| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latin America Industrial Catalyst Market Size 2024 |

USD 1593.6 Million |

| Latin America Industrial Catalyst Market, CAGR |

5.13% |

| Latin America Industrial Catalyst Market Size 2032 |

USD 2378.32 Million |

Market Overview:

The Latin America Industrial Catalyst Market is projected to grow from USD 1593.6 million in 2024 to an estimated USD 2378.32 million by 2032, with a compound annual growth rate (CAGR) of 5.13% from 2024 to 2032.

Several factors are fueling the demand for industrial catalysts in Latin America. The region’s rich oil and gas reserves have led to significant investments in refining and petrochemical industries, where catalysts play a crucial role in enhancing process efficiency and product yields. Countries like Brazil are investing in advanced refining technologies, boosting the demand for catalysts. Additionally, the push towards renewable energy sources, such as bioethanol production from sugarcane in Brazil, is driving the need for specialized catalysts. The automotive industry’s growth further contributes to catalyst demand, particularly in emission control systems to meet stringent environmental standards. Furthermore, the expanding chemical manufacturing industry, which relies heavily on catalysts for various processes, continues to support the market’s growth. The increasing shift to cleaner fuels and sustainable production processes is amplifying the need for effective catalysts in these sectors.

Moreover, the shift toward cleaner technologies in industrial processes, alongside government incentives for sustainable development, is encouraging the adoption of more efficient catalytic solutions. The ongoing efforts to optimize refinery outputs and reduce environmental footprints in key industries further fuel catalyst demand across the region. As Latin American countries focus on improving energy efficiency and meeting global environmental standards, the role of industrial catalysts in achieving these goals becomes increasingly significant. The increasing focus on reducing carbon emissions and adopting low-carbon technologies in sectors like transportation and energy further emphasizes the need for advanced catalysts. Additionally, ongoing R&D efforts in the region are expected to lead to the development of more efficient and environmentally friendly catalyst technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Latin America Industrial Catalyst Market is projected to grow from USD 1,593.6 million in 2024 to USD 2,378.32 million by 2032, at a CAGR of 5.13%.

- The global industrial catalyst market is projected to grow from USD 31.56 billion in 2024 to USD 51.15 billion by 2032, with a CAGR of 6.22% from 2024 to 2032.

- Brazil leads the market, driven by its rich oil and gas reserves, with significant investments in refining technologies boosting demand for catalysts.

- The shift toward renewable energy and biofuels, particularly bioethanol from sugarcane in Brazil, is creating a growing need for advanced catalysts.

- Stricter environmental regulations across the region are increasing the demand for catalysts, particularly in emission control and cleaner fuel production.

- The petrochemical industry in Latin America is expanding rapidly, driving increased use of catalysts to improve process efficiency and yield.

- Research and development investments are leading to the development of more efficient and environmentally friendly catalyst technologies.

- Despite growth opportunities, high catalyst development and maintenance costs, along with a shortage of skilled workforce, pose challenges to market expansion.

Market Drivers:

Market Drivers:

Growing Petrochemical and Refining Industries

The Latin American industrial catalyst market is experiencing significant growth, largely driven by the expansion of petrochemical and refining industries in the region. Latin America holds abundant oil and gas reserves, which have led to a surge in refining capacities and petrochemical production. For instance, in Mexico, Pemex’s six domestic refineries processed over 1 million barrels per day (b/d) of crude in March 2024, marking a significant milestone in boosting gasoline and diesel production while reducing imports by 25% from the previous year. Catalysts are integral to these industries as they help improve the efficiency of various processes, such as refining crude oil and producing chemicals and fuels. In countries like Brazil and Mexico, increased investments in refining infrastructure and technological advancements are directly contributing to the demand for high-performance catalysts. This trend is expected to continue as the region further enhances its refining capabilities to meet global demand for cleaner and more efficient fuels.

Shift Toward Renewable Energy and Biofuels

Another key driver of the Latin American industrial catalyst market is the region’s increasing focus on renewable energy, particularly in biofuel production. Brazil, one of the leading producers of bioethanol from sugarcane, relies heavily on catalysts for optimizing fermentation processes and improving yield. As Latin American countries seek to reduce dependency on fossil fuels and lower carbon emissions, the demand for biofuels and related technologies, such as advanced catalysts, is expected to grow. The region’s renewable energy policies, along with government incentives for biofuel production, are further encouraging investments in catalyst technologies that enhance biofuel efficiency and sustainability. This shift is propelling the need for specialized catalysts in bioethanol, biodiesel, and other biofuels.

