Market Overview

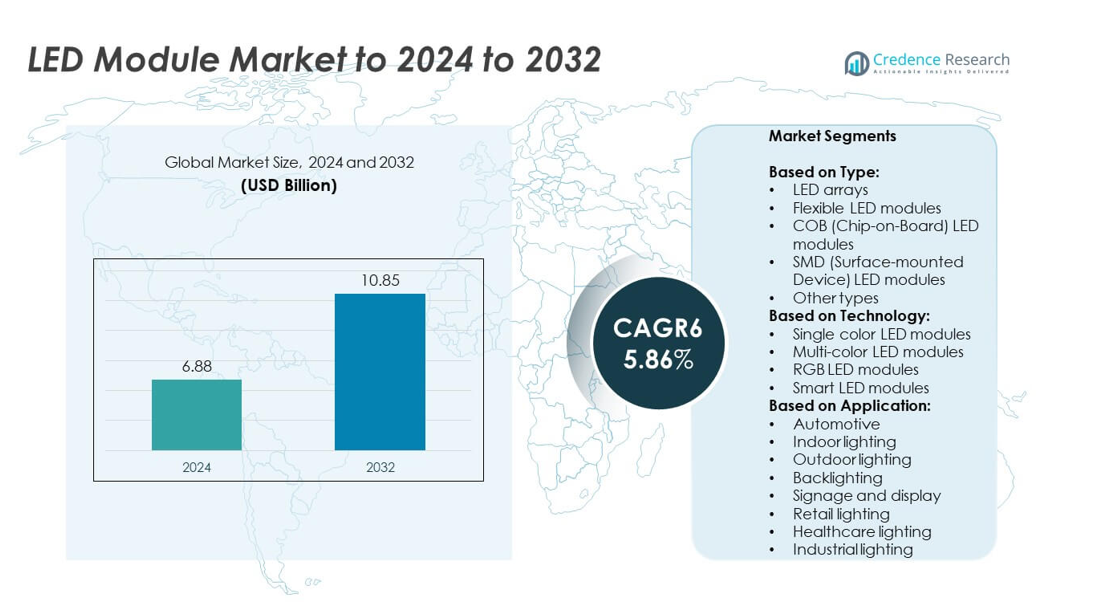

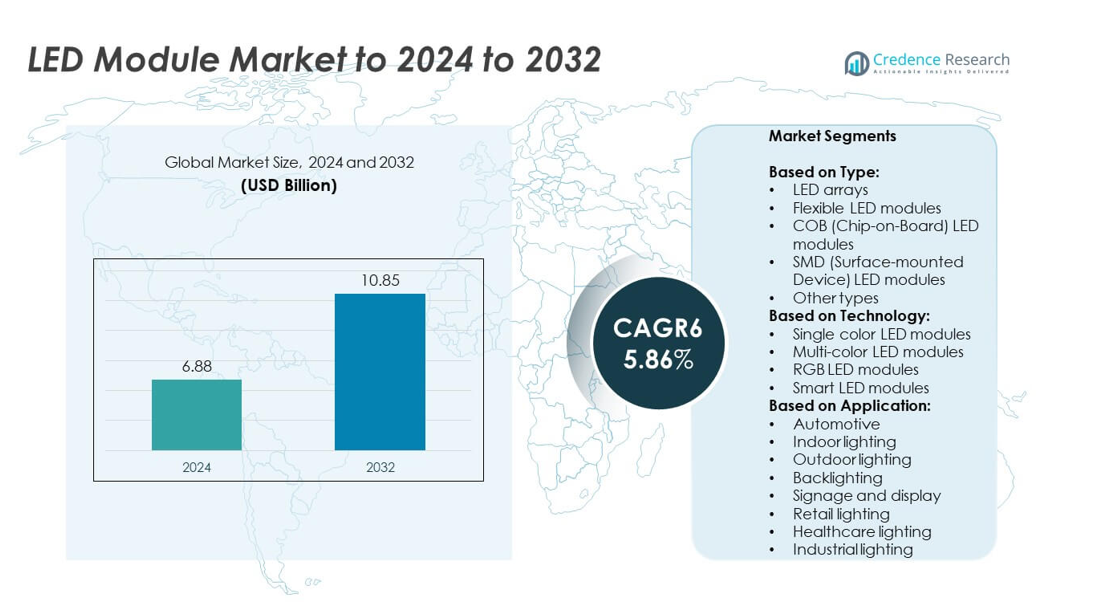

The LED Module Market size was valued at USD 6.88 billion in 2024 and is anticipated to reach USD 10.85 billion by 2032, at a CAGR of 5.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LED Module Market Size 2024 |

