Market Overview

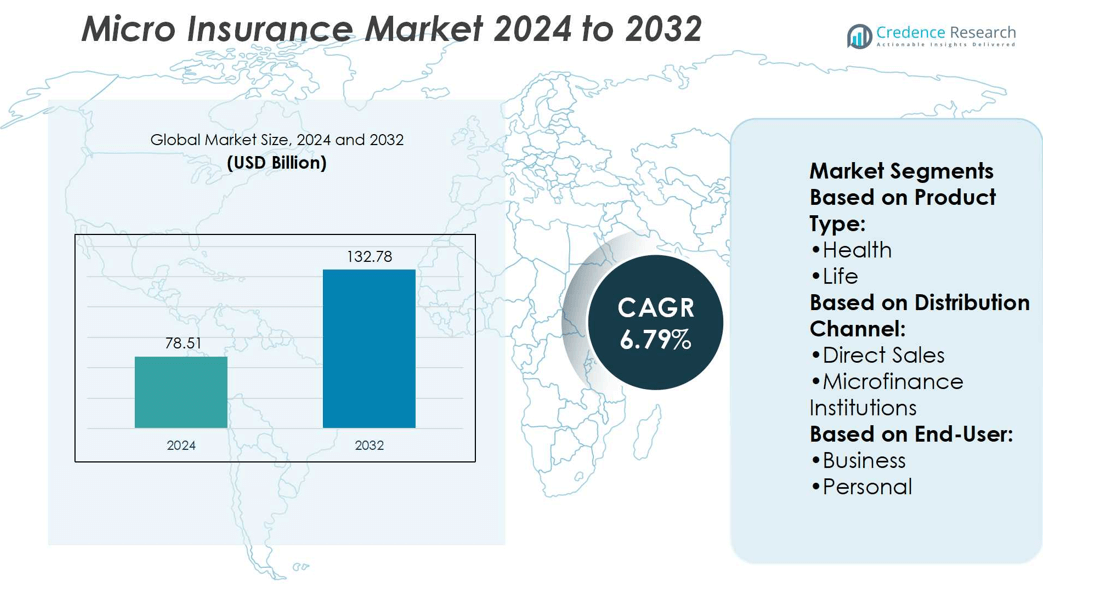

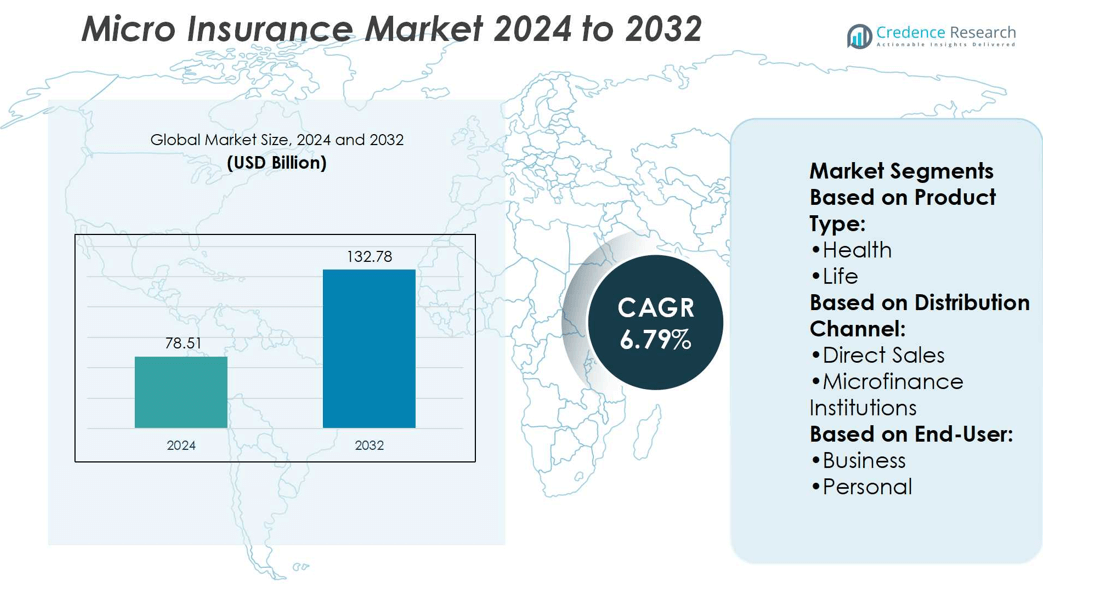

Micro Insurance Market size was valued at USD 78.51 billion in 2024 and is anticipated to reach USD 132.78 billion by 2032, at a CAGR of 6.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Micro Insurance Market Size 2024 |

