Market Overview

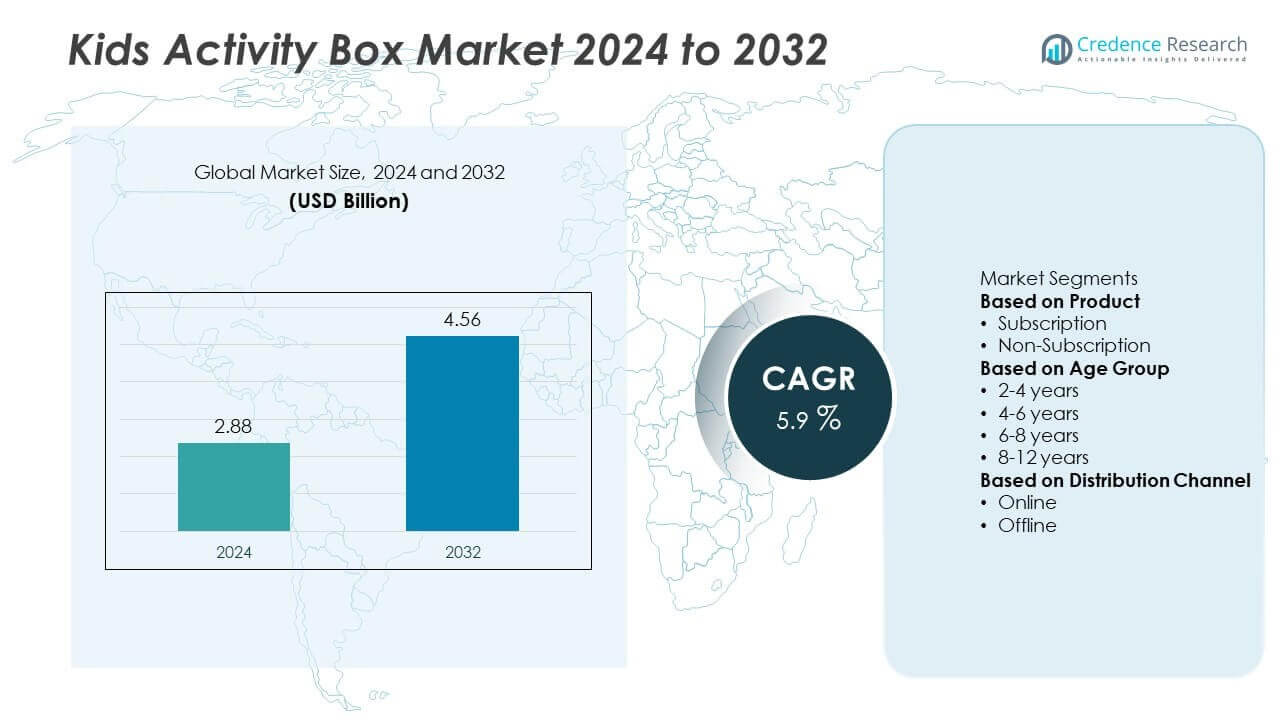

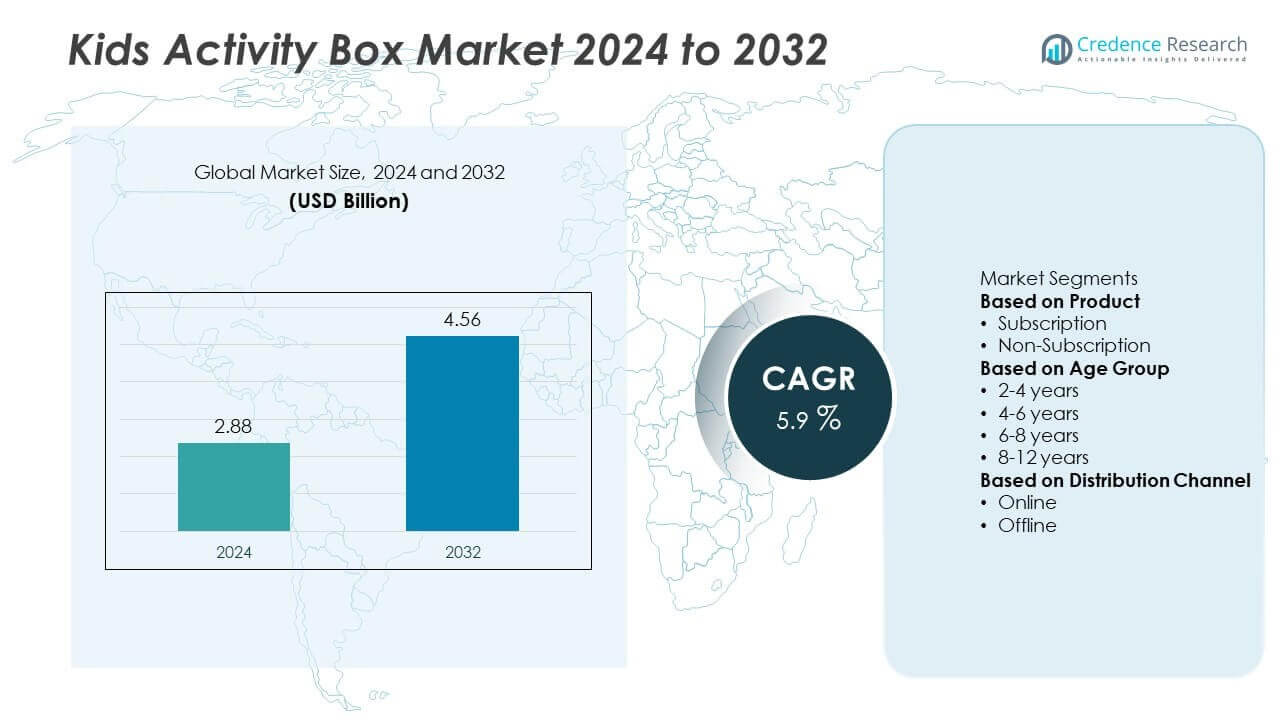

Kids Activity Box Market size was valued at USD 2.88 billion in 2024 and is projected to reach USD 4.56 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Kids Activity Box Market Size 2024 |

USD 2.88 Billion |

| Kids Activity Box Market, CAGR |

5.9% |

| Kids Activity Box Market Size 2032 |

USD 4.56 Billion |

Top players in the Kids Activity Box market include Genius Box LLP, KiwiCo, Inc., BrightMinds Ltd, BrainyToys Pvt Ltd, toucanBox Ltd, Green Kid Crafts, LLC, First Group Enterprises Ltd, Imagismart Solutions Pvt Ltd, Flinto Learning Solutions Pvt Ltd, and The Kids World (Inspiring Kids World). These companies focus on providing innovative, thematic, and STEM-based subscription boxes that engage children and support early learning development. Asia-Pacific leads the market with 34% share, driven by rising disposable incomes, growing e-commerce adoption, and parental focus on education. North America follows with 32% share, supported by strong subscription-based models and premium product offerings, while Europe holds 27% share, driven by demand for eco-friendly and STEAM-focused activity kits.

Market Insights

- Kids Activity Box market was valued at USD 2.88 billion in 2024 and is projected to reach USD 4.56 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

- Rising focus on early childhood education and cognitive skill development drives demand, with subscription-based boxes holding the largest share and the 4-6 years age group leading adoption.

- Trends include increasing popularity of STEM and thematic learning kits, personalization of boxes, and growing use of eco-friendly materials to attract environmentally conscious parents.

- The market is competitive with key players such as KiwiCo, Inc., Genius Box LLP, and Green Kid Crafts, LLC focusing on innovation, flexible subscription models, and expansion through e-commerce platforms.

- Asia-Pacific leads with 34% share, followed by North America at 32% and Europe at 27%, supported by growing online sales, rising disposable incomes, and increasing parental interest in engaging educational solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Subscription-based kids activity boxes dominate the market with over 65% share due to their convenience and recurring engagement model. Parents prefer subscription plans as they provide curated, age-appropriate activities delivered regularly, helping maintain a child’s learning and creativity cycle. These boxes often include STEM, arts, and DIY kits that encourage continuous skill development. Non-subscription boxes appeal to one-time buyers or gift purchases but have lower retention rates. The rising popularity of personalized learning solutions and flexible monthly or quarterly plans continues to fuel the growth of subscription-based activity boxes globally.

