CHAPTER NO. 1 : INTRODUCTION 30

1.1.1. Report Description 30

Purpose of the Report 30

USP & Key Offerings 30

1.1.2. Key Benefits for Stakeholders 30

1.1.3. Target Audience 31

1.1.4. Report Scope 31

1.1.5. Regional Scope 32

CHAPTER NO. 2 : EXECUTIVE SUMMARY 33

2.1. Medical Robots Market Snapshot 33

2.1.1. Global Medical Robots Market, 2018 – 2032 (USD Million) 35

CHAPTER NO. 3 : GEOPOLITICAL CRISIS IMPACT ANALYSIS 36

3.1. Russia-Ukraine and Israel-Palestine War Impacts 36

CHAPTER NO. 4 : MEDICAL ROBOTS MARKET – INDUSTRY ANALYSIS 37

4.1. Introduction 37

4.2. Market Drivers 38

4.2.1. Increasing Need for Automation in Healthcare 38

4.2.2. Advancements in Healthcare Funding & Infrastructure 39

4.3. Market Restraints 40

4.3.1. High Cost of Medical Robots 40

4.4. Market Opportunities 41

4.4.1. Market Opportunity Analysis 41

4.5. Porter’s Five Forces Analysis 42

CHAPTER NO. 5 : ANALYSIS COMPETITIVE LANDSCAPE 43

5.1. Company Market Share Analysis – 2023 43

5.1.1. Global Medical Robots Market: Company Market Share, by Volume, 2023 43

5.1.2. Global Medical Robots Market: Company Market Share, by Revenue, 2023 44

5.1.3. Global Medical Robots Market: Top 6 Company Market Share, by Revenue, 2023 44

5.1.4. Global Medical Robots Market: Top 3 Company Market Share, by Revenue, 2023 45

5.2. Global Medical Robots Market Company Revenue Market Share, 2023 46

5.3. Company Assessment Metrics, 2023 47

5.3.1. Stars 47

5.3.2. Emerging Leaders 47

5.3.3. Pervasive Players 47

5.3.4. Participants 47

5.4. Start-ups /SMEs Assessment Metrics, 2023 47

5.4.1. Progressive Companies 47

5.4.2. Responsive Companies 47

5.4.3. Dynamic Companies 47

5.4.4. Starting Blocks 47

5.5. Strategic Developments 48

5.5.1. Acquisitions & Mergers 48

New Product Launch 48

Regional Expansion 48

5.6. Key Players Product Matrix 49

CHAPTER NO. 6 : PESTEL & ADJACENT MARKET ANALYSIS 50

6.1. PESTEL 50

6.1.1. Political Factors 50

6.1.2. Economic Factors 50

6.1.3. Social Factors 50

6.1.4. Technological Factors 50

6.1.5. Environmental Factors 50

6.1.6. Legal Factors 50

6.2. Adjacent Market Analysis 50

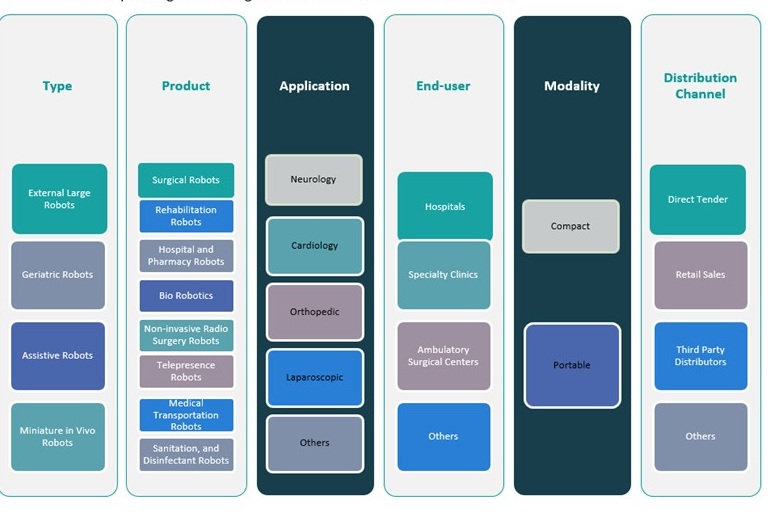

CHAPTER NO. 7 : MEDICAL ROBOTS MARKET – BY TYPE SEGMENT ANALYSIS 51

7.1. Medical Robots Market Overview, by Type Segment 51

7.1.1. Medical Robots Market Revenue Share, By Type, 2023 & 2032 52

7.1.2. Medical Robots Market Attractiveness Analysis, By Type 53

7.1.3. Incremental Revenue Growth Opportunity, by Type, 2024 – 2032 53

7.1.4. Medical Robots Market Revenue, By Type, 2018, 2023, 2027 & 2032 54

7.2. External Large Robots 55

7.2.1. Global External Large Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 56

7.2.2. Global External Large Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 56

7.3. Geriatric Robots 57

7.3.1. Global Geriatric Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 58

7.3.2. Global Geriatric Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 58

7.4. Assistive Robots 59

7.4.1. Global Assistive Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 60

7.4.2. Global Assistive Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 60

7.5. Miniature in Vivo Robots 61

7.5.1. Global Miniature in Vivo Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 62

7.5.2. Global Miniature in Vivo Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 62

CHAPTER NO. 8 : MEDICAL ROBOTS MARKET – BY PRODUCT SEGMENT ANALYSIS 63

8.1. Medical Robots Market Overview, by Product Segment 63

8.1.1. Medical Robots Market Revenue Share, By Product, 2023 & 2032 64

8.1.2. Medical Robots Market Attractiveness Analysis, By Product 65

8.1.3. Incremental Revenue Growth Opportunity, by Product, 2024 – 2032 65

8.1.4. Medical Robots Market Revenue, By Product, 2018, 2023, 2027 & 2032 66

8.2. Surgical Robots 67

8.2.1. Global Surgical Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 68

8.2.2. Global Surgical Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 68

8.3. Rehabilitation Robots 69

8.3.1. Global Rehabilitation Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 70

8.3.2. Global Rehabilitation Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 70

8.4. Hospital and Pharmacy Robots 71

8.4.1. Global Hospital and Pharmacy Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 72

8.4.2. Global Hospital and Pharmacy Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 72

8.5. Bio Robotics 73

8.5.1. Global Bio Robotics Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 74

8.5.2. Global Bio Robotics Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 74

8.6. Non-invasive Radio Surgery Robots 75

8.6.1. Global Non-invasive Radio Surgery Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 76

8.6.2. Global Non-invasive Radio Surgery Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 76

8.7. Telepresence Robots 77

8.7.1. Global Telepresence Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 78

8.7.2. Global Telepresence Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 78

8.8. Medical Transportation Robots 79

8.8.1. Global Medical Transportation Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 80

8.8.2. Global Medical Transportation Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 80

8.9. Sanitation, and Disinfectant Robots 81

8.9.1. Global Sanitation, and Disinfectant Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 82

8.9.2. Global Sanitation, and Disinfectant Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 82

CHAPTER NO. 9 : MEDICAL ROBOTS MARKET – BY MODALITY SEGMENT ANALYSIS 83

9.1. Medical Robots Market Overview, by Modality Segment 83

9.1.1. Medical Robots Market Revenue Share, By Modality, 2023 & 2032 84

9.1.2. Medical Robots Market Attractiveness Analysis, By Modality 85

9.1.3. Incremental Revenue Growth Opportunity, by Modality, 2024 – 2032 85

9.1.4. Medical Robots Market Revenue, By Modality, 2018, 2023, 2027 & 2032 86

9.2. Compact 87

9.2.1. Global Compact Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 88

9.2.2. Global Compact Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 88

9.3. Portable 89

9.3.1. Global Portable Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 90

9.3.2. Global Portable Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 90

CHAPTER NO. 10 : MEDICAL ROBOTS MARKET – BY APPLICATION SEGMENT ANALYSIS 91

10.1. Medical Robots Market Overview, by Application Segment 91

10.1.1. Medical Robots Market Revenue Share, By Application, 2023 & 2032 92

10.1.2. Medical Robots Market Attractiveness Analysis, By Application 93

10.1.3. Incremental Revenue Growth Opportunity, by Application, 2024 – 2032 93

10.1.4. Medical Robots Market Revenue, By Application, 2018, 2023, 2027 & 2032 94

10.2. Neurology 95

10.2.1. Global Neurology Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 96

10.2.2. Global Neurology Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 96

10.3. Cardiology 97

10.3.1. Global Cardiology Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 98

10.3.2. Global Cardiology Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 98

10.4. Orthopedic 99

10.4.1. Global Orthopedic Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 100

10.4.2. Global Orthopedic Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 100

10.5. Laparoscopic 101

10.5.1. Global Laparoscopic Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 102

10.5.2. Global Laparoscopic Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 102

10.6. Others 103

10.6.1. Global Others Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 104

10.6.2. Global Others Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 104

CHAPTER NO. 11 : MEDICAL ROBOTS MARKET – BY END-USER SEGMENT ANALYSIS 105

11.1. Medical Robots Market Overview, by End-user Segment 105

11.1.1. Medical Robots Market Revenue Share, By End-user, 2023 & 2032 106

11.1.2. Medical Robots Market Attractiveness Analysis, By End-user 107

11.1.3. Incremental Revenue Growth Opportunity, by End-user, 2024 – 2032 107

11.1.4. Medical Robots Market Revenue, By End-user, 2018, 2023, 2027 & 2032 108

11.2. Hospitals 109

11.2.1. Global Hospitals Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 110

11.2.2. Global Hospitals Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 110

11.3. Specialty Clinics 111

11.3.1. Global Specialty Clinics Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 112

11.3.2. Global Specialty Clinics Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 112

11.4. Ambulatory Surgical Centers 113

11.4.1. Global Ambulatory Surgical Centers Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 114

11.4.2. Global Ambulatory Surgical Centers Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 114

11.5. Others 115

11.5.1. Global Others Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 116

11.5.2. Global Others Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 116

CHAPTER NO. 12 : MEDICAL ROBOTS MARKET – BY DISTRIBUTION CHANNEL SEGMENT ANALYSIS 117

12.1. Medical Robots Market Overview, by Distribution Channel Segment 117

12.1.1. Medical Robots Market Revenue Share, By Distribution Channel, 2023 & 2032 118

