Market Overview

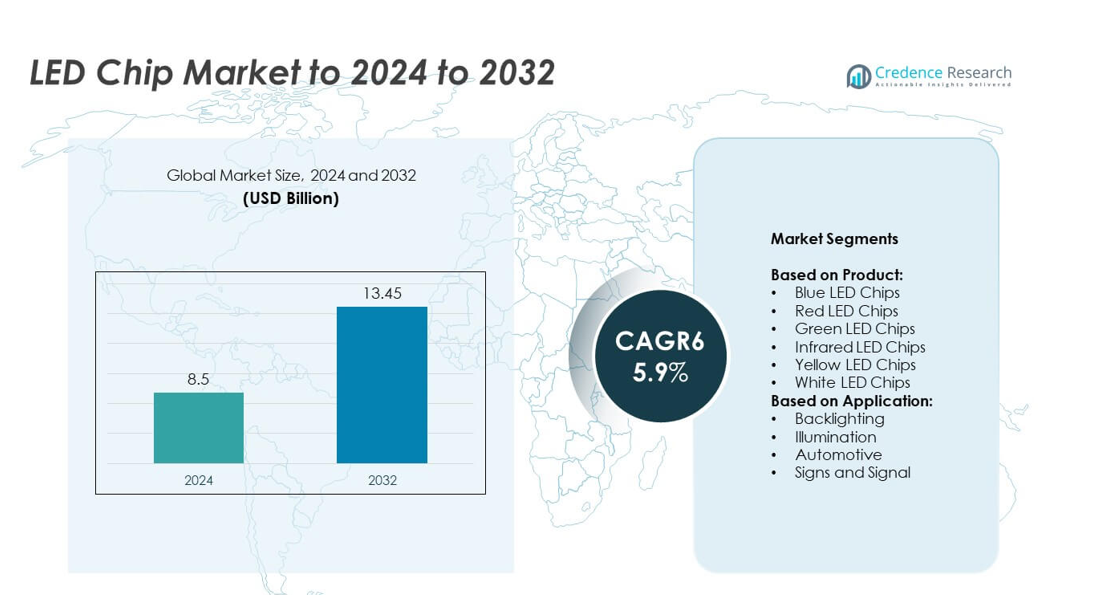

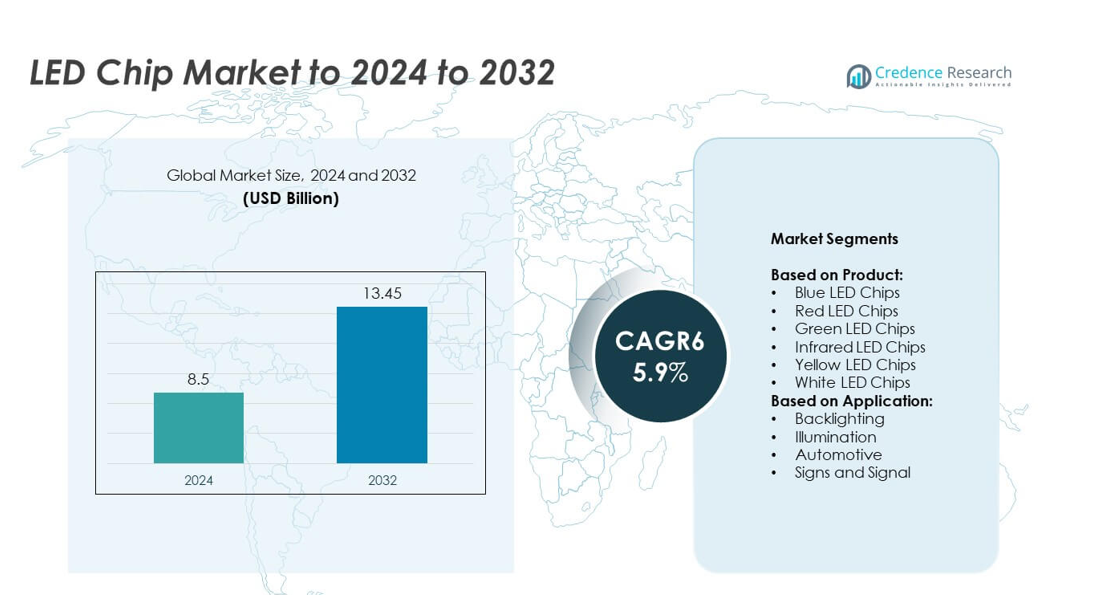

The LED Chip market size was valued at USD 8.5 billion in 2024 and is anticipated to reach USD 13.45 billion by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LED Chip market Size 2024 |

