| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Spa Services Market Size 2024 |

USD 49,407.7 Million |

| Luxury Spa Services Market, CAGR |

7.20% |

| Luxury Spa Services Market Size 2032 |

USD 85,926.4 Million |

Market Overview:

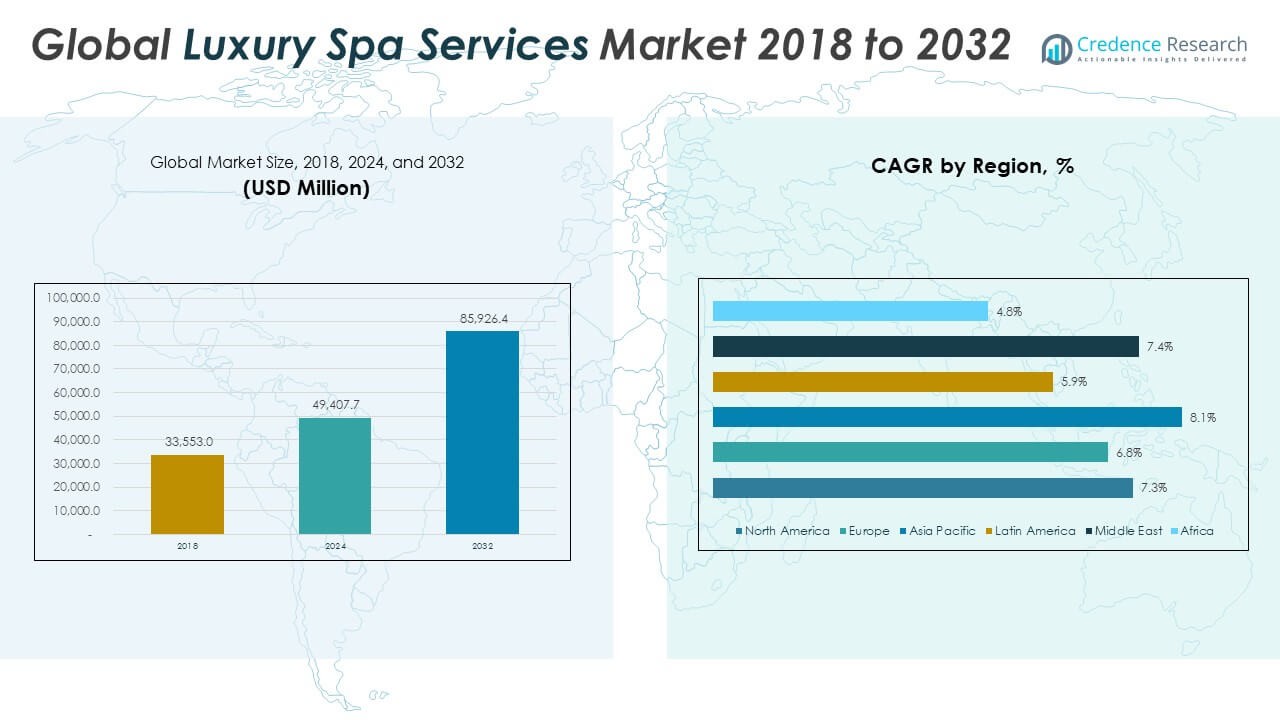

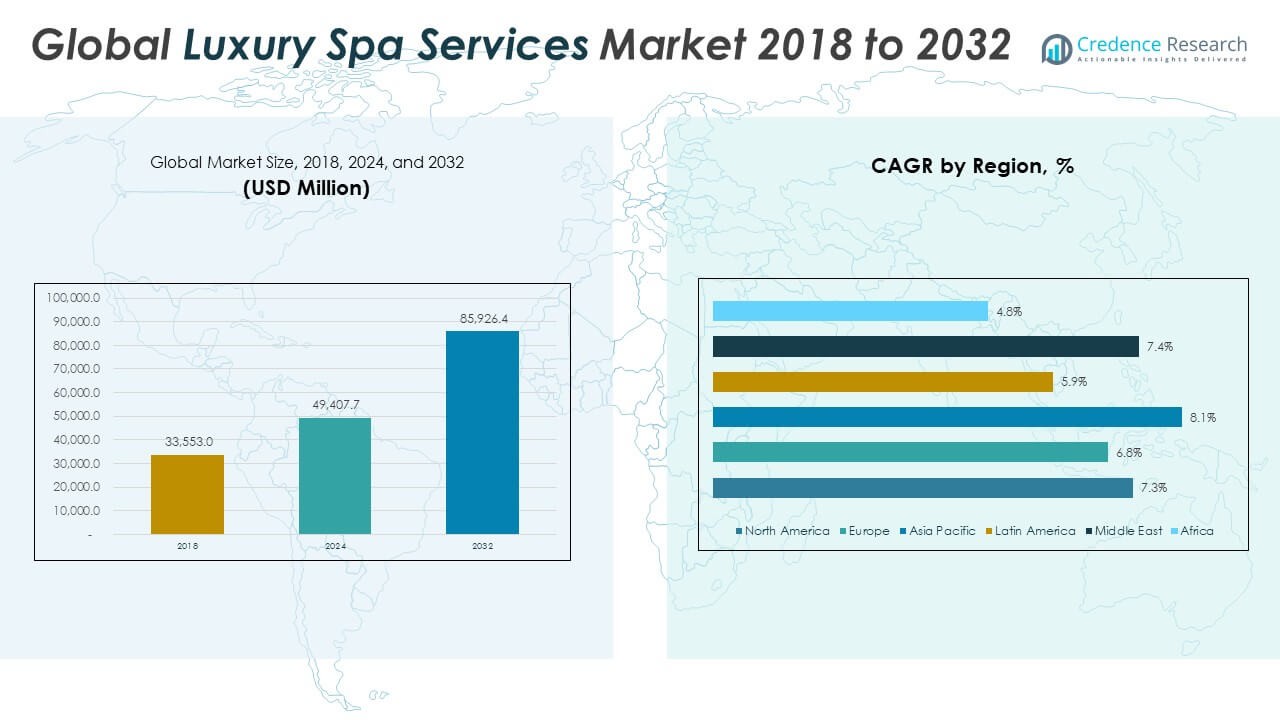

The Luxury Spa Services Market size was valued at USD 33,553.0 million in 2018 to USD 49,407.7 million in 2024 and is anticipated to reach USD 85,926.4 million by 2032, at a CAGR of 7.20% during the forecast period.

The market is primarily driven by the rising popularity of wellness tourism, growing demand for preventive health and self-care, and the integration of advanced therapeutic technologies into spa services. High-net-worth individuals are increasingly investing in luxurious and transformative wellness experiences such as hydrotherapy, cryotherapy, stem-cell facials, and personalized longevity programs. Additionally, partnerships between luxury hospitality brands and medical wellness providers are expanding the scope of services offered at upscale spa facilities. The wellness industry’s evolution from indulgence-based treatments to science-backed therapies is attracting both new demographics, including men and Gen Z consumers, and repeat clientele seeking lasting health benefits. Mental health awareness, stress-related disorders, and the search for holistic well-being further support the rising appeal of luxury spa services globally.

Regionally, North America leads the luxury spa services market due to its well-established wellness infrastructure, high consumer spending on health and beauty, and growing interest in technologically advanced spa solutions. The United States, in particular, continues to be a key market, with hotel-based and medical spas offering innovative treatments and high-end experiences. Europe follows closely, benefiting from a strong tradition of destination and thermal spas in countries like Germany, France, and Hungary. The region contributes a significant share to global revenues and maintains consistent growth through wellness tourism and cultural acceptance of spa treatments. However, the fastest growth is observed in Asia-Pacific, driven by rising disposable incomes, rapid urbanization, and the revival of traditional healing practices in countries like India, China, Thailand, and Indonesia. Luxury spa resorts in the region are increasingly appealing to both domestic and international tourists.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Luxury Spa Services Market reached USD 49,407.7 million in 2024 and is projected to grow to USD 85,926.4 million by 2032, expanding at a CAGR of 7.20%.

- Wellness tourism remains the top growth driver, with affluent travelers seeking health-focused vacations that include personalized spa and wellness treatments.

- Demand for preventive healthcare is rising, with services like detoxification, biohacking, and hormone balancing gaining traction among health-conscious clients.

- Technological integration—such as AI diagnostics, cryotherapy, and oxygen therapy—is enhancing treatment personalization and operational efficiency.

- Strategic alliances between hospitality groups, biotech companies, and wellness brands are expanding service scope and client reach across the luxury segment.

- High operating costs, talent shortages, and pricing pressures challenge profitability, especially for smaller operators striving to maintain luxury standards.

- Regionally, North America leads due to advanced infrastructure, while Asia-Pacific shows the fastest growth driven by urbanization and rising wellness tourism.

Market Drivers:

Rising Wellness Tourism and High-End Health Experiences Drive Demand

The Luxury Spa Services Market is experiencing rapid growth due to the rising popularity of wellness tourism among affluent travelers. Consumers are prioritizing health-centric vacations that integrate premium spa treatments into holistic travel experiences. Destinations offering luxurious, culturally unique, and medically supervised spa programs are gaining traction across the globe. Properties that combine scenic retreats with tailored services such as Ayurvedic therapy, hydrothermal circuits, and anti-aging programs are seeing increased occupancy. Demand is high for wellness resorts that focus on physical rejuvenation and mental wellness. This trend is elevating luxury spa services into essential components of travel itineraries, especially in regions with strong health and hospitality infrastructure.

Consumer Preference for Preventive Healthcare and Personalized Wellness Solutions

The shift in consumer behavior toward preventive health and longevity is reinforcing the market’s momentum. Affluent clients prefer luxury spa offerings that support long-term health management over short-term indulgence. Services such as detoxification programs, biohacking therapies, and medical-grade facials are gaining popularity for their clinical backing and effectiveness. Consumers expect spa treatments to deliver measurable benefits, including improved sleep, reduced inflammation, and stress relief. The Luxury Spa Services Market is expanding its reach by offering highly personalized wellness solutions that align with individual health goals. It is also integrating nutrition planning, hormone balancing, and lifestyle coaching into curated treatment journeys.

- For instance, INNBEAUTY PROJECT serum is promoted as dermatologist-tested, hypoallergenic, and non-comedogenic, and is claimed to deliver visible improvements in elasticity, luminosity, and hydration.

Technological Integration Elevates Service Efficiency and Consumer Satisfaction

Advancements in spa technologies are transforming how luxury services are delivered and perceived. From AI-driven diagnostic tools to oxygen chambers and cryotherapy units, technology is redefining the standard of care in high-end wellness facilities. Consumers value the precision, customization, and time efficiency offered by tech-enabled treatments. Luxury spa operators are incorporating data-based personalization to match services with skin types, biological age, and stress levels. It enables spas to offer treatments with higher efficacy and reduced recovery times. The market benefits from this enhanced service quality, which builds loyalty among discerning clients.

- For example, Six Senses Spas, for instance, have integrated the Biohacking Recovery Lounge concept across several flagship properties since 2024. This lounge features state-of-the-art equipment such as the Somadome meditation pod, which uses binaural beats and chromotherapy to reduce guest stress levels.

Strategic Partnerships and Expanding Customer Demographics Broaden Market Reach

Hotel chains, wellness brands, and biotech companies are forming strategic alliances to elevate luxury spa offerings. These partnerships strengthen brand positioning and allow shared expertise in delivering advanced services. The Luxury Spa Services Market is witnessing diversification in its customer base, with growing interest from male clients and younger generations. Gen Z and millennials are opting for luxury experiences that blend aesthetics, wellness, and social value. Men are engaging more frequently with spa treatments focused on performance recovery and mental wellness. This shift is encouraging market players to redesign services and environments that cater to evolving expectations without diluting brand exclusivity.

Market Trends:

Integration of Scientific Therapies with Traditional Spa Practices Enhances Service Value

The Luxury Spa Services Market is witnessing a significant trend toward merging traditional wellness treatments with science-backed therapies. Facilities are adopting evidence-based modalities such as infrared saunas, cryotherapy, and IV nutrition to enhance the effectiveness of conventional services like massages and facials. Clients seek experiences that not only relax but also provide measurable physiological benefits. Spa operators are curating treatments that combine ancient healing techniques with modern diagnostics. This hybrid model attracts wellness-conscious consumers who value authenticity and results. It also supports the market’s shift from luxury indulgence to performance-based wellness solutions.

- For instance, Starpool has developed spa systems that incorporate infrared technology, remote diagnostics, and energy optimization features like their Green Pack system, which claims to achieve significant energy savings by managing power distribution and maintaining optimal sauna and steam bath temperatures.

Personalization and Data-Driven Offerings Elevate Client Experiences

High-end spas are adopting personalization through biometric assessments, AI diagnostics, and genetic profiling. These tools allow practitioners to design treatment programs tailored to individual needs and preferences. The Luxury Spa Services Market is leveraging this approach to deliver hyper-customized services that reflect each client’s wellness goals. Data-driven insights help optimize session duration, product choice, and recovery recommendations. Clients experience better outcomes, leading to increased satisfaction and retention. It encourages repeat visits and higher spending per session, strengthening the value proposition of luxury spa brands.

Wellness Real Estate and Lifestyle Integration Expand Market Influence

Luxury spas are becoming central features in wellness-focused real estate and lifestyle resorts. Developers are incorporating spa facilities into residential communities, luxury hotels, and private clubs to meet the growing demand for year-round wellness access. The Luxury Spa Services Market is expanding beyond standalone facilities, embedding itself into daily living environments. Spa memberships, on-site therapists, and exclusive wellness lounges are turning into long-term lifestyle offerings. This model ensures continuous client engagement and supports the positioning of spa services as essential, not occasional. It reinforces brand loyalty and opens new revenue streams for spa operators.

Ethical Luxury and Sustainability Practices Reshape Consumer Expectations

Affluent clients increasingly evaluate spa brands based on their ethical sourcing, environmental practices, and community impact. The market is responding by using organic skincare products, biodegradable packaging, and eco-friendly facility designs. The Luxury Spa Services Market is aligning with sustainability goals without compromising on opulence. Brands are adopting cruelty-free formulations and offering experiences rooted in local, natural ingredients. Consumers appreciate transparency and value-driven experiences, which influence booking choices. It drives innovation and accountability, making sustainability a competitive advantage in the luxury wellness space.

- For example, Green Spa” or eco-friendly spas prioritize the use of organic ingredients, recyclable packaging, and support for local communities. They also tend to favor production methods that utilize renewable resources.

Market Challenges Analysis:

High Operational Costs and Talent Shortages Affect Profitability and Service Consistency

The Luxury Spa Services Market faces persistent pressure from high operating expenses tied to premium facility standards, advanced equipment, and skilled labor. Maintaining an elite ambiance with personalized services requires significant investment in interiors, technology, and wellness product inventory. Recruiting and retaining qualified therapists, aestheticians, and medical wellness experts adds further complexity due to global talent shortages. It often leads to inconsistent service quality, longer wait times, or limited treatment availability in peak seasons. Smaller operators struggle to balance luxury expectations with rising fixed costs, impacting their margins. These challenges demand efficient workforce planning and streamlined operations to maintain profitability.

Economic Uncertainty and Pricing Sensitivity Limit Market Accessibility

Luxury spa services are discretionary in nature, making the market vulnerable to economic fluctuations and changing consumer spending patterns. Periods of financial instability often lead to reduced spending on high-end wellness, even among affluent segments. The Luxury Spa Services Market must navigate this by offering flexible pricing strategies without diluting brand prestige. It also faces pressure from mid-tier spas expanding their offerings to include premium-like experiences at lower price points. This growing competition can affect customer retention, especially among younger clients seeking value-driven luxury. Balancing exclusivity with evolving affordability expectations remains a critical challenge for sustained market growth.

Market Opportunities:

Expansion into Emerging Wellness Destinations Unlocks Untapped Demand

The Luxury Spa Services Market can achieve strong growth by expanding into emerging wellness hubs across Asia, the Middle East, and Latin America. Rising disposable incomes and increasing awareness of wellness benefits are driving interest in premium spa experiences in these regions. Integrating local healing traditions with luxury treatments appeals to both domestic clients and international wellness tourists. It allows brands to create culturally relevant offerings that stand out in competitive markets. Strategic partnerships with luxury resorts and medical wellness providers can further accelerate market entry. This approach helps diversify revenue streams and reduce dependence on saturated urban centers.

Digital Integration and At-Home Luxury Wellness Create New Revenue Channels

Advanced digital tools enable luxury spas to offer personalized pre-visit consultations, virtual wellness coaching, and subscription-based at-home treatment kits. Consumers seek convenience and value brands that provide a seamless online-to-offline experience. The Luxury Spa Services Market can benefit by investing in platforms that extend its reach beyond physical locations. Offering app-based bookings, wellness tracking, and AI-guided treatment recommendations enhances client engagement. It also opens opportunities to build recurring revenue through high-end product lines and membership models. This digital evolution supports scalability while maintaining exclusivity.

Market Segmentation Analysis:

The Luxury Spa Services Market is segmented by service type, spa type, and gender, each contributing uniquely to overall market growth.

By service type, massage therapies account for the largest revenue share due to their broad appeal across demographics and proven therapeutic benefits. Facial and skin treatments follow closely, driven by rising demand for anti-aging solutions and personalized skincare. Wellness rituals, which include detox programs and holistic therapies, are gaining popularity among wellness-focused consumers. Pain management and medical spa services are expanding their reach with science-backed offerings such as physiotherapy, hydrotherapy, and recovery-focused treatments. The “others” category includes niche services like aromatherapy and energy healing.

- For instance, Anantara Hotels, Resorts & Spasintroduced the “Journey of Siam” wellness ritual, which combines traditional Thai therapies with herbal detoxification.

By spa type, the market is categorized into medispa and non-medispa. Medispas lead in growth due to their integration of advanced technologies and medically supervised treatments. Non-medispa facilities continue to appeal to traditional wellness seekers, offering experiential and relaxation-driven services.

- The Bamford Wellness Spa in the UK is a well-regarded example of a non-medical spa focusing on traditional wellness seekers, emphasizing a holistic approach to well-being. It offers a range of treatments and classes designed to nurture the body, mind, and spirit, using natural and organic products.

By gender, women dominate market demand; however, the male segment is growing steadily with increased interest in grooming, recovery, and mental wellness services. The Luxury Spa Services Market is evolving to serve both core and emerging client segments through tailored experiences across all categories.

Segmentation:

By Service Type:

- Massage Therapies

- Facial & Skin Treatments

- Wellness Rituals

- Pain Management / Medical

- Others

By Spa Type:

By Gender:

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

The North America Luxury Spa Services Market size was valued at USD 9,582.74 million in 2018 to USD 14,163.77 million in 2024 and is anticipated to reach USD 24,755.39 million by 2032, at a CAGR of 7.30% during the forecast period. North America holds a leading position with the highest market share in the global Luxury Spa Services Market. The region benefits from strong consumer spending power, widespread wellness awareness, and advanced spa technologies. The United States dominates regional demand, driven by high-end urban spas and resort-based wellness centers. It consistently attracts both domestic and international wellness travelers seeking premium services. The integration of medical-grade treatments and digital wellness experiences further strengthens its position. Strategic collaborations between luxury hotels and wellness brands continue to enhance growth in North America.