Stringent Environmental Regulations

The implementation of stricter environmental regulations across Latin America is driving the demand for industrial catalysts, particularly in the automotive and chemical industries. Governments are introducing more stringent emissions standards to curb pollution and improve air quality. Catalysts are essential in meeting these regulatory requirements, especially in vehicles and industrial processes, where they help reduce harmful emissions. In the automotive sector, catalysts are used in exhaust systems to minimize emissions of nitrogen oxides (NOx), carbon monoxide (CO), and hydrocarbons. The increasing emphasis on sustainable and environmentally friendly practices in industries, combined with the rising adoption of green technologies, has led to a higher demand for catalysts that support compliance with these regulations.

Technological Advancements and R&D Investments

Technological advancements and ongoing research and development (R&D) efforts are also fueling the growth of the industrial catalyst market in Latin America. As industries in the region seek to enhance productivity and optimize resource usage, the need for more efficient catalysts becomes more pronounced. Companies are investing in R&D to develop next-generation catalysts that offer higher performance, longer life cycles, and lower environmental impact. These innovations are particularly relevant in the petrochemical and energy sectors, where operational efficiency is a key consideration. For example, Petrobras has integrated cutting-edge technologies like SNOX at its RNEST refinery to reduce emissions while improving operational efficiency. Additionally, the emergence of novel catalytic processes and materials is providing new opportunities for growth in the industrial catalyst market. As Latin American industries continue to modernize and innovate, demand for advanced catalyst technologies is expected to rise.

Market Trends:

Growing Adoption of Green Catalysts

A notable trend in the Latin American industrial catalyst market is the increasing adoption of green catalysts. As environmental awareness grows and governments enforce stricter emissions standards, industries in the region are turning to more sustainable catalytic technologies. Green catalysts offer several advantages, including reduced environmental impact and lower energy consumption, making them an attractive option for industries seeking to enhance their sustainability profiles. The shift toward green catalysts is particularly prominent in sectors such as biofuel production and chemical manufacturing, where cleaner, more efficient processes are essential for meeting both regulatory requirements and market demand for eco-friendly products. The rise of green chemistry, particularly in bioethanol and biodiesel production, is further driving this trend.

Emergence of Advanced Catalytic Technologies

The Latin American industrial catalyst market is witnessing an increased focus on the development of advanced catalytic technologies. These innovations include catalysts with enhanced selectivity, stability, and resistance to deactivation, which are essential for improving the efficiency of various industrial processes. For instance, in 2024, KBR introduced its KCOTKlean technology, which significantly reduces carbon emissions in catalytic processes while enhancing efficiency in olefins production. The rise of technologies like catalyst recycling, which prolongs catalyst life and reduces operational costs, is gaining traction across multiple sectors. As companies continue to seek ways to optimize their operations, these next-generation catalytic technologies are expected to become increasingly important. Industries in Latin America, such as oil refining and petrochemicals, are embracing these advancements to improve yields and reduce waste, ensuring their competitiveness in a global market that demands higher efficiency and sustainability.

Integration of Digitalization and AI in Catalyst Management

Digitalization and artificial intelligence (AI) are emerging as transformative trends in the management of industrial catalysts in Latin America. By leveraging digital tools and AI algorithms, companies are improving the monitoring and optimization of catalytic processes. These technologies allow for real-time data analysis, predictive maintenance, and the optimization of catalyst performance, leading to cost savings and enhanced productivity. The integration of digital technologies into catalyst management systems is particularly prevalent in sectors such as oil and gas, where efficiency and precision are critical. As more companies in Latin America adopt Industry 4.0 solutions, the role of AI and digitalization in improving catalyst effectiveness and reducing operational downtime will continue to grow.

