Market Overview

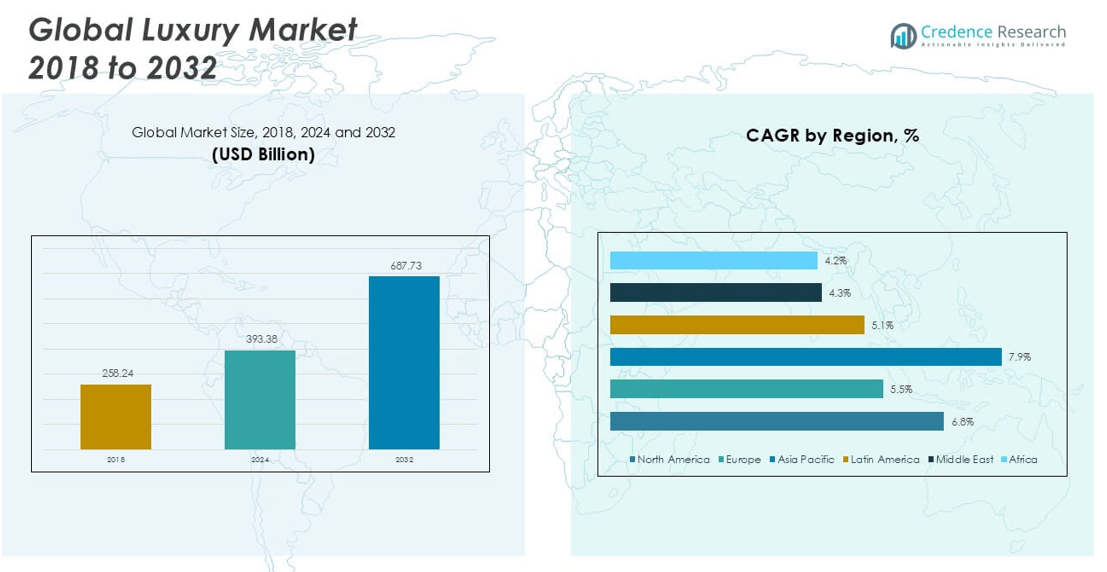

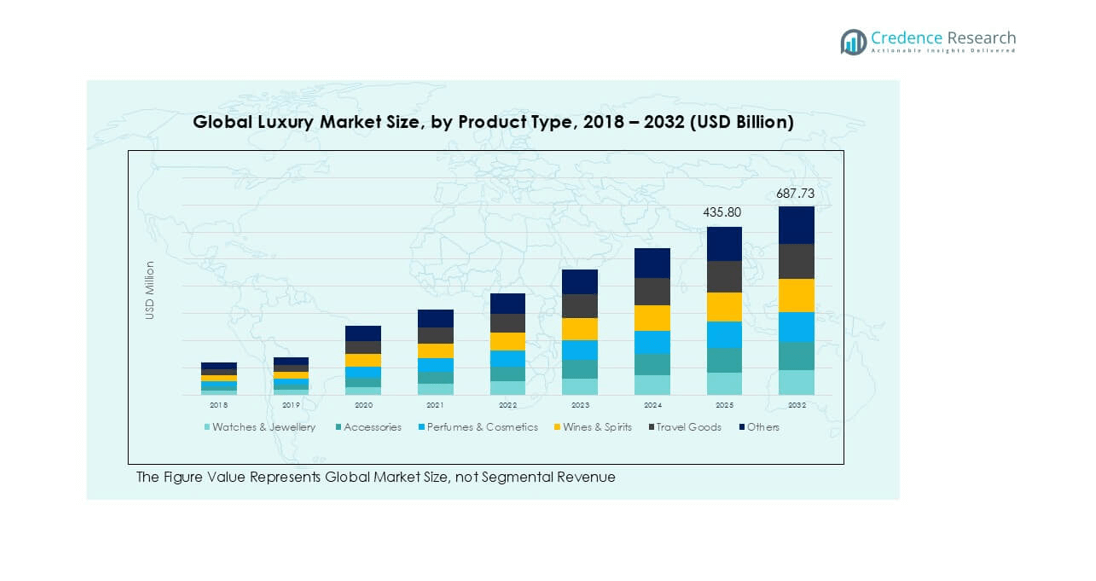

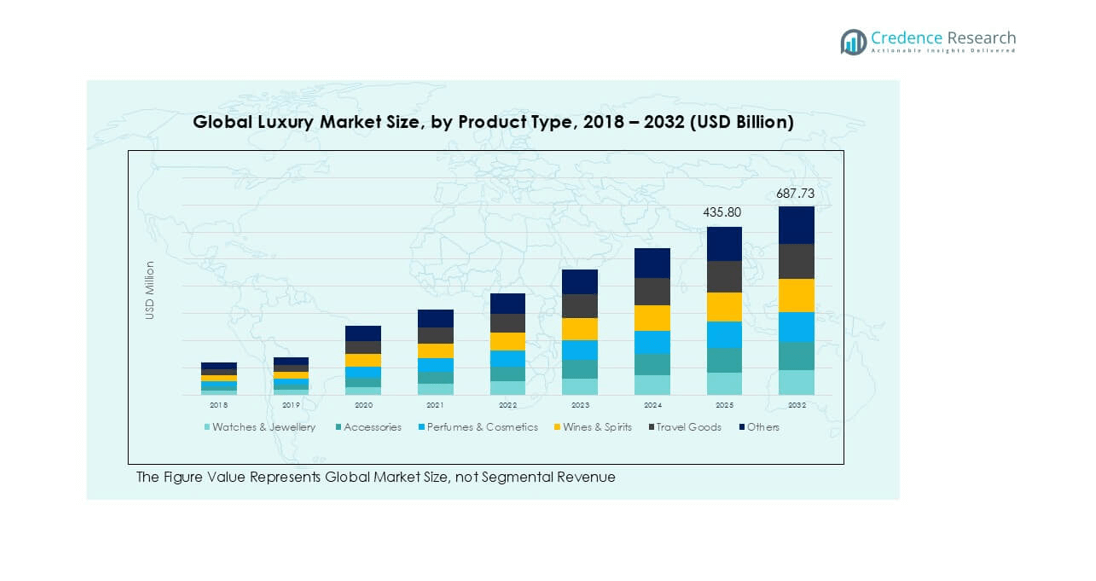

The luxury goods market size was valued at USD 258.24 billion in 2018, increased to USD 393.38 billion in 2024, and is anticipated to reach USD 687.73 billion by 2032, at a CAGR of 6.73% during the forecast period..

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Goods Market Size 2024 |

USD 393.38 billion |

| Luxury Goods Market, CAGR |

6.73% |

| Luxury Goods Market Size 2032 |

USD 687.73 billion |

The global luxury goods market is led by key players such as LVMH, Kering, Richemont, Chanel, Patek Philippe SA, Rolex SA, and Omega, all of which command strong brand equity, global distribution, and diversified luxury portfolios. These companies continue to drive innovation through digital channels, exclusive product launches, and sustainability initiatives. Among regions, North America holds the dominant position with a 42.9% market share in 2024, supported by high consumer spending power and strong retail infrastructure. Asia Pacific follows closely, driven by rising affluence and demand from younger demographics.

Market Insights

- The global luxury goods market was valued at USD 393.38 billion in 2024 and is expected to reach USD 687.73 billion by 2032, growing at a CAGR of 6.73% during the forecast period.

- Growth is primarily driven by rising disposable income, an expanding affluent class in Asia Pacific, and increasing demand for premium experiences and personalized luxury products.

- Key trends include the rise of sustainable and ethical luxury, digital transformation, and growing influence of Gen Z and Millennials, particularly in online luxury sales.

- The market is highly competitive, led by major players such as LVMH, Kering, Richemont, Chanel, Rolex SA, and Omega, who dominate segments like watches & jewellery and perfumes & cosmetics.

- Regionally, North America holds the largest share at 42.9%, followed by Asia Pacific at 29.3%, while Watches & Jewellery remains the dominant product segment due to cultural significance and investment appeal.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

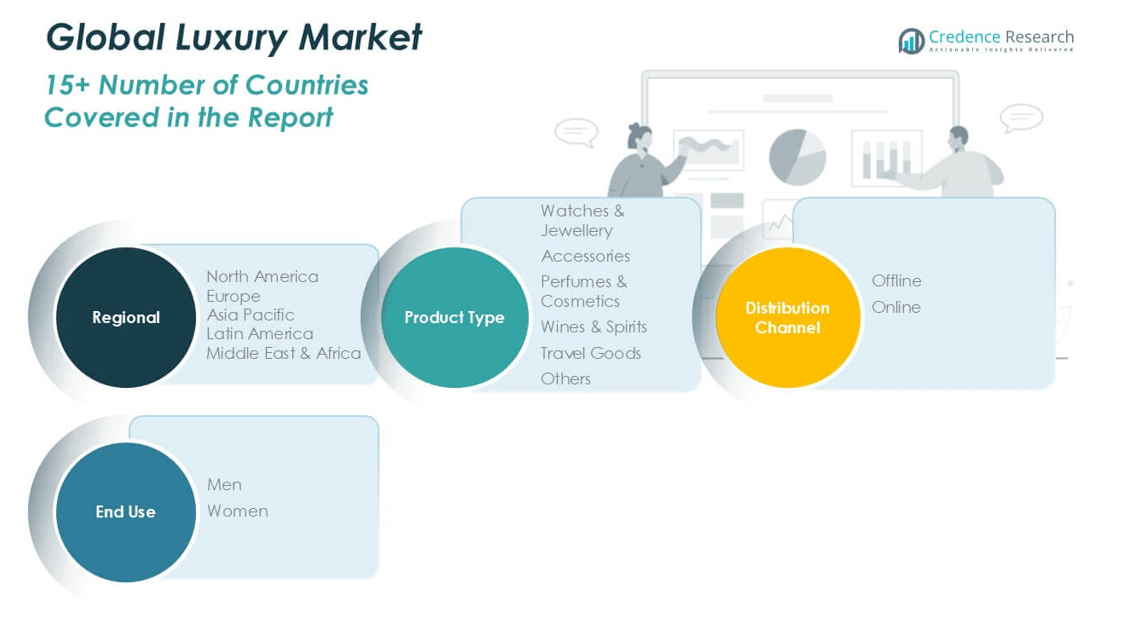

Market Segmentation Analysis:

By Product Type

The Watches & Jewellery segment dominates the luxury goods market, accounting for the largest market share in 2024. This segment benefits from strong brand heritage, high resale value, and emotional association with gifting and legacy. Demand is further fueled by rising disposable incomes, a growing interest in investment-grade timepieces, and expanding retail presence in emerging markets. While Perfumes & Cosmetics and Accessories also contribute significantly, the enduring appeal of luxury watches and high-end jewelry continues to drive strong consumer engagement, especially in Asia-Pacific and Middle Eastern countries where status symbols hold cultural significance.

- For instance, Rolex alone produced approximately 2 million timepieces in 2024, with its Datejust model accounting for nearly 329,000 units—a testament to investment-grade appeal and global demand

By Distribution Channel

The Offline channel remains the leading distribution segment, contributing the majority share of revenue in the luxury goods market. Physical retail stores, including flagship outlets, luxury malls, and multi-brand boutiques, offer consumers an immersive brand experience, personalized services, and instant product access, which continue to be crucial in high-value purchases. However, the Online segment is witnessing the fastest growth, driven by digital transformation, increasing e-commerce trust, and broader accessibility to global brands. Luxury companies are increasingly adopting omnichannel strategies, leveraging both online platforms and offline presence to enhance customer convenience and loyalty.

- For instance, Chanel has integrated AI‑based virtual assistants generating personalized fashion recommendations in real time, supported by predictive analytics and generative tooling across its digital platforms.

By End Use

The Women segment holds a dominant position in the luxury goods market, generating the highest revenue share in 2024. Women consumers drive demand across all luxury product categories, particularly in perfumes, handbags, fashion accessories, and fine jewelry. Changing lifestyles, increasing workforce participation, and the influence of fashion-forward media have expanded their purchasing power. Meanwhile, the Men segment is showing growing traction, especially in watches, grooming products, and bespoke fashion. Brands are increasingly targeting male consumers with curated offerings, signaling potential for long-term expansion in this segment.

Market Overviews

Rising Disposable Income and Expanding Affluent Class

The increasing number of high-net-worth individuals (HNWIs) and expanding upper-middle-class populations globally, particularly in Asia-Pacific and the Middle East, are fueling demand for luxury goods. With greater financial capacity, consumers are more inclined to spend on premium products that reflect their lifestyle aspirations. This growth is further accelerated by urbanization, favorable economic conditions, and the cultural value placed on status symbols. As emerging economies continue to thrive, luxury brands benefit from a broader consumer base with a high propensity for discretionary spending.

- For instance, in China and India, luxury brands have doubled store openings over five years in key cities, enhancing accessibility and brand presence (example: Chanel opened over 50 new flagship stores across Asia in that period).

Digital Transformation and Omnichannel Expansion

The integration of digital technologies across the luxury value chain has significantly enhanced brand accessibility and customer engagement. Luxury brands are investing in e-commerce platforms, virtual try-ons, and AI-driven personalization to deliver premium experiences online. Additionally, omnichannel strategies that blend in-store and digital interactions are driving higher conversion rates. This digital evolution allows brands to reach younger, tech-savvy consumers globally while retaining exclusivity through curated online experiences, limited-edition drops, and influencer collaborations.

- For instance, The RealReal uses AI to authenticate ultra‑luxury items—processing authentication tasks 10% faster compared to the previous year—and sells 75% of listings within 90 days.

Strong Brand Equity and Heritage Appeal

Heritage, craftsmanship, and brand legacy remain core pillars driving consumer loyalty in the luxury goods market. Consumers value the historical narrative, exclusivity, and artisanal quality that luxury brands represent. Iconic houses like Louis Vuitton, Rolex, and Chanel continue to command premium pricing due to their strong brand equity and consistent value proposition. This long-standing heritage appeal enables luxury companies to maintain pricing power, attract repeat customers, and differentiate themselves in an increasingly competitive retail landscape.

Key Trends & Opportunities

Sustainability and Ethical Luxury

The shift toward sustainable consumption is reshaping the luxury goods market, with consumers prioritizing ethical sourcing, transparency, and eco-friendly practices. Brands are responding by incorporating sustainable materials, reducing carbon footprints, and embracing circular fashion models. This trend presents an opportunity for luxury labels to align with environmentally conscious consumers, enhance brand perception, and tap into a growing segment that values purpose-driven purchases alongside aesthetic appeal.

- For instance, LVMH reported that 31% of materials used across its Maisons (products and packaging) were sourced via recycling processes in 2024, and its renewable energy share reached 63% of total energy consumption, with 3.8 million hectares of biodiversity habitats preserved or restored over four years.

Growing Demand from Gen Z and Millennials

Younger demographics are emerging as key growth drivers, with Gen Z and Millennials seeking luxury products that reflect identity, innovation, and personalization. These consumers are highly engaged via social media and expect digital-native experiences from luxury brands. Limited-edition collections, NFT-based exclusives, and influencer-driven marketing strategies are resonating with these segments. Catering to their evolving tastes presents a major opportunity for brands to build long-term loyalty and expand their market share.

Key Challenges

Counterfeit Products and Brand Dilution

The luxury goods market continues to face significant challenges from counterfeit goods, which dilute brand value and erode consumer trust. The rise of online marketplaces and peer-to-peer platforms makes it easier for fakes to circulate globally. Brands must invest heavily in authentication technologies, legal enforcement, and consumer education to protect their intellectual property and preserve exclusivity. Counterfeiting not only impacts revenue but also damages long-standing reputations built on craftsmanship and authenticity.

- For instance, The RealReal’s machine-learning authentication, trained on over 40 million sold items, reduces manual processes and enhances counterfeit detection across brands like Chanel, Rolex, and Gucci.

Economic Uncertainty and Geopolitical Tensions

Global economic instability, inflationary pressures, and geopolitical risks such as trade restrictions or conflicts can dampen consumer spending on non-essential items like luxury goods. Market disruptions in key regions, including Europe and Asia, impact both supply chains and demand cycles. Fluctuating currency values and shifting regulatory landscapes further add to operational complexity. Luxury brands must adopt agile strategies to navigate volatility while maintaining brand prestige and pricing stability.

