Market Overview:

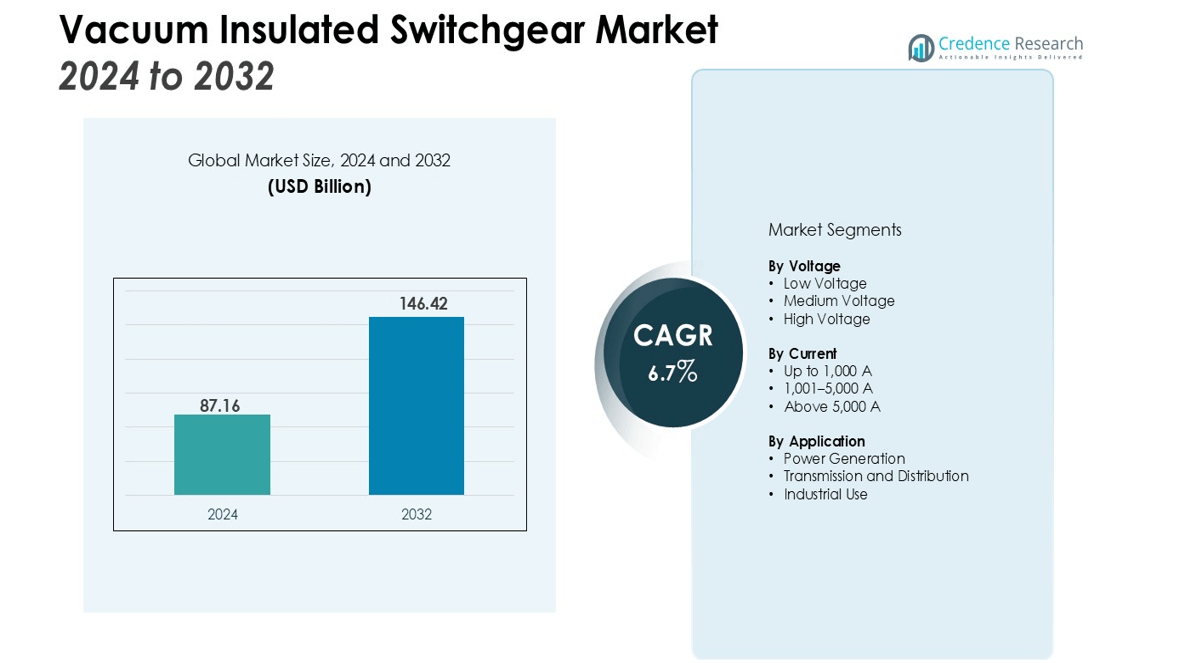

The Vacuum Insulated Switchgear Market size was valued at USD 87.16 billion in 2024 and is anticipated to reach USD 146.42 billion by 2032, at a CAGR of 6.7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vacuum Insulated Switchgear Market Size 2024 |

USD 87.16 billion |

| Vacuum Insulated Switchgear Market, CAGR |

6.7% |

| Vacuum Insulated Switchgear Market Size 2032 |

USD 146.42 billion |

Market growth is driven by the global push toward SF₆-free technologies, rising renewable energy integration, and the need for efficient power distribution. Vacuum insulation enhances operational safety and reduces environmental risks, making it a preferred choice in substations, smart grids, and renewable projects. Growing investments in upgrading aging grid infrastructure and the adoption of digital monitoring solutions further support the market’s expansion.

Regionally, Europe leads the Vacuum Insulated Switchgear Market with a significant share, supported by strong regulatory focus on low-emission equipment and widespread deployment in renewable projects. North America follows, driven by infrastructure modernization and grid reliability initiatives. The Asia Pacific region is expected to record the fastest growth, fueled by urbanization, rapid industrialization, and rising electricity demand in countries like China and India. Meanwhile, Latin America and the Middle East & Africa are gaining momentum due to expanding industrial bases and growing renewable investments.

Market Insights:

- The Vacuum Insulated Switchgear Market is valued at USD 87.16 billion and projected to reach USD 146.42 billion by 2032, with a CAGR of 6.7%.

- Global demand is rising due to SF₆-free technologies that reduce environmental risks and align with sustainability policies.

- Strong growth is supported by renewable energy projects where vacuum systems ensure reliability in solar and wind integration.