- For instance, KiwiCo claims that its team of experts, including educators and engineers, spends over 1,000 hours developing and perfecting each crate. This lengthy process involves extensive prototyping and rigorous testing by children to ensure the projects are engaging and educational.

By Age Group

The 4–6 years age group leads the market with more than 40% share, supported by the high demand for early learning kits that focus on motor skills, problem-solving, and creative play. Parents and educators view this developmental stage as critical for building foundational skills, boosting the appeal of structured activity boxes. Boxes designed for this segment often include interactive games, puzzles, and craft-based projects. Demand in the 6–8 years and 8–12 years segments is also growing, driven by interest in STEM-based learning and coding kits. The 2–4 years category remains niche but benefits from rising awareness of early childhood development.

- For instance, the Preschool Box from Subscription Box Kids is confirmed to send 16+ educational activities each month for children ages 3 to 5. Each box includes a book, crafts, and a parent guide to support learning. These activities cover subjects like letters, numbers, and fine motor skills to help prepare children for kindergarten.

By Distribution Channel

Online channels account for nearly 70% share of the market, driven by the convenience of e-commerce platforms and subscription-based delivery models. Digital storefronts allow parents to explore a wide range of customized boxes and flexible subscription options. Direct-to-consumer brands are increasingly leveraging social media and targeted marketing to reach young parents. Offline sales, through specialty toy stores and educational centers, continue to serve customers seeking physical evaluation before purchase. The rapid growth of online retail, combined with subscription models, strengthens the dominance of the online segment and supports global expansion of kids activity box providers.

Key Growth Drivers

Key Growth Drivers

Rising Focus on Early Childhood Development

Parents are increasingly prioritizing early childhood learning, driving demand for kids activity boxes. These boxes offer structured activities that promote cognitive, motor, and creative skills in a fun, engaging way. Educational experts emphasize the importance of hands-on learning during formative years, which supports market growth. Schools and preschools are also adopting such products to complement traditional teaching methods. This focus on holistic development continues to boost adoption of subscription-based boxes, making them a preferred choice among parents seeking continuous educational engagement for their children.

- For instance, KiwiCo offers its Kiwi Crate for ages 5–8, which includes STEM-based projects, delivering one crate per month to subscribers. The contents of each crate vary by project, but each box contains the necessary materials for the month’s featured activity, along with an illustrated magazine.

Growing Popularity of Subscription-Based Models

Subscription-based activity boxes are gaining traction due to their convenience and recurring delivery schedules. Parents appreciate curated, age-appropriate kits that save time and effort while offering continuous learning opportunities. Companies are providing flexible monthly, quarterly, and annual subscription plans, catering to different budgets and preferences. Personalization options, where boxes are tailored to a child’s age and interest, further enhance appeal. The predictability of recurring revenue streams encourages providers to innovate and expand product offerings, fueling steady growth of the subscription segment.

- For instance, Lovevery offers a subscription to The Play Kits, which provide a series of developmentally appropriate playthings for children from birth to age 4. The kits are delivered every 2 to 3 months, with more frequent deliveries for babies and less frequent for toddlers. Each kit is designed to correspond with specific developmental windows and contains multiple items that encourage tactile and sensory learning.

Increasing Digital and E-Commerce Penetration

The rise of e-commerce platforms has significantly expanded access to kids activity boxes, particularly in emerging economies. Parents can easily browse, compare, and purchase activity kits online, benefitting from discounts, reviews, and subscription flexibility. Digital marketing through social media and influencer collaborations helps brands target young parents more effectively. Global shipping options have also widened market reach. This growing digital presence has made activity boxes more accessible, allowing smaller brands to compete with established players and driving strong adoption through direct-to-consumer models.

