Market Overview:

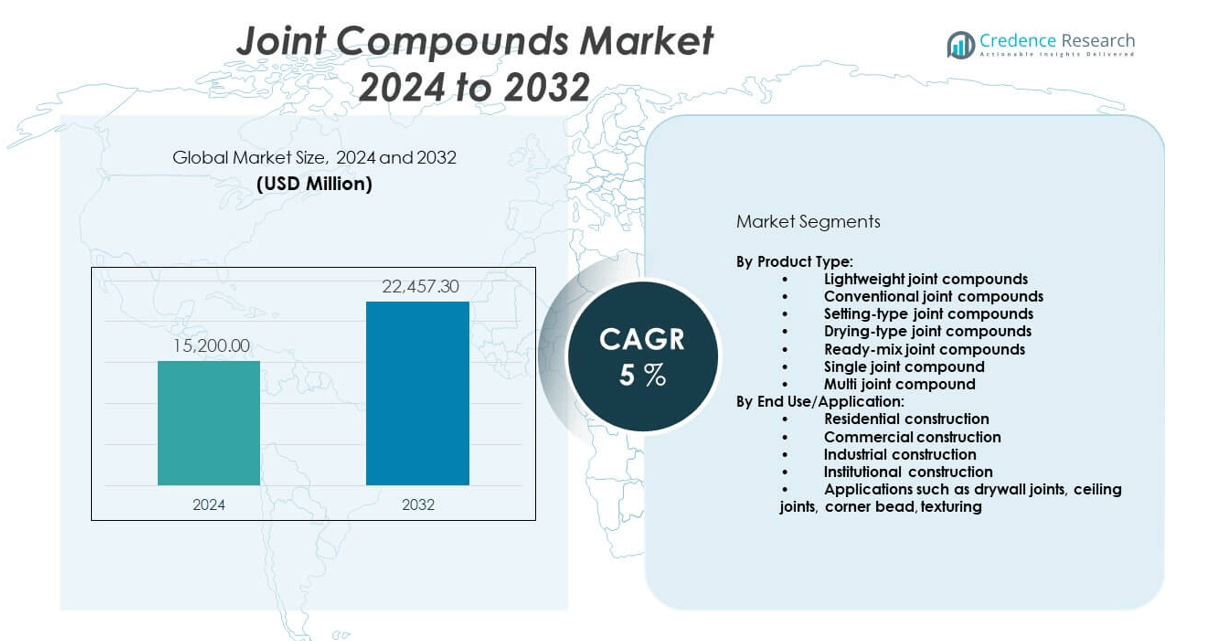

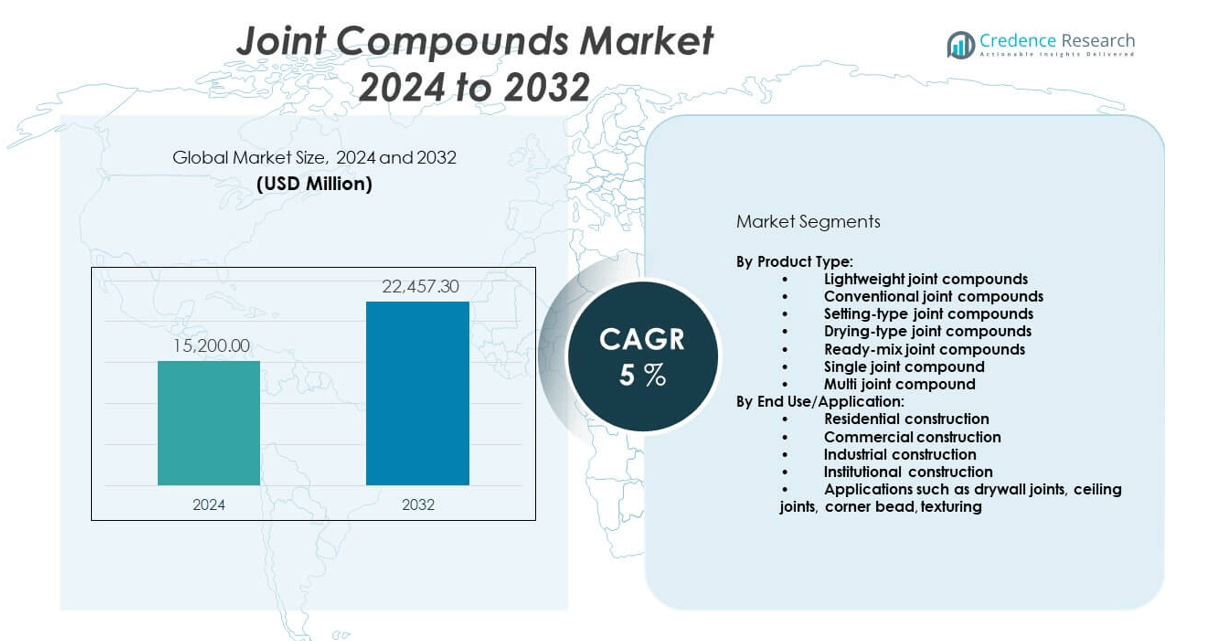

The Joint compounds market is projected to grow from USD 15,200 million in 2024 to an estimated USD 22,457.3 million by 2032, with a compound annual growth rate (CAGR) of 5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Joint Compound Market Size 2024 |

USD 15,200 million |

| Joint Compound Market, CAGR |

5% |

| Joint Compound Market Size 2032 |

USD 22,457.3 million |

Growth in the joint compounds market is driven by rising construction activities across residential, commercial, and infrastructure sectors. The increasing demand for drywall installations in modern buildings, combined with the shift toward cost-effective and time-saving building materials, supports market expansion. Additionally, innovations in lightweight and dust-control formulations enhance product performance and user safety, making them more appealing to both professionals and DIY users. Growing renovation and remodeling trends, especially in urban areas, further stimulate demand for joint compounds.

Regionally, North America and Europe lead the joint compounds market due to their mature construction industries and high adoption of drywall systems. The United States remains a key contributor owing to ongoing housing and commercial developments. Meanwhile, Asia-Pacific emerges as a high-growth region, driven by urbanization, expanding middle-class populations, and government investments in infrastructure. Countries like China, India, and Southeast Asian nations show strong potential due to rapid construction activity and rising demand for modern building materials.

Market Insights:

- The joint compounds market is projected to grow from USD 15,200 million in 2024 to USD 22,457.3 million by 2032, registering a CAGR of 5% during the forecast period.

- Growing residential and commercial construction activities globally drive demand for joint compounds, especially in drywall applications.

- Increased focus on interior aesthetics and smooth surface finishing continues to support product adoption across both new and renovation projects.

- Volatile raw material prices and availability of low-cost substitutes such as plaster of Paris restrain consistent market expansion.

- Lack of awareness and traditional construction practices in developing regions limit the penetration of modern joint compound systems.

- North America and Europe dominate the market due to high construction standards, DIY culture, and widespread use of drywall.

