Market Overview

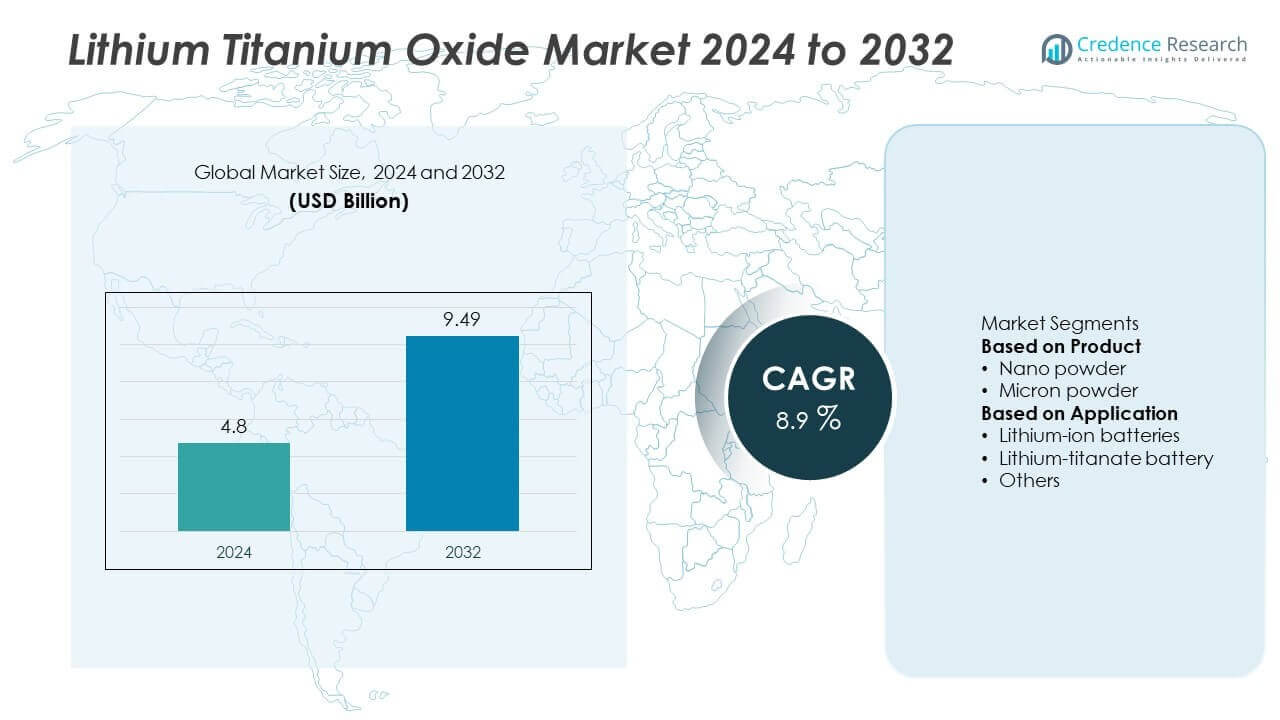

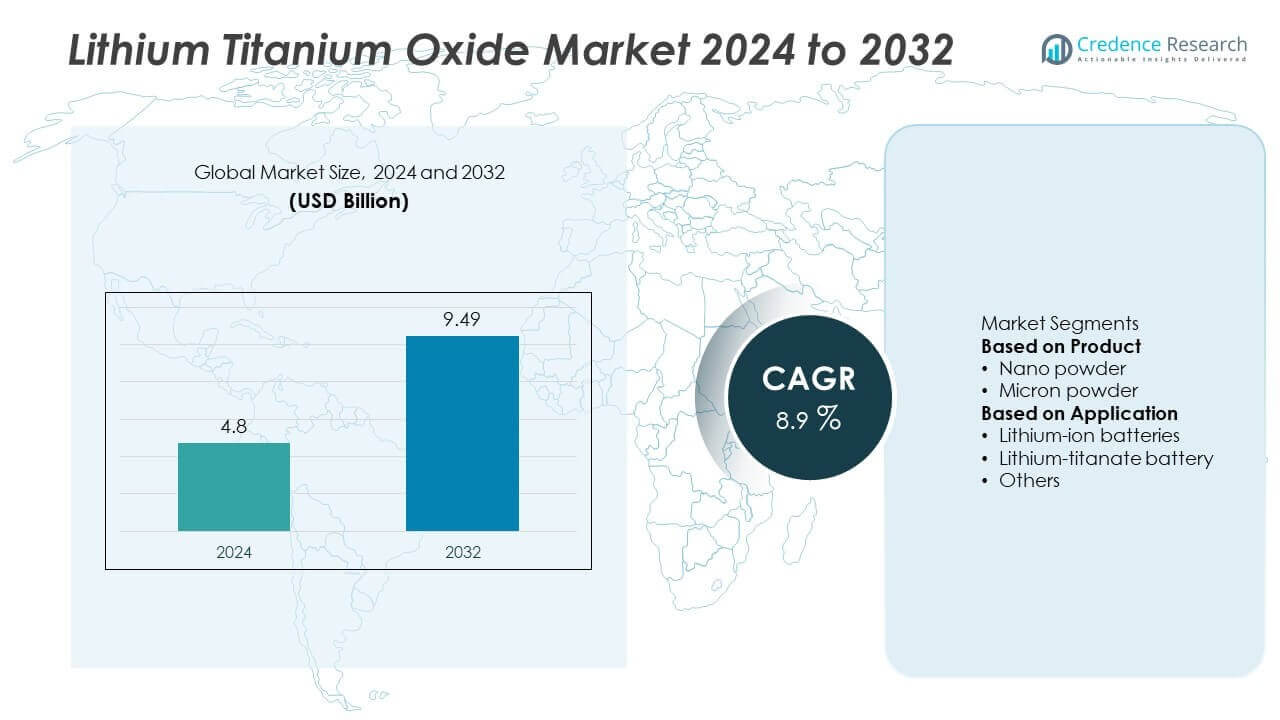

The Lithium Titanium Oxide (LTO) Market was valued at USD 4.8 billion in 2024 and is projected to reach USD 9.49 billion by 2032, expanding at a CAGR of 8.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium Titanium Oxide (LTO) Market Size 2024 |

USD 4.8 Billion |

| Lithium Titanium Oxide (LTO) Market, CAGR |

8.9% |

| Lithium Titanium Oxide (LTO) Market Size 2032 |

USD 9.49 Billion |

The lithium titanium oxide (LTO) market is driven by top players such as Toshiba Corporation, Altairnano, Microvast Holdings, Leclanché SA, Yinlong Energy, Seiko Instruments, Sichuan Xingneng New Materials, Fujifilm Corporation, ProLogium Technology, and BTR New Energy Materials. These companies focus on enhancing battery performance, safety, and cost efficiency while expanding applications across electric vehicles, grid storage, and high-safety systems. Regionally, North America led the market with 34% share in 2024, supported by strong EV adoption and clean energy investments, while Asia-Pacific followed closely with 32% share, fueled by large-scale manufacturing and government subsidies. Europe accounted for 26% share, driven by strict emission policies and renewable integration.

Market Insights

Market Insights

- The lithium titanium oxide (LTO) market was valued at USD 4.8 billion in 2024 and is projected to reach USD 9.49 billion by 2032, growing at a CAGR of 8.9%.

- Market drivers include rising demand for electric vehicles and renewable energy storage, as LTO batteries offer fast charging, long cycle life, and superior safety, making them ideal for mobility and grid-scale applications.

- Market trends highlight advancements in nanotechnology and electrode design, expanding applications into aerospace, defense, and industrial sectors, while safety-focused industries increasingly adopt LTO batteries.

