| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Sanitary Napkins Market Size 2024 |

USD 927.9 million |

| Luxury Sanitary Napkins Market, CAGR |

6.87% |

| Luxury Sanitary Napkins Market Size 2032 |

USD 1,579.8 million |

Market Overview:

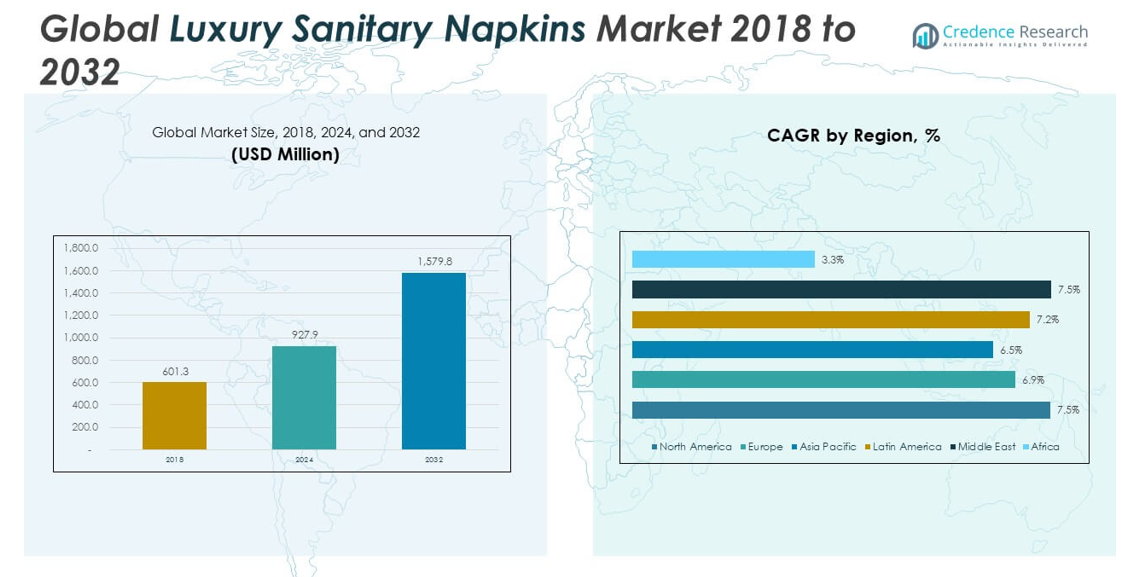

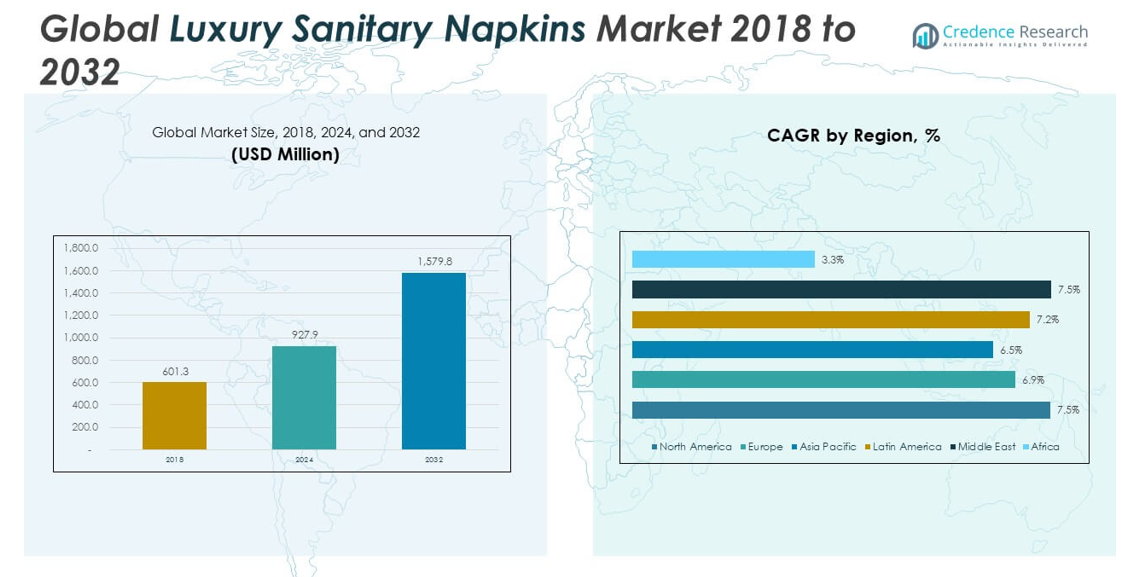

The Luxury Sanitary Napkins Market size was valued at USD 601.3 million in 2018 to USD 927.9 million in 2024 and is anticipated to reach USD 1,579.8 million by 2032, at a CAGR of 6.87% during the forecast period.

The luxury sanitary napkins market is experiencing notable growth due to increasing consumer awareness around menstrual hygiene and personal wellness. A significant number of women are now actively seeking safer, more comfortable alternatives to traditional sanitary products, especially those free from chlorine, dyes, synthetic fragrances, and harsh chemicals. This shift is particularly strong among urban consumers who prioritize premium, dermatologically safe solutions made from organic cotton, bamboo fiber, or biodegradable materials. As disposable incomes continue to rise globally, particularly in developing countries, women are more willing to invest in high-quality menstrual care products that offer enhanced protection and comfort. Additionally, sustainability concerns are reshaping buying patterns, with a growing preference for eco-friendly packaging and plastic-free designs. Innovation also fuels market expansion, with brands introducing ultra-thin, high-absorbency, and ergonomically designed pads.