- Asia-Pacific shows the fastest growth potential, fueled by rapid urbanization, infrastructure development, and rising awareness of advanced finishing materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from New Residential and Commercial Construction Activities:

The expansion of residential and commercial construction across urban and semi-urban areas drives sustained demand for drywall and joint finishing products. Governments are funding large-scale housing and infrastructure programs, particularly in developing economies. Contractors prefer joint compounds due to their ease of application and ability to reduce labor costs. Homeowners renovating old spaces also choose these compounds to ensure smooth wall finishes. The joint compounds market benefits from rapid urban migration and population growth. It supports increased drywall installations across interior partitions and ceilings. Builders seek efficient finishing solutions that speed up project timelines. This requirement positions joint compounds as essential products in construction workflows.

- For instance, USG Corporation reported that its Sheetrock® Brand ultra-lightweight joint compounds reduce application time by up to 20% compared to conventional compounds, directly contributing to faster project completion. Homeowners renovating old spaces also choose these compounds to ensure smooth wall finishes.

Increased Focus on Interior Aesthetics and Smooth Surface Finishing:

A growing number of consumers prioritize interior aesthetics, driving demand for materials that deliver clean finishes. Interior designers and contractors select joint compounds to achieve seamless surfaces before painting or wallpaper application. The joint compounds market meets the need for defect-free wall systems in both luxury and mid-tier segments. Product formulations continue to improve in smoothness and consistency. Construction professionals value compounds that reduce sanding and allow easy feathering. This preference influences purchasing decisions and encourages repeat use. The trend toward minimalist, flawless interiors further promotes the use of joint finishing systems. Market players respond by offering tailored solutions for different application needs.

- For instance, USG’s Sheetrock® Brand Plus 3® Joint Compound is 25% lighter than conventional compounds, offering less shrinkage and easier sanding, which facilitates better finishing with fewer coats. It’s GREENGUARD Gold Certified, qualifying as a low-VOC product, promoting healthier indoor air quality.

