Market Overview

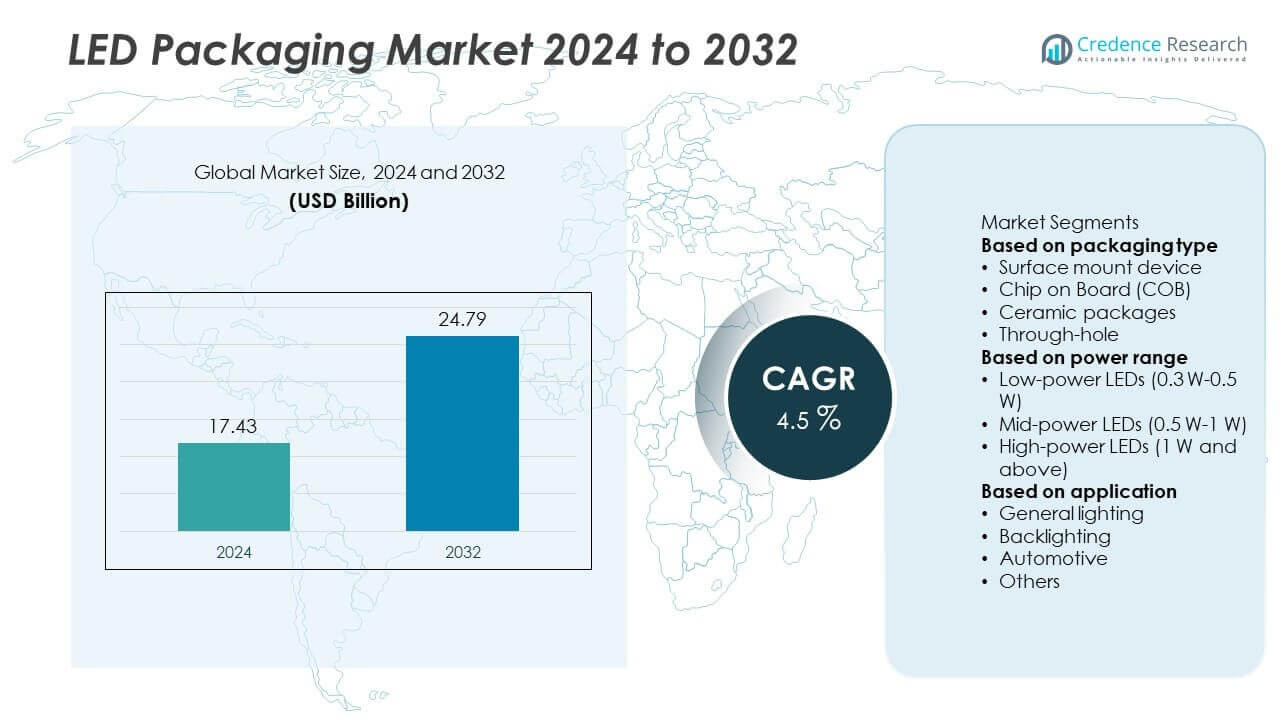

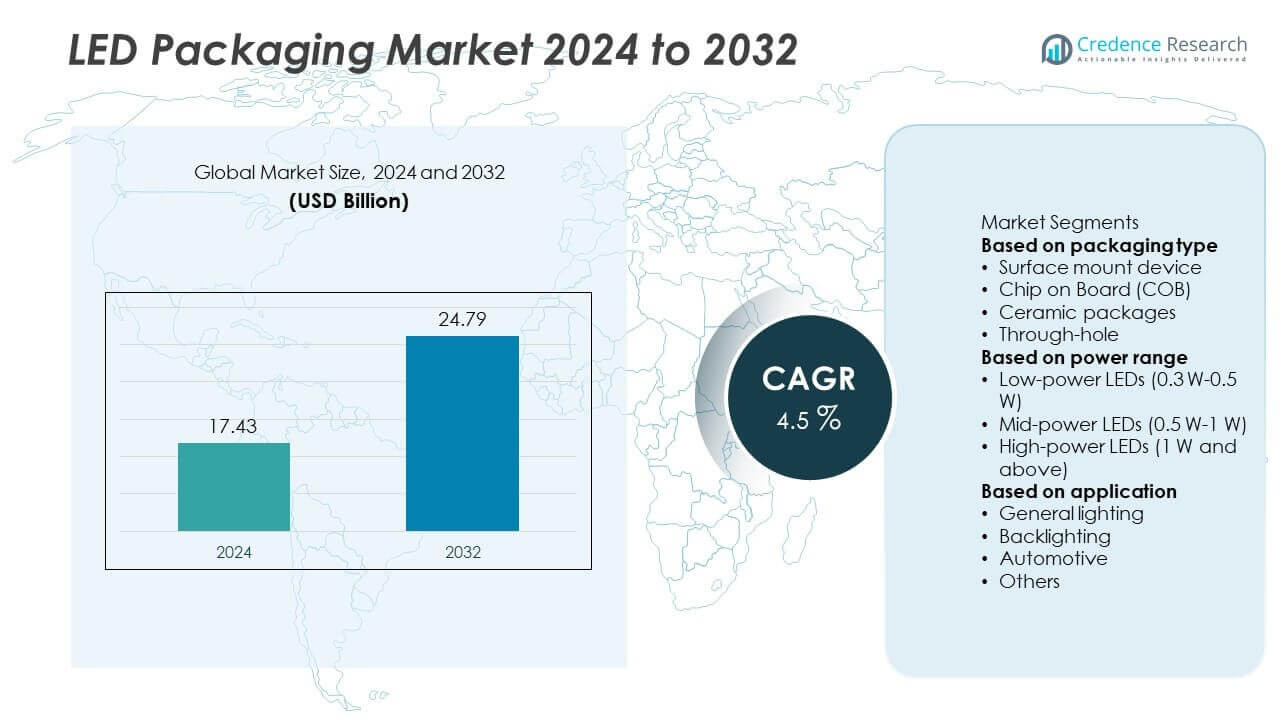

The LED Packaging market was valued at USD 17.43 billion in 2024 and is projected to reach USD 24.79 billion by 2032, expanding at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LED Packaging Market Size 2024 |

USD 17.43 Billion |

| LED Packaging Market, CAGR |

4.5% |

| LED Packaging Market Size 2032 |

USD 24.79 Billion |

The LED packaging market is driven by top players including Samsung Electronics Co. Ltd., Nichia Corporation, Seoul Semiconductor Co., Ltd., Lumileds Holding B.V., Ams-Osram AG, Everlight Electronics Co., Ltd., MLS Co., Ltd., Cree LED, LG Innotek, and Toyoda Gosei Co., Ltd. These companies lead through innovations in chip-on-board, surface mount device, and ceramic packaging to improve performance, heat dissipation, and energy efficiency. They actively invest in R&D, strategic collaborations, and capacity expansions to strengthen market presence. Regionally, Asia-Pacific dominated with 36% share in 2024, supported by large-scale manufacturing and strong consumer electronics demand, followed by North America at 27% share and Europe at 25% share, reflecting robust adoption in automotive and general lighting applications.

Market Insights

- The LED packaging market was valued at USD 17.43 billion in 2024 and is projected to reach USD 24.79 billion by 2032, expanding at a CAGR of 4.5% during the forecast period.

- Rising demand for energy-efficient solutions drives adoption, with general lighting leading the market at 52% share in 2024, supported by government initiatives and widespread replacement of traditional lighting systems.

- Key trends include the growing integration of LED packages in automotive applications, miniaturization for compact devices, and expanding use in smart and connected lighting systems.

- The market is highly competitive with major players such as Samsung Electronics, Nichia Corporation, Seoul Semiconductor, Lumileds, Ams-Osram, Everlight Electronics, MLS, Cree LED, LG Innotek, and Toyoda Gosei focusing on innovation, R&D investments, and global expansion.