12.1.2. Medical Robots Market Attractiveness Analysis, By Distribution Channel 119

12.1.3. Incremental Revenue Growth Opportunity, by Distribution Channel, 2024 – 2032 119

12.1.4. Medical Robots Market Revenue, By Distribution Channel, 2018, 2023, 2027 & 2032 120

12.2. Direct Tender 121

12.2.1. Global Direct Tender Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 122

12.2.2. Global Direct Tender Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 122

12.3. Retail Sales 123

12.3.1. Global Retail Sales Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 124

12.3.2. Global Retail Sales Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 124

12.4. Third Party Distributors 125

12.4.1. Global Third Party Distributors Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 126

12.4.2. Global Third Party Distributors Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 126

12.5. Others 127

12.5.1. Global Others Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 128

12.5.2. Global Others Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 128

CHAPTER NO. 13 : MEDICAL ROBOTS MARKET – REGIONAL ANALYSIS 129

13.1. Medical Robots Market Overview, by Regional Segments 129

13.2. Region 130

13.2.1. Global Medical Robots Market Revenue Share, By Region, 2023 & 2032 130

13.2.2. Medical Robots Market Attractiveness Analysis, By Region 131

13.2.3. Incremental Revenue Growth Opportunity, by Region, 2024 – 2032 131

13.2.4. Medical Robots Market Revenue, By Region, 2018, 2023, 2027 & 2032 132

13.2.5. Global Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 133

13.2.6. Global Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 133

13.3. Type 134

13.3.1. Global Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 134

13.3.2. Global Medical Robots Market Revenue, By Type, 2024 – 2032 (USD Million) 134

13.4. Product 135

13.4.1. Global Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 135

13.4.2. Global Medical Robots Market Revenue, By Product, 2024 – 2032 (USD Million) 136

13.5. Application 137

13.5.1. Global Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 137

13.5.2. Global Medical Robots Market Revenue, By Application, 2024 – 2032 (USD Million) 137

13.6. End-user 138

13.6.1. Global Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 138

13.6.2. Global Medical Robots Market Revenue, By End-user, 2024 – 2032 (USD Million) 138

13.7. Modality 139

13.7.1. Global Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 139

13.7.2. Global Medical Robots Market Revenue, By Modality, 2024 – 2032 (USD Million) 139

13.8. Distribution Channel 140

13.8.1. Global Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 140

13.8.2. Global Medical Robots Market Revenue, By Distribution Channel, 2024 – 2032 (USD Million) 140

CHAPTER NO. 14 : MEDICAL ROBOTS MARKET – NORTH AMERICA 141

14.1. North America 141

14.1.1. Key Highlights 141

14.1.2. North America Medical Robots Market Revenue, By Country, 2018 – 2023 (USD Million) 142

14.1.3. North America Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 143

14.1.4. North America Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 144

14.1.5. North America Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 145

14.1.6. North America Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 146

14.1.7. North America Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 147

14.1.8. North America Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 148

14.2. U.S. 149

14.3. Canada 149

14.4. Mexico 149

CHAPTER NO. 15 : MEDICAL ROBOTS MARKET – EUROPE 150

15.1. Europe 150

15.1.1. Key Highlights 150

15.1.2. Europe Medical Robots Market Revenue, By Country, 2018 – 2023 (USD Million) 151

15.1.3. Europe Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 152

15.1.4. Europe Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 153

15.1.5. Europe Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 154

15.1.6. Europe Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 155

15.1.7. Europe Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 156

15.1.8. Europe Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 157

15.2. UK 158

15.3. France 158

15.4. Germany 158

15.5. Italy 158

15.6. Spain 158

15.7. Russia 158

15.8. Belgium 158

15.9. Netherland 158

15.10. Austria 158

15.11. Sweden 158

15.12. Poland 158

15.13. Denmark 158

15.14. Switzerland 158

15.15. Rest of Europe 158

CHAPTER NO. 16 : MEDICAL ROBOTS MARKET – ASIA PACIFIC 159

16.1. Asia Pacific 159

16.1.1. Key Highlights 159

16.1.2. Asia Pacific Medical Robots Market Revenue, By Country, 2018 – 2023 (USD Million) 160

16.1.3. Asia Pacific Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 161

16.1.4. Asia Pacific Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 162

16.1.5. Asia Pacific Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 163

16.1.6. Asia Pacific Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 164

16.1.7. Asia Pacific Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 165

16.1.8. Asia Pacific Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 166

16.2. China 167

16.3. Japan 167

16.4. South Korea 167

16.5. India 167

16.6. Australia 167

16.7. Thailand 167

16.8. Indonesia 167

16.9. Vietnam 167

16.10. Malaysia 167

16.11. Philippines 167

16.12. Taiwan 167

16.13. Rest of Asia Pacific 167

CHAPTER NO. 17 : MEDICAL ROBOTS MARKET – LATIN AMERICA 168

17.1. Latin America 168

17.1.1. Key Highlights 168

17.1.2. Latin America Medical Robots Market Revenue, By Country, 2018 – 2023 (USD Million) 169

17.1.3. Latin America Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 170

17.1.4. Latin America Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 171

17.1.5. Latin America Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 172

17.1.6. Latin America Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 173

17.1.7. Latin America Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 174

17.1.8. Latin America Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 175

17.2. Brazil 176

17.3. Argentina 176

17.4. Peru 176

17.5. Chile 176

17.6. Colombia 176

17.7. Rest of Latin America 176

CHAPTER NO. 18 : MEDICAL ROBOTS MARKET – MIDDLE EAST 177

18.1. Middle East 177

18.1.1. Key Highlights 177

18.1.2. Middle East Medical Robots Market Revenue, By Country, 2018 – 2023 (USD Million) 178

18.1.3. Middle East Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 179

18.1.4. Middle East Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 180

18.1.5. Middle East Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 181

18.1.6. Middle East Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 182

18.1.7. Middle East Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 183

18.1.8. Middle East Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 184

18.2. UAE 185

18.3. KSA 185

18.4. Israel 185

18.5. Turkey 185

18.6. Iran 185

18.7. Rest of Middle East 185

CHAPTER NO. 19 : MEDICAL ROBOTS MARKET – AFRICA 186

19.1. Africa 186

19.1.1. Key Highlights 186

19.1.2. Africa Medical Robots Market Revenue, By Country, 2018 – 2023 (USD Million) 187

19.1.3. Africa Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 188

19.1.4. Africa Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 189

19.1.5. Africa Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 190

19.1.6. Africa Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 191

19.1.7. Africa Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 192

19.1.8. Africa Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 193

19.2. Egypt 194

19.3. Nigeria 194

19.4. Algeria 194

19.5. Morocco 194

19.6. Rest of Africa 194

CHAPTER NO. 20 : COMPANY PROFILES 195

20.1. Medtronic 195

20.1.1. Company Overview 195

20.1.2. Product Portfolio 195

20.1.3. Swot Analysis 195

20.1.4. Business Strategy 196

20.1.5. Financial Overview 196

20.2. Titan Medical Inc. 197

20.3. Accuray Incorporated 197

20.4. Stryker 197

20.5. Stereotaxis, Inc. 197

20.6. Company 6 197

20.7. Company 7 197

20.8. Company 8 197

20.9. Company 9 197

20.10. Company 10 197

20.11. Company 11 197

20.12. Company 12 197

20.13. Company 13 197

20.14. Company 14 197

List of Figures

FIG NO. 1. Global Medical Robots Market Revenue, 2018 – 2032 (USD Million) 35

FIG NO. 2. Porter’s Five Forces Analysis for Global Medical Robots Market 42

FIG NO. 3. Company Share Analysis, 2023 43

FIG NO. 4. Company Share Analysis, 2023 44

FIG NO. 5. Company Share Analysis, 2023 44

FIG NO. 6. Company Share Analysis, 2023 45

FIG NO. 7. Medical Robots Market – Company Revenue Market Share, 2023 46

FIG NO. 8. Medical Robots Market Revenue Share, By Type, 2023 & 2032 52

FIG NO. 9. Market Attractiveness Analysis, By Type 53

FIG NO. 10. Incremental Revenue Growth Opportunity by Type, 2024 – 2032 53

FIG NO. 11. Medical Robots Market Revenue, By Type, 2018, 2023, 2027 & 2032 54

FIG NO. 12. Global Medical Robots Market for External Large Robots, Revenue (USD Million) 2018 – 2032 55

FIG NO. 13. Global Medical Robots Market for Geriatric Robots, Revenue (USD Million) 2018 – 2032 57

FIG NO. 14. Global Medical Robots Market for Assistive Robots, Revenue (USD Million) 2018 – 2032 59

