Market Overview

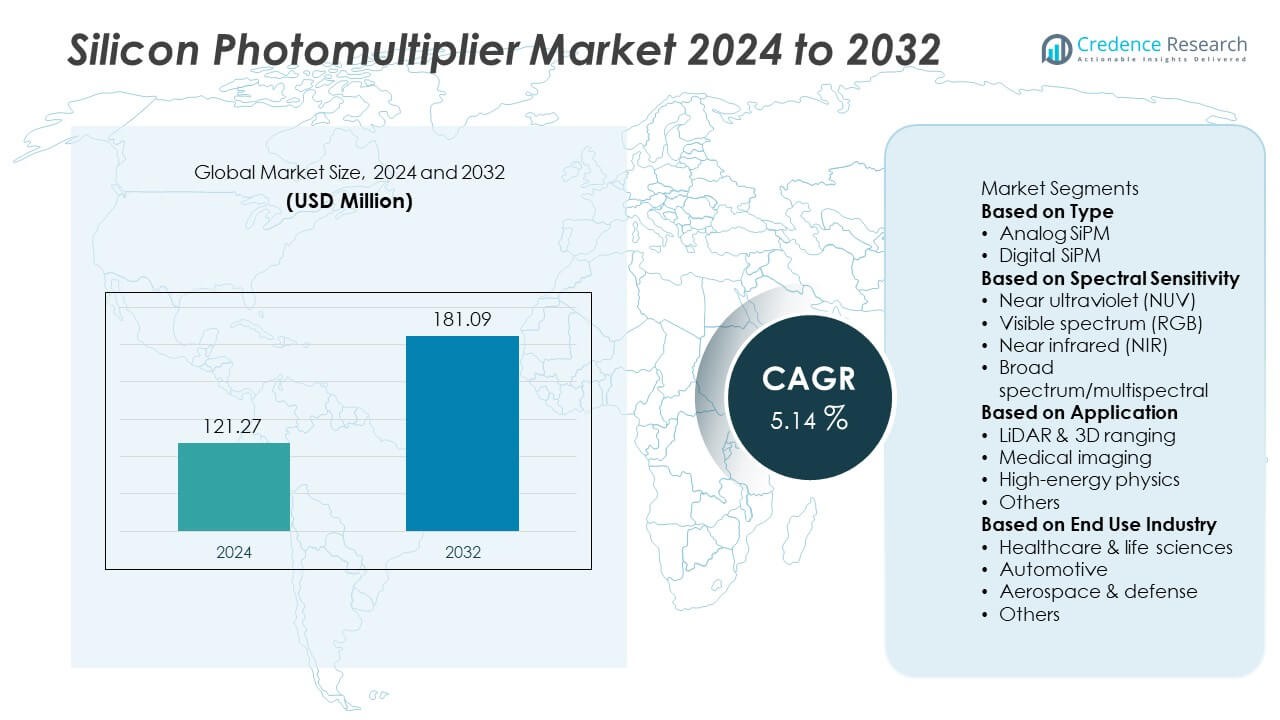

The Silicon Photomultiplier market was valued at USD 121.27 million in 2024 and is projected to reach USD 181.09 million by 2032, growing at a CAGR of 5.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicon Photomultiplier Market Size 2024 |

USD 121.27 Million |

| Silicon Photomultiplier Market, CAGR |

5.14% |

| Silicon Photomultiplier Market Size 2032 |

USD 181.09 Million |

The silicon photomultiplier market is led by key players such as Hamamatsu Photonics K.K., Broadcom Inc., Excelitas Technologies Corp., Semiconductor Components Industries, LLC, Texas Instruments Incorporated, SensL Technologies, STMicroelectronics, KETEK GmbH, First Sensor AG, and Photonis. These companies are driving innovation in analog and digital SiPMs, focusing on medical imaging, LiDAR, and high-energy physics applications. Regionally, North America held 36% share in 2024, supported by advanced healthcare infrastructure and strong research funding. Europe accounted for 29% share, driven by automotive safety applications and nuclear research programs, while Asia-Pacific captured 25% share, emerging as the fastest-growing region with rising adoption in healthcare and smart mobility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The silicon photomultiplier market was valued at USD 121.27 million in 2024 and is projected to reach USD 181.09 million by 2032, expanding at a CAGR of 5.14% during the forecast period.

- Growing adoption in medical imaging, particularly PET and CT scanners, is a major driver, with the medical imaging segment holding 48% share in 2024 due to rising demand for accurate diagnostic tools.

- A key trend is the increasing shift toward digital SiPMs, offering lower noise and integrated processing, gaining traction in LiDAR and advanced healthcare applications.

- The competitive landscape includes major players such as Hamamatsu Photonics K.K., Broadcom Inc., Excelitas Technologies Corp., Semiconductor Components Industries, LLC, STMicroelectronics, SensL Technologies, KETEK GmbH, First Sensor AG, Texas Instruments Incorporated, and Photonis, all focusing on innovation and global expansion.

- Regionally, North America led with 36% share, followed by Europe at 29%, while Asia-Pacific captured 25%, emerging as the fastest-growing region with strong investments in healthcare and smart mobility.

Market Segmentation Analysis:

By Type

The analog silicon photomultiplier segment dominated the market in 2024 with 60% share, driven by its high sensitivity, compact design, and cost-effectiveness. Analog SiPMs are widely used in medical imaging, particle physics, and radiation detection due to their fast response times and superior photon-counting capabilities. Their established integration into existing detection systems makes them the preferred choice in healthcare and research institutions. While digital SiPMs are gaining traction for advanced applications requiring precise data processing and lower noise, analog devices continue to lead due to broader adoption and proven performance reliability.

- For instance, Hamamatsu Photonics continues to lead in medical imaging devices, producing analog silicon photomultiplier (SiPM) modules with competitive performance features, including photon detection efficiencies exceeding 50% and timing resolutions in the range of tens to low hundreds of picoseconds, for applications like PET scanners.

By Spectral Sensitivity

The visible spectrum (RGB) segment held the largest 45% share of the silicon photomultiplier market in 2024, reflecting its extensive use in applications requiring accurate light detection across common wavelengths. These devices are crucial in medical imaging, LiDAR, and industrial inspection, where detection precision enhances imaging resolution and reliability. Near ultraviolet (NUV) and near infrared (NIR) detectors are expanding in demand for specialized uses such as biochemical detection and long-range sensing. However, RGB sensors remain dominant due to their versatility, high efficiency, and wide-scale adoption across multiple end-use industries.

- For instance, Excelitas Technologies has developed silicon photomultiplier (SiPM) modules, such as the LynX™ series, for low-light-level detection in life sciences and analytical instruments.

By Application

Medical imaging accounted for the largest 48% share of the silicon photomultiplier market in 2024, supported by rising use in PET scanners, CT detectors, and advanced diagnostic equipment. SiPMs enable superior image clarity, high sensitivity, and low noise, which are critical for accurate disease detection and treatment planning. Growing healthcare investments and the shift toward precision medicine further accelerate demand in this segment. While LiDAR and 3D ranging are rapidly emerging in automotive and robotics, medical imaging maintains leadership, as healthcare providers prioritize advanced detection technologies for improved patient outcomes and operational efficiency.

Key Growth Drivers

Expanding Demand in Medical Imaging

Medical imaging is a primary growth driver for the silicon photomultiplier market. SiPMs are increasingly adopted in PET, CT, and SPECT systems due to their high sensitivity, fast response times, and low noise levels, which improve diagnostic accuracy. Rising global cancer cases and the need for early disease detection are fueling investments in advanced imaging equipment. Healthcare providers prefer SiPM-enabled systems for enhanced performance and reliability, positioning medical imaging as the largest contributor to market expansion during the forecast period.

- For instance, onsemi has developed J-Series silicon photomultiplier (SiPM) sensors specifically for high-performance timing applications, such as Time-of-Flight PET (ToF-PET). These sensors can achieve a photon detection efficiency (PDE) of up to 50% at 420nm.

Rising Adoption in LiDAR and 3D Ranging

The growing use of LiDAR and 3D ranging in autonomous vehicles, robotics, and geospatial applications is driving silicon photomultiplier adoption. SiPMs offer superior photon detection efficiency and compact design, enabling precise distance measurement and high-resolution mapping. Automotive manufacturers are increasingly integrating SiPM-based LiDAR for navigation and safety features in driver-assist systems. The technology’s adaptability to harsh environments and long-range capabilities further enhances its role in mobility solutions, supporting rising demand from industries focused on automation and smart systems.

- For instance, in early 2021, onsemi released the ArrayRDM-0112A20-QFN, an automotive-qualified SiPM array for LiDAR. This 12-pixel array features high near-infrared (NIR) light sensitivity for 905 nm applications, enabling long-distance detection of targets even in bright sunlight conditions.

Advancements in High-Energy Physics Research

High-energy physics is another major driver, with SiPMs widely used in particle detection and nuclear research. Their ability to replace traditional photomultiplier tubes with compact, durable, and magnetic-field-resistant alternatives makes them ideal for cutting-edge experiments. Research facilities globally are upgrading to SiPM-based detectors to enhance accuracy and efficiency in particle tracking. Increased funding for scientific exploration, including neutrino experiments and dark matter research, is strengthening demand. This driver highlights SiPMs’ critical role in advancing physics studies, ensuring long-term market opportunities in the research domain.

Key Trends & Opportunities

Shift Toward Digital SiPMs

A major trend is the shift toward digital silicon photomultipliers, which offer integrated signal processing, lower noise, and improved dynamic range. Digital SiPMs are gaining momentum in medical imaging and LiDAR applications, where precision and data accuracy are essential. Manufacturers are investing in digital technology to capture demand for compact and intelligent detection solutions. While analog devices maintain dominance, the transition toward digital models presents growth opportunities, especially as industries demand higher reliability and smarter detection systems.

- For instance, Deutsches Elektronen-Synchrotron (DESY) developed a digital SiPM featuring a pixel pitch of about 70 micrometers and integrated 12-bit Time-to-Digital Converters (TDCs) delivering timing resolution better than 100 picoseconds, with a readout frame rate of 3 MHz tested successfully in 2024.

Integration into Next-Generation Healthcare Solutions

SiPM integration into next-generation healthcare systems is a key opportunity. Their compact size and high detection efficiency align with the growing need for portable and wearable diagnostic devices. Emerging uses include point-of-care scanners, handheld imaging tools, and advanced therapeutic monitoring. With healthcare shifting toward faster, patient-friendly solutions, SiPM manufacturers are well-positioned to expand into innovative medical applications. This trend underscores the broader adoption of SiPMs beyond traditional imaging systems, creating new pathways for growth across global healthcare markets.

- For instance, Philips Healthcare’s Vereos Digital PET/CT system, a stationary scanner introduced in 2013, uses proprietary Digital Photon Counting (DPC) technology, with digital SiPM detectors and 1:1 crystal coupling to achieve enhanced image quality, higher volumetric resolution, and reduced scan times for improved patient care.

Key Challenges

High Manufacturing and System Costs

One significant challenge for the silicon photomultiplier market is the high cost of production and system integration. SiPMs require advanced semiconductor fabrication, adding to expenses compared to conventional photomultiplier tubes. Additionally, medical imaging and LiDAR systems incorporating SiPMs often become costlier, limiting adoption in price-sensitive markets. Without improvements in cost-efficiency and large-scale manufacturing, broader penetration in developing regions may remain constrained.

Limited Awareness and Technical Complexity

Another challenge is limited awareness and the technical complexity associated with SiPM integration. Many industries remain reliant on traditional photodetectors due to familiarity and ease of use. The advanced electronics and calibration needed for SiPM operation can deter adoption, particularly in smaller facilities and industries with limited technical expertise. Addressing this challenge requires stronger education efforts, collaborative research, and simplified integration solutions to accelerate SiPM acceptance across wider market applications.

Regional Analysis

North America

North America held 36% share of the silicon photomultiplier market in 2024, supported by strong adoption in medical imaging and research applications. The United States leads demand, with extensive use of SiPMs in PET and CT scanners, as well as growing investments in particle physics research. Favorable reimbursement policies and funding for healthcare modernization further strengthen market growth. Canada contributes through its expanding research facilities, while Mexico is seeing increased uptake in industrial applications. The region’s advanced infrastructure and focus on next-generation imaging technologies solidify its leading position in the global market.

Europe

Europe accounted for 29% share of the silicon photomultiplier market in 2024, driven by healthcare advancements, scientific research, and automotive innovation. Countries such as Germany, France, and the U.K. are leading consumers, with strong integration of SiPMs in PET systems and high-energy physics facilities. The region also supports growth through the rising adoption of LiDAR in automotive safety and industrial automation. European research programs continue to fund SiPM applications in nuclear and particle physics, reinforcing steady demand. Strong regulatory frameworks and focus on innovation help maintain Europe’s position as a key market hub.

Asia-Pacific

Asia-Pacific captured 25% share of the silicon photomultiplier market in 2024, emerging as the fastest-growing region. China, Japan, and South Korea drive demand through their robust electronics, healthcare, and automotive sectors. Japan’s advancements in PET imaging and China’s expanding investments in LiDAR for smart mobility are key contributors. South Korea’s emphasis on semiconductor and photonics technologies further boosts adoption. Government support for healthcare modernization and funding for advanced research projects strengthen regional growth. The combination of rising healthcare demand and expanding automotive applications positions Asia-Pacific as a major growth frontier.

Latin America

Latin America represented 6% share of the silicon photomultiplier market in 2024, with Brazil and Mexico driving demand. Growth is supported by increasing investments in medical imaging infrastructure, particularly PET and CT scanners, to address rising healthcare needs. Brazil’s expanding hospital network and Mexico’s growing focus on diagnostic capabilities are key contributors. Adoption in research and industrial applications remains limited but is gradually expanding. Challenges include high system costs and limited technical expertise, but ongoing modernization of healthcare facilities and partnerships with global suppliers are expected to improve market accessibility in the region.

Middle East & Africa

The Middle East & Africa held 4% share of the silicon photomultiplier market in 2024, reflecting modest but growing adoption. Demand is concentrated in countries such as Saudi Arabia, the UAE, and South Africa, where healthcare investments and advanced medical imaging equipment are increasing. Research activities and adoption in security and industrial applications are also gradually rising. However, limited technical infrastructure and high costs pose challenges for broader adoption. Ongoing government initiatives to modernize healthcare systems and partnerships with international medical technology providers are expected to support steady growth across the region.

Market Segmentations:

By Type

By Spectral Sensitivity

- Near ultraviolet (NUV)

- Visible spectrum (RGB)

- Near infrared (NIR)

- Broad spectrum/multispectral

By Application

- LiDAR & 3D ranging

- Medical imaging

- High-energy physics

- Others

By End Use Industry

- Healthcare & life sciences

- Automotive

- Aerospace & defense

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the silicon photomultiplier market is defined by key players including Hamamatsu Photonics K.K., Broadcom Inc., Excelitas Technologies Corp., Semiconductor Components Industries, LLC, Texas Instruments Incorporated, SensL Technologies, STMicroelectronics, KETEK GmbH, First Sensor AG, and Photonis. These companies are focusing on technological innovation, product reliability, and expanding application reach to strengthen their market positions. Hamamatsu and Excelitas lead in medical imaging applications, while Broadcom and STMicroelectronics leverage their semiconductor expertise for LiDAR and automotive solutions. Players are increasingly investing in digital SiPMs to meet demand for high precision and low noise in advanced imaging and ranging applications. Strategic collaborations with healthcare providers, research institutes, and automotive manufacturers are enhancing adoption and ensuring long-term growth opportunities. Expansion into emerging regions, particularly Asia-Pacific, coupled with R&D initiatives in miniaturization and high-performance designs, underscores the competitive strategies shaping the global silicon photomultiplier market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hamamatsu Photonics K.K.

- Broadcom Inc.

- Excelitas Technologies Corp.

- Semiconductor Components Industries, LLC

- Texas Instruments Incorporated

- SensL Technologies

- STMicroelectronics

- KETEK GmbH

- First Sensor AG

- Photonis

Recent Developments

- In March 2025, ST expanded its silicon photonics roadmap, emphasizing integration of photonics and electronics on 300 mm wafers.

- In February 2025, STMicroelectronics announced new silicon photonics + next-gen BiCMOS tech to support 800 Gb/s and 1.6 Tb/s optical interconnects.

- In July 2024, Hamamatsu Photonics launched S16786-0515WM, a near-infrared, high-sensitivity SiPM optimized for LiDAR, achieving ~15 % photon detection efficiency at 905 nm using microlens technology.

- In July 2024, Hamamatsu expanded its MPPC (SiPM) product line for LiDAR applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Spectral Sensitivity, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for advanced medical imaging systems.

- Analog SiPMs will retain dominance, but digital SiPMs will gain stronger adoption.

- Medical imaging will remain the leading application supported by PET and CT technologies.

- LiDAR adoption will rise with autonomous vehicles and robotics development.

- High-energy physics research will continue driving demand for precision detection solutions.

- North America will maintain leadership with strong research and healthcare investments.

- Europe will sustain growth through automotive safety and nuclear research applications.

- Asia-Pacific will grow fastest with increasing focus on healthcare and smart mobility.

- Manufacturers will invest in miniaturization and integration for next-generation devices.

- Competition will intensify as global players expand portfolios and regional presence.