Market Overview

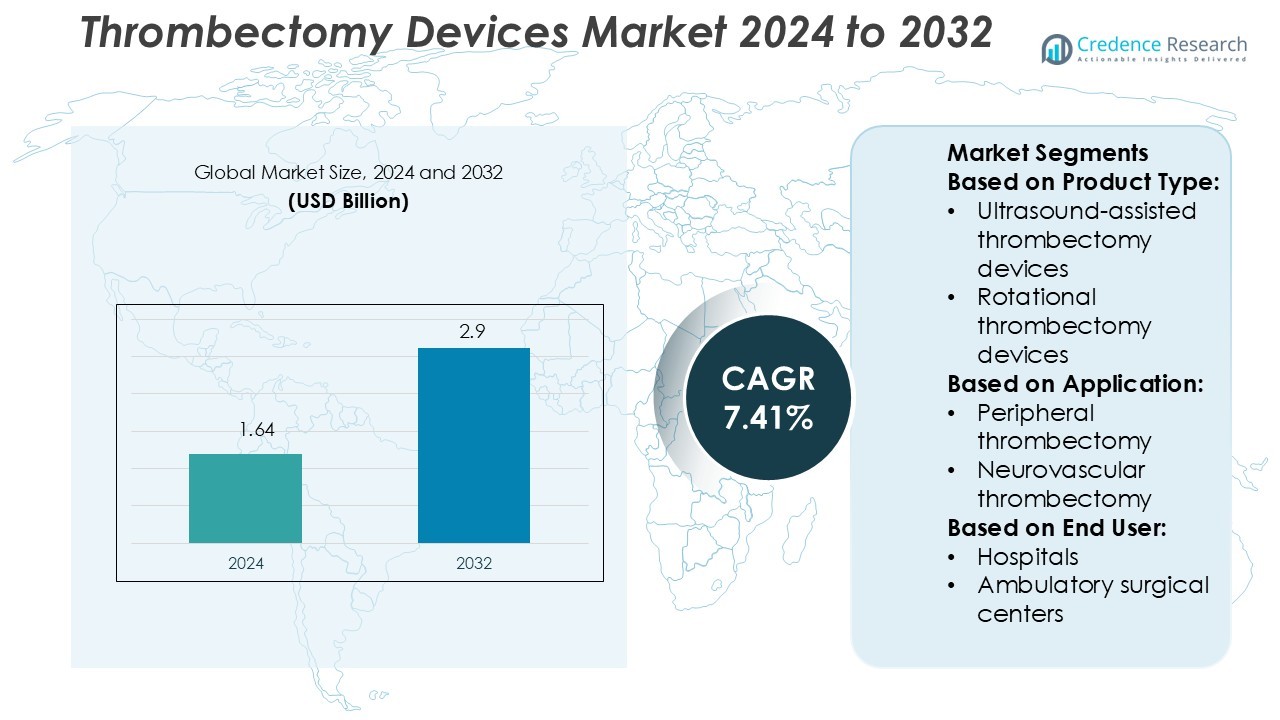

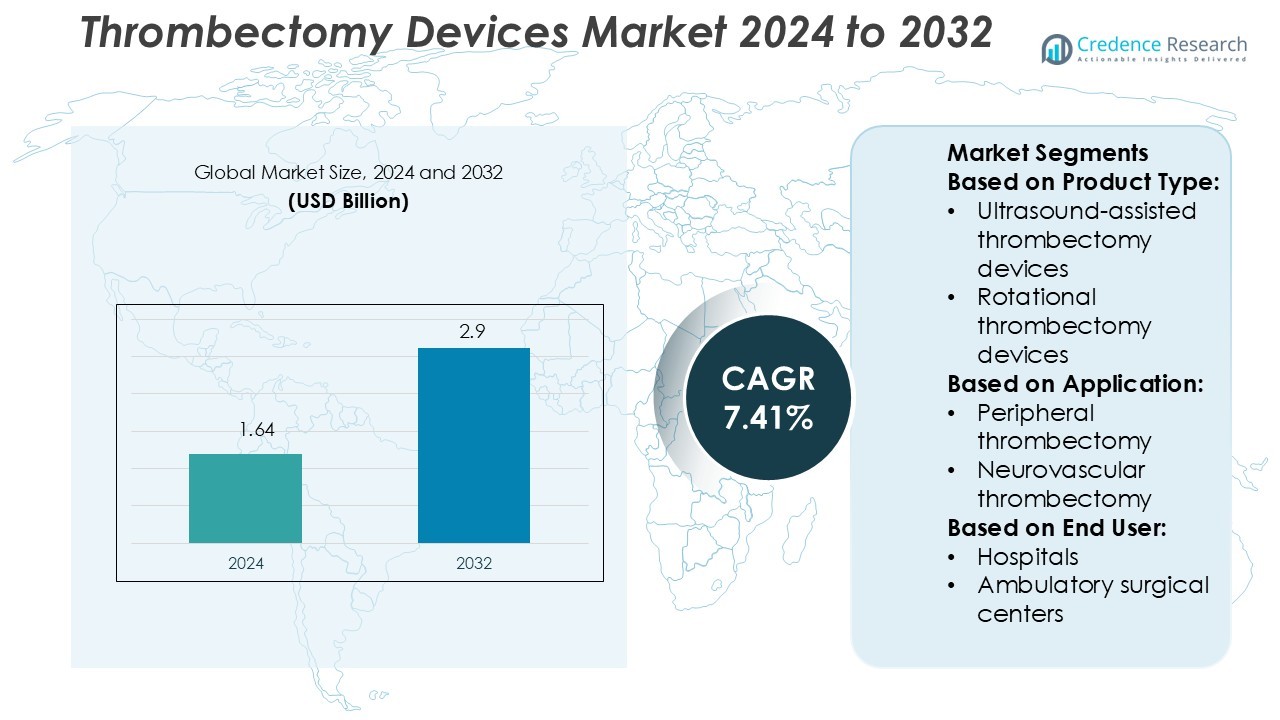

Thrombectomy Devices Market size was valued USD 1.64 billion in 2024 and is anticipated to reach USD 2.9 billion by 2032, at a CAGR of 7.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thrombectomy Devices Market Size 2024 |

USD 1.64 Billion |

| Thrombectomy Devices Market, CAGR |

7.41% |

| Thrombectomy Devices Market Size 2032 |

USD 2.9 Billion |

The Thrombectomy Devices Market is driven by leading companies such as Edwards Lifesciences Corporation, Lemaitre Vascular Inc., Penumbra, Inc., Stryker Corporation, Terumo Corporation, Boston Scientific Corporation, Johnson & Johnson Services Inc., Medtronic Plc., Teleflex Incorporated, and Weigao Group (Argon Medical). These players focus on technological innovation, expanding product portfolios, and improving patient outcomes through advanced mechanical and aspiration systems. Strong R&D investments and strategic collaborations enhance their global presence. North America leads the global market with a 37.2% share, supported by a well-established healthcare infrastructure, high adoption of minimally invasive procedures, and favorable reimbursement policies. Continuous product development and clinical validation further strengthen the region’s dominance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Thrombectomy Devices Market was valued at USD 1.64 billion in 2024 and is projected to reach USD 2.9 billion by 2032, registering a CAGR of 7.41% during the forecast period.

- Growing prevalence of cardiovascular and neurovascular diseases and the rising preference for minimally invasive procedures drive market expansion.

- Continuous product innovation, such as advanced aspiration and mechanical systems, reflects strong competition among global players focused on improving procedural efficiency.

- High device costs and strict regulatory requirements restrain market growth, particularly in emerging economies with limited healthcare access.