The Europe Luxury Spa Services Market size was valued at USD 10,471.90 million in 2018 to USD 15,117.34 million in 2024 and is anticipated to reach USD 25,588.88 million by 2032, at a CAGR of 6.80% during the forecast period. Europe commands a significant market share due to its long-standing tradition of wellness tourism and spa culture. Countries like Germany, France, and Hungary contribute substantially, offering thermal spas, destination retreats, and integrated wellness resorts. The Luxury Spa Services Market here is shaped by regional consumer preferences for authenticity, sustainability, and experiential luxury. European spas emphasize holistic approaches that blend natural therapies with modern wellness. The presence of heritage spa towns and luxury hospitality infrastructure boosts the market’s appeal. It maintains steady growth by catering to wellness-minded travelers across all age groups.

The Asia Pacific Luxury Spa Services Market size was valued at USD 7,942.00 million in 2018 to USD 12,353.34 million in 2024 and is anticipated to reach USD 23,011.09 million by 2032, at a CAGR of 8.10% during the forecast period. Asia Pacific represents the fastest-growing region in the Luxury Spa Services Market, supported by rising incomes and evolving consumer lifestyles. Countries such as China, India, Thailand, and Indonesia are emerging as prime destinations for wellness tourism. The market thrives on a unique blend of ancient healing traditions and luxury offerings. It gains momentum from both domestic travelers and international visitors seeking culturally rich and immersive wellness experiences. Government support for wellness tourism and infrastructure development enhances regional growth. Asia Pacific is quickly becoming a global hub for high-end spa services.

The Latin America Luxury Spa Services Market size was valued at USD 2,909.05 million in 2018 to USD 4,002.02 million in 2024 and is anticipated to reach USD 6,307.00 million by 2032, at a CAGR of 5.90% during the forecast period. Latin America holds a smaller but steadily expanding share of the global Luxury Spa Services Market. The region benefits from its natural landscapes and biodiversity, which serve as the foundation for wellness resorts. Brazil, Mexico, and Costa Rica are key contributors, attracting wellness tourists with eco-luxury experiences. The market is increasingly incorporating indigenous therapies and sustainable spa practices. It appeals to travelers seeking off-the-beaten-path relaxation without compromising on comfort. Limited infrastructure in some areas presents a challenge, but it also offers potential for high-end development.

The Middle East Luxury Spa Services Market size was valued at USD 1,714.56 million in 2018 to USD 2,550.14 million in 2024 and is anticipated to reach USD 4,493.95 million by 2032, at a CAGR of 7.40% during the forecast period. The Middle East is emerging as a competitive player in the Luxury Spa Services Market, supported by luxury tourism and wellness-focused urban development. Countries like the UAE and Saudi Arabia are investing heavily in high-end wellness resorts and spa-integrated real estate. The region’s hospitality sector emphasizes opulence and personalized wellness, often delivered through premium hotel chains. It attracts a growing number of global travelers looking for modern luxury rooted in cultural richness. Strong government support and infrastructure investments position the Middle East as a high-potential market. The demand for wellness experiences that blend innovation with tradition is steadily increasing.

The Africa Luxury Spa Services Market size was valued at USD 932.77 million in 2018 to USD 1,221.08 million in 2024 and is anticipated to reach USD 1,770.08 million by 2032, at a CAGR of 4.80% during the forecast period. Africa accounts for the smallest share in the Luxury Spa Services Market but shows long-term growth potential. Countries like South Africa, Morocco, and Kenya are introducing wellness tourism offerings that highlight natural settings and indigenous practices. The market is gradually attracting attention from global luxury travelers seeking unique, culturally immersive spa experiences. Infrastructure limitations remain a constraint, yet new investments in tourism and wellness resorts are expanding capacity. It is positioning itself as a niche destination for authentic and eco-conscious spa services. Africa offers a differentiated value proposition through its cultural diversity and unspoiled environments.

