Market Overview:

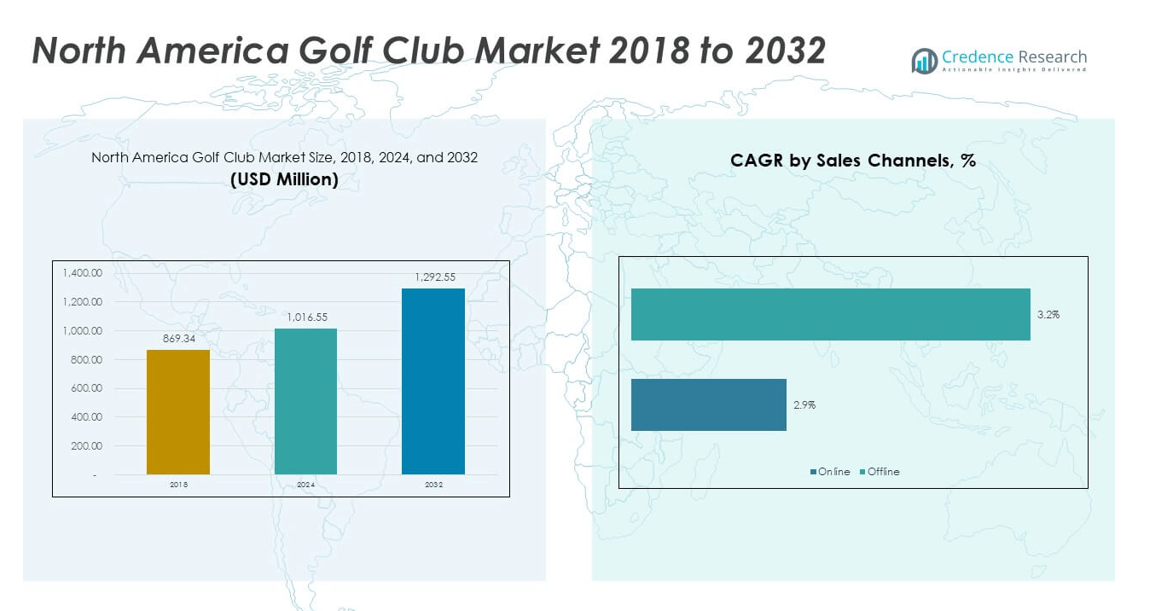

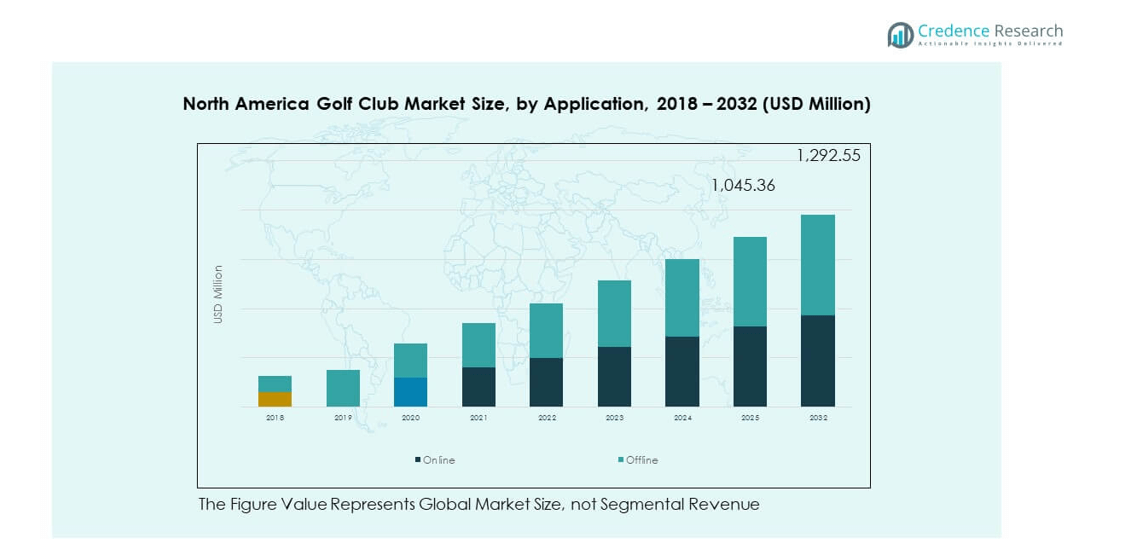

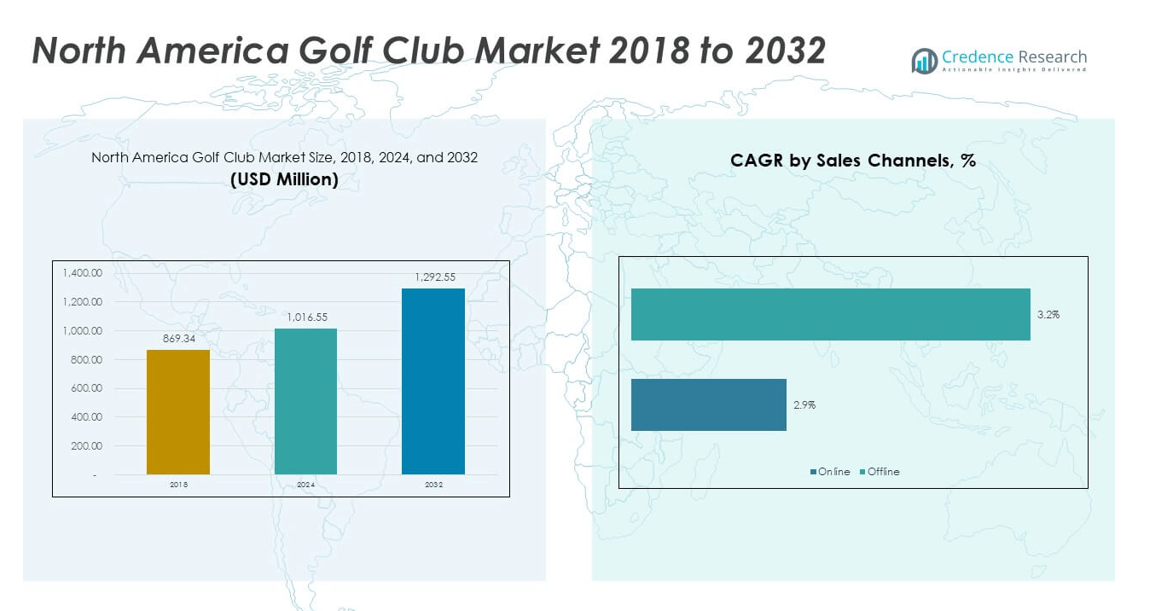

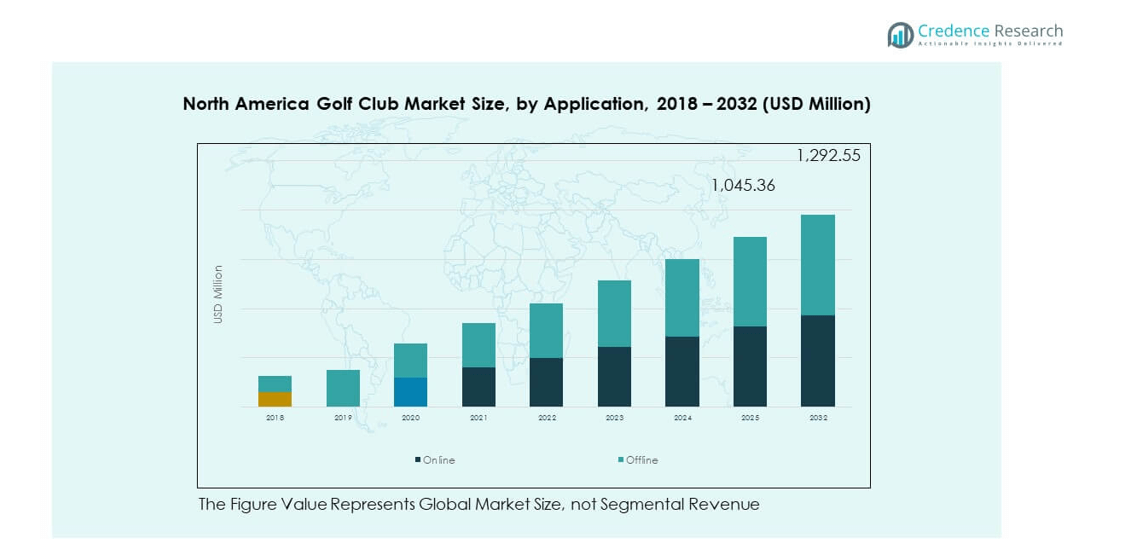

The North America Golf Club Market size was valued at USD 869.34 million in 2018 to USD 1,016.55 million in 2024 and is anticipated to reach USD 1,292.55 million by 2032, at a CAGR of 3.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Golf Club Market Size 2024 |

USD 1,016.55 million |

| North America Golf Club Market, CAGR |

3.05% |

| North America Golf Club Market Size 2032 |

USD 1,292.55 million |

The market growth is driven by rising participation in golf as both a leisure activity and a competitive sport, supported by increasing investments in golf course development and modernization. The popularity of golf tourism, combined with the sport’s growing appeal among younger demographics, is boosting demand for high-quality clubs. Advancements in club design and materials, aimed at enhancing performance and comfort, are further contributing to the market expansion. Brand endorsements, high-profile tournaments, and the integration of technology in equipment are also encouraging more consumers to invest in premium golf clubs.

Geographically, the United States dominates the North America Golf Club Market due to its extensive network of golf courses, high participation rates, and strong industry infrastructure. Canada is emerging as a significant growth