Key Trends & Opportunities

Integration of STEM and Coding Kits

STEM-based learning boxes are becoming a major trend as parents seek to equip children with science and technology skills early. Kits focusing on robotics, coding, and simple engineering projects engage kids in problem-solving and critical thinking activities. This aligns with global education initiatives promoting STEM education from primary school levels. Providers offering such boxes differentiate themselves in a competitive market and appeal to tech-savvy parents. This trend presents a long-term growth opportunity, particularly in regions investing heavily in STEM-focused education programs.

- For instance, Green Kid Crafts delivers 4 to 6 projects per themed box, with different boxes available for children ages 3–5 (Junior Box) and 5–10+ (Discovery Box). Each monthly kit includes all necessary materials, which emphasize eco-friendly and recycled content, along with a 12-page magazine featuring instructions and additional ideas.

Personalization and Thematic Boxes

Personalized and theme-based boxes are emerging as a key opportunity to improve engagement and retention. Providers are curating boxes based on a child’s age, interests, and skill level, offering unique monthly themes like space, wildlife, or art exploration. These thematic variations maintain excitement and encourage repeat subscriptions. The ability to customize activity difficulty also appeals to parents looking to track developmental progress. Such personalization strengthens brand loyalty and allows companies to charge premium prices for tailored learning experiences.

- For instance, STEM Discovery Boxes sends three unique STEM projects each month. Designed for children ages 7 to 12, each box includes all necessary materials for hands-on, educational activities. This helps kids explore different science, technology, engineering, and math topics in a creative and engaging way.

Key Challenges

High Customer Acquisition and Retention Costs

The market faces challenges due to significant expenses in acquiring and retaining subscribers. Intense competition among providers leads to heavy marketing spending and discounts to attract new customers. Retaining users over the long term requires consistent quality, innovation, and fresh content, which increases operational costs. Failure to keep content engaging risks subscription cancellations. Companies must balance cost efficiency with product differentiation to maintain profitability and sustain growth in a competitive landscape.

Price Sensitivity and Affordability Issues

Kids activity boxes can be expensive for middle-income households, limiting penetration in cost-sensitive markets. Subscription fees, especially for premium STEM or international kits, may discourage repeat purchases. Economic downturns and inflationary pressures further impact discretionary spending on educational toys. Providers need to offer affordable, value-driven options or introduce tiered pricing models to reach a wider audience. Balancing affordability with product quality and innovation remains a key challenge for sustaining market adoption globally.

Regional Analysis

North America

North America holds 32% market share, driven by strong demand for subscription-based activity boxes and high awareness of early childhood education. The United States leads adoption, with parents seeking engaging and educational solutions for at-home learning and play. Growth is supported by the presence of established players offering STEM, DIY, and art-focused boxes. E-commerce penetration and marketing campaigns through social media strengthen consumer engagement. The rise of homeschooling and focus on screen-free learning experiences continue to boost market demand, while Canada contributes steadily with increasing adoption in urban centers and premium product offerings.

Europe

Europe accounts for 27% market share, supported by rising demand for experiential learning tools and creative play kits. Countries like the U.K., Germany, and France drive market growth with high parental spending on education-focused toys. The popularity of STEAM-themed boxes, emphasizing science, technology, engineering, arts, and mathematics, fuels adoption. Subscription models are well-received due to convenience and customization options. Strong distribution networks, including retail partnerships and online platforms, enhance availability. Increasing focus on sustainable and eco-friendly materials in activity boxes also appeals to environmentally conscious European consumers, further supporting market expansion in this region.

Asia-Pacific

Asia-Pacific leads with 34% market share, making it the fastest-growing region. Rising disposable incomes, urbanization, and growing emphasis on early childhood development drive demand. China and India are major contributors, with parents seeking affordable, interactive learning solutions. Local and global players are expanding product portfolios with culturally relevant content and competitive pricing. E-commerce growth and digital payment adoption accelerate subscription-based purchases. Japan and South Korea favor premium and STEM-focused kits, while Southeast Asia is witnessing rapid adoption of low-cost boxes. Government education initiatives and increasing popularity of home-based learning further strengthen regional market growth.

