Market Overview:

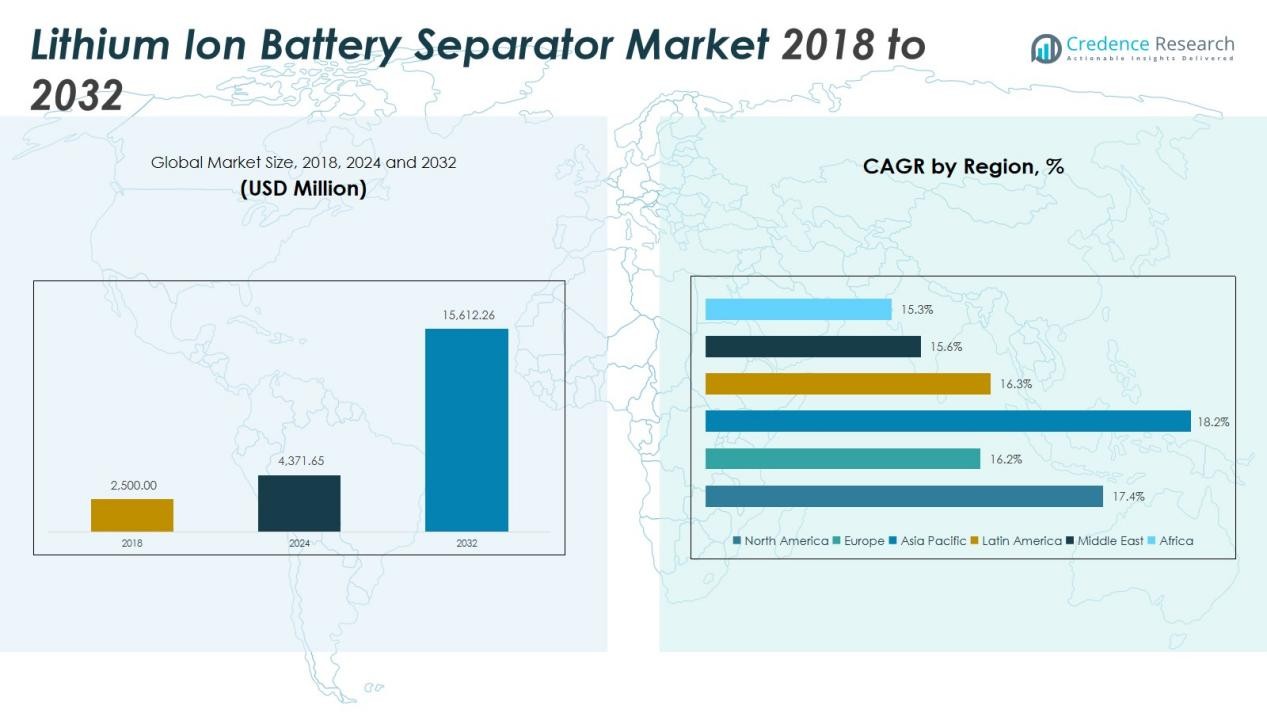

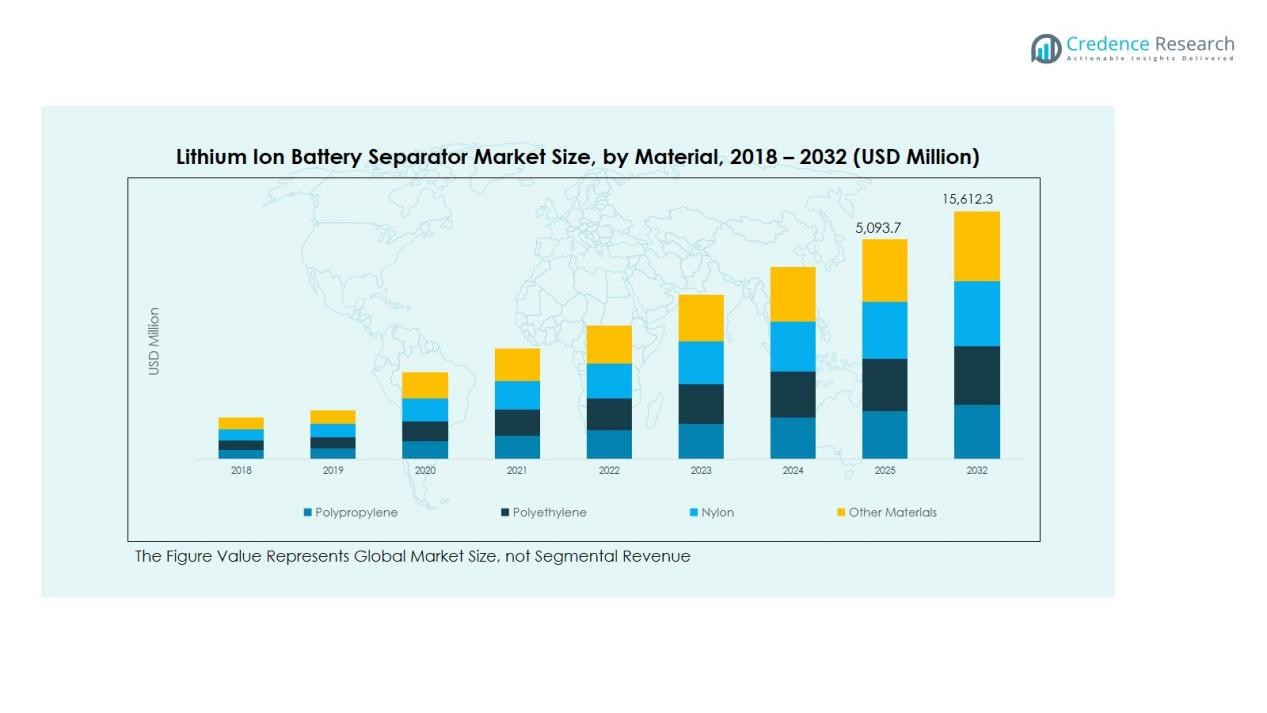

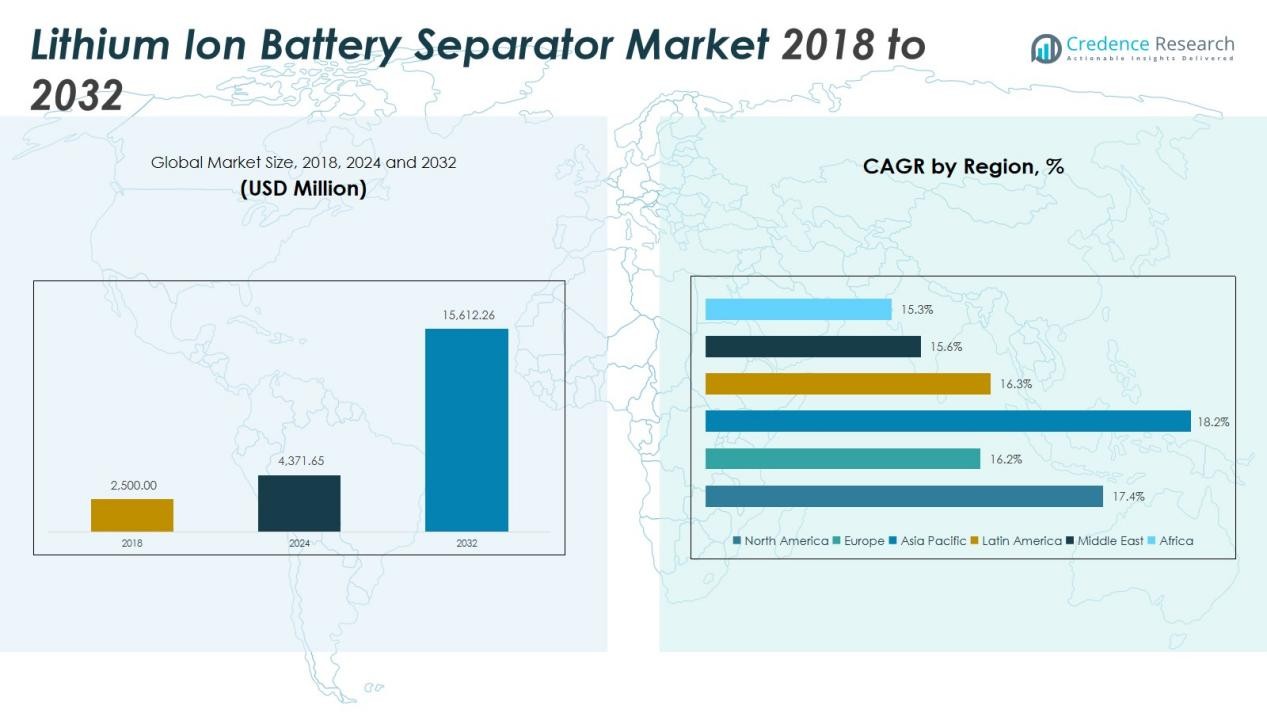

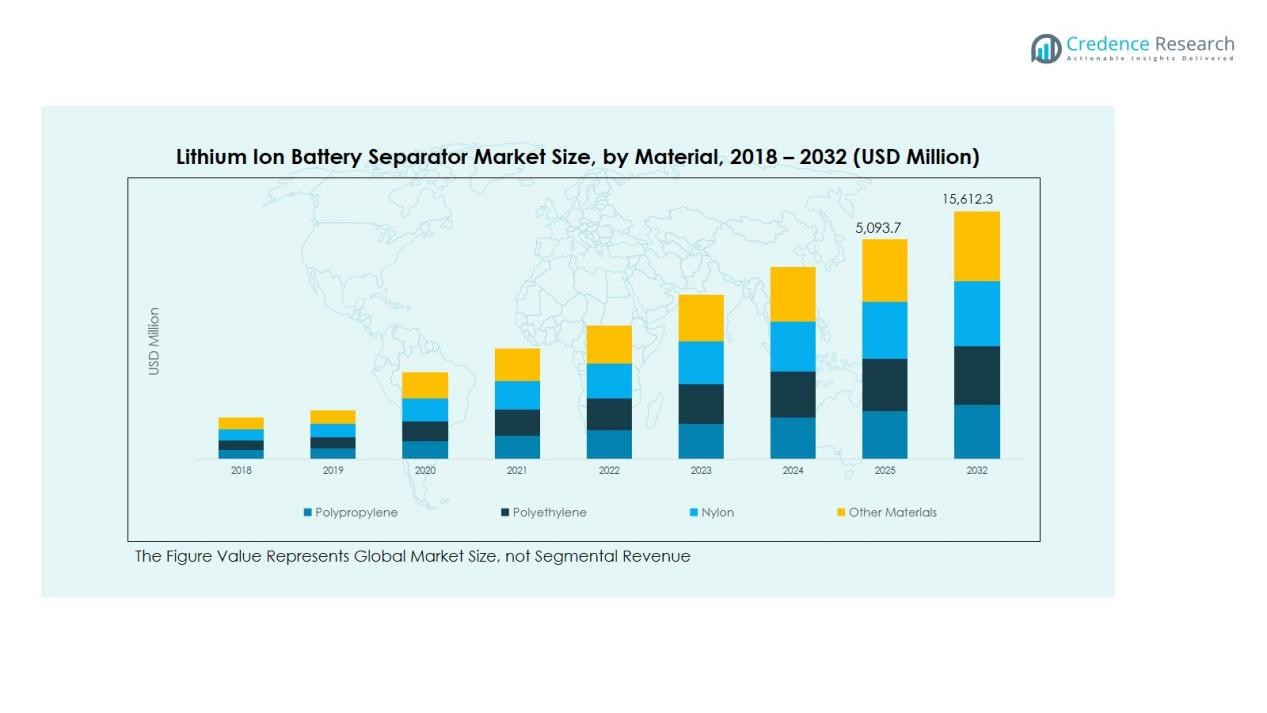

The Global Lithium Ion Battery Separator Market size was valued at USD 2,500 million in 2018 to USD 4,371.65 million in 2024 and is anticipated to reach USD 15,612.26 million by 2032, at a CAGR of 17.35 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium Ion Battery Separator Market Size 2024 |

USD 4,371.65Million |

| Lithium Ion Battery Separator Market, CAGR |

17.35 % |

| Lithium Ion Battery Separator Market Size 2032 |

USD 15,612.26 Million |

Growing emphasis on high energy density and safety in battery design drives demand for advanced separator materials. Manufacturers are adopting ceramic-coated and multilayer separators to enhance thermal stability and prevent short circuits. Increasing investments in lithium-ion battery gigafactories and R&D for next-generation batteries further strengthen market growth.