USD 8.5 billion |

| LED Chip market, CAGR |

5.9% |

| LED Chip market Size 2032 |

USD 13.45 billion |

The LED chip market is shaped by prominent players such as Nichia Corporation, Osram Opto Semiconductors GmbH, Cree, Inc., Epistar Corporation, and San’an, who focus on innovation, efficiency improvements, and expanding applications across illumination, automotive, and consumer electronics. These companies leverage advanced manufacturing capabilities and strategic partnerships to strengthen their global presence while driving technological developments in micro-LED, infrared, and UV solutions. Regionally, Asia-Pacific dominated the market with nearly 38% share in 2024, supported by large-scale production in China, Japan, and South Korea, alongside strong domestic consumption and government-backed energy-efficiency initiatives.

Market Insights

- The LED chip market was valued at USD 8.5 billion in 2024 and is projected to reach USD 13.45 billion by 2032, growing at a CAGR of 5.9% between 2025 and 2032.

- Growth is driven by rising demand for energy-efficient lighting, smart city projects, and increasing use of LEDs in automotive systems and advanced displays.

- Micro-LED development and expanding applications in infrared and UV segments for healthcare, disinfection, and security create strong market trends.

- Competition remains intense as players focus on R&D, cost efficiency, and strategic partnerships to address pricing pressure and innovation demands.

- Asia-Pacific led with nearly 38% share in 2024, followed by North America at 28% and Europe at 24%, while blue LED chips held the largest product share with over 35%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Blue LED chips held the dominant share of over 35% in the LED chip market in 2024. Their leadership is driven by widespread use in general lighting, mobile devices, and display backlighting. The ability of blue LEDs to combine with phosphors to produce white light further enhances demand. Rising adoption in smart lighting systems and energy-efficient solutions sustains growth. White LED chips follow closely, supported by demand in residential and commercial illumination. Advancements in efficiency, reduced power consumption, and long operational life reinforce blue LED chips as the primary growth driver.

- For instance, Cree LED has offered a range of XLamp® XP-G3 S Line LEDs, which are recognized for high efficacy and reliability in applications such as horticulture. While the company’s white XP-G3 S Line LEDs have achieved high efficacy ratings, including figures up to 225 LPW (lumens per watt).

By Application

Illumination was the leading application segment in 2024, accounting for nearly 40% of the LED chip market share. The shift from conventional lighting to LED-based systems across households, offices, and public infrastructure supports this dominance. Global energy-efficiency regulations and falling LED production costs fuel rapid adoption. Additionally, the increasing integration of LEDs into smart homes and connected lighting ecosystems drives growth. Automotive and backlighting applications remain strong contributors, but illumination continues to lead due to government-backed energy-saving programs and large-scale replacement of traditional lighting solutions.

- For instance, Signify reported that its installed base of connected light points increased to 124 million globally by the end of 2023, up from 114 million in 2022.

Key Growth Drivers

Rising Demand for Energy-Efficient Lighting

The growing need for energy-efficient lighting solutions is a primary driver for the LED chip market. Governments worldwide are implementing stringent energy regulations, encouraging a shift from traditional bulbs to LEDs. Consumers and industries benefit from lower electricity costs and longer lifespan, making LEDs a preferred choice. The adoption of LED-based illumination in residential, commercial, and industrial sectors further boosts demand. This transition not only reduces energy consumption but also supports sustainability goals, solidifying energy-efficient lighting as the key growth driver.

- For instance, in August 2023, Panasonic reported its “Contribution Impact”—the CO₂ emissions avoided by customers using Panasonic products—increased to 37.23 million tons in fiscal year 2023, up from 23.47 million tons in fiscal year 2021.

Expanding Automotive Applications

Automotive lighting is a significant growth catalyst in the LED chip market. The rising adoption of advanced driver assistance systems (ADAS) and connected vehicles has accelerated the use of LED chips in headlights, taillights, and interior lighting. Automakers are integrating LEDs for improved safety, durability, and energy savings. The trend toward electric vehicles and autonomous cars further increases LED demand, as these vehicles require innovative lighting solutions. Automotive manufacturers’ focus on style, efficiency, and compliance with safety regulations strengthens LED chip penetration in the automotive industry.

- For instance, Valeo, a leading automotive supplier, reported total sales of €22.04 billion in its 2023 financial results, with original equipment sales comprising 85% of its revenue.