- The competitive landscape features key players such as Toshiba Corporation, Altairnano, Microvast Holdings, Leclanché SA, Yinlong Energy, Seiko Instruments, Sichuan Xingneng New Materials, Fujifilm Corporation, ProLogium Technology, and BTR New Energy Materials, with Asia-Pacific firms leveraging strong manufacturing ecosystems.

- Regional analysis shows North America leading with 34% share, followed by Asia-Pacific at 32%, Europe at 26%, while Latin America and MEA held 4% each; by product, nano powder led with 55%, and by application, lithium-ion batteries dominated with 60%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The nano powder segment held the dominant share of over 55% in 2024 within the lithium titanium oxide market. Nano powders are increasingly preferred due to their high surface area, superior electrochemical performance, and faster lithium-ion diffusion, making them suitable for advanced energy storage systems. Rising demand in electric vehicles and portable electronics continues to boost adoption. In contrast, micron powder accounts for a smaller portion, largely used in cost-sensitive applications where performance is secondary. The strong focus on high-performance batteries ensures nano powders maintain leadership.

- For instance, Altairnano has demonstrated that its nano-structured lithium titanium oxide anodes enable batteries to deliver over 20,000 charge-discharge cycles at a 6-minute charge rate, maintaining stable capacity.

By Application

The lithium-ion batteries segment led the market with more than 60% share in 2024. This dominance is driven by widespread use in electric vehicles, hybrid cars, and consumer electronics that require efficient and durable storage solutions. Lithium titanium oxide improves safety, reduces overheating, and extends cycle life, which strengthens its position in battery chemistry. The lithium-titanate battery segment, though smaller, is gaining attention in grid storage and high-power applications. Other uses, including aerospace and specialty electronics, contribute marginally but enhance market diversity.

- For instance, Yinlong Energy’s LTO-based batteries are installed in over 30,000 electric buses in China, with each bus using battery packs rated at 100–150 kWh, demonstrating large-scale adoption in transportation.

Key Growth Drivers

Growing Electric Vehicle Adoption

The lithium titanium oxide (LTO) market is expanding due to the global shift toward electric vehicles (EVs). LTO batteries provide rapid charging, long cycle life, and enhanced safety, making them ideal for both passenger and commercial EVs. Government incentives, stricter emission norms, and automaker investments in EV fleets fuel demand. As electric mobility becomes mainstream, reliance on high-performance storage solutions grows, positioning LTO as a vital technology in supporting the global EV transition.

- For instance, Toshiba Corporation’s SCiB LTO batteries used in the Mitsubishi i-MiEV support ultra-fast charging of up to 80% capacity in 15 minutes and deliver over 20,000 cycle life, enabling durable EV integration.

Rising Demand for Renewable Energy Storage

The increasing share of renewable energy in global power generation drives the adoption of advanced storage systems. LTO batteries excel in grid-scale projects because of their ability to endure frequent charge-discharge cycles and deliver long-term stability. Utilities and energy providers use LTO to integrate intermittent solar and wind energy effectively. With investments in smart grids and distributed energy networks accelerating worldwide, the role of LTO batteries in renewable energy storage continues to strengthen significantly.

- For instance, Leclanché SA deployed its battery systems in grid projects such as the Marengo project in Illinois, providing 20 MW / 20 MWh of capacity for frequency regulation. The project helps stabilize renewable energy supply by participating in the PJM Ancillary Service Market.

Advancements in Battery Materials and Design

Technological progress in nanomaterials, electrode design, and hybrid chemistries is advancing the performance of LTO batteries. Companies are working to improve energy density while preserving safety and long cycle life. These innovations expand LTO adoption into aerospace, industrial machinery, and defense applications. Increased R&D spending is also reducing costs and improving scalability. As breakthroughs emerge, LTO is gaining competitiveness against other lithium-ion chemistries, ensuring its place in future energy storage markets.