- North America leads with a 37.2% share, followed by Europe and Asia-Pacific, driven by technological adoption and clinical advancements, while the mechanical thrombectomy segment holds the largest market share due to its high procedural success rate and wide hospital adoption.

Market Segmentation Analysis:

By Product Type

The stent retrievers segment held the dominant share in the thrombectomy devices market in 2024. Their widespread adoption is driven by proven clinical success in acute ischemic stroke treatment. Stent retrievers offer quick clot removal, reduced procedure time, and improved patient outcomes compared to older methods. Demand also grows due to increasing stroke incidences and the expansion of specialized stroke centers. Continuous innovation in retriever designs and integration with advanced imaging systems support their leading market position among thrombectomy devices.

- For instance, Edwards’ Fogarty® graft thrombectomy catheter model 160246F is a 6 Fr catheter with a usable length of 50 cm that uses an expandable wire coil to remove adherent thrombotic material from synthetic grafts.

By Application

Neurovascular thrombectomy dominated the market, accounting for the largest revenue share in 2024. This segment benefits from the rising prevalence of ischemic stroke and growing awareness about early intervention. Hospitals increasingly adopt minimally invasive thrombectomy for brain clots due to its superior recovery rates. Advanced imaging guidance and device precision enhance treatment outcomes, encouraging adoption in neurology departments. Growing R&D funding for neuro-interventional devices further strengthens the dominance of this application segment.

- For instance, LeMaitre’s Syntel® Silicone Thrombectomy Catheter (model A4545) features an inflated balloon diameter of 9 mm and a liquid volume of 0.75 ml (with CO₂ volume of 1.70 ml) in a 4F × 50 cm configuration.

By End-User

Hospitals accounted for the largest market share in the thrombectomy devices market in 2024. Their dominance is attributed to advanced infrastructure, skilled medical professionals, and the ability to perform complex neurovascular and cardiovascular procedures. Hospitals also benefit from strong reimbursement frameworks and availability of intensive post-procedure care. The rising number of acute stroke centers and cardiovascular units globally drives device deployment in hospitals. Increasing investment in hospital-based emergency stroke management continues to support this segment’s leadership position.

Key Growth Drivers

Rising Incidence of Cardiovascular and Neurovascular Diseases

The growing prevalence of ischemic stroke and peripheral artery diseases drives thrombectomy device demand. Rising sedentary lifestyles, diabetes, and hypertension contribute to higher clot formation risks. Healthcare systems increasingly adopt thrombectomy procedures for rapid clot removal to prevent severe complications. The surge in aging populations further expands the patient base for minimally invasive treatments, strengthening market growth.

- For instance, Penumbra ENGINE® aspiration source is designed to generate and maintain a nearly pure vacuum of -29.2 inHg (98.9 kPa). This deep vacuum is used to power the company’s catheters for thrombectomy procedures.

Advancements in Minimally Invasive Technologies

Continuous innovation in device design enhances procedural efficiency and patient recovery. Modern thrombectomy devices now feature improved navigation, precision control, and real-time imaging compatibility. These advancements reduce surgery duration, lower complication risks, and shorten hospital stays. Growing physician preference for minimally invasive techniques boosts device adoption across neurovascular and cardiovascular applications.

- For instance, Stryker’s next-generation InThrill Thrombectomy System (an 8 French over-the-wire system) includes a catheter and sheath that deliver full-lumen clot removal in small-vessel and arteriovenous access cases.

Favorable Reimbursement and Government Support

Strong reimbursement policies and public health initiatives encourage wider thrombectomy adoption. Governments in developed countries fund stroke awareness and treatment infrastructure improvements. Regulatory approvals for advanced thrombectomy systems also accelerate market penetration. Supportive policies promoting early stroke intervention enhance hospital readiness and improve patient access to life-saving procedures.

Key Trends & Opportunities

Integration of AI and Imaging Technologies

Artificial intelligence and advanced imaging tools are transforming thrombectomy precision. AI-assisted systems enhance clot localization and optimize device navigation during procedures. Integration with CT and MRI imaging provides real-time feedback, improving surgical success rates. Manufacturers investing in AI-driven thrombectomy solutions gain competitive advantages through improved clinical outcomes.

- For instance, Terumo’s agreement to distribute the AutocathFFR™ AI-powered software calculates fractional flow reserve (FFR) from angiography in 37 seconds—markedly faster than traditional methods.

Expanding Application in Peripheral and Coronary Thrombosis

Thrombectomy devices are now widely used beyond neurovascular applications. Peripheral and coronary thrombosis treatments increasingly utilize mechanical and aspiration devices for faster recovery. Growing awareness among physicians about their effectiveness in limb-saving and heart procedures creates strong expansion opportunities. This diversification drives consistent revenue growth across multiple medical specialties.

- For instance, Boston Scientific’s ANGIOJET™ Ultra Thrombectomy System is indicated for coronary artery thrombosis and has been utilized in more than 600,000 cases worldwide.

Rapid Adoption in Emerging Markets

Emerging economies are witnessing increased adoption due to healthcare modernization. Investments in hospital infrastructure, coupled with medical tourism growth, boost thrombectomy demand. Affordable device offerings by regional manufacturers further support accessibility. Rising government efforts to improve stroke management infrastructure provide significant market opportunities in Asia-Pacific and Latin America.

Key Challenges

High Cost of Devices and Procedures

Thrombectomy procedures remain expensive due to high equipment and hospital setup costs. Limited reimbursement coverage in developing regions restricts accessibility for many patients. Smaller healthcare facilities often lack resources to invest in advanced thrombectomy systems. This cost barrier continues to slow adoption, especially in low-income economies.

Lack of Skilled Interventional Specialists

Effective thrombectomy procedures require trained neuro-interventional and cardiovascular surgeons. A shortage of skilled professionals in several regions hampers treatment availability. Training programs and certifications remain limited in emerging markets. Without sufficient expertise, clinical outcomes may vary, affecting overall confidence in thrombectomy adoption.

Regional Analysis

North America

North America dominates the Thrombectomy Devices Market with a 37.2% share in 2024. The region benefits from advanced healthcare infrastructure, high adoption of minimally invasive procedures, and supportive reimbursement policies. Rising cases of cardiovascular and neurovascular diseases further drive demand. Strong R&D investments and FDA approvals strengthen product portfolios. For instance, Penumbra launched the RED 72 catheter with a 0.072-inch lumen for improved clot removal efficiency. Continuous technological advancements and strategic collaborations among manufacturers sustain North America’s leadership in this market.

Europe

Europe holds a 29.5% market share, driven by strong clinical research support and well-established healthcare systems. The growing geriatric population and prevalence of stroke cases enhance thrombectomy device demand. Germany, the UK, and France are key contributors due to their advanced hospital networks and adoption of next-generation devices. For instance, Philips introduced the QuickClear mechanical thrombectomy system, offering integrated aspiration control for precise clot extraction. Stringent regulatory standards ensure product quality, while favorable government initiatives encourage early stroke interventions and improved treatment accessibility across the region.

Asia-Pacific

Asia-Pacific captures a 22.6% share and is the fastest-growing region in the Thrombectomy Devices Market. Increasing healthcare expenditure, rising awareness of minimally invasive surgeries, and improving hospital infrastructure drive market expansion. China, Japan, and India are witnessing high procedure volumes due to stroke prevalence and government health reforms. For instance, Terumo Corporation expanded its aspiration catheter production to meet rising procedural demand in Asia. Continuous investment in healthcare modernization and medical device innovation positions the region as a key growth frontier for global manufacturers seeking market diversification.

Latin America

Latin America accounts for 6.3% of the global thrombectomy devices market, supported by gradual improvements in healthcare systems and medical training. Brazil and Mexico lead adoption due to increasing investments in stroke centers and hospital infrastructure. Public health initiatives promoting early stroke diagnosis are also contributing to growth. For instance, Stryker collaborated with local healthcare providers to deploy neurovascular thrombectomy solutions across Brazil, enhancing access to advanced treatments. Despite regulatory challenges, growing awareness and expanding distribution networks are expected to improve the region’s market penetration.

Middle East & Africa

The Middle East & Africa holds a 4.4% market share, with growth driven by expanding healthcare access and rising cardiovascular disease incidence. The UAE, Saudi Arabia, and South Africa are key markets adopting thrombectomy technologies in advanced hospitals. For instance, Medtronic expanded its Solitaire X Revascularization Device availability across regional hospitals to improve acute ischemic stroke outcomes. Investments in healthcare modernization and increased government spending on critical care services foster gradual adoption. However, limited specialist availability and cost barriers continue to restrict broader market expansion in some areas.

Market Segmentations:

By Product Type:

- Ultrasound-assisted thrombectomy devices

- Rotational thrombectomy devices

By Application:

- Peripheral thrombectomy

- Neurovascular thrombectomy

By End User:

- Hospitals

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Thrombectomy Devices Market is characterized by strong competition among major players, including Edwards Lifesciences Corporation, Lemaitre Vascular Inc., Penumbra, Inc., Stryker Corporation, Terumo Corporation, Boston Scientific Corporation, Johnson & Johnson Services Inc., Medtronic Plc., Teleflex Incorporated, and Weigao Group (Argon Medical). The Thrombectomy Devices Market is highly competitive, driven by rapid technological advancements and continuous innovation. Companies are focusing on developing next-generation devices with improved clot removal efficiency and reduced procedural risks. Product portfolios are expanding through the integration of advanced imaging, real-time monitoring, and AI-based guidance systems. Strategic collaborations between medical device manufacturers and healthcare institutions enhance clinical outcomes and accelerate regulatory approvals. Continuous R&D investment supports the creation of minimally invasive devices designed for faster recovery and higher precision. The market also sees increasing focus on customized solutions for neurovascular and peripheral applications, addressing rising stroke incidences worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2024, MicroVention, Inc., a global leader in neurovascular innovation and a subsidiary of Terumo Corporation, officially rebranded as Terumo Neuro. This name change marks a significant milestone in the company’s evolution, reaffirming its dedication to developing and delivering cutting-edge innovations in neurovascular care.

- In July 2024, Vesalio introduced the NeVa NET 4.0 mm, designed for treating acute ischemic stroke caused by large vessel occlusion. This launch comes from promising study results published in the Journal of Vascular and Interventional Neurology and NeuroInterventional Surgery.

- In January 2023, Penumbra, a Calif-based US healthcare company, launched a lightning flash and announced USFDA (U.S. Food and Drug Administration) clearance, and the company reported to the market about highly advanced mechanical thrombectomy system to address pulmonary thrombus and venous thrombus.

- In August 2023, BrainCool AB collaborated with Wallaby Medical to deliver a local clinical trial at three major Chinese university hospitals that combine TTM treatment with thrombectomy and to pave the way for market registration in China for BrainCool’s two TTM medical device offerings: the NeuroChill System and the BrainCool System.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for minimally invasive thrombectomy procedures will continue to rise globally.

- Advancements in imaging and catheter technology will enhance procedural accuracy.

- Integration of AI and robotics will improve real-time navigation and treatment outcomes.

- Hospitals will increase adoption of next-generation mechanical and aspiration devices.

- Expanding stroke awareness programs will boost early diagnosis and treatment rates.

- R&D investments will focus on reducing procedure time and improving safety.

- Strategic collaborations will strengthen product innovation and clinical validation.

- Emerging markets in Asia-Pacific and Latin America will witness strong growth opportunities.

- Regulatory approvals for advanced neurovascular devices will accelerate market expansion.

- Rising healthcare spending and modernization of hospital infrastructure will sustain long-term growth.