Expansion of Catalyst Applications in Emerging Sectors

In addition to traditional sectors like petrochemicals and automotive, the industrial catalyst market in Latin America is expanding into emerging industries. The growing focus on renewable energy, clean hydrogen production, and energy storage technologies is opening up new opportunities for catalyst applications. For example, in countries like Chile, which is positioning itself as a leader in clean hydrogen production, catalysts are playing a vital role in facilitating more efficient hydrogen generation through electrolysis. As the demand for clean energy solutions grows, industries in Latin America are increasingly relying on specialized catalysts to optimize processes related to energy conversion, storage, and distribution. This shift reflects broader global trends in the adoption of cleaner and more sustainable energy sources, with Latin America poised to play a key role in these advancements.

Market Challenges Analysis:

High Cost of Catalyst Development and Maintenance

The high cost of catalyst development and maintenance remains a significant challenge in the Latin American industrial catalyst market. For instance, in Brazil, Petrobras faces substantial expenses in developing advanced refining catalysts to meet environmental standards and improve efficiency. The company has invested heavily in R&D for hydrocracking and fluid catalytic cracking technologies, which require expensive raw materials like zeolites and metals, as well as sophisticated production techniques. Additionally, maintaining catalyst performance over time involves periodic regeneration or replacement, further increasing operational costs. These financial barriers are particularly prohibitive for small and medium-sized enterprises (SMEs), limiting their ability to adopt cutting-edge catalytic solutions

Limited Availability of Skilled Workforce

Another challenge facing the Latin American industrial catalyst market is the limited availability of skilled professionals to manage and optimize catalytic processes. The specialized knowledge required to design, implement, and maintain cutting-edge catalyst technologies is often in short supply in the region. This skill gap can hinder the adoption of advanced catalyst solutions, as industries may struggle to find adequately trained personnel to operate and manage catalyst systems effectively. In countries where the industrial sector is rapidly growing, such as Brazil and Mexico, there is a pressing need for workforce development initiatives to ensure the availability of skilled professionals who can handle complex catalyst technologies.

Regulatory Challenges and Compliance

The evolving regulatory landscape in Latin America also presents challenges for the industrial catalyst market. While many countries in the region are adopting stricter environmental standards, the pace and consistency of regulatory enforcement can vary significantly. Companies may face difficulties in navigating complex and sometimes fragmented regulations across different countries, which can delay the implementation of catalyst solutions or increase compliance costs. Additionally, industries may struggle to keep up with rapidly changing environmental regulations that require ongoing investment in catalyst technologies that meet new emission standards and sustainability goals.

Market Opportunities:

The Latin American industrial catalyst market presents significant opportunities driven by the region’s increasing focus on renewable energy and clean technologies. As countries such as Brazil, Mexico, and Chile look to diversify their energy portfolios and reduce dependence on fossil fuels, there is a growing demand for catalysts in biofuels, clean hydrogen production, and other renewable energy sectors. Brazil’s prominent role in bioethanol production and the emerging interest in clean hydrogen in countries like Chile highlight the potential for catalysts to optimize processes and improve yield efficiency in these areas. Furthermore, advancements in catalyst technologies, such as those for carbon capture and storage (CCS), offer substantial growth potential as Latin American nations work towards meeting global sustainability targets. This shift towards renewable energy presents a promising opportunity for companies to develop and deploy advanced catalytic solutions in emerging clean energy markets.

Another key opportunity lies in the ongoing technological advancements in the petrochemical and refining sectors across Latin America. With the continued expansion of refining capacities in countries like Brazil and Mexico, the demand for high-performance catalysts to enhance operational efficiency and meet stringent environmental regulations is expected to rise. The ongoing investments in refinery modernization and the increasing emphasis on producing cleaner fuels create an avenue for catalyst manufacturers to provide innovative solutions. Additionally, the trend of adopting digital technologies and AI to optimize catalytic processes further amplifies market opportunities. Companies that can offer advanced catalytic solutions, coupled with digital optimization tools, will likely see significant demand in these high-growth sectors.