Advancements in Smart and Connected Lighting

The increasing use of smart and connected lighting systems is a major driver of LED chip growth. Integration with IoT platforms enables remote control, adaptive lighting, and energy monitoring. These features attract both residential and commercial users seeking automation and efficiency. Governments are also promoting smart city projects, which heavily rely on intelligent lighting solutions. The ability of LED chips to support dimming, color tuning, and networked operations aligns with modern needs. This creates long-term opportunities for manufacturers to expand their offerings in advanced lighting ecosystems.

Key Trends & Opportunities

Miniaturization and Micro-LED Development

The rise of micro-LED technology represents a key trend reshaping the LED chip market. Micro-LEDs deliver superior brightness, energy efficiency, and longer lifespan compared to traditional LEDs. Their growing use in advanced displays, wearables, and AR/VR devices drives demand. With consumer electronics companies investing heavily in R&D, micro-LEDs are poised to revolutionize display quality. The miniaturization trend allows integration into thinner and lighter devices, meeting consumer expectations for performance and design. This technology opens significant opportunities for players to diversify their product portfolios and capture emerging markets.

- For instance, Apple has been actively developing micro-LED technology, reflected by its acquisition of micro-LED developer LuxVue Technology and the numerous patents it continues to file and update, with a strong focus on wearables and other display types. One patent analysis from early 2018 identified more than 60 patent families, indicating substantial development in areas such as transfer, assembly, and interconnects, before 2024.

Expansion in Infrared and UV Applications

Infrared and ultraviolet LED chips are creating new growth opportunities beyond traditional lighting. Infrared LEDs are widely used in biometric sensors, automotive night vision, and security surveillance systems. Similarly, UV LEDs are increasingly adopted in sterilization, medical devices, and water purification applications. Growing health and safety concerns after the COVID-19 pandemic have boosted UV LED demand, particularly for disinfection systems. The versatility of these chips in industrial and consumer applications highlights a major trend, enabling manufacturers to expand into high-value niche markets.

- For instance, Crystal IS demonstrated a single-chip UVC LED output of 160 mW at 260–270 nm in 2023, used for germicidal systems.

Key Challenges

High Initial Costs and Manufacturing Complexity

The LED chip market faces challenges from high production costs and complex manufacturing processes. Advanced chips, such as micro-LEDs, require precision engineering and specialized equipment, which increase capital investments. These costs are often transferred to consumers, limiting large-scale adoption in price-sensitive regions. Additionally, the competitive pressure to continuously improve performance and reduce costs puts strain on manufacturers. Balancing efficiency, quality, and affordability remains a persistent hurdle. Overcoming these barriers is crucial for LED chip producers to maintain profitability and expand market penetration globally.

Intense Competition and Price Erosion

Price erosion driven by intense competition is a major challenge in the LED chip industry. Manufacturers, especially from Asia-Pacific, are offering low-cost products that intensify market rivalry. While this boosts affordability, it reduces profit margins for global players. The pressure to cut prices also impacts R&D investments, slowing innovation in advanced technologies. Furthermore, oversupply in certain segments adds to pricing instability. To address this challenge, companies must focus on differentiation, advanced applications, and strategic partnerships to sustain growth and remain competitive in the global market.

Regional Analysis

North America

North America accounted for nearly 28% of the LED chip market share in 2024, driven by strong demand in illumination, automotive, and display applications. The United States leads the region due to government-backed energy efficiency programs and widespread adoption of LED lighting across commercial and residential sectors. The automotive industry’s increasing use of LEDs in advanced lighting systems also fuels growth. Canada and Mexico contribute steadily, supported by infrastructure modernization and manufacturing activities. Technological innovation, rising smart home penetration, and stringent energy regulations ensure North America remains a key market for LED chip development.

Europe

Europe held around 24% of the LED chip market share in 2024, supported by strict energy efficiency regulations and rapid adoption of sustainable lighting. Countries such as Germany, France, and the UK drive demand with strong automotive manufacturing bases and large-scale infrastructure projects. The European Union’s policies promoting energy-efficient products accelerate LED integration across industries. Automotive LED applications, particularly in luxury and electric vehicles, provide strong momentum. Additionally, smart city initiatives in major European cities are creating opportunities for intelligent lighting systems, keeping Europe a significant contributor to global LED chip adoption.

Asia-Pacific

Asia-Pacific dominated the LED chip market with nearly 38% share in 2024, making it the largest regional market. China, Japan, South Korea, and Taiwan lead with advanced manufacturing capabilities and high-volume production. China remains the hub for mass production, benefiting from government subsidies and large-scale demand in lighting and consumer electronics. Japan and South Korea contribute through technological innovations and premium applications such as automotive and displays. Rapid urbanization and infrastructure expansion in India and Southeast Asia also add momentum. The combination of cost-effective production and high domestic consumption cements Asia-Pacific’s leadership in the market.

