Market Overview:

The Mexico Safety Gloves Market size was valued at USD 92.4 million in 2018 to USD 110.7 million in 2024 and is anticipated to reach USD 165.5 million by 2032, at a CAGR of 5.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Safety Gloves Market Size 2024 |

USD 110.7 million |

| Mexico Safety Gloves Market, CAGR |

5.16% |

| Mexico Safety Gloves Market Size 2032 |

USD 165.5 million |

Market drivers include strong growth in construction, automotive, and manufacturing industries that require reliable protective solutions. Companies prioritize employee safety to meet compliance standards and reduce workplace accidents. The healthcare and food sectors further expand glove demand, with high reliance on disposable products. Government initiatives emphasize adherence to occupational safety guidelines, encouraging firms to invest in durable and specialized gloves. Industrial modernization and awareness programs also contribute to increased adoption across large and small enterprises. The combination of regulatory support, sectoral growth, and rising safety awareness fuels steady market momentum.

Regionally, northern Mexico leads due to its concentration of manufacturing plants and maquiladora facilities linked to U.S. supply chains. Central Mexico follows closely, supported by automotive, food processing, and healthcare hubs that generate consistent glove demand. Southern Mexico remains an emerging subregion, with energy and infrastructure projects gradually expanding safety requirements. Differences in industrial activity explain why northern and central areas dominate, while southern states continue to build their role as contributors. Each subregion reflects distinct industrial strengths shaping overall market performance.

Market Insights

- The Mexico Safety Gloves Market was valued at USD 92.4 million in 2018, USD 110.7 million in 2024, and is projected to reach USD 165.5 million by 2032, at a CAGR of 5.16%.

- Northern Mexico holds the largest share at 42% due to its strong manufacturing base, Central Mexico follows with 36% supported by automotive and healthcare hubs, and Southern Mexico accounts for 22% driven by energy and infrastructure projects.

- Southern Mexico is the fastest-growing region with a 22% share, fueled by oil, gas, and construction activities requiring specialized protective gloves.

- Disposable gloves dominate with 58% of the type segment, supported by healthcare and food industry demand, while reusable gloves account for 42% due to their role in manufacturing and heavy industries.

- By application, mechanical protection leads with 41% of the segment share, followed by chemical gloves at 27%, reflecting high demand in industrial and hazardous work environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Industrial Expansion and Demand for Safer Work Environments

Industrial growth in Mexico has created significant demand for safety gloves across sectors such as construction, automotive, and oil and gas. Employers increasingly prioritize protective equipment to reduce workplace injuries and meet compliance standards. The Mexico Safety Gloves Market is expanding because industries face stricter enforcement from authorities. Companies seek high-quality gloves to minimize accidents and avoid legal penalties. It reflects a shift in corporate culture toward proactive safety investments. The presence of international firms enforces global practices in Mexican facilities. Rising manufacturing activity strengthens the adoption of gloves in large-scale operations. This broad industrial demand fuels the steady growth of the market.

Stringent Workplace Safety Regulations and Government Enforcement

Government initiatives push industries to meet occupational safety benchmarks, driving safety glove adoption. Regulatory bodies mandate protective equipment across construction, chemical handling, and mining activities. The Mexico Safety Gloves Market benefits from policies that enforce worker safety and employer accountability. It makes protective gear mandatory, reducing compliance gaps across companies. Enforcement campaigns highlight the risks of neglecting worker safety standards. Frequent audits push firms to maintain adequate inventory of certified gloves. Employers view compliance not just as legal duty but also reputation management. Strong regulation and monitoring reinforce market expansion over time.

- For instance, Mexico’s NOM-017-STPS-2024 on personal protective equipment requires employers to provide certified PPE that complies with official standards and to maintain records covering inspection, maintenance, replacement, and disposal, with enforcement through inspections and audits.

Influence of Multinational Corporations and Global Safety Standards

Multinational corporations operating in Mexico introduce global workplace safety benchmarks. They adopt international glove standards to align with parent company policies. The Mexico Safety Gloves Market grows as these firms demand high-performance and certified gloves. It raises local expectations, influencing domestic manufacturers to improve product quality. International safety norms encourage suppliers to innovate in materials and durability. The presence of global players fosters competition, raising overall safety culture. Employees in these corporations expect better protective gear, driving wider demand. This influence strengthens the supply chain and elevates market performance.

Rising Awareness of Occupational Hazards Across Industries

Awareness of workplace hazards has become stronger across Mexico’s workforce. Training programs highlight risks from chemical exposure, cuts, abrasions, and heat. The Mexico Safety Gloves Market expands as employees push for better protection. It drives employers to source gloves with superior safety certifications. Growing campaigns by labor unions amplify the focus on worker health. Awareness spreads in small and medium enterprises, widening market coverage. Companies see improved productivity when workers feel safer. Heightened awareness builds long-term demand for protective gloves across industries.

- For instance, Mexico’s Ministry of Labor and Social Welfare issued new federal labor inspection guidelines in June 2025, requiring employers to provide personal protective equipment such as gloves to inspectors when conditions demand it, with penalties applied for non-compliance.

Market Trends

Technological Advancements in Glove Materials and Design

New materials enhance performance of protective gloves in industrial and commercial use. Manufacturers develop cut-resistant fabrics, chemical barriers, and heat-resistant coatings. The Mexico Safety Gloves Market benefits from gloves engineered for durability and flexibility. It raises product value by offering better comfort and longer lifespan. Technology integration supports gloves tailored to industry-specific risks. Smart gloves with sensors for safety monitoring gain visibility. Demand for eco-friendly materials also emerges as a parallel trend. Innovation in materials drives sustained growth of the market.

- For instance, Ansell’s HyFlex® 11-561 glove features patented INTERCEPT™ Cut Resistance Technology, delivering ANSI/ISEA 105-2024 Cut A3 protection. It is about 20% lighter than comparable gloves and offers improved abrasion resistance for longer wear life.

Shift Toward Sustainable and Eco-Friendly Product Lines

Sustainability becomes an important trend influencing glove production and demand. Manufacturers introduce biodegradable coatings and recycled materials in product lines. The Mexico Safety Gloves Market reflects this shift through environmentally responsible supply chains. It aligns with global movements for reducing industrial waste. Buyers prefer products that combine protection with environmental responsibility. Eco-friendly solutions attract interest from multinational buyers and regulatory agencies. Green certifications add value and open new business opportunities. Sustainability trends reshape manufacturing and purchasing preferences across industries.

- For instance, SHOWA introduced the 6110PF single-use nitrile glove with Eco Best Technology® (EBT), which achieved 82% biodegradation in 386 days under ASTM D5526 test conditions, as confirmed by independent laboratory certification.

Customization for Industry-Specific Safety Applications

Industries demand gloves designed for specific applications such as welding, oil handling, or laboratory work. Manufacturers introduce products with specialized coatings, grips, and resistance levels. The Mexico Safety Gloves Market adapts by offering tailored solutions for niche industries. It drives demand in sectors where generic gloves cannot meet safety needs. Customization provides competitive differentiation for manufacturers and suppliers. Buyers value gloves engineered to meet exact operational challenges. This trend enhances both worker confidence and workplace efficiency. Tailored product innovation positions the market for consistent growth.

E-Commerce Platforms and Direct Distribution Growth

Digital platforms change purchasing behavior across industries in Mexico. Companies order safety gloves directly from e-commerce marketplaces. The Mexico Safety Gloves Market benefits from faster access to products and competitive pricing. It enables small enterprises to source certified gloves without intermediaries. Online distribution expands visibility for local and global brands. Direct-to-consumer strategies build stronger connections with buyers. The convenience of digital purchasing drives adoption in remote and urban regions alike. Online channels strengthen distribution networks and reshape the market structure.

Market Challenges Analysis

Intense Competition and Pricing Pressures Impacting Profit Margins

The safety gloves market in Mexico faces heavy competition among global and local suppliers. Companies compete aggressively on pricing to secure large industrial contracts. The Mexico Safety Gloves Market experiences reduced profit margins due to downward pricing trends. It forces manufacturers to cut costs, often limiting investment in product innovation. Buyers prioritize affordability over quality in smaller enterprises, creating uneven adoption. Competition also fragments the market, with numerous players targeting similar sectors. It challenges established companies to differentiate through superior design or compliance certifications. Maintaining profitability under these pressures requires strategic planning.

Supply Chain Constraints and Dependence on Imports

Supply chain instability limits the consistent availability of high-quality safety gloves. The Mexico Safety Gloves Market depends heavily on imports for advanced materials and technologies. It creates risks during global disruptions, such as raw material shortages or shipping delays. Local manufacturing capacity remains insufficient for meeting diverse industrial demands. Import reliance increases costs due to tariffs and fluctuating exchange rates. Disruptions reduce product availability for key industries, creating operational risks. Manufacturers struggle to balance costs with reliability in this environment. Building stronger domestic supply capacity could reduce long-term challenges.

Market Opportunities

Expansion of Industrial Projects and Infrastructure Development

Large infrastructure and industrial projects in Mexico create new demand for safety gloves. The Mexico Safety Gloves Market grows as construction, mining, and automotive hubs expand operations. It strengthens supplier opportunities by linking product demand to long-term projects. Employers seek reliable supply partners to equip large workforces. It encourages global companies to expand distribution in Mexico. Local manufacturers gain chances to collaborate with foreign buyers. Opportunities rise as industrial development continues to spread across regions. Growth aligns with the increasing demand for certified and durable gloves.

Innovation in Premium and Smart Protective Gear

Technology advancements create opportunities for premium protective gloves in the market. The Mexico Safety Gloves Market benefits from demand for smart gloves with monitoring features. It attracts industries seeking advanced protection for high-risk tasks. Premium products offer durability, comfort, and compliance advantages. Manufacturers adopting innovation can capture premium market segments. Buyers prefer gloves that combine safety with added operational value. It builds new revenue streams for suppliers targeting specialized industries. Innovation unlocks opportunities to elevate product appeal in competitive environments.

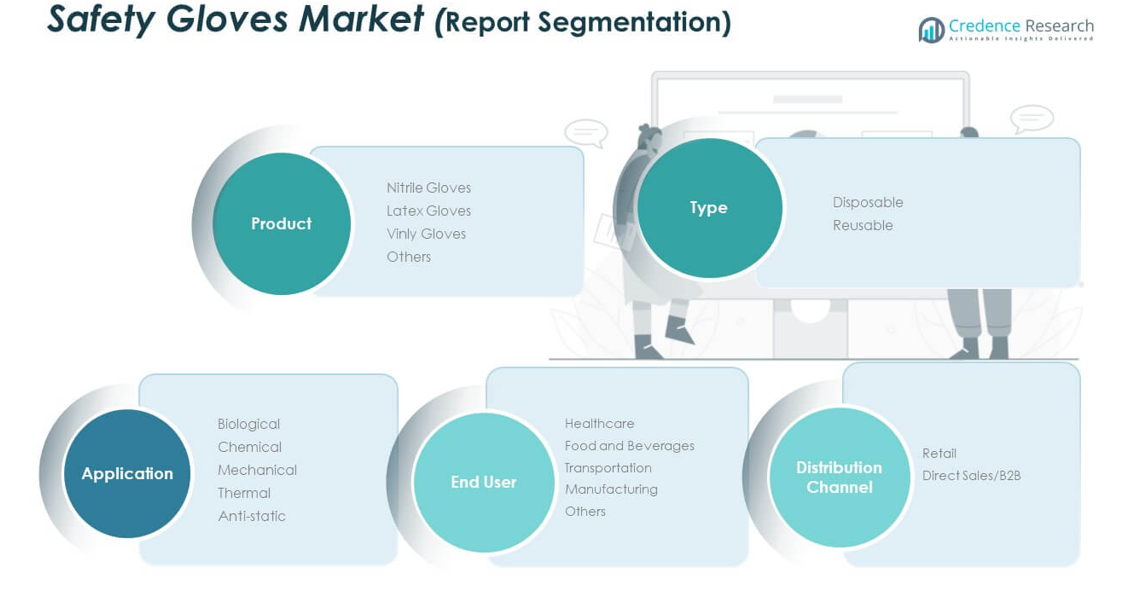

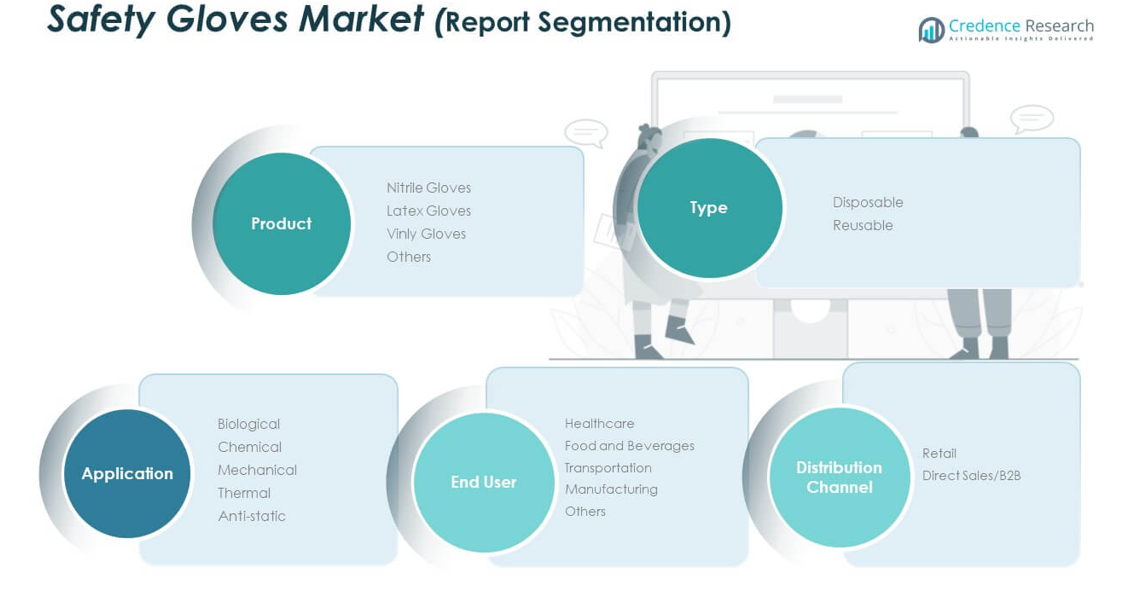

Market Segmentation Analysis

By product, nitrile gloves dominate the Mexico Safety Gloves Market due to their superior resistance to chemicals, punctures, and oils. Latex gloves retain a strong position in healthcare and food processing because of their comfort and fit, while vinyl gloves remain cost-effective options for short-term use. Other glove categories include specialized products designed for unique industrial needs, contributing to broader market diversity.

- For instance, Ansell’s Solvex® 37-676 nitrile gloves are certified to EN 374:2003 and EN ISO 374-1:2016 Type A (JKLOPT), offering superior abrasion and puncture resistance compared to neoprene or natural rubber, and are engineered for reliable protection in harsh chemical environments.

By type, disposable gloves hold the larger share, driven by high consumption in healthcare, laboratories, and food handling. It reflects the growing preference for single-use protection where contamination risks remain high. Reusable gloves sustain demand in manufacturing and heavy industries where durability and long-term performance are critical.

By end-user, healthcare leads due to extensive use of disposable gloves in hospitals and clinics. Food and beverages also contribute significantly, supported by hygiene regulations. Manufacturing and transportation sectors use gloves for mechanical and safety purposes, while others include niche industries with varied protective needs.

By application, mechanical protection forms the largest share, driven by industrial tasks that require abrasion and cut resistance. Chemical, thermal, biological, and anti-static applications highlight the diverse demand across sectors. By sales channel, direct sales and B2B networks dominate large-scale supply contracts, while retail channels expand access for smaller businesses and consumers.

- For example, Honeywell’s Perfect Fit A6 cut-resistant gloves feature ANSI/ISEA Cut Resistance Level A6 and are available with a thin polyurethane coating for superior dexterity, as confirmed by technical datasheets and official Honeywell product documentation.

Segmentation

By Product Segment

- Nitrile Gloves

- Latex Gloves

- Vinyl Gloves

- Others

By Type Segment

By End-User Segment

- Healthcare

- Food and Beverages

- Transportation

- Manufacturing

- Others

By Application Segment

- Biological

- Chemical

- Mechanical

- Thermal

- Anti-static

By Sales Channel Segment

- Retail

- Direct Sales / B2B

Regional Analysis

Northern Mexico

Northern Mexico accounts for 42% of the Mexico Safety Gloves Market, driven by its strong industrial base and proximity to U.S. supply chains. Manufacturing plants, automotive hubs, and maquiladora facilities create consistent demand for protective gloves across production lines. It benefits from cross-border trade with the United States, encouraging higher adoption of certified safety equipment. Construction and logistics activities in border cities also expand product demand. Multinational corporations with factories in the region enforce global safety standards, further boosting market growth. Northern Mexico remains the leading subregion due to its industrial dominance and export-oriented activities.

Central Mexico

Central Mexico holds 36% of the Mexico Safety Gloves Market, supported by a concentration of automotive, healthcare, and food processing industries. The region’s capital cities host large numbers of industrial parks and commercial hubs, creating opportunities for glove suppliers. It benefits from government-backed infrastructure projects that enforce workplace safety compliance. Healthcare institutions also demand large volumes of disposable gloves, supporting consistent market revenue. Rising investments in manufacturing facilities drive sustained demand for reusable protective gloves. Central Mexico maintains its position as the second-largest subregion by blending industrial strength with healthcare-driven consumption.

Southern Mexico

Southern Mexico captures 22% of the Mexico Safety Gloves Market, reflecting steady growth linked to oil, gas, and energy projects. Industries in this region demand specialized gloves for chemical handling, thermal protection, and mechanical work. It faces slower adoption compared to other subregions due to smaller manufacturing activity. However, ongoing development projects in energy and construction sectors continue to expand glove usage. The region benefits from increasing government focus on workplace safety in hazardous environments. Southern Mexico remains an emerging contributor, with its share expected to grow as industrial activities accelerate.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ansell

- MCR Safety

- 3M

- Klein Tools

- Magid Glove & Safety Manufacturing, LLC

- Guantes Internacionales S.A. de C.V.

- Dursafety Inc.

- GRUPO ALYGER SA DE CV

- Honeywell International Inc.

- Everpro Gloves

- Other Key Players

Competitive Analysis

The Mexico Safety Gloves Market features a mix of multinational corporations and domestic manufacturers competing for market presence. Global players such as Ansell, Honeywell International, and 3M focus on introducing certified, high-performance gloves tailored to industrial applications. It strengthens their position through product innovation, strategic partnerships, and acquisitions that expand distribution channels. Domestic companies like Guantes Internacionales S.A. de C.V. and Grupo Alyger SA de CV play a vital role by offering cost-effective products and catering to local demand across healthcare, food, and manufacturing sectors. The market is characterized by intense competition, where price sensitivity remains a challenge for premium players. Local firms gain an advantage by maintaining strong regional networks and addressing small and medium-sized enterprises. It encourages global companies to enhance localization strategies to capture broader customer bases. E-commerce platforms and direct sales channels also create opportunities for companies to expand visibility and reach new clients. Competitive dynamics remain driven by innovation in materials, sustainable product design, and compliance with regulatory standards. The ability to balance quality, affordability, and reliable supply positions companies for long-term growth in this evolving market.

Recent Developments

- In August 2025, Bunzl completed the acquisition of Guantes Internacionales S.A. de C.V. (Gisa), a leading Mexican PPE distributor, with 2024 revenue data provided (MXN 399 million).

- In July 2024, Ansell completed the acquisition of Kimberly-Clark’s Personal Protective Equipment (KCPPE) business, adding established brands Kimtech™ and KleenGuard™ to its portfolio.

Report Coverage

The research report offers an in-depth analysis based on Product Segment, Type Segment, End-User Segment, Application Segment and Sales Channel Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as industrial expansion in construction, automotive, and energy sectors accelerates.

- Stronger government enforcement of workplace safety rules will sustain glove adoption across industries.

- Global players will expand local partnerships to strengthen supply networks and meet regional demand.

- Technological innovation in glove materials will improve durability, flexibility, and overall protective performance.

- Growing preference for sustainable and eco-friendly gloves will influence procurement decisions by large buyers.

- Healthcare demand will remain steady, with disposable gloves dominating hospital and laboratory environments.

- Small and medium enterprises will drive growth through rising compliance awareness and affordable product access.

- E-commerce and direct sales channels will transform distribution models and expand supplier reach.

- Southern Mexico will emerge as a growing contributor due to energy and infrastructure projects.

- Competition will intensify, with differentiation focused on quality certifications, innovation, and regional service networks.