Market Overview:

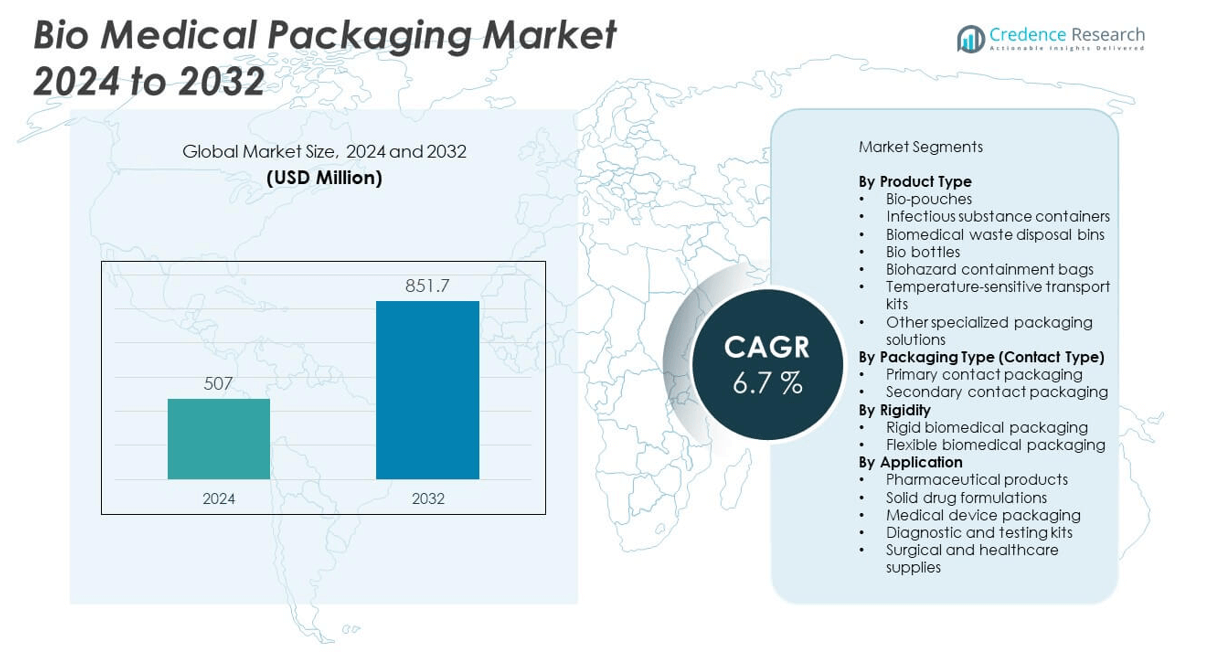

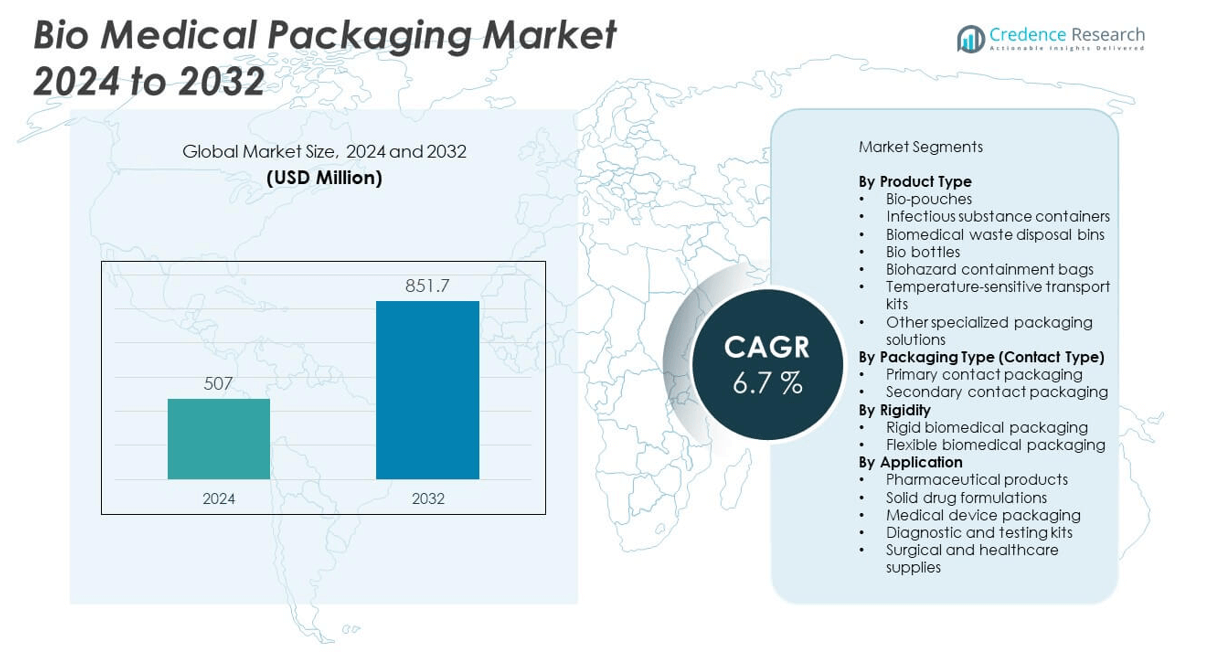

The Bio Medical Packaging Market is projected to grow from USD 507 million in 2024 to an estimated USD 851.7 million by 2032, with a compound annual growth rate (CAGR) of 6.7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bio Medical Packaging Market Size 2024 |

USD 507 million |

| Bio Medical Packaging Market, CAGR |

6.7% |

| Bio Medical Packaging Market Size 2032 |

USD 851.7 million |

Growth in the biomedical packaging market is being driven by the increasing demand for secure and sterile packaging solutions in the pharmaceutical and healthcare industries. With rising global healthcare expenditure and the surge in biopharmaceuticals, manufacturers are adopting advanced materials and technologies to ensure product safety, shelf life, and regulatory compliance. The growing need for tamper-evident, temperature-sensitive, and contamination-resistant packaging is pushing innovation in barrier films, blister packs, and pre-filled syringes. Moreover, stricter regulatory frameworks are compelling manufacturers to adopt more reliable, traceable, and sustainable packaging solutions.

Regionally, North America dominates the biomedical packaging market due to its well-established pharmaceutical sector, strong regulatory oversight, and consistent investments in research and development. Europe also holds a significant share, driven by high healthcare standards and strong demand for biologics. Meanwhile, the Asia-Pacific region is emerging as a high-growth area due to expanding healthcare infrastructure, increasing production of generics and biologics, and supportive government initiatives in countries like India, China, and South Korea. Latin America and the Middle East & Africa are also witnessing steady growth, supported by improving access to healthcare and increasing pharmaceutical exports.