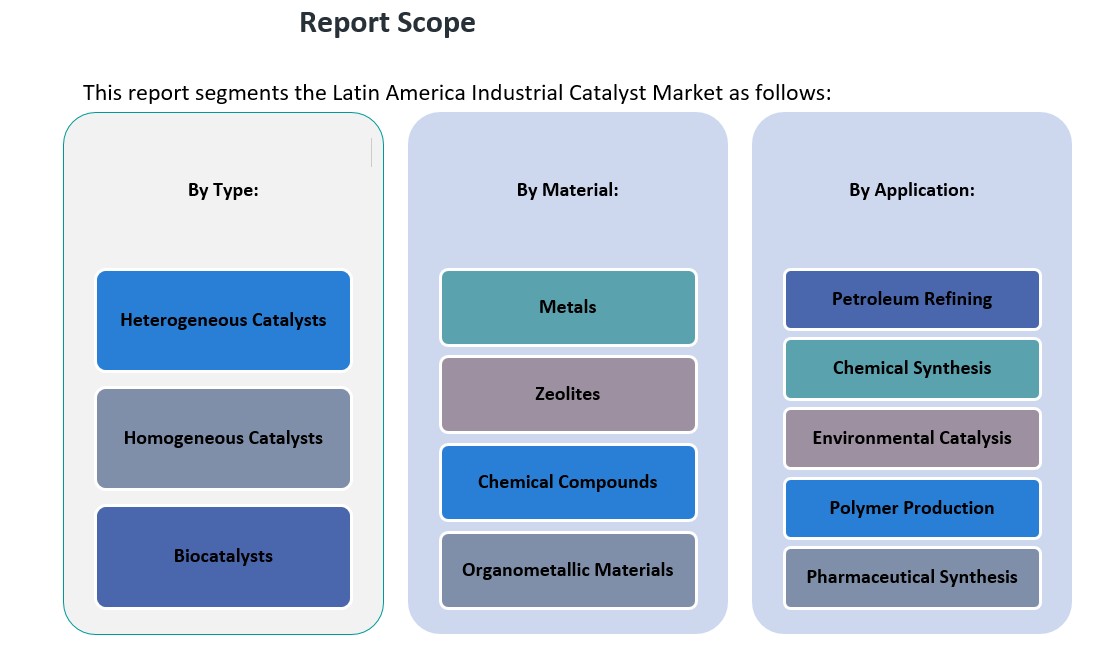

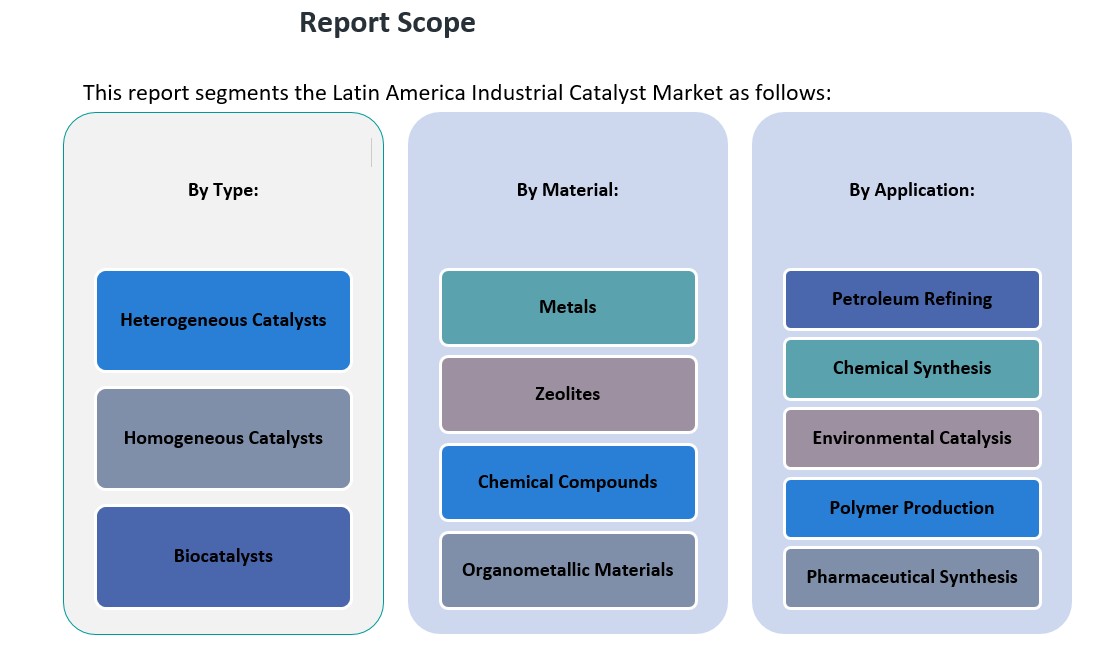

Market Segmentation Analysis:

The Latin American industrial catalyst market is segmented into several categories, including type, application, and material, each exhibiting unique growth patterns and contributing to the overall market dynamics.

By Type Segment

The market is predominantly driven by heterogeneous catalysts, which are widely used in petroleum refining and chemical synthesis processes. These catalysts play a critical role in improving the efficiency of various reactions and enhancing the production of high-value products. Homogeneous catalysts, though less common, are seeing increasing adoption in chemical and pharmaceutical synthesis due to their high selectivity and effectiveness in specific reactions. Biocatalysts are emerging as a growing segment, particularly in the biofuel and pharmaceutical industries, where environmental sustainability and green chemistry practices are gaining traction.

By Application Segment

In terms of application, petroleum refining holds the largest share of the market, driven by the need for catalysts to produce cleaner fuels and optimize refinery operations. Chemical synthesis follows closely, as catalysts are integral to the production of essential chemicals used in various industries, including agriculture, plastics, and textiles. Environmental catalysis is gaining prominence due to stricter environmental regulations, especially in emission control and waste treatment. Polymer production is also a significant application, with catalysts used to control polymerization processes, and pharmaceutical synthesis continues to grow as biocatalysts play an increasing role in the development of specialized drugs.

By Material Segment

In terms of materials, metals (such as platinum, palladium, and nickel) are the most widely used in industrial catalysts due to their efficiency and effectiveness in a variety of applications, particularly in petroleum refining. Zeolites and chemical compounds are crucial in chemical synthesis and environmental catalysis, while organometallic materials are gaining traction in pharmaceutical synthesis and fine chemical production due to their high reactivity and specificity. Each material type plays a key role in ensuring efficient catalytic performance across different industries in Latin America.

Segmentation:

By Type Segment

- Heterogeneous Catalysts

- Homogeneous Catalysts

- Biocatalysts

By Application Segment

- Petroleum Refining

- Chemical Synthesis

- Environmental Catalysis

- Polymer Production

- Pharmaceutical Synthesis

By Material Segment

- Metals

- Zeolites

- Chemical Compounds

- Organometallic Materials

Regional Analysis:

The Latin American industrial catalyst market is characterized by diverse regional dynamics, with each country demonstrating unique growth drivers and demand patterns influenced by their industrial activities. The key markets within the region include Brazil, Mexico, Argentina, and Chile, with Brazil holding the largest market share. Brazil’s industrial catalyst market is primarily driven by its significant petrochemical, refining, and biofuel sectors. The country is a global leader in bioethanol production, and its robust refining industry is one of the largest in Latin America. Brazil is expected to maintain its dominant market share, accounting for nearly 40-45% of the overall market in the region due to its substantial investments in refining technology, renewable energy, and clean fuels.

Mexico follows as the second-largest market in the region, holding approximately 25-30% of the industrial catalyst market share. The country’s large automotive and oil refining sectors are key contributors to catalyst demand. Mexico’s automotive industry, in particular, relies heavily on catalysts for emission control in vehicles, while the oil refining sector requires advanced catalysts for the production of cleaner fuels. The Mexican government’s increasing focus on improving air quality and complying with stricter environmental regulations further supports the market for catalysts. Additionally, Mexico’s growing energy sector, particularly in natural gas production, is creating new opportunities for catalysts, particularly in cleaner energy technologies.

Argentina and Chile are smaller players in the industrial catalyst market but represent emerging opportunities. Argentina’s refining industry, coupled with growing chemical manufacturing, presents moderate growth potential for catalyst applications. Chile, on the other hand, is rapidly emerging as a hub for clean hydrogen production, which will likely boost demand for specialized catalysts in the coming years. Together, Argentina and Chile represent approximately 10-15% of the regional market share, with both countries showing potential for growth driven by environmental policies and investments in clean energy.

The other smaller markets within the region, including Venezuela, Colombia, and Peru, contribute to the remaining 15-20% of the industrial catalyst market share. While these countries are experiencing steady growth in their respective refining and chemical industries, their market shares are comparatively smaller due to economic challenges, political instability, and less developed industrial infrastructure. However, as these markets stabilize and expand, they will offer additional opportunities for catalyst suppliers, particularly in the oil and gas and chemical sectors.

Key Player Analysis:

- BASF S.A.