Innovation in Product Formulations to Improve Efficiency and Application:

Manufacturers are introducing lightweight, low-dust, and fast-drying joint compounds to support modern construction demands. These formulations enable faster project completion while reducing clean-up and health risks. The joint compounds market shows consistent growth where users seek high-performance materials with superior adhesion. Builders favor ready-mix and pre-blended types that simplify the mixing process. Technological enhancements improve product shelf life and texture stability. New dust control compounds also improve safety conditions on job sites. It helps maintain compliance with worker health regulations and indoor air quality standards. Brands position themselves competitively by emphasizing productivity-enhancing innovations.

Strong Influence of DIY Trends and Retail Product Availability:

DIY home improvement projects have gained popularity among homeowners, especially in North America and Europe. Consumers now purchase joint compounds from retail hardware chains and online platforms with ease. The joint compounds market benefits from accessible packaging options like small tubs and pouches. Brands focus on offering beginner-friendly solutions with clear instructions. Retail promotions and tutorial content boost awareness and usage frequency. Social media and home renovation content creators influence product adoption. Manufacturers invest in branding and shelf visibility to capture DIY buyers. This shift diversifies the customer base beyond professionals.

Market Trends:

Growth in Green Building Certifications and Sustainable Construction:

Sustainability certifications like LEED and BREEAM are shaping the way construction materials are selected. Buyers now seek joint compounds with low VOC emissions and recyclable packaging. The joint compounds market aligns with these trends by developing eco-friendly formulations. Regulatory agencies and green building councils promote cleaner materials across projects. Builders comply with environmental requirements to qualify for tax incentives and project approvals. Product innovations now focus on bio-based binders and mineral-based additives. It supports reduced carbon footprints in new developments. Sustainability remains a competitive differentiator for brands in this market.

- For instance, USG Beadex® Brand All Purpose Lite Joint Compound weighs up to 35% less than conventional compounds, with less shrinkage and easy sanding, certified low-VOC, ideal for embedding tape, finishing, and skim coating drywall surfaces.

Surge in Use of Ready-Mix Joint Compounds Across Large-Scale Projects:

Construction firms are adopting ready-mix joint compounds to improve application speed and consistency. These products eliminate the need for on-site blending and reduce human error. The joint compounds market is witnessing broader acceptance of these solutions in commercial and industrial builds. Ready-mix types offer uniform performance across different climate conditions. Contractors save time and minimize waste, improving project economics. Packaging innovations support bulk delivery and long-term storage. Demand increases where skilled labor is in short supply. It helps streamline operations for large-volume drywall projects.

- For example, National Gypsum Company’s Sheetrock® Brand ready-mixed joint compound offers uniform consistency that remains stable for up to 60 days unopened, supporting bulk storage and reducing material waste on large projects.

Integration with Automated Drywall Application Systems and Robotics:

Automation is reshaping traditional construction practices, including wall finishing processes. New tools and robotic systems now apply joint compounds with precision. The joint compounds market tracks this shift by supporting machine-compatible formulations. Builders achieve faster turnaround with fewer manual interventions. Robotics adoption increases in developed countries due to rising labor costs. Material suppliers collaborate with equipment firms to optimize flow characteristics. Productivity and consistency improve across high-rise and modular construction projects. It positions joint compounds as vital components in automated systems. This trend opens new market segments for growth.

Expansion of E-commerce Platforms for Product Distribution and Access:

E-commerce platforms enable customers to access joint compounds directly, bypassing traditional wholesale channels. Online marketplaces display technical specifications, reviews, and application videos. The joint compounds market embraces digital sales, especially in the DIY and small contractor segments. Logistics capabilities improve through warehousing partnerships and same-day delivery services. Customers benefit from pricing transparency and seasonal promotions. It helps manufacturers collect data on customer preferences and buying behavior. E-commerce expands reach in secondary cities and rural areas. The trend reshapes distribution strategies for established brands and new entrants.

Market Challenges Analysis:

Volatility in Raw Material Prices and Supply Chain Disruptions:

Key raw materials used in joint compound manufacturing include gypsum, limestone, and various binders. Fluctuating prices for these inputs affect production costs and profit margins. The joint compounds market faces risks from energy price swings and transportation constraints. Manufacturers must navigate price volatility while maintaining competitive pricing. Supply chain disruptions, such as port delays or natural disasters, affect delivery timelines. It creates inconsistency in product availability across regions. Companies invest in alternate sourcing and inventory management to manage risks. Inflationary pressures also impact consumer affordability in price-sensitive segments.