Market Insights:

- The Bio Medical Packaging Market was valued at USD 507 million in 2024 and is projected to reach USD 851.7 million by 2032, growing at a CAGR of 6.7%.

- Increasing demand for sterile, tamper-proof packaging in biopharmaceuticals is driving market growth.

- Rising prevalence of chronic diseases has boosted the need for reliable packaging of injectable and specialty drugs.

- High material and compliance costs present a challenge for small and mid-sized manufacturers.

- North America leads the market with 34% share, supported by strong R&D and regulatory infrastructure.

- Asia Pacific is witnessing the fastest growth due to expanding healthcare infrastructure and pharmaceutical production.

- Evolving regulations around traceability and sustainability are reshaping packaging design and innovation strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Sterile Packaging in Pharmaceuticals and Biologics Drives Adoption

The growing complexity of pharmaceutical products, especially biologics and personalized medicines, is increasing the demand for sterile and secure packaging solutions. The Bio Medical Packaging Market benefits from the need to protect sensitive drugs from contamination and environmental exposure. Regulatory mandates by agencies such as the FDA and EMA require packaging solutions that ensure product integrity throughout the supply chain. Companies are prioritizing packaging systems that can maintain sterility and extend shelf life. Pre-filled syringes, blister packs, and vials with tamper-evident seals are gaining preference across global pharmaceutical operations. The shift toward home-based care and self-administration of medications has further increased the need for user-friendly and safe packaging. It reflects the growing focus on patient safety and product efficacy.