- Grid modernization and smart infrastructure programs accelerate adoption, with digital monitoring improving operational efficiency and fault detection.

- Compact designs address urban and industrial needs, lowering space requirements and reducing construction costs for substations.

- Europe leads with 38% share, followed by Asia Pacific at 29% and North America at 22%, while the Middle East and Latin America together hold 11%.

- High costs and limited user expertise remain challenges, yet rising awareness, sustainability mandates, and digital integration create lasting growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Risig Focus on Environmentally Sustainable Power Distribution

he Vacuum Insulated Switchgear market is gaining traction due to global initiatives to cut greenhouse gas emissions. Governments and utilities are promoting SF₆-free alternatives to minimize environmental risks. Vacuum insulation provides a safe and sustainable substitute, reducing carbon footprints while maintaining performance. It aligns with climate action policies and industry goals to adopt cleaner technologies. This transition positions the technology as a core solution for eco-friendly power infrastructure.

- For instance, in May 2024, Norwegian grid operator Norgesnett partnered with Siemens to install SF6-free blue GIS switchgear, a move projected to save approximately 1,200 tonnes of CO2 over the product’s lifetime compared to traditional SF6-gas switchgear.

Increasing Investments in Renewable Energy Projects

The expansion of solar and wind projects has accelerated demand for reliable and low-maintenance switchgear systems. Vacuum Insulated Switchgear supports efficient energy distribution in renewable power plants and substations. It ensures operational stability in variable power generation environments. Rising global renewable capacity has created consistent opportunities for deployment in large-scale and distributed energy systems. This trend strengthens the role of vacuum technology in the energy transition.

- For instance, Siemens Energy invested €60 million in its Berlin facility to increase the production of vacuum interrupters for its SF6-free Blue portfolio, strengthening the supply chain for technologies essential to the renewable energy sector.

Grid Modernization and Digital Infrastructure Upgrades

Aging grid networks worldwide require modernization to meet growing power demands and resilience needs. Vacuum Insulated Switchgear integrates advanced monitoring features that enhance system reliability and operational control. It supports smart grid initiatives by providing compact designs suitable for urban and industrial networks. Digital integration improves fault detection and minimizes downtime in critical applications. These benefits make it a key technology in modern grid infrastructure.

Rising Demand for Compact and Space-Saving Switchgear Solutions

Urbanization and industrial expansion are driving the need for equipment that saves space without compromising performance. Vacuum Insulated Switchgear offers compact designs that fit limited installation areas while delivering high efficiency. It reduces land and building costs for utilities and industries, supporting cost-effective deployment. The smaller footprint makes it suitable for substations in densely populated cities and industrial plants. Its space-saving advantage has become a crucial factor in adoption across global markets.

Market Trends:

Adoption of SF₆-Free Technologies and Green Product Development

The Vacuum Insulated Switchgear market is witnessing a strong shift toward SF₆-free technologies driven by strict global regulations on greenhouse gas emissions. Manufacturers are focusing on developing eco-friendly alternatives that maintain reliability and safety standards without compromising performance. It reflects a clear industry movement to align with sustainability targets set by utilities and governments. Companies are investing in R&D to launch advanced materials and insulation systems that meet environmental guidelines. Green certifications and lifecycle assessments are increasingly influencing procurement decisions in utilities and industrial sectors. This trend underscores the growing importance of sustainability as a key market differentiator.

- For instance, GE Grid Solutions developed the world’s first 420 kV circuit-breaker using its g³ (g-cubed) gas-insulating technology, an alternative to SF₆.

Integration of Digital Monitoring and Smart Grid Capabilities

The Vacuum Insulated Switchgear market is evolving with the integration of digital features designed for real-time performance tracking and predictive maintenance. It supports smart grid applications by enabling remote monitoring and enhancing system reliability in both urban and industrial power networks. Utilities are adopting intelligent switchgear solutions to reduce downtime, improve fault detection, and optimize operational efficiency. The inclusion of IoT sensors and communication modules allows better asset management and reduced maintenance costs. Growing demand for energy efficiency and operational transparency is accelerating the deployment of smart switchgear systems. This digital integration is expected to remain a critical trend shaping the market’s future growth.