Europe dominates the luxury sanitary napkins market, supported by widespread consumer demand for premium, health-conscious, and sustainable hygiene products. Countries like Germany, the UK, France, and the Netherlands exhibit strong sales due to their well-established retail infrastructure and high disposable incomes. North America, particularly the U.S., follows closely, driven by early adoption of organic and chemical-free sanitary pads, increasing awareness of menstrual health, and a preference for direct-to-consumer models that offer personalized experiences. Asia-Pacific represents a rapidly emerging market, with countries such as China, India, Japan, and South Korea seeing growing interest in high-end feminine hygiene products due to rising incomes, improved menstrual education, and greater urbanization. Younger consumers in metropolitan areas are driving this demand, particularly through digital and social media influence. Meanwhile, Latin America, the Middle East, and Africa are showing gradual progress, aided by urban expansion.

Market Insights:

- The Luxury Sanitary Napkins Market grew from USD 601.3 million in 2018 to USD 927.9 million in 2024 and is projected to reach USD 1,579.8 million by 2032, with a CAGR of 6.87%.

- Rising consumer awareness of menstrual hygiene and wellness is increasing demand for chemical-free, skin-friendly products made from organic cotton and bamboo fiber.

- Sustainability is a major market driver, with eco-conscious buyers preferring biodegradable pads and plastic-free packaging, encouraging brands to adopt green innovations.

- Growing disposable income, especially in developing nations, is enabling more women to shift from conventional to premium sanitary products with enhanced comfort and performance.

- Direct-to-consumer models and digital platforms are expanding product reach, with online channels offering personalized services and increasing brand visibility.

- High product costs and limited rural access pose challenges, making it difficult to scale premium offerings in low-income and price-sensitive markets.