USD 6.88 billion |

| LED Module Market, CAGR |

5.8% |

| LED Module Market Size 2032 |

USD 10.85 billion |

The LED module market is driven by top players including Lite-On Technology Corporation, Epistar Corporation, Lumileds Holding B.V., Cree, Inc., Samsung, Nichia Corporation, Everlight Electronics Co., Ltd., LG Innotek Co., Ltd., and Acuity Brands Lighting, Inc. These companies emphasize innovation in SMD and COB designs, expanding applications in automotive, indoor lighting, and smart systems. Asia Pacific leads the market with a dominant 34% share in 2024, supported by strong manufacturing hubs and rising demand across consumer and industrial sectors. North America follows with 28%, driven by smart lighting adoption and sustainability initiatives, while Europe captures 24% with strict energy-efficiency regulations.

Market Insights

- The LED module market was valued at USD 6.88 billion in 2024 and is projected to reach USD 10.85 billion by 2032, growing at a CAGR of 5.86%.

- Rising demand for energy-efficient and durable lighting systems in residential, commercial, and automotive applications is driving market expansion.

- Trends such as the integration of smart and IoT-enabled LED modules, along with growing adoption of flexible and modular designs, are shaping future growth.

- Competition is strong with companies investing in product innovation, capacity expansion, and partnerships to enhance their global presence. High initial costs of advanced modules and challenges in heat management remain key restraints.

- Asia Pacific leads with 34% market share, followed by North America at 28% and Europe at 24%. Indoor lighting holds the largest application share, while SMD modules dominate by type due to compact design and wide usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The LED Module market by type is dominated by SMD (Surface-mounted Device) LED modules, accounting for the largest share in 2024. Their compact size, high brightness, and energy efficiency make them the preferred choice across industries. SMD modules are widely used in automotive, display boards, and indoor lighting due to their flexibility and durability. COB (Chip-on-Board) modules are also gaining traction for applications requiring high lumen output. Growth in demand for energy-efficient and compact designs in smart devices, displays, and architectural lighting continues to drive adoption of these modules.

- For instance, Lumileds publishes data for some of its COB modules, showing lumen output above 2,800 lm in certain configurations.

By Technology

Single-color LED modules held the largest market share in 2024, driven by their cost-effectiveness and wide adoption in general lighting applications. These modules dominate indoor and outdoor lighting installations where consistent brightness and long lifespan are required. However, smart LED modules and RGB modules are witnessing rising demand with the expansion of connected lighting and decorative applications. Increasing integration with IoT platforms and smart home systems is accelerating the use of multi-color and intelligent modules, though single-color modules remain dominant due to affordability and lower operational complexity.

- For instance, The WS2811 driver IC supports 256 gray levels per channel (i.e. 8-bit per channel) for RGB modules.

By Application

Indoor lighting emerged as the largest application segment in 2024, capturing the dominant share of the LED module market. Growing demand for energy-efficient residential, commercial, and office lighting systems drives this dominance. Adoption is supported by government initiatives promoting LED use to reduce energy consumption. While outdoor lighting and automotive segments show significant growth, the large-scale replacement of traditional bulbs with LEDs in residential and commercial spaces continues to boost indoor lighting demand. The rapid expansion of smart building projects and sustainable urban infrastructure further strengthens this application segment’s market leadership.

Key Growth Drivers

Rising Demand for Energy-Efficient Lighting

The primary growth driver for the LED module market is the rising demand for energy-efficient lighting solutions. Governments across major economies are implementing strict energy-efficiency standards and incentivizing LED adoption, boosting large-scale replacements of traditional bulbs. LEDs consume significantly less power and offer longer lifespans, making them cost-effective for residential, commercial, and industrial use. Growing awareness of sustainability and the need to reduce carbon emissions further accelerate this shift. This factor positions energy efficiency as the leading growth driver for the LED module market during the forecast period.

- For instance, in a project that concluded in 2017, Signify (then Philips Lighting) upgraded nearly 90,000 Jakarta streetlights to energy-efficient LED and connected them to a Philips CityTouch lighting management system. The project was completed in seven months, with approximately 430 light points being connected per day.

Advancements in Smart and Connected Lighting

Another key driver is the growing adoption of smart and connected lighting systems. Integration of LED modules with IoT platforms, wireless controls, and automation technologies is transforming lighting applications across smart homes, offices, and urban infrastructure. These modules enable dimming, color adjustment, and remote monitoring, enhancing user convenience and energy savings. Demand for intelligent and customizable lighting solutions in residential and commercial spaces continues to rise, creating strong opportunities for smart LED module adoption. This trend is reshaping both consumer expectations and industrial investments in connected lighting ecosystems.

