Market Overview

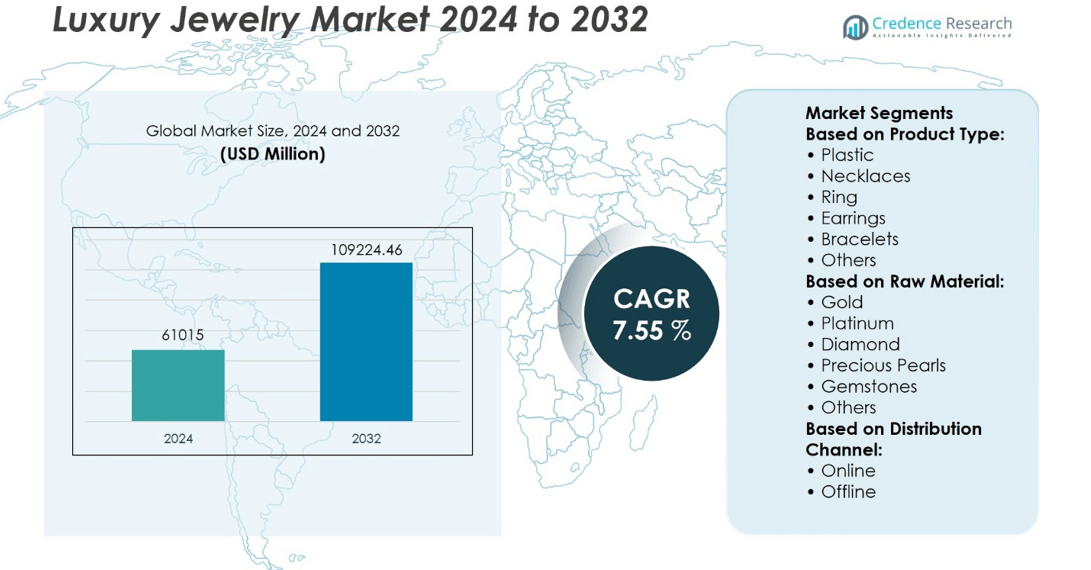

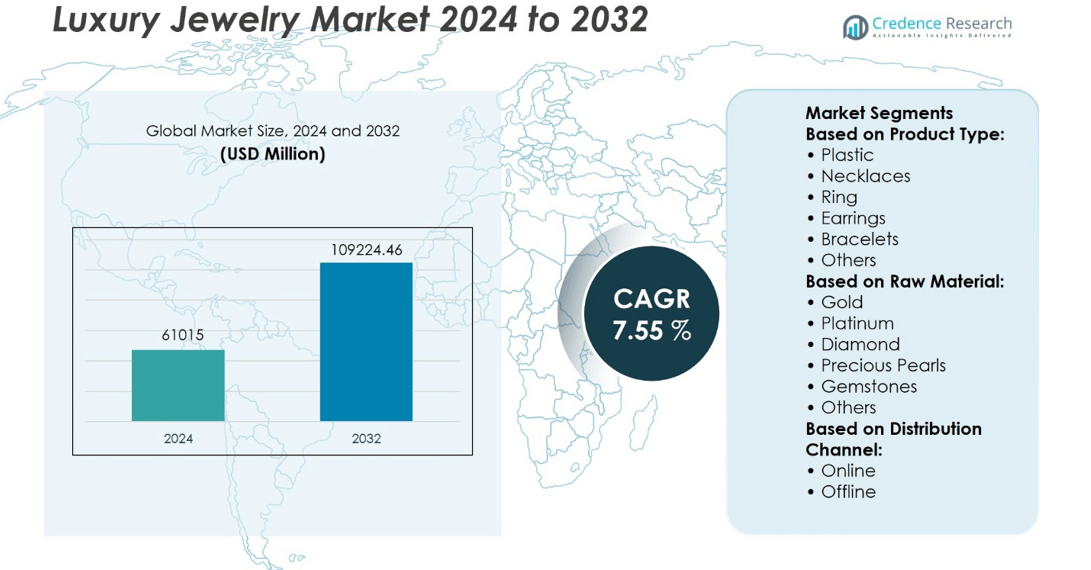

Luxury Jewelry Market size was valued at USD 61015 million in 2024 and is anticipated to reach USD 109224.46 million by 2032, at a CAGR of 7.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Jewelry Market Size 2024 |

USD 61015 million |

| Luxury Jewelry Market, CAGR |

7.5% |

| Luxury Jewelry Market Size 2032 |

USD 109224.46 million |

The Luxury Jewelry Market grows on strong drivers such as rising disposable income, cultural significance of jewelry in weddings and celebrations, and expanding demand from high-net-worth individuals across global regions. It benefits from increasing adoption of sustainable materials, ethical sourcing, and transparent supply chains that align with evolving consumer values. Digital transformation enhances accessibility through e-commerce, virtual try-ons, and personalized online experiences. Design innovation, blending heritage with modern aesthetics, strengthens brand appeal among younger consumers. The market trends highlight growing interest in gender-neutral collections, bespoke services, and integration of jewelry as both a fashion statement and long-term investment.

The Luxury Jewelry Market shows strong geographical presence, with Asia-Pacific leading due to cultural affinity and rising incomes, North America sustaining growth through high purchasing power, and Europe maintaining strength with heritage brands and tourist demand. The Middle East and Latin America present emerging opportunities fueled by rising affluence and brand expansion. Key players include Cartier, Tiffany & Co., Bvlgari, Van Cleef & Arpels, Chopard, Harry Winston, Graff Diamonds, Piaget, Mikimoto, and Rolex, each reinforcing global market competitiveness.

Market Insights

- The Luxury Jewelry Market size was valued at USD 61015 million in 2024 and is expected to reach USD 109224.46 million by 2032, at a CAGR of 7.55%.

- Rising disposable income and cultural importance of jewelry in weddings and celebrations drive consistent global demand.

- Growing adoption of sustainable materials, ethical sourcing, and transparent supply chains shapes purchasing decisions.

- Digital transformation with e-commerce, virtual try-ons, and personalized services enhances consumer engagement.

- Competition remains strong as leading brands focus on heritage, craftsmanship, exclusivity, and design innovation.

- High costs of raw materials and strict regulations act as restraints, challenging smaller entrants in the market.

- Asia-Pacific dominates growth with cultural affinity and rising incomes, North America thrives on high purchasing power, Europe sustains heritage-driven demand, and the Middle East and Latin America show emerging opportunities supported by brand expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand Driven by High-Net-Worth Individuals and Expanding Affluent Classes

The Luxury Jewelry Market benefits from the steady rise in high-net-worth individuals and the expanding affluent classes in both developed and emerging economies. Consumers with significant disposable income invest in fine jewelry to showcase wealth, heritage, and social standing. It reflects a preference for exclusivity, rarity, and craftsmanship in purchase decisions. Global wealth growth drives consistent demand for premium collections, rare gemstones, and bespoke designs. Luxury brands strengthen their positioning through private showrooms and exclusive launches targeted at elite buyers. This factor elevates the overall growth trajectory of the market.

- For instance, Cartier, part of Richemont Group, reported jewelry sales of €12,480 million in fiscal 2024, supported by strong demand from affluent customers across Asia and the Middle East.

Increasing Consumer Preference for Branded and Authenticated Jewelry Pieces

The Luxury Jewelry Market gains momentum from a rising preference for branded products that guarantee authenticity and enduring value. Buyers prioritize traceability of materials, certified gemstones, and hallmarking processes to ensure credibility. It strengthens trust and promotes loyalty toward established luxury houses. Brands highlight heritage, craftsmanship, and innovation to reinforce exclusivity. Authentication technologies, including blockchain-based certification, enhance buyer confidence. This driver enhances the market’s resilience against counterfeit products.

- For instance, Tiffany & Co., acquired by LVMH in 2021, reported jewelry sales of $5,115 million in fiscal 2023, supported by its Diamond.

Expansion of E-Commerce Channels and Digital Client Engagement Platforms

The Luxury Jewelry Market adapts to changing consumer behavior through digital retail and personalized online experiences. E-commerce platforms introduce wider product visibility, curated catalogs, and secure purchasing frameworks for global clients. It enables international expansion of luxury brands by reaching customers beyond traditional flagship stores. Virtual try-on solutions, AI-driven recommendations, and live consultations replicate the luxury experience online. High-value transactions through secure digital platforms create strong trust among consumers. This factor broadens access to luxury collections and elevates sales opportunities.

Heightened Focus on Sustainability and Ethical Sourcing Practices

The Luxury Jewelry Market evolves through growing emphasis on sustainability, transparency, and ethical sourcing. Consumers seek responsibly mined diamonds, recycled metals, and environmentally conscious practices in jewelry manufacturing. It compels brands to disclose sourcing methods and adopt traceability measures. Government regulations and industry standards reinforce this direction, ensuring compliance with ethical benchmarks. Leading luxury houses integrate sustainability into brand narratives, appealing to socially responsible consumers. This shift strengthens the long-term trust and value perception of the market.

