Market Overview:

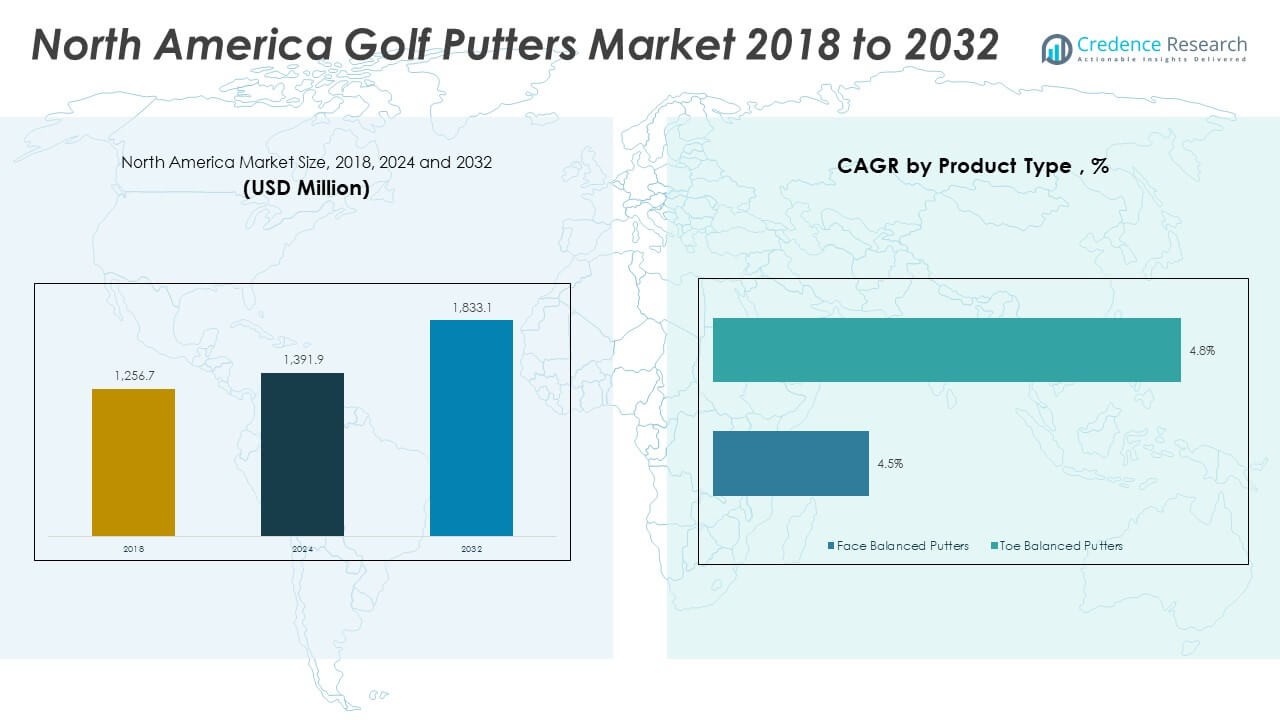

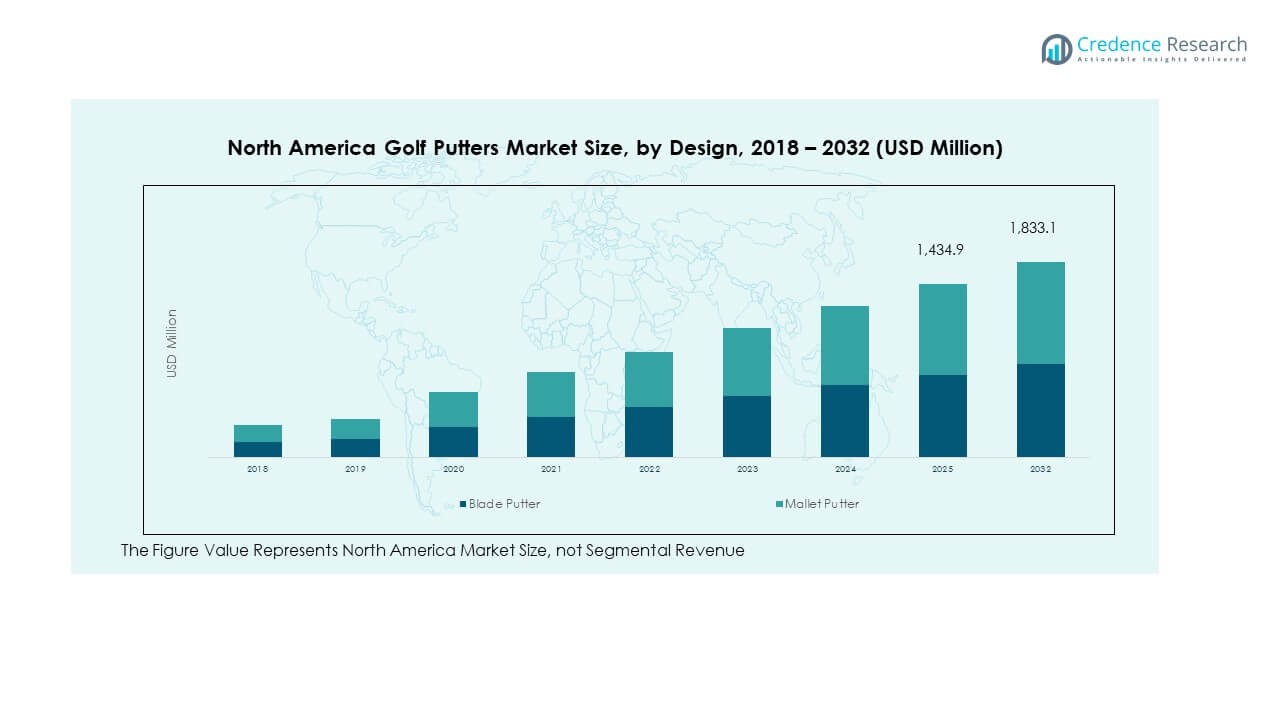

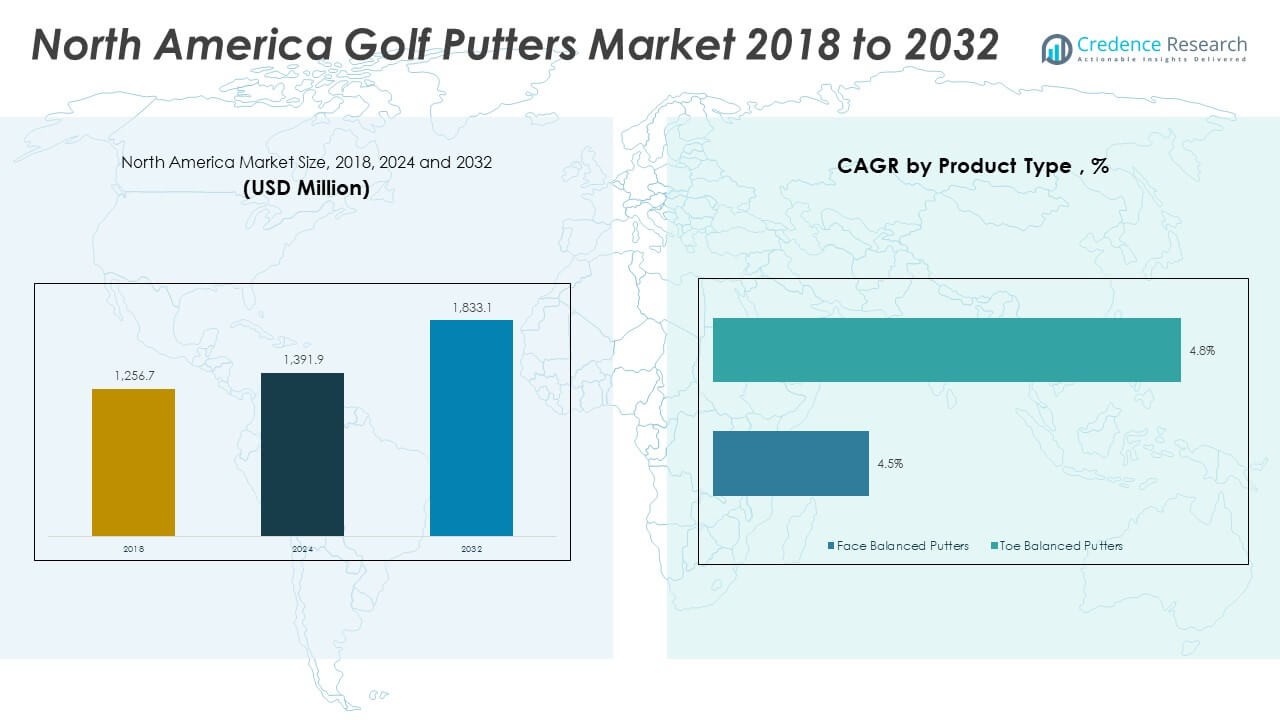

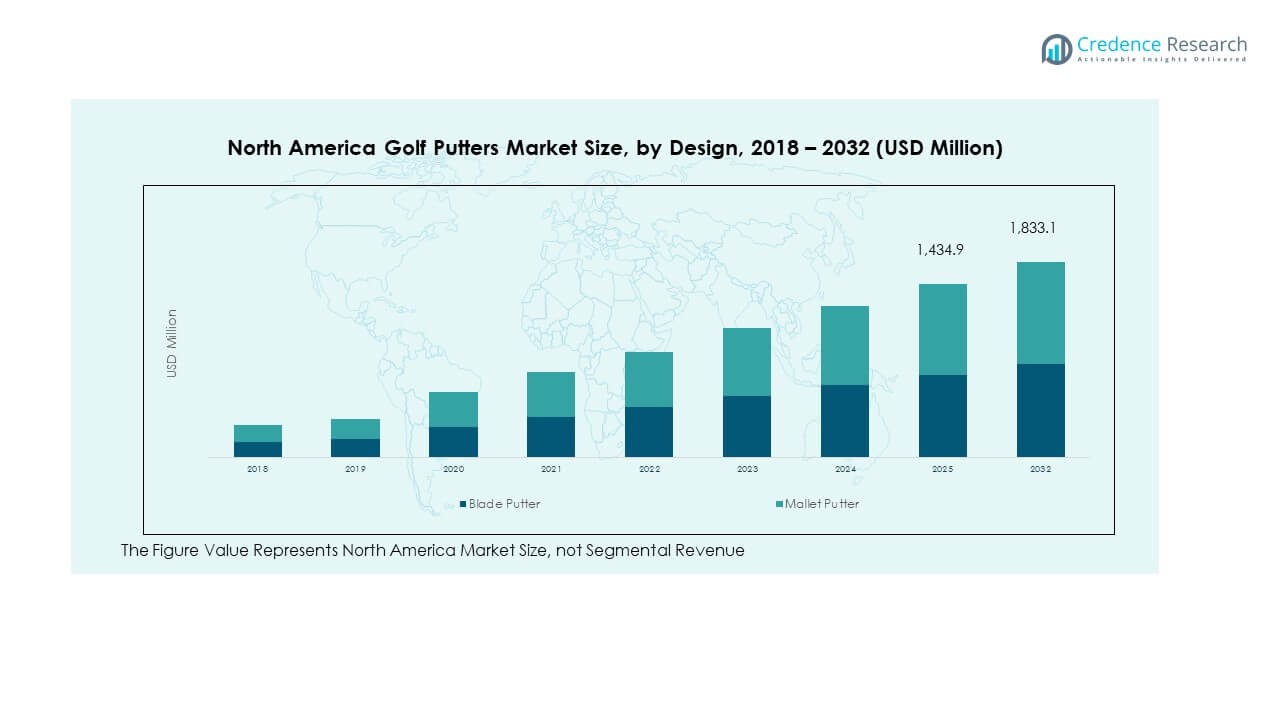

The North America Golf Putters Market size was valued at USD 1,256.7 million in 2018 to USD 1,391.9 million in 2024 and is anticipated to reach USD 1,833.1 million by 2032, at a CAGR of 3.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Golf Putters Market Size 2024 |

USD 1,391.9 Million |

| North America Golf Putters Market, CAGR |

3.60% |

| North America Golf Putters Market Size 2032 |

USD 1,833.1 Million |

The market growth is driven by the rising adoption of technologically advanced putters that enhance precision and consistency for players. Manufacturers are introducing high-MOI designs, adjustable weighting systems, and advanced face inserts to cater to varied playing styles. Increased participation in golf tournaments, coupled with higher spending on premium equipment by both amateur and professional players, is boosting demand. Additionally, golf’s popularity among younger demographics and the influence of celebrity endorsements are further encouraging investments in new putter designs.

In North America, the United States dominates the golf putters market due to its extensive golf course infrastructure, high participation rates, and significant consumer spending on sports equipment. Canada follows as an emerging contributor, supported by a growing interest in recreational golf and increasing availability of indoor golf facilities that drive equipment sales. Mexico, while smaller in scale, is witnessing gradual growth as golf tourism expands, especially around resort destinations. Collectively, these factors position the region as a competitive hub for both established and innovative golf equipment manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Golf Putters Market was valued at USD 1,256.7 million in 2018, reached USD 1,391.9 million in 2024, and is projected to reach USD 1,833.1 million by 2032, at a CAGR of 3.60%.

- The Global Golf Putters Market size was valued at USD 3,120.0 million in 2018 to USD 3,493.8 million in 2024 and is anticipated to reach USD 4,607.8 million by 2032, at a CAGR of 3.6% during the forecast period.

- The United States holds the largest share at 72%, driven by extensive golf course infrastructure and consumer spending, followed by Canada with 18% supported by recreational growth, and Mexico with 10% linked to tourism demand.