FIG NO. 15. Global Medical Robots Market for Miniature in Vivo Robots, Revenue (USD Million) 2018 – 2032 61

FIG NO. 16. Medical Robots Market Revenue Share, By Product, 2023 & 2032 64

FIG NO. 17. Market Attractiveness Analysis, By Product 65

FIG NO. 18. Incremental Revenue Growth Opportunity by Product, 2024 – 2032 65

FIG NO. 19. Medical Robots Market Revenue, By Product, 2018, 2023, 2027 & 2032 66

FIG NO. 20. Global Medical Robots Market for Surgical Robots, Revenue (USD Million) 2018 – 2032 67

FIG NO. 21. Global Medical Robots Market for Rehabilitation Robots, Revenue (USD Million) 2018 – 2032 69

FIG NO. 22. Global Medical Robots Market for Hospital and Pharmacy Robots, Revenue (USD Million) 2018 – 2032 71

FIG NO. 23. Global Medical Robots Market for Bio Robotics, Revenue (USD Million) 2018 – 2032 73

FIG NO. 24. Global Medical Robots Market for Non-invasive Radio Surgery Robots, Revenue (USD Million) 2018 – 2032 75

FIG NO. 25. Global Medical Robots Market for Telepresence Robots, Revenue (USD Million) 2018 – 2032 77

FIG NO. 26. Global Medical Robots Market for Medical Transportation Robots, Revenue (USD Million) 2018 – 2032 79

FIG NO. 27. Global Medical Robots Market for Sanitation, and Disinfectant Robots, Revenue (USD Million) 2018 – 2032 81

FIG NO. 28. Medical Robots Market Revenue Share, By Modality, 2023 & 2032 84

FIG NO. 29. Market Attractiveness Analysis, By Modality 85

FIG NO. 30. Incremental Revenue Growth Opportunity by Modality, 2024 – 2032 85

FIG NO. 31. Medical Robots Market Revenue, By Modality, 2018, 2023, 2027 & 2032 86

FIG NO. 32. Global Medical Robots Market for Compact, Revenue (USD Million) 2018 – 2032 87

FIG NO. 33. Global Medical Robots Market for Portable, Revenue (USD Million) 2018 – 2032 89

FIG NO. 34. Medical Robots Market Revenue Share, By Application, 2023 & 2032 92

FIG NO. 35. Market Attractiveness Analysis, By Application 93

FIG NO. 36. Incremental Revenue Growth Opportunity by Application, 2024 – 2032 93

FIG NO. 37. Medical Robots Market Revenue, By Application, 2018, 2023, 2027 & 2032 94

FIG NO. 38. Global Medical Robots Market for Neurology, Revenue (USD Million) 2018 – 2032 95

FIG NO. 39. Global Medical Robots Market for Cardiology, Revenue (USD Million) 2018 – 2032 97

FIG NO. 40. Global Medical Robots Market for Orthopedic, Revenue (USD Million) 2018 – 2032 99

FIG NO. 41. Global Medical Robots Market for Laparoscopic, Revenue (USD Million) 2018 – 2032 101

FIG NO. 42. Global Medical Robots Market for Others, Revenue (USD Million) 2018 – 2032 103

FIG NO. 43. Medical Robots Market Revenue Share, By End-user, 2023 & 2032 106

FIG NO. 44. Market Attractiveness Analysis, By End-user 107

FIG NO. 45. Incremental Revenue Growth Opportunity by End-user, 2024 – 2032 107

FIG NO. 46. Medical Robots Market Revenue, By End-user, 2018, 2023, 2027 & 2032 108

FIG NO. 47. Global Medical Robots Market for Hospitals, Revenue (USD Million) 2018 – 2032 109

FIG NO. 48. Global Medical Robots Market for Specialty Clinics, Revenue (USD Million) 2018 – 2032 111

FIG NO. 49. Global Medical Robots Market for Ambulatory Surgical Centers, Revenue (USD Million) 2018 – 2032 113

FIG NO. 50. Global Medical Robots Market for Others, Revenue (USD Million) 2018 – 2032 115

FIG NO. 51. Medical Robots Market Revenue Share, By Distribution Channel, 2023 & 2032 118

FIG NO. 52. Market Attractiveness Analysis, By Distribution Channel 119

FIG NO. 53. Incremental Revenue Growth Opportunity by Distribution Channel, 2024 – 2032 119

FIG NO. 54. Medical Robots Market Revenue, By Distribution Channel, 2018, 2023, 2027 & 2032 120

FIG NO. 55. Global Medical Robots Market for Direct Tender, Revenue (USD Million) 2018 – 2032 121

FIG NO. 56. Global Medical Robots Market for Retail Sales, Revenue (USD Million) 2018 – 2032 123

FIG NO. 57. Global Medical Robots Market for Third Party Distributors, Revenue (USD Million) 2018 – 2032 125

FIG NO. 58. Global Medical Robots Market for Others, Revenue (USD Million) 2018 – 2032 127

FIG NO. 59. Global Medical Robots Market Revenue Share, By Region, 2023 & 2032 130

FIG NO. 60. Market Attractiveness Analysis, By Region 131

FIG NO. 61. Incremental Revenue Growth Opportunity by Region, 2024 – 2032 131

FIG NO. 62. Medical Robots Market Revenue, By Region, 2018, 2023, 2027 & 2032 132

FIG NO. 63. North America Medical Robots Market Revenue, 2018 – 2032 (USD Million) 141

FIG NO. 64. Europe Medical Robots Market Revenue, 2018 – 2032 (USD Million) 150

FIG NO. 65. Asia Pacific Medical Robots Market Revenue, 2018 – 2032 (USD Million) 159

FIG NO. 66. Latin America Medical Robots Market Revenue, 2018 – 2032 (USD Million) 168

FIG NO. 67. Middle East Medical Robots Market Revenue, 2018 – 2032 (USD Million) 177

FIG NO. 68. Africa Medical Robots Market Revenue, 2018 – 2032 (USD Million) 186

List of Tables

TABLE NO. 1. : Global Medical Robots Market: Snapshot 33

TABLE NO. 2. : Drivers for the Medical Robots Market: Impact Analysis 38

TABLE NO. 3. : Restraints for the Medical Robots Market: Impact Analysis 40

TABLE NO. 4. : Global External Large Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 56

TABLE NO. 5. : Global External Large Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 56

TABLE NO. 6. : Global Geriatric Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 58

TABLE NO. 7. : Global Geriatric Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 58

TABLE NO. 8. : Global Assistive Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 60

TABLE NO. 9. : Global Assistive Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 60

TABLE NO. 10. : Global Miniature in Vivo Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 62

TABLE NO. 11. : Global Miniature in Vivo Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 62

TABLE NO. 12. : Global Surgical Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 68

TABLE NO. 13. : Global Surgical Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 68

TABLE NO. 14. : Global Rehabilitation Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 70

TABLE NO. 15. : Global Rehabilitation Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 70

TABLE NO. 16. : Global Hospital and Pharmacy Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 72

TABLE NO. 17. : Global Hospital and Pharmacy Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 72

TABLE NO. 18. : Global Bio Robotics Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 74

TABLE NO. 19. : Global Bio Robotics Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 74

TABLE NO. 20. : Global Non-invasive Radio Surgery Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 76

TABLE NO. 21. : Global Non-invasive Radio Surgery Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 76

TABLE NO. 22. : Global Telepresence Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 78

TABLE NO. 23. : Global Telepresence Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 78

TABLE NO. 24. : Global Medical Transportation Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 80

TABLE NO. 25. : Global Medical Transportation Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 80

TABLE NO. 26. : Global Sanitation, and Disinfectant Robots Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 82

TABLE NO. 27. : Global Sanitation, and Disinfectant Robots Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 82

TABLE NO. 28. : Global Compact Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 88

TABLE NO. 29. : Global Compact Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 88

TABLE NO. 30. : Global Portable Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 90

TABLE NO. 31. : Global Portable Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 90

TABLE NO. 32. : Global Neurology Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 96

TABLE NO. 33. : Global Neurology Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 96

TABLE NO. 34. : Global Cardiology Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 98

TABLE NO. 35. : Global Cardiology Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 98

TABLE NO. 36. : Global Orthopedic Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 100

TABLE NO. 37. : Global Orthopedic Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 100

TABLE NO. 38. : Global Laparoscopic Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 102

TABLE NO. 39. : Global Laparoscopic Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 102

TABLE NO. 40. : Global Others Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 104

TABLE NO. 41. : Global Others Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 104

TABLE NO. 42. : Global Hospitals Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 110

TABLE NO. 43. : Global Hospitals Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 110

TABLE NO. 44. : Global Specialty Clinics Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 112

TABLE NO. 45. : Global Specialty Clinics Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 112

TABLE NO. 46. : Global Ambulatory Surgical Centers Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 114

TABLE NO. 47. : Global Ambulatory Surgical Centers Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 114

TABLE NO. 48. : Global Others Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 116

TABLE NO. 49. : Global Others Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 116

TABLE NO. 50. : Global Direct Tender Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 122

TABLE NO. 51. : Global Direct Tender Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 122

TABLE NO. 52. : Global Retail Sales Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 124

TABLE NO. 53. : Global Retail Sales Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 124

TABLE NO. 54. : Global Third Party Distributors Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 126

TABLE NO. 55. : Global Third Party Distributors Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 126

TABLE NO. 56. : Global Others Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 128

TABLE NO. 57. : Global Others Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 128

TABLE NO. 58. : Global Medical Robots Market Revenue, By Region, 2018 – 2023 (USD Million) 133

TABLE NO. 59. : Global Medical Robots Market Revenue, By Region, 2024 – 2032 (USD Million) 133

TABLE NO. 60. : Global Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 134

TABLE NO. 61. : Global Medical Robots Market Revenue, By Type, 2024 – 2032 (USD Million) 134

TABLE NO. 62. : Global Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 135

TABLE NO. 63. : Global Medical Robots Market Revenue, By Product, 2024 – 2032 (USD Million) 136

TABLE NO. 64. : Global Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 137

TABLE NO. 65. : Global Medical Robots Market Revenue, By Application, 2024 – 2032 (USD Million) 137

TABLE NO. 66. : Global Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 138

TABLE NO. 67. : Global Medical Robots Market Revenue, By End-user, 2024 – 2032 (USD Million) 138

TABLE NO. 68. : Global Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 139

TABLE NO. 69. : Global Medical Robots Market Revenue, By Modality, 2024 – 2032 (USD Million) 139

TABLE NO. 70. : Global Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 140

TABLE NO. 71. : Global Medical Robots Market Revenue, By Distribution Channel, 2024 – 2032 (USD Million) 140

TABLE NO. 72. : North America Medical Robots Market Revenue, By Country, 2018 – 2023 (USD Million) 142

TABLE NO. 73. : North America Medical Robots Market Revenue, By Country, 2024 – 2032 (USD Million) 142

TABLE NO. 74. : North America Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 143

TABLE NO. 75. : North America Medical Robots Market Revenue, By Type, 2024 – 2032 (USD Million) 143

TABLE NO. 76. : North America Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 144

TABLE NO. 77. : North America Medical Robots Market Revenue, By Product, 2024 – 2032 (USD Million) 144

TABLE NO. 78. : North America Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 145

TABLE NO. 79. : North America Medical Robots Market Revenue, By Application, 2024 – 2032 (USD Million) 145

TABLE NO. 80. : North America Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 146

TABLE NO. 81. : North America Medical Robots Market Revenue, By End-user, 2024 – 2032 (USD Million) 146

TABLE NO. 82. : North America Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 147

TABLE NO. 83. : North America Medical Robots Market Revenue, By Modality, 2024 – 2032 (USD Million) 147

TABLE NO. 84. : North America Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 148

TABLE NO. 85. : North America Medical Robots Market Revenue, By Distribution Channel, 2024 – 2032 (USD Million) 148

TABLE NO. 86. : Europe Medical Robots Market Revenue, By Country, 2018 – 2023 (USD Million) 151

TABLE NO. 87. : Europe Medical Robots Market Revenue, By Country, 2024 – 2032 (USD Million) 151

TABLE NO. 88. : Europe Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 152

TABLE NO. 89. : Europe Medical Robots Market Revenue, By Type, 2024 – 2032 (USD Million) 152

TABLE NO. 90. : Europe Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 153

TABLE NO. 91. : Europe Medical Robots Market Revenue, By Product, 2024 – 2032 (USD Million) 153

TABLE NO. 92. : Europe Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 154

TABLE NO. 93. : Europe Medical Robots Market Revenue, By Application, 2024 – 2032 (USD Million) 154

TABLE NO. 94. : Europe Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 155

TABLE NO. 95. : Europe Medical Robots Market Revenue, By End-user, 2024 – 2032 (USD Million) 155

TABLE NO. 96. : Europe Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 156

TABLE NO. 97. : Europe Medical Robots Market Revenue, By Modality, 2024 – 2032 (USD Million) 156

TABLE NO. 98. : Europe Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 157

TABLE NO. 99. : Europe Medical Robots Market Revenue, By Distribution Channel, 2024 – 2032 (USD Million) 157

TABLE NO. 100. : Asia Pacific Medical Robots Market Revenue, By Country, 2018 – 2023 (USD Million) 160

TABLE NO. 101. : Asia Pacific Medical Robots Market Revenue, By Country, 2024 – 2032 (USD Million) 160

TABLE NO. 102. : Asia Pacific Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 161

TABLE NO. 103. : Asia Pacific Medical Robots Market Revenue, By Type, 2024 – 2032 (USD Million) 161

TABLE NO. 104. : Asia Pacific Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 162

TABLE NO. 105. : Asia Pacific Medical Robots Market Revenue, By Product, 2024 – 2032 (USD Million) 162

TABLE NO. 106. : Asia Pacific Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 163

TABLE NO. 107. : Asia Pacific Medical Robots Market Revenue, By Application, 2024 – 2032 (USD Million) 163

TABLE NO. 108. : Asia Pacific Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 164

TABLE NO. 109. : Asia Pacific Medical Robots Market Revenue, By End-user, 2024 – 2032 (USD Million) 164

TABLE NO. 110. : Asia Pacific Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 165

TABLE NO. 111. : Asia Pacific Medical Robots Market Revenue, By Modality, 2024 – 2032 (USD Million) 165

TABLE NO. 112. : Asia Pacific Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 166

TABLE NO. 113. : Asia Pacific Medical Robots Market Revenue, By Distribution Channel, 2024 – 2032 (USD Million) 166

TABLE NO. 114. : Latin America Medical Robots Market Revenue, By Country, 2018 – 2023 (USD Million) 169

TABLE NO. 115. : Latin America Medical Robots Market Revenue, By Country, 2024 – 2032 (USD Million) 169

TABLE NO. 116. : Latin America Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 170

TABLE NO. 117. : Latin America Medical Robots Market Revenue, By Type, 2024 – 2032 (USD Million) 170

TABLE NO. 118. : Latin America Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 171

TABLE NO. 119. : Latin America Medical Robots Market Revenue, By Product, 2024 – 2032 (USD Million) 171

TABLE NO. 120. : Latin America Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 172

TABLE NO. 121. : Latin America Medical Robots Market Revenue, By Application, 2024 – 2032 (USD Million) 172

TABLE NO. 122. : Latin America Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 173

TABLE NO. 123. : Latin America Medical Robots Market Revenue, By End-user, 2024 – 2032 (USD Million) 173

TABLE NO. 124. : Latin America Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 174

TABLE NO. 125. : Latin America Medical Robots Market Revenue, By Modality, 2024 – 2032 (USD Million) 174

TABLE NO. 126. : Latin America Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 175

TABLE NO. 127. : Latin America Medical Robots Market Revenue, By Distribution Channel, 2024 – 2032 (USD Million) 175

TABLE NO. 128. : Middle East Medical Robots Market Revenue, By Country, 2018 – 2023 (USD Million) 178

TABLE NO. 129. : Middle East Medical Robots Market Revenue, By Country, 2024 – 2032 (USD Million) 178

TABLE NO. 130. : Middle East Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 179

TABLE NO. 131. : Middle East Medical Robots Market Revenue, By Type, 2024 – 2032 (USD Million) 179

TABLE NO. 132. : Middle East Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 180

TABLE NO. 133. : Middle East Medical Robots Market Revenue, By Product, 2024 – 2032 (USD Million) 180

TABLE NO. 134. : Middle East Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 181

TABLE NO. 135. : Middle East Medical Robots Market Revenue, By Application, 2024 – 2032 (USD Million) 181

TABLE NO. 136. : Middle East Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 182

TABLE NO. 137. : Middle East Medical Robots Market Revenue, By End-user, 2024 – 2032 (USD Million) 182

TABLE NO. 138. : Middle East Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 183

TABLE NO. 139. : Middle East Medical Robots Market Revenue, By Modality, 2024 – 2032 (USD Million) 183

TABLE NO. 140. : Middle East Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 184

TABLE NO. 141. : Middle East Medical Robots Market Revenue, By Distribution Channel, 2024 – 2032 (USD Million) 184

TABLE NO. 142. : Africa Medical Robots Market Revenue, By Country, 2018 – 2023 (USD Million) 187

TABLE NO. 143. : Africa Medical Robots Market Revenue, By Country, 2024 – 2032 (USD Million) 187

TABLE NO. 144. : Africa Medical Robots Market Revenue, By Type, 2018 – 2023 (USD Million) 188

TABLE NO. 145. : Africa Medical Robots Market Revenue, By Type, 2024 – 2032 (USD Million) 188

TABLE NO. 146. : Africa Medical Robots Market Revenue, By Product, 2018 – 2023 (USD Million) 189

TABLE NO. 147. : Africa Medical Robots Market Revenue, By Product, 2024 – 2032 (USD Million) 189

TABLE NO. 148. : Africa Medical Robots Market Revenue, By Application, 2018 – 2023 (USD Million) 190

TABLE NO. 149. : Africa Medical Robots Market Revenue, By Application, 2024 – 2032 (USD Million) 190

TABLE NO. 150. : Africa Medical Robots Market Revenue, By End-user, 2018 – 2023 (USD Million) 191

TABLE NO. 151. : Africa Medical Robots Market Revenue, By End-user, 2024 – 2032 (USD Million) 191

TABLE NO. 152. : Africa Medical Robots Market Revenue, By Modality, 2018 – 2023 (USD Million) 192

TABLE NO. 153. : Africa Medical Robots Market Revenue, By Modality, 2024 – 2032 (USD Million) 192

TABLE NO. 154. : Africa Medical Robots Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 193

TABLE NO. 155. : Africa Medical Robots Market Revenue, By Distribution Channel, 2024 – 2032 (USD Million) 193