Market Trends

Growing Influence of High Jewelry Collaborations and Limited-Edition Collections

The Luxury Jewelry Market observes strong momentum from collaborations between heritage brands and renowned designers or artists. These partnerships create limited-edition collections that heighten exclusivity and attract elite buyers. It strengthens brand prestige while catering to consumers seeking originality and cultural connection. Limited availability reinforces desirability and premium positioning. Collaborations often integrate unique craftsmanship with modern aesthetics to appeal to younger high-net-worth audiences. This trend elevates luxury jewelry into collectible art forms.

- For instance, Bvlgari, part of LVMH, collaborated with architect Zaha Hadid on the B.Zero1 Design Legend collection, and in 2023 its jewelry division reported sales of 3,079 million, reflecting how innovative collaborations with world-class designers can strengthen exclusivity and drive substantial revenues.

Digital Transformation through Virtual Retail Experiences and Immersive Tools

The Luxury Jewelry Market adapts to digital transformation with technologies that enhance engagement. Virtual try-on solutions, augmented reality, and immersive platforms replicate the in-store luxury experience. It provides consumers with confidence in high-value purchases without physical presence. Brands invest in AI-driven personalization to create tailored product recommendations. Secure digital channels support global expansion while maintaining exclusivity. This trend accelerates the adoption of omnichannel strategies in luxury retail.

- For instance, Cartier integrated augmented reality try-on features and immersive e-commerce platforms across key markets, which contributed to Richemont’s Jewellery Maisons division generating €15,328 million in sales during fiscal year 2025.

Increasing Popularity of Gender-Neutral and Customizable Jewelry Designs

The Luxury Jewelry Market evolves with rising acceptance of gender-neutral collections and customizable pieces. Consumers value personal expression over traditional design boundaries. It drives brands to release versatile collections suited for diverse audiences. Customization options, including engraving and modular designs, strengthen emotional connection and individuality. Younger consumers view jewelry as both an investment and a lifestyle accessory. This trend reshapes creative direction and expands customer inclusivity.

Strong Emphasis on Ethical Luxury and Sustainable Craftsmanship Standards

The Luxury Jewelry Market witnesses a marked shift toward ethical sourcing and sustainable craftsmanship. Responsible mining practices, recycled metals, and lab-grown diamonds gain acceptance among conscious consumers. It compels leading brands to integrate transparency into supply chains and marketing strategies. Certifications and blockchain traceability assure buyers of ethical authenticity. Consumers increasingly favor brands that align with sustainability and social responsibility values. This trend reinforces long-term trust in luxury jewelry investments.

Market Challenges Analysis

Rising Impact of Counterfeiting and Market Saturation in Key Luxury Hubs

The Luxury Jewelry Market faces persistent challenges from counterfeit products and unauthorized replicas that undermine brand integrity. Counterfeiting erodes consumer trust and diverts significant revenue from legitimate channels. It compels brands to invest heavily in authentication technologies and legal enforcement. Market saturation in mature regions further intensifies competition, reducing growth opportunities for established players. Rising consumer expectations for innovation and exclusivity pressure brands to continuously refresh collections. These factors complicate long-term stability in competitive markets.

Escalating Raw Material Costs and Vulnerability to Regulatory Scrutiny

The Luxury Jewelry Market confronts rising costs of precious metals and gemstones, which directly impact margins and pricing strategies. It forces brands to balance between premium positioning and affordability for high-net-worth buyers. Regulatory scrutiny on ethical sourcing, environmental compliance, and labor practices intensifies the operational burden. Transparency requirements demand robust traceability systems, adding cost and complexity to global supply chains. Currency fluctuations further complicate procurement for brands dependent on international sourcing. These challenges place sustained pressure on profitability and operational efficiency.

Market Opportunities

Expansion Potential through Emerging Markets and Wealth Growth in New Economies

The Luxury Jewelry Market holds significant opportunities in emerging economies where rising disposable incomes and expanding affluent classes stimulate demand. It benefits from the growing number of first-time luxury buyers seeking premium products that symbolize status and investment value. Urbanization and lifestyle shifts in Asia-Pacific, Middle East, and parts of Latin America create untapped avenues for luxury brands. Strategic retail expansion into these regions provides access to a wider consumer base. Exclusive boutiques, pop-up experiences, and personalized services can strengthen loyalty in these new markets. This creates a foundation for sustained revenue growth across underpenetrated geographies.