Limited Awareness in Emerging Economies and Presence of Substitutes:

In emerging markets, contractors often rely on traditional plaster methods due to lack of awareness about joint compounds. These legacy practices delay the adoption of drywall systems. The joint compounds market encounters barriers where building codes and training systems remain underdeveloped. Competing materials like putties or plaster-of-paris products offer low-cost alternatives. It restricts market penetration among small builders and rural projects. Promotional efforts and product demonstrations remain limited in underserved regions. Distribution infrastructure poses challenges in expanding market reach. Education and local adaptation strategies are required to shift buyer behavior.

Market Opportunities:

Growing Adoption in Modular Construction and Prefabricated Buildings:

Modular construction continues to gain momentum across urban housing and commercial spaces. These projects require fast and clean interior finishing systems. The joint compounds market can capitalize on this trend by offering pre-mixed solutions tailored for modular units. Prefabrication firms seek consistent quality and minimal drying time. Lightweight compounds enable easy transport and handling. It supports efficiency and standardization in off-site production. Joint compounds with quick-set formulations align well with tight modular project schedules. This sector opens avenues for specialized product lines.

Rising Infrastructure Development in Asia-Pacific and Middle East:

Governments in Asia-Pacific and the Middle East are investing heavily in urban development and public infrastructure. These projects boost demand for drywall and finishing systems across commercial and institutional buildings. The joint compounds market can leverage this expansion by building local partnerships and supply networks. Construction norms in these regions are shifting toward global standards. Builders prioritize efficient and sustainable materials to meet regulatory and performance benchmarks. It enables wider acceptance of joint compounds. Tailored marketing and pricing strategies can unlock untapped regional demand.

Market Segmentation Analysis:

By Product Type

The joint compounds market offers a wide range of product types tailored to construction needs. Lightweight joint compounds lead in adoption due to ease of handling, reduced shrinkage, and suitability for overhead work. Conventional joint compounds continue to serve general-purpose needs in standard building projects. Setting-type joint compounds, which cure through chemical reactions, appeal to professionals working under time constraints. Drying-type variants remain preferred in indoor environments where consistent airflow allows proper evaporation. Ready-mix joint compounds gain traction in both professional and DIY applications because they reduce preparation time and ensure consistent quality. Single joint compounds meet growing demand for multi-purpose solutions, simplifying inventory and application. Multi joint compounds offer tailored performance for specific drywall finishing stages, catering to skilled contractors.

- For instance, Ready-mix joint compounds gain traction in both professional and DIY applications because they reduce preparation time and ensure consistent quality. Single joint compounds meet growing demand for multi-purpose solutions, simplifying inventory and application.

By End Use/Application

In terms of end use, residential construction drives the highest demand, supported by urban housing developments and interior remodeling. Commercial construction ranks next, with widespread usage in offices, retail outlets, and hospitality spaces. Industrial construction adopts joint compounds for interior finishing in warehouses, factories, and distribution centers, focusing on durability. Institutional construction, including educational and healthcare facilities, contributes steady demand due to compliance with safety and aesthetic standards. Key application areas include drywall joints, ceiling joints, corner bead reinforcement, and surface texturing. It reflects the need for versatile, fast-setting, and smooth-finishing compounds across diverse construction scenarios.

- For instance, Commercial construction ranks next, with widespread usage in offices, retail outlets, and hospitality spaces. Industrial construction adopts joint compounds for interior finishing in warehouses, factories, and distribution centers, focusing on durability.

Segmentation:

By Product Type:

- Lightweight joint compounds

- Conventional joint compounds

- Setting-type joint compounds

- Drying-type joint compounds

- Ready-mix joint compounds

- Single joint compound

- Multi joint compound

By End Use/Application:

- Residential construction

- Commercial construction

- Industrial construction

- Institutional construction

- Applications such as drywall joints, ceiling joints, corner bead, texturing

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Mature Market Driven by High Drywall Usage

North America holds the largest share in the joint compounds market, accounting for approximately 33.6% of the global revenue in 2024. The United States dominates regional demand due to widespread use of drywall in both residential and commercial buildings. Strong DIY culture, mature construction practices, and frequent renovation cycles support steady product consumption. Leading manufacturers operate extensive distribution networks across the U.S. and Canada, ensuring product availability and market penetration. Demand remains high across both new housing and remodeling segments, especially in suburban areas. It continues to benefit from favorable economic conditions, skilled labor availability, and advanced interior finishing standards.

Asia-Pacific: Fastest-Growing Region with Expanding Urban Infrastructure

Asia-Pacific represents the fastest-growing region in the joint compounds market and holds a 28.3% market share in 2024. Rapid urbanization, large-scale infrastructure development, and rising disposable incomes drive demand for modern construction materials. Countries like China, India, Vietnam, and Indonesia show strong growth due to government-backed housing projects and commercial development. Adoption of drywall systems is increasing in urban areas, replacing traditional plastering techniques. International brands are expanding operations and forming partnerships with local distributors to capture the growing demand. It gains traction in the region by offering efficient, quick-drying, and easy-to-apply compounds suited for high-volume construction.

