Market Overview

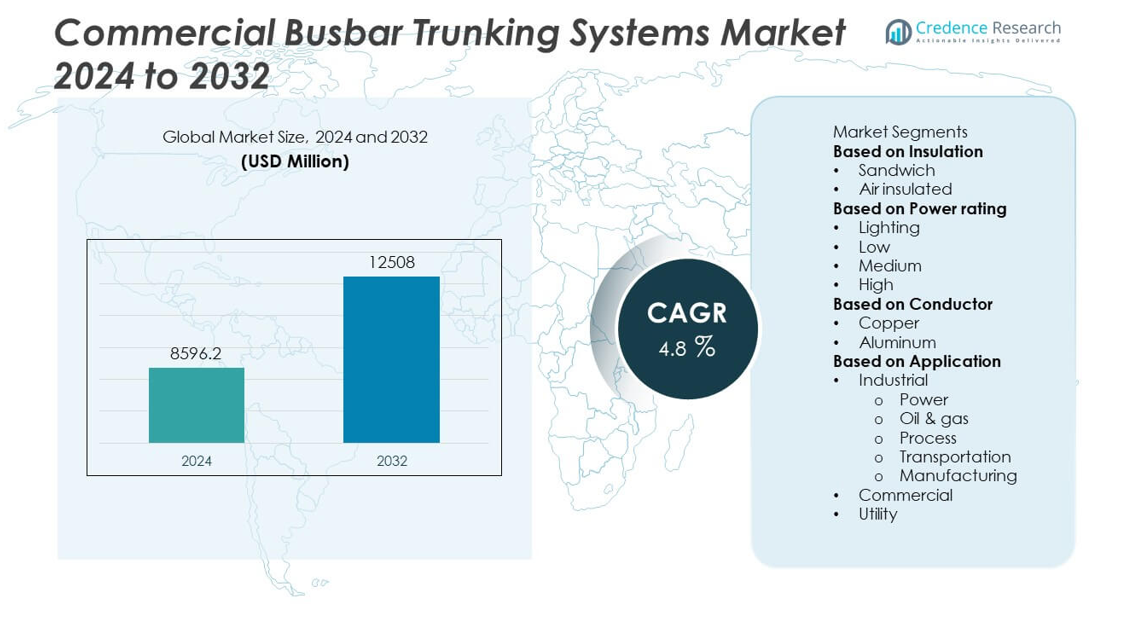

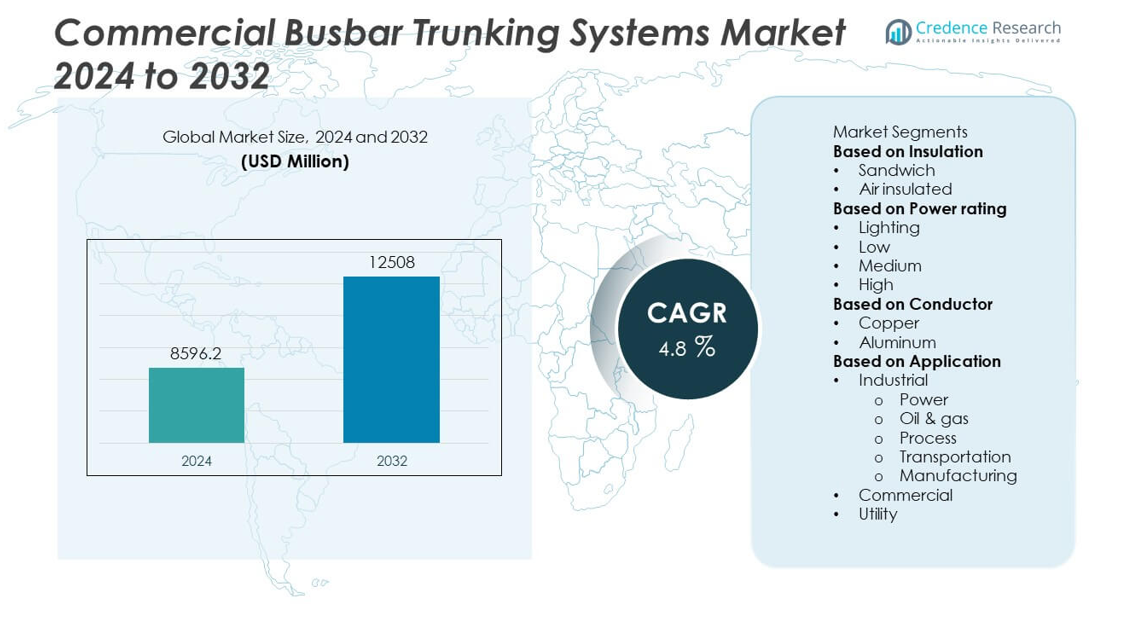

The Commercial Busbar Trunking Systems Market size was valued at USD 8,596.2 million in 2024 and is anticipated to reach USD 12,508 million by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Busbar Trunking Systems Market Size 2024 |

USD 8,596.2 million |

| Commercial Busbar Trunking Systems Market, CAGR |

4.8% |

| Commercial Busbar Trunking Systems Market Size 2032 |

USD 12,508 million |

The Commercial Busbar Trunking Systems Market experiences strong growth driven by rapid urbanization, infrastructure development, and increasing demand for energy-efficient power distribution. It benefits from technological advancements such as IoT integration and modular designs that enhance system flexibility and monitoring capabilities. Rising regulatory emphasis on safety and sustainability further supports adoption across commercial and industrial sectors. The market also trends toward smart buildings and digital infrastructure, encouraging innovation in intelligent busbar solutions.

The Commercial Busbar Trunking Systems Market demonstrates significant regional variation driven by differing levels of industrialization, infrastructure development, and regulatory environments. Asia Pacific leads in adoption due to rapid urbanization and large-scale infrastructure projects, while North America and Europe emphasize advanced technology integration and energy efficiency in mature markets. Emerging regions like the Middle East, Africa, and Latin America show growing interest, fueled by infrastructure modernization and smart city initiatives. Key players driving innovation and market expansion include ABB, Eaton, Anord Mardix, and C&S Electric Limited. These companies focus on developing modular, energy-efficient, and IoT-enabled busbar trunking solutions that meet global safety standards and evolving customer demands.

Market Insights

- The Commercial Busbar Trunking Systems Market was valued at USD 8,596.2 million in 2024 and is projected to grow at a CAGR of 4.8% through 2032.

- Rapid urbanization and infrastructure development drive demand for efficient and scalable power distribution systems across commercial and industrial sectors.