- For instance, Georgia Power manages around 900,000 outdoor lights and has undertaken one of the largest smart street lighting deployments globally. The utility has upgraded hundreds of thousands of its lights to LEDs with networked controls.

Expanding Automotive and Display Applications

The automotive and signage sectors play a critical role in driving LED module demand. Automakers are rapidly integrating LED modules into headlights, taillights, and interior lighting due to their durability, brightness, and energy savings. Similarly, demand for LED-based signage and displays in retail and advertising has surged with the need for high-visibility and dynamic content. Flexible and compact modules, including SMD and COB, have strengthened their adoption in vehicle design and commercial displays. The increasing use of advanced lighting systems in vehicles and public infrastructure remains a major growth accelerator for the market.

Key Trends & Opportunities

Emergence of Smart Cities and Sustainable Infrastructure

One of the most prominent trends is the growing role of LED modules in smart city projects and sustainable infrastructure development. Municipalities are replacing conventional streetlights with energy-efficient LED-based systems integrated with sensors and connectivity features. These modules enhance public safety, optimize energy consumption, and lower maintenance costs. With governments investing heavily in smart city initiatives, the opportunity for LED module suppliers is expanding rapidly. The emphasis on sustainable infrastructure and eco-friendly lighting solutions will continue to boost demand for advanced LED modules globally.

- For instance, Interact (Signify) upgraded nearly 90,000 streetlights in Jakarta in 7 months, connecting ~430 light points per day.

Innovation in Flexible and Modular Designs

Technological innovation in flexible and modular LED designs presents a strong opportunity for manufacturers. Flexible LED modules are gaining popularity in architectural lighting, automotive interiors, and signage where creative and customizable designs are required. Their adaptability and compact form factor allow seamless integration into diverse applications, from curved surfaces to dynamic displays. Growing demand for advanced lighting aesthetics in retail, hospitality, and automotive sectors further accelerates their adoption. This innovation-driven trend is opening new revenue streams for companies offering versatile, high-performance LED module solutions.

- For instance, Citizen / CITILED’s COB Version 9 series achieves 142 lm/W at 3000 K and qualifies narrow chromaticity (2-SDCM).

Key Challenges

High Initial Costs of Advanced LED Modules

Despite long-term cost savings, the high upfront cost of advanced LED modules remains a key challenge. Technologies such as COB and smart modules involve higher production costs due to complex manufacturing processes and integration with electronics. This cost barrier affects adoption in price-sensitive markets, especially in developing economies. Small businesses and residential users often hesitate to invest in premium LED modules despite efficiency benefits. The challenge of balancing performance, affordability, and mass adoption continues to hinder faster penetration in certain application areas.

Heat Management and Performance Limitations

Thermal management is another major challenge in the LED module market. Excessive heat generation can reduce the lifespan, brightness, and overall performance of LED modules, particularly in compact or high-power applications. Designing efficient heat dissipation systems increases complexity and production costs for manufacturers. In automotive and industrial applications, where high brightness and durability are critical, these limitations can restrict adoption. Overcoming heat-related performance issues through advanced materials and cooling technologies remains essential to ensure reliability and wider acceptance of LED modules.

Regional Analysis

North America

North America held a market share of around 28% in the global LED module market in 2024. The region’s growth is supported by rising adoption of energy-efficient lighting in residential and commercial sectors, as well as government initiatives promoting sustainable infrastructure. The United States leads due to strong demand in indoor lighting, automotive, and signage applications, while Canada shows steady adoption in smart city projects. Increasing investments in advanced technologies, such as smart LED modules, further drive growth. The region’s mature lighting market and high awareness of energy savings strengthen its dominance.

Europe

Europe accounted for nearly 24% of the global LED module market in 2024. The region benefits from strict energy efficiency regulations and rapid replacement of conventional lighting with LED-based systems. Countries such as Germany, the UK, and France lead due to strong adoption in automotive, healthcare, and retail lighting applications. Growing demand for decorative and architectural lighting further supports market expansion. Smart city initiatives, particularly in Western and Northern Europe, are also fueling adoption of connected lighting solutions. Sustainability-focused policies and innovation in flexible LED modules position Europe as a key growth hub.

Asia Pacific

Asia Pacific dominated the LED module market with the largest share of 34% in 2024. The region’s leadership is driven by large-scale production, cost advantages, and high demand across consumer electronics, automotive, and industrial lighting. China, Japan, and South Korea are major contributors, supported by strong manufacturing bases and technology advancements. Rapid urbanization and smart city projects in India and Southeast Asia further boost demand. Expanding infrastructure development and government support for energy-efficient lighting accelerate adoption. Asia Pacific remains the fastest-growing region, benefiting from both domestic consumption and exports to global markets.