Latin America

Latin America holds 5% market share, with Brazil and Mexico leading demand for kids activity boxes. Rising middle-class population and increasing focus on child development drive purchases of educational and creative play kits. Subscription-based models are gaining traction, though affordability remains a key consideration. Local brands are entering the market with competitively priced offerings, expanding accessibility. E-commerce platforms are playing a vital role in reaching remote consumers. Economic growth, combined with growing interest in screen-free learning, is expected to sustain steady market expansion and open opportunities for both regional and international players.

Middle East & Africa

Middle East & Africa represent 2% market share, showing gradual growth as awareness of early learning tools rises. The UAE and Saudi Arabia lead adoption, supported by growing demand for premium educational products among high-income households. Parents in urban areas are turning to subscription-based and thematic activity boxes to supplement formal education. South Africa shows steady interest, driven by an expanding online retail sector and rising focus on early childhood development. Market penetration remains low due to price sensitivity, but increasing investment in education and e-commerce infrastructure is expected to unlock future growth potential.

Market Segmentations:

By Product

- Subscription

- Non-Subscription

By Age Group

- 2-4 years

- 4-6 years

- 6-8 years

- 8-12 years

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Kids Activity Box market includes key players such as Genius Box LLP, KiwiCo, Inc., BrightMinds Ltd, BrainyToys Pvt Ltd, toucanBox Ltd, Green Kid Crafts, LLC, First Group Enterprises Ltd, Imagismart Solutions Pvt Ltd, Flinto Learning Solutions Pvt Ltd, and The Kids World (Inspiring Kids World). These companies focus on delivering curated, age-appropriate educational kits designed to enhance creativity, problem-solving, and STEM learning. Market leaders invest heavily in product innovation, introducing thematic and personalized subscription boxes to boost customer engagement and retention. Strategic use of e-commerce platforms, influencer marketing, and flexible subscription plans help expand their reach across diverse geographies. Some players are emphasizing sustainability by using eco-friendly materials, appealing to environmentally conscious parents. Competitive differentiation is shaped by the ability to offer high-quality, cost-effective solutions while continuously refreshing content to keep children engaged and encourage long-term subscription renewals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Genius Box LLP

- KiwiCo, Inc.

- BrightMinds Ltd

- BrainyToys Pvt Ltd

- toucanBox Ltd

- Green Kid Crafts, LLC

- First Group Enterprises Ltd

- Imagismart Solutions Pvt Ltd

- Flinto Learning Solutions Pvt Ltd

- The Kids World (Inspiring Kids World)

Recent Developments

- In July 2025, toucanBox Ltd was noted on Tracxn as providing monthly craft subscription boxes for children aged 3-7 years.

- In February 2024, Green Kid Crafts launched a new line of STEAM subscription boxes for children aged 3-10+, each box containing 4-6 science and art projects designed to foster creativity and environmental awareness.

- In 2024, KiwiCo partnered with major retailers Target and Barnes & Noble to sell its activity boxes in stores. This expanded the company’s direct-to-consumer subscription model into the physical retail market.

- In 2024, KiwiCo was ranked #8 on USA Today’s 10Best Readers’ Choice Awards for “Best Subscription Box for Kids”.

Report Coverage

The research report offers an in-depth analysis based on Product, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for subscription-based activity boxes will grow as parents seek continuous learning solutions.

- STEM and coding kits will gain popularity, focusing on science and technology skill development.

- Personalization and themed boxes will increase customer retention and improve engagement levels.

- E-commerce platforms will drive higher sales through global reach and flexible subscription options.

- Sustainability will influence purchasing decisions, leading to more eco-friendly packaging and materials.

- Companies will expand into emerging markets with affordable and localized content.

- Collaboration with schools and educational institutions will open new revenue streams.

- Digital integration with companion apps will enhance learning experiences and track progress.

- Marketing through influencers and social media will boost brand visibility among young parents.

- Competition will intensify, pushing players to innovate and refresh content regularly to retain subscribers.

Key Growth Drivers

Key Growth Drivers