- Mexico, holding 10% share, is the fastest-growing region, with expansion fueled by resort-based golf facilities, international tourism, and urban indoor golf adoption.

- By design, mallet putters captured 58% of the market share in 2024, reflecting strong adoption due to high-MOI features and enhanced alignment technologies.

- Blade putters accounted for 42% of the North America Golf Putters Market in 2024, appealing to traditional players seeking precision and feel on greens.

Market Drivers

Rising Demand for Advanced Putter Designs Driving Equipment Sales

The North America Golf Putters Market is witnessing strong demand due to continuous innovations in design and technology. High-MOI mallet putters, adjustable weighting systems, and AI-enabled inserts are gaining popularity among professionals and amateurs. Consumers are prioritizing putters that deliver better alignment, stability, and forgiveness on greens. Golfers across skill levels are exploring equipment that can improve scoring consistency. Premium brands are capitalizing on this trend by expanding product lines with customization options. Golf retail outlets are highlighting advanced models as performance-enhancing tools. It is encouraging players to invest in technologically refined putters. This driver reinforces the market’s focus on innovation-led growth.

Growing Golf Participation and Recreational Adoption Stimulating Market Expansion

Golf’s popularity in the United States and Canada continues to strengthen the demand for putters. A surge in recreational participation across younger demographics has influenced steady sales. Families and younger professionals are taking up golf at clubs, resorts, and urban facilities. The rise of indoor golf simulators has further boosted year-round demand for equipment. Players are engaging in golf not only as a sport but also as a lifestyle activity. It is creating consistent demand for entry-level as well as premium putters. Golf organizations and communities are actively promoting the sport among new audiences. This trend sustains steady revenue growth in the market.

- For instance, in January 2025, Callaway Golf partnered with Five Iron Golf to launch Callaway Tour Fitting across all of Five Iron’s simulator-based venues in North America, integrating Odyssey putters into premium fitting experiences and providing urban golfers with direct access to tour-level equipment.

Influence of Celebrity Endorsements and Sponsorships Enhancing Product Visibility

The endorsement of golf putters by professional players is a strong driver for the market. High-profile golfers often highlight specific brands that achieve visibility on global tours. Product launches supported by major tournaments significantly elevate consumer interest. Retailers align their marketing strategies with tournament season demand spikes. Golf enthusiasts aspire to use the same models as professionals, boosting adoption rates. It is strengthening the connection between brand credibility and consumer loyalty. Sponsorship agreements with key players also help manufacturers expand recognition in international markets. This driver ensures that consumer purchase decisions are heavily influenced by professional visibility.

Rising Disposable Income and Premiumization of Equipment Supporting Growth

The growing purchasing power of consumers across North America is enabling higher spending on premium golf equipment. Affluent segments of players are investing in advanced putters with customized features. Premium golf putters offer unique finishes, exclusive grips, and advanced face technologies. Manufacturers are positioning such offerings as lifestyle-driven equipment rather than functional tools alone. It is helping brands capture higher margins from luxury-driven golfers. Retail outlets and specialty stores are increasing premium inventory to match consumer preferences. Online platforms are also highlighting premium customization options to enhance customer experience. This driver is ensuring a consistent shift toward higher-value equipment sales.

- For instance, in 2023, Bettinardi Golf introduced its Limited Run SS35 Tiki Putter, crafted from 303 stainless steel with intricate tribal-inspired milling and a black PVD finish, reinforcing its reputation for precision craftsmanship and exclusivity in the premium putter segment.

Market Trends

Integration of Smart Technology Enhancing Player Performance

The integration of smart sensors into golf putters is becoming a major trend in the North America Golf Putters Market. Players are adopting equipment that tracks swing metrics, alignment, and stroke path. These digital tools provide real-time insights that aid in training and practice sessions. Golfers are increasingly combining traditional performance features with data-driven analysis. It is supporting a new wave of technology-driven golfing culture. Manufacturers are collaborating with technology firms to create connected putters with mobile compatibility. These innovations are reshaping the way golfers approach game improvement. This trend highlights a technological shift across the industry.

- For example, TaylorMade, Srixon-Cleveland Golf, and Cobra Puma Golf have partnered with Arccos Golf to integrate shot-tracking technology into their equipment, while PING offers Arccos Smart Sensors through its custom-order program, enabling golfers to automatically capture on-course shots and access real-time performance analytics via the Arccos Caddie app.

Sustainability and Eco-Friendly Material Usage in Manufacturing Practices

The demand for sustainable golf equipment is growing steadily in North America. Consumers are showing preference for brands using recycled metals, bio-based grips, and energy-efficient production. Manufacturers are responding by investing in greener supply chains and reducing carbon emissions. It is creating opportunities for differentiation among eco-conscious golfers. Golf clubs and retailers are marketing sustainable equipment as a responsible lifestyle choice. Regulations around environmental standards are further influencing production methods. This trend emphasizes a shift toward environmentally responsible sports equipment manufacturing. Sustainable practices are positioning brands as innovators committed to long-term ecological balance.

Personalization and Custom Fitting Shaping Consumer Preferences

The increasing demand for personalized golf equipment is a defining trend in the market. Golfers are selecting putters tailored to their grip style, shaft length, and alignment preferences. Custom fitting services are being expanded across retail outlets and specialty stores. It is driving customer loyalty by offering an enhanced playing experience. Premium brands are enabling online customization platforms for consumers to design bespoke putters. This shift aligns with consumer preference for unique and performance-driven products. Golf enthusiasts are valuing equipment that reflects individual identity and playing style. This trend is reinforcing long-term consumer engagement with leading brands.

Expansion of Golf Tourism and Indoor Facilities Boosting Putter Adoption

The rise of golf tourism across North America is influencing equipment demand. Golf resorts are attracting both domestic and international players, creating consistent sales opportunities. Indoor golf facilities are increasing in urban centers, offering year-round access to the sport. It is creating steady demand for practice-friendly putters and beginner-oriented designs. Equipment rental services at resorts and simulators are also enhancing brand visibility. Golf tourism events are stimulating sales through experiential exposure. Manufacturers are targeting these channels as key sales accelerators. This trend ensures that putter adoption continues beyond traditional golf club settings.

- For instance, Topgolf, part of Topgolf Callaway Brands, attracts over 30 million unique guests annually across its North American venues. By offering in-venue access to Callaway-branded putters including rentals and demos. Topgolf delivers broad experiential exposure and equipment trial opportunities in both simulator and driving-range settings, enhancing brand engagement among beginners and enthusiasts.

Market Challenges Analysis

High Equipment Costs and Market Saturation Restricting Wider Adoption

The North America Golf Putters Market faces challenges linked to high equipment costs and market saturation. Premium putters are priced significantly higher, limiting accessibility for casual players. Retailers often struggle to balance inventories between entry-level and high-end models. It is making it difficult for new entrants to compete against established brands. Golf remains a costly sport, discouraging mass adoption among middle-income groups. The saturation of leading brands is creating intense competitive pressure. Smaller companies face difficulties in maintaining distribution and visibility. This challenge restricts growth opportunities in an otherwise expanding market.

Seasonal Dependence and Fluctuations in Participation Hindering Growth

The golf industry is inherently seasonal in several parts of North America, affecting steady putter sales. Harsh winters in northern states reduce outdoor participation and slow retail momentum. Indoor facilities help offset this limitation, but they do not fully balance the seasonal impact. It is causing fluctuations in annual revenue streams for manufacturers and retailers. Market performance often peaks during tournament seasons but slows afterward. These variations make long-term sales projections more complex. Manufacturers must invest in innovative channels to counterbalance seasonal demand gaps. This challenge continues to influence the stability of market expansion.

Market Opportunities

Technological Convergence Creating New Product Categories

The North America Golf Putters Market presents opportunities through convergence of technology and performance. The integration of AI, machine learning, and real-time feedback systems creates new product categories. Golfers are showing willingness to adopt digital innovations that improve training efficiency. It is encouraging brands to expand smart putter portfolios. Retailers are promoting these products as advanced tools for consistent improvement. The opportunity lies in combining tradition with innovation to capture broader consumer interest. This direction is reshaping competitive strategies and creating space for market differentiation.

Growth of Emerging Demographics and Recreational Segments Supporting Expansion

New demographics are driving expansion opportunities across the golf putters market. Younger players are entering the sport at higher rates due to accessible indoor facilities and recreational appeal. Women golfers are representing an expanding consumer segment with rising equipment demand. It is creating opportunities for brands to design inclusive and targeted product lines. Lifestyle-oriented golfers are adopting equipment as part of social and networking activities. The rising presence of community programs and entry-level training camps further expands outreach. Manufacturers tapping into these segments are positioned to capture new market share effectively.

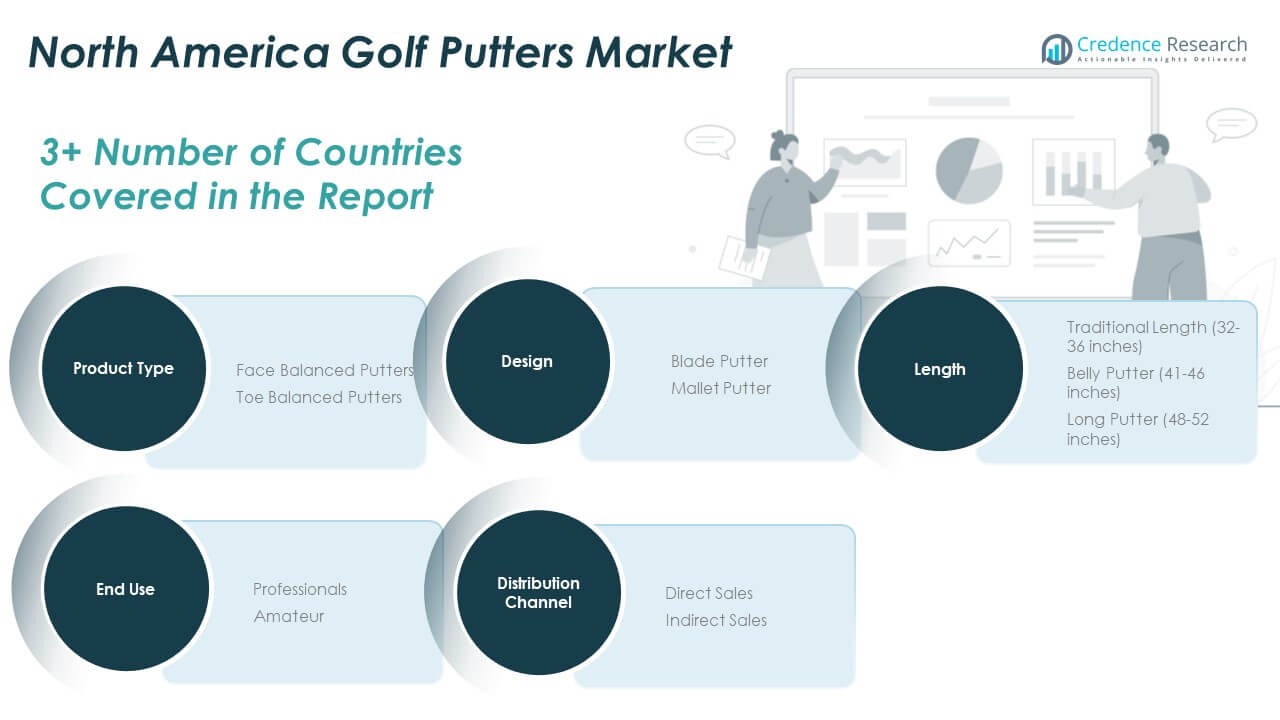

Market Segmentation Analysis:

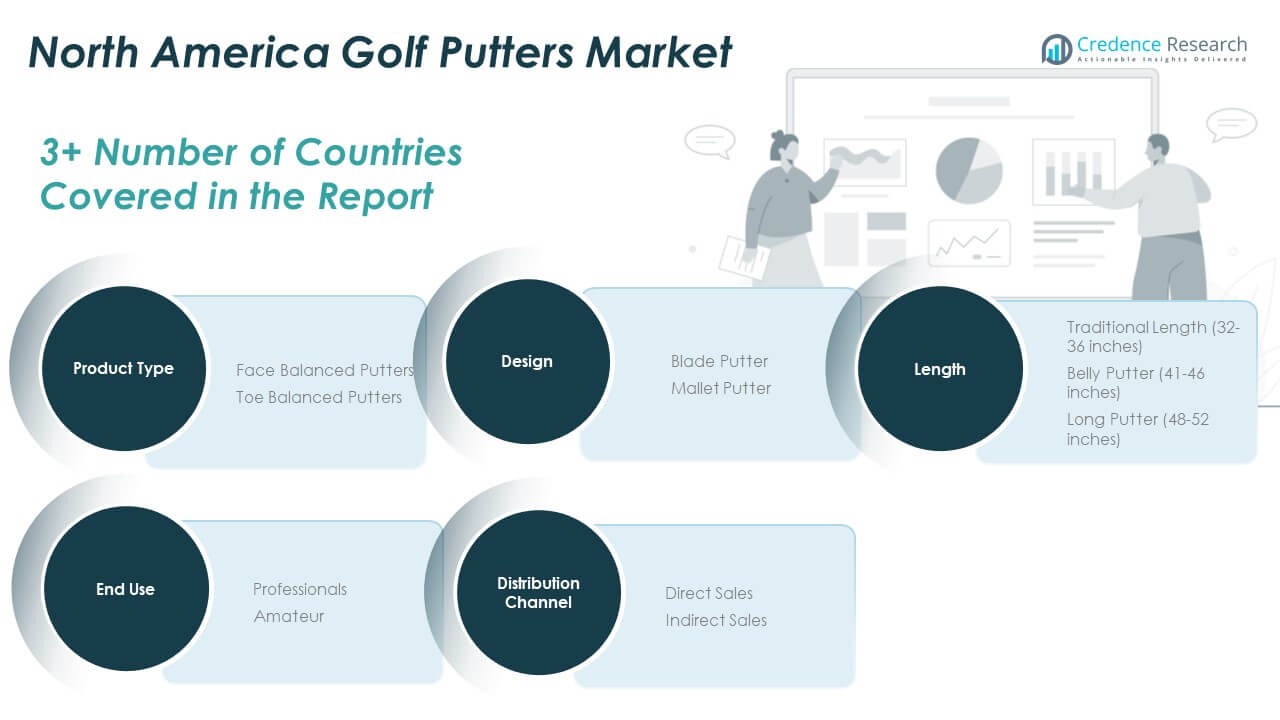

The North America Golf Putters Market is segmented

By product type into face balanced putters and toe balanced putters. Face balanced putters are gaining preference among straight-stroke players due to their stability and forgiveness, while toe balanced putters remain popular among golfers with arc-style strokes. This diversity in demand ensures balanced growth across both categories, with brands tailoring designs to meet specific swing mechanics.

- For instance, Odyssey introduced the Ai‑ONE Jailbird Mini DB (Double Bend) in This face‑balanced model features a double‑bend shaft, designed for straight‑stroke players, and benefits from the AI‑designed Ai‑ONE insert that enhances face stability and consistency.

By design, the market is divided into blade putters and mallet putters. Blade putters appeal to traditional players valuing precision and feel, whereas mallet putters dominate the market with their high-MOI designs and alignment features. It reflects the trend of golfers increasingly seeking equipment that improves consistency under competitive and recreational settings.

By end-use, professionals and amateurs shape the demand spectrum. Professionals drive adoption of advanced, tour-proven models, while amateurs create demand for user-friendly and affordable alternatives. It ensures that both premium and entry-level equipment lines find traction in the market.

By length, traditional putters between 32–36 inches remain dominant, while belly and long putters attract niche adoption among players seeking alternative putting styles. This segmentation underlines evolving preferences aligned with comfort and performance.

- For instance, Scotty Cameron’s 2024 Phantom mallet series including models such as the Phantom 5, Phantom 7, and Phantom 9 came in standard lengths of 33″, 34″, and 35″, catering directly to the mainstream preference for putters in the 32–36-inch range.

By distribution channel, direct sales through brand outlets and online platforms are growing due to customization and brand engagement. Indirect sales through sporting goods retailers and specialty stores continue to capture wide audiences. It demonstrates the importance of diversified distribution strategies for sustained market penetration.

Segmentation:

By Product Type

- Face Balanced Putters

- Toe Balanced Putters

By Design

- Blade Putter

- Mallet Putter

By End-use

By Length

- Traditional Length (32–36 inches)

- Belly Putter (41–46 inches)

- Long Putter (48–52 inches)

By Distribution Channel

- Direct Sales

- Indirect Sales

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The United States holds the largest share of the North America Golf Putters Market, accounting for 72% of the regional revenue. The country benefits from an extensive golf course infrastructure, widespread participation, and a strong culture of professional and amateur tournaments. High consumer spending on sports equipment drives demand for premium and technologically advanced putters. It also benefits from endorsements by leading PGA professionals, which enhance brand visibility and influence consumer preferences. Retail networks and online platforms are well established, providing easy access to a wide variety of putter designs. The U.S. remains the hub of product innovation, customization, and early adoption of smart golf equipment.

Canada contributes 18% of the market share, driven by steady growth in recreational golf and a rising interest in indoor golf simulators. Golf participation in Canada is expanding among younger demographics and women golfers, creating opportunities for both mid-range and premium equipment. It benefits from seasonal demand peaks, with significant activity during summer months supported by regional tournaments. Specialty stores and pro shops are critical to equipment distribution, while e-commerce platforms are increasingly shaping consumer buying behavior. It reflects a balanced demand structure, with both traditional blade putters and mallet putters gaining adoption. The Canadian market continues to show promise in sustaining steady growth across amateur and entry-level players.

