| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Matting Agents Market Size 2024 |

USD 518.45 million |

| Matting Agents Market, CAGR |

5.85% |

| Matting Agents Market Size 2032 |

USD 844.20 million |

Market Overview

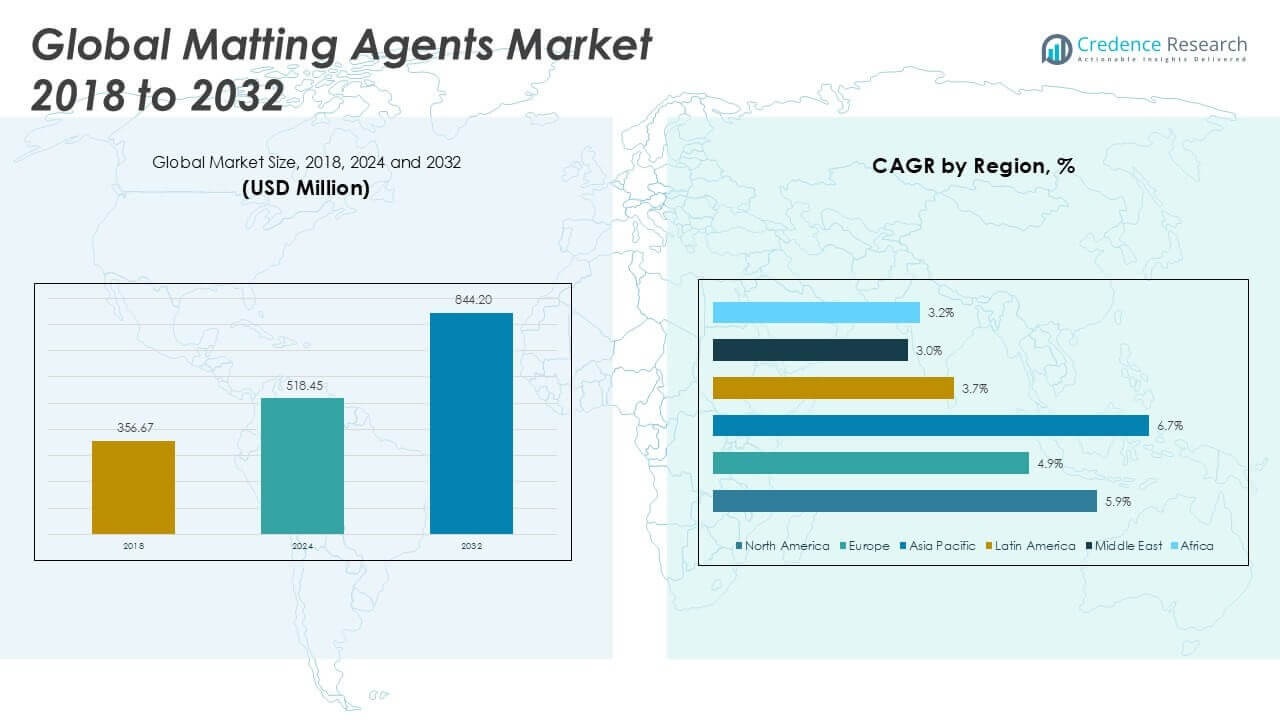

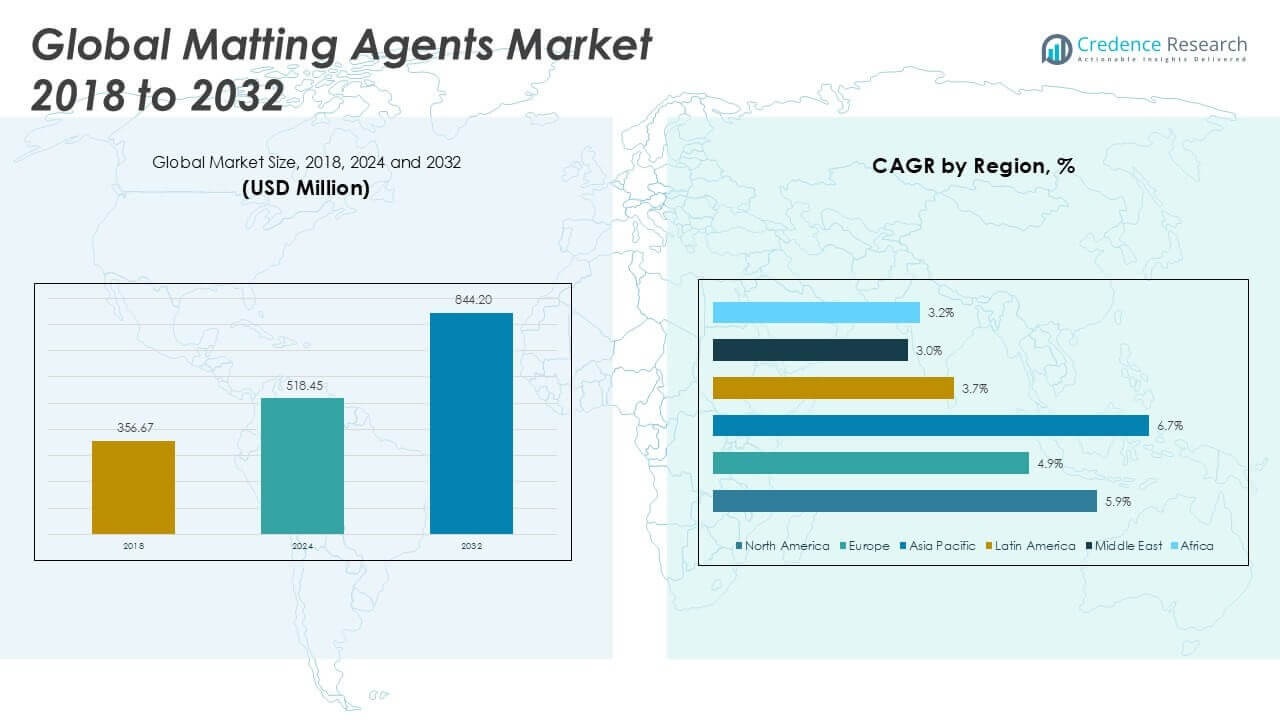

The Matting Agents Market size was valued at USD 356.67 million in 2018 to USD 518.45 million in 2024 and is anticipated to reach USD 844.20 million by 2032, at a CAGR of 5.85% during the forecast period.

The Matting Agents Market is driven by increasing demand for low-gloss and matte finishes in paints, coatings, and inks across automotive, industrial, and architectural applications. Manufacturers are adopting matting agents to enhance surface aesthetics, improve scratch resistance, and reduce glare, aligning with evolving consumer preferences and stringent industry standards. Growing investments in construction and infrastructure projects, especially in emerging economies, further accelerate market expansion. Technological advancements in silica-based, wax-based, and polymer-based matting agents have improved compatibility, dispersion, and performance, supporting their adoption in waterborne and solvent-based systems. Sustainability trends are influencing the development of eco-friendly and low-VOC formulations, meeting regulatory requirements and customer expectations for green solutions. Additionally, the rising use of matting agents in plastics, wood coatings, and printing inks is broadening the market scope. These factors collectively contribute to sustained growth and innovation within the Matting Agents Market.

The Matting Agents Market demonstrates strong geographical diversity, with Asia Pacific emerging as the leading region due to rapid industrialization, urban development, and increasing demand for advanced coatings in countries like China, Japan, and India. North America and Europe also represent significant markets, driven by robust automotive, construction, and manufacturing sectors, along with a strong focus on sustainable and innovative coating solutions. Latin America, the Middle East, and Africa are witnessing gradual adoption of matting agents, supported by infrastructure growth and modernization initiatives. Key players shaping the competitive landscape include Akzo Nobel NV, BASF SE, and Evonik Industries AG, all of whom leverage advanced research, product innovation, and regional expansion strategies to capture opportunities across these diverse markets. Their investments in eco-friendly technologies and tailored customer solutions help them respond effectively to dynamic regional demands and regulatory requirements.

Market Insights

- The Matting Agents Market was valued at USD 518.45 million in 2024 and is projected to reach USD 844.20 million by 2032, registering a CAGR of 5.85% during the forecast period.

- Rising demand for matte and low-gloss finishes in automotive, architectural, and industrial coatings is a major driver for the market, reflecting evolving consumer and industry preferences.