USD 78.51 billion |

| Micro Insurance Market, CAGR |

6.79% |

| Micro Insurance Market Size 2032 |

USD 132.78 billion |

The Micro Insurance Market grows through rising demand for affordable protection in low-income communities and government-backed initiatives supporting financial inclusion. It benefits from strict regulatory frameworks that encourage compliance and trust while addressing risks linked to health, agriculture, and property. The market advances with digital platforms and mobile wallets that simplify premium payments and claims, extending coverage in rural and unbanked areas. It also reflects a trend toward parametric products offering transparent payouts and partnerships that integrate insurance with microfinance services. Increasing collaboration between insurers, NGOs, and development agencies strengthens outreach and promotes sustainable adoption across underserved populations.

The Micro Insurance Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific recording the fastest expansion due to its large underserved population. North America and Europe benefit from structured regulations, while Latin America and Africa rely on community-based models supported by NGOs. Key players include Zurich Insurance Group, Allianz SE, Swiss Re, Axa Group, Bajaj Allianz Life Insurance Co. Ltd., MicroEnsure, BRAC, SKS Microfinance, Telenor Microfinance Bank, and MetLife Foundation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Micro Insurance Market was valued at USD 78.51 billion in 2024 and is projected to reach USD 132.78 billion by 2032, at a CAGR of 6.79%.

- Rising demand for affordable coverage among low-income households and government initiatives drive steady adoption.

- Increasing use of digital platforms, mobile wallets, and parametric products shapes emerging market trends.

- Competition intensifies with insurers, microfinance institutions, NGOs, and telecom operators expanding innovative distribution models.

- Limited awareness, operational inefficiencies, and high costs in rural outreach remain key restraints.

- Asia-Pacific leads in growth potential, while North America and Europe benefit from structured regulations.

- Latin America and Africa rely on NGO-led programs, supported by key players such as Zurich Insurance Group, Allianz SE, Swiss Re, Axa Group, Bajaj Allianz Life Insurance Co. Ltd., MicroEnsure, BRAC, SKS Microfinance, Telenor Microfinance Bank, and MetLife Foundation.

Market Drivers

Rising Demand for Affordable and Accessible Financial Protection in Low-Income Communities

The Micro Insurance Market grows through rising awareness of financial protection among underserved populations. Households with limited income seek affordable coverage for health, agriculture, and property risks. It enables families to safeguard assets against sudden shocks and emergencies. Non-governmental organizations and cooperatives promote tailored products to strengthen community resilience. Partnerships with local banks and microfinance institutions expand distribution reach. The trend highlights demand for low-premium products designed to reduce financial vulnerability.

- For instance, Allianz SE’s development of its Connected Platforms enables automatic detection of motor incidents, Official Allianz documents and news releases state that for minor damage, cash settlements can be processed in under 60 seconds.

Expansion of Government-Supported Programs and Regulatory Frameworks Encouraging Adoption

The Micro Insurance Market benefits from strong government initiatives promoting inclusive finance. Policymakers introduce regulations supporting micro-level coverage to improve insurance penetration. It creates a supportive environment for private insurers to enter rural and semi-urban areas. Subsidized schemes and tax incentives encourage participation from vulnerable segments. Governments also emphasize transparent claim processes to build policyholder trust. The push aligns with national development goals focused on social security and poverty reduction.

- For instance, Telenor Microfinance Bank’s Easypaisa platform, now known as Easypaisa Digital Bank, and powered by Ericsson’s cloud-native Mobile Financial Services, now processes more than 2.1 billion digital transactions annually, supporting over 18.2 million monthly active users through its open-API ecosystem.

Integration of Digital Platforms and Mobile Technology Enhancing Distribution Efficiency

The Micro Insurance Market advances through digital channels that improve access and efficiency. Mobile applications simplify premium collection and claims settlement, reducing administrative costs. It supports real-time communication with policyholders in remote locations. Insurers leverage mobile wallets and digital IDs to streamline enrollment. Technology enables wider coverage with low operational overheads. Digital ecosystems accelerate outreach among populations previously excluded from financial services.

Growing Partnerships Between Insurers, NGOs, and Development Agencies Driving Market Reach

The Micro Insurance Market strengthens through collaboration between insurers, NGOs, and global development agencies. Cooperative models support the rollout of specialized coverage for farmers and small businesses. It fosters knowledge sharing to design policies tailored to local risks. International organizations fund capacity-building programs for community agents. Insurers gain access to broader networks through such partnerships. The strategy creates scalable frameworks to expand micro-level insurance adoption globally.

Market Trends

Adoption of Parametric Insurance Models for Faster and Transparent Payouts

The Micro Insurance Market experiences rising acceptance of parametric products that trigger claims on predefined events. Farmers and small enterprises gain immediate compensation without lengthy assessments. It improves trust in insurance by ensuring transparent and predictable outcomes. Climate-related risks such as droughts, floods, and storms drive demand for this model. International agencies promote parametric structures to address disaster-prone regions. The approach enables cost efficiency for insurers while supporting vulnerable communities.

- For instance, BRAC’s parametric insurance for smallholder farmers in Bangladesh has covered almost 80,000 farmers and insured around 10,000 acres of crops, delivering payouts worth BDT 3.7 million through area yield index-based triggers—calculating yield averages and initiating prompt payments when yields fall below expectations.

Increasing Role of Mobile Money and Fintech Platforms in Premium Collection

The Micro Insurance Market advances through integration with fintech platforms that simplify payment and claims. Mobile money services support low-income customers who lack access to traditional banking. It allows flexible premium payments aligned with income cycles. Digital solutions also reduce transaction costs for insurers operating in remote areas. Partnerships with telecom providers extend coverage to previously unserved populations. The trend reinforces technology as a backbone for micro-level financial inclusion.

- For instance, AXA EssentiALL team in March 2025 confirmed that the initiative had served 17.4 million customers across 21 markets. This reach includes both emerging and mature markets, highlighting the initiative’s expansion beyond its initial focus on emerging economies.

Product Diversification Tailored to Agriculture, Health, and Small Business Segments

The Micro Insurance Market witnesses steady diversification across health, crop, and livelihood protection products. Insurers design specialized offerings to cover region-specific risks. It reflects a shift toward customizing policies based on local income and lifestyle needs. Health-focused products cover outpatient care and preventive services, appealing to low-income families. Agriculture-linked products address losses from weather variability and pest outbreaks. The broadening scope underscores insurers’ commitment to designing sector-focused micro-level solutions.

Growing Involvement of Global Development Institutions in Scaling Distribution Networks

The Micro Insurance Market expands with stronger participation from multilateral and development institutions. Agencies invest in pilot programs to scale sustainable distribution frameworks. It strengthens capacity for local insurers and cooperatives to reach underserved markets. Development-backed programs also facilitate knowledge transfer and training for community-level insurance agents. Collaborative models foster innovation in claims management and customer engagement. The involvement of global institutions ensures steady momentum for market expansion.

Market Challenges Analysis

Low Awareness Levels and Limited Trust Among Target Segments Restricting Adoption

The Micro Insurance Market faces hurdles due to low awareness and financial literacy in underserved communities. Many households lack understanding of insurance principles, leading to limited uptake of products. It reduces the effectiveness of outreach despite growing distribution networks. Misconceptions about claim delays or denied payouts further weaken trust. Insurers struggle to communicate value propositions in simple and culturally relevant ways. This gap highlights the need for stronger education and transparent engagement strategies.

Operational Inefficiencies and High Costs in Reaching Remote Populations

The Micro Insurance Market encounters operational barriers linked to serving geographically dispersed and low-income customers. High transaction costs affect the sustainability of insurers offering low-premium products. It limits scalability, especially in rural regions with weak infrastructure. Manual claim processes and fragmented agent networks contribute to inefficiency. Fraudulent claims also create financial strain for insurers working on thin margins. These operational issues demand investment in digital solutions and improved verification systems to ensure long-term viability.

Market Opportunities

Emerging Potential in Climate Risk Coverage and Agricultural Insurance Solutions

The Micro Insurance Market creates significant opportunities in protecting small farmers against climate-related risks. Rising incidents of floods, droughts, and pest outbreaks increase demand for tailored agricultural products. It allows insurers to introduce weather-indexed and parametric models for faster claim settlements. Development agencies actively fund projects that expand agricultural micro-insurance in vulnerable regions. Governments also encourage schemes that strengthen food security and rural resilience. This creates a pathway for insurers to scale products aligned with climate adaptation goals.

Expansion Through Digital Transformation and Strategic Collaborations Across Sectors

The Micro Insurance Market benefits from opportunities driven by digitalization and multi-sector collaborations. Mobile platforms and AI-driven tools simplify enrollment, premium collection, and claims, reducing costs for providers. It supports scalability in rural areas with limited infrastructure. Partnerships with telecom companies, banks, and NGOs extend access to unbanked populations. Cross-sector collaboration fosters innovation in product design and delivery models. This trend enables insurers to expand outreach and achieve sustainable growth in underserved markets.

Market Segmentation Analysis:

By Product Type

The Micro Insurance Market demonstrates diverse growth across product categories. Health micro-insurance remains the leading segment, covering outpatient care, hospitalization, and preventive services for low-income families. It improves access to basic healthcare while reducing financial vulnerability from medical emergencies. Life micro-insurance provides protection against income loss due to death, ensuring security for dependents. Property micro-insurance addresses risks from fire, theft, and natural disasters, catering to small businesses and households. The rising incidence of climate-related events reinforces the demand for property-focused solutions. Each product type strengthens financial resilience among populations with limited resources.

- For instance, MetLife Foundation has contributed over $1 billion in grants aimed at building financial health and resilience in underserved communities worldwide, supporting inclusive programs like micro-insurance innovation challenges and resilient community-building investments.

By Distribution Channel

The Micro Insurance Market expands through diverse distribution channels tailored to local needs. Direct sales remain effective in regions with strong community-based networks, allowing insurers to build trust. Microfinance institutions play a critical role by bundling insurance with financial services, ensuring higher penetration in rural areas. It improves access for customers already engaged in micro-credit programs. Digital platforms drive rapid transformation, offering low-cost enrollment, premium payment, and claim management. Mobile wallets and online portals simplify insurance delivery to unbanked and remote populations. The combination of physical and digital models enhances outreach and operational efficiency.

- For instance, Bajaj Allianz Life Insurance Co. Ltd. (BALIC), through its various distribution channels, has expanded its reach into underserved rural districts across India. The company reported that it served over 2.82 crore new customers.

By End User

The Micro Insurance Market serves both personal and business segments with distinct product needs. The personal segment dominates through coverage for individuals and families seeking affordable health, life, and property protection. It ensures access to financial safety nets in communities with minimal savings. The business segment focuses on micro and small enterprises exposed to operational risks and natural hazards. It enables entrepreneurs to protect assets and stabilize income streams. The dual structure highlights the role of micro-insurance in supporting both households and local economies. Rising awareness across both segments supports consistent demand growth.

Segments:

Based on Product Type:

Based on Distribution Channel:

- Direct Sales

- Microfinance Institutions

Based on End-User:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regonal Analysi

North America

North America accounts for 32% of the Micro Insurance Market, supported by structured financial systems and regulatory frameworks. It benefits from government-led inclusion programs that encourage insurers to extend coverage to underserved groups. The region also witnesses strong adoption of health and life micro-insurance products targeting low-income households and migrant workers. It leverages advanced digital infrastructure to deliver services through mobile platforms and online channels. Community-based organizations and credit unions expand awareness in rural and semi-urban areas. Insurers also collaborate with non-profits to design products addressing specific needs such as property loss or personal accident coverage. The region demonstrates steady growth driven by both technological adoption and strong policy support.

Europe Representing

Europe holds 27% of the Micro Insurance Market, with adoption led by countries focusing on social security expansion. The region emphasizes regulatory compliance under frameworks such as GDPR, ensuring transparency and data protection in insurance delivery. It prioritizes coverage for migrant populations, seasonal workers, and small-scale farmers across Eastern and Southern Europe. Health micro-insurance plays a key role in strengthening access to primary care services for low-income groups. Distribution relies on microfinance institutions and cooperative banks that maintain trust within communities. European insurers also experiment with parametric insurance to support vulnerable households in disaster-prone regions. The combination of robust regulations and innovative models sustains the region’s strong contribution.

Asia-Pacific

Asia-Pacific secures 21% of the Micro Insurance Market, reflecting large populations with limited financial access. The region benefits from rapid digitalization, with insurers leveraging mobile platforms for enrollment, premium collection, and claims. It emphasizes agriculture-linked micro-insurance, protecting farmers from risks related to floods, droughts, and pest outbreaks. Governments in South Asia and Southeast Asia implement subsidy programs to expand outreach in rural communities. Insurers also partner with telecom companies to extend coverage to remote areas with high mobile penetration. Health and life products remain critical, with strong demand among informal workers and migrant laborers. The region showcases the fastest expansion potential due to its demographic profile and policy support.

Latin America

Latin America represents 12% of the Micro Insurance Market, led by Brazil, Mexico, and Colombia. The region prioritizes micro-insurance solutions addressing agricultural risks and small business protection. It focuses on community-driven approaches, with NGOs and cooperatives promoting awareness at the grassroots level. Health and life coverage also expand through partnerships with microfinance institutions. Digital tools enhance distribution, particularly in urban low-income neighborhoods. Governments emphasize inclusion policies, though fragmented infrastructure limits scalability in remote areas. It shows steady adoption but requires further regulatory clarity to accelerate penetration across diverse economic groups.

Middle East and Africa

The Middle East and Africa capture 8% of the Micro Insurance Market, supported by international development agencies and NGOs. The region emphasizes agricultural and property insurance due to high exposure to natural disasters and climate risks. It faces challenges of low financial literacy and weak infrastructure, yet mobile penetration improves accessibility. Partnerships with telecom providers and microfinance institutions support delivery of affordable products. Governments and donor agencies invest in pilot programs that expand coverage in underserved rural areas. Health coverage remains critical, addressing gaps in national healthcare systems. The region demonstrates potential for long-term expansion once regulatory and operational barriers are reduced.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zurich Insurance Group

- SKS Microfinance

- Allianz SE

- MicroEnsure

- Telenor Microfinance Bank

- BRAC

- Swiss Re

- Axa Group

- MetLife Foundation

- Bajaj Allianz Life Insurance Co. Ltd.

Competitive Analysis

The Micro Insurance Market features players such as Zurich Insurance Group, SKS Microfinance, Allianz SE, MicroEnsure, Telenor Microfinance Bank, BRAC, Swiss Re, Axa Group, MetLife Foundation, and Bajaj Allianz Life Insurance Co. Ltd. The Micro Insurance Market demonstrates intense competition driven by insurers, microfinance institutions, and digital platforms. Companies focus on developing affordable products tailored to health, life, and agricultural risks for low-income communities. It highlights a trend toward mobile-enabled distribution, which reduces costs and expands coverage in remote areas. Partnerships with NGOs, cooperatives, and telecom operators strengthen outreach and improve customer trust. Global reinsurers support innovation by promoting parametric models that ensure faster payouts in disaster-prone regions. The competitive landscape reflects a balance between commercial insurers seeking scalable solutions and development agencies working to expand financial inclusion.

Recent Developments

- In March 2025, Swiss Re, in partnership with Good Carbon, introduced a novel carbon-credit non-delivery insurance. This innovative product is designed to address the risks associated with carbon credit projects by incorporating a buffer pool for replacement credits, ensuring greater reliability and trust in carbon offset mechanisms.

- In March 2025, SolaX Power, a Global solar inverter brand, announced its plan to introduce its latest innovation of solar micro-inverters that will be tailored for the Indian market. The inverters will be specifically designed for smaller residential rooftop solar installations.

- In December 2024, Enphase Energy, Inc., a global leader in energy technology and microinverter-based solar and battery systems, collaborated with Frank Energie, an energy provider in the Netherlands.

- In May 2024, Allianz Partners unveiled its allyz Cyber Care in four EU markets. This offering combines advanced preventive technologies with comprehensive insurance benefits, aiming to address the growing concerns around cyber threats and provide enhanced protection for consumers.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise for parametric products offering faster and transparent claim settlements.

- Mobile platforms will become the primary channel for policy distribution and premium collection.

- Partnerships with telecom operators will expand access in remote and underserved regions.

- Governments will strengthen regulatory frameworks to promote inclusion and transparency.

- Health and agriculture-focused products will remain the fastest-growing segments.

- Digital identity systems will streamline enrollment and reduce fraud risks.

- Reinsurers will play a larger role in supporting climate risk coverage.

- Insurers will invest in AI-driven analytics for efficient claim assessment and risk profiling.

- Collaboration between insurers, NGOs, and development agencies will increase market penetration.

- Education and awareness initiatives will improve trust and adoption among low-income households.