Changing Consumer Expectations and Experience Gap

As consumer behavior evolves, luxury brands face increasing pressure to deliver seamless, personalized, and meaningful experiences across all touchpoints. Any gap between brand promise and customer experience can result in lost loyalty. High expectations around responsiveness, customization, and social responsibility require continuous innovation. Balancing tradition with modern relevance, especially across diverse demographics and regions, is a persistent challenge for maintaining competitive differentiation.

Regional Analysis

North America

North America held the largest share of the global luxury goods market in 2024, accounting for approximately 42.9% of total revenue. The market was valued at USD 111.85 billion in 2018 and reached USD 168.60 billion in 2024. It is projected to grow to USD 295.58 billion by 2032, registering a CAGR of 6.8%. This growth is driven by high consumer purchasing power, brand loyalty, and well-established luxury retail infrastructure in the U.S. and Canada. Increased online luxury purchases and the integration of digital innovation into in-store experiences further strengthen the region’s dominance in the global landscape.

- For example, LVMH expanded its scope of environmental reporting to cover 99% of its production and store sites by 2023, delivering environmental information on 30,000 products via QR-coded traceability systems.

Europe

Europe accounted for 18.7% of the global luxury goods market share in 2024, with a market value of USD 73.61 billion, up from USD 50.96 billion in 2018. The market is expected to reach USD 117.68 billion by 2032, growing at a CAGR of 5.5%. The region remains a critical hub for luxury fashion, accessories, and heritage brands, particularly in France, Italy, and Switzerland. Although the market is mature, steady demand from both local consumers and international tourists continues to fuel growth. Europe’s emphasis on craftsmanship and sustainability aligns with evolving global consumer preferences.

- For instance, Chopard has increased its use of recycled steel in jewellery and watches to 80%, with plans to reach 90% by 2025.

Asia Pacific

Asia Pacific emerged as the fastest-growing region in the luxury goods market, representing around 29.3% of global revenue in 2024. The market size grew from USD 71.36 billion in 2018 to USD 115.05 billion in 2024, and it is anticipated to reach USD 220.15 billion by 2032, at a robust CAGR of 7.9%. Growth is driven by rising disposable income, expanding middle-class population, and increasing brand awareness across countries like China, Japan, South Korea, and India. The region’s younger demographic and digital adoption make it a strategic focus for luxury brands expanding their customer base.

Latin America

Latin America accounted for 4.8% of the global luxury goods market in 2024, with revenues growing from USD 12.48 billion in 2018 to USD 18.79 billion in 2024. The market is projected to reach USD 29.16 billion by 2032, expanding at a CAGR of 5.1%. Brazil and Mexico are key contributors, supported by growing urbanization, a rise in affluent consumers, and the expansion of premium retail outlets. While the region faces economic volatility and currency fluctuations, international luxury brands continue to invest in retail presence and localized marketing strategies to tap into its long-term potential.

Middle East

The Middle East held a 2.4% share of the global luxury goods market in 2024, with its size increasing from USD 6.80 billion in 2018 to USD 9.41 billion in 2024. The market is forecasted to reach USD 13.71 billion by 2032, registering a CAGR of 4.3%. High-net-worth individuals and a cultural affinity for premium goods drive demand across countries like the UAE and Saudi Arabia. Luxury malls, tax-free shopping zones, and exclusive brand showrooms enhance consumer access. Although growth is moderate, the region remains lucrative for ultra-luxury categories, particularly in watches, jewelry, and haute couture.

Africa

Africa contributed around 2.0% to the global luxury goods market share in 2024, with its market value increasing from USD 4.78 billion in 2018 to USD 7.92 billion. It is expected to reach USD 11.45 billion by 2032, growing at a CAGR of 4.2%. Nigeria and South Africa are the leading markets, supported by an emerging affluent class and urban luxury enclaves. While infrastructure limitations and political instability pose challenges, luxury brands are targeting niche segments and investing in digital strategies to engage tech-savvy consumers. Africa’s untapped potential offers long-term growth opportunities for aspirational luxury offerings.

