| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Industrial Hemp Market Size 2023 |

USD 2,803.52 Million |

| North America Industrial Hemp Market, CAGR |

21.6% |

| North America Industrial Hemp Market Size 2032 |

USD 16,312.71 Million |

Market Overview

North America Industrial Hemp Market size was valued at USD 2,803.52 million in 2023 and is anticipated to reach USD 16,312.71 million by 2032, at a CAGR of 21.6% during the forecast period (2023-2032).

The North America industrial hemp market is experiencing robust growth driven by increasing consumer awareness of the environmental and health benefits associated with hemp-based products. The legalization of industrial hemp cultivation across various U.S. states and Canada has significantly expanded its application across industries, including textiles, food and beverages, personal care, and automotive. Rising demand for sustainable and plant-based alternatives is encouraging manufacturers to adopt hemp in product innovation. Additionally, growing interest in cannabidiol (CBD) products for wellness and therapeutic uses continues to boost market momentum. Technological advancements in processing and cultivation practices are enhancing crop yield and quality, further strengthening supply chains. The market also benefits from supportive regulatory frameworks and government initiatives aimed at promoting sustainable agriculture. These trends, coupled with increasing investments from major players and startups alike, are positioning industrial hemp as a key contributor to the region’s bio-economy and a viable alternative to traditional raw materials.

The North America industrial hemp market is geographically anchored by the United States, followed by Canada and Mexico, with each country contributing uniquely to the region’s growth. The U.S. leads in terms of cultivation, innovation, and product development, supported by favorable legislation and a rapidly expanding wellness industry. Canada, with its mature regulatory framework and strong agricultural base, plays a crucial role in supplying high-quality hemp for both domestic use and export. Mexico is an emerging player, showing potential through evolving regulations and growing interest in hemp-based industries. The regional market is driven by key players such as Green Thumb Industries, Canopy Growth Corporation, Aurora Cannabis Inc., and The Cronos Group, who are actively investing in product diversification, sustainability, and technological advancements. Other notable companies, including Ecofibre Ltd., Curaleaf Holdings, and Hemp, Inc., are also contributing to the market’s growth through strategic partnerships and expansion of hemp-derived product lines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America industrial hemp market was valued at USD 2,803.52 million in 2023 and is projected to reach USD 16,312.71 million by 2032, growing at a CAGR of 21.6% from 2023 to 2032.

- The global industrial hemp market was valued at USD 7,987.24 million in 2023 and is expected to reach USD 46,774.80 million by 2032, growing at a CAGR of 21.7% from 2023 to 2032.

- Increasing demand for sustainable, plant-based alternatives across industries is a key driver of market growth.

- The booming CBD wellness sector and growing use of hemp in personal care, nutrition, and construction are shaping major industry trends.

- Leading companies are focusing on product innovation, strategic partnerships, and expanding processing capacity to stay competitive.

- Regulatory inconsistencies across U.S. states and limited infrastructure for large-scale processing act as market restraints.

- The U.S. dominates the regional market due to legal reforms and industrial adoption, while Canada shows strong export potential and Mexico is emerging steadily.

- Ongoing investments in research and development are enhancing hemp applications and positioning the crop as a key player in the bioeconomy.

Report Scope

This report segments the North America Industrial Hemp Market as follows:

Market Drivers

Regulatory Support and Legalization of Industrial Hemp

One of the primary drivers of the North American industrial hemp market is the favorable regulatory environment. For instance, the U.S. Department of Agriculture (USDA) established the Domestic Hemp Production Program under the 2018 Farm Bill, providing guidelines for hemp cultivation and compliance. Canada, already ahead in hemp regulation, provides a structured framework that further solidifies the region’s leadership in hemp production. Government policies supporting sustainable agriculture and green industrial practices continue to strengthen the regulatory landscape, making it conducive for market growth. These legal advancements have not only legitimized the hemp industry but have also attracted stakeholders from sectors like agriculture, biotechnology, and consumer goods.

Rising Demand for Sustainable and Plant-Based Alternatives

Environmental concerns and the shift toward sustainability are major factors fueling demand for industrial hemp. For instance, the Environmental Protection Agency (EPA) highlights hemp’s carbon-negative properties, making it a preferred material for biodegradable plastics and construction materials like hempcrete. Moreover, the growing popularity of plant-based diets and cruelty-free lifestyles has increased the demand for hemp-derived food products, such as hemp seeds, oil, and protein powders. These products offer high nutritional value, making them appealing to health-conscious consumers. The strong alignment of hemp with environmental and wellness trends has positioned it as a preferred material across diverse industries.

Growth of the CBD Market and Wellness Industry

The expansion of the cannabidiol (CBD) market is another significant driver for industrial hemp cultivation in North America. CBD, a non-psychoactive compound derived from hemp, has gained widespread popularity due to its potential therapeutic benefits, including pain relief, stress reduction, and sleep support. This has led to the rapid growth of the CBD wellness sector, with applications in personal care, pharmaceuticals, and nutraceuticals. Industrial hemp serves as the primary source of legal CBD, making it essential to meet rising demand. Furthermore, the increasing acceptance of alternative medicine and natural remedies has prompted consumers to explore hemp-derived products. Retailers and e-commerce platforms have broadened access to CBD-infused products, further fueling demand and creating new opportunities for hemp growers and manufacturers across North America.

Technological Advancements and Investment in Hemp Processing

Technological innovation in hemp cultivation, harvesting, and processing is accelerating the growth of the market. Advances in seed genetics, automated farming equipment, and processing techniques are enhancing yield quality, reducing production costs, and increasing overall efficiency. These developments are encouraging more farmers to include hemp in their crop rotation. Simultaneously, a surge in public and private investment has led to the development of dedicated hemp processing facilities and research labs. Startups and established companies alike are entering the market, attracted by the economic potential and diverse applications of hemp. The resulting improvement in supply chains, product quality, and scalability is making industrial hemp more accessible and economically viable, further solidifying its place in North America’s future-focused agricultural and industrial landscape.

Market Trends

Expansion of Hemp-Based Consumer Products

The North American industrial hemp market is witnessing a rapid expansion in the variety and availability of hemp-based consumer products. For instance, the U.S. Department of Agriculture (USDA) has recognized the nutritional benefits of hemp seeds and oils, encouraging their inclusion in food products. Companies like Manitoba Harvest are introducing hemp protein powders and milk alternatives to cater to health-conscious consumers. Additionally, personal care brands such as Dr. Bronner’s are leveraging hemp oil in lotions and shampoos to meet the demand for clean-label and natural formulations. This diversification of product offerings is driving consumer interest and fostering innovation.

Surge in Popularity of CBD and Wellness Products

The booming wellness industry in North America is playing a pivotal role in shaping the industrial hemp market. CBD, extracted from industrial hemp, has gained significant consumer acceptance for its reported benefits in stress relief, pain management, and sleep support. The growing number of CBD-infused products—including oils, gummies, capsules, and beverages—reflects this trend. As more consumers turn to holistic health and natural wellness solutions, the demand for CBD is expected to maintain upward momentum. Regulatory clarifications and increasing education around the safety and efficacy of CBD are also contributing to mainstream adoption. This trend has not only broadened the scope of industrial hemp applications but has also elevated its visibility in health and retail sectors.

Innovation in Hemp-Based Industrial Applications

Industrial hemp is gaining recognition beyond food and wellness, as its fibers and stalks offer valuable raw material for a wide array of industrial uses. Manufacturers are increasingly exploring hemp for eco-friendly applications such as biodegradable plastics, construction materials (e.g., hempcrete), textiles, insulation, and paper. Automotive and construction sectors are especially interested in hemp composites for lightweight and durable materials. Research institutions and private companies across North America are investing in developing next-generation hemp technologies. This trend indicates a shift in perception—from hemp as a niche agricultural product to a sustainable industrial resource—positioning it as a cornerstone in the circular economy and green manufacturing practices.

Strengthening Investment and Strategic Partnerships

Growing investor confidence and strategic collaborations are accelerating the industrial hemp market’s development across North America. For instance, venture capital firms are funding startups focused on hemp cultivation and processing, while partnerships between agricultural producers and consumer brands are streamlining supply chains. Organizations such as the Hemp Industries Association are fostering collaboration and standardization within the sector, enhancing market transparency and driving innovation. These efforts are creating a robust foundation for the sustainable growth of the industrial hemp market.

Market Challenges Analysis

Regulatory Ambiguities and Compliance Barriers

Despite the legalization of industrial hemp under the 2018 U.S. Farm Bill, the North American market continues to face significant regulatory challenges. For instance, the National Hemp Association has highlighted the lack of harmonized federal and state-level policies, which complicates compliance for businesses operating across multiple jurisdictions. Inconsistent THC testing standards, as noted by the USDA, further exacerbate these challenges by creating variability in product quality and consumer trust. Additionally, the American Herbal Products Association has reported that the absence of standardized quality assurance guidelines poses a significant barrier to market entry, particularly for small and mid-sized enterprises that lack the resources to navigate these complexities.

Infrastructure Gaps and Market Saturation Risks

Another pressing challenge in the North American industrial hemp market is the underdeveloped infrastructure for processing and distribution. While cultivation has expanded rapidly, the processing capacity for turning raw hemp into usable materials—such as fiber, hurd, and CBD extracts has not kept pace. This mismatch often leads to bottlenecks, reduced profitability, and wastage of raw materials. Additionally, the rapid entry of new players, particularly in the CBD segment, has contributed to short-term market saturation. Oversupply has driven down prices and squeezed profit margins, particularly for farmers who lack access to stable offtake agreements. Many stakeholders are also navigating limited access to financial services, as some banks and insurers remain cautious due to hemp’s association with cannabis. Without significant investment in supply chain infrastructure and more balanced market development, these challenges could constrain the industry’s growth potential and delay its maturity.

Market Opportunities

The North America industrial hemp market presents substantial opportunities driven by growing demand for sustainable, plant-based alternatives across various industries. As consumers increasingly prioritize environmentally friendly products, industrial hemp is gaining recognition for its versatility, low environmental impact, and wide-ranging applications. This shift opens doors for hemp-based innovations in packaging, construction materials, textiles, and bio-composites. Companies that integrate hemp into their product lines can capitalize on its appeal to eco-conscious consumers and regulatory incentives promoting green materials. Additionally, as the automotive and construction sectors seek lighter, stronger, and biodegradable alternatives, industrial hemp is positioned as a viable solution, especially with growing interest in hempcrete, insulation, and composite panels.

Furthermore, the rise of wellness-focused lifestyles continues to drive demand for hemp-derived food, beverages, and cannabidiol (CBD) products. North America’s expanding nutraceutical and personal care markets provide fertile ground for hemp-infused offerings, from dietary supplements to skincare solutions. As regulatory frameworks evolve to support clearer guidelines around CBD usage, market access and consumer confidence are expected to improve. Investment in research and development also opens opportunities for enhanced product innovation and efficiency across the hemp supply chain. Moreover, strategic collaborations between farmers, processors, and consumer brands can strengthen supply chains and foster long-term growth. With the right infrastructure and policy support, industrial hemp has the potential to become a cornerstone of sustainable agriculture and a competitive raw material in the global bioeconomy.