- Europe leads the market due to strong demand for health-conscious products, followed by North America, while Asia Pacific shows rapid growth driven by urbanization and youth-driven digital adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Safe, Skin-Friendly Feminine Hygiene Products

Consumers are increasingly prioritizing safety, comfort, and skin compatibility in their personal care routines. Conventional pads often contain synthetic fibers, chlorine, and artificial fragrances, which can cause irritation or allergic reactions. The Luxury Sanitary Napkins Market responds to this concern by offering hypoallergenic alternatives made from organic cotton, bamboo fiber, or other natural materials. These products are free from harsh chemicals, enhancing comfort and reducing the risk of rashes or discomfort during menstruation. Women are becoming more health-conscious and expect menstrual products to align with broader wellness goals. The demand for clean-label, non-toxic hygiene options has strengthened the position of premium sanitary napkin brands.

- For example, Sparkle manufactures sanitary pads using only skin-friendly, natural materials such as bamboo fiber, banana fiber, and cornstarch, explicitly avoiding plastics, harsh chemicals, and artificial fragrances that can cause irritation or rashes. Their production facility, spanning 50,000 square feet, is ISO 9001 and ISO 13485 certified and features a fully automatic Italian production line capable of producing over 1 million sustainable pads per day.

Sustainability Preferences Drive Shift Toward Eco-Conscious Menstrual Solutions

Eco-awareness is influencing consumer decisions across personal care categories. In the Luxury Sanitary Napkins Market, brands that use biodegradable materials, compostable packaging, and plastic-free components attract environmentally conscious buyers. Many consumers view premium hygiene products not only as a health choice but also as a contribution to environmental responsibility. The growing availability of sustainable luxury pads encourages loyal brand adoption. Retailers and online platforms have increased visibility for eco-friendly options, helping buyers make informed decisions. This market continues to benefit from strong alignment with global sustainability movements.

Income Growth and Lifestyle Shifts Enable Premium Product Adoption

Higher disposable incomes and evolving lifestyle standards have expanded access to premium menstrual hygiene products. In both developed and developing economies, more women are willing to invest in luxurious solutions that promise greater comfort, effectiveness, and discreet packaging. The Luxury Sanitary Napkins Market benefits from these socioeconomic shifts, particularly among urban professionals and younger demographics. Consumers now associate quality and performance with health, hygiene, and confidence, increasing their openness to spending on superior alternatives. This shift is also supported by greater awareness of product differentiation and long-term health implications. Premium hygiene is no longer limited to niche segments but is entering mainstream consumer preferences.

Digital Retail and Direct-to-Consumer Models Expand Product Reach

The rise of e-commerce and subscription services has redefined how consumers access menstrual care products. The Luxury Sanitary Napkins Market has capitalized on this trend through direct-to-consumer models, enabling personalized delivery and seamless access. Social media and digital marketing further amplify brand exposure, particularly among tech-savvy consumers who value convenience and transparency. Online platforms allow for deeper consumer engagement, product education, and tailored experiences. These channels support repeat purchases and customer loyalty through ease of access and recurring delivery models. It continues to benefit from digital ecosystems that promote premium hygiene solutions beyond traditional retail.

- For instance, Bliss Natural, in addition to its product innovations, has implemented a social impact model: for every 10 pads sold, one is donated to a woman in a rural area, with over 1 million pads distributed to date, demonstrating how digital and direct sales can also drive social responsibility alongside commercial success.

Market Trends:

Growing Popularity of Organic and Chemical-Free Sanitary Products

Organic and toxin-free menstrual products have gained significant traction among health-conscious consumers. Women are increasingly aware of the potential health risks linked to synthetic ingredients in conventional sanitary pads. The Luxury Sanitary Napkins Market has responded by offering products made with certified organic cotton, bamboo fibers, and plant-based layers. These chemical-free alternatives cater to consumers seeking gentle, breathable, and non-irritating solutions for menstrual care. Brands highlight transparency in sourcing and ingredient disclosures to build trust and differentiate their offerings. It continues to shift toward cleaner formulations that meet the expectations of educated, wellness-driven buyers.

- For instance, BingBing Paper, a major manufacturer, produces sanitary pads featuring a 100% organic cotton surface that is chlorine-free and designed for sensitive skin. Their products emphasize breathability, leak protection, and comfort, incorporating multiple layers and advanced absorbent materials.