- Regionally, Asia-Pacific dominated with 36% share, followed by North America at 27%, Europe at 25%, while Latin America and the Middle East & Africa accounted for 7% and 5%

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Packaging Type

Surface mount device (SMD) packaging dominated the LED packaging market in 2024, holding 48% share. Its widespread use is driven by compact size, high efficiency, and versatility across lighting applications. SMD LEDs are extensively adopted in general lighting, automotive, and display technologies due to their improved heat dissipation and durability. Manufacturers prefer SMD packaging for cost efficiency and scalability in mass production. With rising demand for energy-efficient lighting solutions and growing LED penetration in residential and commercial sectors, SMD packaging continues to lead over chip-on-board (COB) and ceramic alternatives.

- For instance, Samsung Electronics has developed numerous advanced LED technologies, including innovations in phosphor blends and thermal management for automotive lighting. The company has made incremental and significant improvements in luminous efficacy over time, such as achieving a record-high efficacy of 235 lumens per watt with a new package in 2021.

By Power Range

Mid-power LEDs, ranging from 0.5 W to 1 W, captured the largest share of the LED packaging market in 2024, accounting for 44% share. These LEDs strike a balance between energy efficiency and brightness, making them ideal for indoor lighting, displays, and signage. They offer longer lifespans, lower thermal output, and cost benefits compared to high-power variants. The rapid adoption of mid-power LEDs in commercial lighting, office spaces, and retail environments has fueled demand. Their expanding role in smart lighting systems and IoT-enabled applications reinforces their dominance across global markets.

- For instance, Cree LED, a subsidiary of Penguin Solutions (formerly SMART Global Holdings), supplies a broad portfolio of mid-power, high-power, and other application-optimized LED components.

By Application

General lighting led the LED packaging market in 2024, representing 52% share. Rising adoption of LEDs for residential, commercial, and industrial illumination has accelerated this segment’s dominance. Governments worldwide promote LED use through energy-saving policies and subsidies, strengthening their integration into sustainable building projects. Improved performance of LED packaging technologies, including better heat management and higher luminous efficiency, further boosts application in general lighting. While automotive and backlighting applications are growing steadily, especially with EV adoption and display demand, general lighting remains the key driver of global LED packaging market expansion.

Key Growth Drivers

Rising Demand for Energy-Efficient Lighting

Global initiatives promoting energy conservation drive adoption of LED technology, with LED packaging playing a central role in performance and efficiency. Governments support the transition through subsidies, tax benefits, and stricter energy regulations, accelerating replacement of conventional lighting. LED packages deliver superior brightness, longer lifespan, and reduced power consumption, making them a preferred choice for residential, commercial, and industrial lighting. Growing awareness of sustainability among consumers and enterprises further boosts demand. This shift toward eco-friendly lighting continues to reinforce the dominance of LED packaging solutions worldwide.

- For instance, ams OSRAM (formerly OSRAM Opto Semiconductors) achieved €1.448 billion in opto semiconductor revenue in fiscal year 2024, continuing to advance energy-efficient LED technology for commercial applications.

Expanding Automotive Applications

The automotive sector is increasingly adopting LED packaging solutions for headlamps, tail lamps, and interior lighting. High-power and mid-power LED packages improve brightness, thermal management, and durability, meeting evolving safety and design standards. With the rise of electric and autonomous vehicles, manufacturers demand advanced LED packaging for enhanced aesthetics and energy savings. Automakers also integrate adaptive and smart lighting systems, driving innovation in this space. The growing emphasis on energy-efficient, high-performance vehicle lighting ensures that automotive applications remain a strong growth driver for the LED packaging market.

- For instance, Nichia Corporation is a prominent supplier of automotive LEDs, including the advanced µPLS (Micro Pixelated Light Solution) developed with Infineon, which was implemented in premium vehicles starting in 2023.

Growth in Display and Backlighting Systems

The surge in demand for smartphones, televisions, laptops, and digital signage has accelerated LED packaging use in backlighting. Surface mount devices and mid-power LEDs dominate this space due to compact size and efficient luminous output. Increasing penetration of high-definition and OLED displays further supports adoption of advanced LED packaging technologies. Expansion of e-commerce and advertising industries boosts demand for digital display solutions, where LED packages ensure enhanced brightness and reliability. As global consumers shift toward high-quality displays, LED packaging remains a critical component enabling superior visual performance.

