Market Overview:

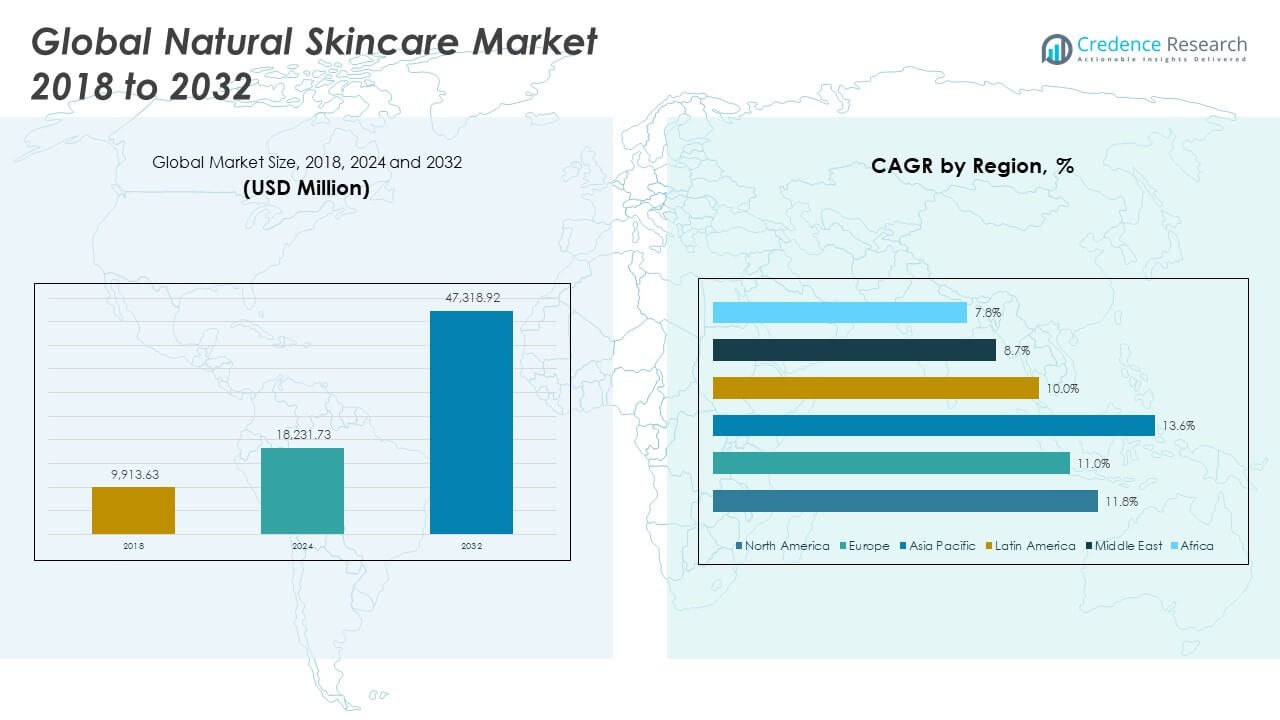

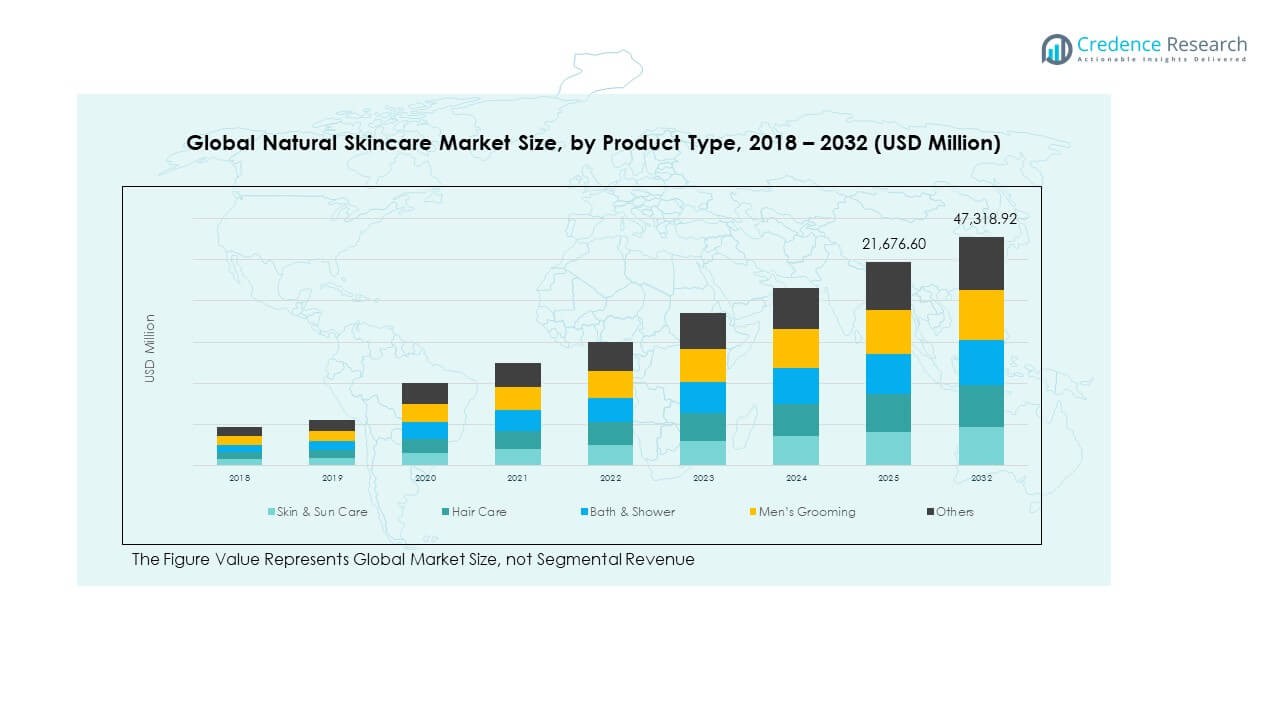

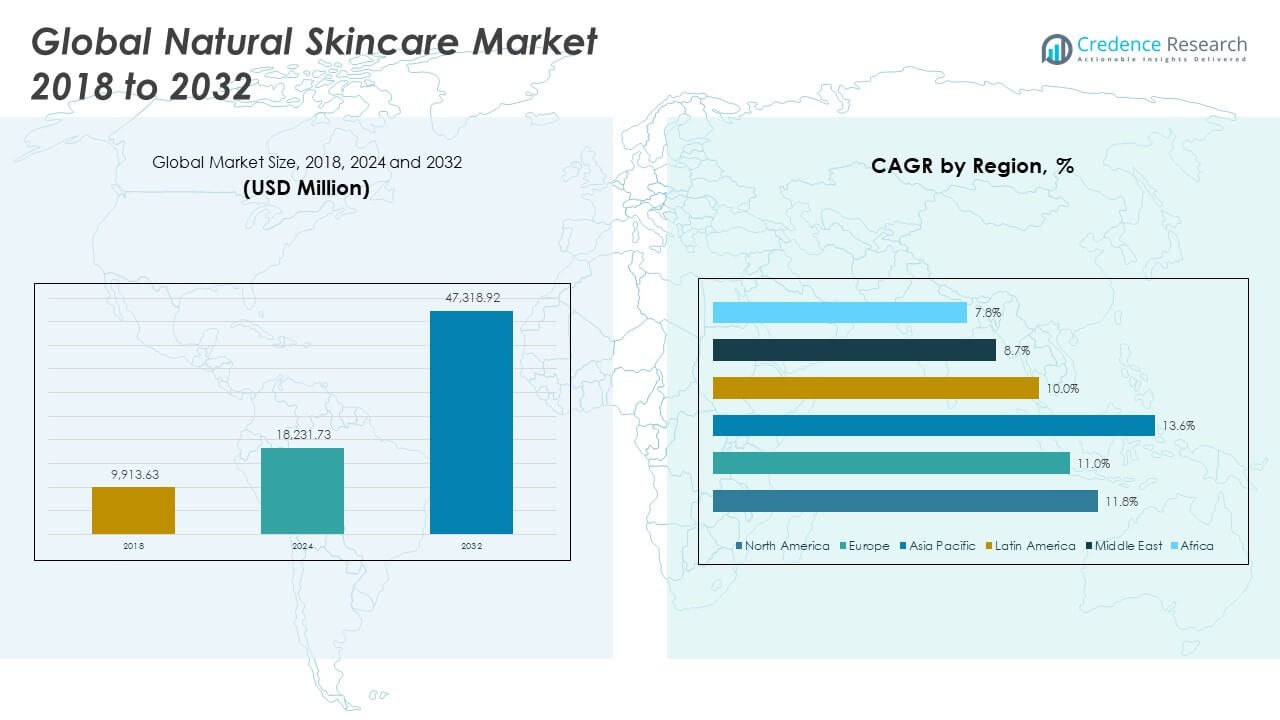

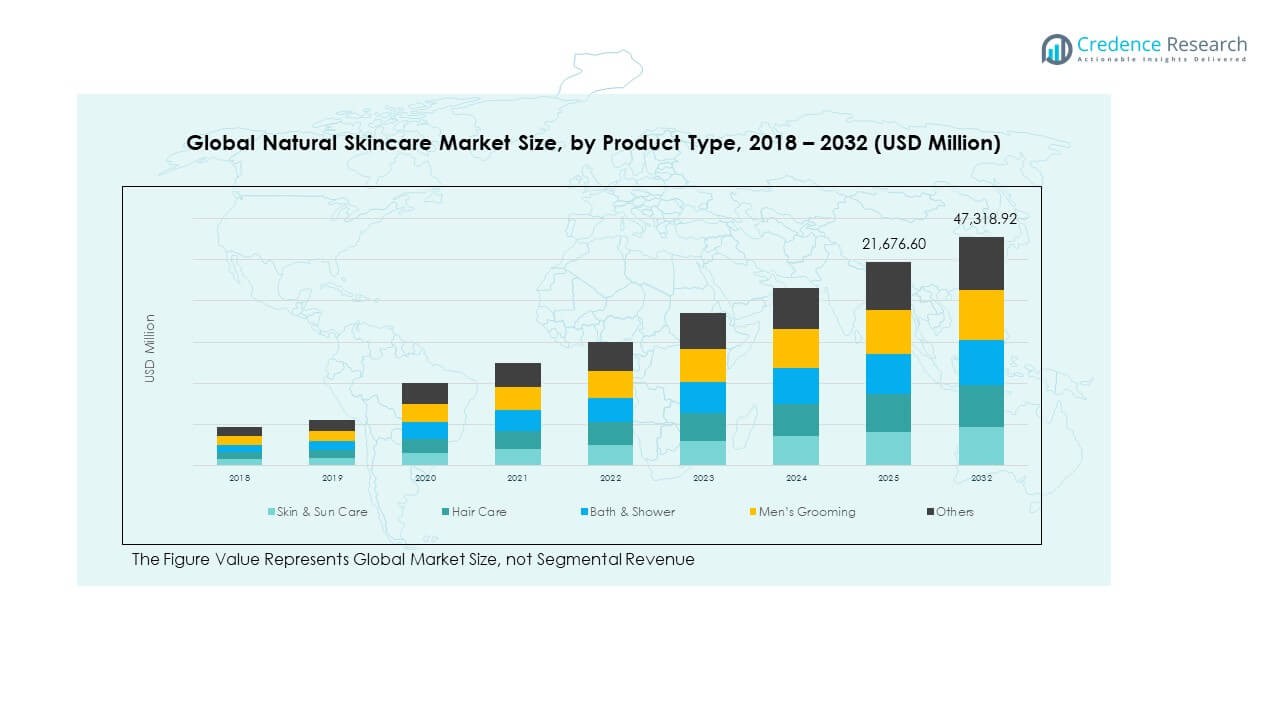

The Global Natural Skincare Market size was valued at USD 9,913.63 million in 2018 to USD 18,231.73 million in 2024 and is anticipated to reach USD 47,318.92 million by 2032, at a CAGR of 11.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Natural Skincare Market Size 2024 |

USD 18,231.73 Million |

| Natural Skincare Market, CAGR |

11.80% |

| Natural Skincare Market Size 2032 |

USD 47,318.92 Million |

The market is driven by rising consumer preference for safe, plant-based, and chemical-free products. Growing awareness of harmful effects of synthetic ingredients has shifted demand toward eco-friendly alternatives. Brands are investing in clean formulations, sustainable packaging, and cruelty-free certifications to build consumer trust. Strong digital marketing, influencer endorsements, and e-commerce growth expand accessibility to wider demographics. Premiumization trends, personalized product offerings, and innovation in bio-active ingredients further fuel adoption. It continues to gain momentum as consumers link natural skincare with wellness and long-term skin health.

Regionally, North America leads the market due to high spending power, strong retail presence, and strict regulatory standards favoring clean-label cosmetics. Europe follows with significant demand supported by sustainability-focused consumers and established organic certification frameworks. Asia Pacific is emerging as the fastest-growing region, fueled by rising disposable incomes, K-beauty trends, and wider access to herbal skincare. Latin America shows steady adoption driven by growing middle-class populations, while the Middle East gains traction with demand for premium personal care. Africa remains at a developing stage but shows promise through urbanization and local use of natural resources.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Natural Skincare Market was USD 9,913.63 million in 2018, USD 18,231.73 million in 2024, and will reach USD 47,318.92 million by 2032, at a CAGR of 11.80%.

- North America held 43.68% of the 2024 share, Europe 28.22%, and Asia Pacific 20.25%, reflecting strong consumer spending, sustainability focus, and cultural influence on natural beauty.

- Asia Pacific, with a 20.25% share in 2024, is the fastest-growing region due to rising disposable incomes, urbanization, and K-beauty trends.

- Skin & Sun Care accounted for the largest segment in 2024 with an estimated 38% share, driven by increasing demand for natural sun protection and facial care.

- Hair Care followed with around 26% share, supported by preference for herbal formulations addressing scalp health and hair damage concerns.

Market Drivers

Rising Consumer Shift Toward Plant-Based and Chemical-Free Skincare Solutions

The growing awareness of harmful effects caused by synthetic chemicals is driving a strong preference for plant-based skincare. Consumers are becoming more conscious about what goes on their skin, and natural ingredients provide a safe alternative. Demand is particularly high among younger demographics who associate natural skincare with health and wellness. The Global Natural Skincare Market benefits from increasing acceptance of organic and cruelty-free labels. Consumers are influenced by certifications and transparent sourcing that boost product credibility. Premium positioning of natural skincare strengthens its appeal across high-income groups. It is supported by lifestyle changes that prioritize sustainability. This alignment with consumer values reinforces long-term market expansion.

- For example, Blissoma, a U.S.-based skincare company, formulates products with 75% or more active plant-based ingredients well above the industry norm of 5%–20%. The company also operates a solar-powered manufacturing facility and uses recyclable glass and aluminum packaging to minimize plastic use.

Increasing Demand for Premium and Customized Natural Skincare Products

Rising disposable incomes in both developed and emerging economies are creating demand for premium natural skincare. Consumers are investing more in customized solutions tailored to their specific skin types and preferences. The Global Natural Skincare Market experiences growth from innovations such as anti-aging serums with botanical extracts. Brands are focusing on clean formulations without harmful preservatives. Personalized products, developed through skin testing and data-driven insights, improve brand loyalty. It is benefiting from stronger brand-customer engagement across digital platforms. The desire for high-quality and safe alternatives to conventional products keeps expanding. Such consumer behavior creates a premium-driven growth pattern for the market.

- For example, L’Oréal’s Perso device (announced 2020) performs skin analysis via its AI-powered ModiFace tech and dispenses custom skincare, foundation or lipstick. The system adjusts for environmental factors (e.g. UV, humidity) and user preferences to create tailored formulas.

E-Commerce Expansion and Wider Retail Accessibility of Natural Skincare

The proliferation of e-commerce platforms has boosted access to natural skincare products across global markets. Online stores provide consumers with easy comparisons, reviews, and transparent ingredient details. The Global Natural Skincare Market gains momentum from online sales that reach remote locations. Social media marketing campaigns also highlight authenticity and create trust. It is increasingly supported by influencer endorsements that shape purchase behavior. Offline retail, including specialty stores and supermarkets, is allocating more shelf space to natural skincare. Expanding distribution channels enable wider consumer adoption. This retail growth directly supports the rising demand for eco-conscious products.

Growing Impact of Regulatory Policies and Sustainability Standards in Skincare

Regulatory support for clean-label cosmetics is pushing companies toward natural formulations. Governments and health authorities are encouraging safer alternatives to chemical-laden skincare. The Global Natural Skincare Market aligns with strict sustainability standards, ensuring higher transparency and safety. Brands invest in eco-friendly packaging and ethical sourcing to remain competitive. It is strengthened by consumer trust built through compliance with certifications. Manufacturers focusing on sustainability attract loyal consumers who value responsible practices. Regulatory enforcement also restricts harmful ingredients, opening space for innovation in natural alternatives. These combined efforts reinforce the credibility and acceptance of natural skincare worldwide.

Market Trends

Emergence of Multi-Functional Natural Skincare Products for Diverse Applications

The demand for multi-functional products is reshaping consumer choices. Skincare items offering hydration, anti-aging, and sun protection in one product are gaining traction. The Global Natural Skincare Market benefits from innovation that merges convenience with safety. Consumers prefer simplified routines supported by all-in-one solutions. It is increasingly driven by products with botanical extracts combined with clinically validated results. Brands use multi-purpose formulations to reduce costs for consumers while enhancing effectiveness. Such versatility allows natural skincare to expand into broader consumer categories. This trend highlights a balance of efficacy, safety, and convenience.

Adoption of Sustainable Packaging and Circular Economy Practices in Skincare

Sustainable packaging is becoming a core focus for skincare companies worldwide. Brands are introducing biodegradable, refillable, and recyclable materials to appeal to eco-conscious consumers. The Global Natural Skincare Market is evolving through integration of circular economy principles. It is also influenced by regulatory support and consumer demand for reduced plastic use. Companies that prioritize zero-waste packaging are improving brand positioning. Socially responsible consumers reward sustainable practices through higher loyalty and repeat purchases. Sustainability in packaging now serves as both a marketing and operational strategy. This trend enhances brand identity and meets rising environmental expectations.

- For example, The Body Shop rolled out 720 refill stations across its stores globally, with 130 more planned in 2023, aiming to save over 1 million plastic bottles by year end. Customers refill hair, hand-wash or shower products using aluminium bottles, encouraging reuse and reducing single-use plastic waste.

Integration of Advanced Technologies for Personalized Skincare Solutions

Technology is reshaping the natural skincare industry through personalization. Digital platforms and AI tools analyze skin conditions and recommend suitable products. The Global Natural Skincare Market benefits from apps and tools that enhance consumer engagement. It is strengthened by growing trust in science-backed natural solutions. Virtual consultations and AI-driven skin mapping tools increase customer satisfaction. Personalized recommendations also reduce product returns and improve effectiveness. Integration of tech-driven personalization supports premium product adoption. This synergy between technology and natural formulations sets new benchmarks in skincare.

Rising Influence of Wellness and Holistic Beauty Across Skincare Products

Wellness-driven beauty concepts are influencing product development strategies. Skincare is now positioned as part of overall health and self-care. The Global Natural Skincare Market adapts by merging wellness with beauty routines. It is supported by demand for stress-relief, aromatherapy, and nutrient-enriched ingredients. Natural skincare is promoted as a lifestyle choice, not just cosmetic care. Brands link skincare with mental well-being, emphasizing rituals and relaxation. Consumers connect wellness with healthier, long-term skin improvement. This trend integrates skincare into broader wellness ecosystems.

- For example, Tata Harper’s Superkind Bio-Barrier Serum has 26 high-performance botanical ingredients and is marketed in the U.S. for sensitive or reactive skin. The serum claims to support and strengthen the skin’s moisture barrier, soothe visible stress, and rebalance the skin’s microbiome.

