Market Overview:

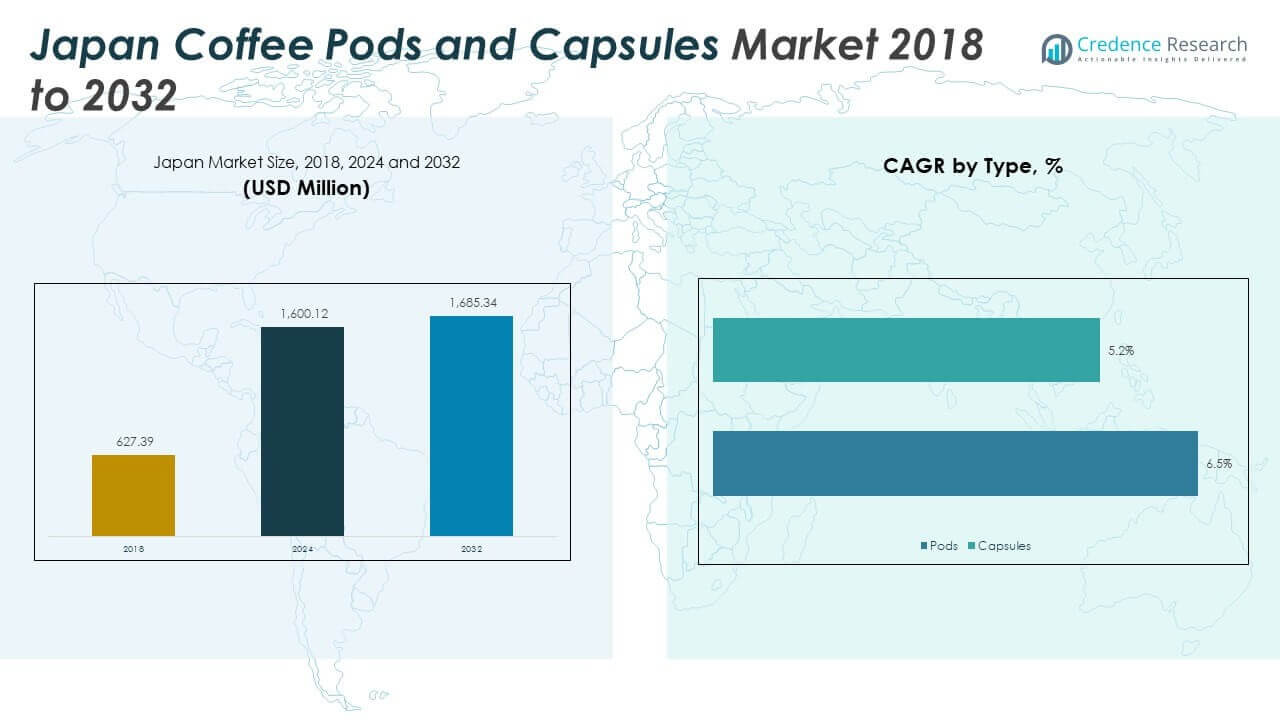

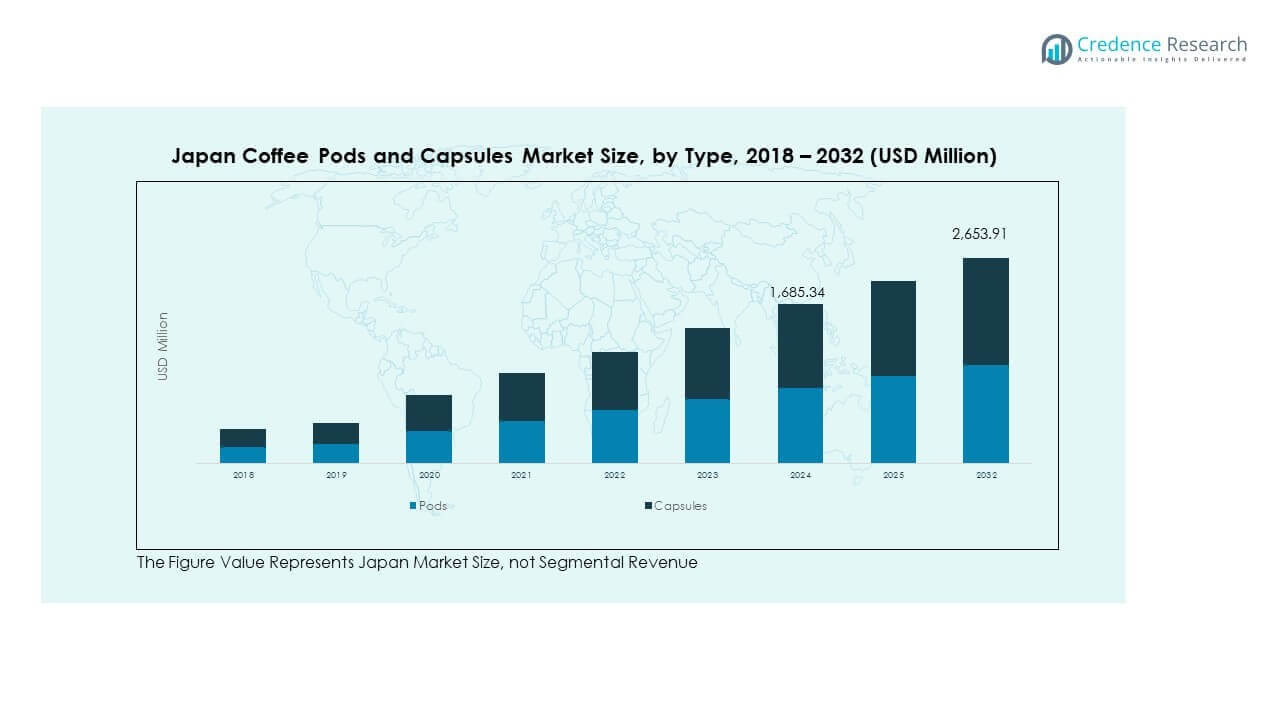

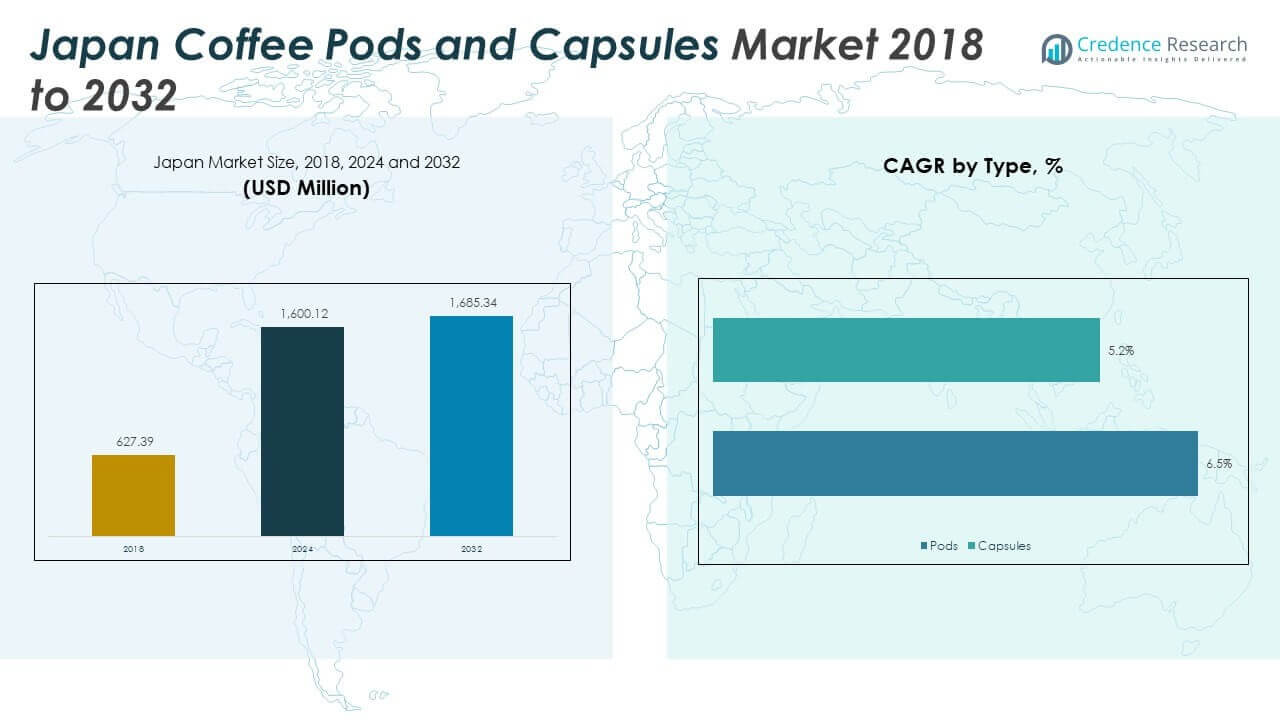

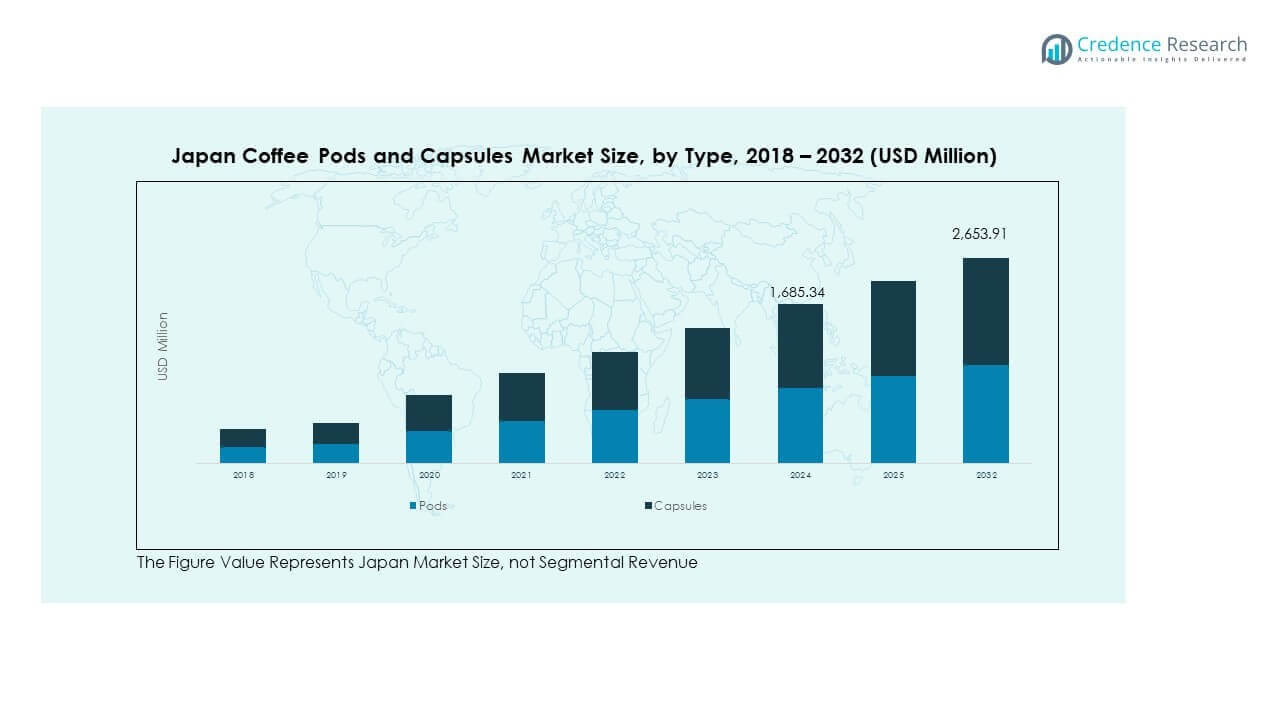

The Japan Coffee Pods Capsules Market size was valued at USD 627.39 million in 2018 to USD 1,685.34 million in 2024 and is anticipated to reach USD 2,653.91 million by 2032, at a CAGR of 5.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Coffee Pods Capsules Market Size 2024 |

USD 1,685.34 Million |

| Japan Coffee Pods Capsules Market, CAGR |

5.84% |

| Japan Coffee Pods Capsules Market Size 2032 |

USD 2,653.91 Million |

The market is driven by growing consumer demand for convenience, premium quality, and café-style coffee experiences at home. Rising urbanization, busy lifestyles, and the popularity of single-serve brewing systems are fueling adoption. Japanese consumers are increasingly open to innovative flavors, sustainable packaging, and eco-friendly capsules, boosting demand further. Strong marketing campaigns and product diversification by global and domestic brands are reinforcing growth. The presence of advanced retail infrastructure and e-commerce platforms also supports wider product availability across the country.