Europe, Latin America, and Middle East & Africa: Steady Growth Across Diverse Markets

Europe holds a 21.4% share in the joint compounds market, driven by rising energy-efficient building practices and strong interior finishing norms. Countries like Germany, the UK, and France emphasize smooth wall surfaces for thermal insulation and aesthetic value. Latin America contributes around 9.2%, with growth centered in Brazil, Mexico, and Chile where urban expansion supports moderate demand. The Middle East and Africa hold a 7.5% share, with construction activity rising in the UAE, Saudi Arabia, and South Africa. Market penetration in these regions improves with increased awareness, access to modern materials, and government infrastructure spending. It faces growth opportunities across both new builds and institutional projects in these emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- USG Corporation / USG Boral

- Knauf Gips KG (including USG-Knauf)

- Saint-Gobain S.A. / Compagnie de Saint-Gobain

- DAP Products Inc.

- ProForm Finishing Products LLC

- National Gypsum Company

- Georgia-Pacific

- Hamilton Drywall Products

- Kuiken Brothers

- AGT Products Inc.

- Freeman Products, Inc.

- Proroc

- Westpac

- Murco Petroleum

- ASG Plaster

- India Gypsum Pvt. Ltd.

- Hilti

- Chiyoda UTE Co. Ltd.

- Solid Products, Inc.

- Etex Group

- Holcim

Competitive Analysis:

The joint compounds market features a moderately consolidated competitive landscape, with a mix of global manufacturers and regional players competing on product quality, pricing, and distribution. Leading companies such as USG Corporation, Knauf, and Saint-Gobain dominate with strong brand portfolios and wide-reaching supply chains. These firms invest in product innovation, such as lightweight and dust-control compounds, to maintain market leadership. Regional players like India Gypsum Pvt. Ltd. and AGT Products Inc. focus on price competitiveness and localized customer service. It continues to see intense competition in emerging markets, where price sensitivity and adoption of drywall systems are evolving. Companies emphasize brand trust, retail visibility, and contractor relationships to gain market share.

Recent Developments:

- In February 2025, CGC, a subsidiary of USG Corporation, launched its latest innovative product, the 1/2 inch Sheetrock® Brand UltraLight PRO Panels. These gypsum panels represent CGC’s lightest half-inch panels to date, achieving a weight reduction of up to 8.9 percent. The product utilizes proprietary technology to enhance durability, featuring strengthened edges that significantly reduce fastener blowouts, edge damage, and corner damage. This advancement aims to improve longevity and installation efficiency for new construction and remodeling projects, aligning with CGC’s commitment to sustainability and innovation in building materials.

- In 2023, USG Corporation formed a strategic partnership with Canvas, a construction robotics company, to transform the drywall industry. This collaboration combines USG’s extensive materials expertise with Canvas’s onsite robotics technology to address industry challenges such as labor shortages, schedule delays, cost overruns, and quality inconsistencies. This initiative leverages over a century of USG’s innovation history and aims to advance drywall finishing productivity and safety through technology integration.

Market Concentration & Characteristics:

The joint compounds market exhibits moderate concentration, with top players holding significant shares in North America, Europe, and parts of Asia-Pacific. It remains highly competitive due to the presence of both multinational brands and domestic manufacturers. Product differentiation centers on performance features such as drying speed, ease of application, and environmental compliance. The market shows strong demand from both professional contractors and DIY consumers. Growth depends on distribution reach, construction activity, and brand loyalty in retail and wholesale segments. Companies compete through innovation, localized marketing, and technical support.

Report Coverage:

The research report offers an in-depth analysis based on Product Type and End Use/Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise steadily due to consistent growth in residential and commercial construction worldwide.

- Lightweight and ready-mix joint compounds will continue gaining market share due to labor efficiency.

- Technological advancements will drive innovation in eco-friendly and dust-control formulations.

- DIY adoption will expand further, supported by online retail access and consumer tutorials.

- Urban renovation and remodeling projects will remain a key volume driver in developed markets.

- Asia-Pacific will experience the highest growth rate due to rapid infrastructure development.

- Strategic partnerships and regional acquisitions will intensify among leading manufacturers.

- Digital tools and automation in drywall application will influence product compatibility and design.

- Product standardization and sustainability certifications will become competitive differentiators.

- Companies will invest in localized manufacturing to reduce supply chain costs and improve responsiveness.