- Braskem

- Johnson Matthey

- Grupo Petroquímico Beta

- Albemarle Corporation

- Dow Chemical (Latin America operations)

- Clariant AG

- Evonik Industries AG

- Repsol

- Petrobras

Competitive Analysis:

The Latin American industrial catalyst market is highly competitive, with a mix of global players and regional suppliers dominating the landscape. Leading multinational companies, such as BASF, Honeywell UOP, and Albemarle Corporation, hold a significant market share due to their advanced catalyst technologies, extensive product portfolios, and strong brand recognition. These companies leverage their global presence and R&D capabilities to introduce cutting-edge solutions for petroleum refining, chemical synthesis, and environmental catalysis. Regional players also play an essential role, offering tailored catalyst solutions that address specific market needs in countries like Brazil, Mexico, and Argentina. These companies focus on cost-effective solutions and local market expertise to cater to the unique demands of Latin American industries, particularly in biofuel production and automotive emissions control. The market is characterized by ongoing innovation, with companies investing heavily in R&D to develop more efficient, sustainable, and cost-effective catalytic solutions to meet growing environmental and industrial demands.

Recent Developments:

- In February 2023, Rotating Machinery Services Inc., a U.S.-based engineering and maintenance company specializing in rotating machinery, acquired Siemens Energy Inc.’s fluid catalyst cracking unit (FCCU) Hot Gas Expander product line.

- In December 2024, BASF inaugurated its new Catalyst Development and Solids Processing Center in Ludwigshafen, Germany. This state-of-the-art facility aims to accelerate the development of innovative catalyst and process technologies, serving as a hub for pilot-scale synthesis of chemical catalysts. The center is equipped with cutting-edge process equipment, enabling faster and more focused R&D activities essential for the green transformation.

- In Feb, 2025, Johnson Matthey PLC announced a partnership with Bosch to develop catalyst-coated membranes (CCMs) for fuel cell stacks. These CCMs will be integrated into Bosch’s fuel cell power modules for commercial vehicles, promoting zero-emission hydrogen technology. The collaboration focuses on advancing cleaner mobility solutions and energy generation.

- In March 2025, ExxonMobil Chemical Companyshowcased its Signature Polymers brand at PLASTIMAGEN MEXICO 2025 in Mexico City. The company highlighted advanced solutions for mechanical and chemical recycling, including its Vistamaxx™ performance polymers and Exxtend™ technology, which support the circular economy by enabling the incorporation of recycled content into high-performance plastics

Market Concentration & Characteristics:

The Latin American industrial catalyst market exhibits moderate concentration, with a few large multinational companies dominating the sector, while regional players contribute significantly to market dynamics. Major global corporations, such as BASF, Honeywell UOP, and Albemarle, lead the market by providing advanced catalyst technologies across various industries, including petroleum refining, chemical synthesis, and environmental applications. These companies benefit from strong R&D capabilities, a broad product portfolio, and established relationships with large-scale industrial clients. However, regional players also hold a substantial share, particularly in countries like Brazil and Mexico, where localized solutions and cost-effective offerings are crucial. The market is characterized by a mix of high technological innovation, with companies continuously investing in new catalyst development, and growing demand for sustainable and environmentally friendly solutions. Overall, the market remains competitive, with ongoing investments in research, product diversification, and regional expertise driving growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, Application Segment and Material Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to experience steady growth driven by increasing demand for cleaner fuels in the petroleum refining industry.

- Rising investments in renewable energy technologies, particularly biofuels and hydrogen production, will boost catalyst demand.

- Stricter environmental regulations across Latin America will propel the adoption of emission-control catalysts, particularly in automotive and industrial sectors.

- Technological advancements in catalyst efficiency and longevity will enhance performance in key applications like chemical synthesis and polymer production.

- A shift towards green catalysts, focusing on sustainability and reduced environmental impact, will shape future market trends.

- Growing demand for biocatalysts in pharmaceutical and food industries will open new growth avenues.

- The expansion of the chemical synthesis industry, especially in emerging markets, will drive increased catalyst usage.

- The market for catalysts in environmental applications, including waste treatment and carbon capture, is expected to grow rapidly.

- Increased automation and digitalization in catalyst management will improve operational efficiency and optimize resource use.

- Regional diversification in catalyst applications will offer new opportunities for both global and local players, especially in emerging markets.

Market Drivers:

Market Drivers: