Market Overview:

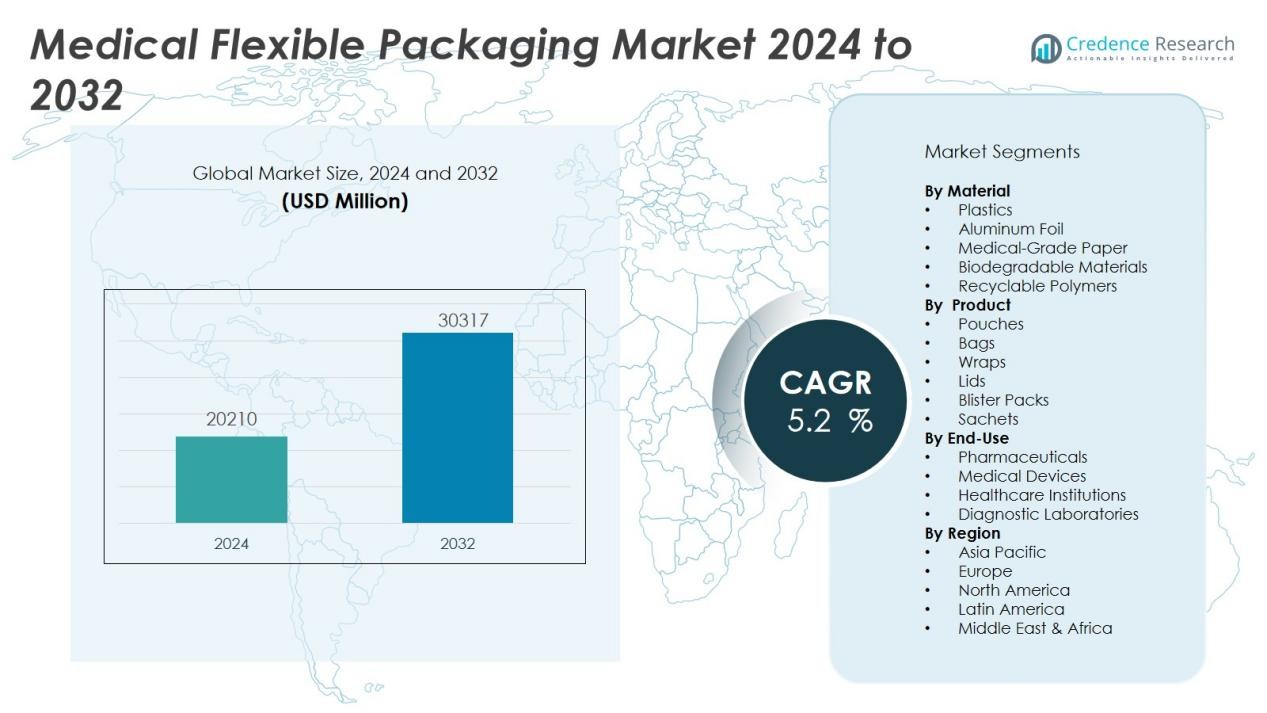

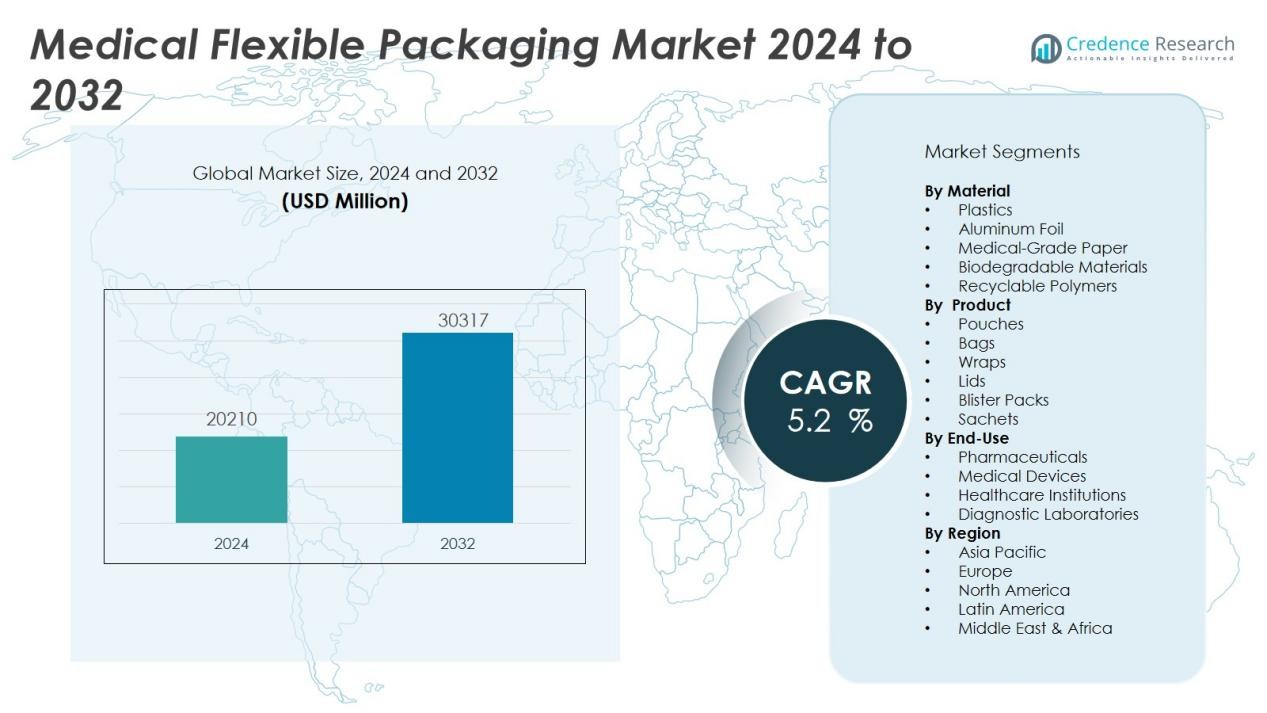

The medical flexible packaging market size was valued at USD 20210 million in 2024 and is anticipated to reach USD 30317 million by 2032, at a CAGR of 5.2 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Flexible Packaging Market Market Size 2024 |

USD 20210 Million |

| Medical Flexible Packaging Market Market, CAGR |

5.2 % |

| Medical Flexible Packaging Market Market Size 2032 |

USD 30317 Million |

Market growth is primarily fueled by rising pharmaceutical production, increasing consumption of medical devices, and heightened regulatory requirements for product safety and integrity. The ongoing expansion of biopharmaceuticals and injectable drugs, coupled with a shift toward patient-centric and home-based healthcare, has intensified the need for packaging formats that ensure sterility, tamper evidence, and extended shelf life. Moreover, the adoption of sustainable and recyclable materials is shaping product innovation, as healthcare providers and manufacturers seek to minimize environmental impact while complying with strict safety standards. The proliferation of smart and intelligent packaging technologies further enhances product traceability, anti-counterfeiting, and real-time condition monitoring, supporting global supply chain security.

Regionally, North America leads the medical flexible packaging market due to its strong pharmaceutical sector, advanced healthcare systems, and strict regulatory oversight. The United States holds a major share, supported by large-scale manufacturing and the presence of leading companies such as Amcor plc, AptarGroup, Inc., BD, Berry Global Inc., WINPAK LTD., Sealed Air, Mondi, and Huhtamaki Oyj. Europe maintains a strong position with its established healthcare