Market Overview:

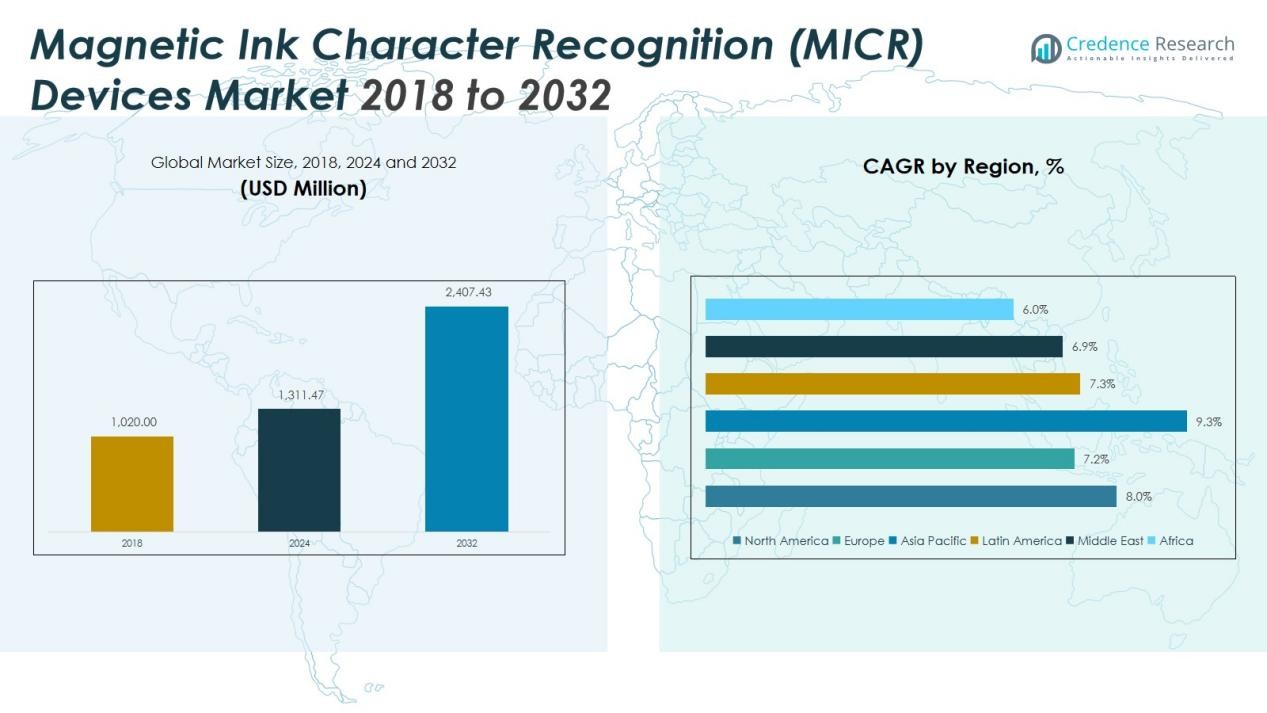

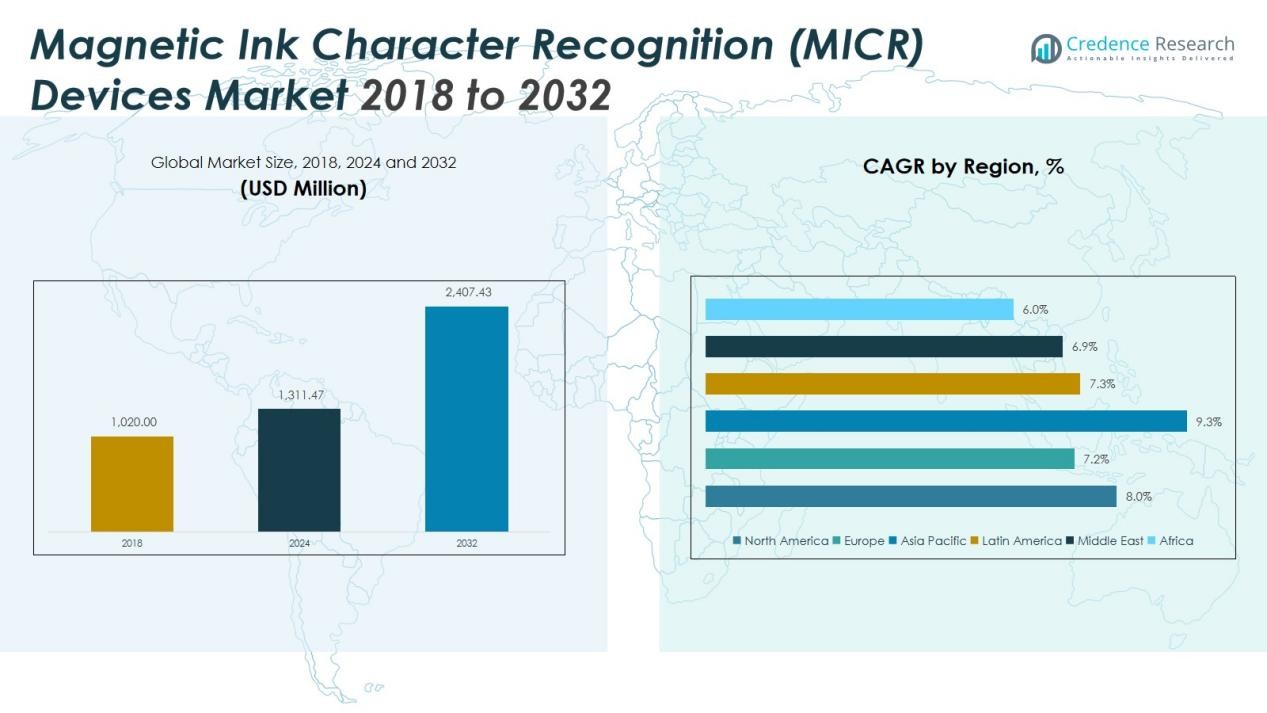

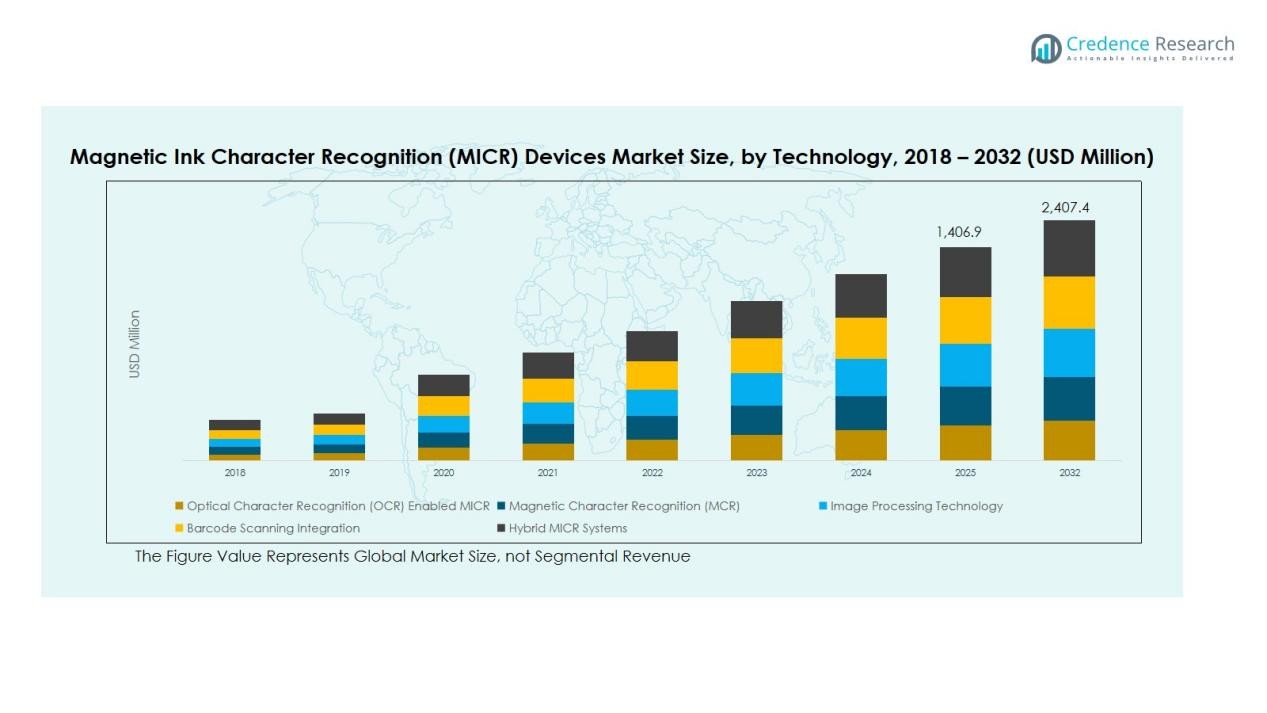

The Global Magnetic Ink Character Recognition (MICR) Devices Market size was valued at USD 1,020 million in 2018 to USD 1,311.47 million in 2024 and is anticipated to reach USD 2,407.43 million by 2032, at a CAGR of 7.98% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Magnetic Ink Character Recognition (MICR) Devices Market Size 2024 |