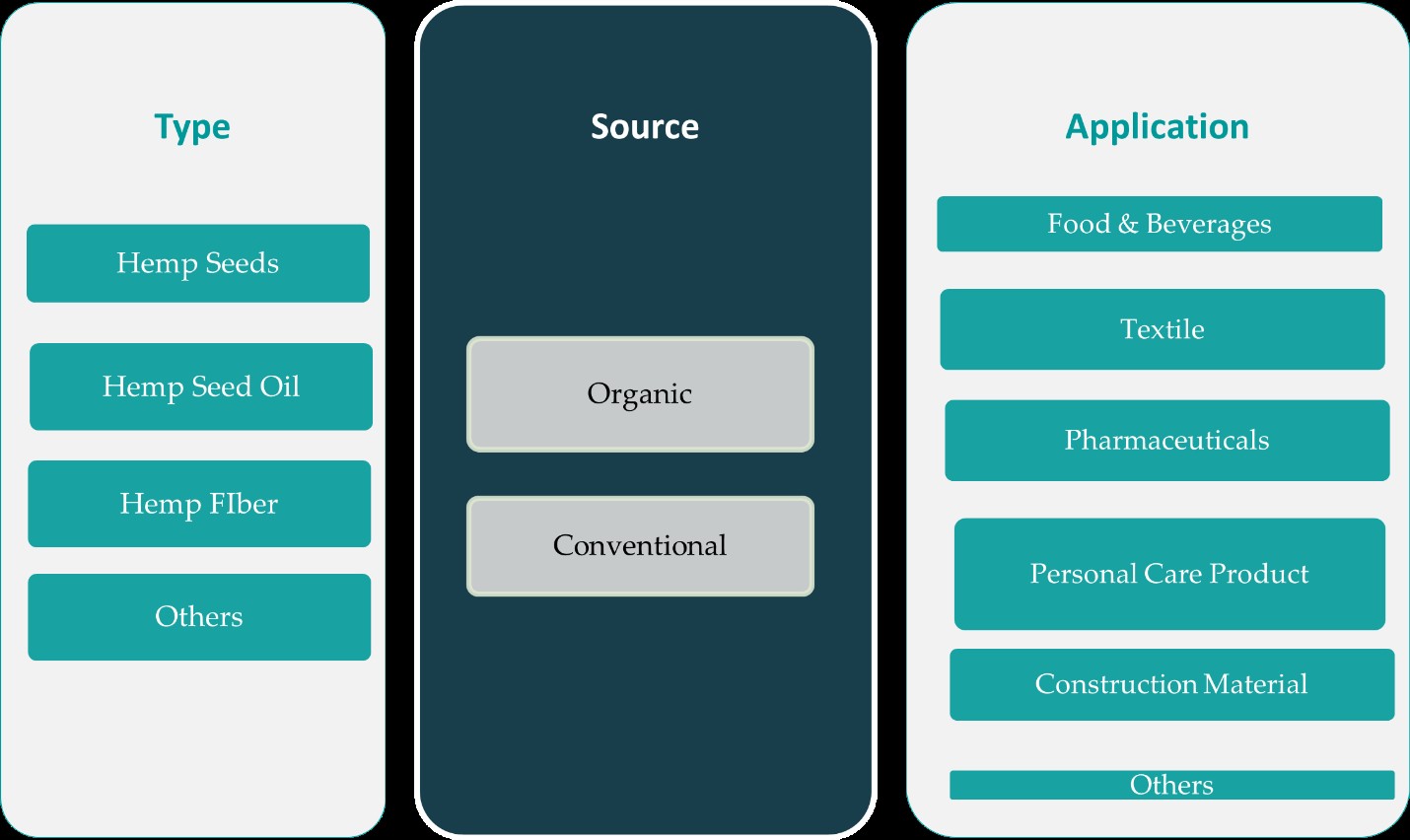

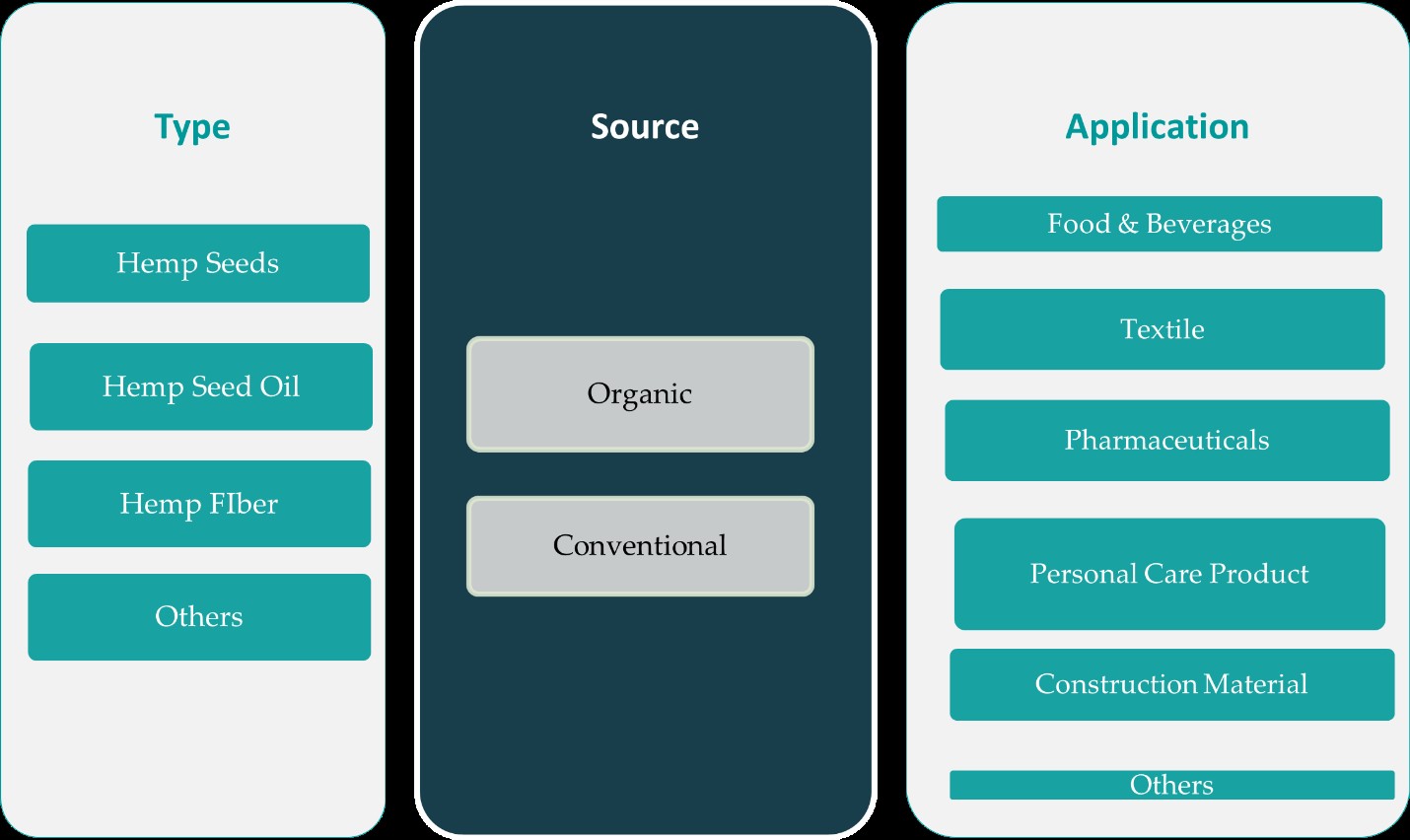

Market Segmentation Analysis:

By Type:

The North America industrial hemp market is segmented by type into hemp seed, hemp seed oil, hemp fiber, and others, each playing a distinct role in meeting consumer and industrial demand. Hemp seed holds significant market share due to its high nutritional value and growing popularity in health foods, including snacks, protein powders, and dairy alternatives. Hemp seed oil is also gaining traction in the cosmetics, personal care, and wellness industries, driven by consumer interest in natural skincare products and its anti-inflammatory properties. Meanwhile, hemp fiber is emerging as a critical raw material in eco-friendly textiles, paper, bioplastics, and construction, owing to its strength, biodegradability, and low environmental footprint. The “others” category, which includes cannabidiol (CBD) extracts and hemp-based composites, continues to expand rapidly, fueled by demand in the wellness and pharmaceutical sectors. Together, these segments reflect the crop’s versatility and its ability to cater to a wide range of high-growth industries in the North American market.

By Source:

Based on source, the market is divided into organic and conventional hemp, with both segments offering unique advantages to manufacturers and consumers. The organic segment is witnessing robust growth due to increasing consumer preference for chemical-free, non-GMO, and sustainably grown products. Organic certification adds a premium value to hemp seeds, oils, and CBD products, particularly in the food and wellness sectors. This trend aligns with the broader clean-label movement, where transparency and ethical sourcing influence purchasing decisions. On the other hand, the conventional segment continues to dominate in terms of volume, driven by cost-effectiveness and wider availability. Conventional hemp is commonly used in industrial applications like textiles, construction materials, and bioplastics, where scalability and raw material affordability are key factors. As awareness and income levels rise, the organic segment is expected to grow steadily, while conventional hemp maintains its stronghold in large-scale manufacturing, creating a balanced and complementary dynamic within the regional market.

