Market overview

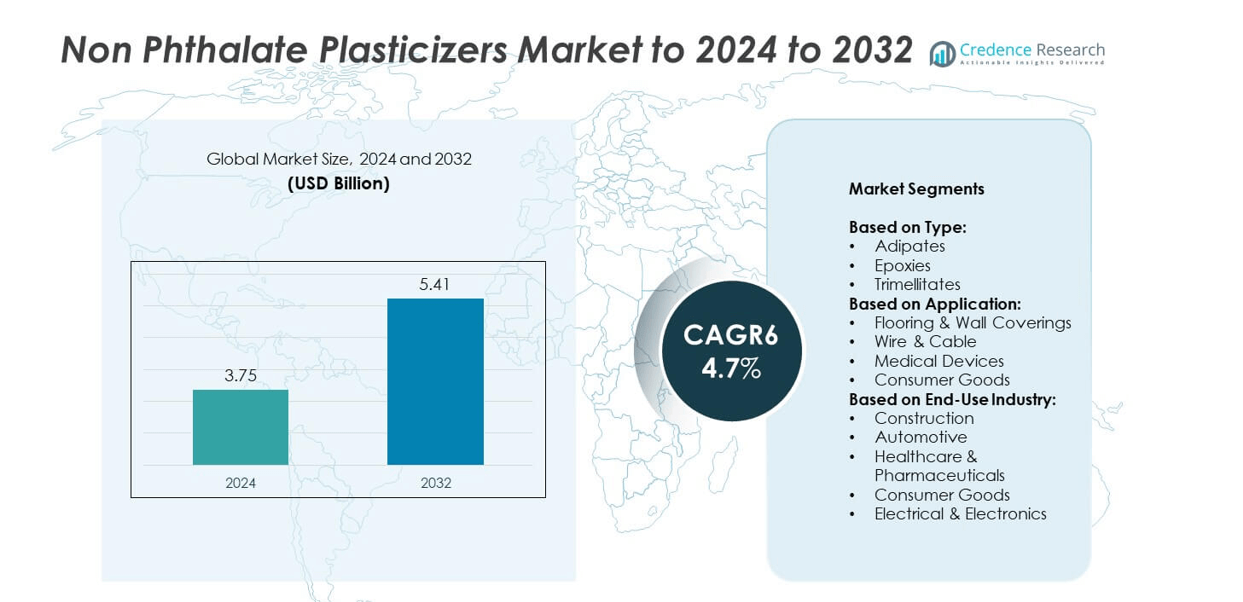

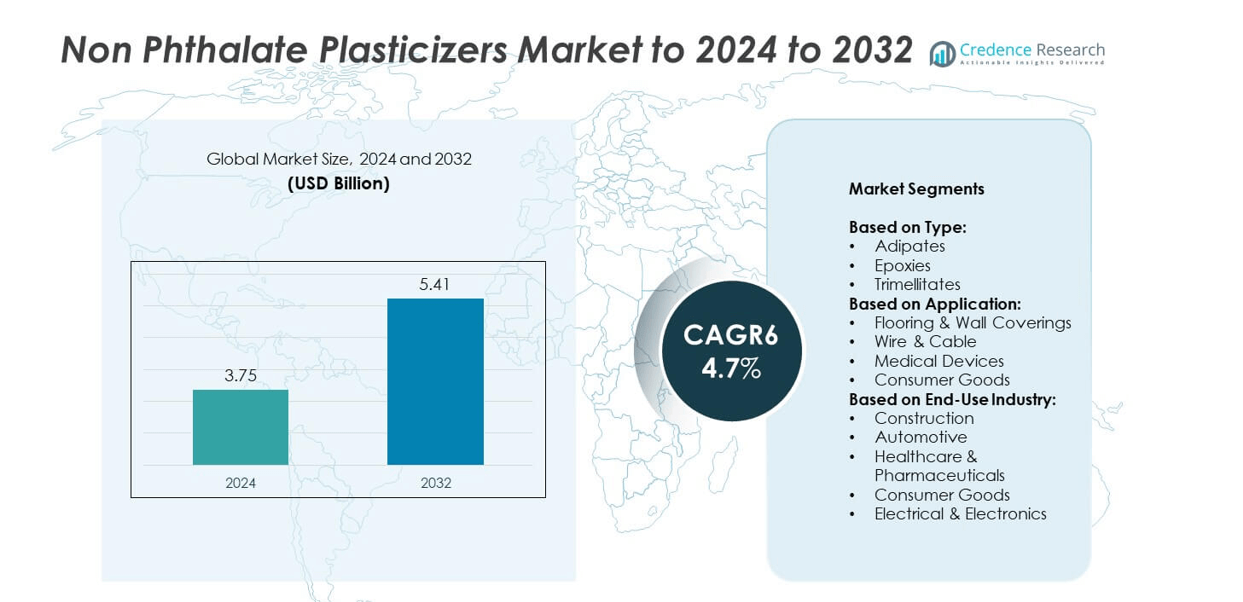

The non-phthalate plasticizers market size was valued at USD 3.75 billion in 2024 and is anticipated to reach USD 5.41 billion by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non Phthalate Plasticizers Market Size 2025 |

USD 3.75 billion |

| Non Phthalate Plasticizers Market, CAGR |

4.7% |

| Non Phthalate Plasticizers Market Size 2032 |

USD 5.41 billion |

The non-phthalate plasticizers market is shaped by prominent players including Teknor Apex Company, Solvay S.A., ExxonMobil Chemical Company, REAGENS SpA, Eastman Chemical Company, PolyOne Corporation, Emery Oleochemicals Group, BASF SE, Hallstar, Shandong Hongxin Chemicals Co., Ltd., Dow Chemical Company, Arkema Inc., LANXESS AG, and 4G BioPlast Ltd. These companies focus on sustainable innovations, bio-based formulations, and regulatory compliance to expand their presence across diverse applications such as construction, automotive, medical devices, and electronics. Regionally, North America led the global market in 2024 with a 32% share, driven by strict regulations, robust construction activities, and expanding healthcare demand. Europe followed with 28%, supported by sustainability mandates and advanced manufacturing capabilities, while Asia Pacific accounted for 25% as the fastest-growing region due to rapid industrialization and strong automotive and electronics production. This competitive and regional balance highlights the industry’s strong growth trajectory.

Market Insights

- The non-phthalate plasticizers market was valued at USD 3.75 billion in 2024 and is projected to reach USD 5.41 billion by 2032, growing at a CAGR of 4.7%.

- Growth is fueled by regulatory restrictions on phthalates, rising demand in construction materials, and increasing adoption in medical devices due to safety and biocompatibility benefits.

- A key trend is the shift toward bio-based plasticizers, with companies investing in sustainable formulations to align with environmental goals and consumer preferences for safer alternatives.

- The market is highly competitive, with global leaders focusing on R&D, product innovation, and capacity expansions, while regional players strengthen supply chains and target cost-sensitive applications.

- North America led with 32% share in 2024, followed by Europe at 28% and Asia Pacific at 25%; by type, adipates dominated with over 38% share, driven by cost-effectiveness and broad application versatility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Adipates dominated the non-phthalate plasticizers market in 2024, accounting for over 38% share. Their wide use stems from excellent low-temperature performance and flexibility, making them suitable for PVC applications in construction and automotive products. Epoxies are gaining traction due to their ability to improve thermal stability and resistance, particularly in wire and cable coatings. Trimellitates hold demand in high-temperature applications such as automotive interiors and durable consumer goods. The dominance of adipates is driven by their cost-effectiveness, versatility, and compliance with safety regulations favoring non-phthalate alternatives.

- For instance, Evonik operates a phthalate-free plasticizer facility at Marl with annual capacity 40,000 metric tons.

By Application

Flooring and wall coverings emerged as the largest application segment, capturing nearly 34% of the market share in 2024. Rising construction activities in residential and commercial spaces are fueling demand for flexible PVC-based flooring materials. Wire and cable applications follow closely, driven by the need for durable, heat-resistant coatings in power and telecom sectors. Medical devices are also expanding steadily as healthcare shifts to biocompatible and safe plasticizers. The flooring and wall coverings segment remains dominant, primarily due to sustained infrastructure growth and increasing urbanization worldwide.

- For instance, BASF’s Pasadena (Texas) plant for Palatinol® DOTP (a non-ortho plasticizer) has nameplate capacity 60,000 metric tons/year.

By End-Use Industry

Construction led the end-use industry segment, holding about 36% of the non-phthalate plasticizers market share in 2024. The sector’s dominance is linked to high consumption of flexible PVC products, including flooring, roofing membranes, and wall coverings. Automotive ranked second, with demand rising for durable interior materials resistant to temperature fluctuations. Healthcare and pharmaceuticals are expanding due to strict safety regulations and growing use of biocompatible devices. The construction segmen

Key Growth Drivers

Stringent Regulatory Frameworks

Regulatory restrictions on phthalates by agencies such as the EPA, FDA, and EU REACH have accelerated the adoption of non-phthalate alternatives. These frameworks ensure compliance with safety standards in applications including medical devices, food packaging, and construction materials. Growing health concerns linked to phthalates further strengthen this regulatory push. As a result, manufacturers are compelled to shift toward eco-friendly plasticizers, boosting overall market demand. This remains the most critical driver, as regulations directly shape long-term market growth and product innovation strategies across industries.

- For instance, In September 2023, the Oman Daily Observer reported that OQ Chemicals, at the time owned by Oman’s state-owned OQ Group, had a total production capacity of “over 1.7 million tonnes per annum” of oxo chemicals.

Rising Demand from Construction and Infrastructure

The construction sector significantly fuels the non-phthalate plasticizers market due to high demand for flooring, wall coverings, and roofing membranes. Urbanization and smart city projects in North America, Europe, and Asia Pacific enhance the need for flexible PVC applications. Non-phthalate alternatives are preferred in these materials for durability, flexibility, and compliance with environmental standards. With infrastructure investments expanding globally, particularly in Asia Pacific, this sector continues to dominate consumption, ensuring a steady pipeline of demand for non-phthalate plasticizers over the forecast period.

- For instance, Tarkett has confirmed that 100% of its vinyl production sites in Europe, North America, Serbia, and China have been using phthalate-free plasticizer technology since 2018, with the exception of certain products that use recycled content. The company has also publicly stated that its iQ Optima flooring, first launched in 1984, has sold more than 100 million square meters worldwide.

Expanding Healthcare and Medical Applications

Healthcare has emerged as a major growth driver, supported by strict safety regulations and rising healthcare expenditure worldwide. Non-phthalate plasticizers are widely used in medical devices such as IV bags, catheters, and tubing due to their biocompatibility and non-toxic profile. Increasing demand for advanced, patient-safe medical equipment is accelerating product adoption. North America and Europe lead this trend, while Asia Pacific shows rapid growth with healthcare infrastructure expansion. The medical industry’s reliance on safe and compliant materials firmly establishes healthcare as a critical driver for long-term market growth.

Key Trends & Opportunities

Shift Toward Bio-Based Plasticizers

One of the most significant trends is the shift toward bio-based non-phthalate plasticizers derived from renewable resources. Growing environmental concerns and sustainability goals are driving adoption across industries. These products reduce reliance on fossil fuels and provide lower toxicity, making them suitable for sensitive applications like medical devices and consumer goods. Companies are investing heavily in R&D to enhance the performance of bio-based alternatives. The opportunity lies in aligning product innovation with sustainability mandates, enabling manufacturers to capture long-term growth while meeting eco-regulation requirements.

- For instance, in 2023, Emery Oleochemicals’ Green Polymer Additives division promoted its new bio-based plasticizer innovations, including the 100% bio-based and biodegradable polymeric plasticizers EDENOL® 2178 and EDENOL® 2192, at major trade shows like Chinaplas and Plastindia. These products were initially developed and introduced in 2022.

Growth in Automotive and Electronics Applications

Automotive interiors and electrical components present rising opportunities for non-phthalate plasticizers due to their flexibility, durability, and thermal stability. In automotive, demand is driven by lightweight and sustainable materials to meet emission and safety regulations. In electronics, non-phthalates are increasingly used in cables and insulation to enhance performance and reduce toxicity. Asia Pacific, with its strong automotive and electronics base, leads in adoption. This trend highlights significant opportunities for manufacturers to expand into high-performance applications, strengthening market growth beyond traditional construction and healthcare sectors.

- For instance, BASF doubled capacity for its non-phthalate plasticizer Hexamoll® DINCH from 100,000 to 200,000 metric tons.

Key Challenges

Higher Production Costs

One of the major challenges is the higher production cost of non-phthalate plasticizers compared to conventional phthalates. Advanced formulations and compliance with safety certifications increase overall manufacturing expenses. These costs often translate into higher product pricing, which can limit adoption, particularly in cost-sensitive markets. Small and medium-scale industries in emerging economies face difficulties in making the transition, slowing market penetration. Addressing cost barriers through technological innovation and scaling production remains critical for ensuring competitive positioning and broader adoption of non-phthalate alternatives globally.

Limited Awareness in Emerging Markets

Another key challenge lies in the limited awareness of phthalate-related health risks in emerging regions such as parts of Latin America, Africa, and Southeast Asia. While regulations are strict in developed economies, slower policy implementation in these markets hampers adoption. Industries in these regions often prioritize cost efficiency over safety compliance, delaying the transition toward non-phthalate options. This awareness gap poses a restraint on global expansion and reduces the pace of sustainable adoption. Strengthening education and regulatory enforcement remains essential to overcome this challenge.

Regional Analysis

North America

North America held the largest share of the non-phthalate plasticizers market in 2024, accounting for 32%. The region benefits from stringent regulatory frameworks such as EPA and FDA restrictions on phthalates, which drive the adoption of safer alternatives. Strong demand comes from construction materials, automotive interiors, and medical devices, particularly in the United States. Growing infrastructure investments, coupled with consumer preference for sustainable products, further fuel regional growth. In addition, established healthcare and electronics industries continue to expand usage of biocompatible and flexible plasticizers, ensuring North America’s leadership in the global market.

Europe

Europe represented 28% of the global non-phthalate plasticizers market share in 2024. The region’s growth is largely influenced by strict EU regulations under REACH and the European Green Deal, promoting eco-friendly materials. Demand is high in construction, automotive, and electrical sectors, with Germany, France, and the UK leading consumption. Medical applications are also expanding due to increasing emphasis on patient safety and sustainability in device manufacturing. The adoption of advanced formulations, coupled with the push for circular economy practices, positions Europe as a strong market with steady long-term demand for non-phthalate plasticizers.

Asia Pacific

Asia Pacific accounted for 25% of the non-phthalate plasticizers market in 2024, making it the fastest-growing region. Rapid industrialization, urbanization, and infrastructure development in China, India, and Southeast Asia are driving high consumption in construction and consumer goods. The region’s expanding automotive industry and strong electronics manufacturing base further contribute to growth. Medical device adoption is also accelerating as healthcare investment rises across emerging economies. Favorable government initiatives supporting sustainable manufacturing and increasing awareness of phthalate-related health risks strengthen regional demand, ensuring Asia Pacific maintains its momentum as a key growth driver.

Latin America

Latin America captured 9% of the global non-phthalate plasticizers market in 2024. Brazil and Mexico are leading contributors, driven by rising construction activity and a growing automotive sector. Consumer goods and packaging applications are also expanding due to higher urbanization rates and shifting lifestyles. Although regulatory frameworks are less stringent compared to North America and Europe, growing awareness about health and environmental concerns is gradually supporting the adoption of safer alternatives. Investments in infrastructure projects and the recovery of manufacturing sectors are expected to enhance demand, positioning Latin America as a steadily growing market.

Middle East & Africa

The Middle East and Africa region accounted for 6% of the non-phthalate plasticizers market in 2024. Growth is supported by rising infrastructure development, especially in Gulf countries, where large-scale residential and commercial projects dominate demand. The automotive sector in South Africa and healthcare expansion in Gulf states contribute to regional adoption. Although overall consumption remains smaller compared to other regions, increasing government focus on sustainable construction and healthcare safety standards is boosting market growth. The region’s gradual shift toward eco-friendly materials provides opportunities for future expansion of non-phthalate plasticizer use.

Market Segmentations:

By Type:

- Adipates

- Epoxies

- Trimellitates

By Application:

- Flooring & Wall Coverings

- Wire & Cable

- Medical Devices

- Consumer Goods

By End-Use Industry:

- Construction

- Automotive

- Healthcare & Pharmaceuticals

- Consumer Goods

- Electrical & Electronics

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the non-phthalate plasticizers market is shaped by leading players such as Teknor Apex Company, Solvay S.A., ExxonMobil Chemical Company, REAGENS SpA, Eastman Chemical Company, PolyOne Corporation, Emery Oleochemicals Group, BASF SE, Hallstar, Shandong Hongxin Chemicals Co., Ltd., Dow Chemical Company, Arkema Inc., LANXESS AG, and 4G BioPlast Ltd. These companies focus on product innovation, regulatory compliance, and expansion of sustainable solutions to strengthen their market presence. Strategic initiatives include developing bio-based alternatives, enhancing production efficiency, and expanding into high-growth sectors like healthcare, automotive, and construction. Global players are investing in advanced research to improve material performance and reduce toxicity, aligning with rising consumer and regulatory demand for safer alternatives. Regional companies are also increasing competitiveness by targeting cost-sensitive applications and strengthening local supply chains. Collaborations, mergers, and capacity expansions remain central strategies to achieve wider adoption and maintain leadership in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Teknor Apex Company

- Solvay S.A.

- ExxonMobil Chemical Company

- REAGENS SpA

- Eastman Chemical Company

- PolyOne Corporation

- Emery Oleochemicals Group

- BASF SE

- Hallstar

- Shandong Hongxin Chemicals Co., Ltd.

- Dow Chemical Company

- Arkema Inc.

- LANXESS AG

- 4G BioPlast Ltd.

Recent Developments

- In 2025, LANXESS AG Exhibited at K 2025 with a focus on additives, colorants, and pigments, highlighting their additives portfolio, which includes multiple non-phthalate plasticizers alongside their Mesamoll product line.

- In 2024, Perstorp Introduced Pevalen Pro 100, a non-phthalate plasticizer derived from 100% renewable carbon using mass balance principles, lowering the carbon footprint by around 80% compared to fossil-based alternatives.

- In 2023, BASF SE Launched Ecoflex EL 1165, a low-odor and low-migration non-phthalate plasticizer suitable for applications like food packaging, toys, and medical devices.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, supported by stricter global regulations on phthalates.

- Adoption in medical devices will expand due to rising demand for safe, biocompatible materials.

- Construction will remain the largest end-use sector, driven by infrastructure development worldwide.

- Automotive applications will increase with the shift toward lightweight and sustainable interior materials.

- Bio-based plasticizers will gain momentum as industries align with sustainability goals.

- Asia Pacific will witness the fastest growth, supported by industrialization and urbanization.

- Europe will strengthen its position with strong regulatory frameworks and circular economy initiatives.

- North America will sustain dominance with advanced healthcare and automotive adoption.

- Manufacturers will invest more in R&D to improve cost-efficiency and performance of alternatives.

- Awareness programs and stricter policies in emerging regions will drive broader global adoption.