Asia Pacific dominates the Global Lithium-Ion Battery Separator Market, led by strong EV and battery manufacturing hubs in China, Japan, and South Korea. North America follows, supported by expanding EV adoption and renewable energy storage initiatives. Europe is also witnessing strong growth, driven by strict emission regulations and rising demand for sustainable mobility solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Lithium Ion Battery Separator Market was valued at USD 2,500 million in 2018 and reached USD 4,371.65 million in 2024, with expectations to attain USD 15,612.26 million by 2032 at a CAGR of 17.35%.

- Rising demand for electric vehicles and large-scale energy storage systems is driving strong market growth worldwide.

- Manufacturers are focusing on ceramic-coated and multilayer separators to enhance battery safety, efficiency, and thermal stability.

- High production costs and dependence on polypropylene and polyethylene materials remain key challenges affecting scalability and profitability.

- Asia Pacific leads the market with a 45% share, followed by North America at 25% and Europe at 20%, supported by strong EV production and renewable energy initiatives.

Market Drivers:

Rising Demand for Electric Vehicles (EVs) Boosting Battery Production

The growing adoption of electric vehicles is a major driver for the Global Lithium Ion Battery Separator Market. Automakers are increasing EV production to meet sustainability targets and emission regulations. This shift raises demand for lithium-ion batteries, where separators play a key role in safety and performance. It supports the need for high-quality materials that ensure energy efficiency and thermal stability under demanding conditions.

- For instance, Entek’s planned factory in Indiana is expected to produce 1.72 billion square meters of separator material annually, which is enough to support the production of approximately 1.9 million mid-size EVs.

Expansion of Energy Storage Systems Strengthening Market Growth

The growing focus on renewable energy storage is increasing lithium-ion battery deployment across utility and residential sectors. Energy storage systems help stabilize power grids and optimize renewable energy use. The Global Lithium Ion Battery Separator Market benefits from this trend, as separators are essential for maintaining battery life and preventing internal short circuits. It drives investments in advanced separator technologies with improved durability and heat resistance.

- For instance, a Chinese research team developed a high-temperature-resistant separator that allowed lithium symmetric cells to cycle stably for 1,200 hours under testing conditions.

Technological Innovations Enhancing Safety and Efficiency

Continuous advancements in separator materials are enhancing battery safety and energy output. Companies are developing ceramic-coated and multilayer separators that provide better mechanical strength and thermal shutdown capabilities. The Global Lithium Ion Battery Separator Market is gaining from these innovations, which address performance and safety challenges in high-capacity batteries. It encourages adoption across EVs, power tools, and energy storage applications.

Government Policies and Investments Supporting Battery Manufacturing

Governments are promoting battery manufacturing through incentives, subsidies, and infrastructure investments. These initiatives aim to strengthen domestic supply chains and reduce reliance on imports. The Global Lithium Ion Battery Separator Market benefits from such policy support, driving expansion of local separator production facilities. It enables faster scaling of battery technologies and aligns with global sustainability goals.

Market Trends:

Shift Toward Advanced Separator Materials for Enhanced Safety and Performance

The Global Lithium Ion Battery Separator Market is witnessing a strong shift toward advanced materials such as ceramic-coated, polyethylene (PE), and polypropylene (PP) separators. Manufacturers are improving separator thermal stability and puncture resistance to meet the growing safety demands of EV and energy storage systems. Ceramic-coated separators are gaining traction due to their ability to maintain integrity under high temperatures. It supports longer battery life and improved charge efficiency in demanding applications. The market is also seeing research into composite and multilayer designs that balance mechanical strength with ionic conductivity. These innovations are creating competitive advantages for companies investing in high-performance separator technologies.

- For instance, SK IE Technology has developed a separator with high heat resistance that can withstand temperatures of up to 350 degrees Celsius, a critical feature for preventing fires in lithium-ion batteries.

Growing Focus on Sustainable and High-Efficiency Production Processes

Sustainability has become a major trend shaping the Global Lithium Ion Battery Separator Market. Manufacturers are adopting eco-friendly production techniques and recyclable materials to align with environmental regulations and customer preferences. Dry-process manufacturing and solvent-free coating technologies are being developed to reduce emissions and production costs. It enables cleaner manufacturing and enhances separator uniformity for large-scale applications. The shift toward circular economy practices is encouraging partnerships for recycling used batteries and reclaiming separator materials. Companies that embrace sustainable innovation are strengthening their position in the evolving global battery ecosystem.

- For instance, American Battery Technology Company (ABTC) partnered with Call2Recycle to expand U.S. lithium‑ion battery recycling access via ABTC’s closed‑loop process, Call2Recycle’s network has facilitated the recycling of over 160 million pounds of batteries, supporting circular recovery of separator‑containing cells.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes

The Global Lithium Ion Battery Separator Market faces challenges from the high cost and complexity of separator manufacturing. Producing advanced multilayer and ceramic-coated separators requires precision, controlled environments, and specialized equipment. These factors increase production costs and limit scalability for smaller manufacturers. It also raises entry barriers, reducing market participation and innovation from new players. Maintaining consistency in separator thickness and pore distribution adds further technical difficulty. Such challenges affect profitability and slow down production expansion across emerging markets.

Supply Chain Dependence and Material Availability Issues

The market experiences strong pressure from supply chain disruptions and raw material constraints. Polypropylene and polyethylene, key separator materials, are subject to price fluctuations driven by global petrochemical markets. The Global Lithium Ion Battery Separator Market is vulnerable to these shifts, which impact cost stability and delivery timelines. It also depends heavily on Asian manufacturers, leading to regional concentration risks. Delays in raw material sourcing or logistics disruptions can affect battery output for EVs and energy storage systems. Companies are seeking local production and recycling initiatives to reduce long-term supply risks.

Market Opportunities:

Expansion of Electric Mobility and Energy Storage Applications

The growing adoption of electric mobility and renewable energy storage presents significant opportunities for the Global Lithium Ion Battery Separator Market. Rising EV sales worldwide are increasing the demand for high-performance batteries with superior safety and efficiency. It creates prospects for advanced separator materials capable of operating under high voltage and temperature conditions. Energy storage systems supporting solar and wind integration further expand market potential. Manufacturers investing in durable and cost-effective separators can capture emerging opportunities in these high-growth sectors. The market’s evolution aligns with global efforts toward carbon neutrality and energy sustainability.

Innovation in Next-Generation Battery Technologies

Ongoing advancements in solid-state and lithium-sulfur batteries open new avenues for separator innovation. Research into solid electrolytes and hybrid separator designs is gaining traction to improve ion transfer and reduce thermal risks. The Global Lithium Ion Battery Separator Market can benefit from collaborations between material scientists and battery producers to develop next-generation solutions. It encourages product differentiation and long-term partnerships with EV and electronics manufacturers. Growing government funding for advanced battery R&D also supports new market entrants. These developments position separator technology at the center of the next wave of energy storage advancements.

Market Segmentation Analysis:

By Material

The Global Lithium Ion Battery Separator Market is segmented into polypropylene, polyethylene, nylon, and other materials. Polypropylene holds the largest share due to its superior mechanical strength and chemical stability. It provides strong resistance to thermal shrinkage, supporting safety in high-energy applications. Polyethylene follows with extensive use in consumer electronics and EV batteries for its cost efficiency and flexibility. Nylon-based separators are gaining attention for their improved electrolyte compatibility and higher porosity. It helps manufacturers enhance ion transport while maintaining separator durability. Ongoing research into composite and coated materials is driving innovation for better performance.

- For instance, Celgard 2325 trilayer PP/PE/PP separator delivers a puncture strength of 450 gf, supporting safer high‑energy lithium cells.

