and renewable feedstocks also creates opportunities for iso-octane producers. Expansion of blending facilities and regulatory compliance initiatives further boost market consumption, positioning Europe as a key region for advanced fuel component adoption.

Asia-Pacific

Asia-Pacific leads the iso-octane market with 34% market share, making it the largest and fastest-growing region. China and India dominate demand due to rising vehicle production, urbanization, and government policies encouraging higher-octane fuel use. Japan and South Korea contribute through advanced refinery capacities and strong adoption in premium gasoline blends. The region experiences rapid capacity expansions and investments in petrochemical complexes to meet growing domestic and export demand. Increasing focus on reducing vehicular emissions and improving fuel efficiency further drives iso-octane consumption, making Asia-Pacific the primary growth hub for global suppliers.

Latin America

Latin America holds 5% market share, with Brazil and Mexico as major contributors. Growing automotive production and increasing adoption of higher-octane fuels drive demand for iso-octane. Government initiatives to improve fuel quality and reduce emissions support market expansion. Brazil’s ethanol-focused fuel blending programs complement iso-octane demand for premium gasoline applications. Investments in refining capacity upgrades and modernization projects strengthen supply in the region. Despite economic volatility, rising disposable incomes and urbanization continue to boost vehicle ownership, sustaining steady growth for iso-octane consumption across transport and industrial sectors in Latin America.

Middle East & Africa

Middle East & Africa represent 3% market share, with growth fueled by rising fuel quality standards and refinery modernization projects. GCC countries, including Saudi Arabia and the UAE, invest heavily in advanced refining technologies to produce high-octane gasoline components, supporting iso-octane adoption. Africa’s demand is growing gradually, driven by increasing vehicle imports and infrastructure development. Limited refining capacity remains a challenge, but imports of high-octane components are bridging the supply gap. Expanding petrochemical investments and focus on clean fuel initiatives are expected to boost market potential across the region in the coming years.

Market Segmentations:

By Purity

By Grade

By Upstream

- Crude Oil

- Natural Gas

- Coal

By Downstream

- Fuel Blending

- Chemical Production

- Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Iso-Octane market includes major players such as Borealis, ExxonMobil, Gazprom, LyondellBasell, PBF Energy, Rosneft, BP, SK Chemical, Shell, and Phillips 66. The market is moderately consolidated, with leading companies focusing on expanding production capacity and strengthening global supply chains to meet rising demand for high-octane gasoline blending components. Key players invest heavily in upgrading refining technologies and adopting environmentally friendly production processes to comply with tightening fuel quality standards. Strategic collaborations and long-term supply agreements with automotive fuel distributors help secure consistent demand. Many producers are also exploring bio-based feedstocks and sustainable production techniques to align with global decarbonization goals. Innovation in catalytic reforming and isomerization technologies is improving yield efficiency, lowering production costs, and enhancing market competitiveness. Continuous investment in R&D, combined with regional expansion and strategic partnerships, allows these companies to maintain strong market positions while addressing evolving regulatory and consumer requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Shell plc cancelled plans for a biofuels facility in Rotterdam which had earlier been designed to produce 820,000 metric tons per year when it was approved.

- In August 2025, Shell announced it will start an overhaul of its Norco, Louisiana refinery’s gasoline unit (112,000 barrels per day resid catalyst cracking unit) earlier than scheduled; that work includes changes to its alkylation facility.

- In July 2025, PBF Energy reported partial operational restart of its Martinez refinery after a fire in February 2025, producing limited quantities of gasoline, jet fuel, and intermediates including iso-octane components.

- In July 2025, Borealis reported continued advanced research into low-carbon iso-octane production, piloting bio-based feedstock technologies as part of their circular economy strategy aligned with EU emission targets.

Report Coverage

The research report offers an in-depth analysis based on Purity, Grade, Upstream, Downstream and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for iso-octane will grow with stricter fuel quality regulations and emission standards.

- Asia-Pacific will remain the largest market, supported by vehicle production and urbanization.

- Refiners will invest in advanced catalytic reforming and isomerization technologies to boost yield.

- Bio-based and sustainable production methods will gain momentum to meet decarbonization goals.

- Premium and high-octane fuel consumption will rise with growing sales of performance vehicles.

- North America will expand with upgrades in refining capacity and blending infrastructure.

- Europe will see growth driven by Euro 6 and upcoming Euro 7 fuel standards.

- Strategic collaborations between producers and fuel distributors will ensure stable supply.

- R&D will focus on cost reduction and efficiency improvement for large-scale production.

- Market competition will intensify as players adopt green initiatives and expand globally.