Geographically, the Japan Coffee Pods Capsules Market demonstrates strong performance in major metropolitan areas such as Tokyo, Osaka, and Yokohama, where busy professionals drive higher adoption of single-serve coffee. Emerging demand is also visible in secondary cities, supported by expanding retail and online channels. The cultural inclination toward high-quality and specialty beverages positions Japan as one of the most dynamic markets in Asia-Pacific. This trend is further reinforced by consumer preference for sustainable and innovative coffee solutions, making the market competitive and regionally significant.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Coffee Pods Capsules Market was valued at USD 627.39 million in 2018, reached USD 1,685.34 million in 2024, and is projected to hit USD 2,653.91 million by 2032, reflecting a CAGR of 5.84%.

- Kanto held the largest share at 40% in 2024, supported by dense urban populations and advanced retail infrastructure, followed by Kansai with 25% and Chubu with 15%.

- Kyushu, with a 12% share, is the fastest-growing region, driven by expanding e-commerce penetration and increasing consumer awareness of capsule coffee convenience.

- Capsules accounted for the majority of segmental revenue in 2024, with more than 60% share, reflecting higher demand for premium, machine-compatible products.

- Pods maintained a smaller but stable share of under 40%, catering to households preferring affordable, traditional brewing methods.

Market Drivers:

Market Drivers:

Rising Demand for Convenience and Single-Serve Coffee Solutions:

The Japan Coffee Pods Capsules Market is fueled by rising consumer preference for easy-to-use coffee solutions. Busy urban lifestyles are pushing demand for single-serve capsules that deliver speed without compromising quality. Consumers are drawn to consistent taste and portion control, making capsules a practical choice for households and offices. Growing penetration of modern brewing machines strengthens capsule adoption. It is also supported by product marketing that emphasizes convenience and premium taste. Brands highlight the balance between café-quality beverages and home preparation ease. This focus on time-saving and quality sustains strong consumer acceptance.

Increasing Interest in Premium and Specialty Coffee Flavors:

Japanese consumers are showing higher interest in premium blends and unique flavors, driving capsule adoption. Global and domestic brands are introducing specialty capsules to meet demand for varied tastes. Younger buyers prefer experimenting with exotic blends, single-origin beans, and artisanal options. It is leading to a diversified product portfolio that appeals to different income groups. Seasonal and limited-edition flavors attract repeat purchases and strengthen brand loyalty. Manufacturers are investing in product differentiation to capture niche consumer groups. This trend strengthens the market by linking innovation with customer satisfaction.

- For instance, Starbucks Japan expanded its specialty capsule portfolio in 2024 with single-origin Ethiopia and seasonal limited-edition flavors which boosted repeat purchases among urban millennials.

Expansion of Retail Infrastructure and Online Sales Channels:

Strong retail infrastructure and the growth of online platforms are supporting capsule sales in Japan. Supermarkets, convenience stores, and specialty coffee outlets offer wide product availability across urban centers. E-commerce platforms bring capsules to consumers seeking quick delivery and competitive pricing. It is further enhanced by digital marketing strategies that target younger demographics. Subscription models are also gaining momentum, offering consistent supply and customer retention. Cross-promotions with brewing machine companies expand reach and encourage first-time purchases. This distribution strength increases accessibility, helping the market grow steadily.

Sustainability Efforts and Focus on Eco-Friendly Packaging:

Eco-consciousness in Japan is driving adoption of biodegradable and recyclable capsules. Consumers are becoming more aware of environmental concerns linked to single-use plastics. Companies are responding with aluminum, compostable, or paper-based capsule innovations. It is reshaping buyer decisions, as eco-friendly features add value to the product. Brands that emphasize sustainability in packaging and sourcing build trust and consumer preference. Marketing campaigns highlighting green credentials boost visibility in competitive retail spaces. This alignment with sustainability strengthens market prospects while meeting regulatory and consumer expectations.

Market Trends:

Market Trends:

Integration of Smart Brewing Machines with Capsule Systems:

Technological advancement is a key trend shaping the Japan Coffee Pods Capsules Market. Smart brewing machines equipped with connectivity and app-based controls are gaining attention. These devices allow customization of strength, flavor, and brewing size, offering more flexibility. It is attracting tech-savvy consumers looking for advanced features in everyday appliances. Integration with voice assistants and mobile apps increases appeal. The pairing of capsules with smart machines enhances convenience and modernizes home brewing. This fusion of technology and coffee culture creates long-term adoption momentum.

- For instance, the Bosch Tassimo T20 machine uses barcode scanning for automatic drink customization.

Rising Popularity of Subscription and Direct-to-Consumer Models:

Subscription services are transforming how Japanese consumers access capsules regularly. Direct-to-consumer platforms deliver products on a scheduled basis, offering price savings and convenience. It is attracting loyal customers who value reliable supply and exclusive deals. Personalized subscription plans, based on preferred flavors and consumption habits, increase satisfaction. This model helps brands maintain recurring revenue while deepening customer engagement. Exclusive capsule launches through online subscriptions also build anticipation and demand. The direct relationship with customers gives companies better insights into evolving preferences.

- For instance, UCC Ueshima Coffee operates various subscription and loyalty programs, such as its Drip Pod machine service in Japan and other Asian markets, with personalization efforts aimed at increasing customer engagement and retention.

Collaborations Between Coffee Brands and Appliance Manufacturers:

Strategic collaborations between capsule brands and appliance makers are shaping growth. Partnerships introduce bundled deals of machines and capsules, encouraging adoption among new users. It is expanding consumer reach by lowering barriers to entry. Co-branding opportunities provide visibility and premium positioning in retail and online channels. Manufacturers leverage each other’s expertise to deliver seamless brewing experiences. Collaborative promotions target urban buyers with competitive pricing and added value. These alliances are strengthening market expansion through integrated product offerings.

Shift Toward Health-Oriented and Functional Coffee Capsules:

Consumers are increasingly drawn to health-focused beverage options. Capsule manufacturers are launching variants infused with vitamins, antioxidants, and plant-based ingredients. It is addressing demand from health-conscious buyers seeking functional benefits in coffee. Low-caffeine and decaffeinated capsules are also rising in popularity among older consumers. The blending of wellness trends with daily coffee habits creates a growing niche. Marketing strategies highlight these health benefits to capture attention in competitive spaces. The diversification into functional capsules makes the market more resilient to changing consumer needs.

