| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Clinical Trial Management System (CTMS) Market Size 2024 |

USD 431.73 Million |

| North America Clinical Trial Management System (CTMS) Market, CAGR |

11.12% |

| North America Clinical Trial Management System (CTMS) Market Size 2032 |

USD 1,115.22 Million |

Market Overview

The North America Clinical Trial Management System (CTMS) Market is projected to grow from USD 431.73 million in 2024 to an estimated USD 1,115.22 million by 2032, with a compound annual growth rate (CAGR) of 11.12% from 2025 to 2032. The growth of this market is largely driven by the increasing complexity of clinical trials and the need for more efficient management systems.

Several factors are driving this market’s expansion. The increasing adoption of electronic systems in clinical trials is facilitating the shift from manual to automated processes. Additionally, the growing focus on patient-centric trials, advancements in technology, and the need for regulatory compliance are fueling demand for CTMS solutions. Trends such as the integration of artificial intelligence (AI) and machine learning (ML) in clinical trials are further enhancing the capabilities of these systems, providing real-time data insights and improving trial management efficiency.

Geographically, North America is a leading market for CTMS, driven by the region’s strong healthcare infrastructure and high investment in research and development. The United States, in particular, dominates the market, hosting a large number of pharmaceutical and biotechnology companies, as well as research institutions. Key players in the North American CTMS market include Veeva Systems, Parexel International Corporation, Medidata Solutions, and Oracle Corporation, which are advancing the adoption of advanced technologies and providing comprehensive trial management solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Clinical Trial Management System (CTMS) market is projected to grow from USD 431.73 million in 2024 to USD 1,115.22 million by 2032, with a CAGR of 11.12% from 2025 to 2032.

- The global CTMS market is projected to grow from USD 1,230.00 million in 2024 to USD 3,197.78 million by 2032, with a CAGR of 11.20%. The demand for efficient and streamlined management of clinical trials drives this growth.

- The market is driven by increasing complexity in clinical trials, growing demand for automation, and the need for regulatory compliance, along with advancements in AI and machine learning technologies.

- High implementation and maintenance costs for CTMS solutions can be a barrier, especially for smaller organizations, and data security concerns are increasing as more data is collected and shared digitally.

- North America dominates the CTMS market, with the United States leading due to its well-established healthcare infrastructure, significant R&D investment, and presence of major pharmaceutical companies.

- AI and machine learning integration in CTMS platforms enhances trial management efficiency, predictive analytics, and data insights, driving adoption across clinical research organizations.

- Cloud-based CTMS solutions are gaining popularity due to their flexibility, scalability, and cost-efficiency, making them attractive to both large and small pharmaceutical companies.

- The rising focus on patient-centric clinical trials is fueling the demand for CTMS systems that offer improved patient engagement, remote monitoring, and real-time data collection capabilities.

Market Drivers

Increasing Complexity of Clinical Trials

The growing complexity of clinical trials is one of the primary drivers of the North America Clinical Trial Management System (CTMS) market. Modern clinical trials are becoming increasingly intricate, involving multiple sites, large sample sizes, and diverse patient populations. Managing such complex trials manually or using outdated systems is inefficient and prone to errors. CTMS software solutions address these challenges by streamlining the management of trial data, optimizing workflows, and improving communication across multiple stakeholders, including clinical research organizations, sponsors, and regulatory bodies. This increased demand for more advanced, centralized systems to manage complex clinical trials is fueling the adoption of CTMS in North America. Additionally, the growing prevalence of multi-center and multi-regional studies amplifies the need for systems that can integrate data from diverse sources and provide real-time visibility into trial progress. As a result, pharmaceutical companies, research organizations, and healthcare institutions in North America are increasingly turning to CTMS platforms to enhance operational efficiency, reduce trial timelines, and ensure better management of resources and data integrity.