Opportunities through Innovation in Sustainable Materials and Digital Experiences

The Luxury Jewelry Market can leverage innovation in sustainable materials and digital platforms to attract younger, socially conscious buyers. It gains momentum from rising demand for lab-grown diamonds, recycled metals, and ethically sourced gemstones. Transparent supply chains and certification systems reinforce consumer trust. At the same time, digital engagement tools such as virtual try-on, AI-based personalization, and secure e-commerce channels create new sales pathways. Integration of technology with craftsmanship enables brands to extend exclusivity into the online sphere. This dual focus on sustainability and digital luxury offers strong opportunities for long-term differentiation.

Market Segmentation Analysis:

By Product Type

The Luxury Jewelry Market shows versatility across necklaces, rings, earrings, bracelets, and other premium categories. Rings remain central, supported by strong association with weddings, engagements, and milestone celebrations. Necklaces attract significant attention due to their role in high jewelry collections and cultural symbolism. It underlines the enduring relevance of earrings as both fashion statements and investment pieces. Bracelets appeal to younger demographics seeking versatile and collectible designs. Other luxury items, including brooches and bespoke creations, strengthen the overall product mix and cater to niche demand.

By Raw Material

The Luxury Jewelry Market demonstrates strong demand across gold, platinum, diamonds, precious pearls, and gemstones. Gold remains the most widely used material, valued for both cultural significance and investment appeal. Platinum attracts consumers seeking exclusivity and rarity, while diamonds maintain dominance in engagement and wedding collections. It highlights enduring consumer trust in certified diamond jewelry across global markets. Precious pearls and colored gemstones add diversity, appealing to buyers who prioritize uniqueness and aesthetic value. Other innovative materials, including recycled metals and lab-grown diamonds, expand options for socially responsible consumers.

- For instance, Bvlgari, a brand owned by LVMH, contributed to LVMH’s impressive Watches & Jewelry division sales of €10,902 million by expanding its Forever and Serpenti collections.

By Distribution Channel

The Luxury Jewelry Market evolves with a dual focus on online and offline channels. Offline retail continues to dominate through flagship stores, exclusive boutiques, and high-end department stores where brand experience and personal interaction remain crucial. It emphasizes the role of offline formats in reinforcing brand heritage and exclusivity. Online channels gain momentum as digital platforms enhance accessibility and personalization. Virtual try-on tools, secure transactions, and curated digital catalogs increase consumer confidence in purchasing high-value items online. Both channels create complementary growth pathways that strengthen the reach and visibility of luxury jewelry brands.

- For instance, Tiffany & Co. strengthened its e-commerce presence by exclusive high-jewelry SKUs in 2023, contributing to LVMH’s Watches & Jewelry division revenue of €10,902 million.

Segments:

Based on Product Type:

- Plastic

- Necklaces

- Ring

- Earrings

- Bracelets

- Others

Based on Raw Material:

- Gold

- Platinum

- Diamond

- Precious Pearls

- Gemstones

- Others

Based on Distribution Channel:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a 39.2% share of the luxury jewelry market, supported by high purchasing power and established luxury brands. The United States leads demand, particularly in metropolitan areas such as New York and Los Angeles. Consumers in the region value design innovation, personalization, and sustainable sourcing. E-commerce and digital marketing enhance accessibility, while celebrity endorsements and cultural trends drive brand loyalty. North America remains a key hub for innovation and luxury retail.

Europe

Europe accounts for 21.5% share of the global luxury jewelry market. The region is home to some of the most prestigious luxury houses, including those in France, Italy, and Switzerland. Heritage, craftsmanship, and strong tourism activity sustain demand. European consumers favor classic, timeless designs alongside new trends in ethical sourcing and sustainable production. Luxury jewelry is also supported by high tourist spending in destinations like Paris, Milan, and London.

Asia-Pacific

Asia-Pacific dominates the global luxury jewelry market with 66.6% share. The region’s leadership is driven by strong demand in China and India, where jewelry holds cultural importance in weddings, festivals, and investments. Rising disposable income, a growing middle class, and urbanization support continuous growth. Local manufacturing, brand recognition, and increasing customization also strengthen the region’s position. International and domestic players expand aggressively, making Asia-Pacific the largest and fastest-growing market.

