Market Overview

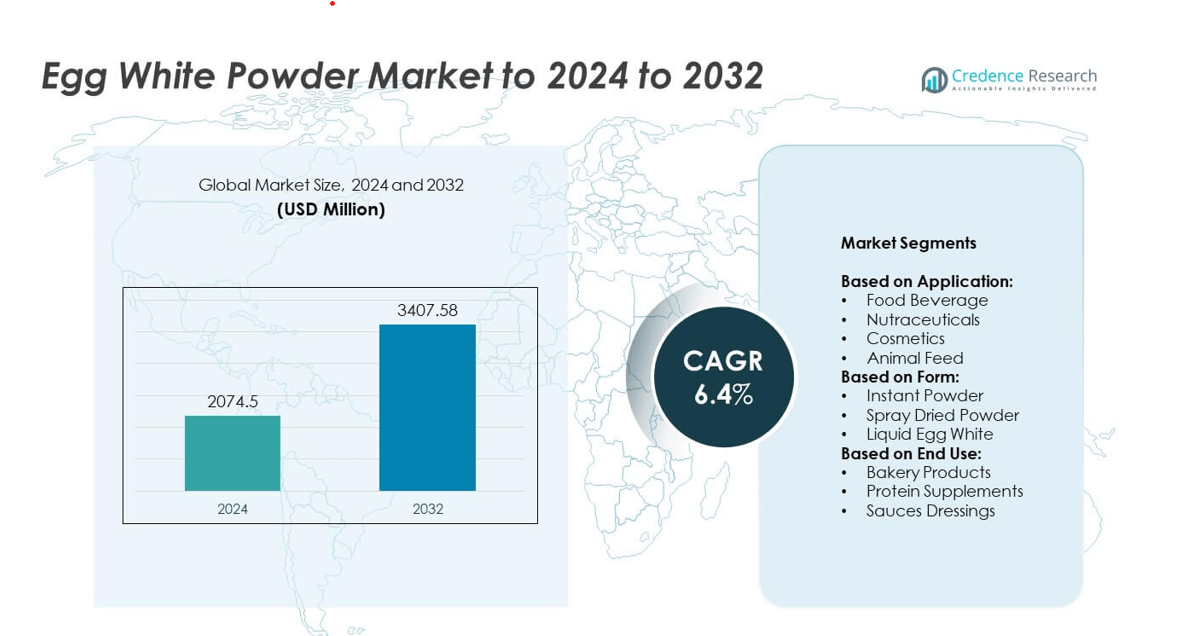

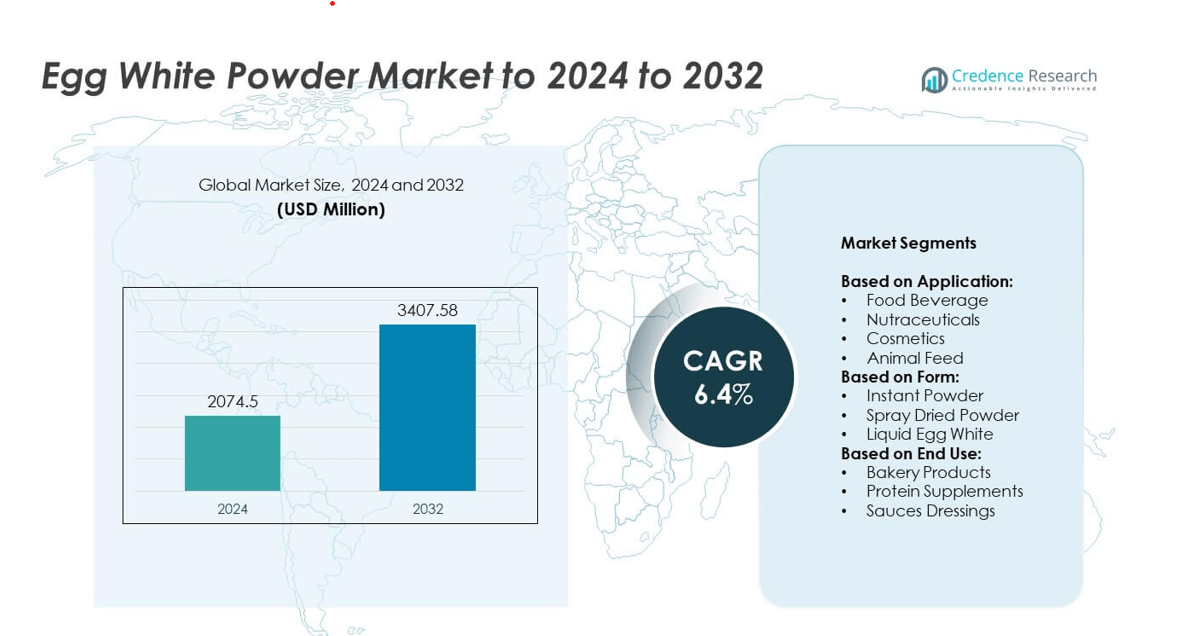

Egg White Powder Market size was valued at USD 2,074.5 million in 2024 and is anticipated to reach USD 3,407.58 million by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Egg White Powder Market Size 2024 |

USD 2,074.5 million |

| Egg White Powder Market, CAGR |

6.4% |

| Egg White Powder Market Size 2032 |

USD 3,407.58 million |

The Egg White Powder market is driven by prominent players such as Sanovo, Ovostar Union NV, Parmovo Srl, Venky’s (India) Ltd, Nutraceutical International, Foodchem International Corp, Taiyo Kagaku Co Ltd, OVODAN International AS, AgroEgg Pte Ltd, Taj Agro International, Egg Domain Pty Ltd, and Netto Industria De Alimentos Ltda. These companies focus on technological innovation, sustainable production, and expanding product applications across food, nutraceutical, and cosmetics sectors. North America led the global market in 2024, holding a 35% share, supported by strong demand from bakery, functional food, and supplement manufacturers. Europe followed with a 28% share, driven by advancements in clean-label and organic formulations.

Market Insights

- The Egg White Powder market was valued at USD 2,074.5 million in 2024 and is projected to reach USD 3,407.58 million by 2032, growing at a CAGR of 6.4%.

- Rising demand for high-protein and low-fat food products is the main growth driver, supported by expanding use in bakery, nutraceutical, and dietary supplement applications.

- Key trends include the growing adoption of organic and non-GMO egg white powder, along with advancements in spray drying and microencapsulation technologies that improve product quality.

- The market is competitive, with major players focusing on sustainable sourcing, product innovation, and regional expansion to strengthen global presence.

- North America held a 35% share in 2024, followed by Europe at 28% and Asia-Pacific at 25%; the food and beverage segment led the market with over 58% share, driven by the strong bakery and protein supplement industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The food and beverage segment dominated the egg white powder market in 2024, accounting for over 58% of the total share. Its wide use in bakery, confectionery, and ready-to-eat products drives this dominance. High protein content and excellent foaming, gelling, and binding properties make egg white powder essential for producing meringues, macarons, and protein-enriched snacks. Rising consumer preference for high-protein and low-fat diets further strengthens demand. Nutraceuticals and cosmetics segments are also growing steadily, fueled by increasing health awareness and the use of natural protein ingredients in skincare formulations.

- For instance, SKM Egg Products processes 1.8 million eggs/day and produces 6,500 tonnes/year of egg powder for food makers.

By Form

Spray-dried powder emerged as the leading form, holding around 62% market share in 2024. Its superior solubility, long shelf life, and easy handling make it ideal for industrial food processing and large-scale manufacturing. Spray drying preserves functional properties, making the powder suitable for protein bars, instant beverages, and confectionery. Instant powder follows, supported by growing adoption in household and small-scale food applications. The liquid egg white segment is expanding at a steady pace due to its use in ready-mix and bakery operations that require quick processing and high-quality protein sources.

- For instance, Venky’s desugared spray-dried albumen lists protein ≥78% and solubility ≥95% on spec.

By End Use

The bakery products segment dominated the egg white powder market in 2024, capturing nearly 54% of global revenue. Demand is driven by the growing production of cakes, pastries, and desserts that rely on egg white powder for aeration, structure, and texture enhancement. Its long shelf life and easy storage make it a preferred alternative to fresh eggs in large-scale bakeries. Protein supplements represent the fastest-growing category, supported by the increasing fitness and sports nutrition trend worldwide. Sauces and dressings also contribute to growth, leveraging egg white powder’s emulsifying and stabilizing benefits.

Key Growth Drivers

Rising Demand for High-Protein Food Products

The growing consumer preference for high-protein and low-fat foods is a major driver of the egg white powder market. The powder’s rich amino acid profile makes it a preferred protein source for athletes and health-conscious consumers. Its use in protein bars, shakes, and dietary supplements continues to expand as functional nutrition gains popularity. Manufacturers are introducing fortified and organic variants to attract clean-label buyers, further supporting global market expansion.

- For instance, Rembrandt Foods REMPRO 8000 SF disperses in <1 minute and delivers 10–15 g protein/100 mL.

Expanding Applications in Bakery and Confectionery

Egg white powder has become essential in bakery and confectionery industries due to its foaming and binding properties. It replaces liquid eggs efficiently, offering convenience, stability, and consistent quality. Its growing use in meringues, macarons, and desserts supports market growth. Increasing demand for packaged bakery goods and ready-to-eat snacks, especially in urban regions, drives large-scale adoption. The expanding bakery sector in Asia-Pacific and Europe continues to strengthen this segment’s dominance.

- For instance, Ovodan’s Free Range High Whip Egg Albumen Powder is specified with a guaranteed protein content of ≥80.0% and a typical value of 84.1% based on random sampling. It is optimized for whipping ability and foam stability, making it suitable for confectionery and bakery applications

Rising Adoption in Nutraceutical and Cosmetic Formulations

The use of egg white powder in nutraceuticals and cosmetics is rising due to its natural protein content and skin-nourishing qualities. It is used in supplements for muscle recovery and in skincare products for firming and anti-aging effects. The global shift toward natural, protein-based ingredients is accelerating this adoption. Growing awareness of egg-derived proteins as multifunctional and clean-label components further propels demand across health and personal care industries.

Key Trends & Opportunities

Shift Toward Organic and Non-GMO Egg White Powder

The market is witnessing a clear shift toward organic and non-GMO variants driven by consumer health awareness. Manufacturers are investing in sustainable sourcing and clean-label certifications to meet rising demand. Organic egg white powder offers allergen-free, antibiotic-free, and additive-free benefits, aligning with global wellness trends. This shift is creating new growth opportunities for producers catering to premium food and nutraceutical brands focused on transparency and purity.

- For instance, egg processors can utilize the Pelbo Synchro500 line to achieve an output of up to 180,000 eggs per hour, while high-capacity tray washing systems, such as the Sanovo STW 6500, can handle up to 6,500 trays per hour.

Technological Advancements in Drying and Processing Techniques

Advances in spray drying and microencapsulation are improving product stability, solubility, and shelf life. These innovations help preserve protein functionality and taste, making egg white powder suitable for wider industrial applications. Automation and digital process control enhance efficiency and quality consistency. Such technologies enable manufacturers to meet stringent safety and nutritional standards while reducing production costs, driving competitiveness in both mature and emerging markets.

- For instance, Actini OVOline systems rate 1,000–6,000 kg/h pasteurization and 27,000–144,000 eggs/hour breaking.

Key Challenges

Price Volatility and Supply Chain Constraints

Egg price fluctuations and supply disruptions significantly impact production costs for egg white powder manufacturers. Disease outbreaks, such as avian influenza, often affect egg availability and pricing. Transportation delays and trade restrictions further strain the global supply chain. These factors create uncertainty in raw material sourcing and force producers to adjust pricing frequently. Ensuring consistent supply and cost stability remains a critical challenge for both suppliers and end users.

Competition from Alternative Protein Sources

The growing availability of plant-based and synthetic protein substitutes poses a challenge to egg white powder demand. Alternatives such as pea, soy, and whey proteins are gaining popularity among vegan and lactose-intolerant consumers. These products often offer competitive pricing and sustainability benefits. To maintain market share, egg white powder producers must focus on innovation, highlighting functional advantages like superior foaming, emulsification, and clean-label appeal over synthetic or plant-based options.

Regional Analysis

North America

North America dominated the egg white powder market in 2024, accounting for around 35% of the global share. Strong demand from the bakery, protein supplements, and functional food sectors drives regional growth. The U.S. remains a major contributor due to widespread use of high-protein and clean-label food ingredients. Food manufacturers increasingly favor powdered egg products for their shelf stability and safety. Expanding applications in sports nutrition and the rising adoption of natural protein sources further enhance market penetration across the region.

Europe

Europe held about 28% of the egg white powder market share in 2024, supported by strong bakery and confectionery industries. Countries such as Germany, France, and the U.K. lead production and consumption due to advanced food processing capabilities. Increasing consumer preference for organic and non-GMO egg-based ingredients strengthens market demand. The European food industry’s strict quality standards and innovation in high-protein bakery formulations also drive adoption. The region continues to invest in sustainable production methods to meet environmental regulations and growing consumer awareness.