Integration of High-Performance Features and Smart Design

Consumers expect premium menstrual products to deliver not only comfort but also advanced performance. The Luxury Sanitary Napkins Market now emphasizes features such as multi-layer absorption, odor control, leak-lock barriers, and ultra-thin ergonomic structures. These innovations improve usability, especially for women with active lifestyles who seek reliable protection. Smart packaging, resealable pouches, and minimalistic branding further elevate product appeal. It remains focused on design innovation that aligns functionality with aesthetics. The segment’s evolution reflects consumer demand for both practicality and sophistication in menstrual hygiene.

Strong Brand Positioning Around Sustainability and Ethical Manufacturing

Sustainability is no longer a niche preference; it has become central to brand identity in the premium hygiene sector. The Luxury Sanitary Napkins Market has embraced this shift by aligning with ethical sourcing, cruelty-free certification, and low-impact manufacturing practices. Brands that communicate clear commitments to sustainability tend to attract and retain socially responsible consumers. Recyclable packaging, plastic-free components, and support for women-led supply chains are gaining prominence. It supports long-term loyalty by appealing to values beyond product performance. Consumers often choose brands that reflect their environmental and ethical beliefs.

Increased Visibility Through Influencer and Social Media Campaigns

Digital platforms have become essential for promoting premium sanitary napkin brands. The Luxury Sanitary Napkins Market benefits from influencer partnerships, product reviews, and targeted content that resonates with modern consumers. Social media enables brand storytelling, real-time engagement, and education about menstrual health and product differentiation. Younger audiences, in particular, rely on peer recommendations and visual content when evaluating menstrual care options. It has expanded its consumer base through curated campaigns that emphasize both lifestyle and product credibility. Effective use of digital marketing continues to influence purchase decisions in this competitive space.

- For example, companies like Glad Rags and Aisle have introduced reusable pads with innovative designs, using influencer partnerships and curated digital content to expand market reach particularly among younger, sustainability-minded consumers.

Market Challenges Analysis:

High Product Cost and Limited Accessibility in Price-Sensitive Markets

The premium pricing of luxury sanitary napkins presents a significant barrier to widespread adoption, particularly in developing and price-sensitive regions. The Luxury Sanitary Napkins Market caters to consumers willing to pay more for enhanced quality, but affordability remains a challenge for the broader population. Many women continue to rely on conventional products due to budget constraints, despite growing awareness of the health and environmental benefits of premium options. Retail distribution of luxury pads is also limited in rural and semi-urban areas, further restricting market reach. It faces difficulties in balancing quality with cost-efficiency, especially when targeting expansion in emerging economies. Brands must address this gap to unlock broader consumer acceptance and long-term growth.

Low Awareness and Cultural Taboos Surrounding Menstrual Health

Menstrual health remains a stigmatized subject in many regions, limiting product education and consumer engagement. The Luxury Sanitary Napkins Market is impacted by persistent cultural taboos and misinformation, which discourage open dialogue and informed product choices. In regions where menstrual hygiene is not widely discussed, premium brands struggle to establish relevance and trust. Low awareness about product differentiation and benefits also hinders adoption among first-time users. It requires strategic investment in awareness campaigns, partnerships with healthcare providers, and school-based programs to overcome stigma. Addressing deep-rooted social barriers is critical to expanding the market’s footprint across diverse geographies.

Market Opportunities:

Untapped Potential in Emerging Economies and Urban Centers

Rising disposable income and increasing urbanization in countries across Asia-Pacific, Latin America, and Africa present a strong opportunity for market expansion. The Luxury Sanitary Napkins Market can benefit from growing awareness of menstrual health and a shift toward premium personal care preferences among young, urban women. Expanding retail networks and mobile-based e-commerce platforms enhance product visibility and accessibility. It can capture new consumers by offering region-specific solutions and culturally sensitive branding. Strategic collaborations with local distributors and healthcare organizations can accelerate penetration. Markets with large female populations and rising education levels hold long-term growth potential.

