Market Overview

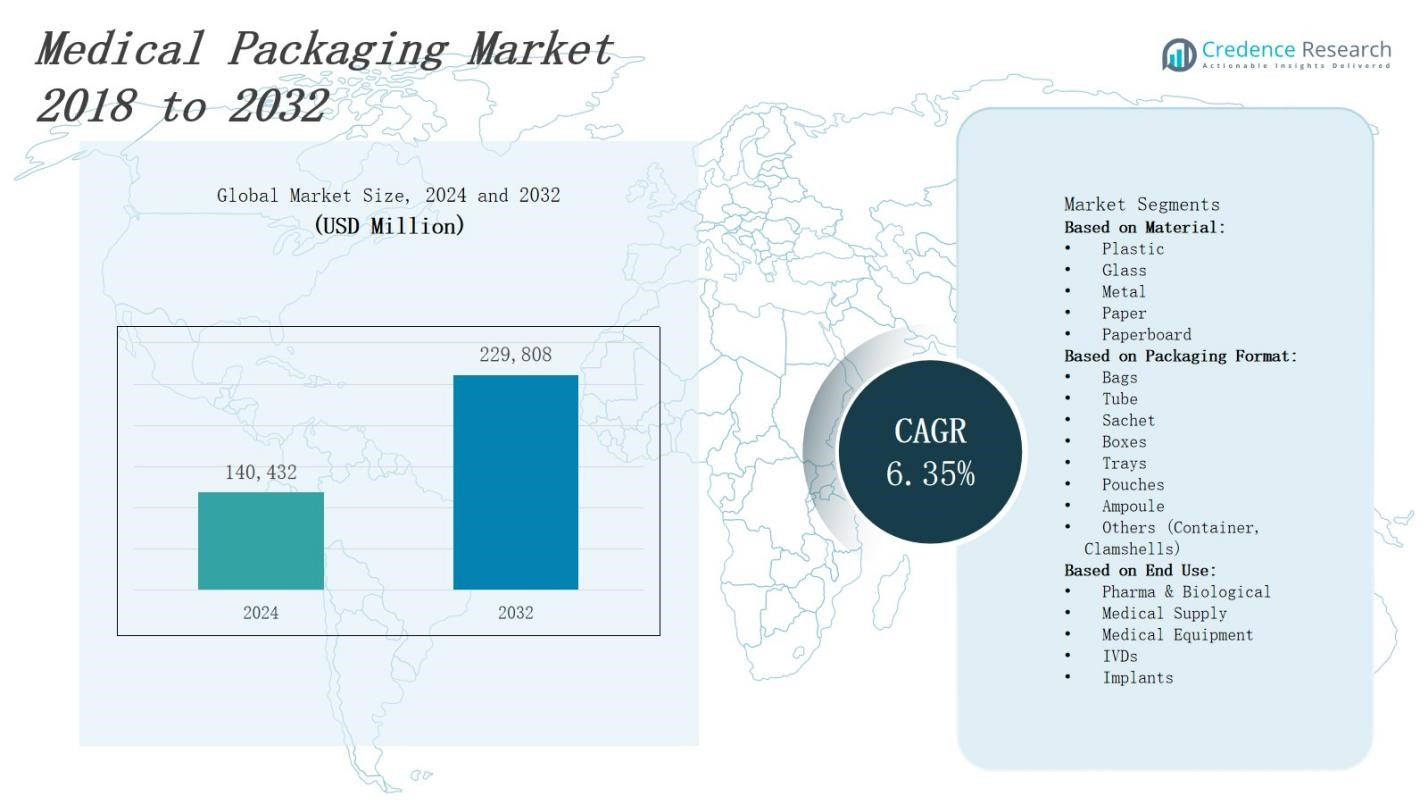

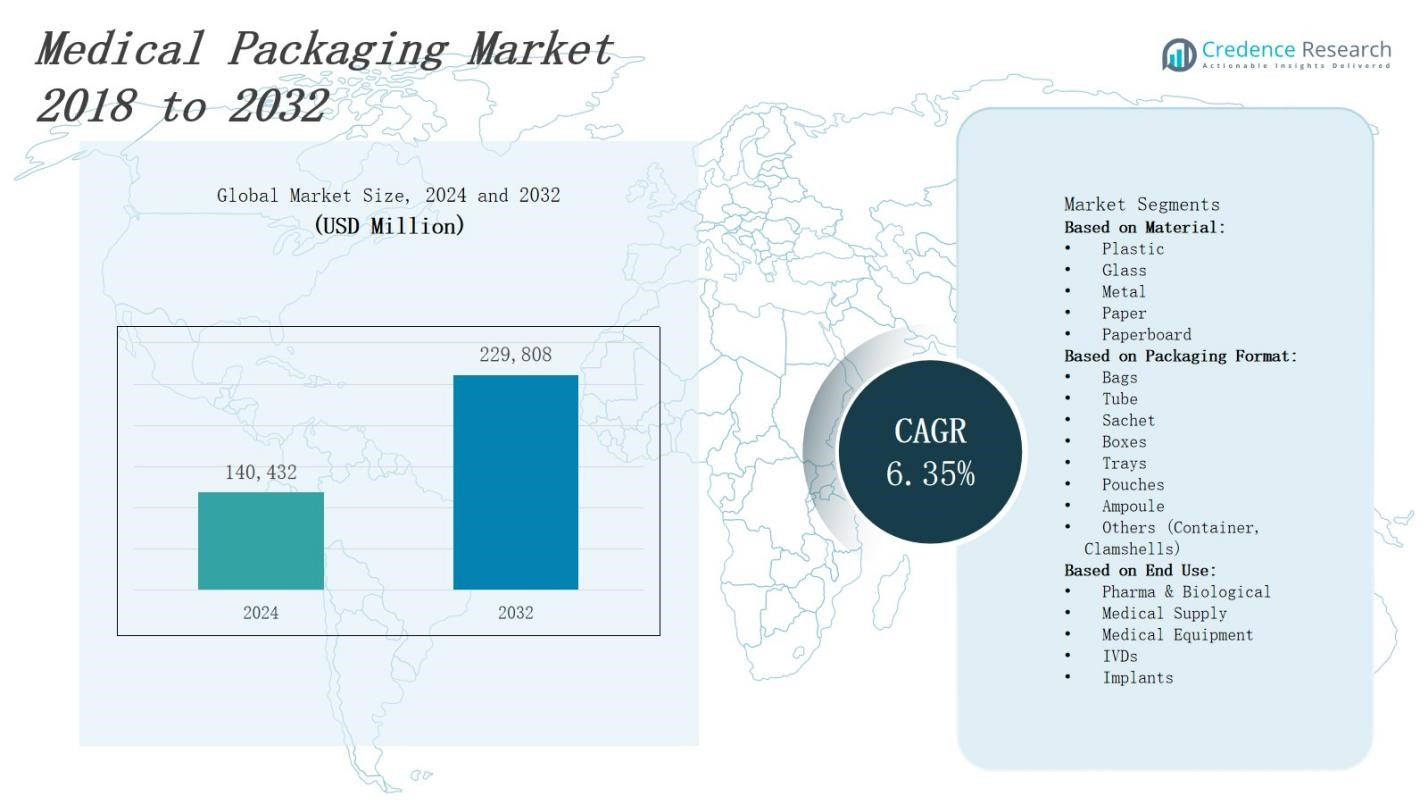

The medical packaging market is projected to grow from USD 140,432 million in 2024 to USD 229,808 million by 2032, representing a CAGR of 6.35%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Packaging Market Size 2024 |

USD 140,432 Million |

| Medical Packaging Market, CAGR |

6.35% |

| Medical Packaging Market Size 2032 |

USD 229,808 Million |

Robust demand for single-use medical devices and a surge in pharmaceutical shipments drive the medical packaging market, prompting innovation in tamper-evident seals, unit-dose cartridges, and barrier films. Regulatory emphasis on sterility and patient safety elevates adoption of advanced materials such as multilayer plastics and recyclable polymers. Expansion of biologics and temperature-sensitive therapeutics fuels integration of active packaging solutions like phase-change materials and RFID-enabled monitoring. Rising e‑commerce in healthcare accelerates development of lightweight, damage-resistant formats capable of ensuring integrity across supply chains. Manufacturers leverage digital printing and automation to customize packaging, enhance traceability, and reduce time to market, supporting scalable production excellence.

The medical packaging market shows varied regional strengths: North America leads with a 40% share driven by advanced infrastructure, Europe follows with 28% emphasizing recyclable solutions, Asia Pacific holds 19% fueled by expanding healthcare access, Latin America contributes 8% through cost‑effective barrier films, and Middle East & Africa accounts for 5% backed by cold‑chain investments. Key players—including Avery Dennison, 3M, E.I. du Pont, CCL Industries, Amcor, Constantia Flexibles, Bemis, Sonoco, and WestRock—leverage R&D, sustainable materials, and strategic partnerships to reinforce global supply chains and drive innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The medical packaging market will expand from USD 140,432 million in 2024 to USD 229,808 million by 2032, growing at a 6.35% CAGR.

- Robust demand for single‑use devices and surge in pharmaceutical shipments spurs development of tamper‑evident seals, unit‑dose cartridges, and high‑barrier films.

- Strict sterility and serialization mandates drive adoption of advanced materials, automated inspection, and track‑and‑trace technologies.

- Growth of biologics and temperature‑sensitive therapies boosts deployment of insulated shippers, phase‑change inserts, and real‑time monitoring.

- Rising healthcare e‑commerce accelerates lightweight, damage‑resistant formats, while digital printing enables on‑demand, variable data coding.

- Regional shares stand at North America 40%, Europe 28%, Asia Pacific 19%, Latin America 8%, and Middle East & Africa 5%, reflecting varied market drivers.

- LeadingplayersAvery Dennison, 3M, E.I. du Pont, CCL Industries, Amcor, Constantia Flexibles, Bemis, Sonoco, and WestRock—drive innovation through R&D and strategic partnerships.

Market Drivers

Surging Demand for Single-Use and Specialty Devices

Rising prevalence of chronic diseases and infection‑control protocols fuel demand for medical devices in the medical packaging market. Manufacturers scale capacity for syringes, catheters, and biosensors to meet hospital and home‑care needs. Regulatory mandates enforce sterility across the supply chain. It compels adoption of barrier films, multilayer plastics, and tamper‑evident seals. Industry players invest in R&D to optimize package design and material performance. Growth in ambulatory care settings strengthens momentum.

For instance, Abbott’s FreeStyle Libre is a single-use wearable glucose sensor that provides continuous, real-time blood sugar monitoring for diabetics via smartphone integration, reducing hospital visits.

Regulatory Mandates Elevate Safety Standards

Strict guidelines from FDA, EMA, and agencies enforce sterility, labeling, and serialization in the medical packaging market. Manufacturers adopt tamper‑evident closures and barcoding to maintain compliance. It drives investment in automated inspection systems and track‑and‑trace technologies. ISO certification fosters global harmonization of quality standards. Regulators tighten requirements for temperature mapping and stability data. Industry partners enhance collaboration to streamline approval processes. Patient safety concerns underpin rigorous oversight across supply chains.

For instance, Johnson & Johnson implemented tamper-evident packaging with serialized barcodes on their pharmaceutical products to meet FDA serialization requirements, reducing counterfeiting risks.

Innovation in Advanced Materials and Technologies

Collaboration between material scientists and pharma firms accelerates development of novel substrates for the medical packaging market. Industry introduces biodegradable polymers and high‑barrier laminates to extend shelf life. It integrates phase‑change materials and RFID sensors to maintain temperature‑sensitive drug integrity. Manufacturers test antimicrobial coatings and UV‑resistant films. Regulatory validation of these technologies encourages rapid adoption. Digital printing enables variable data coding. E‑commerce growth steers demand toward lightweight, durable packaging formats.

Growth of Biologics and Temperature‑Sensitive Therapies

Expansion of biologics and temperature‑sensitive therapies drives innovation in the medical packaging market. Companies deploy insulated containers and phase‑change inserts to preserve cold chain integrity. It prompts integration of real‑time temperature monitoring and data loggers. Manufacturers partner with logistics providers to optimize shipment routes. Regulatory emphasis on cold chain validation enforces strict performance standards. Investments in sustainable insulation materials support eco‑efficient solutions. Home healthcare growth increases demand for insulated kits.

Market Trends

Integration of Smart and Digital Technologies

Digital printing, RFID, and NFC tags drive enhanced traceability. It enables real‑time monitoring and authentication. Pharmaceutical companies implement serialized barcodes to meet regulatory and anti‑counterfeiting mandates. The medical packaging market embraces IoT‑enabled closures and sensors to track environmental conditions. Industry leaders partner with tech firms to develop cloud‑based monitoring platforms. Manufacturers invest in automated inspection lines and AI‑driven vision systems to ensure quality. Customizable printing supports on‑demand production, reducing waste.

For instance, Pfizer employs RFID tags on drug packages like Viagra to authenticate products upon scanning, effectively combating counterfeit drugs.

Shift Toward Sustainable and Eco‑Friendly Solutions

Sustainability drives material innovation across the medical packaging market. Companies adopt recyclable polymers and paper‑based substrates to lower environmental impact. Regulatory bodies enforce extended producer responsibility and recyclable content targets. It prompts development of compostable films and mono‑material structures that simplify recycling. Lightweight designs reduce transportation costs and emissions. Industry consortia collaborate on closed‑loop recycling programs. Consumer preference for green products strengthens adoption of eco‑certified packaging, pushing suppliers to certify materials under recognized sustainability standards.

For instance, IFCO’s reusable plastic crates (RPCs) extend the shelf life of fresh produce by up to four days compared to single-use packaging and produce up to 62% lower greenhouse gas emissions than cardboard, supporting durable and eco-friendly supply chains.

Rise of Patient‑Centric and Customized Packaging

Patient‑centric trends shape the medical packaging market around customized dosage forms and user‑friendly designs. Brands release unit‑dose strips, prefilled syringes, and dose‑specific blisters that simplify administration. It encourages inclusion of tactile features and clear labeling for older patients. Digital patient instructions on QR‑coded labels improve compliance. Packaging developers integrate child‑resistant and senior‑friendly closures. Partnership with device manufacturers yields integrated delivery systems. Personalized packaging supports home healthcare growth and therapy adherence.

Expansion of Cold Chain Solutions for Biologics

Growth in biologics and cell therapies drives demand for robust cold chain packaging in the medical packaging market. Developers employ insulated shippers and phase‑change inserts that maintain strict temperature ranges. It motivates use of real‑time temperature monitoring and data loggers to verify integrity. Logistic providers optimize routes to reduce transit time. Packaging providers validate performance under accelerated and real‑time conditions. Stakeholders invest in sustainable insulation materials that meet performance and environmental criteria. Validation services ensure regulatory acceptance of cold chain solutions.

Market Challenges Analysis

Regulatory Compliance and Cost Pressures Challenge Manufacturers

Regulatory bodies impose stringent requirements for sterility, traceability, and serialization that increase development cost. The medical packaging market faces pressure to comply with varying international standards that complicate global distribution. It forces manufacturers to invest in advanced validation protocols and detailed documentation. Evolving data standards for track‑and‑trace create integration challenges with existing production lines. Equipment upgrades and staff training raise operational expenses. It drives smaller suppliers to struggle with capital requirements. Collaboration between stakeholders remains essential to streamline compliance workflows.

Supply Chain Disruptions and Material Scarcity Increase Risk

Global supply fluctuations create delays in sourcing high‑barrier films and specialty polymers. The medical packaging market must manage lead times that extend due to raw material shortages. It challenges manufacturers to maintain inventory levels without inflating warehousing costs. Temperature‑sensitive products require robust cold‑chain networks that remain vulnerable to transport disruptions. Fluctuations in energy prices sharpen inflationary pressures on production and logistics. It compels organizations to explore alternative suppliers and material innovation. Cross‑functional coordination between procurement, production, and quality teams proves critical to mitigate risk.

Market Opportunities

Expansion into Emerging Markets and Personalized Medicine

Rising healthcare investment in Asia‑Pacific, Latin America, and Middle East drives demand for advanced packaging solutions tailored to regional needs. Growth of personalized medicine and gene therapies presents opportunities for customized dosage forms and patient‑specific packs. The medical packaging market can leverage flexible blister formats and unit‑of‑use assemblies to support niche therapies. It fosters collaboration between packaging firms and biotech companies on co‑development of integrated delivery systems. Digital printing technologies enable short runs and rapid turnaround for clinical trial requirements. Strategic expansion into local markets through partnerships with regional distributors reduces entry barriers. Investments in capacity and local manufacturing further enhance responsiveness and cost competitiveness.

Growth of Sustainable and Smart Packaging Solutions

Regulatory pressure on environmental impact opens opportunity for recyclable and compostable materials. Demand for digital features such as RFID sensors and interactive labels supports growth in smart packaging. The medical packaging market can benefit from hybrid materials that balance performance and sustainability. It drives packaging providers to develop integrated monitoring and temperature‑control systems. Adoption of IoT‑enabled platforms enables real‑time supply chain visibility and data‑driven insights. Partnerships with logistics specialists extend reach into cold chain and biologics segments. Value‑added services like packaging validation and analytics strengthen customer loyalty and create new revenue streams.

Market Segmentation Analysis:

By Material

The medical packaging market relies heavily on plastic due to its lightweight and barrier properties. It employs glass for injectable products that require inert surfaces. Metal finds use in foil laminates and protective seals. Paper and paperboard support eco‑friendly initiatives through recyclable cartons and inserts. Material selection balances cost, performance, and regulatory compliance. Suppliers collaborate with converters to validate new substrates under ISO standards. Continuous innovation drives substitution of materials to optimize functionality and sustainability.

For instance, SCHOTT Pharma produces Type I Borosilicate glass vials widely used for injectable drugs and vaccines, offering chemical resistance and innovative inner coatings (e.g., EVERIC® range) that reduce drug interaction and enhance storage safety.

By Packaging Format

Manufacturers deploy bags and pouches for flexible, low‑volume shipments. It uses tubes and sachets for unit‑dose formulations that enhance patient convenience. Boxes and trays serve bulk handling and protective transit. Ampoules remain essential for sterile injectables and biologics. Clamshells and specialty containers accommodate diagnostic kits and surgical instruments. Format choice reflects product stability, user requirements, and supply chain constraints. Partnerships between design firms and pharmaceutical companies accelerate development of user‑friendly formats.

For instance, Amcor Plc. launched recyclable flexible pouches with barrier layers that protect sensitive biologics and reduce plastic waste in line with sustainability goals.

By End Use

Pharma & biological products dominate the medical packaging market, driven by vaccine and biologic growth. It supports medical supply items such as gloves and drapes with sterile barrier solutions. Medical equipment packaging leverages custom inserts and shock‑absorbent trays. IVD kits require humidity‑resistant pouches and clear labeling. Implantable devices depend on rigid containers and tamper‑evident seals. End‑use segmentation guides investment in tailored materials and formats to meet stringent safety and quality standards.

Segments:

Based on Material:

- Plastic

- Glass

- Metal

- Paper

- Paperboard

Based on Packaging Format:

- Bags

- Tube

- Sachet

- Boxes

- Trays

- Pouches

- Ampoule

- Others (Container, Clamshells)

Based on End Use:

- Pharma & Biological

- Medical Supply

- Medical Equipment

- IVDs

- Implants

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America commands the leading position in the medical packaging market with a 40% share. It benefits from advanced healthcare infrastructure and high regulatory compliance standards. Strong investment in innovative materials and smart packaging drives continued expansion. It leverages automated production lines to meet stringent quality requirements. Demand for single‑use devices and biologics fuels growth. Collaboration between packaging firms and pharmaceutical companies enhances supply chain efficiency.

Europe

Europe secures a 28% share of the medical packaging market. It relies on strict EU regulations to uphold safety and traceability. Investment in recyclable and mono‑material structures supports sustainability targets. It drives adoption of antimicrobial coatings and temperature‑stable solutions. Regional consortia advance harmonized standards for shelf‑life testing. Collaboration with research institutes accelerates development of eco‑efficient substrates.

Asia Pacific

Asia Pacific holds a 19% share of the medical packaging market. It experiences rapid growth due to expanding healthcare access and rising middle‑class populations. It embraces flexible blister formats and unit‑dose pouches for cost‑effective distribution. Local manufacturers invest in phase‑change materials to support cold‑chain logistics. It partners with global suppliers to upgrade production capabilities. Government incentives promote localized manufacturing to reduce import dependence.

Latin America

Latin America accounts for 8% of the medical packaging market. It faces challenges from uneven regulatory frameworks and infrastructure gaps. It prioritizes cost‑effective barrier films for medical supplies. Regional firms invest in training programs to enhance quality control. It explores public‑private partnerships to upgrade cold‑chain networks. Growth in e‑health initiatives supports demand for home‑care kits.

Middle East & Africa

Middle East & Africa captures a 5% share of the medical packaging market. It invests in healthcare infrastructure to meet rising patient needs. It adopts insulated shippers and temperature‑monitored labels for vaccine distribution. Local regulations evolve to enforce serialization and traceability. It partners with logistics specialists to strengthen last‑mile delivery. Growth in telemedicine drives demand for patient‑centric packaging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sonoco Company (U.S.)

- Constantia Flexibles Group GmbH (Austria)

- Bemis Company, Inc. (U.S.)

- Avery Dennison Corporation (U.S.)

- WestRock Company (U.S.)

- CCL Industries Inc. (Canada)

- I. du Pont de Nemours and Company (U.S.)

- Amcor Limited (Australia)

- 3M Company (U.S.)

Competitive Analysis

Leading corporations, such as Avery Dennison Corporation, 3M Company, and E.I. du Pont de Nemours and Company, leverage extensive R&D pipelines to deliver advanced barrier films and tamper‑evident solutions in the medical packaging market. CCL Industries Inc. and Constantia Flexibles Group GmbH differentiate through flexible packaging formats and digital printing capabilities. Amcor Limited and Bemis Company, Inc. provide recyclable and mono‑material structures that meet strict environmental mandates. Sonoco Company and WestRock Company use automated inspection and serialization platforms to support rigid container segments. It targets strategic partnerships with pharmaceutical firms to co‑develop integrated delivery systems. Market leaders expand capacity and secure acquisitions to strengthen regional presence and address diverse regulatory requirements. Smaller players work with contract manufacturers to provide niche services, such as specialized unit‑dose packaging and cold chain validation. Competition centers on technology adoption, sustainable materials, and supply chain resilience.

Recent Developments

- On July 16, 2025, Thermo Fisher Scientific agreed to acquire Sanofi’s Ridgefield, New Jersey, sterile fill‑finish and packaging facility to bolster its U.S. medical packaging footprint.

- On May 22, 2025, IK Partners’ consortium acquired Sterimed Group, strengthening its position in sterile flexible medical packaging.

- On May 13, 2025, Packaging Compliance Labs completed the acquisition of Quest Engineering Solutions to expand its testing capabilities and East Coast presence.

- On June 6, 2025, Evertis selected Honeywell’s Aclar® film for its Evercare pharmaceutical brand to enhance moisture barrier and recyclability in packaging.

Market Concentration & Characteristics

The medical packaging market displays a moderate concentration, with the top four firms controlling 50% of global revenue, while smaller specialists address niche requirements. Leading companies such as Avery Dennison, 3M, E.I. du Pont, and Amcor secure leadership through substantial research budgets and expansive manufacturing networks. It faces high entry barriers due to stringent regulatory approvals and significant capital outlay for clean‑room facilities. Regional converters deliver tailored solutions to meet local compliance demands. Manufacturers forge strategic alliances to access emerging technologies and expand service portfolios. Contract packagers support clinical trial programs and small‑batch production. Market characteristics include strict sterility assurance, barrier integrity standards, and robust cold‑chain capabilities. Buyers leverage scale to negotiate favorable terms, while innovators introduce sustainable substrates and smart sensor integration. Competitive dynamics balance economies of scale with agility, enabling growth across both established and emerging segments.

Report Coverage

The research report offers an in-depth analysis based on Material, Packaging Format, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will invest in biodegradable polymers and compostable substrates to fulfill sustainability mandates in packaging.

- Industry will integrate IoT sensors to enable real-time monitoring, enhance traceability, and improve packaging performance.

- Packaging providers will adopt digital printing technologies to deliver personalized dose labeling and short-run production.

- Companies will expand cold-chain solutions to support complex biologics and ensure stability across transportation networks.

- Suppliers will implement mono-material packaging designs to simplify recycling processes and reduce environmental impact significantly.

- Firms will collaborate with pharmaceutical partners to co-develop integrated delivery systems that enhance patient compliance.

- Technology vendors will deploy AI-driven inspection systems to ensure quality control and identify packaging defects.

- Manufacturers will develop child-resistant and senior-friendly closure systems to improve overall safety and patient usability.

- Stakeholders will optimize supply chain networks to reduce lead times, cut waste and enhance efficiency.

- Providers will offer data analytics services to support traceability, ensure compliance and deliver optimization insights.