Market Overview

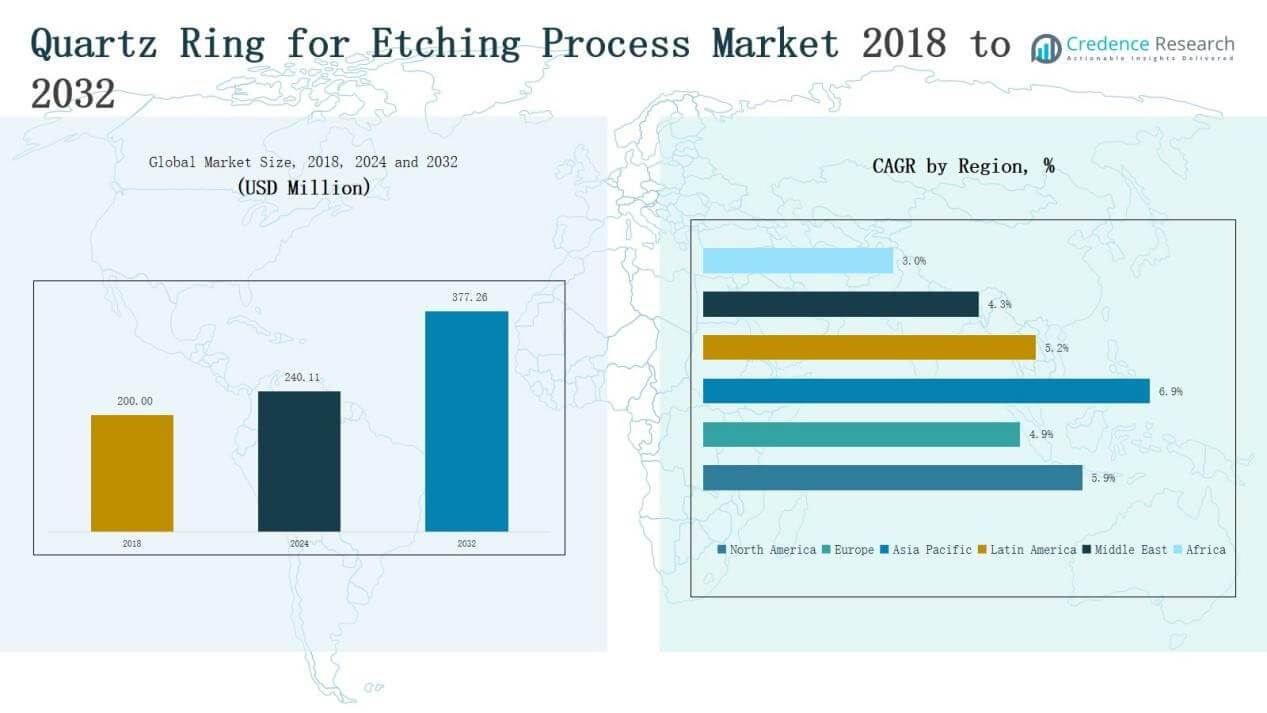

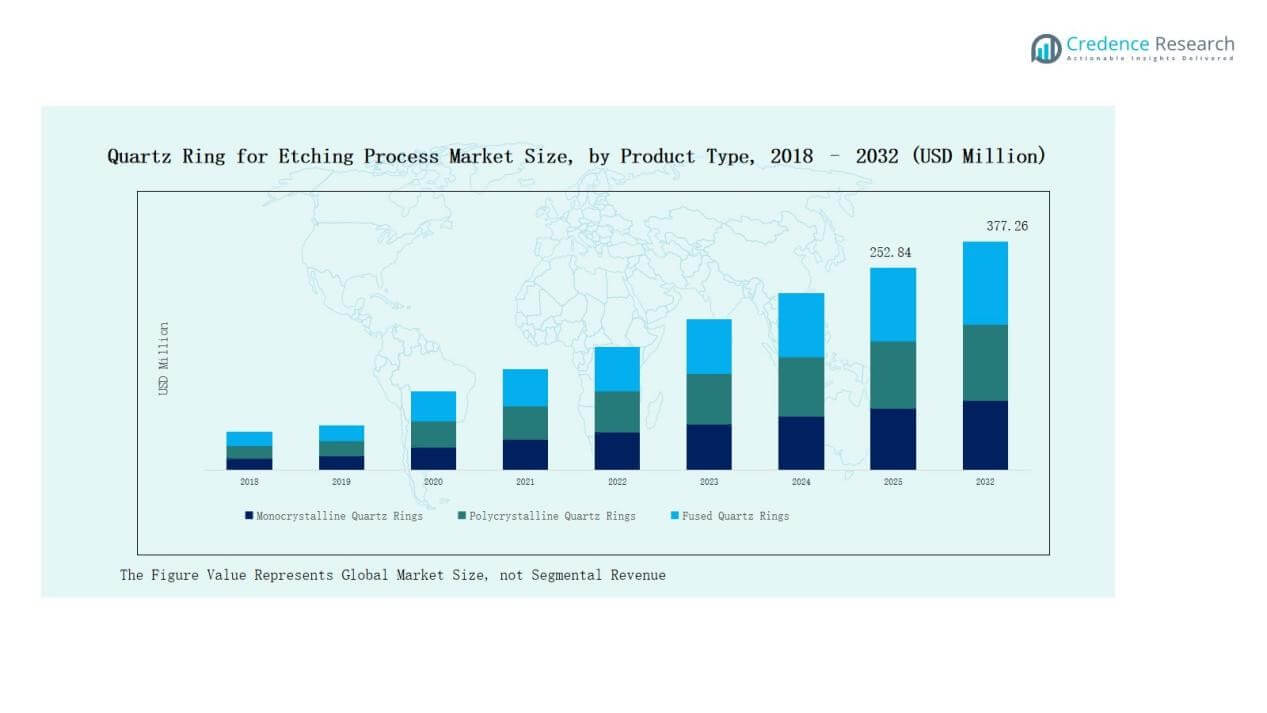

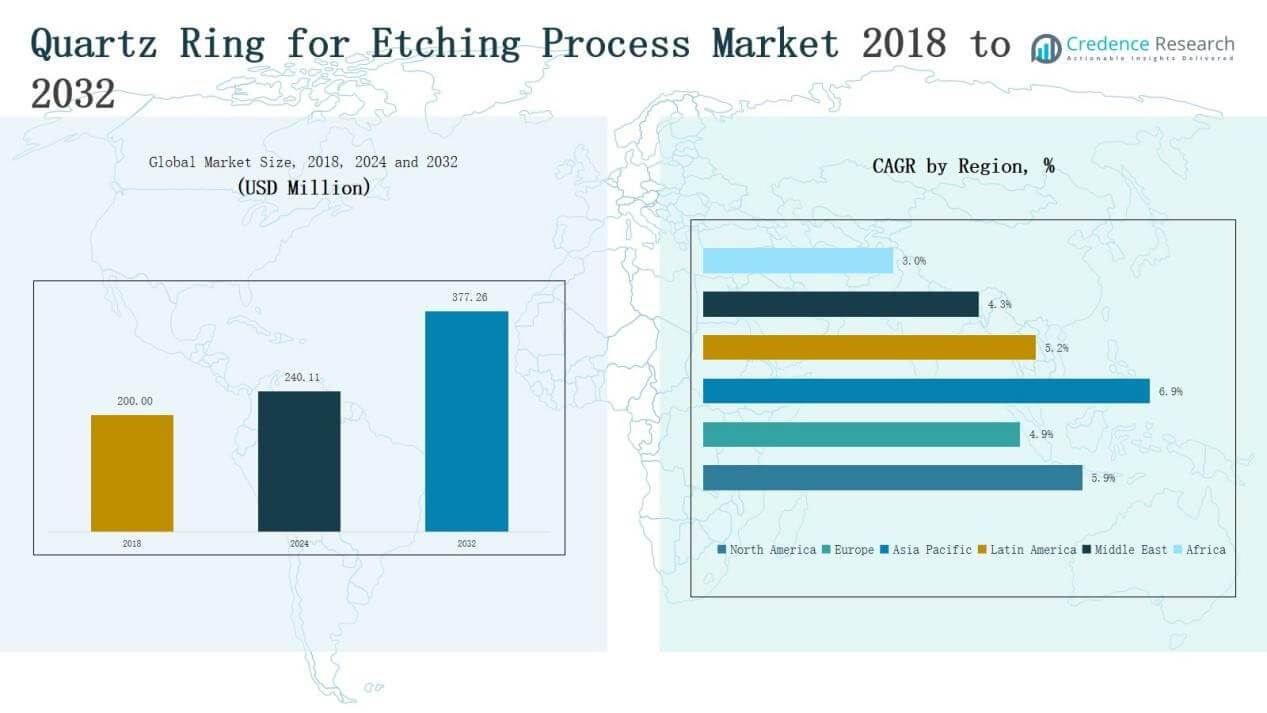

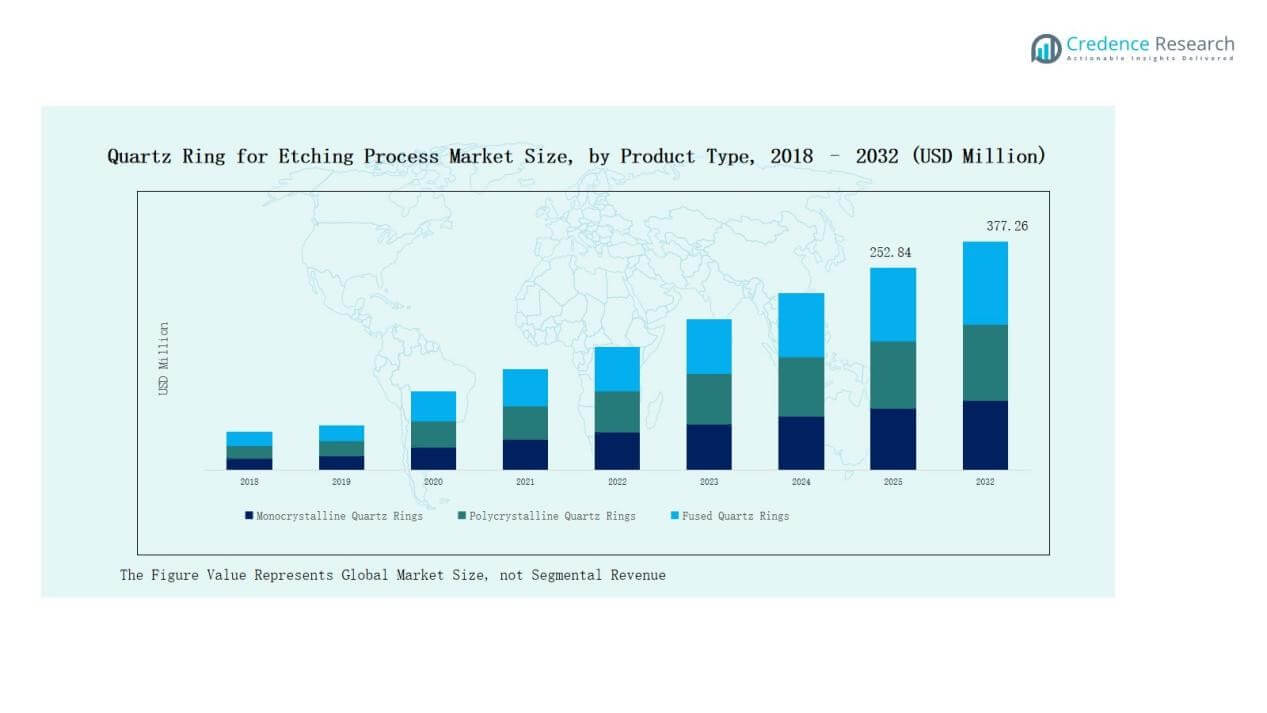

Quartz Ring for Etching Process Market size was valued at USD 200.00 million in 2018, reached USD 240.11 million in 2024, and is anticipated to reach USD 377.26 million by 2032, at a CAGR of 5.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Quartz Ring for Etching Process Market Size 2024 |

USD 240.11 Billion |

| Quartz Ring for Etching Process Market, CAGR |

5.88% |

| Quartz Ring for Etching Process Market Size 2032 |

USD 377.26 Billion |

The Quartz Ring for Etching Process Market is shaped by key players such as Shin-Etsu Quartz Products Co. Ltd., Heraeus Holding GmbH, Tosoh Corporation, Momentive Performance Materials Inc., and Saint-Gobain S.A., alongside regional contributors including MARUWA Co. Ltd., Raesch Quarz GmbH, Wacom Quartz, Quartz Scientific Inc., ZCQ Quartz, Top Seiko Co. Ltd., and Quartz Infrared Inc. These companies compete through advanced fabrication capabilities, high-purity product offerings, and long-term partnerships with semiconductor manufacturers. In 2024, North America led the market with a 35% share, supported by strong semiconductor manufacturing capacity, significant R&D investments, and growing aerospace and electronics demand.

Market Insights

Market Insights

- The Quartz Ring for Etching Process Market grew from USD 200.00 million in 2018 to USD 240.11 million in 2024 and is projected at USD 377.26 million by 2032, with a CAGR of 88%.

- Monocrystalline quartz rings led with 42% share in 2024, driven by high purity, structural uniformity, and suitability for advanced semiconductor etching processes.

- By application, semiconductor manufacturing dominated with 48% share in 2024, supported by rising chip production, smaller node demand, and capacity expansion in foundries.

- Electronics end-user segment accounted for 46% share in 2024, fueled by semiconductor fabs, consumer electronics, and growing chipmaker demand, while aerospace and automotive sectors also expanded usage.

- North America led with 35% share in 2024, valued at USD 83.94 million, while Asia Pacific followed as the fastest-growing region with strong semiconductor and electronics manufacturing momentum.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Monocrystalline quartz rings dominated the product type segment with over 42% share in 2024. Their superior purity, structural uniformity, and low defect rates make them highly suitable for advanced semiconductor etching processes. Polycrystalline quartz rings followed due to cost-effectiveness and widespread use in mid-range applications. Fused quartz rings held a smaller but steady share, supported by versatility in optical and laboratory use. The demand for monocrystalline quartz continues to rise with scaling semiconductor manufacturing nodes.

For instance, Heraeus showcased advancements in fused quartz materials tailored for EUV lithography optics, enhancing precision and heat resistance for semiconductor equipment.

By Application

Semiconductor manufacturing led the application segment with 48% share in 2024, reflecting strong adoption in wafer etching processes. The growth is driven by rising chip production, demand for smaller nodes, and expansion of foundry capacity. Laser optics contributed significantly, supported by precision needs in industrial and defense applications. Optical components and telecommunications showed steady growth, while medical devices saw niche demand. Continuous advancements in semiconductor technology secure the dominance of the semiconductor segment.

For instance, ASML shipped its first High-NA EUV system, enhancing precision for sub-2nm chips in next-generation semiconductor devices.

By End-User

Electronics was the leading end-user segment with 46% market share in 2024, supported by robust demand from semiconductor fabs, consumer electronics, and chipmakers. The aerospace sector contributed meaningfully, leveraging quartz components for durability and performance in etching systems. Automotive applications grew with rising adoption of advanced driver-assistance systems and electrification. Healthcare and energy utilities held smaller shares, though their demand is rising for precision instruments and clean energy technologies. Electronics will remain the core driver of market growth.

Key Growth Drivers

Key Growth Drivers

Rising Semiconductor Manufacturing Demand

The semiconductor industry’s expansion is a primary growth driver for the Quartz Ring for Etching Process Market. As global demand for advanced chips increases, fabs require high-purity, defect-free etching materials to maintain efficiency and yield. Monocrystalline quartz rings are particularly favored for their superior stability under extreme etching conditions. With leading foundries investing in advanced node production, the need for quartz rings in wafer processing continues to accelerate, directly boosting market growth across developed and emerging manufacturing hubs.

For instance, SemiMat, a German quartz manufacturer, supplies ultra-pure quartz components tailored for epitaxy and plasma etching, crucial for semiconductor manufacturers advancing AI and high-performance computing chips.

Advancements in Etching Technologies

Ongoing improvements in etching processes, including plasma, dry, and laser etching, are propelling demand for specialized quartz rings. These techniques require durable, thermally resistant materials to ensure accuracy and repeatability in microfabrication. Quartz rings offer excellent thermal stability, chemical resistance, and minimal contamination risk, making them indispensable in etching chambers. As manufacturers move toward finer geometries and high-precision designs, the adoption of advanced quartz rings grows. This technological progress directly expands the application scope and market penetration of quartz rings.

For instance, Applied Materials introduced its FLAGSHIP Producer® Selectra™ Etch System, designed for next-generation patterning, where quartz chamber components are essential to maintain etch precision and reduce particle contamination.

Growing Adoption in High-Tech Applications

Beyond semiconductors, high-tech industries such as aerospace, telecommunications, and medical devices are fueling demand for quartz rings. These sectors require precision components that withstand harsh environments while ensuring performance reliability. In optical systems, quartz rings provide enhanced transparency and resistance to thermal stress. In healthcare, their biocompatibility supports medical device manufacturing. With high-tech applications expanding rapidly, the market benefits from diversified demand. This growth reduces reliance on semiconductor cycles while ensuring stable long-term revenue opportunities for quartz component suppliers.

Key Trends & Opportunities

Shift Toward Miniaturization and Nanofabrication

A major trend driving opportunities is the push for miniaturized electronic devices and nanofabrication processes. Smaller semiconductor nodes require advanced etching solutions that maintain precision at the atomic scale. Quartz rings, with their ability to withstand extreme plasma and chemical environments, are increasingly vital. This trend benefits manufacturers offering high-quality, defect-free rings optimized for nanoscale applications. Companies aligning with nanotechnology growth will secure stronger positions as industries emphasize next-generation chip performance and compact device integration.

For instance, Applied Materials launched its Centura Sculpta® pattern-shaping system, designed to reduce the need for multiple patterning steps in advanced semiconductor nodes, reinforcing demand for durable quartz process components.

Rising Demand for Sustainable Manufacturing

Sustainability is emerging as a key opportunity in the Quartz Ring for Etching Process Market. Leading players focus on eco-friendly production techniques, recycling initiatives, and extended lifecycle performance of quartz components. Customers prefer suppliers that minimize waste and reduce carbon footprint during quartz fabrication. This trend aligns with broader environmental compliance policies in semiconductor and electronics manufacturing. Companies investing in sustainable practices and green technologies gain competitive advantage, strengthening their brand reputation while meeting rising customer expectations.

For instance, ZSM expanded its global quartz export business to regions including the Middle East and Europe, emphasizing sustainable supply chain management and export-grade packaging to reduce logistics emissions and material waste.

Key Challenges

High Production Costs of Quartz Rings

One of the critical challenges lies in the high cost of producing quartz rings, especially monocrystalline variants. Their manufacturing requires advanced precision cutting, polishing, and defect-free crystal growth, which drive up expenses. These costs often limit adoption among smaller fabs or research institutions. Additionally, fluctuations in raw material pricing further affect profitability. Companies must balance pricing strategies and operational efficiency while ensuring uncompromised quality, as cheaper alternatives risk contamination in high-precision etching processes.

Technological Complexity in Advanced Etching

The growing complexity of etching processes presents a significant challenge for quartz ring suppliers. As chip geometries shrink and multi-patterning techniques expand, rings must deliver higher thermal resistance and precise tolerance levels. Meeting these stringent specifications often stretches manufacturing capabilities and increases rejection rates. Suppliers face rising pressure to innovate while maintaining cost-effectiveness. Failure to meet evolving process requirements can reduce competitiveness, especially as leading fabs prioritize vendors that consistently deliver components for advanced etching technologies.

Dependence on Semiconductor Industry Cyclicality

The market faces risk from its heavy dependence on semiconductor industry cycles. Periods of oversupply, reduced capital expenditure, or global demand slowdowns directly impact quartz ring procurement. While diversification into healthcare, optics, and aerospace helps, semiconductors remain the core demand driver. This reliance exposes manufacturers to volatility and sharp revenue fluctuations. To counter this, suppliers must strengthen customer bases across multiple industries, ensuring resilience against semiconductor downturns while maintaining steady long-term business growth.

Regional Analysis

North America

North America dominated the Quartz Ring for Etching Process Market with a 35% share in 2024, valued at USD 83.94 million, up from USD 70.80 million in 2018. The market is projected to reach USD 131.70 million by 2032, growing at a CAGR of 5.77%. Growth is fueled by advanced semiconductor fabs in the U.S. and increasing R&D investments. Strong presence of leading technology firms and consistent demand for high-precision components in aerospace and electronics strengthen regional leadership, positioning North America as a key hub for quartz ring innovation.

Europe

Europe accounted for a 20% market share in 2024, generating USD 47.30 million, compared with USD 41.44 million in 2018. The region is expected to achieve USD 69.02 million by 2032, reflecting a CAGR of 4.78%. Market growth is supported by demand from industrial laser optics, medical device manufacturing, and expanding semiconductor initiatives in Germany and France. Europe’s emphasis on sustainable manufacturing and advanced materials research adds to market opportunities. Despite slower growth than Asia Pacific, Europe remains a steady contributor, particularly in high-value optical and precision engineering applications.

Asia Pacific

Asia Pacific emerged as the fastest-growing region with a 32% share in 2024, valued at USD 76.03 million, up from USD 61.16 million in 2018. It is forecasted to reach USD 129.44 million by 2032, at a robust CAGR of 7.02%. The region’s growth is driven by expanding semiconductor manufacturing in China, Taiwan, South Korea, and Japan. Rising investments in 5G, consumer electronics, and automotive semiconductors further accelerate demand. Asia Pacific’s cost-effective production capabilities and government-backed industrial policies strengthen its leadership potential, making it a critical growth engine for the global quartz ring market.

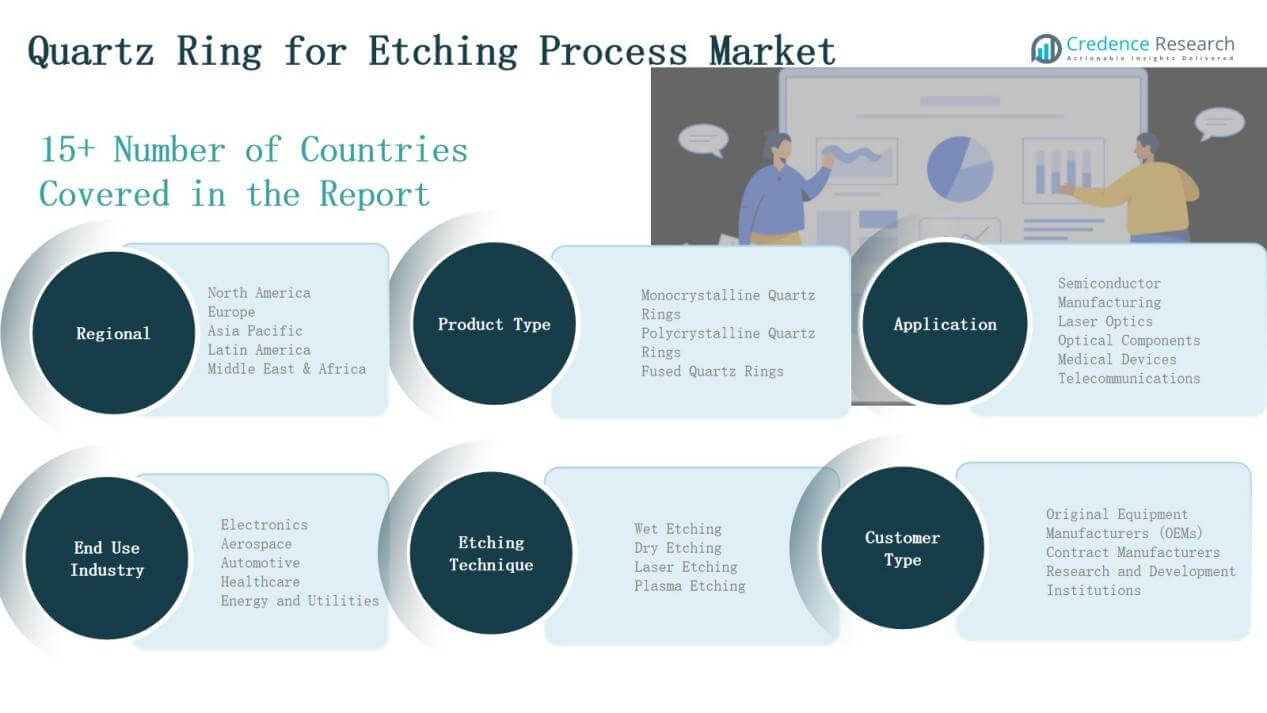

Market Segmentations:

Market Segmentations:

By Product Type

- Monocrystalline Quartz Rings

- Polycrystalline Quartz Rings

- Fused Quartz Rings

By Application

- Semiconductor Manufacturing

- Laser Optics

- Optical Components

- Medical Devices

- Telecommunications

By End-User

- Electronics

- Aerospace

- Automotive

- Healthcare

- Energy and Utilities

By Etching Technique

- Wet Etching

- Dry Etching

- Laser Etching

- Plasma Etching

By Customer Type

- Original Equipment Manufacturers (OEMs)

- Contract Manufacturers

- Research and Development Institutions

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Quartz Ring for Etching Process Market is moderately consolidated, with competition shaped by global and regional players specializing in high-purity quartz products. Leading companies such as Shin-Etsu Quartz Products Co. Ltd., Heraeus Holding GmbH, Tosoh Corporation, Momentive Performance Materials Inc., and Saint-Gobain S.A. dominate through broad product portfolios, advanced fabrication technologies, and long-term partnerships with semiconductor manufacturers. These players focus on delivering monocrystalline and fused quartz rings that meet stringent performance requirements in advanced etching systems. Regional firms, including MARUWA Co. Ltd., Raesch Quarz GmbH, and Wacom Quartz, strengthen competition by offering cost-efficient solutions and localized supply networks. Emerging players like Quartz Scientific Inc., ZCQ Quartz, and Top Seiko Co. Ltd. contribute by catering to niche applications in optics, healthcare, and R&D. Strategic initiatives such as capacity expansion, sustainability programs, and precision-engineering investments remain central to competitive differentiation, enabling suppliers to secure long-term contracts with electronics and high-tech industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Shin-Etsu Quartz Products Co. Ltd.

- Heraeus Holding GmbH

- Tosoh Corporation

- Momentive Performance Materials Inc.

- Saint-Gobain S.A.

- MARUWA Co. Ltd.

- Raesch Quarz (Germany) GmbH

- Wacom Quartz

- ZCQ Quartz

- Quartz Scientific Inc.

- Top Seiko Co. Ltd.

- Quartz Infrared Inc.

Recent Developments

- In April 2024, Topco Quartz Products (a JV of Topco Scientific & Shin-Etsu Quartz) opened a new plant in southern Taiwan, dedicated to supplying TSMC’s 3 nm process.

- In May 2024, Momentive Performance Materials was fully acquired by KCC Corporation, making Momentive a wholly owned KCC subsidiary.

- In July 2025, Saint-Gobain completed three bolt-on acquisitions to strengthen its construction chemicals presence in North America, Italy, and Peru.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User, Etching Technique, Customer Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with ongoing semiconductor node miniaturization and advanced wafer processing.

- Adoption will expand in aerospace and defense sectors for precision optical components.

- Medical device manufacturing will increasingly use quartz rings for high-purity applications.

- Asia Pacific will strengthen its position as the fastest-growing production and consumption hub.

- North America will maintain leadership through strong semiconductor and R&D investments.

- Europe will focus on sustainable production and high-value optical technology applications.

- Suppliers will invest in advanced fabrication methods to reduce defects and improve durability.

- Strategic partnerships with semiconductor fabs will drive steady revenue opportunities.

- Diversification into telecommunications and 5G applications will broaden end-use adoption.

- Growing emphasis on sustainable and recyclable quartz materials will shape supplier strategies.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: