Market Overview:

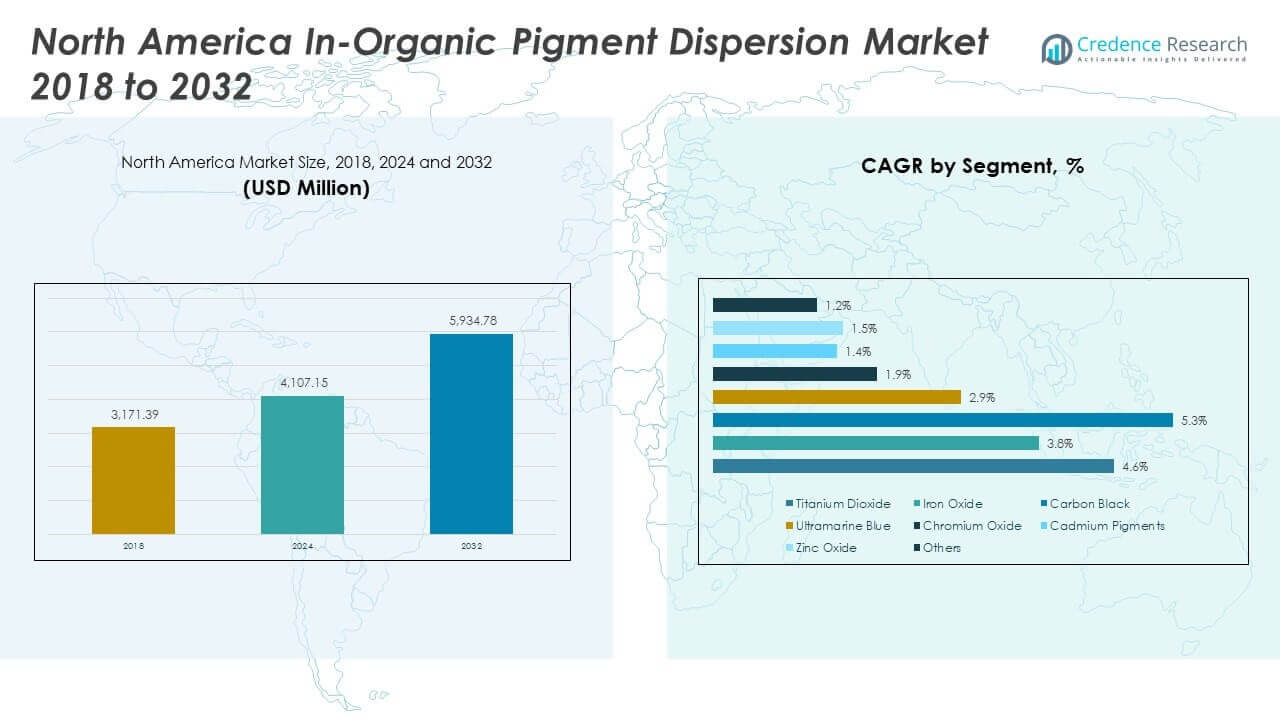

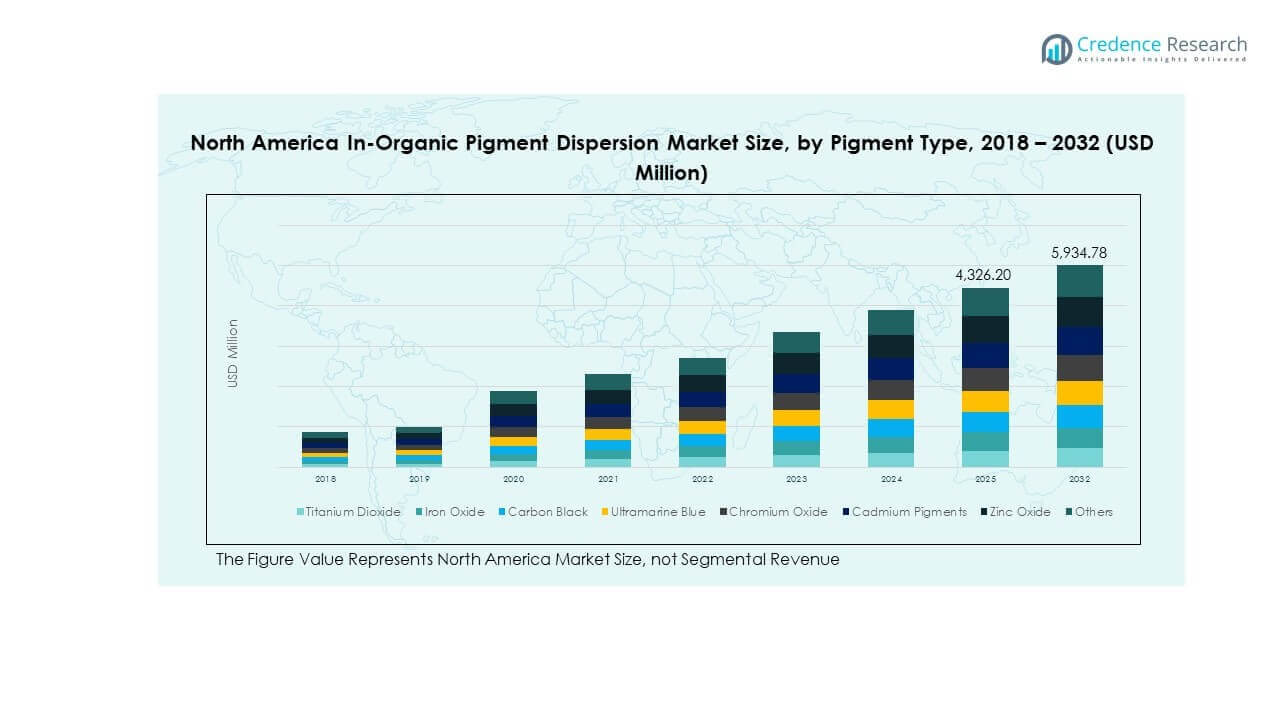

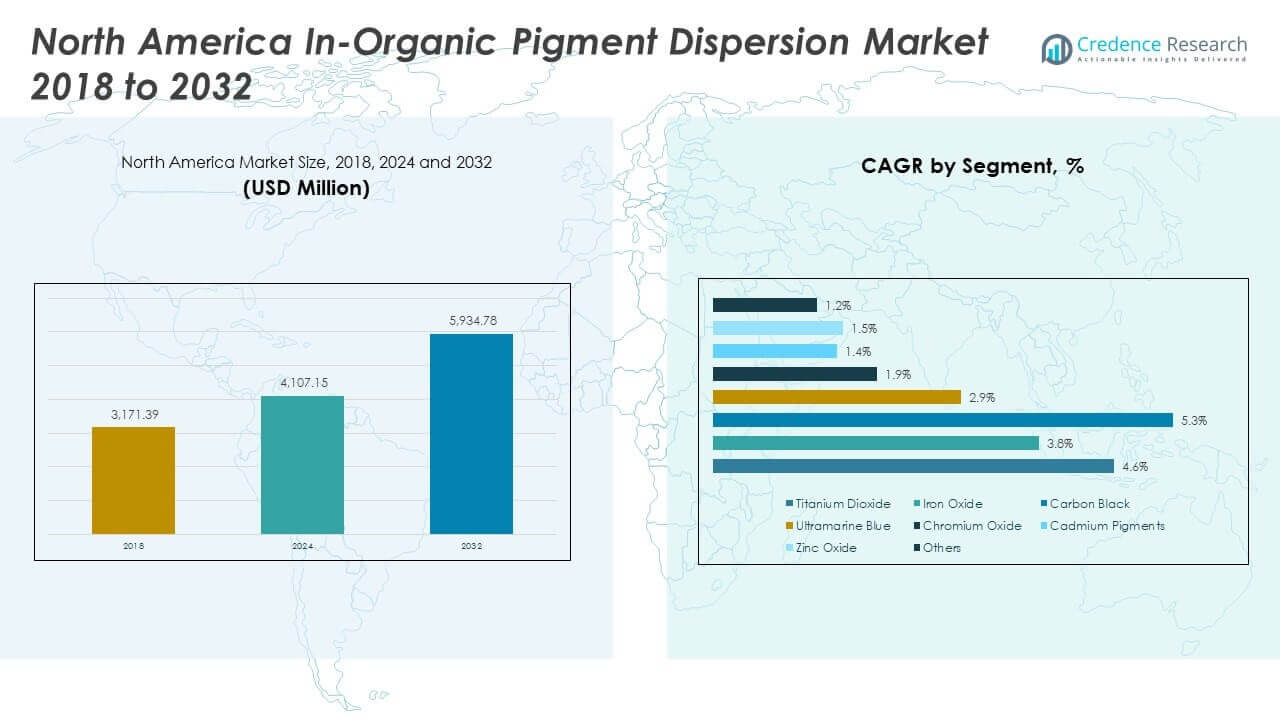

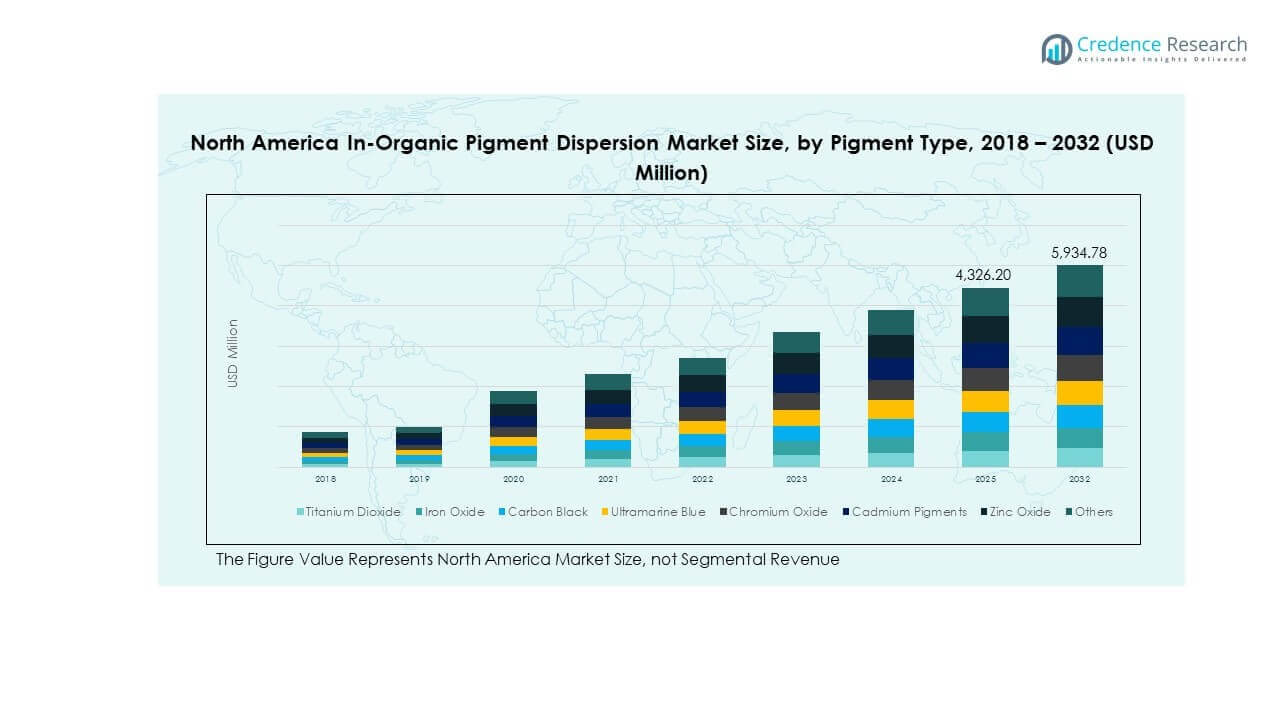

The North America In-Organic Pigment Dispersion Market size was valued at USD 3,171.39 million in 2018 to USD 4,107.15 million in 2024 and is anticipated to reach USD 5,934.78 million by 2032, at a CAGR of 4.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America In-Organic Pigment Dispersion Market Size 2024 |

USD 4,107.15 Million |

| North America In-Organic Pigment Dispersion Market, CAGR |

4.60% |

| North America In-Organic Pigment Dispersion Market Size 2032 |

USD 5,934.78 Million |

The market is driven by increasing demand from industries such as construction, automotive, packaging, and printing inks, which rely on pigment dispersions for durability and performance. The rising adoption of environmentally compliant pigments supports growth as regulations push for safer formulations. Innovation in high-performance pigments offering better stability, weather resistance, and color strength fuels wider application in coatings and plastics. Growing infrastructure projects and industrial activities in North America further strengthen market demand, while sustainability goals accelerate the shift toward eco-friendly pigment dispersion technologies across multiple sectors.