Market Challenges Analysis:

High Product Cost and Limited Affordability Among Price-Sensitive Buyers:

The Japan Coffee Pods Capsules Market faces challenges linked to high costs relative to traditional coffee formats. Capsules are often more expensive than ground or instant coffee, creating barriers for price-sensitive consumers. Imported capsules add further expense due to logistics and tariffs. It is limiting widespread adoption among middle- and lower-income groups. While premium buyers sustain demand, price-driven segments hesitate to switch. This creates a divide in consumer adoption across demographics. Maintaining affordability while preserving quality remains a significant obstacle for long-term growth.

Concerns Over Environmental Impact and Recycling Infrastructure Gaps:

Environmental concerns present another critical challenge for market players. While eco-friendly packaging solutions are emerging, recycling systems remain underdeveloped in many regions. It is creating difficulties in managing capsule waste responsibly. Consumers with high awareness question sustainability claims without visible recycling outcomes. Regulatory pressure may increase costs for manufacturers to comply with stricter eco-guidelines. The challenge lies in balancing convenience with sustainability expectations. Without effective infrastructure, adoption of green capsules faces limits. This environmental gap continues to influence buying decisions in key consumer groups.

Market Opportunities:

Expansion Through Product Innovation and Differentiated Coffee Experiences:

The Japan Coffee Pods Capsules Market holds opportunities in product innovation that meets evolving consumer tastes. Unique blends, seasonal flavors, and limited editions can drive repeat purchases and customer engagement. It is further supported by growing interest in specialty coffee experiences at home. Brands can differentiate by combining technology, sustainability, and artisanal craftsmanship. Offering premium capsules with transparent sourcing strengthens trust among discerning buyers. The ability to diversify and innovate enables companies to build stronger competitive positions.

Growth Potential in Untapped Regional and Demographic Segments:

Market expansion can be achieved by targeting secondary cities and younger demographics. Rising disposable incomes and digital adoption create openings in untapped regions. It is supported by online platforms that provide direct access to capsules across wider geographies. Student and young professional segments represent future growth opportunities. Capturing these groups with affordable entry-level options can widen adoption. The development of eco-friendly solutions tailored for these audiences strengthens appeal. Companies that explore these untapped spaces stand to gain long-term advantages.

Market Segmentation Analysis:

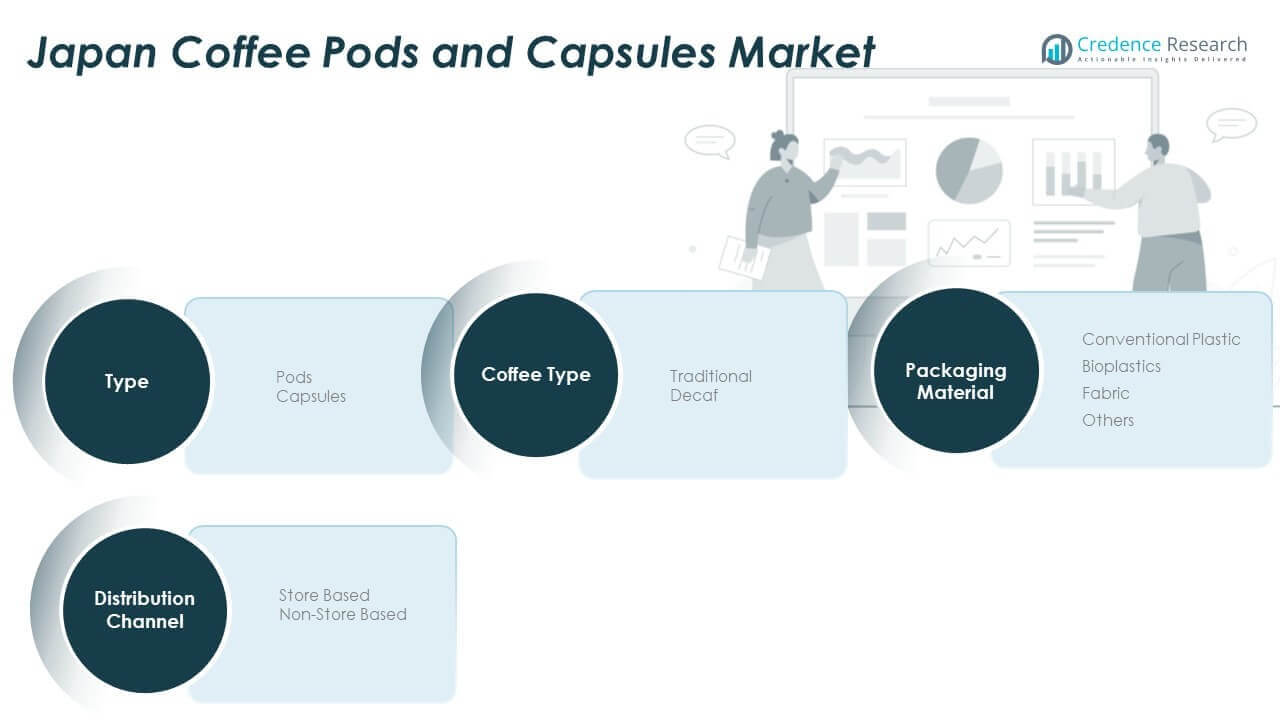

By Type

The Japan Coffee Pods Capsules Market is segmented into pods and capsules, with capsules holding stronger traction due to their compatibility with modern brewing machines. It is gaining preference among younger and urban consumers who seek convenience and variety. Pods maintain a steady demand, particularly in households that prefer traditional brewing methods at lower cost.

- For instance, capsules accounted for over 52% of unit shares in the global single-serve coffee segment in 2024, demonstrating strong growth driven by demand for premium, convenient coffee. However, in Japan, while capsules are popular, they appeal to consumers prioritizing quality and convenience, rather than being overshadowed by pods favored by price-conscious consumers.

By Packaging Material

Conventional plastic remains the most used material, though environmental concerns are driving a transition toward sustainable options. Bioplastics are emerging as a promising alternative, supported by eco-conscious buyers and regulatory expectations. Fabric-based and other innovative packaging materials are also being introduced to reduce waste and improve recyclability.

By Coffee Type

Traditional coffee dominates the Japan Coffee Pods Capsules Market, reflecting strong cultural preference for rich and authentic taste. It is supported by demand from long-time coffee drinkers who value consistent flavor. Decaf is growing steadily, especially among health-conscious and older demographics seeking reduced caffeine without compromising taste.

By Distribution Channel

Store-based retail, including supermarkets, convenience stores, and specialty outlets, accounts for the majority of sales due to product visibility and accessibility. It is reinforced by strong retail networks across metropolitan regions. Non-store-based channels, led by e-commerce platforms, are expanding quickly, supported by digital adoption, subscription models, and the demand for direct-to-consumer delivery.

Segmentation:

Segmentation:

By Type

By Packaging Material

- Conventional Plastic

- Bioplastics

- Fabric

- Others

By Coffee Type

By Distribution Channel

- Store-Based

- Non-Store Based

Regional Analysis:

Dominance of Kanto Region

The Kanto region, led by Tokyo, holds the largest share of the Japan Coffee Pods Capsules Market at nearly 40%. Dense urban populations, fast-paced lifestyles, and exposure to international coffee culture support strong adoption. Consumers in this region value convenience, premium quality, and diverse flavor options. It is further supported by the wide availability of advanced brewing machines and capsule products across supermarkets and specialty stores. The concentration of office workers and younger professionals accelerates demand for single-serve formats. Retailers in Kanto also benefit from higher purchasing power, which sustains premium capsule sales.