contributor, supported by expanding golf facilities and a rising interest in the sport among diverse age groups. Warmer southern regions maintain year-round activity, while northern areas are seeing growth through indoor simulators and seasonal play, enhancing the overall market reach.

Market Insights:

- The North America Golf Club Market was valued at USD 869.34 million in 2018, grew to USD 1,016.55 million in 2024, and is projected to reach USD 1,292.55 million by 2032, registering a CAGR of 3.05% during the forecast period.

- The Global Golf Club Market size was valued at USD 3,154.4 million in 2018 to USD 3,736.7 million in 2024 and is anticipated to reach USD 4,835.6 million by 2032, at a CAGR of 3.31% during the forecast period.

- Growing participation in golf among younger demographics and professionals is driving consistent demand for high-performance and custom-fit clubs.

- Advancements in club design, materials, and technology, including adjustable features and smart analytics, are enhancing player experience and market growth.

- High costs of premium golf clubs and seasonal restrictions in northern regions limit wider adoption and create uneven sales cycles.

- Increasing availability of indoor golf simulators and entertainment-focused golf venues is expanding the sport’s reach beyond traditional outdoor play.

- The United States leads the market due to extensive golf course networks, strong tournament culture, and high player spending power.

- Canada is emerging as a growth region, supported by expanding facilities, community programs, and rising interest across varied age groups.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Popularity of Golf Among Diverse Age Groups:

The North America Golf Club Market benefits from a growing interest in golf across multiple demographics. Younger players are entering the sport due to increased exposure through social media, televised tournaments, and golf simulators. Professional events featuring high-profile athletes attract global attention, influencing equipment preferences. Corporate and leisure golfing events encourage participation among working professionals. Government and private investments in public golf courses expand accessibility. Celebrity endorsements and sponsorships further elevate the sport’s image. Training academies and youth programs strengthen early engagement. The shift toward golf as both a recreational and networking activity drives steady demand for clubs.

- For instance, Takomo Golf has capitalized on this trend by partnering with influencers such as the Bryan Bros and Grant Horvat in 2025, leading to a tenfold increase in their global revenue between 2022 and 2024. This surge reflects heightened brand engagement among younger digital audiences and newcomers entering the sport through TikTok and YouTube golf content, as well as tailored outreach through local clubfitter collaborations.

Technological Advancements in Golf Club Design:

Advancements in club materials and design are a strong growth driver for the North America Golf Club Market. Manufacturers invest in research to develop lighter, more durable shafts and heads, optimizing swing speed and control. Integration of adjustable weights and lofts allows players to customize performance. Computer-aided design (CAD) and precision engineering ensure improved accuracy and distance. Innovations in grip materials enhance comfort and reduce fatigue. Launch monitor technology helps golfers select clubs based on performance metrics. Custom fitting services have become more accessible, aligning equipment with individual playing styles. These developments encourage both professionals and amateurs to invest in new clubs.

- For instance, TaylorMade revolutionized driver technology with the introduction of its Stealth drivers, featuring a 60X Carbon Twist Face made from 60 layers of carbon fiber. Player testing revealed increased ball speeds—up to 3.3mph faster—over their previous titanium-based drivers.

Expansion of Golf Tourism and Destination Courses:

Golf tourism plays a significant role in boosting the North America Golf Club Market. Popular golf destinations in the U.S. and Canada attract domestic and international players. Resorts with integrated golf facilities promote multi-day stays, increasing club usage and purchases. Prestigious tournaments hosted at iconic courses enhance brand visibility for equipment manufacturers. Warm-weather states offer year-round play, appealing to traveling golfers. Cruise lines and travel agencies package golf experiences into premium itineraries. Specialty golf resorts offer rental services, often influencing visitors to buy similar clubs after travel. This synergy between tourism and equipment sales continues to strengthen market performance.

Increasing Influence of Fitness and Lifestyle Trends:

The North America Golf Club Market benefits from golf’s alignment with active lifestyle trends. Players view the sport as a moderate-intensity physical activity that improves flexibility, coordination, and focus. Health-conscious consumers are more willing to invest in high-quality equipment for optimal performance. Walking the course appeals to those seeking outdoor exercise. Golf is positioned as a low-impact sport suitable for all ages, making it attractive for older demographics. Clubs designed to reduce strain on joints and improve posture gain popularity. Professional instruction integrates fitness regimens to improve swing mechanics. The sport’s blend of competition, social interaction, and wellness supports long-term growth.

Market Trends:

Rise of Smart and Connected Golf Clubs:

The North America Golf Club Market is experiencing a trend toward technology-integrated equipment. Smart golf clubs equipped with sensors and Bluetooth connectivity track swing speed, angle, and ball trajectory. Players use mobile apps to analyze performance in real time. Data-driven insights help golfers refine techniques and reduce scoring errors. Manufacturers collaborate with tech companies to integrate GPS and AI into club systems. Wearable-compatible clubs create a seamless training ecosystem. The popularity of analytics among younger, tech-savvy players accelerates adoption. These innovations blur the line between sports equipment and digital training tools, setting new expectations for club functionality.

- For instance, Callaway’s AI-designed Ai 10X face in their 2025 Elyte driver dynamically adjusts thickness across the clubface, resulting in a 10% increase in off-center ball speed versus prior models. Players can review shot metrics on mobile apps in real time—empowering data-driven improvement with tangible performance gains, such as measurable reductions in scoring error percentages on professional tours.

Growth in Sustainable and Eco-Friendly Equipment Materials:

Sustainability is shaping product development in the North America Golf Club Market. Manufacturers adopt recycled metals, bio-based resins, and sustainable grips to reduce environmental impact. Eco-conscious consumers show preference for brands with transparent sourcing practices. Packaging is being redesigned to use recyclable or biodegradable materials. Some companies explore carbon-neutral production facilities to align with green initiatives. Golf courses that prioritize sustainability influence equipment choices among members. Consumer awareness campaigns link eco-friendly products with responsible golfing. This shift encourages innovation in materials without compromising performance or durability.

- For instance, Bridgestone Golf’s e12 CONTACT ball, launched in 2023, incorporates FLEXATIV Surlyn, a fourth-generation contact science cover that increases clubface contact by up to 38%, resulting in improved energy transfer and longer average drive distances. The company’s investment in eco-conscious materials and carbon-neutral manufacturing practices is in direct response to consumer demand for environmentally responsible products, seen in the growing preference for clubs with recycled metals and bio-based resins.