- Sustainability trends are pushing manufacturers to innovate with eco-friendly, low-VOC, and bio-based matting agents that align with global regulations and customer expectations for greener solutions.

- Advancements in silica-based, wax-based, and polymer-based matting agents have enhanced performance, dispersion, and compatibility, allowing for broader application in waterborne, solvent-borne, and powder coatings.

- Competitive dynamics remain intense with key players such as Akzo Nobel NV, BASF SE, Evonik Industries AG, BYK-Chemie GmbH, and PPG Industries Inc. investing in research, new product launches, and geographic expansion to strengthen their market presence.

- Key restraints include the complexity of achieving consistent product performance across diverse applications, rising raw material costs, and the need to comply with stringent environmental regulations in different regions.

- Asia Pacific holds the largest market share, led by China, Japan, and India, while North America and Europe remain significant markets with strong regulatory focus and advanced coating technologies; emerging markets in Latin America, the Middle East, and Africa offer growth opportunities amid rising urbanization and infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Matte Finishes Across Industries

The preference for matte and low-gloss finishes in end-use industries has significantly increased, driving the need for matting agents. The automotive sector values these agents for their ability to enhance vehicle interiors and exteriors with sophisticated, glare-free surfaces. In the architectural and decorative coatings segment, consumers increasingly seek elegant, non-reflective finishes for residential and commercial buildings. The trend extends to industrial equipment, where matte coatings improve product appearance while reducing visual distractions. This demand for superior surface aesthetics supports market growth. Manufacturers of paints, coatings, and inks actively integrate matting agents to meet evolving design trends.

- For instance, the architectural coatings sector has shown a 25% reduction in VOC emissions between 2008 and 2021, indicating a shift toward eco-friendly formulations.

Expansion in Construction and Infrastructure Projects

Strong growth in construction and infrastructure investments, particularly in emerging economies, is a key driver for the Matting Agents Market. Rapid urbanization and government initiatives aimed at upgrading public and private infrastructure have spurred the demand for high-performance architectural coatings. These coatings, enabled by advanced matting agents, offer both visual appeal and enhanced surface durability. The surge in new housing developments and renovation activities further stimulates the adoption of matte coatings in interior and exterior applications. It benefits from an expanding base of construction projects requiring durable, visually appealing finishes. This dynamic sustains consistent market expansion.

Advancements in Technology and Product Formulations

Innovations in matting agent technology play a crucial role in supporting the market’s growth. Development of silica-based, wax-based, and polymer-based matting agents has improved compatibility and efficiency in both waterborne and solvent-borne systems. Enhanced dispersion, improved scratch resistance, and optimized particle size distribution have made these agents more effective across a range of applications. Manufacturers invest in research and development to create products that meet industry demands for durability and performance. The adoption of cutting-edge formulation techniques gives rise to customized solutions for diverse end-user requirements. The Matting Agents Market benefits from continuous product innovation and process improvement.

- For instance, advancements in silica-based, wax-based, and polymer-based matting agents have improved compatibility and efficiency in both waterborne and solvent-borne systems.

Focus on Sustainability and Regulatory Compliance

Rising emphasis on environmental sustainability and regulatory compliance has accelerated the shift toward eco-friendly matting agent solutions. Manufacturers respond by developing low-VOC, non-toxic, and recyclable formulations to meet stringent regulations on emissions and hazardous substances. The drive for sustainable coatings aligns with increasing consumer awareness of environmental impacts and industry initiatives promoting greener alternatives. The market embraces bio-based and renewable raw materials, broadening the range of sustainable options available. The ongoing push for sustainability not only ensures regulatory compliance but also enhances market competitiveness. The Matting Agents Market leverages these trends to reinforce its long-term growth outlook.

Market Trends

Growing Integration of Matting Agents in Eco-Friendly Formulations

The shift toward environmentally responsible products is shaping trends in the Matting Agents Market. Manufacturers prioritize the development of low-VOC, water-based, and solvent-free formulations that minimize environmental impact while delivering high performance. Regulatory agencies enforce stringent standards on emissions and hazardous substances, encouraging industry participants to adopt sustainable solutions. The trend toward bio-based and renewable materials continues to influence new product launches. Consumers and businesses seek coatings that provide both environmental benefits and functional advantages, such as durability and enhanced aesthetics. The market responds by innovating formulations that balance sustainability with performance, reinforcing its alignment with global environmental goals.