Market Challenges Analysis

High Production Costs and Limited Shelf Life of Natural Ingredients

The reliance on natural ingredients creates significant cost challenges for manufacturers. Extraction, sourcing, and processing often involve higher expenses compared to synthetic alternatives. The Global Natural Skincare Market is impacted by pricing pressures that affect both producers and consumers. It is further challenged by shorter shelf life due to lack of chemical preservatives. Maintaining product quality during storage and transport increases logistical complexity. Companies need advanced preservation techniques to ensure consistent performance. Premium pricing strategies limit affordability for mass-market consumers. Balancing cost, quality, and accessibility remains a critical challenge.

Intense Competition and Risk of Mislabeling in the Natural Skincare Industry

Rising demand has led to intense competition among global and regional players. New entrants are crowding the market with varied product claims. The Global Natural Skincare Market faces issues from misleading labels and greenwashing. It is difficult for consumers to distinguish authentic natural products from poorly regulated ones. Lack of standardization creates confusion and undermines trust. Companies with weak transparency practices face reputational risks. Established brands must focus on credible certifications and robust marketing. Addressing authenticity is vital to maintain consumer confidence.

Market Opportunities

Expansion in Emerging Economies with Rising Disposable Incomes and Awareness

Emerging economies present vast opportunities for natural skincare adoption. Rising disposable incomes in Asia Pacific, Latin America, and Africa increase spending on personal care. The Global Natural Skincare Market benefits from urbanization and expanding middle-class populations. It is supported by growing awareness of skincare routines and preference for eco-friendly products. Local production and affordable ranges can attract new consumers. Increased digital penetration enhances awareness through social media and e-commerce. Opportunity lies in creating cost-effective solutions tailored to regional preferences. This path ensures scalability and long-term consumer loyalty.

Innovation in Formulations Through Bio-Active and Functional Natural Ingredients

Bio-active ingredients such as probiotics, algae, and adaptogens are reshaping skincare formulations. These elements improve skin health and offer visible benefits. The Global Natural Skincare Market leverages innovation to enhance consumer trust and satisfaction. It is further supported by clinical validation of ingredient effectiveness. Functional natural ingredients attract health-conscious and science-driven consumers. Companies can differentiate through advanced research and transparent labeling. Aligning innovation with safety and sustainability builds strong competitive advantages. This opportunity strengthens the future direction of natural skincare development.

Market Segmentation Analysis:

The Global Natural Skincare Market is segmented

By product type

Into skin & sun care, hair care, bath & shower, men’s grooming, and others. Skin & sun care dominates due to rising awareness of safe, chemical-free skincare and demand for natural sun protection. Hair care follows strongly, supported by interest in herbal formulations for scalp health. Bath & shower products hold steady demand, while men’s grooming expands with growing interest in natural beard oils and facial care. It continues to diversify across niche categories, reflecting evolving consumer needs.

- For example, ISDIN’s Eryfotona Actinica is a 100% mineral sunscreen with 11% zinc oxide as its active ingredient. Its formula includes DNA Repairsomes® (photolyase enzymes derived from plankton) plus vitamin E, claimed to repair existing sun damage.

By packaging type

The market is divided into bottles & jars, tubes, pouches & sachets, and others. Bottles & jars lead with widespread use in creams and serums. Tubes remain popular for travel-friendly products and lotions. Pouches & sachets gain attention for sample-size options and affordability, while sustainable innovations shape all formats. It reflects growing alignment with eco-conscious choices.

By sales channel

The market includes supermarkets/hypermarkets, department stores, specialty stores, online, and others. Supermarkets and department stores provide broad exposure, while specialty stores emphasize premium positioning and organic labeling. Online sales expand rapidly with digital penetration and influencer-driven marketing. It strengthens accessibility, especially in emerging economies. This diverse channel mix enables strong consumer reach and supports long-term growth across regions.

- For example, in 2024, L’Oréal’s Professional Products Division partnered with about 3 million hairstylists globally. The division also reached 112,000 hairstylists through its Head Up mental health programmed.

Segmentation:

By Product Type

- Skin & Sun Care

- Hair Care

- Bath & Shower

- Men’s Grooming

- Others

By Packaging Type

- Bottles & Jars

- Tubes

- Pouches & Sachets

- Others

By Sales Channel

- Supermarkets/Hypermarkets

- Department Stores

- Specialty Stores

- Online

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Natural Skincare Market size was valued at USD 4,374.23 million in 2018 to USD 7,961.78 million in 2024 and is anticipated to reach USD 20,720.91 million by 2032, at a CAGR of 11.8% during the forecast period. North America accounted for 43.68% of the global market share in 2024. The region leads due to advanced retail infrastructure, high consumer spending power, and strong awareness of chemical-free formulations. Demand is reinforced by premium positioning and wellness-driven lifestyles that encourage safe skincare adoption. The Global Natural Skincare Market benefits from strict regulatory standards in the U.S. that favor clean-label cosmetics. It is further supported by innovations from multinational brands and rising consumer trust in certified organic products. E-commerce expansion strengthens availability across both urban and suburban markets. Celebrity influence and strong digital marketing amplify consumer engagement, boosting demand for sustainable, transparent, and cruelty-free skincare solutions.

Europe

The Europe Global Natural Skincare Market size was valued at USD 2,898.20 million in 2018 to USD 5,143.49 million in 2024 and is anticipated to reach USD 12,592.40 million by 2032, at a CAGR of 11.0% during the forecast period. Europe held 28.22% of the global market share in 2024. The region benefits from well-established beauty traditions and strong consumer preference for sustainable practices. The Global Natural Skincare Market in Europe is driven by strict regulatory frameworks that limit harmful ingredients. It is shaped by high adoption of organic certifications and eco-friendly packaging. Brands in Germany, France, and the UK lead through innovation and sustainable sourcing. Rising consumer demand for holistic wellness aligns with clean skincare choices. Specialty stores and pharmacies dominate distribution, supported by growing online penetration. The cultural emphasis on long-term health reinforces Europe’s leadership in the natural skincare landscape.

Asia Pacific

The Asia Pacific Global Natural Skincare Market size was valued at USD 1,847.36 million in 2018 to USD 3,691.56 million in 2024 and is anticipated to reach USD 10,889.03 million by 2032, at a CAGR of 13.6% during the forecast period. Asia Pacific represented 20.25% of the global market share in 2024. The region shows the fastest growth, driven by rising disposable incomes and evolving beauty standards. The Global Natural Skincare Market in Asia Pacific thrives on demand from China, Japan, South Korea, and India. It is supported by rapid urbanization, increased awareness of skin health, and adoption of herbal traditions. K-beauty and J-beauty trends accelerate product innovation with natural ingredients. E-commerce and cross-border trade expand consumer access to global and domestic brands. Social media and influencer-led promotions further shape consumer choices. This dynamic mix of cultural heritage and modern lifestyle drives rapid growth in natural skincare adoption.

Latin America

The Latin America Global Natural Skincare Market size was valued at USD 448.43 million in 2018 to USD 813.99 million in 2024 and is anticipated to reach USD 1,859.01 million by 2032, at a CAGR of 10.0% during the forecast period. Latin America contributed 4.47% of the global market share in 2024. Growth is supported by rising middle-class populations and expanding retail access. The Global Natural Skincare Market in Latin America benefits from increasing awareness of eco-friendly and sustainable products. It is particularly strong in Brazil, where natural resources support local ingredient sourcing. Herbal and plant-based formulations resonate with regional consumer preferences. Growing digital penetration makes online sales a key distribution channel. Rising urbanization and lifestyle changes also encourage premium skincare adoption. International brands collaborate with local distributors to strengthen their presence in key urban centers.

Middle East

The Middle East Global Natural Skincare Market size was valued at USD 222.62 million in 2018 to USD 365.54 million in 2024 and is anticipated to reach USD 759.44 million by 2032, at a CAGR of 8.7% during the forecast period. The region held 2.00% of the global market share in 2024. Consumer interest is growing due to increasing health awareness and preference for safe alternatives. The Global Natural Skincare Market in the Middle East is influenced by rising urban populations and higher spending on personal care. It is strengthened by strong demand from GCC countries, where premium beauty consumption is high. Regional beauty traditions integrate natural ingredients, boosting acceptance of eco-friendly products. Retail expansion in malls and specialty stores increases accessibility. Online channels are also gaining traction among younger consumers. International brands are entering through regional partnerships, creating growth opportunities.

Africa

The Africa Global Natural Skincare Market size was valued at USD 122.79 million in 2018 to USD 255.37 million in 2024 and is anticipated to reach USD 498.13 million by 2032, at a CAGR of 7.8% during the forecast period. Africa represented 1.40% of the global market share in 2024. Growth remains modest but promising, driven by expanding urbanization and rising awareness of skin health. The Global Natural Skincare Market in Africa is influenced by increasing demand for affordable, safe, and accessible skincare. It is particularly visible in South Africa, where consumer awareness is higher. Limited purchasing power challenges premium adoption but creates opportunities for mid-range products. E-commerce penetration is improving, supported by smartphone use and digital payments. Local brands leverage indigenous ingredients to attract regional consumers. The combination of affordability and natural heritage presents strong potential for gradual market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- The Honest Company

- Seventh Generation, Inc.

- C. Johnson & Son, Inc.

- The Clorox Company

- Burt’s Bees (Clorox)

- L’Oréal (Naturals Portfolio)

- Weleda AG

- Hauschka

- Neal’s Yard Remedies

- Tata Harper

Competitive Analysis:

The Global Natural Skincare Market is highly competitive with the presence of multinational corporations, regional players, and niche brands. It is shaped by companies focusing on clean formulations, eco-friendly packaging, and organic certifications to strengthen brand trust. Leaders such as L’Oréal, The Honest Company, Burt’s Bees, and Weleda dominate through innovation and global distribution networks. Regional players emphasize local ingredients and cultural relevance to attract consumers. It is witnessing increased merger and acquisition activity aimed at portfolio expansion and geographic reach. Start-ups are gaining traction by targeting younger consumers with personalized and sustainable offerings. E-commerce platforms further intensify competition by enabling direct-to-consumer engagement. Continuous investment in product innovation, regulatory compliance, and sustainability practices remains crucial for maintaining market leadership.

Recent Developments:

- In March 2025, Weleda AG entered a high-profile partnership with Princess Madeleine of Sweden to co-launch the minLen skincare brand. This new line, positioned as a multi-generational natural skincare brand, will debut with products for babies, children, and families, with the official public launch happening on March 28, 2025, and retail availability starting September 2025 in Europe.

- In May 2025, Burt’s Bees, a Clorox brand, partnered with Mike’s Hot Honey to release a limited-edition sweet-and-spicy lip balm, available exclusively on Burt’s Bees’ website and TikTok Shop from May 29, 2025. This product taps into the trendy “swicy” (sweet + spicy) flavor category and maintains Burt’s Bees’ hallmark moisturizing and natural ingredient profile.

- In July 2025, The Honest Company launched its new and improved Clean Conscious Diapers, which feature plant-based inner liners and enhanced leak protection tailored for different baby stages. This upgrade was specifically designed to address both performance and safety, making the product available nationwide in the United States starting July 15, 2025.

- In April 2024, Syensqo, a science-based company in Belgium, announced the acquisition of JinYoung Bio, a South Korea-based provider of cosmetic ingredients, particularly known for biomimetic ceramides and biobased functional ingredients. This strategic move is intended to expand Syensqo’s beauty care portfolio with innovative and natural specialty skincare solutions, focusing on using biotechnology for sustainable product development and catering to increased demand for natural skin care solutions globally.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Packaging Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer preference for safe and chemical-free products will continue shaping market expansion.

- Innovation in bio-active and functional natural ingredients will strengthen product differentiation.

- Increasing role of e-commerce will enhance global accessibility and accelerate direct-to-consumer engagement.

- Regional players will expand influence by leveraging indigenous resources and culturally relevant formulations.

- Stricter regulatory frameworks will reinforce clean-label compliance and boost consumer trust.

- Premium and personalized natural skincare ranges will drive strong adoption in urban markets.

- Sustainable packaging innovations will gain greater importance in competitive positioning.

- Strategic mergers and acquisitions will reshape competition and broaden geographic reach.

- Rapid growth in Asia Pacific will establish the region as a core innovation hub.

- Integration of AI and digital tools will redefine consumer experiences and personalized skincare solutions.