Market Overview

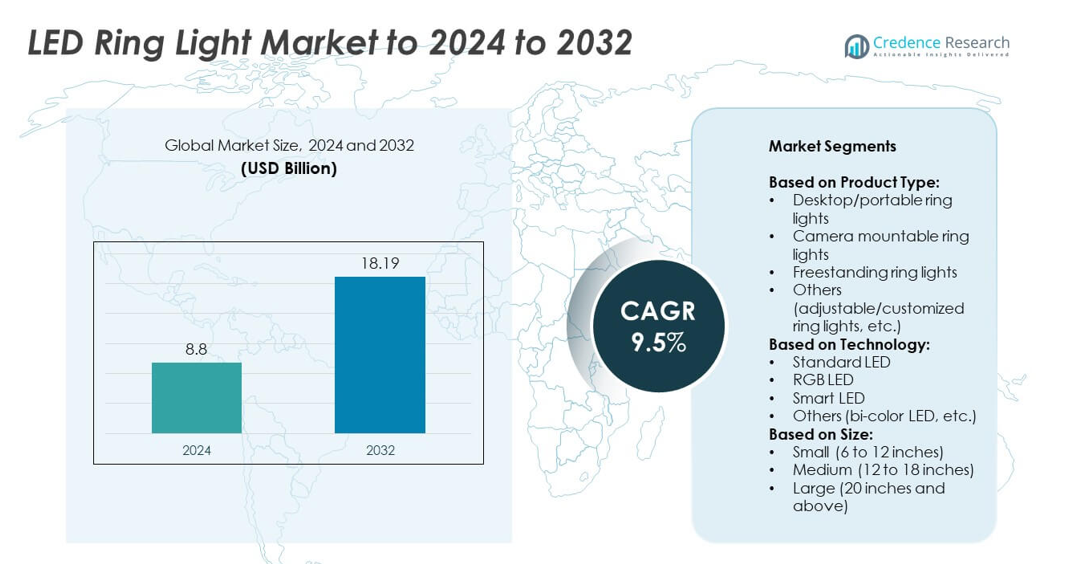

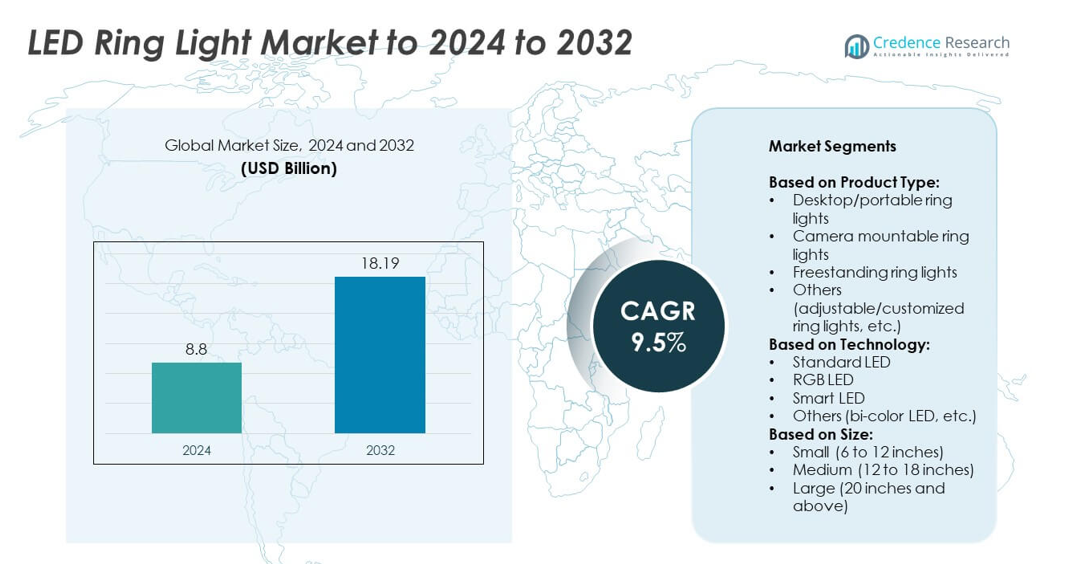

The LED Ring Light market was valued at USD 8.8 billion in 2024 and is anticipated to reach USD 18.19 billion by 2032, expanding at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LED Ring Light market Size 2024 |