Mexico represents 10% of the regional market share, supported by the rise of golf tourism and the expansion of resort-based facilities. International visitors create demand for rental equipment, while local players are gradually investing in personal putters. It benefits from the increasing presence of global brands through retail and resort partnerships. Professional tournaments hosted in the country also enhance consumer exposure to premium models. Urban centers are beginning to adopt indoor golf experiences, expanding opportunities for year-round participation. Mexico remains an emerging market where growth potential is tied to tourism development and rising middle-class spending.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cleveland Golf

- Cobra Golf

- A.B. Golf

- Miura Golf

- Mizuno Corporation

- Nike Golf

- Odyssey Golf (Callaway)

- PING

- Piretti Fine Putters

- PXG (Parsons Xtreme Golf)

- Scotty Cameron (Acushnet)

- TaylorMade

- Wilson Sporting Goods

- Yes! Golf

Competitive Analysis:

The North America Golf Putters Market is characterized by the presence of both global leaders and niche specialists competing across innovation, customization, and brand positioning. Major players such as TaylorMade, PING, Odyssey Golf (Callaway), and Scotty Cameron (Acushnet) dominate with strong brand loyalty, professional endorsements, and premium product portfolios. These companies continuously invest in research and development to enhance alignment technologies, insert materials, and high-MOI designs. Emerging brands like L.A.B. Golf and Piretti Fine Putters are carving a niche by focusing on unique fitting approaches and craftsmanship. It benefits from competitive differentiation where heritage brands emphasize performance consistency, while newer entrants target customization and exclusivity. Distribution strategies also play a pivotal role, with leading brands leveraging both direct-to-consumer channels and established retail networks. Competitive intensity is heightened by endorsements from PGA and LPGA professionals, which influence consumer demand patterns. The competitive landscape reflects a mix of high-volume mass-market offerings and exclusive premium models, aligning with the diverse needs of professionals and recreational players.

Recent Developments:

- In August 2025, PXG announced the launch of its latest high-MOI mallet putters in Scottsdale, Arizona, targeting the North America golf putters market. These new putters feature advanced customization options and performance enhancements designed for both amateur and professional golfers, reflecting the continued demand for innovative technology and premium quality in golf equipment.

- In August 2025, Breakthrough Golf Technology launched the Paradox putter, a zero torque model engineered with Swing Balance Technology to enhance distance control. The Paradox showed a 20% faster true roll and missed putts finishing 10% closer to the hole in testing, and is offered in both blade and fang designs with adjustable loft and lie options.

- In July 2025, private equity firm L Catterton, backed by LVMH, acquired a majority stake in L.A.B. Golf, a company known for its innovative putter designs. L.A.B. Golf sold about 130,000 units last year and is expected to triple its volume in 2025, with putters starting at $399 per unit.

- In January 2025, Odyssey released the Ai-ONE Silver Milled Putters, including models such as Two T CH, Three T S, Seven T DB, and Seven T CH, designed with advanced AI-driven milling for enhanced putting precision. The official launch date was January 17, 2025.

- In November 2024, L.A.B. Golf unveiled the OZ.1 and OZ.1i putters, with the OZ.1i available in December 2024 and the standard OZ.1 available in January 2025. This is confirmed by launch coverage and product previews referencing these exact timelines.

Market Concentration & Characteristics:

The North America Golf Putters Market demonstrates moderate to high concentration, with a few global brands accounting for a substantial share of revenue. It is defined by strong brand recognition, continuous innovation cycles, and heavy reliance on professional endorsements. The market shows characteristics of premiumization, where consumers willingly invest in technologically advanced and customized products. Competitive strategies revolve around product differentiation, retail presence, and digital engagement through e-commerce and online customization tools. Niche manufacturers maintain relevance by offering specialized designs and luxury-oriented craftsmanship, while large corporations sustain dominance through scale, marketing strength, and broad distribution networks.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Design, End-Use, Length and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to strengthen with continuous innovation in putter design that improves alignment, forgiveness, and precision for diverse player profiles.

- Smart putters integrating sensor technology and AI-driven analytics will gain adoption as golfers prioritize performance tracking and data-based improvements.

- Sustainability will influence manufacturing, with brands adopting recycled materials, eco-friendly grips, and greener production practices to meet consumer expectations.

- Custom fitting services will expand across retail stores and online platforms, creating higher demand for personalized equipment tailored to individual playing styles.

- Professional endorsements and visibility during global tours will continue to shape consumer preferences and drive loyalty toward leading brands.

- Golf tourism across resorts and urban indoor facilities will contribute to consistent equipment demand and broaden the consumer base.

- The amateur segment will witness stronger growth, supported by entry-level training programs and recreational adoption in urban centers.

- Premiumization of equipment will accelerate, with affluent consumers driving demand for limited-edition and luxury-oriented putters.

- Direct-to-consumer channels will expand further as online platforms offer customization, exclusive launches, and brand engagement.

- Competitive intensity will increase as niche brands focus on craftsmanship and exclusivity, while established players consolidate dominance through innovation and scale.