Innovation in Product Formats and Subscription-Based Sales Models

Consumer demand for personalization and convenience creates opportunities for innovation in both product design and distribution. The Luxury Sanitary Napkins Market can diversify its offerings through customized absorbency options, discreet packaging, and eco-friendly materials. Subscription services and direct-to-consumer platforms allow brands to build loyalty and improve customer retention. It can further leverage digital tools to gather feedback and tailor offerings to specific lifestyle needs. Brands that emphasize value, experience, and sustainability will attract health-conscious, tech-savvy buyers. Expanding into adjacent wellness categories may also strengthen brand positioning.

Market Segmentation Analysis:

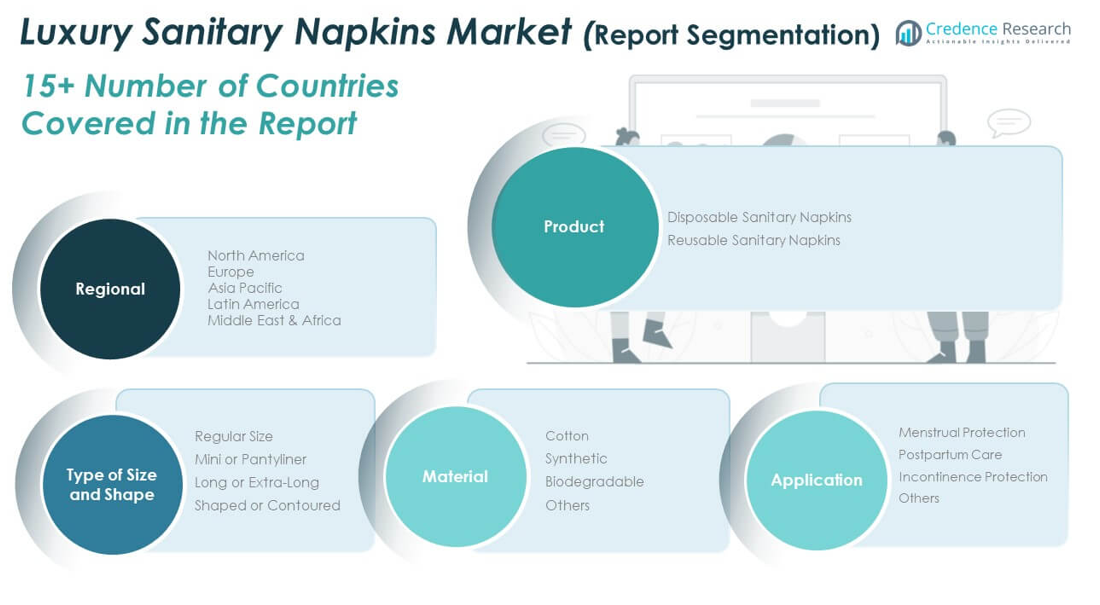

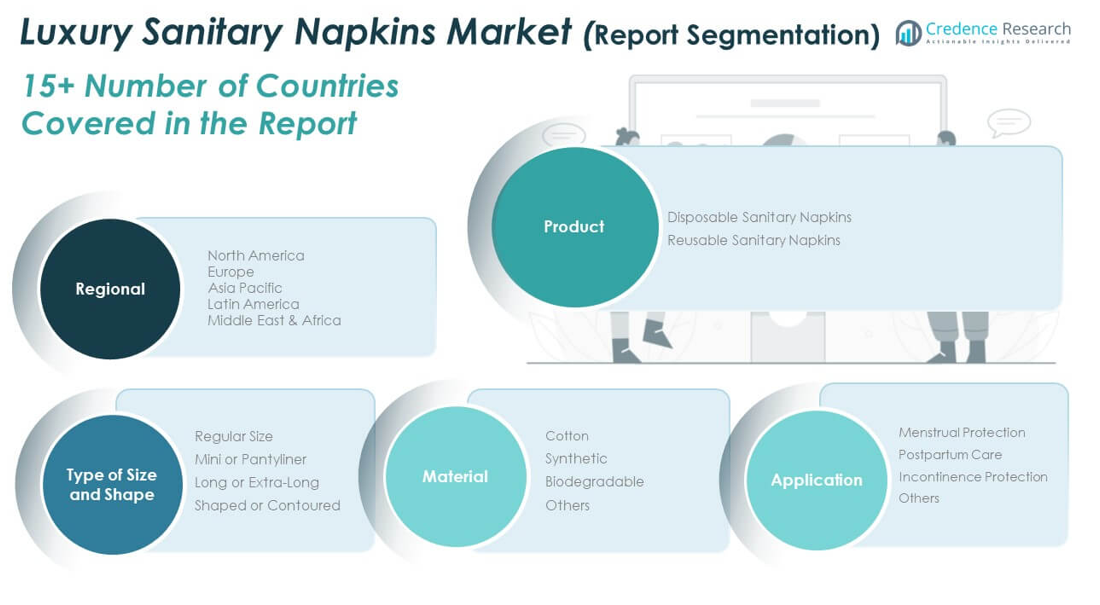

The Luxury Sanitary Napkins Market is segmented by product, size and shape, material, and application, reflecting the diverse preferences and needs of modern consumers.

By product, disposable sanitary napkins dominate the market due to their convenience, widespread availability, and single-use hygiene appeal. Reusable sanitary napkins are gaining interest among environmentally conscious users, offering cost-effective and sustainable alternatives.

- For example, Foshan Jiabo Sanitary Products Technology Co., Ltd. operates 12 production lines dedicated to feminine sanitary napkins and pads, with an annual output of over 1 billion disposable sanitary napkins.

By size and shape, regular size napkins remain the most commonly used, offering standard coverage for daily use. Mini or pantyliner options are preferred for lighter flow or pre- and post-cycle days, while long or extra-long variants cater to heavy flow and overnight use. Shaped or contoured pads provide better fit and enhanced leak protection, appealing to active users.

By material, the market is led by cotton-based products, known for their breathability and hypoallergenic properties. Synthetic materials are used in some premium designs to enhance absorption and durability. Biodegradable material are the most preferred choice.