Increasing Demand for Customization and Personalization:

Customization is a strong trend in the North America Golf Club Market. Players seek equipment tailored to their height, swing speed, and preferred playing style. Club-fitting studios equipped with advanced diagnostics offer precision measurements. Custom paint finishes, engraved shafts, and grip patterns cater to personal preferences. Premium brands market exclusivity through limited-edition designs. Online platforms enable customers to configure club specifications before purchase. Amateur and professional players alike value the performance benefits of tailored equipment. This trend positions customization as a premium growth segment within the market.

Expansion of Indoor Golf and Simulator-Based Training:

The North America Golf Club Market is influenced by the rapid adoption of indoor golfing solutions. Urban golfers use high-tech simulators to practice year-round. Indoor facilities replicate championship courses and weather conditions, attracting both casual players and professionals. Simulator-based coaching integrates club recommendations into training. Retailers use simulators to allow customers to test clubs before purchase. This environment supports the sale of performance-driven equipment adapted for both indoor and outdoor use. The increasing number of golf entertainment venues also boosts exposure to the sport among new players.

Market Challenges Analysis:

High Cost of Premium Golf Clubs and Equipment:

The North America Golf Club Market faces a challenge from the high price point of advanced equipment. Premium clubs often feature cutting-edge materials and precision engineering, increasing retail costs. This limits accessibility for budget-conscious consumers and casual players. Economic fluctuations influence discretionary spending, impacting sales during downturns. Rental and second-hand markets compete directly with new product purchases. Entry-level players may hesitate to invest heavily without long-term commitment to the sport. Brands must balance innovation with affordability to capture broader market share. The presence of counterfeit products also threatens premium manufacturers by offering cheaper alternatives.

Impact of Seasonal and Geographic Limitations on Play:

The North America Golf Club Market experiences fluctuations due to seasonal climate conditions. Northern regions have shorter golfing seasons, reducing overall club usage. Harsh winters limit outdoor play and discourage new equipment purchases. Course closures in certain months affect retail and pro shop sales. Warmer regions provide stability but cannot fully offset declines in colder areas. Indoor facilities mitigate some of this seasonality, yet adoption remains uneven. Travel costs for players seeking year-round play can deter frequent participation. These geographic limitations require targeted marketing strategies to maintain consistent demand.

Market Opportunities:

Emerging Markets Within Canada and Non-Traditional Golf States:

The North America Golf Club Market holds strong potential in regions where golf is gaining popularity beyond traditional hubs. Canadian provinces are seeing investment in new courses and training facilities, expanding player bases. Non-traditional U.S. states with developing golf communities present fresh demand for clubs. Retailers can benefit from targeting these emerging areas with entry-level and mid-range products. Local tournaments and community golf programs create awareness and drive sales. Manufacturers that build relationships with regional golf associations can capture early market share.

Integration of Golf Into Entertainment and Hospitality Sectors:

The North America Golf Club Market can expand through integration with hospitality, events, and entertainment. Golf-themed entertainment venues attract non-traditional players, creating new equipment demand. Hotels and resorts with on-site golf packages encourage rental and purchase opportunities. Corporate events centered on golf strengthen exposure among professionals. Partnerships between equipment brands and leisure chains enable direct product trials. This blending of sport and lifestyle provides recurring sales channels and brand visibility.