Growth Momentum in Kansai and Chubu Regions

Kansai accounts for about 25% of the market, anchored by Osaka and Kyoto’s blend of tradition and modernity. Rising interest in specialty and artisanal coffee experiences supports capsule adoption. It is gaining strength among middle-income groups and students who favor affordable capsule systems. Chubu, with a 15% share, is emerging due to its growing urban hubs and expanding retail networks. The convenience of capsules resonates with working families in these regions, boosting penetration. Both Kansai and Chubu benefit from evolving distribution channels, including convenience stores and online platforms that improve accessibility.

Emerging Potential in Kyushu and Hokkaido

Kyushu holds close to 12% of the Japan Coffee Pods Capsules Market, driven by expanding consumer awareness and improved retail infrastructure. It is gradually gaining momentum through rising online sales and greater availability of eco-friendly capsule options. Hokkaido captures around 8% of the share, where colder climates drive higher consumption of hot beverages. Consumers in these regions are adopting capsule systems at a slower pace but show growing interest in affordable and sustainable options. Rural areas within these regions are beginning to see penetration through e-commerce channels, which bridge the availability gap. Together, Kyushu and Hokkaido represent important growth frontiers for future expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- UCC Ueshima Coffee Co., Ltd.

- UCC Ueshima Coffee

- Keurig Dr Pepper / Tassimo

- Segafredo Zanetti

- Melitta

- Café Royal

- Dunkin’ Donuts

- Tully’s Coffee

Competitive Analysis:

The Japan Coffee Pods Capsules Market features strong competition from both domestic and international brands. UCC Ueshima Coffee holds a significant position with deep local roots and broad distribution. Global players such as Keurig Dr Pepper, Melitta, and Segafredo Zanetti strengthen competition through advanced product portfolios and global recognition. It remains highly competitive with companies investing in flavor innovation, sustainable packaging, and partnerships with appliance manufacturers. Café Royal, Dunkin’ Donuts, and Tully’s Coffee expand market reach with targeted retail strategies and branding. Differentiation relies on convenience, premium blends, and eco-friendly solutions. Price competition exists, but premiumization drives value growth across leading segments.

Recent Developments:

- In June 2024, UCC Ueshima Coffee Co., Ltd. launched two new ready-to-drink canned coffees, Iced Latte and Iced Matcha Latte, expanding their product range with a focus on sustainable packaging using 100% recyclable cans. This launch marked UCC’s first entry into the UK market with these beverages designed for an on-the-go lifestyle.

- In August 2025, Keurig Dr Pepper was reported nearing an $18 billion deal to acquire Dutch coffee company JDE Peet’s, which owns Tassimo among other brands. This acquisition aims to restructure and enhance Keurig Dr Pepper’s beverage portfolio. Keurig Dr Pepper also reaffirmed its FY 2025 guidance in July with positive momentum in US coffee trends.

- Melitta Group announced in early September 2025 that it became the official coffee partner of Real Madrid football club, a five-year partnership including installation of over 200 coffee machines at the Santiago Bernabéu stadium and extensive marketing collaboration with the club’s men’s and women’s teams.

- Café Royal is continuing its evolution as a luxury hospitality brand, opening a grill restaurant space in June 2025 that revives its historic Oscar Wilde Bar location. This reflects ongoing efforts to enhance its luxury hotel and dining offerings.

Report Coverage:

The research report offers an in-depth analysis based on type, packaging material, coffee type, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for sustainable and biodegradable capsules will reshape consumer choices.

- Premium blends and specialty coffee options will attract younger and urban buyers.

- Online channels and subscription models will expand reach across new demographics.

- Collaborations with appliance manufacturers will drive higher machine adoption.

- Regional penetration in secondary cities will unlock new consumption bases.

- Health-oriented capsules, including low-caffeine and functional variants, will gain traction.

- Digital marketing strategies will enhance brand loyalty and consumer engagement.

- Expansion of retail infrastructure will sustain strong store-based sales.

- Smart brewing machines integrated with capsule systems will appeal to tech-savvy users.

- Sustainability regulations will push innovation in packaging and product design.

Market Drivers:

Market Drivers: Market Trends:

Market Trends: Segmentation:

Segmentation: