| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Products for Kids market Size 2024 |

USD 35,139.9 million |

| Luxury Products for Kids market, CAGR |

5.90% |

| Luxury Products for Kids market Size 2032 |

USD 55,510.7 million |

Market Overview:

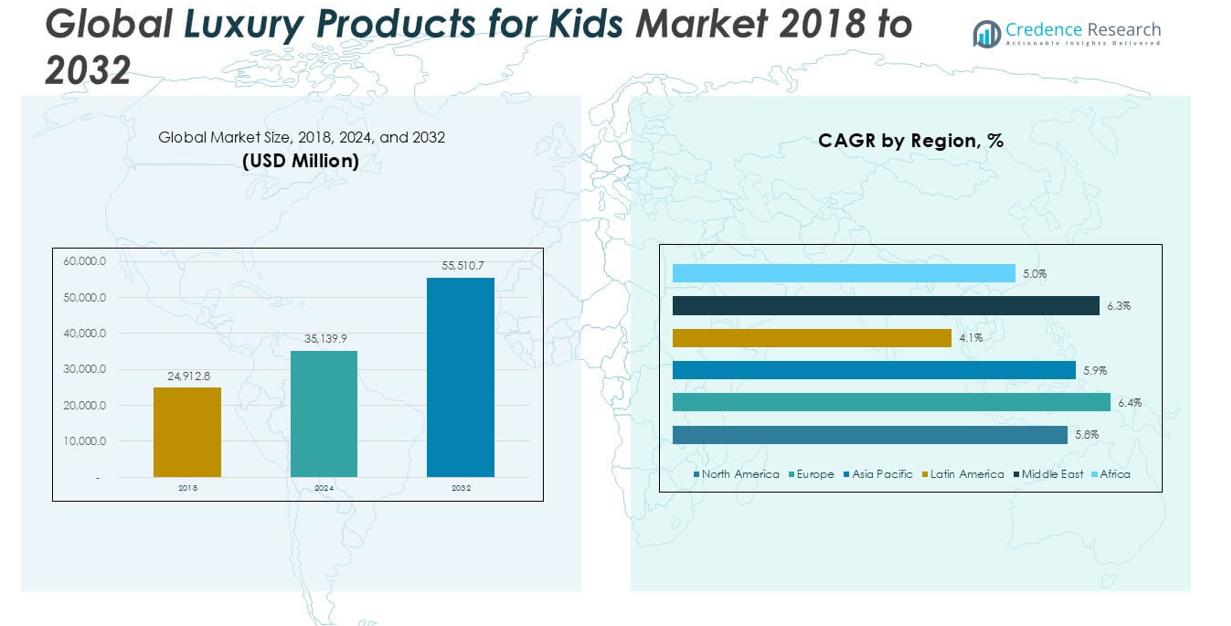

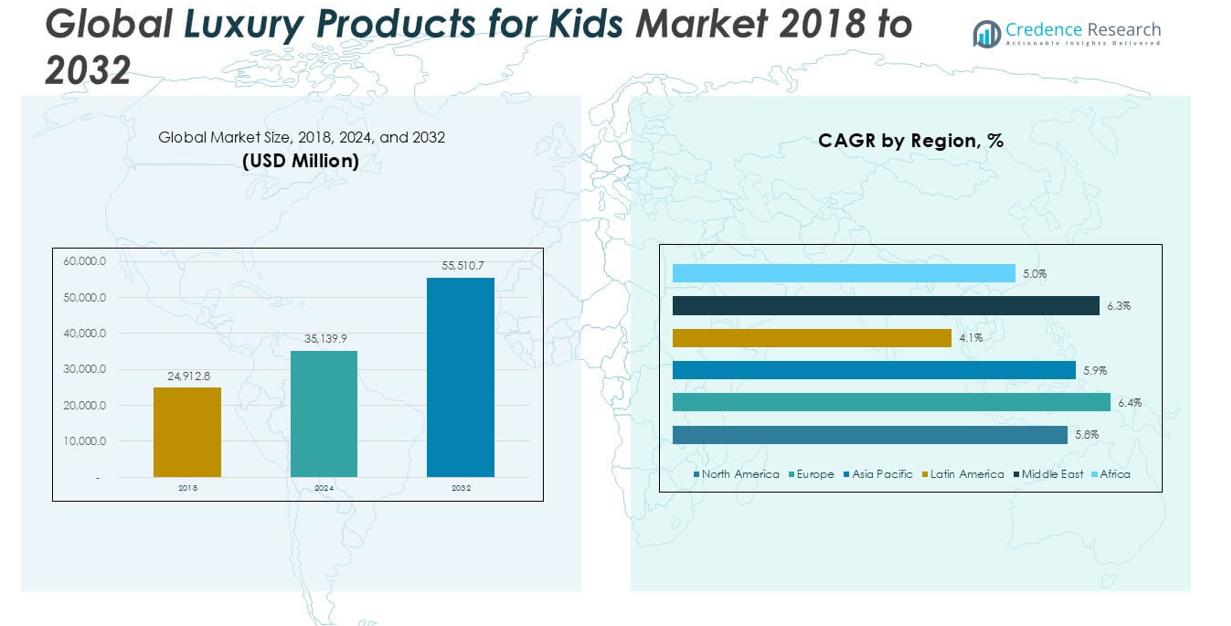

The Luxury Products for Kids market size was valued at USD 24,912.8 million in 2018 and reached USD 35,139.9 million in 2024. It is anticipated to reach USD 55,510.7 million by 2032, at a CAGR of 5.90% during the forecast period.

Top players in the Luxury Products for Kids market include GUCCI Group, United Colors of Benetton, Jack & Jill Clothing Inc., J Crew Group Inc., DKNY, Burberry Group, GIORGIO Armani S.p.A, Fendi Kids, and Moncler Enfant, all of which drive industry standards through premium offerings and distinctive brand identities. These companies lead in product innovation, quality, and exclusive collections, appealing to affluent consumers worldwide. Asia Pacific emerges as the leading region, capturing a 32.9% market share in 2024, driven by rapid urbanization, rising disposable income, and strong demand for branded luxury children’s products, followed by North America and Europe.

Market Insights

- The Luxury Products for Kids market reached USD 35,139.9 million in 2024 and is projected to reach USD 55,510.7 million by 2032, registering a CAGR of 5.90% during the forecast period.

- Market growth is driven by rising disposable incomes, evolving parental preferences for premium quality, and the influence of social media and celebrity endorsements on purchasing decisions.

- The apparel segment holds the largest share, exceeding 30% of the market, while the 1-5 age group represents the most lucrative segment due to high parental investment in early childhood.

- Intense competition among top players such as GUCCI Group, United Colors of Benetton, and Burberry Group fuels innovation and brand collaborations, though high price sensitivity and the proliferation of counterfeit products remain key restraints.

- Asia Pacific dominates with a 32.9% share in 2024, followed by North America and Europe, reflecting strong demand and expanding consumer bases in these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

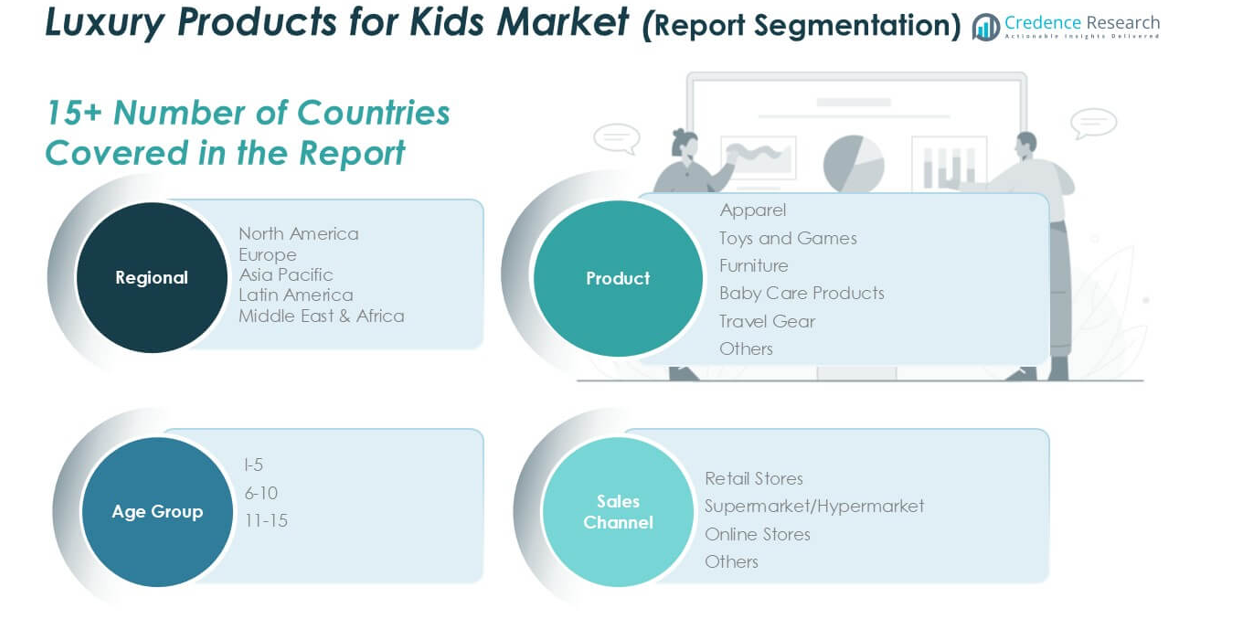

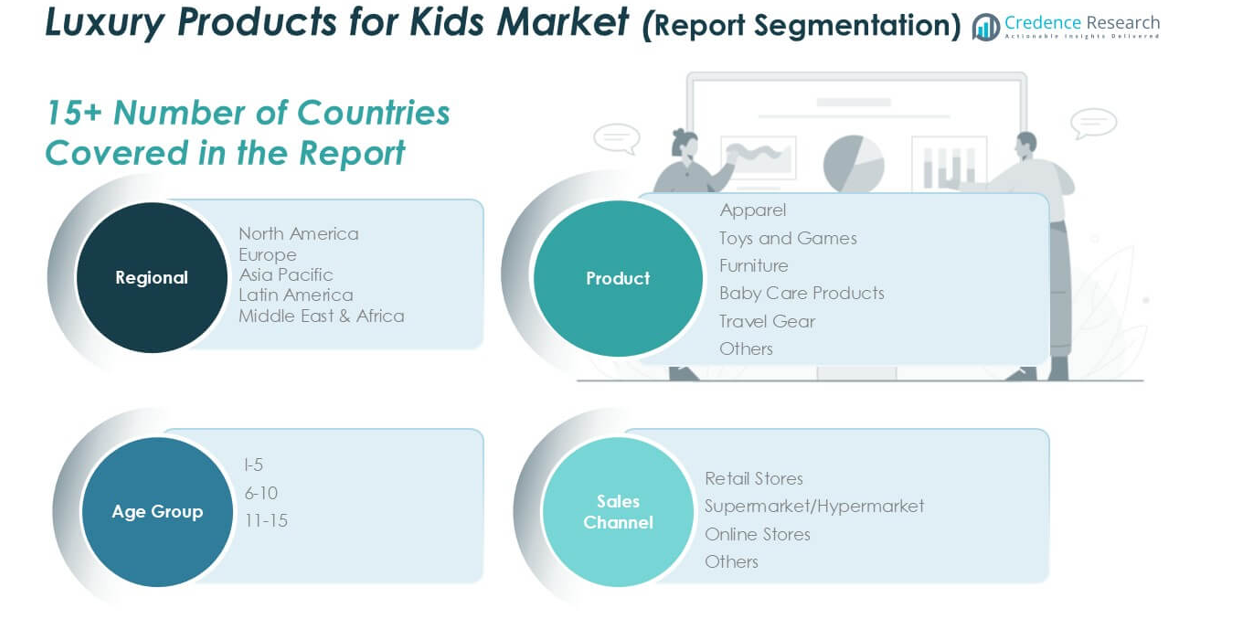

By Product

Apparel holds the largest share in the Luxury Products for Kids market, accounting for over 30% of total revenue. High demand for premium clothing brands, rising disposable incomes, and a growing trend toward designer outfits for children drive this dominance. Parents increasingly seek fashionable, high-quality garments for special occasions and everyday use, supporting continued growth in this segment. Toys and Games and Baby Care Products also contribute significantly, with innovation, safety standards, and the appeal of branded or educational toys boosting their market presence.

- For instance, in 2023, Burberry Kids launched 134 new children’s wear styles globally, with 28 exclusive pieces available only through its online store.

By Age Group

The 1-5 age group represents the dominant sub-segment, capturing nearly 45% of the Luxury Products for Kids market. Parents of younger children prioritize high-quality, safe, and comfortable products, leading to increased expenditure on luxury items for this age range. This group benefits most from premium apparel, toys, and baby care products, as consumers focus on providing the best for infants and toddlers. The 6-10 and 11-15 segments show steady growth as demand for branded items and trend-driven purchases rises with age.

- For instance, Fendi Kids introduced 67 new products in 2023 specifically targeted at the 1-5 age group, expanding its range in the segment.

By Sales Channel

Online Stores emerge as the leading sales channel, accounting for over 35% of market revenue in the Luxury Products for Kids market. The shift to digital platforms, convenience of home delivery, and access to exclusive collections fuel this growth. E-commerce offers a wide variety of luxury brands and personalized shopping experiences, appealing to modern consumers. Retail Stores and Supermarket/Hypermarkets remain important, but the expanding digital landscape and increased trust in online transactions drive the dominance of Online Stores in this segment.

Market Overview

Rising Disposable Income and Changing Lifestyle Preferences

Growth in disposable income among urban families significantly boosts spending on luxury products for children. As parents prioritize quality, safety, and branded appeal for their kids, demand for premium apparel, toys, and accessories increases. This trend is reinforced by social media influences and celebrity endorsements, which encourage aspirational purchasing and enhance brand visibility, resulting in higher market penetration for luxury children’s products.

- For instance, GUCCI Kids saw a 41% year-over-year increase in direct sales from its capsule collection promoted by celebrity brand ambassadors in 2023, selling 19,000 units in the first quarter alone.

Expansion of E-Commerce and Digital Retail Channels

The proliferation of online shopping platforms serves as a major growth driver in the Luxury Products for Kids market. E-commerce provides access to global brands, exclusive collections, and personalized shopping experiences. Parents increasingly value convenience, wider product selection, and direct-to-door delivery, which drives online sales. Companies invest in user-friendly websites and mobile apps to strengthen digital presence and attract tech-savvy consumers.

- For instance, United Colors of Benetton reported that its kids’ luxury section received 3.2 million unique visitors on its website in 2023, and processed over 720,000 online orders for children’s apparel.

Brand Innovation and Premiumization Strategies

Brands continuously innovate to differentiate their offerings and justify premium pricing in the kids’ luxury segment. Customization options, limited-edition products, and collaborations with designers or celebrities boost appeal and customer loyalty. Enhanced product safety, eco-friendly materials, and attention to comfort further elevate the perceived value, enabling brands to maintain growth and capture discerning parents seeking the best for their children.

Key Trends & Opportunities

Sustainability and Ethical Consumption

The shift toward sustainable and ethically sourced materials creates new opportunities in the market. Parents are more conscious of environmental impacts and social responsibility, prompting brands to launch eco-friendly collections and transparent sourcing practices. This not only strengthens brand reputation but also attracts environmentally aware consumers, supporting long-term market growth.

- For instance, in 2023, GIORGIO Armani S.p.A’s children’s division produced 105,000 garments made from Global Organic Textile Standard (GOTS) certified cotton.

Personalization and Experiential Shopping

Personalized products and experiential retail, such as interactive stores and exclusive events, emerge as key trends. Parents appreciate tailored clothing, custom toys, and memorable shopping experiences for their children. This trend enhances customer engagement, increases brand loyalty, and provides differentiation in a competitive market, opening avenues for premium pricing and higher margins.

- For instance, Moncler Enfant’s flagship stores hosted 18 in-store customization events in 2023, delivering over 1,400 personalized jackets and accessories for children worldwide.

Key Challenges

High Price Sensitivity Among Mass Consumers

Despite rising demand, luxury kids’ products face resistance due to high prices, limiting adoption among middle-income groups. Value-conscious shoppers often opt for affordable alternatives, constraining market expansion. Brands must balance exclusivity with accessibility to broaden their consumer base and achieve sustained growth.

Counterfeit and Imitation Products

The proliferation of counterfeit and imitation luxury products poses a significant challenge. These products undercut genuine brands, erode consumer trust, and impact revenue. Addressing this issue requires continuous investment in brand protection, secure supply chains, and consumer education to maintain the integrity of premium offerings.

Rapidly Changing Fashion Trends

Frequent shifts in children’s fashion trends require brands to adapt quickly, increasing design and production costs. Failure to keep up with evolving preferences can result in lost market share. Companies must invest in agile supply chains and responsive marketing to meet changing demands and retain consumer interest.

Regional Analysis

North America

North America holds a substantial share in the Luxury Products for Kids market, reaching USD 9,205.15 million in 2024, up from USD 6,557.06 million in 2018, and is projected to reach USD 14,449.44 million by 2032. The region accounts for approximately 26.2% of the global market in 2024, supported by a strong preference for branded children’s apparel, toys, and accessories. A steady CAGR of 5.8% highlights robust consumer spending, digital retail expansion, and a mature luxury goods sector, ensuring continued dominance in the premium kids’ segment.

Europe

Europe represents a significant portion of the Luxury Products for Kids market, with a 24.6% market share in 2024, reflecting a value of USD 8,654.96 million compared to USD 5,941.71 million in 2018. The market is projected to reach USD 14,249.60 million by 2032, registering the highest CAGR among major regions at 6.4%. Growth is driven by fashion-conscious consumers, demand for sustainable products, and strong brand heritage across countries like France, Italy, and Germany, consolidating Europe’s position as a leading hub for luxury children’s products.

Asia Pacific

Asia Pacific leads the Luxury Products for Kids market with a market share of 32.9% in 2024, reporting a value of USD 11,570.06 million, up from USD 8,188.85 million in 2018. The region is anticipated to reach USD 18,318.54 million by 2032, growing at a CAGR of 5.9%. Rapid urbanization, rising disposable income, and an expanding population of affluent parents, particularly in China and India, drive demand. The influence of global brands and increasing digital adoption further solidify Asia Pacific’s dominance in the luxury kids’ segment.

Latin America

Latin America accounts for a 8.0% market share in 2024, with the Luxury Products for Kids market reaching USD 2,817.22 million, compared to USD 2,187.35 million in 2018. The region is projected to reach USD 3,885.75 million by 2032, with a CAGR of 4.1%. Growth is moderate, supported by rising middle-class income, evolving consumer preferences, and increasing awareness of branded children’s products. However, economic volatility and limited premium retail infrastructure temper the market’s overall expansion in the region.

Middle East

The Middle East holds a 6.3% share in the Luxury Products for Kids market in 2024, with a market size of USD 2,217.83 million, up from USD 1,537.12 million in 2018. Forecasts suggest it will reach USD 3,608.20 million by 2032, reflecting a strong CAGR of 6.3%. High disposable incomes, a youthful population, and a preference for luxury goods fuel regional demand. Exclusive retail environments and high-profile international brands cater to the region’s affluent consumers, supporting steady market growth.

Africa

Africa represents a smaller but steadily expanding share, with the Luxury Products for Kids market valued at USD 674.69 million in 2024, up from USD 500.75 million in 2018. The market is expected to reach USD 999.19 million by 2032, with a CAGR of 5.0% and a market share of 1.9% in 2024. Growing urbanization, a rising affluent segment, and increased brand awareness are driving gradual uptake of luxury children’s products, although market growth remains constrained by lower purchasing power and limited retail presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product

- Apparel

- Toys and Games

- Furniture

- Baby Care Products

- Travel Gear

- Others

By Age Group

By Sales Channel

- Retail Stores

- Supermarket/Hypermarket

- Online Stores

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Luxury Products for Kids market features a strong presence of internationally recognized fashion houses and premium brands, each striving to capture market share through innovation, brand heritage, and exclusive offerings. Leading companies such as GUCCI Group, United Colors of Benetton, Jack & Jill Clothing Inc., J Crew Group Inc., DKNY, Burberry Group, GIORGIO Armani S.p.A, Fendi Kids, and Moncler Enfant anchor the market with wide-ranging product portfolios, iconic designs, and strategic collaborations. These brands focus on enhancing their value proposition through high-quality materials, limited-edition collections, and targeted marketing to affluent parents. Expansion into emerging markets, e-commerce channel development, and personalized customer experiences further strengthen their competitive positioning. The market also witnesses increasing investments in sustainability and ethical practices, as consumers become more discerning. Intense competition encourages continuous product innovation and the launch of exclusive offerings, ensuring dynamic growth and high consumer engagement within the luxury kids’ segment.

Key Player Analysis

- GUCCI Group

- United Colors of Benetton

- Jack & Jill Clothing Inc.

- J Crew Group Inc.

- DKNY

- Burberry Group

- GIORGIO Armani S.p.A

- Fendi Kids

- Moncler Enfant

Recent Developments

- In July 2024, Mubadala Capital, the asset management arm of Abu Dhabi’s sovereign wealth fund, acquired a majority stake in high-end stroller brand Bugaboo from Bain Capital. This acquisition, valuing Bugaboo at several hundred million pounds, aims to leverage growth opportunities in markets such as the U.S. and Asia. Bugaboo’s management team remains in place, with Bain retaining a minority stake.

- In June 2024, Heroes, a company specializing in acquiring small businesses that sell baby and youth products through Amazon Marketplace, reported an annual sales growth rate of 201.43% over three years, reaching sales of £82.2 million. The company has raised over £200 million from investors and has acquired brands such as Trunki, Cherish, and Baby Uma, significantly enhancing its market presence.

Market Concentration & Characteristics

The Luxury Products for Kids Market displays a moderate to high level of market concentration, with several leading global brands holding significant shares. It is characterized by the dominance of renowned fashion houses such as GUCCI Group, Burberry Group, United Colors of Benetton, and GIORGIO Armani S.p.A, which set industry benchmarks through exclusive collections and innovation. The market favors established players with strong brand recognition, high-quality materials, and strategic collaborations. Entry barriers remain high due to the need for significant investment in product development, marketing, and distribution networks. It exhibits strong brand loyalty among affluent consumers, who prioritize premium quality, safety, and style for their children. The market features a broad product range that spans apparel, toys, furniture, and travel gear, with apparel emerging as the largest segment. A growing focus on sustainability, ethical sourcing, and digital retail channels further defines market characteristics, shaping the competitive strategies of top players.

Report Coverage

The research report offers an in-depth analysis based on Product, Age Group, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Luxury Products for Kids Market will expand through rising demand for eco-conscious and ethically sourced goods.

- Luxury brands will increase personalization services to enhance customer experiences.

- E-commerce platforms will gain importance through enhanced virtual showrooms and AI-driven recommendations.

- Collaborations with children’s designers and influencers will support brand differentiation.

- Limited-edition and bespoke collections will appeal to affluent parents seeking uniqueness.

- Augmented reality technology will allow virtual fittings and interactive product exploration.

- Expanding into emerging markets will drive revenue from rising middle-class populations.

- Premium baby care and wellness products will receive heightened attention through health-focused innovations.

- Investments in sustainable packaging and recycling programs will strengthen brand trust.

- Loyalty programs and experiential retail events will fuel customer retention.