By Temperature

The market is divided into 10°C–25°C and 130°C–135°C segments. The 10°C–25°C range is dominant due to its application in standard consumer electronics and low-heat environments. It offers balanced performance and safety at a lower cost. The 130°C–135°C segment is expanding rapidly with the growing demand for high-heat-resistant separators in electric vehicles and industrial batteries. It supports safety under extreme conditions and prevents thermal runaway. This segment’s growth reflects the market’s focus on improving reliability and operational safety in high-capacity batteries.

- For instance, TOB NEW ENERGY offers a separator with a specified shutdown temperature of 153°C.

By Thickness

The segmentation includes 16µm, 20µm, and 25µm thickness categories. The 20µm separator segment leads due to its balance between strength and ionic conductivity. The 16µm category is gaining popularity for lightweight and compact battery designs in portable electronics. The 25µm segment remains relevant for heavy-duty applications requiring higher durability and mechanical stability. It continues to find demand in industrial and grid-scale energy storage systems. Manufacturers are optimizing thickness specifications to improve battery performance and lifecycle efficiency.

Segmentations:

By Material

- Polypropylene

- Polyethylene

- Nylon

- Other Materials

By Temperature

By Thickness

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

By Country (Regional Sub-Segments)

North America: U.S., Canada, Mexico

Europe: UK, France, Germany, Italy, Spain, Russia, Rest of Europe

Asia Pacific: China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

Latin America: Brazil, Argentina, Rest of Latin America

Middle East: GCC Countries, Israel, Turkey, Rest of Middle East

Africa: South Africa, Egypt, Rest of Africa

Regional Analysis:

North America

The North America Lithium Ion Battery Separator Market size was valued at USD 658.00 million in 2018 to USD 1,131.36 million in 2024 and is anticipated to reach USD 4,032.67 million by 2032, at a CAGR of 17.4% during the forecast period. North America holds 25% of the global share, supported by strong EV adoption and expanding renewable energy projects. The Global Lithium Ion Battery Separator Market in this region benefits from established automotive and energy storage manufacturers. It gains traction through government incentives promoting clean mobility and battery production. Major investments by companies like Tesla and General Motors strengthen regional supply chains. Rising demand for high-capacity, safe, and durable batteries drives innovation in separator design. Continuous R&D and infrastructure growth position the region as a key contributor to global expansion.

Europe

The Europe Lithium Ion Battery Separator Market size was valued at USD 468.75 million in 2018 to USD 774.97 million in 2024 and is anticipated to reach USD 2,548.74 million by 2032, at a CAGR of 16.2% during the forecast period. Europe accounts for 20% of the total market share, supported by strict emission norms and strong EV penetration. The Global Lithium Ion Battery Separator Market in Europe benefits from the EU’s Green Deal and investments in battery gigafactories. It is also driven by demand for sustainable energy storage and advanced battery technologies. Growing collaboration between automakers and battery producers enhances material innovation. Government policies encouraging regional production reduce import dependence. Continuous focus on safety, efficiency, and recyclability fuels technological advancement in separator materials.

Asia Pacific

The Asia Pacific Lithium Ion Battery Separator Market size was valued at USD 1,062.50 million in 2018 to USD 1,905.37 million in 2024 and is anticipated to reach USD 7,217.56 million by 2032, at a CAGR of 18.2% during the forecast period. Asia Pacific dominates the market with 45% of the global share, driven by strong manufacturing bases in China, Japan, and South Korea. The Global Lithium Ion Battery Separator Market thrives here due to large-scale EV production and consumer electronics demand. It benefits from supportive government initiatives and cost-efficient production networks. Increasing local investments in lithium-ion battery facilities enhance supply chain resilience. Continuous advancements in separator technology improve performance and safety standards. Strong R&D capabilities make the region the global hub for battery innovation.

Latin America

The Latin America Lithium Ion Battery Separator Market size was valued at USD 155.75 million in 2018 to USD 269.69 million in 2024 and is anticipated to reach USD 892.55 million by 2032, at a CAGR of 16.3% during the forecast period. Latin America holds 6% of the global share, supported by growing EV imports and renewable energy adoption. The Global Lithium Ion Battery Separator Market in this region benefits from increasing industrialization and sustainable energy investments. It is expanding as governments promote clean technologies and electrified transportation. Brazil and Mexico lead with initiatives to attract global battery manufacturers. Regional energy storage projects also drive demand for efficient separator materials. Continued policy support is expected to boost manufacturing capacity and technology adoption.