Key Trends & Opportunities

Adoption in High-Safety Applications

Industries that prioritize safety, such as aerospace, defense, and public transport, are increasingly turning to LTO batteries. Unlike conventional lithium-ion batteries, LTO significantly lowers the risk of overheating and thermal runaway. Manufacturers are targeting applications like electric buses, aviation ground support, and military systems. Demand for stable, reliable, and secure power storage strengthens LTO’s positioning in high-safety sectors. This trend is creating opportunities for growth in specialized, high-value markets.

- For instance, Microvast developed LTO cells known for their enhanced safety and long cycle life of up to 20,000 cycles, and the company’s battery systems are used in heavy-duty commercial equipment.

Growth of Grid-Scale Storage Solutions

The push for reliable grid-scale energy storage is opening new opportunities for LTO. Its high power output and extended cycle life make it suitable for renewable integration, peak load management, and backup applications. Governments are investing heavily in smart grids and renewable infrastructure, fueling wider deployment. Utilities recognize LTO’s advantage in stabilizing fluctuating energy supply, ensuring uninterrupted power. This trend highlights LTO’s increasing role in enabling large-scale energy transition strategies worldwide.

- For instance, Leclanché SA integrated its LTO-based battery systems into the GridSafe project in Ontario, delivering 13 MW / 53 MWh of storage capacity designed for frequency regulation and peak shaving.

Key Challenges

High Cost of Production

High production costs remain a key barrier to wider adoption of LTO batteries. The reliance on expensive raw materials and complex manufacturing processes makes them pricier than conventional lithium-ion alternatives. This cost premium limits adoption in mass-market applications such as consumer electronics. Companies must scale up manufacturing, improve process efficiency, and explore cheaper material options to address this challenge. Reducing costs is essential for increasing competitiveness and driving broader use of LTO technology.

Lower Energy Density

A notable drawback of LTO batteries is their relatively low energy density compared to other lithium-ion chemistries. While they excel in fast charging, cycle life, and safety, the limited capacity reduces suitability for long-range electric vehicles and high-storage-demand applications. This limitation restricts growth in markets where range and efficiency are critical. Industry players are investing in material improvements and hybrid battery designs, but bridging the energy density gap remains a major challenge for LTO adoption.

Regional Analysis

North America

North America accounted for 34% share in 2024, establishing itself as the leading region in the lithium titanium oxide (LTO) market. Growth is supported by high electric vehicle adoption, strong government incentives, and investments in clean energy infrastructure. The United States and Canada are advancing smart grid projects, creating strong demand for efficient storage solutions. Automakers are integrating LTO batteries in EVs due to their long cycle life and safety. Research institutions and battery developers across the region are accelerating technological improvements, further boosting competitiveness. With sustained policy support, North America remains a major hub for LTO demand.

Europe

Europe held 26% share in 2024, driven by stringent emission regulations, the European Green Deal, and widespread renewable adoption. Germany, France, and the UK lead in deploying LTO batteries for electric buses, rail systems, and stationary storage. Government incentives for green mobility and clean energy strengthen adoption across industrial and residential sectors. LTO’s superior safety and cycle life make it a preferred solution in public transport and grid stabilization. European manufacturers and R&D centers also focus on improving performance through nanotechnology. Continued expansion of EV infrastructure and renewable integration sustains strong market prospects in the region.

Asia-Pacific

Asia-Pacific captured 32% share in 2024, emerging as the fastest-growing region in the LTO market. China leads adoption, supported by large-scale EV production, strong subsidies, and a robust battery manufacturing ecosystem. Japan and South Korea contribute with advanced R&D and rising demand for high-safety storage systems. Rapid industrialization and renewable energy deployment further accelerate adoption in emerging economies. LTO batteries are increasingly integrated into grid projects and public transportation fleets across Asia. With leading global battery producers headquartered in this region, Asia-Pacific continues to dominate manufacturing capacity, driving innovation and large-scale commercialization of LTO technologies.