Emphasis on Product Performance and Multi-Functionality

Matting agents are evolving beyond traditional roles to deliver multi-functional benefits such as improved scratch resistance, anti-fingerprint properties, and enhanced durability. The demand for coatings that combine matte appearance with long-term performance drives ongoing research and development. Manufacturers incorporate advanced technologies to ensure consistency in gloss levels and surface finish across various substrates. Product innovation extends to hybrid matting agents, which offer balanced performance characteristics suitable for multiple applications. The Matting Agents Market maintains its competitive edge by continually enhancing product functionality and supporting the needs of sophisticated end-users.

- For instance, the U.S. Department of Energy notes a 35% increase in sustainable coating technologies adoption from 2015 to 2022.

Advancements in Customization and Application Versatility

Matting agents are increasingly tailored to meet specific application needs across diverse industries. Technological progress enables manufacturers to design agents with optimized particle size, improved dispersion, and enhanced compatibility with a variety of resin systems. The trend supports the adoption of matting agents in automotive, industrial, architectural, and packaging sectors, where unique surface effects and performance characteristics are essential. Companies develop specialized grades for plastics, wood coatings, and printing inks, meeting the demands of niche applications. This emphasis on customization broadens the market’s scope and allows stakeholders to address rapidly changing design and functional preferences.

- For instance, the increasing demand for low-VOC or VOC-free solutions is driving the market, as manufacturers seek to conform to regulations and meet environmental concerns.

Rising Adoption in Emerging Economies and New End-Use Applications

The Matting Agents Market is expanding its presence in emerging markets driven by urbanization, rising disposable incomes, and growing investments in infrastructure. Increased construction activity in Asia Pacific, Latin America, and the Middle East creates new opportunities for matte coatings in residential, commercial, and industrial settings. End-users in these regions prioritize modern, low-gloss finishes to enhance property value and appeal. The proliferation of electronic devices and consumer goods with matte surfaces also supports wider adoption of matting agents. It leverages growth in untapped markets by aligning product offerings with local trends and regulatory requirements.

Market Challenges Analysis

Regulatory Pressures and Rising Raw Material Costs

Stringent environmental regulations and fluctuating prices of raw materials present ongoing challenges for the Matting Agents Market. Regulatory frameworks increasingly limit the use of certain chemicals and mandate lower VOC content, requiring significant adjustments in formulation strategies. Sourcing bio-based or specialized ingredients often increases procurement costs and pressures supply chains. It must navigate compliance with regional and global standards, which adds to operational complexity and may slow product launches. Price volatility in key raw materials affects profitability, compelling industry players to seek cost-effective alternatives without compromising performance. These factors require strategic planning and robust supply chain management to sustain market competitiveness.

- For instance, regulatory agencies in North America and Europe enforce strict emissions standards for waste-to-energy operations, affecting the approval and expansion of matting agent projects.

Complexity in Achieving Consistent Product Performance

The Matting Agents Market faces significant challenges related to achieving uniform and consistent performance across various formulations and applications. Variability in raw material quality, differences in resin systems, and the complexity of end-use requirements often result in unpredictable gloss levels and surface textures. Manufacturers must invest in advanced testing and quality control processes to maintain product standards. This demand for precision elevates production costs and extends development timelines. It must address compatibility issues with evolving resin technologies, particularly in high-performance and eco-friendly coatings. The challenge intensifies when customers expect both aesthetic excellence and enhanced functional attributes from matting agent-infused coatings.

Market Opportunities

Expansion into High-Growth Emerging Markets

Emerging economies present substantial opportunities for the Matting Agents Market due to rapid urbanization, increasing construction activities, and rising consumer spending. Growing infrastructure projects and demand for modern architectural finishes in regions such as Asia Pacific, Latin America, and the Middle East drive the uptake of matte coatings. The shift toward premium automotive and consumer goods in these markets supports further adoption of advanced matting technologies. It can capitalize on untapped markets by tailoring solutions to local preferences, building distribution networks, and collaborating with regional manufacturers. The evolving regulatory environment in emerging regions also encourages innovation in sustainable and compliant product offerings.

Product Innovation and Sustainable Solutions

Innovation in sustainable and high-performance matting agents creates new growth avenues for the market. The increasing preference for eco-friendly, low-VOC, and bio-based coatings motivates manufacturers to develop advanced formulations that address both regulatory and customer requirements. It can leverage technological advancements to create multifunctional agents that offer not only enhanced aesthetics but also improved durability, scratch resistance, and anti-fingerprint properties. Collaboration with end-users and research institutions helps identify specific industry needs and accelerates the adoption of next-generation products. These opportunities position the Matting Agents Market to expand its reach and establish leadership in a dynamic, sustainability-focused landscape.

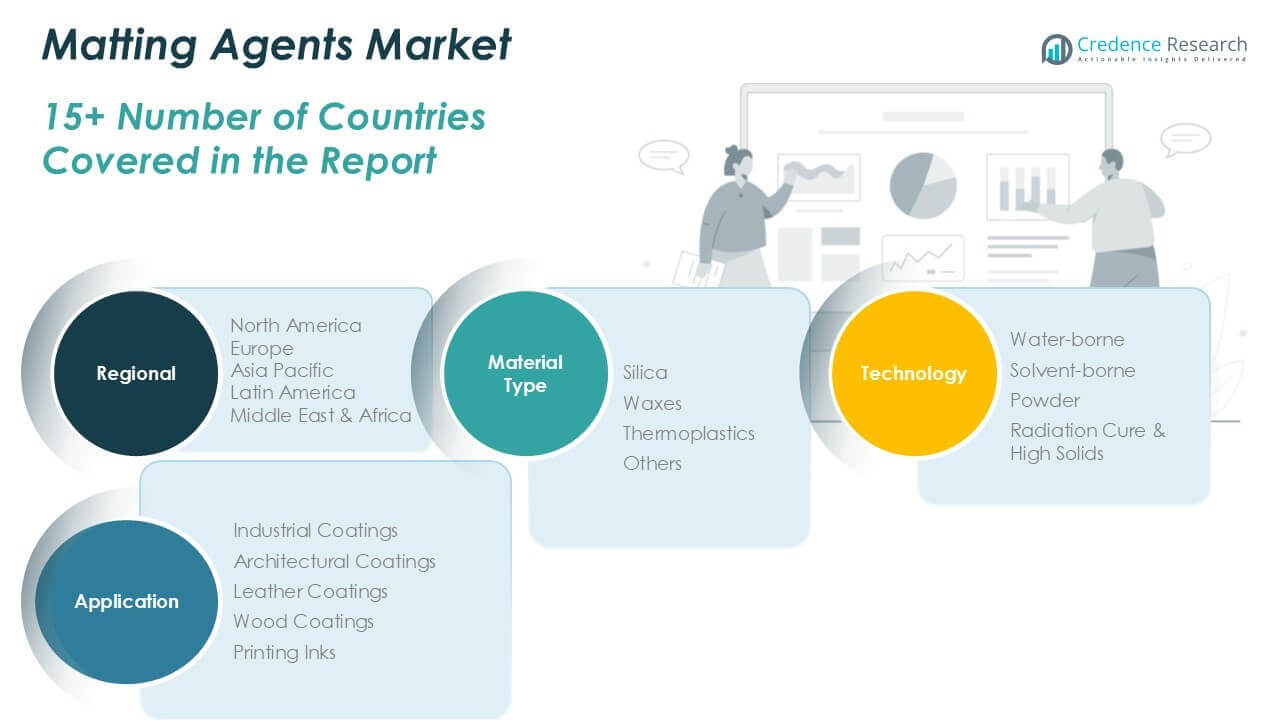

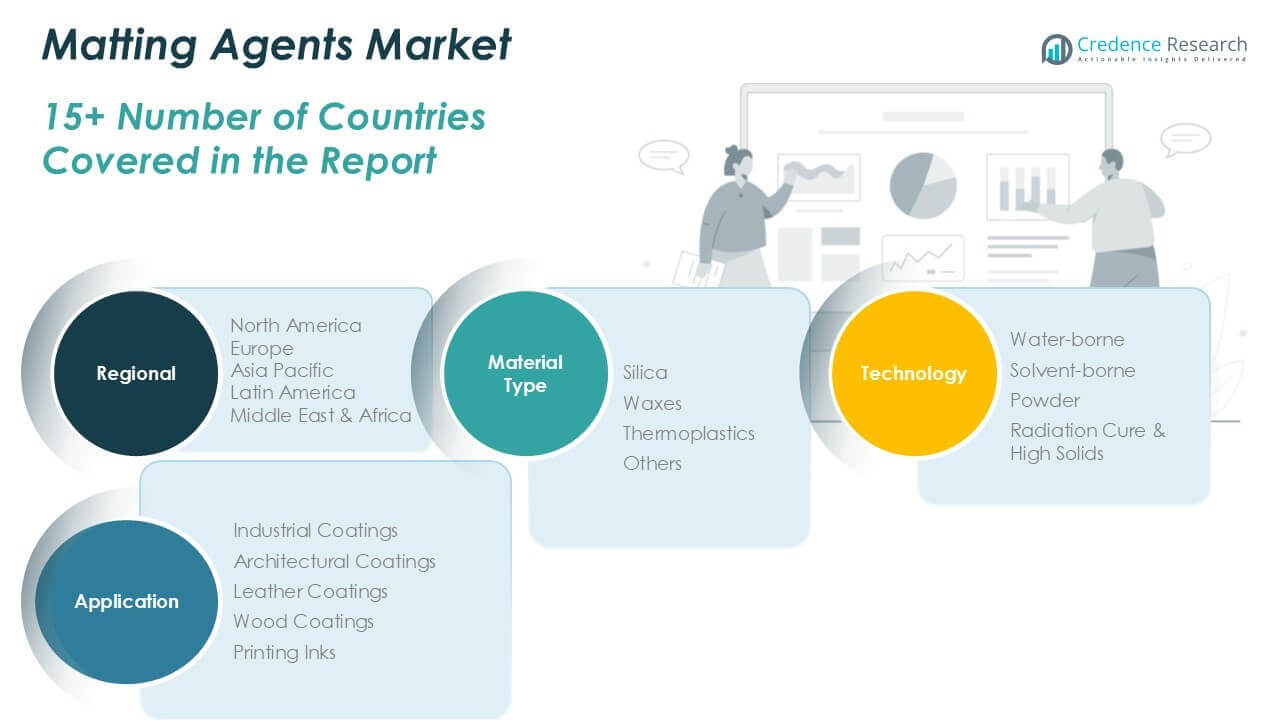

Market Segmentation Analysis:

By Material Type:

By material type, silica leads the market due to its superior efficiency in achieving uniform matte finishes and compatibility with various resin systems. Waxes, including natural and synthetic variants, provide desirable surface characteristics and find use in specialty coatings. Thermoplastics serve niche requirements, offering durability and flexibility, while the ‘others’ category includes emerging and hybrid materials supporting unique performance needs.

By Technology:

Water-borne matting agents gain significant traction, supported by regulatory shifts toward low-VOC formulations and growing environmental awareness. Solvent-borne technologies maintain relevance where rapid drying and high compatibility are essential. Powder coatings exhibit rising demand in industrial applications for their efficiency and waste reduction capabilities. Radiation cure and high solids technologies address requirements for fast processing and minimal emissions, aligning with trends in advanced manufacturing.

By Application:

Industrial and architectural coatings account for the largest share, driven by demand for enhanced aesthetics and durability in construction and manufacturing sectors. Leather and wood coatings rely on matting agents to achieve premium finishes, while the printing inks segment adopts these agents to ensure consistent print quality and tactile appeal. The market leverages this segmentation to cater to specialized end-user needs and drive targeted innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Material Type:

- Silica

- Waxes

- Thermoplastics

- Others

Based on Technology:

- Water-borne

- Solvent-borne

- Powder

- Radiation Cure & High Solids

Based on Application:

- Industrial Coatings

- Architectural Coatings

- Leather Coatings

- Wood Coatings

- Printing Inks

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Matting Agents Market

North America Matting Agents Market grew from USD 105.73 million in 2018 to USD 151.34 million in 2024 and is projected to reach USD 247.45 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.9%. North America is holding a 29% market share in 2024. The United States leads regional demand, supported by a robust coatings industry and significant investments in construction and automotive manufacturing. Canada contributes through advanced infrastructure development and increased adoption of eco-friendly coating technologies. The region benefits from strong regulatory frameworks encouraging low-VOC and sustainable formulations. High consumer demand for high-performance, durable matte finishes further drives growth. Leading companies in the U.S. and Canada are prioritizing innovation and expanding their product portfolios to maintain competitive advantage.

Europe Matting Agents Market

Europe Matting Agents Market grew from USD 82.47 million in 2018 to USD 114.58 million in 2024 and is projected to reach USD 173.06 million by 2032, at a CAGR of 4.9%. Europe holds a 22% market share in 2024. Germany, France, and the United Kingdom anchor regional growth, supported by stringent environmental regulations and high demand for sustainable coatings in automotive, architectural, and industrial applications. Strong presence of multinational coatings manufacturers fuels continuous innovation. The trend toward eco-friendly construction materials and retrofitting existing buildings accelerates adoption of advanced matting technologies. Regulatory pressures and growing awareness of environmental impacts reinforce the market’s shift toward bio-based and water-borne solutions.

Asia Pacific Matting Agents Market

Asia Pacific Matting Agents Market expanded from USD 141.04 million in 2018 to USD 213.38 million in 2024 and is anticipated to reach USD 370.79 million by 2032, representing a CAGR of 6.7%. Asia Pacific holds the largest share at 41% in 2024. China, Japan, South Korea, and India are the primary contributors, with rapid industrialization, urbanization, and infrastructure projects fueling demand for matte coatings. China dominates both production and consumption, leveraging scale and growing investment in environmentally advanced formulations. Rising middle-class populations and evolving design trends in consumer goods and automotive sectors underpin sustained market expansion. It benefits from local manufacturing, a dynamic regulatory environment, and increasing focus on product quality.

Latin America Matting Agents Market

Latin America Matting Agents Market grew from USD 13.00 million in 2018 to USD 18.59 million in 2024 and is projected to reach USD 25.75 million by 2032, with a CAGR of 3.7%. Latin America holds a 3% market share in 2024. Brazil and Mexico account for the majority of market activity, driven by the construction, automotive, and furniture industries. Ongoing urban development and modernization projects boost demand for advanced coatings and surface finishes. The market experiences steady growth despite moderate economic expansion, with increased awareness of sustainable and low-emission products shaping purchasing decisions. Regional manufacturers are investing in capacity expansions and technology upgrades to address evolving end-user requirements.

Middle East Matting Agents Market

Middle East Matting Agents Market increased from USD 8.20 million in 2018 to USD 10.68 million in 2024 and is forecast to reach USD 14.01 million by 2032, with a CAGR of 3.0%. The region represents a 2% market share in 2024. Key markets such as Saudi Arabia and the United Arab Emirates drive demand through large-scale infrastructure, hospitality, and real estate development projects. Investments in high-end architectural and decorative coatings support growth, while regional shifts toward sustainable construction solutions begin to influence market dynamics. The Middle East is focusing on diversifying its economic base, providing opportunities for specialty coating manufacturers to introduce advanced matting technologies.

Africa Matting Agents Market

Africa Matting Agents Market grew from USD 6.21 million in 2018 to USD 9.87 million in 2024 and is projected to reach USD 13.14 million by 2032, at a CAGR of 3.2%. Africa holds a 2% market share in 2024. South Africa, Nigeria, and Egypt lead regional demand, with the construction and industrial sectors as primary growth engines. The market remains in early stages of development, with gradual adoption of advanced coatings and increasing awareness of environmental regulations. Multinational companies see potential for long-term growth and are establishing partnerships with local distributors. It benefits from infrastructure investments and urbanization trends, gradually expanding its footprint in the region.

Key Player Analysis

- Akzo Nobel NV

- Arkema

- Axalta Coating Systems LLC

- BASF SE

- BYK-Chemie GmbH

- CHT Germany GmbH

- Deuteron GmbH

- Evonik Industries AG

- Honeywell International Inc.

- Huber Engineered Materials

- Huntsman International LLC

- Imerys SA

- PPG Industries Inc.

- PQ Corporation

Competitive Analysis

The Matting Agents Market features a competitive landscape dominated by global players including Akzo Nobel NV, Arkema, Axalta Coating Systems LLC, BASF SE, BYK-Chemie GmbH, CHT Germany GmbH, Deuteron GmbH, Evonik Industries AG, Honeywell International Inc., Huber Engineered Materials, Huntsman International LLC, Imerys SA, PPG Industries Inc., and PQ Corporation. These companies maintain their market leadership through robust research and development, focusing on innovation in silica, wax, and polymer-based matting agents to meet evolving end-user requirements. They continuously expand their product portfolios with advanced solutions for waterborne, solvent-borne, and powder coatings, addressing sustainability trends and stringent regulatory demands for low-VOC formulations. Strategic collaborations, mergers, and acquisitions help these players enhance their geographic reach and access new markets, particularly in high-growth regions such as Asia Pacific and Latin America. Competitive pricing, strong distribution networks, and tailored customer support further strengthen their positions. The leading players also invest in technical service and after-sales support to ensure customer satisfaction and long-term partnerships. This proactive approach to market trends and technological advancement enables them to maintain a competitive edge in a dynamic and rapidly evolving global market.

Recent Developments

- In March 2023, BYK, subsegment of ALTANA launched three new additives under the CERAFLOUR product line. With the corn starch-based polymers with wax-like properties, BYK has further expanded its portfolio of sustainable additives. Both additives ensure good matting while maintaining high transparency.

- In March 2023, AkzoNobel Aerospace Coatings launched Aerofleet Coatings Management, a new digital, data-driven service that helps airlines and other large operators to tailor and optimize the coatings’ replacement and maintenance schedule for individual aircraft within an airline fleet.

- In March 2023, BYK officially opened its second manufacturing facility in China, expanding existing premises with laboratories and administration in Shanghai. With an initial output of 4,750 tonnes, the integrated site is part of a larger project at Shanghai Chemical Industry Park (SCIP).

- In July 2022, Evonik launched three new silicas from the specialty chemicals group that are characterized by a combination of efficient, ultra-deep matting, high transparency, and extremely fine surface haptics. All three matting agents can be used universally in water- and solvent-based systems as well as in pigmented and clear formulations. In August 2022, Evonik’s Coating Additives business line is expanding the production capacity of its ACEMATT precipitated matting agents at its manufacturing facility in Taiwans.

Market Concentration & Characteristics

The Matting Agents Market exhibits a moderately concentrated structure, with a few multinational companies holding significant influence through extensive portfolios, advanced research, and strong distribution networks. It features a mix of established global leaders and specialized regional players that compete on product innovation, quality, and technical support. High entry barriers, including stringent regulatory compliance and the need for continuous product development, limit the influx of new entrants. The market is characterized by a growing emphasis on sustainability, with leading manufacturers prioritizing low-VOC and eco-friendly formulations to address evolving environmental regulations and customer expectations. Rapid advancements in silica, wax, and polymer-based technologies enable tailored solutions across diverse end-use applications. It remains dynamic and responsive, driven by shifting industry trends, technological progress, and the ability of key players to adapt quickly to customer requirements across various regions.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will focus on developing bio-based and renewable raw material matting agents to support global sustainability initiatives.

- Increased collaboration between leading chemical companies and coating manufacturers will accelerate the launch of next-generation products.

- Demand for high-performance coatings in electronics, consumer goods, and packaging will create new opportunities for matting agent applications.

- Digitalization and smart manufacturing technologies will streamline production processes and improve product consistency.

- Customized solutions tailored for wood, leather, and printing ink industries will see higher adoption as niche demands rise.

- Regulatory bodies will continue to enforce stricter standards on VOC emissions, shaping product development strategies.

- Companies will enhance their global distribution networks to capture opportunities in underpenetrated markets.

- Research on hybrid and multifunctional matting agents will drive innovation in scratch resistance, anti-fingerprint, and self-cleaning properties.

- Technical support and after-sales service will become key differentiators for market leaders aiming to strengthen customer relationships.

- The growing popularity of digital printing and advanced surface design will fuel demand for specialized matting agents in graphic and decorative applications.