infrastructure and focus on eco-friendly packaging. Asia Pacific records the fastest growth, driven by expanding healthcare access and rising pharmaceutical exports from China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The medical flexible packaging market was valued at USD 20,210 million in 2024 and is set to reach USD 30,317 million by 2032.

- Market growth is driven by rising pharmaceutical production, expanding biologics, and increasing use of injectable drugs and home healthcare.

- Stringent regulatory standards for safety, sterility, and tamper evidence push manufacturers to innovate and adopt intelligent packaging.

- Sustainability trends are accelerating the adoption of recyclable, biodegradable, and eco-friendly materials in packaging solutions.

- North America leads the market with 37% share in 2024, supported by strong healthcare infrastructure and leading global companies.

- Europe holds a 28% share, emphasizing eco-friendly packaging and high regulatory standards; Asia Pacific records 22% share and fastest growth.

- Volatile raw material prices and supply chain disruptions present ongoing challenges for manufacturers seeking stability and competitiveness.

Market Drivers:

Increasing Pharmaceutical Production and Biologics Demand Drive Adoption:

The medical flexible packaging market benefits from a significant rise in pharmaceutical production and a surge in biologics and specialty drug development. Global healthcare systems emphasize efficient delivery and secure containment of sensitive drugs, boosting demand for high-performance packaging. Flexible packaging solutions provide essential barrier protection, maintain drug integrity, and support complex distribution requirements. The growing adoption of injectable therapies and home healthcare further accelerates market expansion.