Latin America

Latin America held 4% share in 2024, with market growth supported by renewable energy initiatives and gradual adoption of electric mobility. Brazil and Mexico are emerging as key contributors, driven by rising investments in solar and wind energy. LTO batteries are gaining traction in distributed energy systems and backup power applications. However, limited infrastructure and high battery costs remain barriers to widespread adoption. Despite these challenges, government-backed clean energy policies and rising consumer interest in sustainable technologies are expected to create new opportunities. Latin America presents a growing, though still developing, market for LTO solutions.

Middle East & Africa (MEA)

The Middle East & Africa region accounted for 4% share in 2024, with growth mainly concentrated in energy diversification projects and renewable integration. Gulf countries are investing in advanced battery storage to support solar energy programs, while South Africa leads regional adoption with smart grid initiatives. LTO batteries appeal to MEA markets for their long cycle life and ability to perform under extreme temperatures. However, high costs and limited local manufacturing slow adoption. As governments push to reduce dependence on fossil fuels, LTO usage is expected to expand gradually across infrastructure and transport applications.

Market Segmentations:

By Product

- Nano powder

- Micron powder

By Application

- Lithium-ion batteries

- Lithium-titanate battery

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive analysis of the lithium titanium oxide (LTO) market highlights the presence of major players including Toshiba Corporation, Altairnano, Microvast Holdings, Leclanché SA, Yinlong Energy, Seiko Instruments, Sichuan Xingneng New Materials, Fujifilm Corporation, ProLogium Technology, and BTR New Energy Materials. These companies compete through continuous investments in R&D to improve energy density, cost efficiency, and charging performance. Many focus on scaling production capacities to meet demand from electric vehicle manufacturers and grid-scale storage projects. Strategic collaborations with automotive OEMs, renewable energy providers, and industrial users help strengthen market positioning. Asia-Pacific firms, particularly in China, gain advantage from large-scale manufacturing ecosystems and government subsidies, ensuring regional dominance. Meanwhile, global players emphasize innovation in nanotechnology and electrode design to deliver safer and longer-lasting batteries. The competitive environment remains intense, with differentiation centered on technological advancement, cost reduction, and expansion into high-safety and renewable-focused applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Toshiba Corporation

- Altairnano

- Microvast Holdings

- Leclanché SA

- Yinlong Energy

- Seiko Instruments

- Sichuan Xingneng New Materials

- Fujifilm Corporation

- ProLogium Technology

- BTR New Energy Materials

Recent Developments

- In June 2025, Toshiba Corporation began sample shipments of its SCiB Nb lithium-ion battery featuring a niobium-titanium oxide (NTO) anode.

- In June 2025, Toshiba Corporation delivered initial samples of NTO-anode cells targeted for commercial applications in electric buses and trucks.

- In January 2025, ProLogium announced its fourth-generation lithium ceramic battery with a fully inorganic electrolyte, eliminating organic content and boosting performance (e.g. faster charging and better low-temperature behavior).

- In June 2024, ProLogium unveiled a battery architecture that integrates 100% silicon composite anodes, claiming improved utilization and cost control.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The lithium titanium oxide market will expand steadily with rising electric vehicle adoption.

- Demand will grow in renewable energy storage projects as smart grids scale globally.

- Advancements in nanotechnology will improve performance and energy density of LTO batteries.

- High-safety applications in aerospace, defense, and public transport will support wider adoption.

- Expansion of large-scale manufacturing in Asia-Pacific will strengthen global supply capabilities.

- Strategic collaborations between battery producers and automotive OEMs will accelerate commercialization.

- Cost reduction initiatives will play a key role in market competitiveness.

- Hybrid battery systems combining LTO with other chemistries will create new opportunities.

- Increasing focus on sustainable mobility will drive integration into commercial fleets and buses.

- Emerging markets in Latin America, Middle East, and Africa will gradually boost regional demand.

Market Insights

Market Insights