Key Trends and Opportunities

Adoption of Smart and Connected Lighting

Smart lighting systems integrated with IoT and AI create new opportunities for LED packaging. Mid-power and COB LED packages are increasingly used in connected lighting for homes, offices, and smart cities. These systems enable remote control, energy monitoring, and adaptive illumination, enhancing user convenience and efficiency. Governments investing in smart infrastructure further drive demand for LED packaging technologies. As IoT ecosystems expand, the integration of intelligent lighting with energy management platforms offers manufacturers strong opportunities to capitalize on this trend.

- For instance, Signify (formerly Philips Lighting) has deployed millions of IoT-connected LED light points globally, enabling real-time energy monitoring and automated dimming for commercial buildings.

Miniaturization and Advanced Materials Development

The trend toward compact and high-performance electronic devices accelerates innovation in LED packaging design. Manufacturers focus on developing smaller, thermally efficient packages with improved reliability and luminous efficacy. Use of advanced ceramic substrates and innovative encapsulation materials enhances durability and performance under harsh conditions. This supports adoption in automotive, aerospace, and industrial applications. Miniaturized LED packaging also aligns with design trends in consumer electronics and wearable devices. Continuous R&D in advanced materials positions manufacturers to deliver high-value solutions, expanding the addressable market for LED packaging.

- For instance, the former Cree Corporate, now Cree LED, has demonstrated the capability of its ceramic-based, high-power XLamp LEDs to deliver excellent luminous efficacy (over 140 lm/W has been reported), operate at high junction temperatures (up to 150°C), and achieve long L70 lifetimes exceeding 60,000 hours under standard testing conditions.

Key Challenges

High Initial Manufacturing and Development Costs

Despite long-term savings, LED packaging requires significant upfront investment in advanced manufacturing technologies and materials. Complex processes, including thermal management and encapsulation, add to production expenses. Smaller companies face barriers in adopting these technologies due to limited budgets. This cost challenge restricts widespread adoption in price-sensitive markets and creates reliance on subsidies and incentives. Without cost-competitive solutions, LED packaging adoption may remain concentrated in developed regions with stronger purchasing power.

Thermal Management and Performance Limitations

Effective heat dissipation remains a critical challenge for LED packaging, especially in high-power applications. Excessive heat reduces lifespan, lowers efficiency, and limits performance in demanding environments like automotive and industrial systems. Advanced materials and design improvements are required to address these issues, but they increase costs and manufacturing complexity. Failure to manage thermal challenges may slow adoption in high-growth areas such as electric vehicles and large-scale industrial lighting. Overcoming these limitations is vital for sustaining long-term competitiveness in the LED packaging market.

Regional Analysis

North America

North America held 27% share of the LED packaging market in 2024, driven by strong adoption in general lighting, automotive, and display applications. The United States leads the region with high demand for energy-efficient solutions supported by government programs promoting sustainable infrastructure. The rise of smart homes and offices further accelerates the use of advanced LED packages. Automotive manufacturers also contribute significantly, adopting high-power LED packages for headlamps and interior lighting. Investments in R&D and a strong presence of technology companies ensure North America remains a key market for LED packaging innovation and growth.

Europe

Europe accounted for 25% share of the LED packaging market in 2024, supported by strict energy efficiency regulations and widespread LED adoption across residential and industrial sectors. Countries such as Germany, France, and the United Kingdom are at the forefront of implementing eco-friendly lighting solutions. Automotive applications play a major role, with European automakers adopting advanced LED packages to improve vehicle performance and aesthetics. Growing investments in smart city projects and sustainable infrastructure also fuel demand. The region’s strong emphasis on environmental goals ensures steady growth for the LED packaging market.

Asia-Pacific

Asia-Pacific dominated the LED packaging market in 2024 with 36% share, making it the largest regional market. China, Japan, South Korea, and India lead in LED manufacturing and consumption, supported by large-scale production facilities and cost advantages. Expanding demand from consumer electronics, general lighting, and automotive sectors drives growth. Governments across the region encourage energy-saving programs and subsidies for LED adoption, reinforcing market expansion. Rising urbanization and infrastructure development further support demand for LED packaging. With growing exports and strong investments in R&D, Asia-Pacific continues to lead global production and innovation in LED packaging.

Latin America

Latin America represented 7% share of the LED packaging market in 2024, with Brazil and Mexico being key contributors. Rising demand for energy-efficient lighting in residential, commercial, and public infrastructure projects drives adoption. Government initiatives supporting renewable energy and efficient lighting systems also contribute to market growth. The region’s automotive sector increasingly integrates LED packages for safety and design improvements. However, economic constraints and limited manufacturing capabilities restrict faster adoption. Partnerships with global LED manufacturers and increasing awareness of energy savings are expected to create steady growth opportunities across Latin America.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the LED packaging market in 2024, with growth led by Gulf countries and South Africa. Rising investments in infrastructure, smart cities, and commercial projects boost demand for LED solutions. Government initiatives aimed at reducing energy consumption support the adoption of LED lighting in public and industrial sectors. Automotive and general lighting are key application areas, while growing urbanization strengthens market opportunities. However, limited local production and higher costs of advanced packaging technologies remain challenges. Despite this, expanding infrastructure investments will gradually enhance regional market penetration.

Market Segmentations:

By packaging type

- Surface mount device

- Chip on Board (COB)

- Ceramic packages

- Through-hole

By power range

- Low-power LEDs (0.3 W-0.5 W)

- Mid-power LEDs (0.5 W-1 W)

- High-power LEDs (1 W and above)

By application

- General lighting

- Backlighting

- Automotive

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the LED packaging market is defined by leading players such as Samsung Electronics Co. Ltd., Nichia Corporation, Seoul Semiconductor Co., Ltd., Lumileds Holding B.V., Ams-Osram AG, Everlight Electronics Co., Ltd., MLS Co., Ltd., Cree LED, LG Innotek, and Toyoda Gosei Co., Ltd. These companies focus on advancing packaging technologies such as surface mount device (SMD), chip-on-board (COB), and ceramic solutions to enhance efficiency, heat dissipation, and brightness. Strategic initiatives include expanding production facilities, investing in miniaturization, and integrating smart features to support applications in general lighting, automotive, and consumer electronics. Partnerships with automotive OEMs and consumer electronics firms strengthen their market position, while investments in R&D drive innovations in high-power and mid-power LED packaging. Sustainability and compliance with energy regulations remain key focus areas, pushing companies to develop eco-friendly and cost-effective solutions. Competition is intense, with firms leveraging global reach, innovation, and strategic collaborations to secure growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Samsung Electronics Co. Ltd.

- Nichia Corporation

- Seoul Semiconductor Co., Ltd.

- Lumileds Holding B.V.

- Ams-Osram AG

- Everlight Electronics Co., Ltd.

- MLS Co., Ltd.

- Cree LED

- LG Innotek

- Toyoda Gosei Co., Ltd.

Recent Developments

- In August 2025, Samsung was reported to push System-on-Panel (SoP) packaging for ultra-large panels, which is an advanced packaging method for semiconductors, potentially affecting LED driver / display integration.

- In March 2025, ams-OSRAM, along with Nichia, developed micro-LED solutions that enable over a 100× increase in resolution vs discrete LED matrix modes, representing packaging innovation in microLED integration.

- In January 2025, Nichia began mass production of a deep UV LED (280 nm, NCSU434D) in December 2024, pushing advances in package for UV applications.

- In November 2023, Samsung published about its advanced heterogeneous integration / advanced packaging business combining memory, logic, chiplets, etc.

Report Coverage

The research report offers an in-depth analysis based on packaging type, power range, application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising adoption of energy-efficient lighting solutions worldwide.

- General lighting will remain the largest application segment supported by government energy policies.

- Automotive demand will expand as EVs and smart lighting systems gain momentum.

- Mid-power LED packages will dominate due to efficiency and cost-effectiveness.

- Chip-on-board (COB) and ceramic packages will see increasing use in high-performance applications.

- Miniaturization will drive adoption in consumer electronics and portable devices.

- Smart and connected lighting systems will create strong opportunities for innovation.

- Asia-Pacific will maintain leadership supported by large-scale manufacturing and exports.

- North America and Europe will grow steadily with automotive and industrial applications.

- Competition will intensify as players invest in R&D and strategic partnerships.