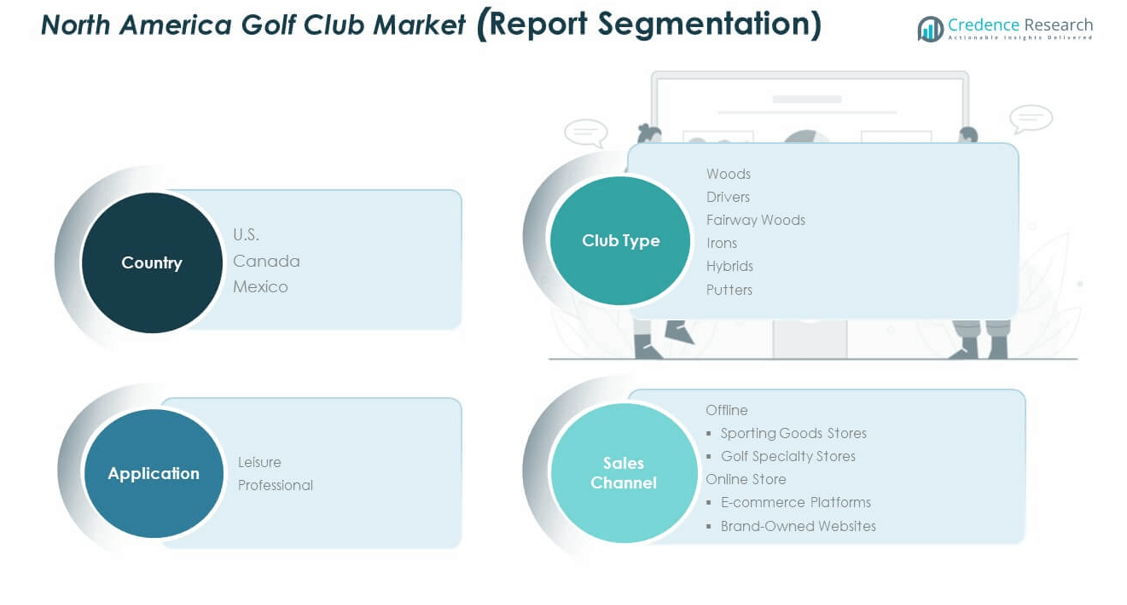

Market Segmentation Analysis:

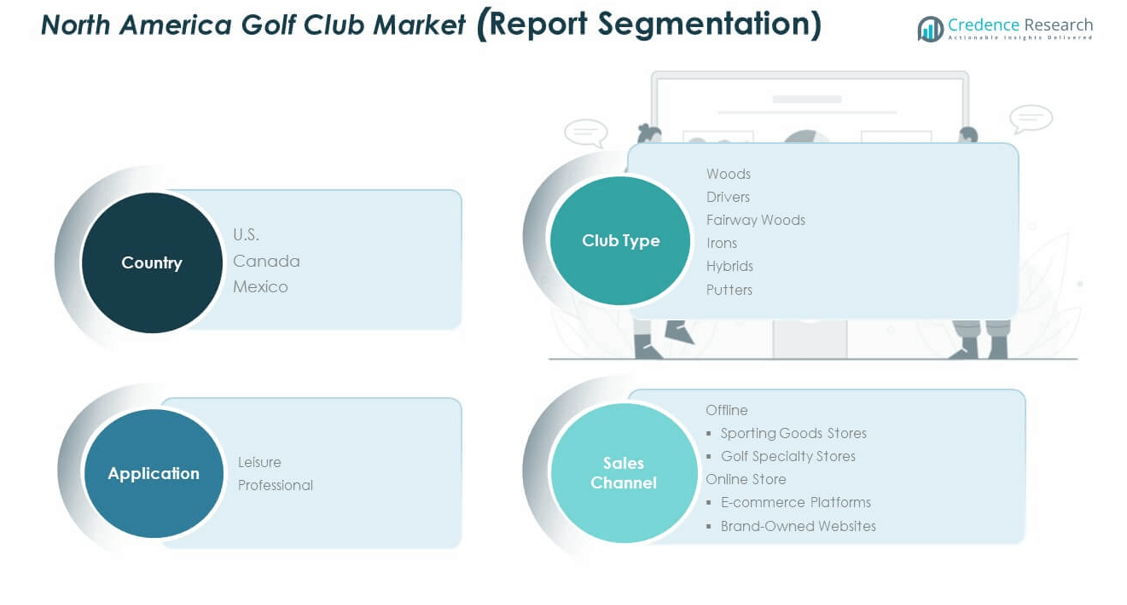

By Club Type

The North America Golf Club Market is segmented into woods, drivers, fairway woods, irons, hybrids, and putters. Irons hold a significant share due to their versatility across skill levels, while drivers remain essential for distance play and attract strong demand for technologically advanced models. Hybrids continue to gain traction as an alternative to long irons, offering ease of use and consistency. Fairway woods maintain steady adoption among players seeking control and reach, while putters represent a consistent sales category given their critical role in scoring. Woods cater to niche needs but benefit from premiumization trends.