Middle East

The Middle East Lithium Ion Battery Separator Market size was valued at USD 81.50 million in 2018 to USD 132.00 million in 2024 and is anticipated to reach USD 416.93 million by 2032, at a CAGR of 15.6% during the forecast period. The region contributes 3% of the total market share, driven by clean energy diversification efforts. The Global Lithium Ion Battery Separator Market in the Middle East is supported by initiatives promoting renewable energy and electric mobility. It gains momentum from projects integrating solar energy storage and smart grid systems. Increasing private and public partnerships are fostering investments in advanced battery infrastructure. Demand for reliable energy storage solutions across the UAE and Saudi Arabia strengthens growth. The region’s strategic focus on sustainability is likely to expand separator applications in upcoming years.

Africa

The Africa Lithium Ion Battery Separator Market size was valued at USD 73.50 million in 2018 to USD 158.27 million in 2024 and is anticipated to reach USD 503.80 million by 2032, at a CAGR of 15.3% during the forecast period. Africa represents 2% of the global share, with rising opportunities in renewable power and mobility electrification. The Global Lithium Ion Battery Separator Market in this region is supported by investments in solar and off-grid energy systems. It benefits from increasing demand for energy storage to improve power reliability. Growing awareness of sustainable energy solutions is driving battery adoption in remote areas. Local assembly initiatives and government-backed energy projects are expanding market potential. Steady infrastructure development and partnerships with global manufacturers are expected to strengthen regional growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- DuPont

- Brückner Maschinenbau GmbH & Co. KG

- Targray Technology International Inc.

- Coperion GmbH

- Celgard, LLC

- Freudenberg Group

- Asahi Kasei Corporation

- Teijin Limited

- Toray Industries Inc.

- Bat-Sol Equipments & Technology

- Shenzhen Senior Technology Material Co., Ltd.

Competitive Analysis:

The Global Lithium Ion Battery Separator Market is highly competitive, with key players focusing on innovation, material advancement, and capacity expansion. Leading companies include DuPont, Brückner Maschinenbau GmbH & Co. KG, Targray Technology International Inc., Coperion GmbH, Celgard, LLC, Freudenberg Group, Asahi Kasei Corporation, and Teijin Limited. These companies emphasize research and development to produce high-performance separators that enhance battery safety, energy density, and lifecycle. It maintains a strong focus on thermal stability and compatibility with next-generation lithium-ion cells. Strategic collaborations with EV manufacturers and energy storage firms help strengthen market presence. Companies are also investing in regional expansion and sustainable manufacturing practices to meet rising global demand. Continuous product differentiation and vertical integration remain essential strategies to retain a competitive edge.

Recent Developments:

- In September 2025, Coperion GmbH announced it would showcase an enhanced portfolio of smart feeding and weighing technologies at the K 2025 trade fair.

- In August 2025, Brückner Maschinenbau GmbH & Co. KG and Coperion GmbH expanded their partnership through a volume contract that designates Coperion as the supplier of ZSK twin-screw extruders for Brückner’s film stretching lines.

Report Coverage:

The research report offers an in-depth analysis based on Material, Temperature, Thickness and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Lithium Ion Battery Separator Market is expected to experience strong growth driven by accelerating electric vehicle production worldwide.

- Rising investments in energy storage systems will create significant demand for high-performance separator materials.

- Manufacturers will focus on developing thinner, more durable, and thermally stable separators for advanced batteries.

- Research into ceramic-coated and multilayer separators will expand to improve safety and efficiency.

- The adoption of eco-friendly and recyclable materials will increase due to tightening environmental regulations.

- Collaborations between battery producers and material innovators will enhance product performance and cost competitiveness.

- Automation and precision manufacturing technologies will streamline separator production and improve quality consistency.

- Asia Pacific will continue to lead global production, supported by a strong supply chain and government incentives.

- Growing adoption of solid-state and next-generation batteries will open new opportunities for material innovation.

- The market will witness consolidation through mergers and partnerships as companies strengthen global reach and technological capabilities.