Geographically, the United States dominates the North America In-Organic Pigment Dispersion Market due to strong industrial manufacturing, advanced infrastructure projects, and high demand from automotive and packaging sectors. Canada shows steady growth supported by rising construction and coatings demand, particularly in residential and commercial developments. Mexico is emerging as a promising market, driven by expanding industrialization and growing automotive manufacturing presence. The region benefits from well-established supply chains, technological advancements, and regulatory frameworks encouraging the adoption of sustainable and high-performance pigment dispersions.

Market Insights

- The North America In-Organic Pigment Dispersion Market was valued at USD 3,171.39 million in 2018, reached USD 4,107.15 million in 2024, and is projected to attain USD 5,934.78 million by 2032, growing at a CAGR of 4.60%.

- The Global In-Organic Pigment Dispersion Market size was valued at USD 16,838.20 million in 2018 to USD 22,344.57 million in 2024 and is anticipated to reach USD 32,078.14 million by 2032, at a CAGR of 4.53% during the forecast period.

- The United States holds 62% share, Canada accounts for 23%, and Mexico represents 15%, with the U.S. leading due to strong industrial demand, Canada advancing through sustainability adoption, and Mexico rising with expanding automotive and plastics production.

- Mexico, though smaller in base share at 15%, emerges as the fastest-growing region, driven by industrialization, foreign investments in manufacturing, and growing infrastructure development.

- By pigment type, titanium dioxide captures the highest share in 2024 at 38%, supported by its broad use in paints, coatings, and plastics.

- Iron oxide follows with a 21% share, sustained by strong demand in construction and decorative materials, reinforcing its importance in regional pigment applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand Across Automotive, Construction, and Packaging Sectors

The North America In-Organic Pigment Dispersion Market benefits from increasing use in coatings, plastics, and inks. Automotive applications rely on dispersions for durable and vibrant finishes, while construction industries adopt them for paints and protective coatings. Packaging continues to drive demand with the need for stronger visual appeal and product differentiation. It plays a critical role in achieving consistent color strength and stability across large-scale production. Regulations emphasizing product safety are shaping consumer preferences toward reliable pigment dispersions. Demand remains supported by rising residential and commercial building activity across the region. Growing urbanization further expands opportunities for high-quality dispersions in infrastructure projects. The combined industrial pull enhances overall growth in the regional market.

Rising Demand for High-Performance Pigments with Enhanced Functional Properties

Manufacturers prioritize pigment dispersions that deliver strong performance under challenging conditions. The North America In-Organic Pigment Dispersion Market advances through demand for heat resistance, chemical stability, and lightfastness. Coatings and plastics industries lead the shift toward premium products that withstand environmental stress. It allows end users to maintain durability without compromising visual quality. Automotive companies increasingly select pigment dispersions to improve vehicle aesthetics and performance. Demand for strong weather-resistant properties has expanded across outdoor applications. Industrial buyers also value cost savings through extended product lifespans. This trend drives consistent focus on advanced pigment solutions across the value chain.

Supportive Regulatory Environment Favoring Safer and Eco-Friendly Pigments

Government regulations encourage adoption of safer pigment dispersions in North America. Environmental standards drive a transition toward non-toxic and heavy-metal-free options. The North America In-Organic Pigment Dispersion Market aligns with sustainable manufacturing practices enforced by industry bodies. It influences procurement policies across packaging and construction sectors. Buyers now evaluate suppliers based on compliance and eco-certifications. These changes strengthen competitive positioning of companies offering green pigment technologies. Regulatory oversight also ensures higher quality and consistency across production. Industry response to compliance measures builds trust among consumers and business buyers.

- For example, in February 2025, LANXESS launched micronized iron oxide yellow pigments Bayferrox 3910, 3910 LV, and 3920 under its Scopeblue label for the North American paints and coatings industry. Produced with eco-efficient raw materials and renewable energy, these pigments achieve a product carbon footprint (PCF) 35% lower than conventional Bayferrox grades, verified through TÜV Rheinland and certified under the ISCC Plus mass balance method.

Growing Role of Technological Innovations and Advanced Dispersion Techniques

Continuous investment in research enhances pigment performance across industries. The North America In-Organic Pigment Dispersion Market adapts through advanced milling, stabilization, and dispersion methods. It ensures pigments achieve finer particle distribution and improved consistency. Technology allows stronger integration into resins and polymers, expanding versatility. Automotive and industrial coatings benefit from greater application efficiency and reduced waste. Technological advances also reduce energy costs in pigment processing. Suppliers invest in automation to streamline production and quality control. This ongoing innovation supports long-term competitiveness in the regional market.

- For example, Clariant and other pigment producers in North America implemented precision-controlled milling and advanced dispersion technologies from 2020 onwards. These techniques deliver finer particle distributions and consistent dispersion for high-performance coatings. Products introduced under these lines show improved color stability and reduced waste in industrial production.

Market Trends

Shift Toward Customized Pigment Solutions to Address Industry-Specific Needs

The North America In-Organic Pigment Dispersion Market shows rising interest in tailor-made pigment systems. Automotive manufacturers seek dispersions aligned with brand-specific color palettes. Packaging industries prioritize pigments that offer barrier compatibility with diverse substrates. It helps create customized appearances that support product branding. Construction companies require dispersions designed for high durability in harsh conditions. End users value suppliers who deliver flexibility in formulation. Growing demand for personalized pigment solutions reflects a wider focus on differentiation. This trend encourages stronger collaboration between manufacturers and application industries.

Integration of Digital Color Matching and Smart Production Technologies

Pigment producers increasingly deploy digital tools for quality control and efficiency. The North America In-Organic Pigment Dispersion Market incorporates advanced color-matching technologies. It helps ensure precise alignment with customer specifications across industries. Digital systems reduce turnaround times and enhance batch consistency. Automation in production supports higher throughput with minimal errors. Smart manufacturing also drives sustainability by lowering material wastage. Clients benefit from faster response times for customized orders. This trend strengthens competitiveness for regional suppliers in global markets.

- For example, Dynamic Color Solutions (DCS Inc.) in North America offers automated color-dispensing systems tailored for precast concrete producers. Using these systems, clients can choose from over 4,000 standard pigment colors or create custom blends with exceptional precision and accuracy. The automation ensures consistent batch performance and minimizes human error, supporting rapid turnaround of custom orders.

Increased Adoption of Sustainable Raw Materials and Circular Practices

Manufacturers invest in sustainable supply chains to reduce environmental impact. The North America In-Organic Pigment Dispersion Market integrates renewable raw materials into production. It drives industry transformation toward biodegradable or recyclable options. Demand grows for pigments supporting closed-loop manufacturing practices. Industrial buyers prefer suppliers demonstrating circular economy initiatives. Recycling waste streams into pigment applications strengthens eco-friendly strategies. Partnerships with raw material providers improve long-term sustainability. This trend highlights growing consumer and regulatory preference for green products.

Expansion of Dispersions in Advanced Coatings and Specialty Applications

Pigment dispersions gain relevance in high-performance and specialty coatings. The North America In-Organic Pigment Dispersion Market supports aerospace, defense, and electronics sectors. It contributes to advanced coatings that meet strict durability requirements. Specialty pigments expand into thermal insulation, corrosion resistance, and functional films. Demand grows in niche segments requiring superior color strength and performance. Application in 3D printing materials demonstrates further potential for dispersions. Suppliers invest in R&D to meet emerging needs in technology-driven sectors. The trend broadens the scope of pigment dispersions beyond traditional markets.

- For example, Atomic Layer Deposition (ALD) now supports advanced aerospace and electronics coatings in North America. It enables precise control of pigment layers, enhanced durability, and superior adhesion. ALD-coated aerospace components demonstrate improved protection against corrosion and wear while meeting strict weight and material specifications. This technology enables application of high-performance coatings in aviation, automotive, and electronics that satisfy rigorous industry standards.

Market Challenges Analysis

Volatile Raw Material Costs and Supply Chain Disruptions Impacting Growth

The North America In-Organic Pigment Dispersion Market faces challenges due to fluctuating raw material costs. Rising expenses for minerals, solvents, and additives pressure profitability. It complicates long-term supply contracts with major industries. Disruptions in global trade and logistics increase delivery delays and shortages. Price volatility impacts small and medium-scale producers more severely. Clients often shift to alternate suppliers, creating unpredictable demand patterns. Managing consistent production quality under such conditions becomes difficult. Industry stakeholders must balance price sensitivity with reliability of supply.

Intense Market Competition and Stringent Environmental Regulations

Competition remains high among regional and international pigment suppliers. The North America In-Organic Pigment Dispersion Market experiences pricing pressures due to oversupply in certain segments. It drives consolidation strategies to improve market share. Stricter environmental rules limit use of certain pigments, raising compliance costs. Meeting evolving safety standards demands ongoing investment in R&D. Smaller players struggle with regulatory burdens and limited innovation capacity. Customer expectations for greener alternatives intensify competitive challenges. Industry players must differentiate through technology, sustainability, and quality.

Market Opportunities

Growing Penetration of Pigment Dispersions in Smart and Functional Applications

The North America In-Organic Pigment Dispersion Market presents opportunities in advanced applications such as electronics, solar panels, and specialty films. It plays a role in enhancing conductivity, thermal stability, and visual performance. Industries seek pigments that contribute to both aesthetics and functional benefits. Smart coatings with anti-corrosion or UV protection properties expand demand potential. Companies can capture growth by innovating dispersions aligned with these evolving requirements. Expansion into functional markets supports higher margins and new revenue streams. Strategic partnerships accelerate product adoption across specialized industries.

Rising Opportunities in Eco-Friendly and Next-Generation Dispersion Solutions

The North America In-Organic Pigment Dispersion Market gains opportunities through development of sustainable dispersions. It reflects demand from construction, packaging, and automotive sectors for eco-certified materials. Suppliers adopting bio-based solvents and recyclable formulations strengthen their competitive edge. New dispersion technologies with low-VOC content align with stricter environmental laws. Manufacturers advancing eco-label products attract both regulatory and consumer trust. Growing investments in sustainable R&D create pathways for long-term profitability. Industry players focusing on green chemistry achieve stronger positions in the regional market.

Market Segmentation Analysis

By pigment type, titanium dioxide leads the North America In-Organic Pigment Dispersion Market due to its widespread use in paints, coatings, and plastics. Iron oxide holds strong demand in construction and decorative applications, while carbon black supports plastics, printing inks, and industrial coatings. It also finds growth opportunities in specialty pigments such as ultramarine blue and chromium oxide for ceramics, glass, and niche applications. Zinc oxide gains traction in cosmetics and coatings, while cadmium pigments face restrictions yet maintain limited use in specialized segments. The “others” category reflects dispersions tailored for unique performance requirements.

- For example, BASFoffers APEO-free, aqueous iron oxide pigment dispersions such as PureOptions® I Brown Iron Oxide, which are widely adopted in architectural and concrete applications to provide high color durability and comply with sustainability standards.

By application, paints and coatings dominate with significant share supported by construction, automotive, and industrial sectors. Printing inks hold a stable position, driven by packaging and publishing demand. Plastics represent a growing application segment where pigment dispersions provide durability and aesthetic value. Construction materials adopt dispersions for coloring cement, tiles, and infrastructure coatings. It is further supported by use in ceramics, glass, and cosmetics, where pigments add both functional and decorative value. The “others” category includes smaller but emerging applications requiring specialized performance.

- For example, in 2023, Amazon reported using 83,513 metric tons of single-use plastic packaging in the U.S. and Canada, which accounted for 94% of its global plastic packaging usage.

Segmentation

By Pigment Type

- Titanium Dioxide

- Iron Oxide

- Carbon Black

- Ultramarine Blue

- Chromium Oxide

- Cadmium Pigments

- Zinc Oxide

- Others

By Application

- Paints & Coatings

- Printing Inks

- Plastics

- Construction Materials

- Ceramics and Glass

- Cosmetics

- Others

By Region

Regional Analysis

United States

The United States dominates the North America In-Organic Pigment Dispersion Market with a market share of 62%. Strong demand from automotive, construction, and packaging industries sustains its leading position. It benefits from advanced manufacturing capabilities and steady investments in high-performance pigment technologies. Regulatory policies encouraging eco-friendly pigment use drive innovation and adoption. Expanding residential construction and infrastructure projects support consistent demand. U.S.-based players also leverage strong distribution networks to enhance their reach and competitiveness.

Canada

Canada holds a 23% share of the North America In-Organic Pigment Dispersion Market, supported by its growing construction and packaging sectors. Demand increases through rising urban development and infrastructure modernization. It gains momentum as industries emphasize sustainable pigments to meet regulatory requirements. Canadian manufacturers focus on high-quality dispersions that serve paints, coatings, and specialty applications. The country’s export-driven economy benefits from trade partnerships within the region. Continuous investment in green technologies strengthens its competitive edge.

Mexico

Mexico accounts for 15% of the North America In-Organic Pigment Dispersion Market, driven by expanding industrial and automotive production. It experiences growth through the rising adoption of dispersions in plastics and coatings. Affordable labor and strengthening supply chain infrastructure make Mexico attractive for international manufacturers. It benefits from increasing foreign investments in automotive and construction industries. Domestic demand grows with urbanization and packaging sector expansion. The country’s role continues to rise as a key emerging market in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The North America In-Organic Pigment Dispersion Market remains highly competitive with the presence of global and regional players. Leading companies such as DCL Corporation, Chromaflo: A Vibrantz Technologies, and Barentz hold significant influence through strong product portfolios and distribution networks. It experiences intense competition driven by innovation, sustainability commitments, and price pressures. Regional companies like Palmer Holland, Hapco, and ChromaScape strengthen their positions by offering customized solutions to niche industries. Players emphasize mergers, acquisitions, and regional expansion strategies to enhance their market share. International suppliers increase investment in advanced pigment dispersion technologies that align with eco-friendly standards. Competitive success depends on maintaining product quality, regulatory compliance, and operational efficiency. The market structure reflects a balance between established leaders and emerging suppliers adapting to evolving industry demands.

Recent Developments

- In August 2025, a new distribution partnership was established between DCL Corporation and Superior Materials Inc., effective August 1, 2025. This agreement covers distribution of DCL’s pigment products and is aimed at enhancing supply capabilities and market reach for in-organic pigment dispersions in North America.

- In June 2025, Clariant AG launched HOSTAPHAT OPS 100, a dispersing agent specifically developed for metal-containing pigments and their dispersions, supporting advanced pigment preparations in industrial coatings and related markets.

- In February 2025, Lorama Group Inc. acquired the colorant dispersions business of DCL Corporation, including manufacturing assets in Ontario, Canada, and Waterfoot, UK. This strategic move strengthens Lorama’s position as a global color solutions leader and marks a significant shift in DCL’s business structure.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The North America In-Organic Pigment Dispersion Market will see continued growth through rising demand in automotive, construction, and packaging sectors.

- Innovation in pigment technologies will support advanced applications across coatings, plastics, and specialty chemicals.

- Sustainability will drive adoption of eco-friendly pigment dispersions aligned with regional regulatory frameworks.

- Increased R&D spending will enhance dispersion stability, color performance, and long-term durability.

- Expanding infrastructure projects will strengthen demand for paints, coatings, and construction materials.

- Growing plastic consumption across industries will create opportunities for tailored pigment formulations.

- Digitalization of manufacturing processes will improve consistency, quality control, and cost efficiency.

- Strategic alliances and acquisitions will shape the competitive landscape with broader product portfolios.

- Rising urbanization in North America will accelerate adoption of dispersions in residential and commercial projects.

- Continuous expansion into niche applications such as ceramics, glass, and cosmetics will diversify market opportunities.