- For instance, TaylorMade’s Qi35 drivers and fairway woods, introduced in 2025, leveraged advanced inertia calculations to optimize energy transfer, delivering a 12% improvement in moment of inertia (MOI) and providing greater shot stability. Takomo’s 301 CB irons received the “Best Value” and 3rd place in “Best Player’s Irons 2023”—a rare feat rooted in meticulous design and performance proven in benchmarking tests.

By Application

The market divides into leisure and professional segments. Leisure golf dominates, supported by recreational participation, tourism, and casual play. The professional segment, though smaller, drives high-value purchases due to the demand for precision-engineered clubs tailored for performance. Sponsorships, tour exposure, and competitive events strengthen product visibility in this category, driving aspirational purchases among amateurs.

- For instance, the professional market pushes performance, as seen in the adoption of Bridgestone’s e9 Long Drive ball by World Long Drive competitors, yielding documented increases in launch and carry distances for elite players. Meanwhile, the proliferation of accessible custom fitting and data-powered club selection ensures that even leisure golfers now achieve measurable improvements in swing speed and ball flight, narrowing the gap between amateur and professional outcomes.

By Sales Channel

Offline retail remains the leading distribution mode, with sporting goods stores offering variety and accessibility, while golf specialty stores provide expert fitting and premium product ranges. Online stores are expanding quickly, driven by the convenience of e-commerce platforms and the direct engagement of brand-owned websites. Other channels, including pro shops and event-based sales, cater to targeted audiences and often promote personalized offerings. This diversified channel structure supports both mass-market penetration and niche premium sales, reinforcing the overall market growth trajectory.

Segmentation:

By Club Type

- Woods

- Drivers

- Fairway Woods

- Irons

- Hybrids

- Putters

By Application

By Sales Channel

- Offline

- Sporting Goods Stores

- Golf Specialty Stores

- Online Stores

- E-commerce Platforms

- Brand-Owned Websites

- Others

By Country

- United States

- Canada

- Mexico

Regional Analysis:

United States

The United States dominates the North America Golf Club Market, holding approximately 78% of the regional share. Its leadership is supported by an extensive network of golf courses, high player participation rates, and a mature golfing culture. The country hosts major professional tournaments, which drive visibility and influence consumer purchasing trends. Premiumization is a defining feature, with consumers increasingly investing in advanced, custom-fitted equipment. The strong presence of leading manufacturers and a robust retail infrastructure further support market expansion. High adoption of technology-integrated clubs and fitting services reflects the U.S. focus on performance optimization. The combination of a large player base and consistent replacement demand sustains long-term growth.

Canada

Canada accounts for roughly 15% of the regional market, with growth driven by expanding golf facilities and a rising interest in the sport across diverse demographics. The country benefits from an active amateur golf community and a supportive infrastructure for both recreational and competitive play. Seasonal limitations encourage strong participation during warmer months, creating concentrated sales cycles. Investment in indoor golf simulators has extended playing opportunities and boosted year-round engagement. Canadian consumers increasingly seek premium clubs, particularly in urban centers with established golfing communities. Partnerships between golf courses, retailers, and manufacturers enhance product accessibility. This focus on quality and accessibility supports steady growth momentum.

Mexico

Mexico holds an estimated 7% share of the North America Golf Club Market, with expansion supported by golf tourism and resort-based courses. It attracts international players, particularly from the U.S. and Canada, contributing to demand for high-quality clubs and rental equipment. Growing interest among local players is supported by rising disposable incomes and promotional efforts from golfing associations. The market remains smaller in scale but benefits from the presence of luxury resorts integrating golf as a core attraction. Equipment sales are often linked to tourism seasons, with premium clubs gaining visibility through resort pro shops. Continued investment in high-end golfing destinations and training facilities is expected to support further market penetration.