Regulatory Compliance and Data Integrity Requirements

Regulatory compliance is a significant driver for the adoption of CTMS solutions in North America. The pharmaceutical and biotechnology industries face rigorous regulatory requirements from agencies like the U.S. Food and Drug Administration (FDA) and Health Canada. These regulations mandate that clinical trials are conducted in a highly structured and standardized manner, ensuring the safety of participants and the accuracy of trial data. CTMS platforms help companies comply with these regulations by providing tools for tracking and managing the documentation required at each stage of the clinical trial process. They support features like audit trails, electronic signatures, and automatic data validation, which are essential for meeting the stringent requirements for data integrity and compliance. With the increasing focus on regulatory scrutiny and the push for faster approval processes for drugs and treatments, the demand for robust CTMS systems that can ensure compliance while improving the efficiency and accuracy of clinical trials is rapidly growing. The ability to integrate compliance management seamlessly into clinical trial workflows is driving the adoption of CTMS across North America.

Increasing Complexity of Clinical Trials

The growing complexity of clinical trials is one of the primary drivers of the North America Clinical Trial Management System (CTMS) market. Modern clinical trials are becoming increasingly intricate, involving multiple sites, large sample sizes, and diverse patient populations. Managing such complex trials manually or using outdated systems is inefficient and prone to errors. CTMS software solutions address these challenges by streamlining the management of trial data, optimizing workflows, and improving communication across multiple stakeholders, including clinical research organizations, sponsors, and regulatory bodies. For instance, 85% of clinical trials in North America now involve multiple sites, highlighting the increasing complexity of trial designs. Additionally, the growing prevalence of multi-center and multi-regional studies amplifies the need for systems that can integrate data from diverse sources and provide real-time visibility into trial progress. As a result, pharmaceutical companies, research organizations, and healthcare institutions in North America are increasingly turning to CTMS platforms to enhance operational efficiency, reduce trial timelines, and ensure better management of resources and data integrity.

Regulatory Compliance and Data Integrity Requirements

Regulatory compliance is a significant driver for the adoption of CTMS solutions in North America. The pharmaceutical and biotechnology industries face rigorous regulatory requirements from agencies like the U.S. Food and Drug Administration (FDA) and Health Canada. These regulations mandate that clinical trials are conducted in a highly structured and standardized manner, ensuring the safety of participants and the accuracy of trial data. CTMS platforms help companies comply with these regulations by providing tools for tracking and managing the documentation required at each stage of the clinical trial process. For instance, Pfizer utilized CTMS platforms to ensure compliance with FDA guidelines during its COVID-19 vaccine trials, enabling real-time monitoring and audit trail tracking. They support features like audit trails, electronic signatures, and automatic data validation, which are essential for meeting the stringent requirements for data integrity and compliance. With the increasing focus on regulatory scrutiny and the push for faster approval processes for drugs and treatments, the demand for robust CTMS systems that can ensure compliance while improving the efficiency and accuracy of clinical trials is rapidly growing. The ability to integrate compliance management seamlessly into clinical trial workflows is driving the adoption of CTMS across North America.

Market Trends

Cloud-Based CTMS Adoption

Cloud-based CTMS solutions are increasingly gaining popularity across North America due to their scalability, cost-effectiveness, and ease of integration with other software systems. Cloud technology enables clinical trial teams to access critical trial data remotely, promoting collaboration between research institutions, sponsors, and regulatory bodies. These systems also provide enhanced data security, ensuring compliance with regulatory requirements such as 21 CFR Part 11. The shift toward cloud-based solutions offers several advantages, including real-time data access, streamlined communication, and reduced infrastructure costs. Additionally, cloud-based CTMS platforms are flexible, allowing organizations to easily scale resources based on their specific needs, making them an attractive option for both large pharmaceutical companies and smaller research organizations. As cloud computing continues to evolve, its role in CTMS solutions is expected to grow, further driving innovation and adoption.

Increased Focus on Data Integration and Interoperability

The demand for seamless data integration and interoperability across various clinical trial management platforms is another important trend in the North American CTMS market. With the growing complexity of clinical trials, sponsors and research organizations need to manage vast amounts of data from diverse sources such as electronic health records (EHR), laboratory results, and wearable devices. CTMS systems that offer strong integration capabilities can consolidate this data into a centralized platform, providing a more comprehensive view of trial progress. The ability to integrate with other systems, including regulatory compliance tools, patient management systems, and data analytics platforms, improves the accuracy and reliability of clinical trial data. Additionally, interoperability ensures that data can be shared easily between different stakeholders, improving collaboration, decision-making, and overall trial efficiency. As the need for more connected and cohesive trial management systems continues to rise, the focus on data integration and interoperability will remain a key trend in the market.