Key Player Analysis:

- Mandara Spa

- Hyatt Hotel Corporation

- Four Seasons Hotel Limited

- Marriott International, Inc.

- Hilton Hotels & Resorts

- OneSpaWorld Holdings Limited

- Siam Wellness Group

- InterContinental Hotels Group Plc.

- Massage Envy

- Kempinski Hotels S.A.

- Brenners Park-Hotel & Spa

- Other Key Players

Competitive Analysis:

The Luxury Spa Services Market is highly competitive, with key players focusing on innovation, strategic partnerships, and experiential offerings to differentiate their services. Leading brands such as Four Seasons Hotels and Resorts, Banyan Tree Holdings, Six Senses, and Mandarin Oriental dominate through global presence, premium facilities, and personalized wellness programs. It emphasizes signature treatments, exclusive product lines, and integration of medical-grade therapies to attract high-net-worth clients. Operators invest in technology and sustainability to enhance client satisfaction and brand loyalty. Regional players are strengthening their positions by incorporating indigenous wellness practices and targeting niche segments. The market continues to evolve with increasing demand for hybrid wellness experiences that merge science, luxury, and tradition. This competitive landscape drives continuous service refinement and expansion across high-growth destinations.

Recent Developments:

- In June 2025, Woodhouse Spas announced its expansion with a new franchise partnership in Bergen County, New Jersey. The brand signed Veeren and Madhuri Reddy, existing franchisees, to develop a second luxury spa. It will offer therapeutic massages, revitalizing facials, full-body treatments, and personalized wellness packages. The opening strengthens Woodhouse Spas’ upscale footprint and supports its goal of launching up to 25 new locations annually.

- In Jan 2025, Hyatt Hotels Corporation announced a landmark agreement to acquire all outstanding shares of Playa Hotels & Resorts N.V. for approximately $2.6 billion, including $900 million in debt. This acquisition, expected to close by the end of 2025, will significantly expand Hyatt’s all-inclusive luxury resort platform, particularly in Mexico and the Caribbean. The deal is set to strengthen Hyatt’s position in the luxury hospitality sector and enhance its distribution channels, benefiting both guests and shareholders

Market Concentration & Characteristics:

The Luxury Spa Services Market is moderately concentrated, with a mix of global hospitality chains, specialized wellness brands, and regional boutique operators. It is characterized by high entry barriers due to significant capital investment, stringent quality standards, and the need for skilled personnel. Market leaders focus on brand prestige, customized service delivery, and integration of advanced wellness technologies to maintain competitive advantage. The market values exclusivity, cultural relevance, and holistic health outcomes. Consumer expectations continue to evolve, pushing operators to expand offerings beyond relaxation into longevity and preventive health. It displays a strong emphasis on experience design, loyalty programs, and partnerships with luxury product brands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on service type, spa type, and gender. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for science-backed, results-driven wellness treatments will shape service innovation across premium spa facilities.

- Integration of AI and biometric diagnostics will enhance personalization and improve treatment outcomes.

- Wellness real estate developments will drive continuous demand for in-residence spa services.

- Asia Pacific will emerge as the primary growth engine due to rising affluence and wellness tourism initiatives.

- Younger demographics, including Gen Z and millennials, will increase their share of luxury spa spending.

- Collaborations with biotech and skincare brands will strengthen treatment credibility and brand value.

- Sustainable practices and ethical sourcing will become essential differentiators for premium spa operators.

- Expansion into secondary and wellness-focused urban markets will support geographic diversification.

- High-net-worth clients will favor spa memberships and multi-day curated wellness retreats.

- Digital platforms will extend access to luxury spa brands through at-home wellness subscriptions and remote consultations.