Key Player Analysis:

- Haywood Golf

- BirTee Golf

- TaylorMade Golf Company

- Roger Cleveland Golf Company, Inc.

- Bridgestone Sports Ltd

- Acushnet Company

- Callaway

- Takomo Golf Company

- Golfsmith International Holdings, Inc.

- Ben Hogan Golf Equipment Company

- Other Key Players

Competitive Analysis:

The North America Golf Club Market is highly competitive, with a mix of established global brands and niche manufacturers competing for market share. Leading players such as Acushnet Company, Callaway, TaylorMade Golf Company, and Bridgestone Sports Ltd. dominate through brand recognition, product innovation, and extensive distribution networks. It benefits from continuous technological advancements, with manufacturers integrating AI-driven design, multi-material construction, and custom fitting to differentiate offerings. Smaller brands like Haywood Golf and Takomo Golf Company target specific segments with premium craftsmanship and direct-to-consumer sales models. Strategic sponsorships, professional tour endorsements, and exclusive retail partnerships further intensify competition. The market rewards innovation, brand loyalty, and service-driven sales strategies, creating a dynamic environment where both large and emerging players can compete effectively.

Recent Developments:

- In July 2025, Haywood Golf introduced the all-new SV.2 Irons, marking the next generation of their popular Signature irons, focused on game improvement and maximizing distance. In addition, the company unveiled the next-gen Di.2 Driving Iron in late July 2025, designed for explosive distance and unmatched forgiveness, signaling a commitment to high-quality, direct-to-consumer offerings.

- In 2025, BirTee Golf formed a new partnership with the Canadian Junior Golf Association (CJGA), announcing that BirTee Pro tees would now be featured in CJGA events. This partnership aims to increase product exposure among junior golfers in North America.

- In August 2025, TaylorMade Golf Company unveiled its Milled Grind 5 (MG5) wedges, adding to its flagship wedge family with enhanced spin and feel. Additionally, TaylorMade launched the RBZ SpeedLite 11-piece complete set in August 2025, designed with advanced technologies for improved distance, forgiveness, and effortless launch, catering to golfers at all levels.

- In March 2025, Roger Cleveland Golf Company, Inc. (Cleveland Golf) saw Roger Cleveland rejoining as Founder & Advisor after nearly 30 years at Callaway. His return is expected to infuse the company’s wedge and short-game club development with historic craftsmanship and renewed innovation, reaffirming Cleveland Golf’s legacy in the market.

Market Concentration & Characteristics:

The North America Golf Club Market exhibits moderate to high concentration, with a few major brands controlling a significant share while niche players cater to specialized segments. It is characterized by strong brand loyalty, frequent product innovation, and a high degree of differentiation in materials and design. Seasonal demand patterns, tour-driven product visibility, and premiumization trends influence market dynamics. Offline retail remains a dominant channel for premium purchases, while online sales are rapidly growing through direct-to-consumer strategies. Competitive success depends on product performance, brand prestige, and effective consumer engagement.

Report Coverage:

The research report offers an in-depth analysis based on club type, application, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of technology-enhanced golf clubs with AI-based design and performance tracking will drive product differentiation.

- Rising investments in golf course infrastructure and modernization will expand opportunities for both professional and leisure segments.

- Growth in golf tourism, particularly in resort destinations, will stimulate demand for high-quality rental and retail equipment.

- Expanding participation among younger players will strengthen long-term market sustainability and brand loyalty.

- Custom-fitted clubs will gain higher penetration as players seek personalized performance improvements.

- Online sales channels will accelerate, supported by direct-to-consumer strategies and interactive product experiences.

- Indoor simulators and entertainment venues will expand the sport’s reach in regions with seasonal limitations.

- Strategic partnerships between manufacturers and golf tours will enhance product visibility and credibility.

- Sustainability initiatives in manufacturing and materials will influence purchasing preferences among eco-conscious consumers.

- Competitive innovation cycles will shorten, prompting more frequent product launches and brand upgrades.