USD 8.8 billion |

| LED Ring Light market, CAGR |

9.5% |

| LED Ring Light market Size 2032 |

USD 18.19 billion |

The LED ring light market is shaped by prominent players such as Opto Plus, Neewer, Lume Cube, Godox, UBeesize, Ring Light, Yongnuo, Inkeltech, FalconEyes, Pony, Mactrem, Signify, Elgato, K&F Concept, Innens, Impact, and Viltrox. These companies focus on enhancing product quality, integrating smart features, and expanding distribution through e-commerce platforms to capture diverse consumer groups ranging from professionals to hobbyists. Regionally, North America led the market in 2024 with nearly 35% share, driven by strong adoption among content creators, remote professionals, and established digital platforms, positioning it as the dominant hub for market growth.

Market Insights

- The LED ring light market was valued at USD 8.8 billion in 2024 and is projected to reach USD 18.19 billion by 2032, growing at a CAGR of 9.5% during the forecast period.

- Rising demand from content creators, influencers, and remote professionals is fueling strong product adoption, supported by affordability and ease of use across personal and professional applications.

- Key trends include the growing integration of smart features, app-based controls, and RGB customization, making ring lights more appealing for live streaming, gaming, and social media-driven content creation.

- The market is competitive with global and regional players focusing on innovation, product differentiation, and online retail expansion, while facing challenges from intense price competition in emerging markets.

- North America led the market in 2024 with nearly 35% share, followed by Europe at 25% and Asia Pacific at 30%, while freestanding ring lights held the largest segment share at over 40%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The freestanding ring lights segment held the dominant share of the LED ring light market in 2024, accounting for over 40% of total sales. Their leadership stems from strong demand among professional photographers, videographers, and content creators who require stable lighting solutions for studios and live streaming. The adjustable height, wider illumination coverage, and compatibility with professional cameras drive adoption. Desktop or portable ring lights follow closely, boosted by remote work, online learning, and influencer-led demand. Increasing usage of camera mountable ring lights in on-the-go shooting adds to segment diversity.

- For instance, Neewer’s RL-18 freestanding kit uses a 61-inch stand and 240 SMD LEDs.

By Technology

Standard LED ring lights dominated the market in 2024, capturing nearly 45% of the share. Their affordability, high energy efficiency, and wide availability make them the preferred choice for both personal and commercial users. However, RGB LED and smart LED segments are gaining momentum, fueled by the growing popularity of dynamic lighting effects in live streaming, gaming, and social media content creation. Bi-color LED models also appeal to professionals requiring adjustable color temperatures. Still, standard LED remains the leader due to cost-effectiveness and strong penetration across consumer categories.

- For instance, Rotolight’s NEO 3 uses RGBWW chips and supports 16.7 million colour modes.

By Size

Medium-sized ring lights (12 to 18 inches) led the market in 2024, holding more than 50% share. Their dominance is linked to the balance they offer between portability and powerful illumination, making them ideal for influencers, vloggers, and small studios. These lights deliver sufficient brightness for close-up shots while remaining compact for easy handling. Small-sized ring lights are popular among hobbyists and casual users, while large models above 20 inches cater to professional studios. The medium segment continues to grow, supported by rising demand from e-commerce sellers and content creators seeking flexible setups.

Key Growth Drivers

Rising Demand from Content Creators

The rapid growth of digital platforms such as YouTube, Instagram, and TikTok has fueled strong demand for LED ring lights. Content creators, influencers, and streamers rely on these lights for enhanced video quality and professional-grade illumination. The segment’s expansion is further supported by affordable product availability, making professional lighting accessible to a wider consumer base. With millions of new creators entering the digital economy each year, this demand continues to serve as a major growth driver for the global LED ring light market.

- For instance, Elgato’s Ring Light delivers up to 2,500 lumens and supports app-based control for brightness and color temperature (from 2900 to 7000 K).

Expansion of Remote Work and Online Education

The rise of hybrid work models and online education has significantly boosted the use of LED ring lights. Professionals and students increasingly invest in these devices to improve visibility during video calls, webinars, and presentations. Clear and consistent lighting enhances communication and professional appearance, strengthening adoption across households and institutions. This widespread shift to digital platforms has made LED ring lights an essential accessory, ensuring stable growth momentum. The long-term adoption of remote communication practices continues to support this as a key growth driver.