USD 1,311.47 Million |

| Magnetic Ink Character Recognition (MICR) Devices Market, CAGR |

7.98% |

| Magnetic Ink Character Recognition (MICR) Devices Market Size 2032 |

USD 2,407.43 Million |

Rising demand for secure and automated payment processing drives market growth. Financial institutions increasingly adopt MICR-enabled systems to enhance transaction efficiency, reduce manual errors, and strengthen anti-fraud measures. The integration of MICR with cloud-based and AI-powered financial platforms also improves verification speed and accuracy, supporting adoption across both developed and emerging economies.

Regionally, North America dominates the Global Magnetic Ink Character Recognition (MICR) Devices Market, supported by high banking automation and advanced financial infrastructure. Europe follows, driven by strong regulatory frameworks for financial data security. The Asia Pacific region shows the fastest growth, led by expanding banking networks, government initiatives for digital payments, and the modernization of financial systems across China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Magnetic Ink Character Recognition (MICR) Devices Market was valued at USD 1,020 million in 2018, reached USD 1,311.47 million in 2024, and is projected to attain USD 2,407.43 million by 2032, growing at a CAGR of 7.98%.

- Financial institutions continue to rely on MICR technology for its proven durability, precision, and ability to handle high transaction volumes efficiently.

- North America leads the global market with a 34% share in 2024, supported by advanced financial infrastructure and widespread banking automation.

- Europe accounts for 25% of global revenue, driven by stringent compliance standards and a focus on financial transparency.

- The Asia Pacific region, holding 28% in 2024, records the fastest growth due to expanding banking networks, digitalization, and financial inclusion programs across China, India, and Southeast Asia.

- Emerging markets in Latin America, the Middle East, and Africa witness increasing MICR adoption through modernization of payment systems and secure transaction frameworks.

Market Drivers:

Growing Need for Secure and Efficient Banking Transactions

The Global Magnetic Ink Character Recognition (MICR) Devices Market is driven by the growing demand for secure and error-free financial transactions. MICR technology ensures quick authentication of checks and documents, reducing the risk of fraud. Financial institutions prefer MICR devices for their accuracy, durability, and ability to handle high transaction volumes. It continues to serve as a trusted verification tool in an era of digital transformation across the banking sector.

Integration of MICR Technology with Advanced Automation Systems

Integration with automated banking and document processing systems supports the expansion of MICR devices. Banks and corporations use these systems to improve operational efficiency and minimize manual data entry errors. Automated workflows enhance transaction accuracy and speed, promoting faster financial settlements. It encourages organizations to maintain hybrid solutions combining MICR hardware with digital payment systems.

- For Instance, Bank of America has enhanced its treasury operations with AI-driven solutions like Intelligent Receivables, which leverage artificial intelligence and machine learning to automate the reconciliation process and improve efficiency.

Rising Adoption in Emerging Economies with Expanding Banking Infrastructure

Emerging markets in Asia Pacific, Latin America, and Africa are adopting MICR technology due to rapid banking expansion. Governments and financial institutions invest in secure check processing to build trust and ensure regulatory compliance. The growth of retail banking, microfinance, and small business lending accelerates MICR device installations. It helps bridge the gap between traditional and digital financial practices in developing economies.

Emphasis on Fraud Prevention and Regulatory Compliance in Financial Operations

Financial institutions worldwide face stricter regulations for transaction verification and fraud prevention. MICR devices provide a reliable mechanism to meet these compliance standards. Their proven accuracy in reading magnetic codes enhances document authenticity and minimizes financial discrepancies. It strengthens institutional confidence by ensuring that all monetary instruments are verified and traceable within secure processing environments.

- For Instance, An IBM InfoPrint 4000 Advanced Function MICR Printing System is documented to achieve a sustained throughput of 354 impressions per minute (ipm) on two-up, 8.5 x 11-inch paper.

Market Trends:

Integration of MICR Devices with Digital Payment and Cloud-Based Systems

The Global Magnetic Ink Character Recognition (MICR) Devices Market is witnessing a shift toward integration with cloud-based financial systems and digital payment networks. Banks and enterprises are connecting MICR devices with automated clearing houses and online banking platforms to streamline transaction verification. This trend enhances speed, reduces errors, and supports compliance with financial security standards. Cloud-enabled MICR solutions also allow remote access and centralized data management, improving scalability for institutions handling high transaction volumes. It helps financial organizations maintain security while transitioning toward paperless and hybrid transaction environments. Vendors are focusing on developing MICR devices compatible with modern software ecosystems, ensuring future-ready infrastructure.

- For instance, Panini’s Vision E batch check scanner (Vision E-SF) supports a feeder capacity of up to 50 checks and delivers 300 dpi duplex images via Ethernet or Wi-Fi directly to cloud-based RDC platforms.

Shift Toward Compact, Energy-Efficient, and Multi-Functional MICR Devices

Manufacturers are designing compact and power-efficient MICR devices to meet the needs of modern banking environments. The demand for multi-functional equipment capable of handling both magnetic and optical character recognition is growing. It allows financial institutions to process various document types with one device, improving efficiency and reducing costs. The use of lightweight materials and low-power components supports sustainability goals and cost savings. Wireless and USB-enabled MICR scanners are gaining popularity in small and medium financial enterprises. It reflects a broader move toward flexible, space-saving, and energy-conscious technology adoption in the financial sector. This trend positions MICR devices as integral tools in evolving banking automation ecosystems.

- For instance, the Digital Check TellerScan TS240 operates on just 45 W of power, demonstrating compact, energy-efficient performance ideal for space-constrained teller windows.

Market Challenges Analysis:

Rising Shift Toward Digital and Paperless Banking Transactions

The Global Magnetic Ink Character Recognition (MICR) Devices Market faces challenges due to the rapid shift toward digital banking and cashless payment systems. Growing adoption of mobile banking, e-wallets, and online fund transfers reduces dependency on physical checks. Financial institutions are investing in digital solutions that eliminate the need for printed instruments. It limits demand for MICR devices in regions with mature banking infrastructure. Declining check usage in developed markets creates stagnation for traditional MICR equipment manufacturers. The industry must adapt by offering hybrid solutions that integrate MICR with digital verification systems.

High Maintenance Costs and Need for Regular Calibration

MICR devices require frequent maintenance and calibration to maintain reading accuracy and reliability. This increases operational costs, particularly for banks and organizations processing large transaction volumes. Downtime from maintenance or component wear affects workflow efficiency and customer service levels. It forces institutions to balance between performance reliability and budget constraints. Smaller banks and financial firms often hesitate to invest in high-cost MICR systems due to limited returns. The challenge remains in developing durable, low-maintenance devices that maintain performance under continuous use.

Market Opportunities:

Emerging Demand from Developing Economies and Expanding Banking Networks

The Global Magnetic Ink Character Recognition (MICR) Devices Market holds strong potential in developing regions where banking infrastructure is expanding rapidly. Countries in Asia Pacific, Latin America, and Africa are investing in secure check-processing technologies to improve transaction transparency. Rising financial inclusion initiatives and microfinance programs boost the need for reliable verification systems. It creates new opportunities for MICR device suppliers to collaborate with regional banks and government agencies. The deployment of cost-effective, durable, and easy-to-maintain devices will further support adoption. Growing awareness of transaction security among small financial institutions enhances long-term demand prospects.

Advancement in Hybrid and AI-Integrated MICR Solutions

Technological progress in artificial intelligence and automation opens new growth avenues for MICR device manufacturers. Integrating AI-driven recognition algorithms improves accuracy and speeds up document authentication. It enables real-time fraud detection and enhances compliance monitoring across banking operations. The demand for hybrid systems combining magnetic and optical recognition functions is rising in corporate and institutional finance sectors. Vendors investing in cloud-enabled, software-compatible MICR solutions can capture emerging opportunities in digital transformation projects. Strategic partnerships with fintech providers and system integrators will further strengthen market expansion across global financial ecosystems.