Asia-Pacific

Asia-Pacific accounted for nearly 25% of the global market share in 2024 and is projected to grow fastest through 2032. Rapid urbanization, changing dietary patterns, and increasing disposable income are fueling demand for protein-rich foods. China, Japan, and India are major contributors, with expanding bakery and supplement sectors. The rise of fitness culture and the popularity of convenient food products further drive consumption. Government support for food processing industries and technological improvements in egg powder manufacturing are strengthening the region’s global position.

Latin America

Latin America captured approximately 7% of the global market share in 2024. Growth is driven by rising bakery production, processed food exports, and expanding urban consumption. Brazil and Mexico lead the region due to strong poultry production and growing adoption of powdered egg ingredients. Consumers are increasingly shifting toward convenient, high-protein foods, supporting steady market expansion. Local manufacturers are investing in drying technologies to enhance export competitiveness and ensure consistent product quality across international markets.

Middle East & Africa

The Middle East & Africa region accounted for around 5% of the egg white powder market share in 2024. Demand is increasing in Gulf countries due to expanding food manufacturing and tourism-driven hospitality sectors. South Africa and the UAE are key growth hubs, supported by imports from European and Asian suppliers. The market benefits from the rising popularity of bakery and confectionery products and growing awareness of protein-enriched foods. However, limited domestic production capacity and dependency on imports slightly restrain faster market expansion.

Market Segmentations:

By Application:

- Food Beverage

- Nutraceuticals

- Cosmetics

- Animal Feed

By Form:

- Instant Powder

- Spray Dried Powder

- Liquid Egg White

By End Use:

- Bakery Products

- Protein Supplements

- Sauces Dressings

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The egg white powder market features leading companies such as Sanovo, Ovostar Union NV, Parmovo Srl, Venky’s (India) Ltd, Nutraceutical International, Foodchem International Corp, Taiyo Kagaku Co Ltd, OVODAN International AS, AgroEgg Pte Ltd, Taj Agro International, Egg Domain Pty Ltd, and Netto Industria De Alimentos Ltda. These players compete through technological innovation, advanced drying processes, and diverse product portfolios catering to food, nutraceutical, and cosmetic applications. The market is characterized by continuous product differentiation focused on purity, solubility, and protein concentration. Manufacturers emphasize sustainable sourcing, traceability, and compliance with international food safety standards. Strategic partnerships and capacity expansions strengthen global distribution networks, while investments in research support the development of organic and non-GMO formulations. The growing demand for high-protein ingredients and functional food applications continues to fuel competitive intensity, prompting companies to enhance efficiency and expand their presence across emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sanovo

- Ovostar Union NV

- Parmovo Srl

- Venky’s (India) Ltd

- Nutraceutical International

- Foodchem International Corp

- Taiyo Kagaku Co Ltd

- OVODAN International AS

- AgroEgg Pte Ltd

- Taj Agro International

- Egg Domain Pty Ltd

- Netto Industria De Alimentos Ltda

Recent Developments

- In 2025, Taj Agro International Launches of tailored egg white powder solutions for bakery and nutrition sectors

- In 2023, Nutraceutical International aligned with the overall market trend of increasing consumer emphasis on health and wellness. Market research shows high demand for egg white powder as a protein source for fitness and weight management.

- In 2023, Sanovo continued to provide its advanced egg processing equipment to manufacturers globally, including pasteurization and spray-drying systems for egg powder production.

Report Coverage

The research report offers an in-depth analysis based on Application, Form, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The egg white powder market will experience steady growth driven by rising protein demand.

- Food and beverage manufacturers will continue adopting egg white powder for functional benefits.

- Expansion in nutraceutical and sports nutrition sectors will fuel long-term market development.

- Technological improvements in spray drying will enhance product quality and shelf life.

- Organic and non-GMO egg white powder variants will gain wider consumer acceptance.

- Asia-Pacific will emerge as the fastest-growing region due to dietary shifts and industrial expansion.

- Product innovation focusing on clean-label and allergen-free formulations will intensify competition.

- Manufacturers will invest in sustainable and traceable sourcing to meet regulatory standards.

- Growing e-commerce and direct-to-consumer channels will support market accessibility.

- Collaboration between poultry farms and food processors will strengthen global supply stability.