By application, the Luxury Sanitary Napkins Market primarily serves menstrual protection, with increasing demand for postpartum care products tailored for new mothers. It continues to evolve with innovations tailored to comfort, hygiene, and sustainability. Other applications include postpartum care and incontinence protection.

- For instance, products like Dignity Mom Maternity Pads feature super absorbent cores, breathable hypoallergenic fabrics, and adhesive strips for stability, specifically addressing postpartum comfort and hygiene for new mothers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Product

- Disposable Sanitary Napkins

- Reusable Sanitary Napkins

By Type of Size and Shape

- Regular Size

- Mini or Pantyliner

- Long or Extra-Long

- Shaped or Contoured

By Material

- Cotton

- Synthetic

- Biodegradable

- Others

By Application

- Menstrual Protection

- Postpartum Care

- Incontinence Protection

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Luxury Sanitary Napkins Market size was valued at USD 120.92 million in 2018 to USD 194.12 million in 2024 and is anticipated to reach USD 347.56 million by 2032, at a CAGR of 7.5% during the forecast period. North America holds a significant 24.2% share of the global Luxury Sanitary Napkins Market, supported by strong awareness of menstrual health and widespread availability of premium products. The United States drives most of the regional growth, with consumers increasingly seeking organic, sustainable, and dermatologically safe options. It benefits from a mature e-commerce ecosystem and the success of direct-to-consumer brands offering subscription-based deliveries. High income levels, health-focused purchasing behavior, and effective influencer-led campaigns contribute to consistent demand. Retailers and manufacturers invest in innovation and marketing to maintain customer loyalty. The region’s established regulatory environment also supports transparent labeling and product safety.

