Market Overview:

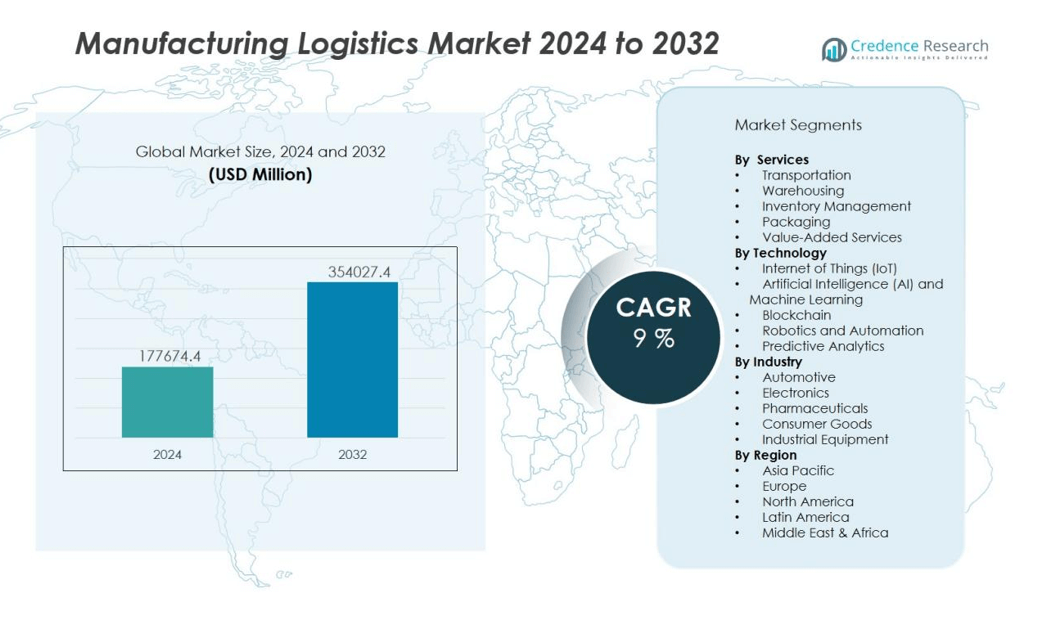

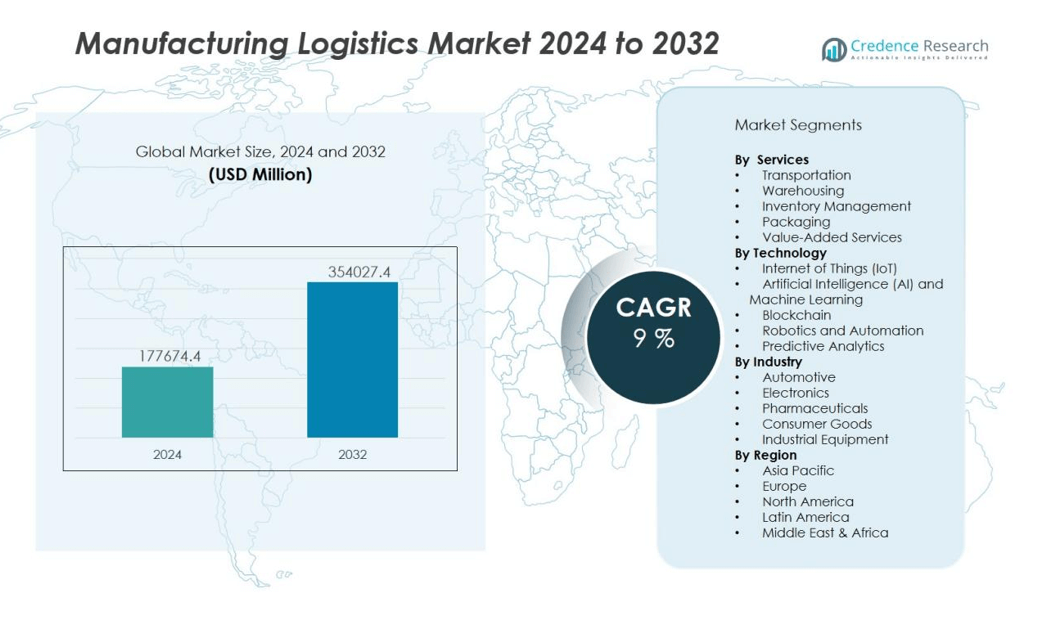

The manufacturing logistics market size was valued at USD 177674.4 million in 2024 and is anticipated to reach USD 354027.4 million by 2032, at a CAGR of 9 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Manufacturing Logistics Market Size 2024 |

USD 177674.4 million |

| Manufacturing Logistics Market, CAGR |

9% |

| Manufacturing Logistics Market Size 2032 |

USD 354027.4 million |

Market growth is driven by rising manufacturing output across industries such as automotive, electronics, pharmaceuticals, and consumer goods. The adoption of automation, robotics, and IoT-enabled tracking systems is enhancing operational efficiency, reducing downtime, and improving inventory management. Growing demand for just-in-time delivery models, coupled with the need to optimize cost and speed in production cycles, is further propelling investments in advanced logistics infrastructure. Sustainability goals and the shift toward green supply chains are also influencing market strategies.

Regionally, Asia-Pacific dominates the manufacturing logistics market due to strong industrial growth in China, India, and Southeast Asia, supported by large-scale manufacturing hubs and expanding export activities. North America and Europe hold significant shares, driven by mature manufacturing sectors, advanced supply chain technologies, and a focus on high-value, customized logistics solutions.

Market Insights:

- The manufacturing logistics market was valued at USD 177,674.4 million in 2024 and is projected to reach USD 354,027.4 million by 2032, growing at a CAGR of 9% from 2024 to 2032.

- Rising manufacturing output across automotive, electronics, pharmaceuticals, and consumer goods sectors is creating sustained demand for efficient logistics solutions.

- Adoption of automation, robotics, and IoT-enabled tracking systems is improving operational efficiency, reducing downtime, and enhancing inventory management accuracy.

- Increasing reliance on just-in-time and lean manufacturing models is driving the need for agile, responsive, and cost-optimized logistics networks.

- Sustainability goals are encouraging investments in electric fleets, route optimization, and recyclable packaging to align with green supply chain practices.

- Asia-Pacific leads the market, supported by large manufacturing hubs in China, India, and Southeast Asia, along with rapid export growth and smart infrastructure investments.

- North America and Europe maintain significant shares, driven by advanced supply chain technologies, mature manufacturing sectors, and a strong focus on high-value, customized logistics solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expansion of Global Manufacturing Networks Driving Demand for Advanced Logistics Solutions:

The manufacturing logistics market benefits from the rapid expansion of global manufacturing networks. Companies are sourcing raw materials from multiple regions and delivering finished products to diverse markets, creating a need for efficient and reliable logistics systems. It supports seamless coordination between suppliers, manufacturers, and distributors to reduce delays and optimize throughput. Increasing cross-border trade has intensified the demand for specialized transportation, warehousing, and customs management capabilities. This expansion encourages investment in integrated logistics platforms that can handle complex, multi-location supply chains.

- For instance, FedEx’s SenseAware ID system delivers nearly real-time visibility for global shipments, allowing proactive logistics management for time-sensitive deliveries in over 220 countries and territories.

Adoption of Automation and Digitalization Enhancing Operational Efficiency:

Automation, robotics, and digital platforms are transforming the manufacturing logistics market by streamlining operations and minimizing human error. IoT-enabled tracking systems, warehouse management software, and predictive analytics tools improve inventory accuracy and reduce downtime. It enables real-time visibility across the supply chain, allowing manufacturers to respond quickly to disruptions. Advanced material handling equipment increases throughput and reduces operational costs. This adoption of smart technologies strengthens competitiveness by enabling faster, more efficient order fulfillment.

- For instance, British Sugar’s automated warehouse in Wissington processes 3,000 pallets daily using the Mecalux Group’s Automated Pallet Shuttle system, dramatically increasing entry and exit speed and safety.

Shift Toward Just-in-Time and Lean Manufacturing Models:

The rising adoption of just-in-time and lean manufacturing practices is significantly influencing logistics strategies. These models require precise coordination between production schedules and material deliveries to avoid inventory excess or shortages. The manufacturing logistics market supports this requirement by ensuring timely transportation and efficient storage management. It also demands agile logistics networks capable of adapting to sudden changes in demand. This shift promotes closer collaboration between logistics providers and manufacturing firms to maintain production continuity.

Growing Emphasis on Sustainability and Green Logistics Practices:

Sustainability goals are prompting manufacturers to implement eco-friendly logistics practices. Companies are investing in electric fleets, optimizing delivery routes, and adopting recyclable packaging materials to reduce environmental impact. It aligns with regulatory requirements and strengthens brand reputation among environmentally conscious consumers. The manufacturing logistics market is responding with innovative solutions that balance efficiency with environmental responsibility. This trend is expected to remain a strong driver as industries work toward net-zero carbon targets.

Market Trends:

Integration of Advanced Technologies Transforming Supply Chain Operations:

The manufacturing logistics market is experiencing a strong shift toward the integration of advanced technologies to improve efficiency, visibility, and accuracy. Artificial intelligence, machine learning, and predictive analytics are enabling data-driven decision-making across logistics operations. IoT-enabled sensors and RFID systems are enhancing real-time tracking of materials and finished goods, reducing losses and delays. Automation in warehousing, including robotic picking systems and autonomous guided vehicles, is streamlining order fulfillment and minimizing manual intervention. Blockchain adoption is strengthening supply chain transparency by ensuring secure, verifiable transactions and tracking product origins. It supports greater collaboration between manufacturers, logistics providers, and suppliers, ultimately reducing operational risks. This technology-driven transformation is creating more resilient and agile logistics networks.

- For instance, Walmart implemented a Hyperledger Fabric-based blockchain solution for food traceability, reducing the time needed to track the origin of over 25 products from 5 different supplies to just 2.2seconds in its U.S.stores.

Rising Demand for Customization, Flexibility, and Sustainable Logistics Solutions:

Manufacturers are increasingly seeking logistics solutions that can adapt to varying production demands, regional market requirements, and sustainability goals. The manufacturing logistics market is responding with flexible, scalable, and tailored services that accommodate fluctuating order volumes and diverse product types. Demand for on-demand warehousing and localized distribution hubs is growing to meet shorter delivery timelines. Green logistics practices, including low-emission transportation, route optimization, and energy-efficient storage facilities, are becoming standard industry expectations. It is driving investment in electric and alternative-fuel vehicle fleets, as well as the use of recyclable and reusable packaging. The emphasis on customization is fostering closer collaboration between manufacturers and logistics partners to ensure service alignment with production strategies. This trend is reinforcing the role of logistics as a strategic enabler in manufacturing competitiveness.

- For example, DHL operates a global logistics fleet with more than 29,200 electric vehicles and plans for 60% of its deliveries to be electric-powered by 2030.

Market Challenges Analysis:

Supply Chain Disruptions and Rising Operational Costs:

The manufacturing logistics market faces persistent challenges from supply chain disruptions caused by geopolitical tensions, raw material shortages, and transportation delays. Fluctuating fuel prices and increased labor costs are adding pressure to operational budgets. It often requires companies to balance speed and efficiency with cost control, which can strain resources. Port congestion, inconsistent customs procedures, and varying international trade regulations further complicate cross-border operations. Unpredictable demand patterns also make inventory planning more complex. These issues can hinder timely deliveries and reduce overall supply chain resilience.

Technological Integration and Skills Shortages Limiting Efficiency Gains:

While technology adoption is a key driver, the manufacturing logistics market struggles with the complexities of integrating advanced systems across diverse operations. Legacy infrastructure, incompatible platforms, and high implementation costs slow digital transformation efforts. It also faces a shortage of skilled professionals capable of managing automation, data analytics, and AI-driven tools. Cybersecurity risks are rising as more logistics processes become connected and data-dependent. Smaller firms often lack the capital and expertise to compete with technologically advanced competitors. These barriers can limit efficiency improvements and slow the industry’s overall modernization pace.

Market Opportunities:

Expansion of Smart and Automated Logistics Infrastructure:

The growing adoption of smart technologies presents significant opportunities for the manufacturing logistics market. Investments in automated warehouses, AI-powered forecasting, and IoT-enabled monitoring systems can enhance accuracy, reduce delays, and optimize resource use. It allows manufacturers to implement predictive maintenance, dynamic route planning, and real-time supply chain visibility. Integration of robotics in material handling can increase throughput while lowering labor dependency. Blockchain adoption can further improve transparency and trust in multi-tier supply chains. These advancements position logistics providers to offer high-value, technology-driven services that meet evolving manufacturing demands.

Growth Potential in Emerging Markets and Sustainable Logistics Solution:

Rapid industrialization in emerging economies creates new demand for efficient logistics networks and localized distribution capabilities. The manufacturing logistics market can benefit from strategic investments in these regions to support expanding production hubs. It also gains momentum from the increasing global focus on sustainability, with opportunities in green transportation, energy-efficient warehousing, and circular supply chain models. Adoption of electric fleets, renewable-powered facilities, and eco-friendly packaging aligns with regulatory requirements and customer expectations. Developing customized logistics solutions for niche sectors, such as high-tech manufacturing or pharmaceuticals, further expands market reach. These opportunities enable providers to diversify offerings and strengthen competitive positioning.

Market Segmentation Analysis:

By Services:

The manufacturing logistics market covers a wide range of services, including transportation, warehousing, inventory management, packaging, and value-added services. Transportation dominates due to the critical need for timely movement of raw materials and finished goods across global supply chains. Warehousing services are expanding with the rise of automated storage solutions and demand for just-in-time delivery models. Value-added services such as kitting, labeling, and product customization are enhancing customer satisfaction and operational efficiency.

- For instance, A.P. Moller – Maersk added 300,000 TEU of dual-fuel vessel capacity to its fleet in 2024.

By Technology:

Advanced technologies are transforming the manufacturing logistics market, with IoT, AI, blockchain, and robotics leading adoption. IoT-enabled tracking devices and real-time monitoring systems improve visibility and control across the supply chain. AI-driven analytics optimize route planning, demand forecasting, and resource allocation. Robotics in material handling reduces labor dependency and increases throughput, while blockchain enhances transparency and traceability in multi-tier supply chains.

- For instance, IBM Food Trust’s blockchain trace module shortened the time to track a mango’s farm origin from 6 days 18 hours 25 minutes to just 2.2 seconds.

By Industry:

The market serves diverse industries, including automotive, electronics, pharmaceuticals, consumer goods, and industrial equipment. Automotive and electronics lead demand due to complex, high-volume supply chains requiring precision and efficiency. Pharmaceuticals rely on specialized logistics for temperature-sensitive and regulated shipments. Consumer goods benefit from fast, flexible distribution networks to meet fluctuating retail demand. Industrial equipment manufacturing demands customized logistics solutions for oversized and high-value products.

Segmentations:

By Services:

- Transportation

- Warehousing

- Inventory Management

- Packaging

- Value-Added Services

By Technology:

- Internet of Things (IoT)

- Artificial Intelligence (AI) and Machine Learning

- Blockchain

- Robotics and Automation

- Predictive Analytics

By Industry:

- Automotive

- Electronics

- Pharmaceuticals

- Consumer Goods

- Industrial Equipment

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds the largest market share of the manufacturing logistics market, driven by high-volume manufacturing hubs in China, India, Japan, and Southeast Asia. The region benefits from extensive industrial infrastructure, skilled labor availability, and strong government support for export-oriented production. It plays a central role in global supply chains, serving both developed and emerging economies. Large-scale investments in smart logistics parks, automation, and port modernization are enhancing operational efficiency. E-commerce growth and rapid industrialization are further increasing the demand for advanced logistics solutions. Cross-border trade within the region strengthens integration and fosters competitive manufacturing ecosystems.

North America :

North America commands a significant market share of the manufacturing logistics market, supported by a robust manufacturing base in the United States, Canada, and Mexico. The region leverages advanced supply chain technologies, including automation, AI-driven analytics, and real-time tracking systems. It benefits from strong domestic demand and well-established trade agreements such as USMCA. Investments in green logistics, electric fleets, and warehouse robotics are driving efficiency gains. The manufacturing sector’s focus on high-value and customized production increases the need for flexible, responsive logistics solutions. Strategic proximity to major consumer markets further strengthens the region’s competitive position.

Europe :

Europe holds a substantial market share of the manufacturing logistics market, supported by advanced manufacturing clusters in Germany, France, Italy, and the United Kingdom. The region’s emphasis on sustainability and compliance with stringent environmental regulations shapes logistics operations. It has been investing heavily in low-emission transport, intermodal freight solutions, and energy-efficient warehousing. Integration of digital platforms for end-to-end supply chain visibility is improving performance and reducing delays. Strong automotive, aerospace, and industrial equipment sectors contribute to steady logistics demand. Cross-border trade within the European Union fosters efficiency and harmonization of logistics standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Deutsche Post AG

- FedEx

- Maersk

- United Parcel Service of America, Inc.

- DB Schenker

- CEVA Logistics (The CMA CGM Group)

- Nippon Express

- Expeditors International

- Kuehne + Nagel

- DSV

- XPO Logistics

- Kerry Logistics

Competitive Analysis:

The manufacturing logistics market is highly competitive, with global and regional players offering a broad range of integrated logistics solutions. Key companies include Deutsche Post AG, FedEx, Maersk, United Parcel Service of America, Inc., DB Schenker, CEVA Logistics (The CMA CGM Group), Nippon Express, and Expeditors International. It is characterized by continuous investment in advanced technologies such as automation, IoT-enabled tracking, and AI-driven analytics to enhance operational efficiency and supply chain visibility. Leading players focus on expanding global networks, improving last-mile delivery capabilities, and offering tailored solutions for industries like automotive, electronics, and pharmaceuticals. Strategic partnerships, mergers, and acquisitions remain common to strengthen service portfolios and geographic reach. Sustainability initiatives, including green transportation and energy-efficient warehousing, are becoming essential competitive differentiators. The market’s dynamic nature drives companies to innovate, optimize costs, and deliver faster, more reliable services to maintain leadership.

Recent Developments:

- In July 2025, DHL Group expanded its electric delivery fleet, adding 2,400 new Ford Pro e-vans in Germany.

- In Feb 2025, FedEx and Amazon renewed a partnership after a six-year hiatus, with FedEx now delivering large/bulky packages to residential Amazon customers under a multi-year agreement.

- In April 2025, DB Schenker was acquired by DSV in a landmark €14.3 billion deal, consolidating financials and executive teams from this date.

Market Concentration & Characteristics:

The manufacturing logistics market is moderately concentrated, with a mix of global logistics providers, regional players, and specialized service companies competing for market share. It is characterized by high entry barriers due to significant capital requirements, advanced technology adoption, and the need for extensive distribution networks. Leading companies differentiate through end-to-end supply chain solutions, technology integration, and industry-specific expertise. Strategic partnerships, mergers, and investments in automation, AI, and sustainable practices are common to enhance competitiveness. The market serves diverse sectors including automotive, electronics, pharmaceuticals, and consumer goods, requiring flexible and customized solutions. Strong competition drives continuous innovation in efficiency, speed, and service quality.

Report Coverage:

The research report offers an in-depth analysis based on Services, Technology, Industry and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Growing adoption of AI, IoT, and predictive analytics will enhance supply chain visibility and operational efficiency.

- Integration of robotics and automation in warehousing will accelerate order fulfillment and reduce labor dependency.

- Demand for green logistics solutions will rise, driving investments in electric fleets, renewable-powered facilities, and eco-friendly packaging.

- Expansion of manufacturing hubs in emerging economies will create opportunities for localized logistics infrastructure.

- Greater emphasis on just-in-time and lean manufacturing models will increase the need for agile and responsive logistics networks.

- Blockchain implementation will improve supply chain transparency, traceability, and security in global operations.

- E-commerce growth will push manufacturers to develop faster, more flexible distribution strategies.

- Strategic collaborations between logistics providers and manufacturers will become more common to deliver tailored industry-specific solutions.

- Resilient supply chain planning will gain priority to address risks from geopolitical shifts, climate change, and demand fluctuations.

- Continuous innovation in intermodal transportation will enhance efficiency in moving goods across regions and markets.