- For instance, Logitech’s Litra Glow produces 250 lumens of edge-lit LED light for video calls.

Technological Advancements in LED Lighting

Ongoing innovations in LED technology have played a vital role in expanding market potential. Features such as adjustable color temperatures, RGB customization, wireless connectivity, and smart integration with mobile apps enhance user experience. Manufacturers are launching models tailored for both casual and professional use, increasing versatility across applications. Improved energy efficiency and durability also strengthen adoption, reducing replacement costs for users. These advancements create strong differentiation among brands and foster sustained growth, making technological innovation one of the most critical growth drivers for the LED ring light market.

Key Trends & Opportunities

Integration of Smart Features

The adoption of smart LED ring lights integrated with Bluetooth, Wi-Fi, and app-based controls represents a growing trend. Users can remotely adjust brightness, color temperature, and effects, making them highly appealing for both professionals and casual users. Integration with smart home ecosystems provides new opportunities for manufacturers to expand product functionality. This innovation aligns with the rising consumer preference for convenience and automation, positioning smart-enabled ring lights as a major opportunity in the evolving LED ring light market.

- For instance, the Godox LR150 is an 18-inch bi-color LED ring light designed for vlogging, photography, and makeup application. It features built-in LEDs that provide a variable color temperature from 3000K to 6000K.

Rising Popularity of RGB and Customized Lighting

The growing demand for RGB LED ring lights among gamers, streamers, and content creators highlights a key trend in the market. Vibrant lighting effects enhance aesthetics and allow personalized user experiences, making these products highly attractive in the entertainment and social media sectors. Customization options, such as bi-color LEDs and adjustable hues, expand creative possibilities for professionals. This trend presents opportunities for companies to introduce innovative lighting models that cater to specialized needs, boosting competitiveness in the global market.

- For instance, Yongnuo markets its YN608 ring light, featuring 304 LEDs, as a budget-friendly and high-performance option for photographers and videographers globally. The brand’s use of an aggressive, competitive pricing strategy is a key part of its business model, allowing it to gain a strong market position and appeal to a wider range of customers in Asia and beyond.

Key Challenges

Price Sensitivity and Market Competition

The LED ring light market faces intense competition from low-cost manufacturers, particularly in Asia-Pacific. Price-sensitive consumers often opt for inexpensive alternatives, leading to margin pressures for established brands. While premium products offer advanced features, affordability remains a decisive factor for mass adoption. Companies must strike a balance between pricing and innovation to remain competitive. This challenge continues to affect profitability, forcing players to focus on cost optimization and differentiation through product design, quality, and brand positioning.

Saturation in Mature Markets

Market saturation in developed economies poses another significant challenge for the LED ring light industry. Regions like North America and Europe already exhibit high adoption levels among creators, professionals, and hobbyists. Growth opportunities in these markets are becoming limited, pushing companies to shift focus toward emerging economies with rising digital penetration. However, building brand presence in new regions requires additional investments in marketing, distribution, and consumer education. This saturation effect makes it harder for established companies to achieve rapid growth in mature markets.

Regional Analysis

North America

North America accounted for the largest share of the LED ring light market in 2024, holding nearly 35%. The region benefits from the strong presence of content creators, vloggers, and professional photographers who drive high product adoption. The widespread use of LED ring lights in remote work setups, online education, and live streaming has further strengthened regional demand. The United States dominates North America due to the influence of digital platforms and advanced retail channels. Continuous innovations by manufacturers and growing consumer spending on high-quality lighting products continue to reinforce North America’s leadership in the global market.

Europe

Europe captured around 25% share of the global LED ring light market in 2024. The region is driven by a strong base of fashion, photography, and e-commerce industries, where ring lights are essential for product shoots and professional content. Countries such as Germany, the United Kingdom, and France contribute significantly due to their advanced digital economies and rising popularity of influencer marketing. Government initiatives supporting creative industries further aid adoption. However, the market faces high competition from low-cost imports. Demand for smart-enabled and eco-friendly lighting solutions continues to support growth in the European LED ring light sector.