Latin America

Latin America captured about 7% of the global LED module market in 2024. Growth in the region is supported by rising adoption of LED lighting in urban infrastructure, commercial spaces, and residential applications. Brazil and Mexico lead the market with increased government focus on energy efficiency programs. Demand for signage and display lighting in retail and advertising sectors is also on the rise. However, economic challenges and high initial costs limit faster penetration in some countries. Despite these barriers, the shift toward sustainable solutions and modernization of lighting systems continues to create growth opportunities.

Middle East and Africa

The Middle East and Africa accounted for approximately 7% of the LED module market in 2024. Demand is primarily driven by large-scale infrastructure projects, including airports, commercial complexes, and smart city developments in Gulf countries. The adoption of LED modules in outdoor lighting and industrial applications is expanding as governments push for energy-efficient solutions. South Africa shows growth in residential and retail lighting markets, while GCC countries lead in high-end applications. Challenges such as cost barriers and limited awareness persist, but strong urban development plans are expected to support steady market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type:

- LED arrays

- Flexible LED modules

- COB (Chip-on-Board) LED modules

- SMD (Surface-mounted Device) LED modules

- Other types

By Technology:

- Single color LED modules

- Multi-color LED modules

- RGB LED modules

- Smart LED modules

By Application:

- Automotive

- Indoor lighting

- Outdoor lighting

- Backlighting

- Signage and display

- Retail lighting

- Healthcare lighting

- Industrial lighting

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The LED module market is highly competitive and features prominent players such as Lite-On Technology Corporation, Genesis Photonics Inc., Epistar Corporation, Lumileds Holding B.V., Bridgelux, Inc., Leotek Electronics USA Corp., Cree, Inc., LG Innotek Co., Ltd., Everlight Electronics Co., Ltd., Lextar Electronics Corporation, GE Lighting, Harvatek Corporation, Samsung, Advanced Lighting Technologies, Hubbell Lighting, Inc., Acuity Brands Lighting, Inc., and Nichia Corporation. Competition is shaped by continuous innovation in energy efficiency, color rendering, and smart module integration to meet evolving consumer and industrial requirements. Companies focus on expanding product portfolios with advanced SMD and COB designs while enhancing durability and cost-effectiveness. Strategic initiatives include scaling production capacity, entering partnerships with automotive and electronics manufacturers, and targeting emerging markets with flexible and smart LED solutions. Growing emphasis on sustainability and compliance with energy-efficiency regulations further drives research and development efforts. This dynamic landscape fosters rapid technological advancements and intensifies global competition among leading players.

Key Player Analysis

- Lite-On Technology Corporation

- Genesis Photonics Inc.

- Epistar Corporation

- Lumileds Holding B.V.

- Bridgelux, Inc.

- Leotek Electronics USA Corp.

- Cree, Inc.

- LG Innotek Co., Ltd.

- Everlight Electronics Co., Ltd.

- Lextar Electronics Corporation

- GE Lighting

- Harvatek Corporation

- Samsung

- Advanced Lighting Technologies

- Hubbell Lighting, Inc.

- Acuity Brands Lighting, Inc.

- Nichia Corporation

Recent Developments

- In 2025, LG Innotek Announced it would start mass production of its Automotive Application Processor Module, enabling the company to expand its electronic components business into the automotive semiconductor sector.

- In 2024, Samsung Unveiled a transparent micro-LED modular screen at CES, showcasing a highly innovative display with a small LED chip and seamless appearance.

- In 2023, Nichia Introduced the Nichia Light Cluster™ Type L, an ultra-wide light distribution LED module, which won a 2023 LpS Digital Innovation Award.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The LED module market will expand steadily with rising demand for energy-efficient lighting.

- SMD modules will continue to dominate due to compact design and wide application use.

- Smart and connected LED modules will see strong adoption in homes and offices.

- Automotive lighting integration will grow with advanced headlight and interior applications.

- Indoor lighting will maintain the largest share supported by retrofitting and new installations.

- Flexible LED modules will gain traction in signage, retail, and architectural projects.

- Asia Pacific will remain the fastest-growing region with strong manufacturing and demand.

- Government sustainability policies will accelerate large-scale adoption across all regions.

- Innovation in thermal management will improve performance and extend module lifespan.

- IoT-enabled LED modules will create opportunities in smart cities and industrial automation.