Market Overview:

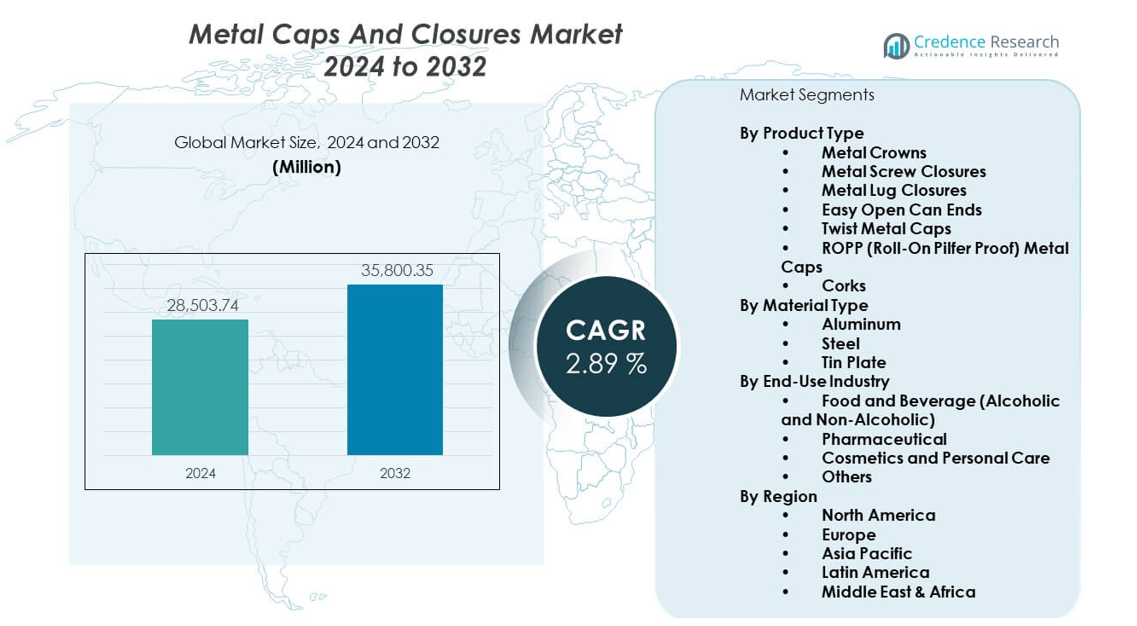

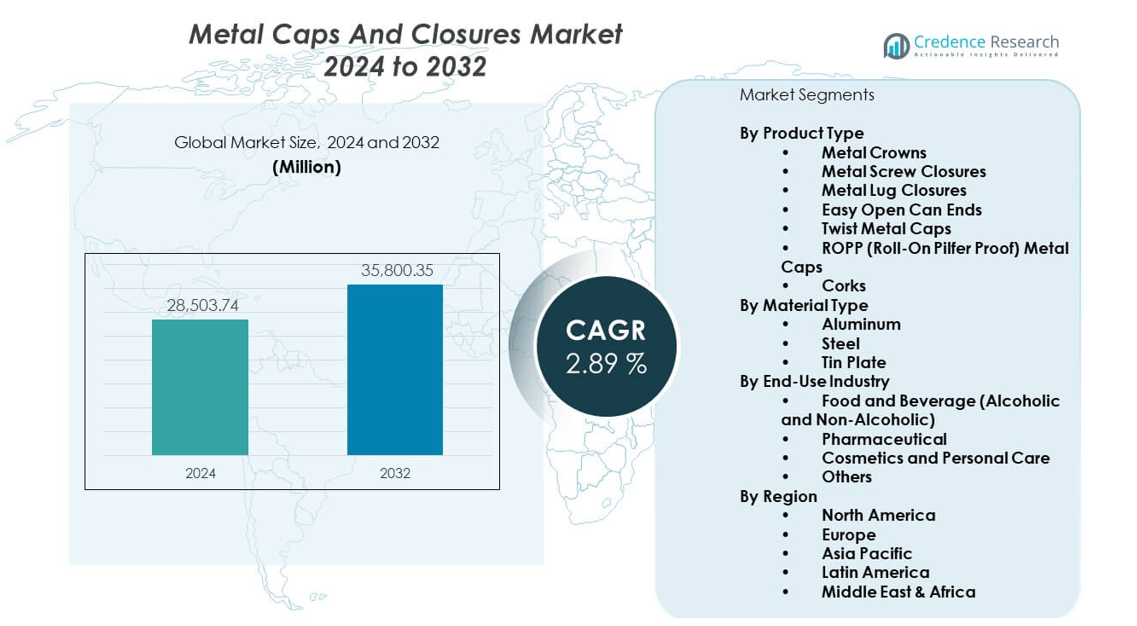

The Metal caps and closures market is projected to grow from USD 28,503.74 million in 2024 to an estimated USD 35,800.35 million by 2032, with a compound annual growth rate (CAGR) of 2.89% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Metal Caps and Closures Market Size 2024 |