Asia Pacific

Asia Pacific held a market share of nearly 30% in 2024, making it one of the fastest-growing regions. The rapid expansion of social media, short-video platforms, and online retail in countries like China, India, and Japan has fueled strong adoption. Affordable product availability and rising smartphone penetration encourage consumers to invest in LED ring lights for content creation and e-learning. Local manufacturers dominate the low-cost segment, while global brands focus on premium offerings. The region’s dynamic youth population and increasing number of online influencers are major drivers, ensuring Asia Pacific remains a key growth engine for the industry.

Latin America

Latin America represented about 6% of the LED ring light market share in 2024. The region is experiencing steady growth, supported by rising social media engagement and growing adoption of influencer-driven marketing. Countries such as Brazil and Mexico lead the regional demand, with younger populations increasingly investing in affordable lighting products for online content. Economic fluctuations and limited purchasing power in some markets restrain rapid expansion. However, the popularity of low-cost ring lights and increasing smartphone-based content creation create strong opportunities. Local e-commerce platforms are also expanding distribution, strengthening market presence across the region.

Middle East and Africa

The Middle East and Africa accounted for nearly 4% of the global LED ring light market in 2024. Growth in the region is supported by increasing digital penetration, expanding e-commerce platforms, and rising interest in online content creation. Countries such as the United Arab Emirates and South Africa are emerging as key adopters due to higher disposable incomes and tech-savvy consumers. However, market expansion is limited by lower awareness in rural areas and dependence on imported products. Still, the increasing adoption of LED ring lights in professional studios and online education highlights promising growth potential across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type:

- Desktop/portable ring lights

- Camera mountable ring lights

- Freestanding ring lights

- Others (adjustable/customized ring lights, etc.)

By Technology:

- Standard LED

- RGB LED

- Smart LED

- Others (bi-color LED, etc.)

By Size:

- Small (6 to 12 inches)

- Medium (12 to 18 inches)

- Large (20 inches and above)

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The LED ring light market is characterized by the presence of notable players including Opto Plus, Neewer, Lume Cube, Godox, UBeesize, Ring Light, Yongnuo, Inkeltech, FalconEyes, Pony, Mactrem, Signify, Elgato, K&F Concept, Innens, Impact, and Viltrox. The competitive landscape reflects strong rivalry, with companies focusing on product innovation, advanced lighting technologies, and affordability to expand their customer base. Manufacturers are investing in smart features, energy-efficient designs, and customizable options to meet the growing demand from content creators, professionals, and hobbyists. Strategic partnerships, online retail expansion, and brand collaborations with influencers are common approaches to enhance market presence. Intense price competition, particularly from low-cost regional producers, continues to influence strategies, while premium brands differentiate through quality and advanced features. The market shows a blend of established global brands and emerging regional companies, creating a dynamic competitive environment driven by constant innovation and evolving consumer needs.

Key Player Analysis

- Opto Plus

- Neewer

- Godox

- UBeesize

- Ring Light

- Yongnuo

- Inkeltech

- FalconEyes

- Pony

- Mactrem

- Signify

- Elgato

- K&F Concept

- Innens

- Impact

- Viltrox

Recent Developments

- In 2025, Godox Introduced a professional studio-grade ring light designed specifically for niche applications like beauty clinics and dermatology/medical photography, expanding its high-margin medical portfolio.

- In 2025, Signify Continued to push Smart Home lighting integration through its Philips Hue line, with general LED advancements focusing on seamless connectivity and ecosystem control that influences future ring light smart features.

- In 2023, Opto Plus launched a new round LED display with a hollow center that can be used to create a ring-shaped ambient light.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The LED ring light market will continue growing with rising demand from digital creators.

- Remote work and online education will sustain long-term adoption of ring lights.

- Technological upgrades such as smart and app-controlled features will drive product innovation.

- Medium-sized ring lights will remain the most preferred choice among users.

- Asia Pacific will emerge as the fastest-growing regional market with strong influencer culture.

- North America will maintain dominance due to established creator ecosystems and premium demand.

- Price competition from low-cost manufacturers will intensify across global markets.

- RGB and customizable lighting will gain more popularity among gaming and streaming communities.

- E-commerce platforms will play a central role in product distribution and brand visibility.

- Growing adoption in professional industries such as fashion and photography will strengthen market prospects.