Latin America

Latin America represents 4.5% share of the luxury jewelry market. Brazil and Mexico are the largest contributors, supported by growing middle classes and urban populations. Consumers in the region are increasingly adopting international luxury brands, while local jewelers gain popularity through cultural designs. Although smaller in scale, Latin America shows steady growth potential as awareness of global trends and online availability improves.

Middle East & Africa

The Middle East & Africa holds 7.8% share of the market. Demand is concentrated in Gulf countries such as the UAE, Saudi Arabia, and Qatar, where luxury jewelry is integral to cultural traditions and gifting. High-income consumers and a young, aspirational population support market expansion. Events such as jewelry expos in Riyadh and Dubai further encourage growth. Africa also shows rising interest, particularly in South Africa, due to increasing urban affluence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mikimoto

- Graff Diamonds

- Rolex

- Bvlgari

- Harry Winston

- Piaget

- Chopard

- Van Cleef & Arpels

- Tiffany & Co.

- Cartier

Competitive Analysis

The luxury jewelry market features led by Cartier, Tiffany & Co., Bvlgari, Van Cleef & Arpels, Chopard, Harry Winston, Graff Diamonds, Piaget, Mikimoto, and Rolex. The luxury jewelry market is highly competitive, defined by heritage brands with long-standing reputations for craftsmanship, exclusivity, and design excellence. Competition centers on product innovation, rare gemstone sourcing, and the ability to deliver personalized experiences that appeal to affluent consumers. Companies focus on expanding global retail footprints, investing in digital platforms, and strengthening brand loyalty through storytelling and cultural collaborations. Sustainability and ethical sourcing have become critical differentiators, with leading houses promoting transparency in their supply chains to meet shifting consumer expectations. Marketing strategies increasingly combine tradition with modernity, highlighting both artisanal heritage and contemporary lifestyle appeal. As competition intensifies, the market rewards players that balance exclusivity with accessibility, while adapting quickly to evolving consumer values and regional preferences.

Recent Developments

- In February 2025, Tanishq debuted at New York Fashion Week, collaborating with fashion designer, Bibhu Mohapatra. The collaboration featured over 40 creations, complementing Bibhu’s 2025 Fall collection inspired by Indian heritage.

- In February 2025, Aesop, known for its unconventional fragrances, collaborated with jeweler Patcharavipa Bodiratnangkura to create a limited-edition rhodium-plated ear cuff, inspired by the brand’s floral fragrance “Aurner.”

- In January 2025, Graff unveiled a new masterpiece in celebration of Haute Couture Week in Paris showcasing exquisite high jewelry creations.

- In July 2024, Marie Claire USA collaborated with luxury jewelry brand Tacori for the WORTH it content series, exploring the brand’s heritage that began three generations ago.

Market Concentration & Characteristics

The Luxury Jewelry Market demonstrates a high level of concentration, with a small group of established global brands controlling significant market share through heritage, exclusivity, and strong distribution networks. It is characterized by premium positioning, limited accessibility, and high brand loyalty, supported by reputations built over decades. The market places strong emphasis on craftsmanship, rare materials, and innovative designs that blend tradition with modern trends. It continues to expand in regions with rising disposable income and cultural affinity for jewelry, while mature markets focus on personalization, ethical sourcing, and sustainable production practices. Competition remains intense, yet differentiated by brand storytelling, bespoke services, and strategic collaborations that enhance exclusivity. High barriers to entry created by capital requirements, brand recognition, and consumer trust reinforce the dominance of incumbents. It reflects a blend of artistry, cultural symbolism, and investment value, shaping luxury jewelry as both a status symbol and a personal expression.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Raw Material, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand further in Asia-Pacific driven by rising incomes and strong cultural demand for jewelry.

- Sustainability will remain a critical focus with brands investing in ethical sourcing and transparent supply chains.

- Digital platforms will play a larger role in sales as consumers increasingly purchase luxury jewelry online.

- Personalization will grow as customers seek unique designs and bespoke services tailored to individual preferences.

- Heritage and craftsmanship will continue to define brand value while appealing to high-net-worth consumers.

- Demand for gender-neutral and versatile designs will increase as fashion trends evolve globally.

- Investment in rare gemstones and high-value collections will rise as consumers view jewelry as both luxury and asset.

- Collaborations with fashion, art, and culture will strengthen brand storytelling and consumer engagement.

- Expansion into emerging markets in Latin America and the Middle East will create new revenue opportunities.

- Innovation in design and integration of modern aesthetics will help established brands retain competitive advantage.