Segments:

Based on Type:

- Hemp Seed

- Hemp Seed Oil

- Hemp Fiber

- Others

Based on Source:

Based on Application:

- Food & Beverages

- Textile

- Pharmaceuticals

- Construction Material

- Others

Based on the Geography:

Regional Analysis

United States

The United States dominates the North American industrial hemp market, accounting for approximately 72% of the regional market share in 2023. This leadership is primarily driven by favorable legislative changes, notably the 2018 Farm Bill, which legalized hemp cultivation at the federal level. The U.S. has seen rapid expansion in hemp farming, CBD product innovation, and increased consumer acceptance of hemp-based goods. States like Colorado, Kentucky, and Oregon have become key production hubs due to their supportive regulatory environments and established agricultural infrastructure. The demand for hemp-derived wellness products, particularly CBD oil, dietary supplements, and cosmetics, continues to propel market growth. Additionally, the presence of major industry players and a growing investment pipeline in processing and R&D further strengthens the U.S. position as a central force in shaping the regional market landscape.

Canada

Canada holds the second-largest share, with around 18% of the North American industrial hemp market in 2023. Canada was an early adopter of industrial hemp legalization and has built a mature and regulated framework for cultivation and processing. The country’s well-established agricultural practices, high-quality hemp varieties, and commitment to sustainability give it a competitive advantage in international trade. Canadian hemp is widely used in food products, textiles, and industrial applications, with a strong focus on exports to the U.S. and European markets. The government’s continued support for research, coupled with clear regulatory standards, enables Canadian producers to maintain quality assurance and consumer trust. Moreover, partnerships between academic institutions and private companies are fostering innovation, especially in hemp fiber processing and biodegradable product development.

Mexico

Mexico, while a smaller player, is gradually emerging with a market share of approximately 6% in 2023, and the potential for growth remains significant. Recent regulatory reforms and increasing public discourse around the economic benefits of hemp cultivation have paved the way for market expansion. As Mexico works toward establishing a formal legal framework for industrial hemp, local entrepreneurs and farmers are exploring its potential in agriculture, textiles, and wellness sectors. The country’s favorable climate and low labor costs present an attractive opportunity for scalable hemp production. Additionally, cross-border trade prospects with the U.S. and Canada may further stimulate market growth once regulatory clarity is achieved, positioning Mexico as a future growth hotspot in the region.

Key Player Analysis

- Green Thumb Industries

- Canopy Growth Corporation

- AURORA CANNABIS INC.

- The Cronos Group

- Ecofibre Ltd

- Curaleaf Holdings, Inc.

- Fresh Hemp Foods Ltd.

- GenCanna

- IND HEMP

- American Hemp

- Hemp, Inc

- Medical Marijuana Inc

- Hemp Oil Canada Inc.

- Industrial Hemp Manufacturing, Inc.

- Others

Competitive Analysis

The competitive landscape of the North America industrial hemp market is characterized by the presence of several established players and emerging companies driving innovation and market expansion. Leading players such as Green Thumb Industries, Canopy Growth Corporation, Aurora Cannabis Inc., The Cronos Group, Ecofibre Ltd., Curaleaf Holdings, Inc., Fresh Hemp Foods Ltd., GenCanna, IND HEMP, American Hemp, Hemp, Inc., Medical Marijuana Inc., Hemp Oil Canada Inc., and Industrial Hemp Manufacturing, Inc. are playing a pivotal role in shaping the industry. These companies are actively focusing on product diversification, technological advancements, and strategic collaborations to strengthen their market positions. Key players are investing in sustainable cultivation practices, advanced processing technologies, and R&D to develop high-quality hemp-based products, including CBD extracts, textiles, food supplements, and industrial applications. Many have also expanded their reach through mergers, acquisitions, and partnerships to optimize supply chains and tap into new consumer segments. The competitive focus remains on innovation, regulatory compliance, and scalability to meet growing demand. As the market continues to evolve, these companies are expected to lead through sustainable growth strategies, brand positioning, and geographic expansion across North America and beyond.