The Europe Luxury Sanitary Napkins Market size was valued at USD 168.96 million in 2018 to USD 261.18 million in 2024 and is anticipated to reach USD 445.67 million by 2032, at a CAGR of 6.9% during the forecast period. Europe accounts for approximately 32.6% of the global Luxury Sanitary Napkins Market and leads in sustainability adoption and organic product consumption. Countries such as Germany, France, and the UK show strong demand for biodegradable and chemical-free menstrual products. It benefits from a well-developed retail structure and high consumer awareness regarding health and environmental impact. Brands gain traction by aligning with European values on eco-consciousness and ethical manufacturing. Public health initiatives and government support for menstrual equity further improve market access. Ongoing product innovation and cultural openness around menstruation continue to support market expansion.

The Asia Pacific Luxury Sanitary Napkins Market size was valued at USD 220.67 million in 2018 to USD 333.79 million in 2024 and is anticipated to reach USD 552.94 million by 2032, at a CAGR of 6.5% during the forecast period. Asia Pacific commands the largest regional share at 39.2% of the global Luxury Sanitary Napkins Market due to its vast population and growing urban female consumer base. Markets such as China, India, Japan, and South Korea experience rising demand for premium hygiene products driven by income growth and shifting lifestyle patterns. It sees increased interest in organic and eco-friendly solutions, especially among younger consumers in metropolitan areas. Awareness campaigns, retail expansion, and digital access improve product visibility and adoption. Global and local brands are scaling up operations to capture market share. Cultural barriers remain in some areas but are gradually reducing through education and advocacy.

The Latin America Luxury Sanitary Napkins Market size was valued at USD 30.06 million in 2018 to USD 47.19 million in 2024 and is anticipated to reach USD 82.15 million by 2032, at a CAGR of 7.2% during the forecast period. Latin America holds a 5.9% share of the global Luxury Sanitary Napkins Market and presents strong growth potential due to improving economic conditions and rising health awareness. Countries such as Brazil, Mexico, and Argentina see an increasing number of women opting for safer and more comfortable menstrual solutions. It benefits from expanding retail channels, social media influence, and brand-led educational initiatives. Consumers are gradually shifting from conventional to organic pads as income levels rise. The market remains competitive, with both international and regional players introducing eco-conscious product lines. Enhanced distribution and affordable premium alternatives will drive further penetration.

The Middle East Luxury Sanitary Napkins Market size was valued at USD 40.89 million in 2018 to USD 65.68 million in 2024 and is anticipated to reach USD 117.70 million by 2032, at a CAGR of 7.5% during the forecast period. The Middle East accounts for 7.6% of the global Luxury Sanitary Napkins Market and is witnessing a shift in consumer behavior towards more health-focused hygiene products. The UAE and Saudi Arabia are leading this transition, driven by a young, tech-savvy female population and high disposable income. It gains momentum from expanding retail infrastructure and increased acceptance of e-commerce. Consumers in the region are becoming more aware of the health benefits of organic and chemical-free pads. Cultural sensitivity and premium branding play a key role in product positioning. Demand for discreet packaging and superior comfort continues to influence purchasing preferences.

The Africa Luxury Sanitary Napkins Market size was valued at USD 19.78 million in 2018 to USD 25.96 million in 2024 and is anticipated to reach USD 33.81 million by 2032, at a CAGR of 3.3% during the forecast period. Africa holds a modest 3.2% share in the global Luxury Sanitary Napkins Market, constrained by affordability issues and limited access in rural areas. However, growing awareness of menstrual health and efforts by NGOs and healthcare initiatives are beginning to change consumer behavior. South Africa, Nigeria, and Kenya are emerging as key markets with rising interest in premium hygiene solutions. It faces challenges in terms of distribution and cultural stigma, but these are gradually being addressed through education and outreach programs. Product availability through mobile commerce and health-based retail campaigns is improving market reach. Future growth depends on affordability and sustained investment in awareness-building.