USD 28,503.74 million |

| Metal Caps and Closures Market, CAGR |

2.89% |

| Metal Caps and Closures Market Size 2032 |

USD 35,800.35 million |

Growth is driven by rising packaging safety rules, higher beverage output, and strong demand for premium containers. Many producers also adopt lightweight metal designs that cut transport costs. Metal closure makers invest in better sealing systems and cleaner production lines. Innovation in corrosion-resistant coatings lifts adoption in food and pharma segments. The market expands further as brands focus on secure and recyclable packaging formats.

North America and Europe lead due to advanced packaging lines, strict quality norms, and higher premium product sales. Asia Pacific emerges fast because of rapid industrial expansion and rising packaged food demand. China and India increase output across beverages and personal care, boosting closure needs. Latin America and the Middle East show steady growth from expanding manufacturing and better retail networks. The global market strengthens with broader use of metal formats across regulated sectors.

Market Insights:

- The Metal caps and closures market was valued at USD 28,503.74 million in 2024 and is projected to reach USD 35,800.35 million by 2032, growing at a CAGR of 2.89% during the forecast period.

- Asia Pacific (42%), Europe (27%), and North America (22%) hold the top regional shares due to strong packaged food demand, advanced manufacturing, and high beverage consumption across these markets.

- Asia Pacific is the fastest-growing region with a 42% share, supported by rising urbanization, expanding FMCG output, and strong pharmaceutical manufacturing.

- Food and beverage accounted for the largest end-use share at 58%, driven by high closure usage in drinks, canned foods, and condiments.

- Aluminum held the largest material share at 46% due to its light weight, corrosion resistance, and strong recyclability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand For Secure And Durable Packaging Across Food, Beverage, And Pharma

The metal caps and closures market grows due to strict safety needs. Brands favor metal caps for stronger seals. Users prefer tamper-evident formats. Pharma units rely on metal for purity control. Beverage players expand lines with high-speed sealing. Metal supports long product shelf life. It maintains barrier strength in tough supply chains. Global food exports reinforce adoption.

- For instance, Closure Systems International (CSI) produces tamper-evident closures for carbonated beverages that offer strong sealing performance, with specific proprietary specifications developed in partnership with clients to manage internal pressures. Similarly, Crown Holdings manufactures beverage ends with aluminum shells designed for a long shelf life, protecting the integrity of the carbonated contents over extended supply chain periods.

Expanding Use Of Premium Containers In Personal Care And Household Goods

Premium packaging lifts demand for metal closures. Beauty brands adopt metal for aesthetics. Strong lid durability improves consumer trust. Recyclability increases brand preference. Home care producers value heat-resistant caps. Metal supports high-viscosity product lines. It aligns with premium segment branding. Consumer focus on quality packaging strengthens uptake.

- For instance, Silgan Holdings manufactures metal closures for premium cosmetic jars that withstand thermal exposure during sterilization cycles without seal distortion, reassuring safety and product integrity in personal care goods.

Shift Toward Lightweight And High-Performance Closure Designs

Producers develop lighter metal formats. Lightweight caps reduce transport loads. Stronger alloys improve sealing safety. Manufacturing units upgrade coating systems. Metal offers consistent thread strength. Automated lines favor uniform closure performance. It fits high-speed filling needs. Efficiency gains support market expansion.

Rising Compliance Pressure Driving Better Sealing And Product Integrity

Regulators enforce tighter hygiene norms. Metal closures help brands meet safety rules. Food units adopt tighter torque control. Pharma firms prefer leak-proof lids. Seal uniformity reduces spoilage risk. It supports long-haul logistics. Global regulatory updates push system upgrades. Quality audits favor metal-based formats.

Market Trends:

Growing Shift Toward Recyclable And Circular Packaging Systems

Recycling norms push metal adoption. Brands commit to circular packaging. Steel and aluminum recycling rates stay high. Consumers support sustainable formats. Metal closures gain traction in eco programs. It aligns with global green goals. Producers adopt recyclable lining materials. Market interest in closed-loop systems rises.

- For instance, Amcor has worked to increase post-consumer recycled content in its packaging products to meet European environmental directives. While Amcor provides aluminum closures and has invested in tin capsules with a high percentage of recycled content, the company achieved a breakthrough by creating flexible packaging with 80% certified recycled plastic for a Cadbury product in Europe, which helps the brand comply with new EU regulations.

Expansion Of Smart And Decorative Closure Technologies

Smart labelling boosts metal usage. Decorative lids lift premium appeal. Embossed finishes attract luxury brands. Digital printing improves customization. Metal supports sharper graphic detail. It strengthens brand identity. High-end beverages prefer ornate lids. Innovation fuels product differentiation.

- For instance, packaging company Tecnocap offers customizable metal closures, some of which feature lithography for high-impact branding on premium products. Another company, PELLICONI & C. S.p.A., produces customizable metal caps for the wine and spirits industry and provides a QR code management platform for traceability and promotions.

Rising Adoption Of Corrosion-Resistant And Chemical-Safe Coating Systems

Producers deploy advanced coatings. Coated metal improves safety. Food units rely on chemical-safe layers. Pharma demands high-purity linings. Corrosion-free designs extend usage. It enhances long-term shelf stability. Beverages with acidic profiles require stronger coatings. Material science upgrades transform performance.

Greater Automation In Closure Manufacturing And Filling Lines

Automation increases consistency. Robotics support high-volume output. Inspection systems reduce defects. Metal closures fit automated torque tools. Uniform dimensions enable faster filling. It improves operational efficiency. Plants favor quick-change tooling. Automation trends raise throughput.

Market Challenges Analysis:

High Raw Material Price Fluctuations And Related Manufacturing Constraints

Rising metal prices pressure margins. Aluminum and steel volatility impacts planning. Smaller producers face cost gaps. Coating chemicals add further strain. It limits expansion decisions. Many firms struggle with contract stability. Global supply risks affect sourcing. Price movements disrupt production cycles. Financial predictability becomes harder.

Competition From Plastic And Composite Alternatives In Cost-Sensitive Markets

Plastic closures challenge metal in low-cost segments. Lighter materials attract mass producers. Some brands shift to hybrid formats. Metal requires stronger logistics planning. It raises weight concerns in bulk shipments. Alternative materials offer cheaper mold options. High-volume retail drives cost focus. Developing regions prefer low-cost packaging. Market share becomes harder to defend.

Market Opportunities:

Rising Demand For Safe And Premium Packaging In Food, Beverage, And Healthcare

Premium goods boost metal closure demand. Brands seek secure sealing. Pharma units value metal purity. Retailers expand premium product shelves. It strengthens closure adoption. Metal supports high-value packaging formats. New hygiene norms lift quality demand. Growth in exports expands prospects.

Expansion Potential In Recyclable, Lightweight, And Sustainable Metal Designs

Sustainability programs create new openings. Lightweight alloys reduce transport loads. New coatings improve safety. Brands commit to recyclable materials. It aligns with green policies. Eco-focused buyers support metal use. Innovation attracts new industries. Demand rises for clean-label packaging.

Market Segmentation Analysis:

By Product Type

The Metal caps and closures market grows through a broad range of closure formats used across high-volume packaging lines. Metal crowns retain solid demand in carbonated beverages due to reliable sealing strength. Metal screw closures support sauces, edible oils, and home care goods with consistent torque performance. Metal lug closures remain important for jars, spreads, and pickled products. Easy open can ends gain traction in canned food due to better user convenience. Twist metal caps serve dairy and beverage uses. ROPP caps dominate spirits and pharma bottles with strong tamper-evident features. Corks maintain a niche in wine and specialty drink segments.

- For instance, Crown Holdings’ global metal crown line provides a secure seal to maintain pressure stability for carbonated soft drinks. Likewise, Silgan’s metal twist caps used for dairy bottles are manufactured to meet European Union food contact standards, including microbiological barrier protection.

By Material Type

Material preferences vary by safety and durability needs. Aluminum leads due to its light weight, corrosion resistance, and high recyclability. Steel supports heavy-duty industrial containers that require stronger structural integrity. Tin plate offers protective coating benefits and suits processed food products. Manufacturers choose materials to match barrier needs, torque strength, and regulatory demands. It helps deliver stable packaging performance across diverse supply chains.

- For instance, Amcor’s beverage closures crafted from aluminum exhibit corrosion resistance when exposed to 5% sodium chloride solution for 144 hours, meeting ASTM B117 salt spray standards. Tin plate closures produced by O.Berk Co. are engineered to deliver a minimum 0.20 mm lacquer coating, ensuring food safety in high-acid product applications.

By End-Use Industry

End-use industries drive steady expansion across global markets. Food and beverage remains the dominant consumer due to high usage in drinks, canned foods, condiments, and ready-to-use products. Pharmaceutical producers rely on metal closures for purity protection, leakage control, and tamper-evident functions. Cosmetics and personal care brands adopt metal caps for premium appeal and product safety. Other users, including chemicals and household goods, prefer metal formats for durability and compatibility with varied formulations.

Segmentation:

By Product Type

- Metal Crowns

- Metal Screw Closures

- Metal Lug Closures

- Easy Open Can Ends

- Twist Metal Caps

- ROPP (Roll-On Pilfer Proof) Metal Caps

- Corks

By Material Type

By End-Use Industry

- Food and Beverage (Alcoholic and Non-Alcoholic)

- Pharmaceutical

- Cosmetics and Personal Care

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The metal caps and closures market holds a strong position in North America with a sizable regional share driven by high consumption of packaged foods, beverages, and pharmaceuticals. The region benefits from advanced manufacturing systems and strict packaging standards. Strong demand from carbonated drinks and ready-to-eat foods supports continuous closure use. Brands in the U.S. and Canada invest in tamper-evident technologies to strengthen safety. It maintains growth through premium packaging in personal care and specialty beverages. High recycling awareness further supports metal demand. Regional players continue upgrading capacity to meet evolving packaging needs.

Europe

Europe secures a significant share due to mature packaging ecosystems and strict sustainability rules. Metal closures gain traction through high recycling rates and strong regulatory pressure on food safety. European beverage producers adopt premium metal formats to enhance brand appeal. Pharma manufacturing hubs in Germany, France, and Italy support the need for consistent sealing performance. It benefits from widespread demand for aluminum and tin plate closures. Ready-meal and canned food categories lift long-term market stability. The region continues to push innovation in coating and decorative closure technology.

Asia Pacific

Asia Pacific holds the largest and fastest-growing share, driven by expanding food, beverage, and pharmaceutical production. Rising urban populations in China and India fuel packaged product demand. Metal closures gain strong adoption in bottled drinks, edible oils, and OTC medications. Regional manufacturers increase capacity to match fast-moving consumer goods growth. It sees strong investment inflows into automated packaging lines. The region’s cost-sensitive environment still supports metal formats due to durability and safety. Growing export activity further boosts closure consumption across diverse industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Crown Holdings, Inc.

- Silgan Holdings Inc.

- Berry Global Inc.

- Guala Closures Group

- Closure Systems International, Inc.

- Amcor Plc

- Technocap Group

- Alcopack Group

- PELLICONI & C. S.p.A.

- Massilly Group

- Berk Company

- Reynolds Packaging Group Ltd

- Nippon Closures Co. Ltd

- Silgan White Cap

- SKS Bottle & Packaging Inc.

Competitive Analysis:

The Metal caps and closures market features strong competition driven by global packaging leaders and specialized closure manufacturers. Key players expand portfolios with lightweight designs, improved coatings, and tamper-evident features to serve food, beverage, and pharmaceutical sectors. Many companies focus on automation upgrades to improve line efficiency and support high-volume output. Premium packaging trends push firms to enhance decorative and customizable closure options. It adapts to sustainability expectations with recyclable materials and reduced-weight formats. Strategic acquisitions strengthen regional reach and technology depth. Competitive intensity increases as brands seek better sealing performance and consistent product integrity.

Recent Developments:

- Amcor Plc completed its acquisition of Berry Global in April 2025, representing an $8.43 billion all-stock transaction announced in November 2024. This landmark merger combines two major packaging companies to enhance capabilities in metal closures and other packaging segments.

- Silgan Holdings Inc. announced an agreement to acquire Weener Packaging in July 2024, which was completed in October 2024. This acquisition strengthens Silgan’s position in the metal closures segment by expanding its product portfolio and market reach.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Material Type, End-Use Industry, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for tamper-evident closures will continue rising across regulated sectors.

- Sustainability efforts will push wider adoption of recyclable metal formats.

- Lightweight metal designs will gain preference among global beverage brands.

- Automation upgrades in filling and capping lines will improve closure compatibility.

- Decorative and premium metal caps will expand within personal care and specialty beverages.

- Pharma growth will lift demand for high-purity and secure sealing formats.

- Advanced coatings will enhance corrosion resistance and product safety.

- Regional manufacturers will increase capacity to meet fast-moving consumer goods needs.

- Export growth in emerging economies will boost metal closure consumption.

- Innovation in hybrid and smart closures will open new revenue streams.