Market Segmentations:

By Product Type

- Watches & Jewellery

- Accessories

- Perfumes & Cosmetics

- Wines & Spirits

- Travel Goods

- Others

By Distribution Channel

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The luxury goods market is highly competitive, dominated by globally established players such as LVMH, Kering, Richemont, Chanel, Rolex SA, Patek Philippe SA, and Omega. These companies leverage strong brand equity, diversified product portfolios, and expansive retail networks to maintain market leadership. LVMH leads the sector with a broad luxury offering across fashion, cosmetics, wines, and watches, while Kering and Richemont focus heavily on high-end fashion and jewelry. Strategic mergers, acquisitions, and collaborations are central to competitive positioning, as seen in LVMH’s acquisition of Tiffany & Co. Brands are increasingly investing in digital transformation, sustainability initiatives, and personalization to engage younger, tech-savvy consumers and expand market reach. Innovation in design, exclusivity in product launches, and experiential marketing remain key differentiators. Furthermore, heritage value and craftsmanship continue to play a critical role in brand preference. The competitive intensity is expected to rise as more regional brands and digital-first entrants seek a share of the growing luxury consumer base.

- For example, LVMH’s LIFE 360 program delivered 68,140 hours of environmental training in 2023 more than double the previous year and expanded renewable energy use across all Maisons to 71% by 2024, up from 36% in 2019.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LVMH

- Kering

- Richemont

- Chanel

- Patek Philippe SA

- Rolex SA

- Omega

Recent Developments

- In January 2024, Miu Miu (part of Prada) launched its fourth limited edition collection of upcycled bags, named “Miu Miu Upcycled: Denim and Patch” bags. This initiative highlights the brand’s ongoing commitment to upcycling and sustainable practices within its product offerings.

- In September 2023, Richemont SA launched a new beauty division named Laboratoire de Haute Parfumerie et Beauté. This division will focus on the development and broader reach of high-end perfumes and beauty products.

- In September 2023, Ralph Lauren expanded its presence in Canada by launching its first luxury brick-and-mortar store and a dedicated e-commerce platform. This expansion provides Canadian consumers with direct access to the brand’s premium offerings via both physical and digital channels.

- In June 2023, Kering Beauté (Kering) announced the signing of an agreement to acquire Creed, a high-end heritage fragrance house. This acquisition is anticipated to contribute to the growth of the luxury goods industry by expanding Kering’s portfolio into the premium fragrance segment and leveraging Creed’s established brand equity to reach a wider consumer base.

- In April 2023, Hey Harper, a Portugal-based luxury jewelry maker, launched Titled ICONS, a new capsule collection of jewelry products in the U.K. The collection includes the GILDED THORNS Ear Cuff, PETALS SPIRAL Bracelet, CRYSTAL BLOOM Ring, GARDEN OF LIGHT Brooch, and others.

Market Concentration & Characteristics

The Luxury goods market exhibits a high level of concentration, with a few dominant players such as LVMH, Kering, Richemont, and Chanel controlling a significant share of global revenue. It is characterized by strong brand equity, limited competition due to high entry barriers, and a customer base with low price sensitivity. Companies operating in this space maintain control over pricing, distribution, and brand experience, often relying on exclusivity, heritage, and craftsmanship to differentiate their offerings. The market caters primarily to high-net-worth individuals and affluent consumers who prioritize quality, authenticity, and status. Demand remains resilient even during economic slowdowns, driven by brand loyalty and aspirational purchasing. Strategic acquisitions, limited product releases, and expansion into emerging markets support long-term competitiveness. Digital channels play an increasing role in customer engagement, but in-store experiences continue to be critical for maintaining brand value. Sustainability and personalization are becoming key expectations among younger demographics, prompting established players to adapt while preserving brand prestige.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The luxury goods market is expected to continue its strong growth trajectory, driven by rising demand from emerging economies.

- Digital transformation will play a central role in enhancing customer engagement and driving online luxury sales.

- Younger consumers, especially Millennials and Gen Z, will increasingly shape brand strategies and product innovation.

- Sustainability and ethical sourcing will become essential elements in brand positioning and consumer decision-making.

- Omnichannel retail strategies will gain more traction, blending physical and digital experiences seamlessly.

- Personalization and exclusive offerings will remain critical in attracting and retaining high-value customers.

- The influence of social media and luxury influencers will continue to grow, shaping consumer preferences globally.

- Investment in AI, AR, and data analytics will support tailored customer experiences and operational efficiency.

- Heritage brands will balance tradition with modernity to stay relevant in a digitally driven market.

- Geopolitical and economic volatility may affect short-term growth, but long-term demand for luxury remains resilient.