Market Overview

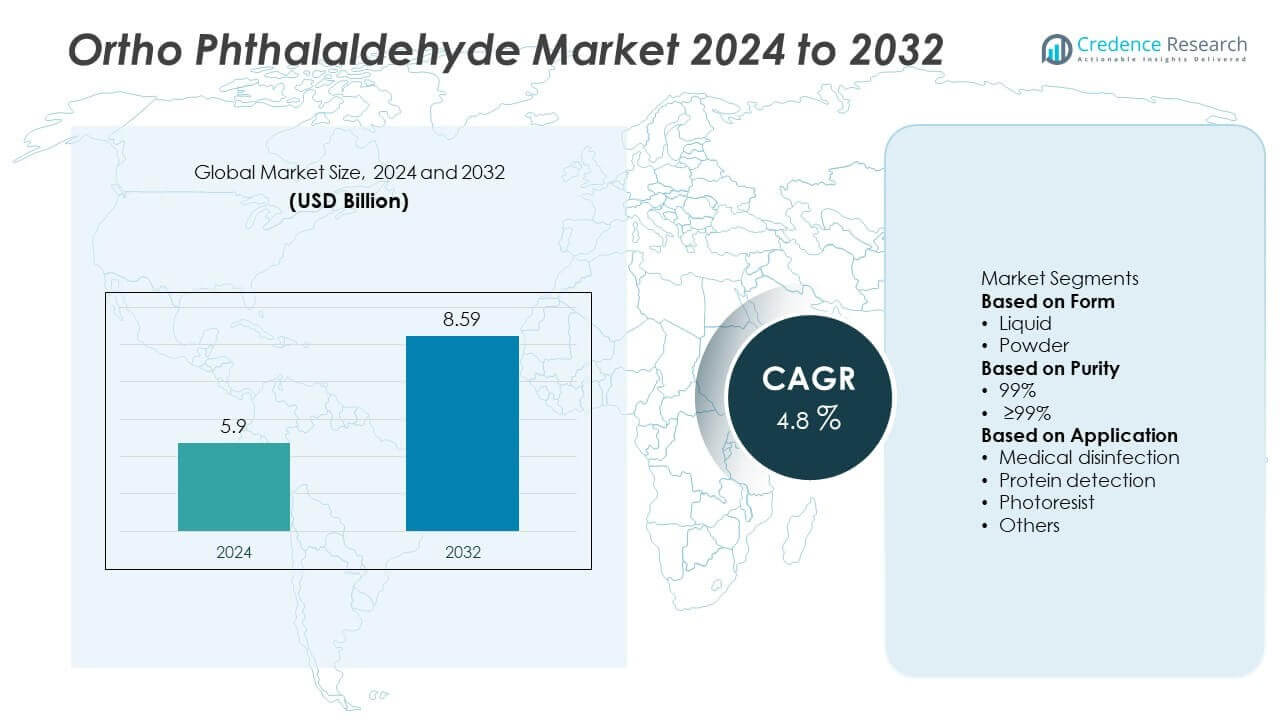

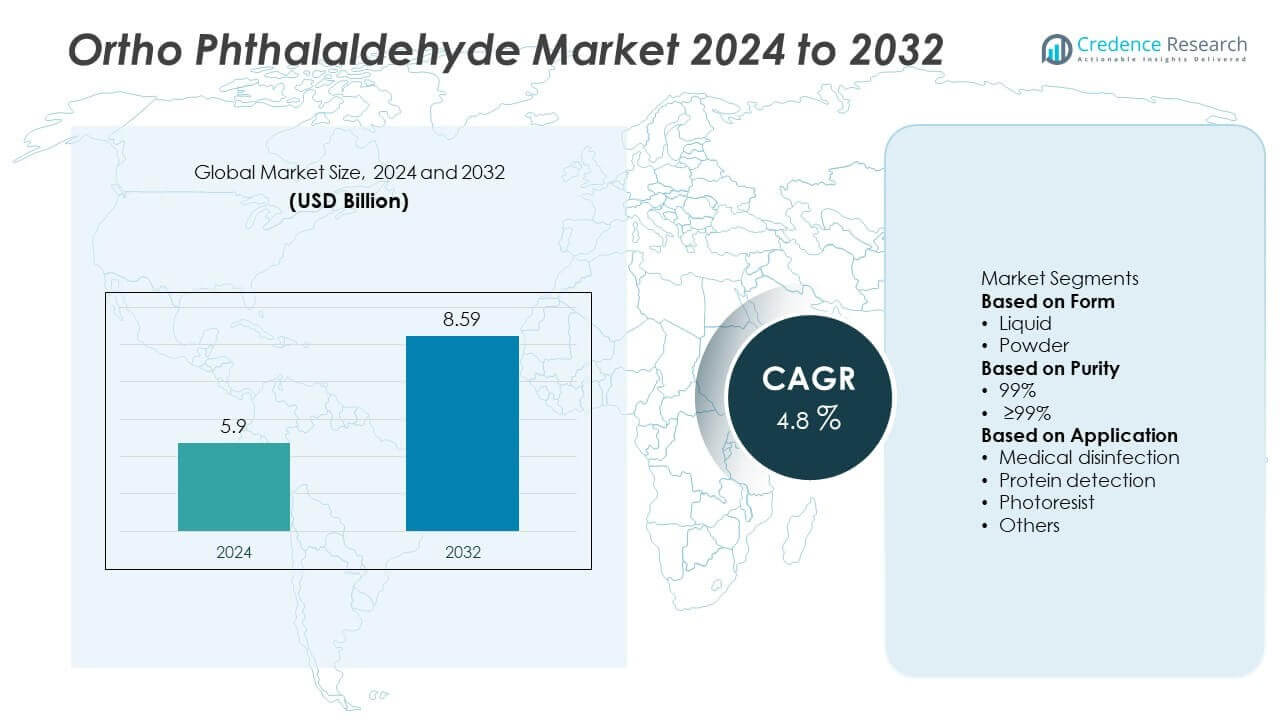

The global Ortho Phthalaldehyde (OPA) Market was valued at USD 5.9 billion in 2024. It is projected to reach USD 8.59 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ortho Phthalaldehyde (OPA) Market Size 2024 |

USD 5.9 Billion |

| Ortho Phthalaldehyde (OPA) Market, CAGR |

4.8% |

| Ortho Phthalaldehyde (OPA) Market Size 2032 |

USD 8.59 Billion |

The ortho phthalaldehyde market is shaped by prominent players including RX Chemicals, MedPurest, Voda Chemicals, Sigma-Aldrich, Lircon, MP Biomedicals, Ataman Kimya, Garonit Pharmaceutical, TCI America, and Advanced Sterilization Products. These companies lead through strong product portfolios, focus on high-purity formulations, and expansion across healthcare and biotechnology sectors. North America emerged as the leading region in 2024 with 35% market share, supported by advanced healthcare systems and strict disinfection standards. Europe followed with 27% share, driven by regulatory frameworks and robust pharmaceutical research, while Asia-Pacific accounted for 25%, registering the fastest growth due to expanding healthcare infrastructure and electronics manufacturing.

Market Insights

Market Insights

- The global ortho phthalaldehyde market was valued at USD 5.9 billion in 2024 and is projected to reach USD 8.59 billion by 2032, growing at a CAGR of 4.8%.

- Growth is driven by rising demand for medical disinfection, which accounted for 55% of applications in 2024, supported by increasing surgical procedures and stringent infection control standards across hospitals and clinics.

- Key trends include the shift toward high-purity ≥99% formulations, which held 60% share, and expanding applications in biotechnology, protein detection, and photoresist materials for the electronics sector.

- The competitive landscape features companies such as RX Chemicals, MedPurest, Sigma-Aldrich, MP Biomedicals, Lircon, and Advanced Sterilization Products, with a focus on R&D and regulatory compliance to capture emerging opportunities.

- Regionally, North America led with 35% share in 2024, followed by Europe at 27% and Asia-Pacific at 25%, while Latin America and Middle East & Africa collectively accounted for 13%, reflecting steady adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

In 2024, the liquid form segment dominated the ortho phthalaldehyde market with over 70% share. Its leadership is driven by extensive use in medical disinfection due to ease of application and high effectiveness against bacteria, spores, and viruses. Liquid OPA is preferred in hospitals and laboratories for sterilizing endoscopes and other surgical instruments, as it provides consistent results with faster action compared to alternatives. The powder form holds a smaller share, primarily used in chemical synthesis and research, but its adoption remains limited due to handling challenges and lower convenience.

- For instance, Advanced Sterilization Products markets its CIDEX™ OPA solution in liquid form with a validated high-level disinfection time of 12 minutes at 20 °C, widely adopted in endoscope reprocessing systems across hospitals.

By Purity

The ≥99% purity segment accounted for nearly 60% of the market in 2024, leading the segment due to its essential role in medical-grade disinfection and sensitive protein detection applications. High-purity OPA ensures better efficiency, lower contamination risk, and compliance with stringent healthcare regulations. Demand is strong from pharmaceutical and biotechnology industries, where accuracy and reliability are critical. The 99% purity grade, while widely available and cost-effective, captured about 40% of the market, serving general industrial and laboratory uses where ultra-high precision is not mandatory.

- For instance, Sigma-Aldrich supplies ortho-phthalaldehyde at ≥99% purity, with batch specifications ensuring a molecular weight of 134.13 g/mol and melting point of 55–57 °C, supporting its application in protein detection assays and pharmaceutical research.

By Application

Medical disinfection remained the dominant application, representing more than 55% of the market in 2024. The growing number of surgical procedures, strict infection control protocols, and rising adoption of high-level disinfectants in hospitals are driving this segment. OPA is widely used for sterilizing endoscopes, surgical tools, and dental instruments, offering advantages over glutaraldehyde due to reduced irritation and faster turnaround. Protein detection and photoresist applications collectively held a smaller share, supported by demand in research labs and electronics manufacturing. Other niche uses added diversity but contributed minimally to overall revenues.

Key Growth Drivers

Rising Demand for Medical Disinfection

The expanding need for infection control in hospitals and clinics is a primary growth driver for the ortho phthalaldehyde market. In 2024, medical disinfection accounted for over 55% of total demand, supported by the increasing number of surgical procedures and strict hygiene standards. OPA’s effectiveness against a wide range of pathogens and its advantages over glutaraldehyde, such as reduced irritation and faster disinfection, enhance its adoption. Growing awareness of healthcare-associated infections (HAIs) and regulatory mandates further fuel market expansion.

- For instance, a Lircon-manufactured OPA disinfectant solution with a validated concentration of 0.55% (w/v) achieves high-level disinfection for endoscopes in a shorter time, specifically over 5 minutes for manual cleaning and automatic disinfection machines at room temperature.

Expansion in Biotechnology and Protein Detection

Biotechnology and pharmaceutical research rely heavily on precise protein detection methods, where OPA plays a crucial role as a reagent. The rising investment in drug discovery and molecular biology research continues to expand OPA usage. High-purity ≥99% OPA products are favored for their accuracy and reliability in sensitive testing applications. Increased funding in life sciences, coupled with growing demand for advanced diagnostic solutions, reinforces steady consumption from laboratories and academic institutions. This segment supports sustained market growth beyond healthcare disinfection.

- For instance, MP Biomedicals supplies ortho-phthalaldehyde at ≥98% purity, which is widely used in protein quantification assays, and its reported melting point range is typically 53–58 °C.

Increasing Use in Electronics and Photoresist Applications

The growth of electronics manufacturing is driving demand for OPA in photoresist formulations, where it is used in semiconductor and display technologies. With rising adoption of smartphones, advanced displays, and microelectronics, manufacturers seek high-quality photoresist materials to enhance precision. OPA’s chemical properties make it suitable for specialized applications in photolithography processes. This trend, coupled with the global push for miniaturized and high-performance electronic devices, is opening new revenue streams. The electronics sector’s expansion, particularly in Asia-Pacific, underpins this long-term growth driver.

Key Trends & Opportunities

Shift Toward Safer and More Efficient Disinfectants

A growing preference for safer disinfectants is shaping market trends. Healthcare facilities are adopting OPA as an alternative to glutaraldehyde, as it offers lower toxicity, reduced odor, and minimal irritation risks. This shift is creating opportunities for manufacturers to expand product offerings tailored for sensitive clinical environments. With infection control regulations tightening worldwide, the transition toward OPA-based disinfectants presents a long-term growth opportunity, particularly in regions with expanding healthcare infrastructure such as Asia-Pacific and Latin America.

- For instance, Voda Chemicals supplies a liquid OPA disinfectant with a validated concentration of 0.55% (w/v), ensuring complete high-level disinfection of medical instruments within 12 minutes at room temperature (20°C), meeting hospital infection control standards.

Emerging Opportunities in High-Purity Applications

The rising demand for ≥99% purity OPA in pharmaceuticals, biotechnology, and advanced diagnostics creates significant growth opportunities. High-purity formulations are essential for applications that require precision and compliance with strict regulatory standards. The expansion of personalized medicine, genetic research, and protein analysis techniques is further driving the adoption of high-quality OPA. Companies investing in advanced production technologies to deliver consistent purity levels can capture greater market share, especially in developed markets with strong R&D focus such as North America and Europe.

- For instance, TCI America offers ortho-phthalaldehyde at ≥99% purity with certified batch specifications, including a molecular weight of 134.13 g/mol and a melting point of 55–57 °C, widely used in biochemical protein labeling assays.

Key Challenges

Health and Safety Concerns in Handling OPA

Despite its benefits, OPA poses health risks if improperly handled, including respiratory irritation and skin sensitization. Regulatory agencies impose strict workplace safety standards for OPA usage, which increases compliance costs for healthcare facilities and laboratories. These concerns can discourage adoption in certain markets, especially where alternative disinfectants are available. The need for protective equipment, specialized storage, and ventilation systems creates additional operational challenges, particularly for small-scale users with limited resources. Managing these safety issues remains a major barrier to wider adoption.

Regulatory Compliance and High Production Costs

Stringent regulations surrounding the production, storage, and disposal of OPA add to the complexity of market growth. Manufacturers must adhere to strict quality and environmental standards, which increase production costs and limit competitiveness in price-sensitive regions. Additionally, high-purity OPA production requires advanced processes and significant investment in quality control, further driving up costs. The combination of regulatory pressures and cost challenges can restrict market entry for new players and slow expansion, especially in emerging markets with limited healthcare budgets.

Regional Analysis

North America

North America held the largest share of the ortho phthalaldehyde market in 2024, accounting for 35% of global revenues. The region’s leadership stems from advanced healthcare infrastructure, high surgical volumes, and strong adoption of OPA-based disinfectants. Strict infection control regulations by agencies such as the FDA and CDC continue to reinforce demand across hospitals and laboratories. Biotechnology and pharmaceutical research further support consumption through protein detection and analytical applications. Ongoing investments in life sciences and rising awareness of healthcare-associated infections position North America as a key growth hub during the forecast period.

Europe

Europe captured 27% of the ortho phthalaldehyde market in 2024, driven by stringent regulatory frameworks on hospital disinfection and sterilization practices. Countries like Germany, France, and the UK lead adoption due to well-established healthcare systems and high procedural volumes. The pharmaceutical and biotechnology sectors also contribute significantly, supported by extensive R&D investments. Growing demand for high-purity OPA in protein detection and medical diagnostics strengthens the regional market. Additionally, favorable government funding for healthcare innovation and emphasis on advanced diagnostic methods ensure continued growth of OPA demand across major European economies.

Asia-Pacific

Asia-Pacific accounted for 25% of the ortho phthalaldehyde market in 2024 and is expected to witness the fastest growth. Expanding healthcare infrastructure in China, India, and Southeast Asia, along with increasing surgical procedures, drives strong demand for OPA-based disinfectants. Rising pharmaceutical manufacturing and biotechnology research also boost usage in high-purity applications. Rapid growth of the electronics sector in countries such as South Korea, Japan, and Taiwan fuels additional demand for OPA in photoresist formulations. Government focus on infection control and increased healthcare investments make Asia-Pacific a significant opportunity for market expansion.

Latin America

Latin America represented 7% of the ortho phthalaldehyde market in 2024, supported by rising healthcare investments and increasing emphasis on hospital hygiene standards. Countries like Brazil and Mexico are leading adopters, particularly in medical disinfection for surgical and clinical settings. Growing awareness of healthcare-associated infections and the gradual modernization of hospital facilities are driving demand. Pharmaceutical research and diagnostic activities remain limited but show potential for expansion. Although the region faces cost-related challenges, the adoption of safer and more efficient disinfectants continues to create opportunities for OPA suppliers in Latin America.

Middle East & Africa

The Middle East & Africa accounted for 6% of the ortho phthalaldehyde market in 2024, with demand primarily concentrated in healthcare disinfection. The Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, lead adoption due to advanced medical facilities and rising investments in healthcare infrastructure. Expanding medical tourism and the growing number of surgical procedures fuel additional demand for OPA. However, limited biotechnology and pharmaceutical research restrict broader applications in the region. Despite these challenges, increasing focus on infection prevention and modernization of healthcare services supports steady OPA consumption.

Market Segmentations:

By Form

By Purity

By Application

- Medical disinfection

- Protein detection

- Photoresist

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the ortho phthalaldehyde market features key players such as RX Chemicals, MedPurest, Voda Chemicals, Sigma-Aldrich, Lircon, MP Biomedicals, Ataman Kimya, Garonit Pharmaceutical, TCI America, and Advanced Sterilization Products. These companies focus on developing high-purity formulations and expanding product portfolios to address growing demand across medical disinfection, biotechnology, and research applications. Strategic initiatives include mergers, collaborations, and regional expansion to strengthen distribution networks and meet regulatory standards. Market leaders emphasize R&D investment to improve product safety, efficiency, and compliance with global healthcare guidelines. Rising competition is driving innovation in safer, eco-friendly alternatives, while manufacturers also prioritize competitive pricing strategies to capture emerging markets. The balance between stringent regulations, production costs, and growing global demand creates an environment where established players dominate, but regional manufacturers are steadily increasing their presence. This dynamic is expected to intensify competition and encourage further product differentiation over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- RX Chemicals

- MedPurest

- Voda Chemicals

- Sigma-Aldrich

- Lircon

- MP Biomedicals

- Ataman Kimya

- Garonit Pharmaceutical

- TCI America

- Advanced Sterilization Products

Recent Developments

- In August 2025, Advanced Sterilization Products filed a MAUDE report referencing CIDEX™ OPA use parameters.

- In 2025, MedPurest published a corporate news post while marketing OPA device disinfectants.

- In January 2024, the biotechnology firm Lircon promoted a concentration of 0.50–0.60% weight-by-volume (w/v) for its Ortho-Phthalaldehyde (OPA) high-level disinfectant.

Report Coverage

The research report offers an in-depth analysis based on Form, Purity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for advanced medical disinfectants.

- Healthcare facilities will adopt OPA more widely due to stricter infection control protocols.

- Biotechnology research will increase OPA use in protein detection and analytical testing.

- Growth in the electronics industry will drive applications in photoresist formulations.

- High-purity grades will gain preference as compliance with quality standards strengthens.

- Emerging markets will boost adoption with growing investments in healthcare infrastructure.

- Manufacturers will focus on safer, eco-friendly, and low-toxicity product alternatives.

- Strategic collaborations and regional expansions will intensify competition among key players.

- Regulatory frameworks will shape production practices and influence product innovation.

- Asia-Pacific will emerge as the fastest-growing region, driven by healthcare and electronics demand.

Market Insights

Market Insights