Recent Developments

- In October 2024, Canopy Growth Corporation acquired Wana, which includes Wana Wellness, LLC, The CIMA Group, LLC, and Mountain High Products, LLC. With this acquisition, Canopy USA holds 100% of Wana’s equity interests. The acquisition will help the company to build a leading brand-focused cannabis company in the US.

- In October 2024, AURORA CANNABIS INC. launched an expanded range of premium medical cannabis oils in Australia in partnership with MedReleaf Australia. Designed to meet diverse patient needs, the new offerings include Aurora THC 25 (Sativa), Aurora THC 25 (Indica), Aurora 12.5:12.5 oil, Aurora 50:50 oil, and Aurora 10:100 oil, all available in 30 ml bottles for physician prescription.

- In June 2024, Curaleaf Holdings, Inc. launched new lines of hemp-derived THC products under its Select and Zero Proof brands. These products will be available across 25 states and the District of Columbia through direct-to-consumer delivery and Curaleaf’s national distribution network.

- In May 2024, The Cronos Group partnered with GROW Pharma, a leading distributor of medicinal cannabis in the UK, to expand its PEACE NATURALS brand into the UK. Through this collaboration, Cronos will supply high-quality, premium cannabis products, ensuring patients in the UK have access to the globally recognized brand PEACE NATURALS.

- In February 2024, RISE Dispensaries, the cannabis retail chain owned by Green Thumb Industries Inc., expanded its presence with the opening of its 15th retail location in Florida and 92nd nationwide. The new store will feature special promotions and complimentary merchandise for its first customers. It opens the company to a much larger reach of its products like chocolate, mints, gummies, and tarts made by its Incredibles brand.

- In January 2023, HempMeds Brasil launched two new full-spectrum products. These new products were created to suit the new requirements of Brazilian doctors who intend to suggest it to their patients.

Market Concentration & Characteristics

The North America industrial hemp market exhibits a moderately fragmented structure with a mix of established corporations and emerging players competing across diverse applications. Market concentration is influenced by the dominance of key players in segments such as CBD, food and beverages, personal care, and industrial materials. While a few companies hold significant market share due to early entry, technological expertise, and vertically integrated operations, the industry remains open to new entrants driven by rising consumer demand and favorable policy shifts. The market is characterized by rapid product innovation, evolving regulatory standards, and increasing emphasis on sustainable sourcing and processing. Companies are adopting strategies such as mergers, acquisitions, and partnerships to expand their geographic footprint and streamline operations. As the industry matures, there is a growing trend toward standardization, certification, and branding, which is expected to influence long-term competitiveness and support the formation of a more structured and resilient supply chain ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The North American industrial hemp market is projected to grow significantly, driven by increasing demand across various industries.

- Legalization of hemp cultivation in the U.S. and Canada has opened opportunities for large-scale farming and production, especially for hemp-derived CBD products.

- Hemp’s versatility is leading to its adoption in diverse sectors, including textiles, construction, personal care, and pharmaceuticals.

- The development of hemp-based bioplastics and sustainable materials is gaining traction as industries seek eco-friendly alternatives.

- Strategic collaborations, partnerships, and mergers are becoming prevalent as companies aim to expand their market presence and product offerings.

- Hemp-based THC products are emerging as a new revenue stream for companies, though they face regulatory challenges and safety concerns.

- The use of hemp in construction materials, such as hempcrete, is being explored for its carbon-negative properties and sustainability benefits.

- Ongoing research and development efforts are focused on enhancing hemp cultivation techniques and processing technologies to improve yield and product quality.

- Consumer interest in natural and organic products is driving the demand for hemp-based foods, beverages, and personal care items.

- Despite the positive outlook, the market faces challenges related to regulatory inconsistencies and the need for standardized quality control measures.