Stringent Regulatory Requirements and Focus on Product Safety Fuel Growth:

Strict global regulations mandate safe, contamination-free packaging for pharmaceuticals and medical devices, directly influencing the medical flexible packaging market. It meets these requirements by ensuring tamper evidence, sterilization compatibility, and extended shelf life. Regulatory bodies such as the FDA and EMA require compliance with rigorous standards, pushing manufacturers to innovate. Demand for traceability and anti-counterfeiting solutions also drives the development of intelligent packaging.

- For instance, nearly 20 billion medical devices per year in the U.S. undergo ethylene oxide sterilization using chemically-compatible packaging, representing about 48% of all devices requiring sterilization and providing consistent protection across widely varying healthcare environments.

Advancements in Packaging Materials and Sustainable Solutions Propel Innovation:

Continuous improvements in barrier materials, lightweight laminates, and recyclable polymers stimulate innovation in the medical flexible packaging market. It delivers not only product protection but also supports environmental goals by reducing waste and material usage. The healthcare sector’s increasing focus on sustainability has accelerated the adoption of eco-friendly flexible packaging, including bioplastics and mono-material solutions. Manufacturers respond to these shifts by introducing greener, cost-effective alternatives.

- For instance, Innovative Bottles uses TotalEnergies Corbion’s Luminy PLA biopolymer for medical vials and specimen containers, offering industrial compostability and reducing reliance on fossil-fuel plastics; each sterile container comes in 110cc size and four colors, and is designed for both performance and sustainability.

Rising Healthcare Infrastructure and Demand in Emerging Markets Expand Opportunities:

Rapid healthcare infrastructure growth in emerging markets strengthens demand in the medical flexible packaging market. Expanding access to healthcare, increasing pharmaceutical production, and rising medical exports from countries such as China and India stimulate regional market growth. It enables secure, efficient delivery of healthcare products across vast and complex supply chains. Local investments in advanced packaging technology further broaden market opportunities.

Market Trends:

Shift Toward Sustainable and Eco-Friendly Flexible Packaging Solutions:

Sustainability has become a defining trend in the medical flexible packaging market, with manufacturers investing in recyclable, compostable, and bio-based materials. Demand for single-use plastics has faced regulatory scrutiny, encouraging companies to develop packaging solutions that reduce environmental impact without compromising product safety or performance. The industry prioritizes lightweight laminates and mono-material films that simplify recycling and lower transportation costs. It has accelerated the introduction of flexible pouches, sachets, and wraps with reduced material use and improved recyclability. Leading players have formed partnerships with material suppliers to enhance green packaging portfolios and meet growing customer expectations. Brands increasingly highlight sustainable packaging as a competitive advantage, prompting widespread innovation across the value chain.

- For instance, Sappi launched two new flexible packaging papers—Seal Light Gloss and Guard MH—produced using renewable raw materials, both of which are compatible with standard paper recycling streams and available in grammages ranging from 54g/m² to 100g/m².

Integration of Smart Packaging Technologies for Enhanced Product Security:

Smart packaging adoption continues to shape the medical flexible packaging market, with companies incorporating RFID tags, QR codes, and near-field communication (NFC) for better product authentication and supply chain visibility. These features help combat counterfeiting and allow real-time monitoring of temperature, humidity, and tampering. Demand for data-driven solutions is strong among pharmaceutical and device manufacturers aiming to comply with stringent traceability regulations. It supports robust supply chain management and ensures the safe, timely delivery of sensitive healthcare products. The trend includes integrating sensors into packaging to capture and transmit information about product condition, storage, and handling. Companies use smart packaging to enhance patient engagement by providing access to usage instructions and safety information through digital platforms.

- For instance, Bayer joined the Blister Pack Collective to commercialize dry-molded fiber blister packs, targeting elimination of over 100,000 tonnes of plastic medical packaging and up to 80% reduction in CO2 emissions annually compared to PVC packs.

Market Challenges Analysis:

Stringent Regulatory Compliance and Complex Approval Processes Increase Barriers:

Meeting diverse regulatory requirements across global markets presents a significant challenge for the medical flexible packaging market. Strict standards for material safety, sterility, and labeling often require lengthy and costly validation processes. Companies must adapt to varying regional regulations, which can slow down product launches and create uncertainty. It must continuously invest in compliance and quality management systems to maintain approvals. Frequent updates to regulations and inspection protocols further complicate operations. Navigating this evolving landscape demands specialized expertise and robust risk management.

Fluctuating Raw Material Prices and Supply Chain Disruptions Impact Stability:

The medical flexible packaging market faces volatility in raw material costs, especially for polymers and specialty films, affecting pricing stability and profit margins. Global supply chain disruptions can delay production and shipment of critical packaging components, increasing lead times and inventory risks. It must manage cost pressures while ensuring reliable sourcing of high-quality materials. The market also experiences competition from alternative packaging formats that may offer cost or performance benefits. Manufacturers often need to absorb unexpected expenses or renegotiate contracts to maintain competitiveness.

Market Opportunities:

Expansion of Personalized Medicine and Advanced Drug Delivery Systems Opens New Avenues:

The growth of personalized medicine and advanced drug delivery systems creates strong opportunities for the medical flexible packaging market. Innovative packaging designs are needed to support patient-specific therapies, single-dose formats, and specialty pharmaceuticals. It can deliver customizable barrier properties and easy-to-use formats that address evolving requirements for safety, convenience, and compliance. The demand for prefilled syringes, pouches, and smart blister packs fuels adoption. Pharmaceutical companies partner with packaging suppliers to co-develop solutions that protect complex molecules and enhance patient adherence. The shift to home-based care and self-administration further expands the application range for flexible packaging.

Adoption of Digital and Intelligent Packaging Solutions Fuels Growth Potential:

Rising adoption of digital and intelligent packaging technologies presents significant growth prospects for the medical flexible packaging market. Integration of sensors, RFID tags, and QR codes helps companies improve product authentication, monitor storage conditions, and meet traceability mandates. It enables real-time visibility throughout the supply chain, reducing risk and supporting regulatory compliance. Digital packaging also offers interactive features that enhance patient engagement and education. Manufacturers who invest in smart packaging gain competitive advantages by increasing security and adding value for healthcare providers and end users. Growing interest in data-driven healthcare solutions will accelerate investment in this area.

Market Segmentation Analysis:

By Material:

The medical flexible packaging market features materials such as plastics, aluminum foil, and medical-grade paper. Plastics, including polyethylene, polypropylene, and polyamide, hold the largest share due to their superior barrier properties, lightweight nature, and versatility in form and function. Aluminum foil provides excellent protection against light, moisture, and contaminants, making it suitable for sensitive pharmaceuticals and diagnostic products. Medical-grade paper is used where breathability and easy sterilization are essential, supporting single-use applications and medical pouches. The market continues to see innovation in biodegradable and recyclable materials to address sustainability requirements.

- For instance, UNSW and Ecopha Biotech are developing biodegradable healthcare packaging made from polyhydroxyalkanoates (PHAs) that can fully degrade, aiming to tackle the 1.25 million tons of healthcare plastic waste generated annually.

By Product:

Key product segments in the medical flexible packaging market include pouches, bags, wraps, lids, and blister packs. Pouches and bags remain popular for packaging medical devices, surgical instruments, and pharmaceuticals due to their ease of use, tamper evidence, and secure sealing. Wraps and lids offer additional protection for trays and containers, supporting hospital and laboratory environments. Blister packs are widely used for tablets, capsules, and unit-dose medications, supporting dosage accuracy and patient safety. Companies focus on developing user-friendly and intelligent packaging solutions that enhance product integrity and traceability.

By End-Use:

The primary end-use segments are pharmaceuticals, medical devices, and healthcare institutions. Pharmaceuticals represent the dominant end-use, supported by high-volume production and strict regulatory demands. Medical devices require flexible packaging for sterile presentation and protection during transport. Healthcare institutions drive demand for disposable, safe, and convenient packaging formats. The medical flexible packaging market serves a diverse client base, adapting to evolving requirements in each end-use sector.

- For instance, the adoption of blow-fill-seal (BFS) technology allows for the aseptic packaging of pharmaceuticals, with companies like Rommelag delivering machines capable of processing up to 34,000 containers per hour to ensure sterility and precision filling.

Segmentations:

By Material:

- Plastics

- Aluminum Foil

- Medical-Grade Paper

- Biodegradable Materials

- Recyclable Polymers

By Product:

- Pouches

- Bags

- Wraps

- Lids

- Blister Packs

- Sachets

By End-Use:

- Pharmaceuticals

- Medical Devices

- Healthcare Institutions

- Diagnostic Laboratories

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America accounted for 37% share of the medical flexible packaging market in 2024, maintaining its dominant position due to a mature healthcare infrastructure and strict regulatory frameworks. The United States drives market growth through significant pharmaceutical manufacturing, medical research, and high adoption of advanced packaging technologies. The region benefits from strong investments in innovation and frequent product launches that prioritize patient safety and product integrity. It has seen rapid uptake of sustainable packaging solutions, influenced by environmental policies and rising consumer awareness. Companies in North America maintain partnerships with healthcare providers and material suppliers to accelerate product development and respond to evolving industry needs. The regulatory environment, led by agencies such as the FDA, supports ongoing quality improvement.

Europe :

Europe secured a 28% share of the medical flexible packaging market in 2024, supported by a robust pharmaceutical sector and a deep focus on sustainability. Stringent regulations across the European Union enforce high standards for safety, eco-friendly materials, and traceability throughout the supply chain. The region emphasizes the development and adoption of recyclable, biodegradable, and mono-material flexible packaging. It has witnessed increasing collaboration between manufacturers, healthcare providers, and technology innovators to meet environmental and compliance goals. Countries such as Germany, France, and the UK are at the forefront of research and product launches in sustainable medical packaging. The European Medicines Agency plays a pivotal role in shaping regulatory trends and advancing market growth.

Asia Pacific:

Asia Pacific represented a 22% share of the medical flexible packaging market in 2024 and is projected to register the fastest growth rate during the forecast period. The expansion is propelled by large-scale pharmaceutical manufacturing, healthcare infrastructure investments, and increasing export activities from China, India, and Southeast Asia. Rising demand for affordable and efficient packaging drives local innovation and capacity expansion. It enables manufacturers to deliver secure, quality healthcare products across vast and diverse regions. Governments encourage adoption of advanced packaging standards and technologies to meet international quality requirements. Partnerships between multinational and local companies are accelerating knowledge transfer and supporting rapid market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor plc

- AptarGroup, Inc.

- BD (Becton, Dickinson and Company)

- Berry Global Inc.

- WINPAK LTD.

- Sealed Air

- Mondi

- Huhtamaki Oyj

- Coveris

- WestRock Company

- Datwyler Holding Inc.

- Catalent, Inc.

Competitive Analysis:

The medical flexible packaging market features intense competition among global leaders and specialized regional firms. Leading companies such as Amcor plc, AptarGroup, Inc., BD (Becton, Dickinson and Company), Berry Global Inc., WINPAK LTD., Sealed Air, Mondi, and Huhtamaki Oyj drive market innovation through robust R&D, broad product portfolios, and strong distribution networks. It requires continuous investment in advanced materials, regulatory compliance, and sustainable packaging solutions to maintain a competitive edge. Strategic collaborations with pharmaceutical companies and healthcare institutions help these players address evolving industry needs. Smaller firms compete by offering customized, agile solutions tailored to local market requirements. Competitive dynamics focus on quality, reliability, and the ability to deliver intelligent packaging technologies that meet strict safety and performance standards.

Recent Developments:

- In July 2025, Amcor announced a significant investment in Nicholasville, Kentucky, to expand post-consumer recycled (PCR) packaging capabilities.

- In February 2025, Avantium and Amcor Rigid Packaging signed a joint development agreement to expand the use of plant-based PEF polymer in rigid containers.

- In July 2025, AptarGroup acquired Mod3 Pharma’s manufacturing capabilities from SWK Holdings to expand services for clinical trial materials.

Market Concentration & Characteristics:

The medical flexible packaging market exhibits moderate concentration, with a mix of global leaders and specialized regional players. Major companies control significant market share through integrated supply chains, advanced R&D capabilities, and strong relationships with pharmaceutical and healthcare customers. It features high entry barriers due to strict regulatory requirements, technological complexity, and the need for validated production processes. The market is characterized by continuous innovation in materials, barrier properties, and intelligent packaging technologies. Leading players invest in sustainability, product differentiation, and quality assurance to maintain a competitive edge. Regional manufacturers compete by offering customized solutions and rapid response to local customer needs.

Report Coverage:

The research report offers an in-depth analysis based on Material, Product, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for personalized medicine and advanced drug delivery systems will drive greater adoption of the medical flexible packaging market.

- Companies will develop packaging formats tailored to single‑dose therapies, prefilled syringes, and patient‑specific dosing.

- Manufacturers will integrate smart and digital features like RFID, QR codes, and condition‑monitoring sensors into flexible packaging.

- Biodegradable polymers and mono‑material films will gain traction to support sustainability and regulatory compliance.

- Partnerships between packaging providers and pharmaceutical firms will accelerate co‑development and time to market.

- Local manufacturing capacity in emerging regions will expand to meet rising medical exports and regional healthcare demands.

- Regulatory bodies will require more stringent validation for traceability, sterility, and anti‑tampering features.

- Supply chains will adopt real‑time tracking and analytics to enhance security and reduce product loss.

- Material science advancements will introduce high‑barrier films that maintain shelf life with reduced weight.

- Industry-wide standards will emerge for smart packaging interoperability and data sharing across the healthcare ecosystem.