Latin America

Latin America represented about 6% of the LED chip market share in 2024, with growth led by Brazil and Mexico. Government policies encouraging energy efficiency and the gradual replacement of traditional lighting support market expansion. The rising adoption of LEDs in commercial and public infrastructure projects, including stadiums and street lighting, boosts demand. The automotive sector in Mexico further contributes with increasing use of LED chips in vehicle lighting. Despite economic constraints, growing consumer awareness of energy savings and supportive policies are expected to improve regional adoption of LED technologies in the coming years.

Middle East and Africa

The Middle East and Africa accounted for nearly 4% of the LED chip market share in 2024, marking the smallest but steadily growing region. Growth is fueled by rising infrastructure investments, smart city initiatives, and large-scale construction projects in the Gulf countries. Demand for energy-efficient lighting in commercial spaces, mosques, and urban development projects supports adoption. Africa, though still emerging, is witnessing gradual penetration through government-led electrification programs and the need for low-cost, efficient lighting. The increasing use of LEDs in street lighting and public infrastructure signals promising growth potential despite economic and regulatory challenges.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product:

- Blue LED Chips

- Red LED Chips

- Green LED Chips

- Infrared LED Chips

- Yellow LED Chips

- White LED Chips

By Application:

- Backlighting

- Illumination

- Automotive

- Signs and Signal

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the LED chip market is shaped by key players such as Bright LED Electronics Corporation, San’an, OSA Opto Light GmbH, Huga Optech, Inc., Epistar Corporation, Kingbright Electronic Co. Ltd., Cree, Inc., Goldeneye, Inc., AVA Technologies, Inc., Dowa Electronics Materials Co., Ltd., Osram Opto Semiconductors GmbH, Bridgelux, Inc., Formosa Epitaxy, Inc., Hitachi Cable, Ltd., Seoul Viosys, Nichia Corporation, and Optek Technology (TT Electronic PLC). These companies compete through advancements in chip efficiency, miniaturization, and integration into next-generation applications such as smart lighting, automotive systems, and consumer electronics. Strong emphasis is placed on R&D investments to develop micro-LEDs, infrared, and UV chips to expand product portfolios and address emerging opportunities. Pricing strategies remain highly competitive, especially in Asia-Pacific, where large-scale manufacturing enables cost advantages. Strategic partnerships, capacity expansions, and entry into niche markets like healthcare and wearables are helping players strengthen their global positions.

Key Player Analysis

- Bright LED Electronics Corporation

- San’an

- OSA Opto Light GmbH

- Huga Optech, Inc.

- Epistar Corporation

- Kingbright Electronic Co. Ltd.

- Cree, Inc.

- Goldeneye, Inc.

- AVA Technologies, Inc.

- Dowa Electronics Materials Co., Ltd.

- Osram Opto Semiconductors GmbH

- Bridgelux, Inc.

- Formosa Epitaxy, Inc.

- Hitachi Cable, Ltd.

- Seoul Viosys

- Nichia Corporation

- Optek Technology (TT Electronic PLC)

Recent Developments

- In 2024, Seoul Viosys Showcased its one-chip WICOP Pixel micro-LED technology, which vertically stacks RGB micro-LEDs.

- In 2023, Nichia Partnered with Infineon to launch an integrated micro-LED matrix solution for high-definition adaptive driving beam (ADB) automotive headlights.

- In 2023, San’an Advanced its joint venture with STMicroelectronics, with the Sanan substrate plant producing its first prototype SiC wafers.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The LED chip market will continue expanding with steady growth across all major regions.

- Blue and white LED chips will remain dominant due to demand in illumination and displays.

- Automotive lighting will see faster adoption, supported by electric and autonomous vehicle growth.

- Micro-LED technology will gain momentum, especially in consumer electronics and premium displays.

- Smart city projects will increase LED chip demand in connected and intelligent lighting systems.

- Infrared and UV LED chips will create new opportunities in medical and security applications.

- Price competition will intensify, pressuring manufacturers to focus on innovation and differentiation.

- Sustainability goals and energy efficiency regulations will further accelerate LED chip adoption.

- Asia-Pacific will maintain leadership, supported by strong manufacturing and domestic consumption.

- Partnerships and R&D investments will drive breakthroughs in miniaturization and advanced chip performance.