- For instance, Eaton’s Power Xpert UX 36 system provides reliable power distribution with a current rating of up to 2500 A. This switchgear is designed for high-end applications up to 36 kV and a short-circuit withstand capacity of 31.5 kA.

Market Challenges Analysis:

High Initial Costs and Complex Installation Requirements

The Vacuum Insulated Switchgear market faces a challenge in terms of high upfront costs and installation complexity. Procurement budgets in developing regions often prioritize conventional switchgear due to lower initial expenses. It requires specialized equipment, skilled workforce, and advanced infrastructure during deployment, which adds to overall project costs. These financial and technical barriers limit adoption among small and medium utilities. Long-term operational savings may offset costs, but decision-makers remain cautious. This challenge slows market penetration in cost-sensitive regions despite strong performance benefits.

Limited Awareness and Technical Expertise Among End Users

The Vacuum Insulated Switchgear market also struggles with limited awareness and knowledge gaps among end users. Many operators and utilities lack technical expertise to fully utilize advanced digital and eco-friendly features. It creates dependency on suppliers for maintenance and training, which increases operational challenges. Resistance to adopting newer technologies persists where traditional systems are entrenched. Inadequate promotion and education on lifecycle advantages further restrict adoption. Bridging this knowledge gap is essential to drive wider acceptance and maximize performance benefits.

Market Opportunities:

Expansion of Renewable Energy and Sustainable Infrastructure Projects

The Vacuum Insulated Switchgear market has significant opportunities linked to the rapid growth of renewable energy projects. Global investments in solar, wind, and hydro power plants require efficient and eco-friendly switchgear solutions. It provides reliability in variable energy generation environments, making it a preferred choice for clean power distribution. Governments are supporting low-carbon technologies through subsidies and policy frameworks, further boosting adoption. Utilities and industries aiming to meet sustainability targets view vacuum technology as a strategic option. This creates strong potential for market growth in both developed and emerging economies.

Growing Demand for Smart Grid and Digital Solutions

The Vacuum Insulated Switchgear market also benefits from rising demand for smart grid infrastructure and digitalized energy management systems. It integrates IoT-enabled sensors and monitoring features that improve asset performance and reduce maintenance costs. Utilities are seeking advanced switchgear that enhances fault detection and operational efficiency in urban networks. Digital adoption aligns with global trends toward automation and intelligent energy distribution. Industrial players are also investing in digital-ready systems to improve reliability and cut downtime. This shift toward smart infrastructure creates long-term opportunities for widespread deployment of vacuum-based systems.

Market Segmentation Analysis:

By Voltage

The Vacuum Insulated Switchgear market is segmented into low, medium, and high voltage categories. Medium voltage holds the largest share, supported by widespread adoption in power distribution networks and renewable energy projects. It is favored for reliability, safety, and compactness in urban substations. High voltage applications are also expanding with investments in transmission infrastructure. Low voltage finds usage in industrial facilities where space-saving and cost-effective solutions are critical.

- For instance, Siemens’ NXAIR medium-voltage switchgear, which features maintenance-free vacuum circuit-breakers, has seen extensive global adoption with more than 610,000 panels now in operation worldwide.

By Current

Segmentation by current includes up to 1,000 A, 1,001–5,000 A, and above 5,000 A. The 1,001–5,000 A range dominates due to its extensive use in utilities and industrial grids. It ensures efficiency for medium and large-scale operations while offering operational safety. Higher current categories are gaining momentum with the expansion of heavy industries and high-capacity substations. Lower current systems remain relevant for smaller networks and commercial installations.

By Application

The market by application includes power generation, transmission and distribution, and industrial use. Transmission and distribution lead due to rising grid modernization initiatives worldwide. It plays a critical role in enhancing reliability and reducing environmental risks across large-scale networks. Power generation applications grow with renewable projects requiring sustainable and efficient switchgear. Industrial applications are expanding with rapid urbanization and manufacturing growth across developing economies.

- For instance, ABB commissioned the world’s first substation featuring eco-efficient gas-insulated switchgear for the Swiss utility ewz in Zurich, a 3 x 50-megavolt-ampere installation that enhances power supply to the city’s northern districts.