- Technological advancements such as IoT integration, modular designs, and enhanced safety features improve system performance and attract increased adoption.

- The shift toward smart buildings and energy-efficient infrastructure fuels market trends focused on digitalization and sustainability in power distribution.

- High initial investment costs and installation complexity pose challenges that slow down widespread acceptance, especially among small and medium-sized enterprises.

- Regional dynamics vary, with Asia Pacific leading due to rapid industrialization and urban growth, while North America and Europe focus on advanced technologies and strict regulations. Emerging markets in the Middle East, Africa, and Latin America show promising growth potential.

- Key players like ABB, Eaton, Anord Mardix, and C&S Electric Limited drive competitive innovation by offering modular, energy-efficient, and IoT-enabled busbar trunking solutions, maintaining strong global market presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Urbanization and Infrastructure Development Accelerate Demand for Efficient Power Distribution

Rapid urbanization and ongoing infrastructure projects drive the need for reliable and scalable electrical distribution solutions. The Commercial Busbar Trunking Systems Market benefits from increased investments in commercial buildings, industrial parks, and smart city initiatives. These systems offer efficient power transmission, supporting high load demands and flexible layouts. Their compact design reduces installation space and time, making them ideal for modern infrastructure. It ensures minimal power loss and enhances overall electrical safety, critical in densely populated urban centers. The shift toward sustainable infrastructure further boosts adoption, as busbar trunking systems contribute to energy efficiency goals.

- For instance, Schneider Electric’s busbar trunking system supports continuous current ratings up to 5,000 amperes and short-circuit withstand ratings up to 105 kiloamperes, enabling safe, high-capacity power distribution in dense urban environments.

Technological Advancements Enhance System Performance and Adaptability

Technological improvements in materials and design expand the functionality and durability of busbar trunking systems. The Commercial Busbar Trunking Systems Market leverages innovations like improved insulation, modular configurations, and advanced monitoring capabilities. These enhancements reduce maintenance requirements and extend operational life. It enables seamless integration with smart grids and building management systems, providing real-time power consumption data. Enhanced safety features, including arc fault detection and fire resistance, meet stringent regulatory standards. Such progress drives preference for busbar systems over traditional cabling in commercial applications.

- For example, Eaton’s xEnergy Busway includes integrated sensors providing real-time load monitoring with data updated every 5 seconds, allowing predictive maintenance and dynamic load management. This system supports continuous current ratings up to 3,200 A and withstands short circuits up to 50 kA.

Rising Focus on Energy Efficiency and Safety Regulations Stimulate Market Growth

Stricter electrical safety codes and increasing emphasis on energy conservation create strong demand for busbar trunking solutions. The Commercial Busbar Trunking Systems Market benefits from compliance requirements that favor standardized, reliable power distribution methods. It offers superior load capacity and fault tolerance, reducing the risk of electrical failures and downtime. The ability to handle higher current densities with minimal heat generation supports efficient energy use. Compliance with international standards ensures compatibility across various industries. This regulatory environment encourages facility owners to invest in advanced busbar systems for long-term operational security.

Expanding Industrial and Commercial Sectors Require Scalable Power Solutions

Growth in manufacturing, data centers, and commercial real estate drives the need for scalable electrical distribution infrastructure. The Commercial Busbar Trunking Systems Market capitalizes on these sectors’ demand for flexible power supply arrangements that accommodate expansion and reconfiguration. It supports quick installation and easy modification, reducing downtime during facility upgrades. High current ratings and customizable layouts suit diverse industrial requirements. The ability to integrate with renewable energy sources also aligns with corporate sustainability objectives. This flexibility positions busbar trunking systems as a preferred choice for evolving commercial and industrial environments.

Market Trends

Integration of Smart Technologies and IoT Enhances System Efficiency and Monitoring

The Commercial Busbar Trunking Systems Market increasingly incorporates smart technologies and Internet of Things (IoT) capabilities to improve operational efficiency. It enables real-time monitoring of power consumption, fault detection, and predictive maintenance, reducing downtime and optimizing energy use. The integration with building management systems allows facility managers to control and analyze electrical distribution remotely. These intelligent features contribute to better asset management and lower operational costs. Manufacturers focus on developing systems compatible with digital infrastructure to meet growing demand for smart buildings. This trend reflects the broader shift toward digitalization in power distribution networks.

- For instance, ABB’s Emax 2 circuit breakers integrated with its Ability™ smart sensor platform provide continuous monitoring with data updates every 3 seconds, enabling immediate fault detection and detailed energy analytics. The system supports digital communication protocols like Modbus and Ethernet/IP, facilitating seamless integration with building management systems.

Growing Adoption of Modular and Prefabricated Busbar Systems in Construction

The preference for modular and prefabricated busbar trunking systems gains momentum in commercial and industrial construction sectors. The Commercial Busbar Trunking Systems Market benefits from the ease of installation, reduced construction time, and flexibility offered by modular designs. It supports rapid deployment in large-scale projects, allowing configurations to adapt to changing power requirements. Prefabricated components minimize onsite labor and improve quality control. This trend aligns with the construction industry’s focus on efficiency and cost savings. Modular systems also facilitate future expansions or modifications without extensive rewiring.

- For instance, Legrand’s XCP-S series busbar systems are rated for continuous currents up to 6,300 A and feature an extra-compact design with interlocked tap-off boxes available up to 1,250 A, facilitating rapid deployment and adaptability in large-scale projects.

Focus on Sustainable and Energy-Efficient Power Distribution Solutions

The market trends reflect increasing demand for sustainable and energy-efficient power distribution methods. The Commercial Busbar Trunking Systems Market addresses this need through designs that reduce electrical losses and improve load management. It supports integration with renewable energy sources such as solar and wind, enabling greener building operations. Manufacturers emphasize environmentally friendly materials and compliance with global energy standards. This shift toward sustainability aligns with corporate social responsibility initiatives and regulatory frameworks. The market moves toward solutions that balance performance with reduced environmental impact.

Expansion in Emerging Markets Drives Infrastructure Modernization

Emerging economies experience rapid industrialization and urban growth, driving demand for modern electrical distribution systems. The Commercial Busbar Trunking Systems Market finds significant opportunities in regions investing heavily in infrastructure upgrades and smart city projects. It provides scalable and reliable power distribution that meets increasing electricity demands. Local governments and private developers prioritize advanced technologies to support economic development. The trend includes growing partnerships between international manufacturers and regional players to enhance market penetration. This geographic expansion contributes to the overall growth and diversification of the market.

Market Challenges Analysis

High Initial Investment and Installation Complexity Hinder Widespread Adoption

The Commercial Busbar Trunking Systems Market faces challenges related to high upfront costs associated with system components and installation. It requires specialized equipment and skilled labor, which can increase project expenses compared to traditional cabling methods. The complexity of design and integration with existing electrical infrastructure further complicates installation processes, especially in retrofit projects. These factors discourage small and medium-sized enterprises from adopting busbar systems despite their long-term benefits. Manufacturers and contractors must focus on cost optimization and training programs to address these barriers. Overcoming this challenge is critical to expanding market penetration across diverse commercial sectors.

Compatibility Issues and Regulatory Variations Impact Market Growth

The market encounters difficulties due to varying regulatory standards and compatibility requirements across regions. The Commercial Busbar Trunking Systems Market must navigate differing electrical codes, safety regulations, and certification processes that affect product design and approval timelines. It complicates global manufacturing and distribution strategies, increasing costs and limiting standardization. Compatibility issues between new busbar systems and legacy infrastructure also pose technical hurdles for end users. Addressing these challenges requires collaboration between industry stakeholders and regulatory bodies to harmonize standards and simplify compliance. This alignment will facilitate smoother adoption and support sustained market growth.

Market Opportunities

Rising Demand for Smart Buildings and Digital Infrastructure Fuels Market Expansion

The Commercial Busbar Trunking Systems Market holds significant opportunities due to increasing investments in smart buildings and digital infrastructure worldwide. It supports the integration of advanced monitoring and control technologies that optimize energy management and enhance safety. Growing adoption of Internet of Things (IoT) solutions in commercial and industrial facilities creates demand for intelligent power distribution systems. This trend encourages manufacturers to innovate and develop systems compatible with smart grid frameworks. Expanding urbanization and the need for energy-efficient infrastructure further drive market growth. Capitalizing on this opportunity requires continuous technological advancement and strategic partnerships with technology providers.

Infrastructure Modernization and Industrial Growth in Emerging Economies Open New Avenues

Emerging economies present lucrative prospects for the Commercial Busbar Trunking Systems Market due to rapid urbanization and industrialization. It addresses the need for reliable, scalable, and efficient power distribution solutions in expanding commercial and manufacturing sectors. Governments’ focus on upgrading aging electrical infrastructure and implementing smart city projects creates high demand. Collaborations between global manufacturers and local enterprises facilitate market entry and customization for regional requirements. The increasing emphasis on sustainability and energy efficiency further supports adoption in these regions. Leveraging these growth drivers can substantially enhance the market’s global footprint and revenue potential.

Market Segmentation Analysis:

By Insulation:

Insulation type plays a crucial role in determining the performance and safety of busbar trunking systems. The market primarily divides into PVC insulated, XLPE insulated, and EPR insulated segments. PVC insulation offers cost-effective protection and suits moderate temperature environments. XLPE insulation delivers superior thermal resistance and mechanical strength, making it suitable for high-load industrial applications. EPR insulation provides excellent flexibility and electrical properties, favored in environments requiring high chemical and heat resistance. The Commercial Busbar Trunking Systems Market leverages these insulation options to meet varied safety regulations and performance expectations across regions and industries.

- For instance, General Cable’s XLPE insulated busbars withstand continuous operating temperatures up to 90°C and short-circuit temperatures reaching 250°C for 1 second, supporting robust industrial applications. EPR insulation delivers superior flexibility and excellent electrical properties, useful in harsh environments.

By Power Rating:

Power rating segmentation reflects the system’s current-carrying capacity, impacting its application range. Typical categories include low power rating (up to 1600 A), medium power rating (1600 A to 4000 A), and high power rating (above 4000 A). Low power rating systems generally find use in commercial buildings and light industrial setups. Medium power ratings suit larger manufacturing units and data centers requiring moderate to high power loads. High power rating busbar systems address heavy industrial plants, power stations, and large infrastructure projects demanding substantial electrical capacity. It provides scalability and reliability across various power consumption levels, supporting the dynamic needs of modern electrical networks.

- For instance, Legrand’s XL3 series supports current ratings up to 1600 A with compact designs for commercial installations. Medium power rating systems fit larger manufacturing units and data centers

By Conductor:

The choice of conductor material influences system efficiency, durability, and cost. Copper and aluminium remain the dominant conductor options in the Commercial Busbar Trunking Systems Market. Copper conductors offer excellent electrical conductivity, corrosion resistance, and mechanical strength, preferred in high-performance applications despite higher costs. Aluminium conductors provide a lightweight and cost-effective alternative, widely used in installations where weight reduction and budget constraints matter. Manufacturers optimize conductor design to balance performance, installation ease, and economic considerations. This segmentation allows end-users to align their power distribution strategy with technical requirements and financial goals.

Segments:

Based on Insulation

Based on Power rating

Based on Conductor

Based on Application

- Industrial

- Power

- Oil & gas

- Process

- Transportation

- Manufacturing

- Commercial

- Utility

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Asia Pacific

The Commercial Busbar Trunking Systems Market exhibits distinct regional dynamics, with Asia Pacific commanding the largest market share of approximately 38% in 2024. Rapid urbanization, industrial expansion, and extensive infrastructure development in countries like China, India, and Southeast Asian nations drive this dominant position. Investments in smart cities, commercial complexes, and manufacturing facilities fuel demand for efficient power distribution solutions. The region’s focus on energy-efficient and scalable electrical infrastructure boosts the adoption of busbar trunking systems. It also benefits from government initiatives promoting modernization of power networks and renewable energy integration. Rising industrialization and a growing construction sector position Asia Pacific as a key growth engine for the market.

North America

North America holds around 25% of the Commercial Busbar Trunking Systems Market share. The presence of advanced infrastructure and early adoption of smart building technologies contribute to this strong foothold. The United States and Canada invest heavily in upgrading aging electrical systems, which supports steady demand for busbar solutions. Emphasis on energy conservation and compliance with stringent safety regulations encourage facility managers to adopt high-performance electrical distribution systems. The growing commercial real estate sector and expansion of data centers further drive market growth. Innovations in IoT-enabled and modular busbar systems in this region set technological benchmarks for other markets.

Europe

Europe accounts for approximately 22% of the market share, driven by mature infrastructure and rigorous regulatory frameworks. Countries such as Germany, the UK, and France lead adoption of busbar trunking systems in commercial and industrial applications. The region emphasizes sustainability and energy efficiency, reflected in increasing integration of busbar systems with renewable energy sources and smart grids. Regulatory compliance related to electrical safety and environmental standards propels market growth. The demand for modular and prefabricated systems is significant, enabling flexible power distribution in expanding urban developments. Europe’s focus on retrofitting older facilities with modern busbar technology supports continued market expansion.

Middle East and Africa (MEA)

The Middle East and Africa (MEA) region captures roughly 10% of the Commercial Busbar Trunking Systems Market share. The area witnesses growing infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries. Large-scale commercial and industrial developments, including oil and gas facilities, benefit from reliable and robust busbar trunking solutions. The region’s emphasis on smart city initiatives and diversification of energy sources opens new avenues for market growth. Despite challenges related to regulatory harmonization, investments in electrical infrastructure modernization support steady adoption rates. MEA’s strategic location also positions it as a growing hub for regional power distribution technology deployment.

Latin America

Latin America represents around 5% of the market share, reflecting gradual infrastructure modernization and expanding commercial sectors in countries like Brazil, Mexico, and Argentina. The adoption of busbar trunking systems grows in response to rising industrial activity and urbanization. The need for energy-efficient and flexible electrical distribution aligns with increasing investments in renewable energy projects and smart infrastructure. However, slower regulatory development and budget constraints limit rapid market expansion. Continued economic growth and infrastructure upgrades offer opportunities to increase market penetration in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eaton

- ABB

- DBTS Industries Sdn Bhd

- Entraco Bks Busducts Pvt. Ltd.

- Effibar

- C&S Electric Limited

- Gersan Elektrik A.S

- Anord Mardix

- Bticino

- EAE

Competitive Analysis

The Commercial Busbar Trunking Systems Market is highly competitive, led by established global players such as ABB, Eaton, Anord Mardix, C&S Electric Limited, Bticino, Gersan Elektrik A.S, DBTS Industries Sdn Bhd, Effibar, Entraco Bks Busducts Pvt. Ltd., and EAE. These companies focus on continuous innovation, product differentiation, and expanding their geographic presence to capture larger market shares. ABB and Eaton stand out with their strong R&D capabilities, offering advanced modular and IoT-enabled busbar solutions that cater to the growing demand for smart infrastructure. Anord Mardix emphasizes customization and rapid delivery, targeting diverse industrial and commercial sectors. C&S Electric Limited leverages cost-effective solutions to strengthen its position in emerging markets. The competitive landscape also reflects strategic partnerships, mergers, and acquisitions to enhance technological portfolios and service networks. Manufacturers invest in improving energy efficiency, safety standards, and system flexibility to meet stringent regulations and evolving customer needs. Product quality, reliability, and after-sales support remain critical factors influencing buyer decisions. Overall, the leading players maintain their dominance through innovation, customer-centric approaches, and expanding their footprint in high-growth regions worldwide.

Recent Developments

- In April 2025, C&S Electric highlighted its Busbar Trunking System as a modern solution for efficient and safe electrical power distribution across industrial, commercial, and residential buildings.

- In May 2024, ABB introduced over 20 new products, including digital busbar systems and solid-state circuit breakers, aimed at improving energy management and smart grid integration.

- In January 2024, DBTS upgraded its medium voltage cast resin busbar trunking systems, focusing on enhanced dielectric strength and thermal resistance to serve heavy industrial sectors better.

Market Concentration & Characteristics

The Commercial Busbar Trunking Systems Market exhibits a moderately concentrated competitive landscape dominated by a few key global players such as ABB, Eaton, and Anord Mardix, who hold significant market shares through extensive product portfolios and strong geographic reach. It also includes several regional manufacturers that cater to specific local demands, contributing to market fragmentation at the regional level. The market’s characteristics reflect high entry barriers due to substantial capital investment requirements, technical expertise, and compliance with stringent safety and performance standards. Innovation and product differentiation remain critical for maintaining competitiveness, with leading companies focusing on modular designs, energy efficiency, and smart integration features. Customer preference increasingly favors reliable, flexible, and scalable solutions that can adapt to complex commercial and industrial power distribution needs. The presence of strict regulatory frameworks worldwide drives standardization efforts, influencing product development and quality benchmarks. This environment fosters continuous technological advancements and strategic collaborations among manufacturers, suppliers, and service providers to address evolving market demands.

Report Coverage

The research report offers an in-depth analysis based on Insulation, Power rating, Conductor, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Commercial Busbar Trunking Systems Market will continue to grow due to increasing urbanization and infrastructure expansion.

- Adoption of smart technologies and IoT integration will enhance system monitoring and energy management.

- Modular and prefabricated busbar systems will gain popularity for their ease of installation and scalability.

- Rising focus on energy efficiency and sustainability will drive demand for advanced busbar solutions.

- Emerging markets will offer significant growth opportunities due to rapid industrialization and modernization efforts.

- Manufacturers will invest more in research and development to improve safety and durability features.

- Integration with renewable energy sources will become a key trend in power distribution systems.

- Regulatory compliance and standardization will shape product design and market expansion strategies.

- Strategic partnerships and collaborations will increase to enhance technological capabilities and market reach.

- Customer preference will shift towards flexible, cost-effective, and maintenance-friendly busbar trunking systems.