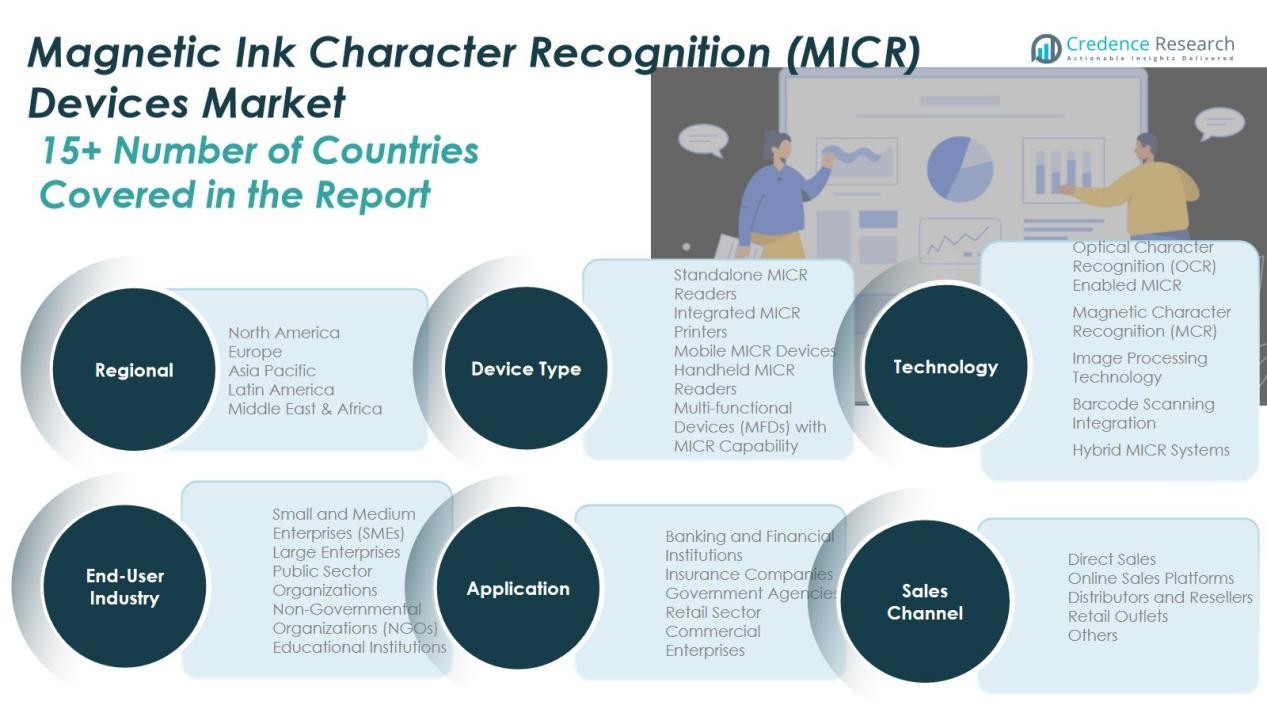

Market Segmentation Analysis:

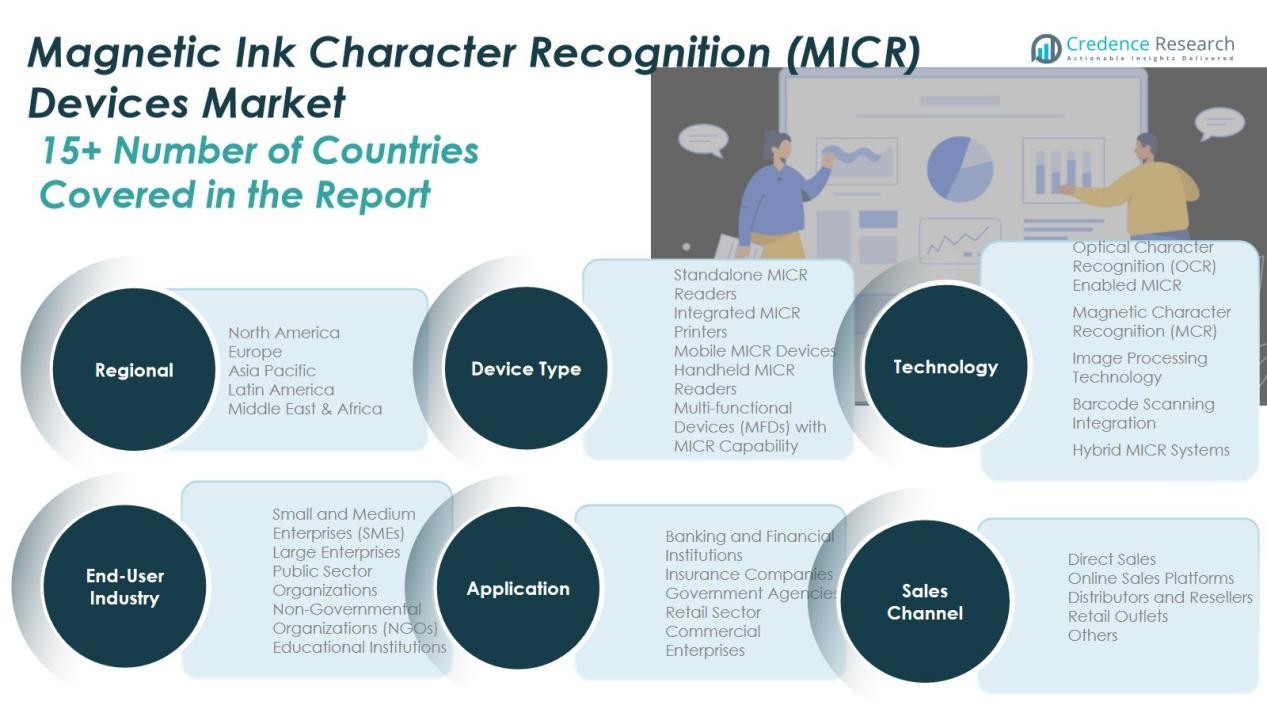

By Device Type

The Global Magnetic Ink Character Recognition (MICR) Devices Market is segmented into standalone MICR readers, integrated MICR printers, mobile MICR devices, handheld MICR readers, and multi-functional devices with MICR capability. Standalone readers dominate due to their reliability and precision in large-scale check processing. Integrated MICR printers gain traction in banking and enterprise sectors for their combined printing and verification functions. It benefits from the adoption of compact mobile and handheld MICR devices across SMEs and retail environments that require flexibility and lower cost solutions.

- For instance, Panini’s Vision X desktop MICR reader processes up to 100 documents per minute (with a potential maximum of 125 DPM) with consistent check-sorting accuracy”

By Application

The market includes banking and financial institutions, insurance companies, government agencies, retail, and commercial enterprises. The banking and financial sector leads due to the continuous use of checks and secure document processing systems. Government agencies adopt MICR systems to manage high volumes of official documents requiring authentication. It witnesses rising adoption in retail and insurance sectors for fraud prevention and verification efficiency.

- For instance, Canon CR‑120 at 120 documents/min; 99%+ MICR accuracy

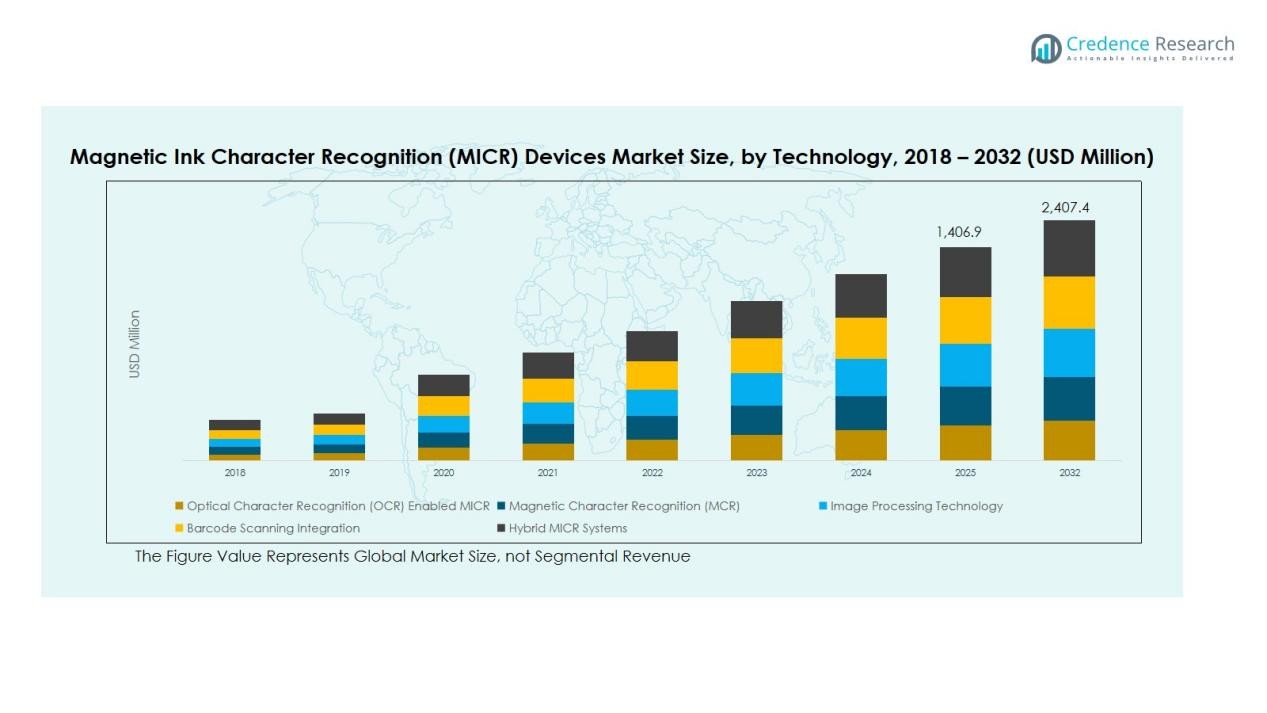

By Technology

The technology segment covers optical character recognition (OCR) enabled MICR, magnetic character recognition (MCR), image processing technology, barcode scanning integration, and hybrid MICR systems. Magnetic character recognition remains the standard for check processing due to accuracy and magnetic ink reliability. Hybrid systems combining magnetic and optical recognition are expanding due to enhanced speed and versatility. It benefits from advancements in image processing and AI-based recognition, which improve data extraction and verification precision across financial applications.

Segmentations:

By Device Type

- Standalone MICR Readers

- Integrated MICR Printers

- Mobile MICR Devices

- Handheld MICR Readers

- Multi-functional Devices (MFDs) with MICR Capability

By Application

- Banking and Financial Institutions

- Insurance Companies

- Government Agencies

- Retail Sector

- Commercial Enterprises

By Technology

- Optical Character Recognition (OCR) Enabled MICR

- Magnetic Character Recognition (MCR)

- Image Processing Technology

- Barcode Scanning Integration

- Hybrid MICR Systems

By End-User Industry

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Public Sector Organizations

- Non-Governmental Organizations (NGOs)

- Educational Institutions

By Sales Channel

- Direct Sales

- Online Sales Platforms

- Distributors and Resellers

- Retail Outlets

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America Magnetic Ink Character Recognition (MICR) Devices Market size was valued at USD 365.16 million in 2018 to USD 463.73 million in 2024 and is anticipated to reach USD 850.07 million by 2032, at a CAGR of 8.0% during the forecast period. North America holds the largest share of the Global Magnetic Ink Character Recognition (MICR) Devices Market, accounting for 34% in 2024. The region benefits from a well-established banking network and advanced financial automation infrastructure. High adoption of secure transaction technologies supports market growth. It is driven by major financial institutions investing in hybrid MICR systems integrated with digital platforms. The U.S. dominates regional demand due to the continuous modernization of check-processing facilities and compliance-focused operations.

Europe

The Europe Magnetic Ink Character Recognition (MICR) Devices Market size was valued at USD 247.86 million in 2018 to USD 305.27 million in 2024 and is anticipated to reach USD 526.63 million by 2032, at a CAGR of 7.2% during the forecast period. Europe represents 25% of the Global Magnetic Ink Character Recognition (MICR) Devices Market in 2024. Strong regulatory frameworks for financial transparency and fraud prevention drive regional adoption. Banks in Germany, the U.K., and France are investing in MICR systems to enhance document verification accuracy. It benefits from advanced automation initiatives across the European banking ecosystem. Growing emphasis on secure cross-border payments further strengthens market potential. Vendors focusing on energy-efficient and compact MICR devices see growing opportunities in European financial institutions.

Asia Pacific

The Asia Pacific Magnetic Ink Character Recognition (MICR) Devices Market size was valued at USD 240.72 million in 2018 to USD 323.73 million in 2024 and is anticipated to reach USD 657.95 million by 2032, at a CAGR of 9.3% during the forecast period. Asia Pacific accounts for 28% of the Global Magnetic Ink Character Recognition (MICR) Devices Market in 2024. Expanding banking networks and financial inclusion programs across China, India, and Southeast Asia fuel market growth. Governments are promoting secure check processing to ensure compliance and reduce fraud. It benefits from increasing demand for hybrid and cost-effective MICR systems in emerging economies. Rapid digitalization and the rise of regional fintech partnerships are supporting modernization efforts. Continuous infrastructure investments make Asia Pacific the fastest-growing regional market.

Latin America

The Latin America Magnetic Ink Character Recognition (MICR) Devices Market size was valued at USD 89.25 million in 2018 to USD 113.95 million in 2024 and is anticipated to reach USD 198.30 million by 2032, at a CAGR of 7.3% during the forecast period. Latin America represents 7% of the Global Magnetic Ink Character Recognition (MICR) Devices Market in 2024. The region shows rising adoption due to expanding retail banking and digital transformation in financial institutions. Brazil and Mexico lead demand, supported by ongoing modernization of banking systems. It benefits from initiatives promoting financial transparency and secure transaction verification. Local manufacturers are developing affordable MICR devices to meet cost-sensitive market needs. Economic growth and regulatory support for secure payment mechanisms strengthen the region’s long-term outlook.

Middle East

The Middle East Magnetic Ink Character Recognition (MICR) Devices Market size was valued at USD 49.16 million in 2018 to USD 60.06 million in 2024 and is anticipated to reach USD 101.85 million by 2032, at a CAGR of 6.9% during the forecast period. The Middle East holds 4% of the Global Magnetic Ink Character Recognition (MICR) Devices Market in 2024. The region’s financial institutions are investing in secure and efficient transaction technologies to meet regulatory requirements. The UAE and Saudi Arabia are leading in adoption due to expanding banking automation. It gains momentum from the integration of MICR systems within digital transformation frameworks. Government-driven initiatives promoting fintech collaboration further enhance regional growth. Increasing focus on fraud prevention and compliance drives consistent investment in MICR solutions.

Africa

The Africa Magnetic Ink Character Recognition (MICR) Devices Market size was valued at USD 27.85 million in 2018 to USD 44.73 million in 2024 and is anticipated to reach USD 72.63 million by 2032, at a CAGR of 6.0% during the forecast period. Africa accounts for 2% of the Global Magnetic Ink Character Recognition (MICR) Devices Market in 2024. Growing financial inclusion programs and the development of banking infrastructure support gradual market expansion. Nigeria, South Africa, and Kenya are key contributors due to rapid digital banking adoption. It benefits from the need to strengthen security in financial transactions and government documentation. International collaborations and donor-funded digital payment initiatives support MICR adoption. Continued investments in secure verification systems position Africa as an emerging market for future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ACOM Solutions

- Canon Inc.

- Hewlett Packard Company

- Epson

- Mui Solusindo Nusantara

- MagTek

- Rosetta Technologies

- Source Technologies

- Troy Group

- Xerox Corporation

- Uniform Industrial Corporation

- ZIH Corp.

Competitive Analysis:

The Global Magnetic Ink Character Recognition (MICR) Devices Market is moderately competitive with several global and regional players focusing on innovation, reliability, and integration capabilities. Key companies such as ACOM Solutions, Canon Inc., Hewlett Packard Company, Epson, Mui Solusindo Nusantara, MagTek, and Rosetta Technologies play a significant role in shaping market dynamics. These firms compete on product quality, pricing, and technological advancements to strengthen their market presence. It emphasizes innovation in hybrid MICR systems, compact device designs, and software compatibility to meet evolving banking and enterprise needs. Strategic partnerships, product diversification, and automation-driven upgrades are central to maintaining competitiveness. Vendors also focus on expanding service networks and offering customized solutions to cater to financial institutions and government agencies seeking secure transaction systems.

Recent Developments:

- In February 2025, HP Inc. entered a definitive agreement to acquire AI capabilities from Humane, including the Cosmos platform, to strengthen intelligent ecosystem offerings.

- In July 2025, Hewlett Packard Enterprise closed its acquisition of Juniper Networks, further expanding its cloud-native and AI-driven networking solutions.

Report Coverage:

The research report offers an in-depth analysis based on Device Type, Application, Technology, End-User Industry, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Magnetic Ink Character Recognition (MICR) Devices Market will witness steady growth driven by the continued demand for secure document verification across financial institutions.

- Adoption of hybrid MICR systems integrating magnetic and optical recognition will expand to improve processing speed and accuracy.

- Automation and AI integration will enhance real-time fraud detection and transaction authentication capabilities in financial operations.

- Manufacturers will focus on compact, energy-efficient, and multi-functional devices suited for digital and hybrid banking environments.

- Emerging economies in Asia Pacific, Latin America, and Africa will drive demand due to financial inclusion and banking expansion initiatives.

- Cloud-based MICR solutions will gain traction among large enterprises seeking centralized document management and compliance monitoring.

- Government digitization projects will increase investments in MICR-enabled systems for secure handling of official documents.

- Vendors will strengthen partnerships with fintech companies to offer integrated verification and payment processing platforms.

- Product innovation will prioritize enhanced durability, faster data reading speeds, and improved magnetic ink precision.

- The market will gradually shift toward sustainability with recyclable materials and low-power MICR devices designed for long-term operational efficiency.