Segmentations:

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Current

- Up to 1,000 A

- 1,001–5,000 A

- Above 5,000 A

By Application

- Power Generation

- Transmission and Distribution

- Industrial Use

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Europe Leading with Strong Sustainability Regulations and Renewable Expansion

Europe holds 38% share of the Vacuum Insulated Switchgear market. The region leads due to strict environmental regulations and strong renewable integration policies. Countries such as Germany, France, and the UK are driving the replacement of SF₆-based systems with sustainable solutions. It gains momentum from government programs promoting renewable energy and low-emission equipment. Investments in offshore wind, solar farms, and modern substations strengthen adoption. The presence of established manufacturers and R&D hubs further consolidates Europe’s leadership.

Asia Pacific Emerging as the Fastest-Growing Regional Market

Asia Pacific holds 29% share of the Vacuum Insulated Switchgear market. Rapid industrialization, urbanization, and increasing electricity demand in China and India drive expansion. It is widely adopted in renewable capacity additions and smart grid deployments. Government-backed infrastructure projects and private investments enhance opportunities across the region. Southeast Asian economies are also investing in modern distribution systems to support industrial growth. This momentum secures Asia Pacific as the fastest-growing regional market.

North America, Middle East, and Latin America Showing Steady Momentum

North America holds 22% share of the Vacuum Insulated Switchgear market. The region benefits from ongoing grid modernization and resilience initiatives in the United States and Canada. It aligns with the need for reliable infrastructure amid rising climate-related challenges. The Middle East contributes 6% share, supported by industrial diversification and renewable investments in Gulf countries. Latin America accounts for 5% share, driven by efforts to expand power access and integrate renewables. Collectively, these regions strengthen the global market’s balanced expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- HD Hyundai Electric

- Hyosung Heavy Industries

- Hitachi

- ABB

- Skema

- Bharat Heavy Electricals

- CG Power and Industrial Solutions

- E + I Engineering

- Eaton

- Mitsubishi Electric

- Schneider Electric

- Fuji Electric

- Ormazabal

- General Electric

- Siemens

- Lucy Group

Competitive Analysis:

The Vacuum Insulated Switchgear market is competitive, with key players like ABB, Siemens, Schneider Electric, and Eaton leading the way. These companies focus on innovation, sustainability, and cost efficiency, offering advanced products for smart grids and renewable energy applications. They invest in digital monitoring features and compact designs to meet growing demand for eco-friendly, reliable power distribution solutions. Smaller companies also target specific niches with cost-effective, customized offerings, increasing competition. Strategic partnerships and collaborations are helping to expand market reach, while the shift toward SF₆-free technologies and smart solutions will continue to drive market dynamics.

Recent Developments:

- In June 2025, ABB launched four new robots at the Automatica 2025 trade fair, including three large industrial robots (IRB 6730S, IRB 6750S, and IRB 6760) and an autonomous mobile robot, the Flexley Mover P603.

- In August 2025, the US subsidiary of CG Power and Industrial Solutions, CG DE SUB, LLC, partnered with Flanders Electric Motors Service to expand its presence and capabilities within the US rail market.

- In February 2025, Eaton launched its 9395 XR Uninterruptible Power Supply (UPS) system and a new line of low-voltage to medium-voltage switchgear solutions at the Elecrama 2025 event.

Report Coverage:

The research report offers an in-depth analysis based on Voltage, Current, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for Vacuum Insulated Switchgear will continue to grow due to increasing investments in renewable energy projects globally.

- As governments enforce stricter environmental regulations, the market will see a rise in SF₆-free switchgear adoption.

- Aging grid infrastructure will drive further adoption of vacuum-based switchgear solutions for grid modernization and reliability improvements.

- Digitalization and the rise of smart grids will boost the need for vacuum insulation with integrated monitoring and control features.

- Increased urbanization and industrialization in developing regions will create new opportunities for compact and space-saving switchgear.

- Vacuum Insulated Switchgear will play a crucial role in large-scale transmission and distribution projects, particularly in renewable energy applications.

- Energy efficiency and sustainability will remain key factors influencing the development and deployment of vacuum-based technologies.

- The growing focus on reducing operational downtime will push utilities and industries to adopt vacuum insulation for improved system performance.

- The expansion of the electric vehicle market and the need for reliable charging infrastructure will drive demand for vacuum switchgear solutions in this sector.

- Competitive dynamics will remain strong, with established companies focusing on R&D, while smaller players bring innovative, cost-effective solutions to the market.