Key Player Analysis:

- Redcliffe Hygiene Private Limited

- Dabur India Ltd

- Diva International Inc.

- Edgewell Personal Care Company

- Hengan International Group Company Limited

- Kao Corporation

- Kimberly-Clark Corporation

- Lil-lets UK Limited

- Ontex

- Organyc

Competitive Analysis:

The Luxury Sanitary Napkins Market features a competitive landscape marked by innovation, sustainability, and strong brand positioning. Leading players such as Rael, Natracare, Cora, The Honest Company, and L. Inc. focus on organic materials, eco-friendly packaging, and direct-to-consumer models to differentiate themselves. It sees consistent product development aimed at improving absorbency, comfort, and skin safety. Companies invest in social media marketing, influencer partnerships, and subscription services to enhance brand loyalty and expand consumer reach. Regional players in Asia and Europe are gaining traction by offering localized, affordable premium alternatives with cultural alignment. Strategic collaborations with retailers, healthcare providers, and NGOs help strengthen market presence and trust. It remains driven by brand transparency, ingredient sourcing, and ethical manufacturing practices. The market continues to evolve with increased attention to personalization, sustainability, and digital engagement, creating a dynamic environment for both established brands and new entrants seeking consumer attention.

Recent Developments:

- In January 2025, Unicharm Corporation partnered with Toyota Tsusho Corporation to launch local manufacturing of Sofy Long Lasting sanitary napkins in Kenya. It established full-scale production and sales beginning in Nairobi, aiming to deliver high-quality yet affordable premium pads to African markets.

- In May 2025, Rael announced a significant retail expansion of its organic, high-performance menstrual care line across major U.S. retailers. It debuted products online in March, then entered 1,549 Walmart stores in May, and will roll out in 5,000 Walgreens and 300 Ulta Beauty locations by mid-2025

- In Dec 2023, Dabur India Ltd expanded its Fem brand into the Indian sanitary napkins market, launching Fem Ultra Care Sanitary Napkins in two variants—FEM Ultracare XL and FEM Ultracare XL+. These products are distributed via Flipkart, and the company also introduced a social initiative, ‘Swasthya Aur Suraksha,’ pledging to donate one sanitary napkin to an underprivileged girl for every pack sold.

Market Concentration & Characteristics:

The Luxury Sanitary Napkins Market remains moderately concentrated, with a mix of global and regional players competing on product quality, sustainability, and brand reputation. It is characterized by high product differentiation, with brands emphasizing organic materials, biodegradable components, and dermatological safety. Innovation plays a central role, with companies offering advanced absorbency technologies and personalized packaging to appeal to niche consumer segments. The market targets health-conscious, urban women willing to invest in premium hygiene solutions. Barriers to entry include regulatory compliance, sourcing of certified organic materials, and brand credibility. It benefits from strong consumer loyalty, particularly through direct-to-consumer channels and subscription services.

Report Coverage:

The research report offers an in-depth analysis based on product, size and shape, material, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for organic and biodegradable materials will drive product innovation.

- Expansion of e-commerce platforms will enhance global accessibility and customer engagement.

- Growth in disposable income across emerging economies will increase premium product adoption.

- Advancements in ergonomic and high-absorbency designs will improve user experience.

- Sustainability initiatives will remain a key focus for product development and branding.

- Direct-to-consumer models and subscription services will strengthen brand loyalty.

- Strategic collaborations with healthcare providers will improve market penetration in underserved regions.

- Increased education and awareness campaigns will reduce stigma and promote informed purchasing.

- Personalized and discreet packaging will attract urban, tech-savvy consumers.

- Entry of new regional players will intensify competition and diversify product offerings.