Integration of Artificial Intelligence and Machine Learning in CTMS Solutions

One of the current trends in the North America Clinical Trial Management System (CTMS) market is the integration of artificial intelligence (AI) and machine learning (ML) into trial management processes. For instance, AI-powered predictive analytics tools are being used to optimize patient recruitment and retention rates, significantly improving trial enrollment timelines. Additionally, machine learning models are employed to process large datasets more effectively, reducing human error and streamlining data analysis. These technologies have demonstrated their ability to enhance trial efficiency, with some platforms reporting up to a 30% reduction in operational costs through automation of routine tasks. By providing real-time insights and predictive modeling, AI and ML are accelerating time-to-market for new therapies and improving the overall quality of clinical trials.

Rise of Patient-Centric Clinical Trials

A notable trend in the North America CTMS market is the growing emphasis on patient-centric clinical trials. For instance, remote monitoring technologies integrated into CTMS platforms allow trial sponsors to collect real-time data from patients, ensuring better health management and engagement throughout the trial process. Mobile health apps and telemedicine integrations have further enhanced patient convenience, reducing the likelihood of dropouts. Patient-centric systems improve retention rates by up to 20%, as they provide greater transparency in trial progress and ensure patients are well-informed. As healthcare providers and sponsors continue to prioritize patient engagement, these platforms are becoming the industry standard, optimizing trial outcomes while enhancing patient experiences.

Market Challenges

Data Privacy and Security Concerns

The North America Clinical Trial Management System (CTMS) market faces significant challenges related to data privacy and security. For instance, clinical trials collect sensitive patient information, including personal health data, which must comply with stringent regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States. Ensuring the security of this data is critical to maintaining patient trust and avoiding potential legal and financial repercussions. As the adoption of cloud-based CTMS solutions grows, the risk of data breaches and cyber-attacks also increases. For example, while cloud providers implement robust security measures, the complexity of managing and securing vast amounts of data across multiple platforms remains a challenge. Additionally, the integration of technologies like wearables, mobile health applications, and remote monitoring in clinical trials amplifies the volume and diversity of data being collected, further complicating data management and protection. Organizations are addressing these challenges by investing in advanced encryption methods, multi-factor authentication, and regular security audits. For instance, some companies are adopting zero-trust security frameworks to enhance data protection and mitigate risks. These measures are essential to safeguarding the integrity of clinical trials and ensuring the continued adoption of CTMS platforms across the industry.

High Implementation and Maintenance Costs

Another challenge facing the North America CTMS market is the high cost associated with the implementation and maintenance of these systems. While CTMS platforms offer significant benefits in terms of efficiency and trial management, the initial costs of acquiring and deploying these solutions can be prohibitive, particularly for smaller research organizations or academic institutions. The expense includes licensing fees, infrastructure setup, and the need for specialized training for users. Additionally, maintaining a CTMS solution requires ongoing investments in software updates, security patches, and support services. These continuous costs can be a financial burden for organizations that are already managing tight research budgets. Furthermore, the complexity of integrating CTMS platforms with other enterprise systems, such as electronic health records (EHR) or laboratory information management systems (LIMS), can lead to additional costs and implementation delays. As a result, some organizations may be hesitant to invest in CTMS solutions or struggle with system adoption, potentially limiting the market’s growth. To overcome this challenge, CTMS providers are focusing on offering scalable, cost-effective solutions with flexible pricing models to make their platforms more accessible to a wider range of users.

Market Opportunities

Expansion of Personalized and Precision Medicine

One of the significant market opportunities for the North America Clinical Trial Management System (CTMS) market lies in the growing demand for personalized and precision medicine. As the focus of medical research shifts towards tailoring treatments to individual patient profiles, clinical trials are becoming more complex and require highly specialized management systems. CTMS platforms can capitalize on this trend by offering features that support the customization of trial protocols, patient stratification, and real-time data analytics. With the increasing adoption of genomic data and biomarkers in clinical trials, CTMS platforms that can integrate diverse data sources and provide insights into personalized treatment pathways will be in high demand. This shift toward precision medicine opens opportunities for CTMS providers to enhance their platforms’ capabilities, thus meeting the evolving needs of pharmaceutical companies, research institutions, and healthcare providers. By enabling the management of trials that target specific patient populations with greater accuracy and efficiency, CTMS solutions can help expedite the development of tailored therapies, making them an indispensable tool in the future of healthcare.

Growth in Virtual and Decentralized Clinical Trials

Another significant opportunity for the North America CTMS market is the rapid rise of virtual and decentralized clinical trials. These trial models, which rely on remote patient monitoring, digital health technologies, and telemedicine, are increasingly being adopted to improve patient access, reduce recruitment timelines, and enhance patient retention. CTMS platforms that can accommodate the needs of decentralized trials, including remote data collection, secure patient communication, and regulatory compliance across multiple jurisdictions, are well-positioned to capitalize on this trend. The expansion of virtual trials, accelerated by the COVID-19 pandemic, is expected to continue as healthcare organizations seek more flexible and cost-effective ways to conduct clinical research. By adapting their systems to support virtual and decentralized trials, CTMS providers can unlock new growth opportunities and expand their customer base across the North American market.

Market Segmentation Analysis

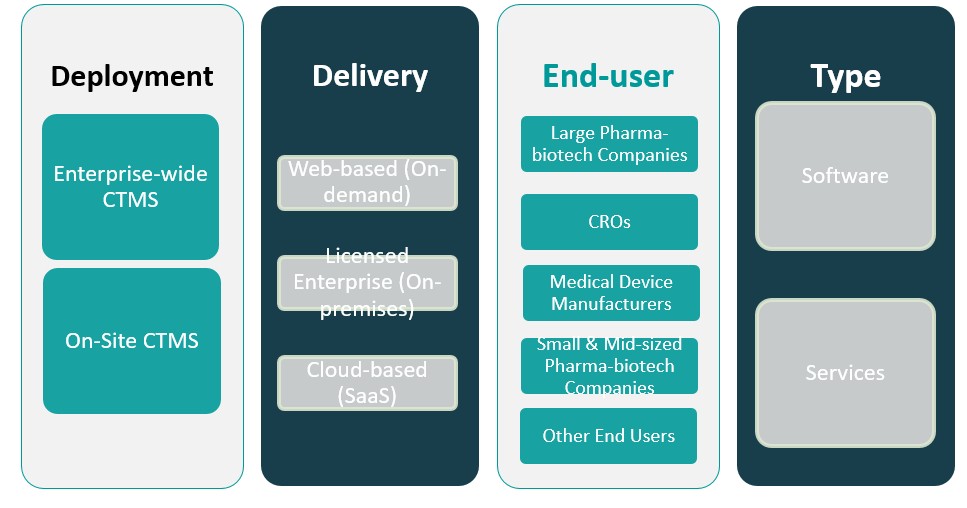

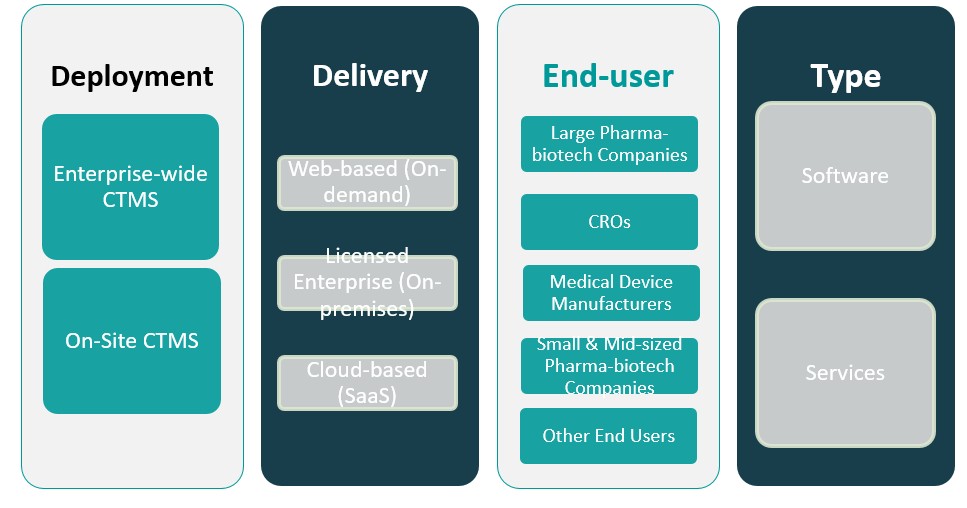

By Deployment

The deployment of CTMS solutions in North America is primarily divided into three categories: enterprise-wide CTMS, on-site CTMS, and cloud-based solutions. Enterprise-wide CTMS is gaining prominence due to its ability to support large-scale, multi-site clinical trials. These systems provide a centralized platform for trial data management, improving collaboration and efficiency across various stakeholders. On-site CTMS solutions are typically adopted by smaller organizations or those requiring localized systems for specific trials. These solutions are more traditional and often require greater resources for implementation and maintenance. Cloud-based CTMS, on the other hand, is increasingly preferred for its scalability, cost-effectiveness, and accessibility. The shift toward cloud-based solutions has been accelerated by the growing need for remote data access and real-time collaboration, particularly in decentralized trials.

By Delivery

The delivery models for CTMS are classified into three categories: web-based (on-demand), licensed enterprise (on-premises), and cloud-based (SaaS). Web-based (on-demand) CTMS offers flexibility, as it is accessed via a web browser and requires minimal infrastructure investment. It is popular among organizations that prefer subscription-based models with lower upfront costs. Licensed enterprise (on-premises) CTMS is suited for large organizations with stringent data security requirements, as it offers full control over system infrastructure. Cloud-based (SaaS) CTMS is becoming the most dominant model due to its scalability, remote accessibility, and ease of integration with other systems. It offers reduced IT costs and is preferred by organizations looking for a flexible and cost-effective solution for managing clinical trials.

Segments

Based on Deployment

- Enterprise-wide CTMS

- On-Site CTMS

Based on Delivery

- Web-based (On-demand)

- Licensed Enterprise (On-premises)

- Cloud-based (SaaS)

Based on End User

- Large Pharma-biotech Companies

- CROs

- Medical Device Manufacturers

- Small & Mid-sized Pharma-biotech Companies

- Other End Users

Based on Type

Based on Region

Regional Analysis

United States (75%)

The United States holds the largest share of the North American CTMS market, accounting for around 75% of the total market. The country is home to a significant number of pharmaceutical companies, contract research organizations (CROs), and academic research institutions, all of which rely heavily on CTMS solutions for managing clinical trials. The U.S. is also the leader in clinical research, with a large volume of multi-center trials conducted across its vast network of hospitals, universities, and research centers. The strong regulatory framework established by the Food and Drug Administration (FDA) further drives the need for efficient and compliant trial management systems. Additionally, the increasing trend toward decentralized and virtual clinical trials in the U.S. is pushing demand for cloud-based CTMS platforms, further contributing to the growth of the market.

Canada (10%)

Canada holds approximately 10% of the North American CTMS market share. While the country’s market is smaller compared to the United States, it is experiencing rapid growth. Canada benefits from a robust healthcare system, increasing numbers of clinical trials, and government support for healthcare innovation. The adoption of CTMS platforms is growing steadily among pharmaceutical companies, academic research institutions, and healthcare organizations. Canada’s healthcare system, which emphasizes patient safety and regulatory compliance, aligns with the capabilities of CTMS solutions to improve trial management and ensure adherence to regulatory standards.

Key players

- Forte Research Systems

- ICON plc

- Merge Healthcare Incorporated

- Bio-Optronics

- DSG Inc.

- ArisGlobal

- ERT Clinical Bioclinica

- Oracle Corporation

- Medidata Solutions

- DATATRAK International, Inc.

Competitive Analysis

The North American Clinical Trial Management System (CTMS) market is highly competitive, with several key players offering diverse solutions to meet the growing demand for efficient trial management. Companies like Medidata Solutions and Oracle Corporation dominate the market, providing comprehensive CTMS solutions that support large-scale clinical trials, leveraging cloud-based platforms and artificial intelligence to streamline trial management processes. ICON plc and ERT Clinical Bioclinica excel in providing robust solutions for data collection and real-time analytics, focusing on improving patient recruitment and monitoring. Forte Research Systems and Bio-Optronics cater to niche markets by offering specialized solutions for smaller research organizations and academic institutions. Meanwhile, companies like Merge Healthcare Incorporated and ArisGlobal are making strides with integrated software platforms that enhance data integrity and regulatory compliance. Overall, the competition is intense, with players constantly innovating to offer scalable, customizable solutions that cater to the evolving needs of the clinical research industry.

Recent Developments

- In May 2024, ICON released its ICON Cares 2023 Report, highlighting initiatives to increase patient access to clinical trials and drive innovation through technology and partnerships.

- In July 2024, Merative released new versions of Merge Imaging Suite components, enhancing usability, deployment, and maintenance.

- In February 2025, Oracle was recognized as a ‘Leader’ in the Everest Group Life Sciences CTMS Products PEAK Matrix Assessment 2024.

- In February 2025, Medidata secured the SCOPE Best of Show Award for Clinical Data Studio.

- In 2024, ArisGlobal reported significant customer growth, including 11 new top-tier pharma LifeSphere customers and a 40% year-over-year increase in new customers in the Asia Pacific region.

Market Concentration and Characteristics

The North America Clinical Trial Management System (CTMS) market exhibits a moderate to high concentration, with a mix of large, established players and niche providers catering to specialized needs. Major companies like Medidata Solutions, Oracle Corporation, and ICON plc hold a significant share of the market, offering comprehensive, enterprise-level CTMS solutions that support large-scale trials, regulatory compliance, and data integration. These players leverage cloud-based platforms, advanced analytics, and AI to enhance the efficiency and scalability of clinical trials. At the same time, smaller players such as Bio-Optronics and Forte Research Systems focus on providing tailored solutions for smaller research organizations and academic institutions. The market is characterized by rapid technological advancements, particularly in cloud computing, AI, and real-time data analytics, as well as an increasing emphasis on decentralized and patient-centric clinical trials. The competitive landscape is dynamic, with continuous innovations and partnerships aimed at improving the overall trial management process.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Deployment, Delivery, End User, Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of cloud-based CTMS solutions will continue to rise, offering flexibility, scalability, and reduced infrastructure costs for clinical trial management.

- AI and machine learning technologies will further integrate into CTMS platforms, enhancing data analytics, predictive modeling, and risk management for more efficient trial processes.

- As decentralized and virtual clinical trials gain traction, CTMS platforms will evolve to support remote monitoring, telemedicine, and real-time data collection, improving patient access and retention.

- Future CTMS systems will incorporate advanced features to ensure seamless compliance with evolving regulatory standards, especially in multi-regional trials.

- The shift towards patient-centric trial designs will drive the demand for CTMS platforms with enhanced patient engagement tools, improving participant satisfaction and trial outcomes.

- As small and mid-sized pharmaceutical companies increasingly seek cost-effective trial management solutions, the demand for scalable CTMS platforms will grow significantly.

- With heightened concerns over data privacy, future CTMS platforms will prioritize robust cybersecurity measures, ensuring compliance with data protection regulations like HIPAA.

- Partnerships between CTMS providers and technology companies will accelerate the development of advanced features, such as integration with EHRs and wearables, enhancing trial efficiency.

- Future CTMS platforms will offer more advanced real-time monitoring capabilities, allowing sponsors and CROs to gain immediate insights into trial progress and make faster decisions.

- The rise of precision medicine will drive demand for CTMS solutions that can manage increasingly complex, personalized trial designs, supporting the integration of genomic and biomarker data.