- For instance, West Pharmaceutical Services developed DeltaCube™ modeling technology, a data-driven platform that simulates container-closure systems using real-world component dimensions and finite element analysis. It enables more accurate prediction of seal integrity, supporting the development of robust packaging systems for biologics and reducing time-to-market through early risk assessment.

Stringent Global Regulations Fuel Packaging Innovation and Compliance

Governments and regulatory authorities have tightened compliance requirements for biomedical products, creating pressure to upgrade packaging standards. The Bio Medical Packaging Market is directly influenced by these regulations, which ensure traceability, safety, and quality throughout the product lifecycle. Manufacturers must demonstrate that their packaging materials are compatible with the drug formulation and do not compromise efficacy. Regulations demand high-performance barrier properties, clear labeling, and traceable packaging systems. Companies are investing in technologies that support compliance with serialization and anti-counterfeiting measures. It drives the development of advanced packaging solutions that integrate digital traceability. The need to meet country-specific regulatory requirements encourages packaging standardization and modular system design. Sustainable compliance remains a primary objective across global supply chains.

Growth in Chronic Disease Prevalence Expands Packaging Demand Scope

The rising global incidence of chronic conditions such as diabetes, cancer, and cardiovascular diseases has expanded the volume of long-term therapeutic treatments. This shift elevates the need for biomedical packaging that supports drug stability, controlled release, and extended shelf life. The Bio Medical Packaging Market is scaling to accommodate increasing demand from hospitals, clinics, and homecare settings. Packaging formats for injectables, transdermal patches, and implantable devices must now ensure not just sterility but long-term efficacy. It also increases demand for packaging that supports cold-chain logistics and smart monitoring. Self-administration trends call for tamper-proof, portable packaging. The industry is responding with flexible packaging formats that combine safety and patient usability. This demand is constant across emerging and developed regions alike.

Advancements in Material Science Enable Enhanced Packaging Performance

Material innovations play a crucial role in improving packaging efficiency, safety, and sustainability. The Bio Medical Packaging Market is leveraging advanced polymer blends, foil laminates, and coatings to enhance barrier properties and chemical compatibility. These materials offer resistance to oxygen, moisture, and UV exposure while maintaining product integrity. Companies are also introducing biodegradable and recyclable options without compromising on protection standards. It strengthens the environmental performance of biomedical packaging systems while aligning with sustainability goals. Materials that support high-speed automation and sterilization processes are gaining traction. The evolution of nanomaterials and smart polymers is expected to further drive innovation. Cost efficiency and compatibility remain core considerations in material development.

- For example, Amcor commercialized AmLite Ultra Recyclable, a high-barrier film with a water vapor transmission rate (WVTR) of 0.08 g/m²/day, already adopted by 15 global pharmaceutical companies for sustainable blister packaging.

Market Trends

Adoption of Smart Packaging Technologies Enhances Drug Monitoring and Safety

Smart packaging solutions are gaining traction for their ability to improve medication tracking and ensure patient safety. The Bio Medical Packaging Market is witnessing increased integration of features like RFID tags, QR codes, and temperature indicators. These elements provide real-time data on handling, storage conditions, and expiration tracking. Digital solutions are improving supply chain visibility and enabling product authentication. It helps reduce medication errors and strengthens recall management. Smart labels also allow better interaction between patients and healthcare providers through embedded information. This technology aligns with the growing trend of connected healthcare systems. Packaging providers are collaborating with tech firms to embed these features without compromising safety.

- For instance, AstraZeneca uses Loftware’s Smartflow platform to manage 10,000+ artwork changes per year, reducing lead times by 60% and ensuring compliance across 1,000+ stakeholders.

Sustainable and Eco-Friendly Packaging Gains Prominence in Biomedical Applications

Growing concerns over plastic waste and carbon emissions are driving a shift toward sustainable packaging options. The Bio Medical Packaging Market is responding with the introduction of biodegradable films, recyclable plastics, and reusable systems. Stakeholders across the value chain are re-evaluating packaging choices to meet environmental goals. It creates opportunities for packaging formats that reduce material usage and support circular economy models. Companies are redesigning packaging to be more compact and lightweight without compromising functionality. Regulations in Europe and North America are pushing the adoption of greener solutions in biomedical packaging. Hospital procurement departments are now considering the environmental profile of packaging during vendor selection. Sustainable sourcing and lifecycle analysis play a larger role in product development strategies.

Personalized Medicine and Biologics Accelerate Custom Packaging Demand

The expansion of personalized therapies and biologics is creating demand for flexible, small-batch, and custom-engineered packaging solutions. The Bio Medical Packaging Market is adapting to accommodate diverse molecular structures and delivery methods. Pharmaceutical companies require packaging that ensures product stability and supports variable dosing. It drives innovation in modular packaging formats and custom-printed labeling. Packaging processes must allow for quick changeovers and low-volume runs without compromising compliance. The integration of automation and digital controls supports this level of flexibility. Custom packaging is especially critical for temperature-sensitive biologics and gene therapies. Growth in this trend enhances the role of contract packaging organizations that can provide scalable and adaptable solutions.

Digital Transformation Across the Supply Chain Enhances Efficiency and Traceability

The ongoing digitalization of pharmaceutical supply chains is influencing packaging design and functionality. The Bio Medical Packaging Market is aligning with these changes through digital printing, automation, and serialization systems. End-to-end traceability is now a priority for manufacturers and regulators alike. It drives the inclusion of 2D barcodes, tamper-evident features, and digital twins in packaging. Advanced machinery supports faster production speeds while maintaining quality. Real-time monitoring systems and cloud integration improve logistics control and reduce inventory errors. Packaging data is being used to support analytics and decision-making. Digital transformation creates a more resilient and responsive packaging ecosystem.

- For example, Gerresheimer AG integrated Datamatrix serialization into its primary packaging, achieving 9% traceability accuracy across 25 international pharma client.

Market Challenges Analysis

High Cost of Advanced Packaging Materials and Technologies Affects Adoption

Biomedical packaging solutions often require advanced materials with high barrier properties, chemical inertness, and sterilization compatibility. The Bio Medical Packaging Market faces cost-related challenges in adopting such materials across developing markets. High-performance films, multilayer laminates, and smart sensors add to the overall packaging cost. It impacts affordability, especially for generics and low-margin therapies. Small and mid-sized manufacturers may struggle with capital-intensive packaging upgrades. Limited access to cold-chain infrastructure in some regions complicates storage and transport needs. Price sensitivity among healthcare providers also discourages experimentation with new formats. Balancing cost, compliance, and innovation remains a persistent hurdle for suppliers.

Complex Regulatory Landscape and Lack of Standardization Create Operational Barriers

The global biomedical sector operates under varying regulatory frameworks, which complicates packaging design and deployment. The Bio Medical Packaging Market must navigate region-specific labeling rules, traceability mandates, and sterilization standards. It increases development time and operational costs, especially for multinational companies. Lack of harmonized guidelines leads to duplication in compliance efforts. Delays in regulatory approvals affect time-to-market for new packaging technologies. The need for rigorous validation, testing, and documentation poses a burden for packaging suppliers. Differences in interpretation between regulatory agencies further intensify complexity. Companies require dedicated compliance teams to ensure adherence across geographies.

Market Opportunities

Rising Demand for Contract Packaging Services Opens Strategic Growth Avenues

Pharmaceutical and biotech firms are increasingly outsourcing packaging activities to specialized service providers. The Bio Medical Packaging Market is well-positioned to leverage this trend by offering scalable, GMP-compliant, and customizable packaging solutions. It enables faster time-to-market and reduces capital burden for drug manufacturers. Outsourcing also supports product diversification and regional expansion. Contract packaging firms benefit by offering high-tech solutions tailored to niche therapeutic categories. It helps manufacturers focus on core competencies while ensuring packaging compliance. Demand for flexibility and innovation in packaging formats continues to drive partnerships between drug makers and third-party providers.

Expansion of Healthcare Infrastructure in Emerging Economies Spurs Packaging Investment

Governments across Asia Pacific, Latin America, and Africa are investing heavily in healthcare infrastructure. The Bio Medical Packaging Market stands to gain from the growing demand for sterile, compliant, and cost-effective packaging systems. It creates opportunities for local manufacturing, technology transfer, and regional supply chain development. Companies entering these markets can benefit from early mover advantages and strategic collaborations. Increasing public and private healthcare spending is generating new demand for localized production and packaging capabilities. Growth in domestic pharmaceutical production in these regions supports long-term investment in packaging innovation.

Market Segmentation Analysis:

The Bio Medical Packaging Market is segmented by product type, contact type, rigidity, and application, each addressing distinct needs across the healthcare ecosystem.

By product type, bio-pouches, infectious substance containers, and temperature-sensitive transport kits lead due to their crucial role in preserving sterility and supporting cold-chain logistics. Biohazard bags and biomedical waste bins are also essential in meeting hospital waste handling protocols. Bio bottles and other specialized packaging formats cater to specific drug containment and transport requirements.

- For example, Tempack’s Diagnosach DSX medical cooler is a lightweight, isothermal shipping container used to transport biological samples under controlled temperatures for up to 4 days. It’s widely used for vaccines, insulin, and diagnostic specimens.

By contact type, the market is classified into primary and secondary packaging. Primary contact packaging holds a larger share, driven by the need for direct protection and contamination prevention of drugs and devices. Secondary packaging supports labeling, storage, and safe distribution, particularly for bulk shipments and diagnostics.

By rigidity, flexible biomedical packaging dominates due to its lightweight, space-efficient, and versatile nature. Rigid packaging is essential for delicate medical instruments and high-value biologics that require structural support.

- For instance, ColorFlex’s stand-up pouches for pharmaceuticals include reclosable zippers and tear notches, offering lightweight, space-saving formats for powders, liquids, and tablets.

By application, pharmaceutical product packaging accounts for a substantial portion of demand, followed by medical device and diagnostic kit packaging. It reflects increased global focus on secure and compliant packaging for high-value therapeutic and testing solutions. Surgical supply packaging also contributes significantly, supported by growing hospital procedural volumes.

Segmentation:

By Product Type

- Bio-pouches

- Infectious substance containers

- Biomedical waste disposal bins

- Bio bottles

- Biohazard containment bags

- Temperature-sensitive transport kits

- Other specialized packaging solutions

By Packaging Type (Contact Type)

- Primary contact packaging

- Secondary contact packaging

By Rigidity

- Rigid biomedical packaging

- Flexible biomedical packaging

By Application

- Pharmaceutical products

- Solid drug formulations

- Medical device packaging

- Diagnostic and testing kits

- Surgical and healthcare supplies

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the largest share of the Bio Medical Packaging Market, accounting for 34%. Strong pharmaceutical and biotechnology industries, coupled with advanced regulatory frameworks, drive regional dominance. The U.S. leads due to high healthcare expenditure, strong R&D activity, and widespread use of biologics. Canada also contributes through stable healthcare infrastructure and increasing pharmaceutical exports. It benefits from the adoption of smart and sustainable packaging technologies supported by leading global manufacturers. The presence of major packaging firms enhances regional capabilities and product innovation.

Europe captures 28% of the Bio Medical Packaging Market, supported by high demand for precision drug delivery and strong environmental regulations. Countries like Germany, France, and the UK are key contributors due to well-established healthcare systems and strict packaging compliance standards. It reflects increasing demand for recyclable and sterilized packaging formats tailored for biologics and specialty drugs. The region maintains a strong presence of material suppliers and packaging technology developers. EU-wide mandates on anti-counterfeit measures further stimulate traceable and secure packaging adoption.

Asia Pacific holds 22% of the Bio Medical Packaging Market and is the fastest-growing region. China and India lead market expansion with increasing generic drug production and growing biopharmaceutical investments. Japan and South Korea contribute through strong regulatory standards and aging populations driving healthcare demand. It benefits from growing healthcare infrastructure, expanding contract packaging activities, and a cost-competitive manufacturing environment. Local players are increasingly forming partnerships with global firms to expand technological reach. Rising adoption of modern packaging formats is reinforcing regional growth momentum.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor plc

- DuPont

- Berry Global Inc.

- 3M Company

- Sonoco Products Company

- West Pharmaceutical Services

- Sealed Air Corporation

- Nelipak Healthcare Packaging

- Wipak Group

- ProAmpac

- Oliver Healthcare Packaging

- Gerresheimer AG

- SCHOTT AG

Competitive Analysis

The Bio Medical Packaging Market features a moderately fragmented structure with strong presence of multinational packaging corporations and specialized regional players. Companies compete on innovation, regulatory compliance, material quality, and production efficiency. Leading players include Amcor plc, Berry Global Inc., DuPont, Sonoco Products Company, and West Pharmaceutical Services. It shows competitive intensity through increased R&D investments and strategic acquisitions to expand product offerings. Many firms are focusing on sustainable packaging materials and smart features like serialization. Contract packaging firms are also gaining prominence by offering flexible and compliant solutions. Strategic collaborations and geographic expansion define current market competition.

Recent Developments:

- In April 2025, Amcor plc completed construction of an advanced coating facility for healthcare packaging in Selangor, Malaysia. This cutting-edge site is the first in Asia to produce both top and bottom substrates for medical device packaging, strengthening regional supply chains and providing customers across Asia-Pacific with improved access, flexibility, and security for sterile packaging needs.

- In February 2025, Berry Global revealed a partnership with Mars to launch packaging for M&M’S, SKITTLES, and STARBURST pantry jars made entirely from 100% recycled plastic (except lids). This sustainable packaging, now available across the U.S., is expected to eliminate over 1,300 metric tons of virgin plastic annually, advancing circular economy goals and reducing emissions for both companies.

- In March 2024, 3M Company introduced the Padded Automatable Curbside Recyclable (PACR) mailer material, a world’s first innovation in paper-based mailers that are recyclable curbside and compatible with automated packaging machines. This new product provides sustainable padded protection for shipping, combining environmental responsibility with improved efficiency for packaging operations

- In October 2024, Sonoco Products Company’s temperature-controlled packaging division, Sonoco ThermoSafe, entered into a global master lease agreement with Saudia Cargo. The partnership is centered around the Pegasus ULD container, which provides up to 300 hours of temperature control during pharmaceutical shipping while utilizing 90% recyclable materials, marking a notable advance in pharma logistics and sustainability.

Market Concentration & Characteristics

The Bio Medical Packaging Market demonstrates medium-to-high market concentration with a blend of global and regional players. It is characterized by high regulatory adherence, technological innovation, and increasing demand for sterile, tamper-proof, and sustainable packaging. Companies prioritize cleanroom manufacturing, traceability, and compatibility with diverse drug formulations. The market also favors suppliers that offer speed-to-market, customization, and strong quality assurance. Digital transformation and sustainability trends continue to influence packaging formats and materials.

Report Coverage:

The research report offers an in-depth analysis based on product type, contact type, rigidity, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for biologics, cell and gene therapies will accelerate the need for sterile, high-barrier biomedical packaging that ensures product stability and integrity throughout the supply chain.

- The push for sustainability will lead to wider adoption of recyclable, biodegradable, and compostable packaging materials without compromising safety or compliance standards.

- Evolving regulatory frameworks will encourage increased investment in serialization, tamper-evident features, and anti-counterfeiting technologies across biomedical packaging formats.

- Contract packaging organizations will expand their global footprint, offering tailored, GMP-compliant solutions that meet diverse regulatory and therapeutic requirements.

- The incorporation of smart technologies such as RFID, QR codes, and real-time temperature sensors will improve supply chain visibility, handling accuracy, and patient safety.

- Growth in home-based therapies and self-administration trends will fuel demand for intuitive, pre-filled, and portable packaging formats that enhance usability.

- Emerging economies will see significant growth in packaging infrastructure, supported by rising pharmaceutical production and government-backed healthcare investments.

- Material innovation in multilayer films, nanocoatings, and chemical-resistant polymers will enhance barrier properties while enabling sustainable solutions.

- Automation and digitalization in packaging lines will drive improvements in productivity, quality control, and traceability across pharmaceutical facilities.

- Collaborations between biopharmaceutical manufacturers and packaging providers will strengthen innovation pipelines and enable rapid adaptation to evolving market needs.